What is the Drive by Wire Market Size?

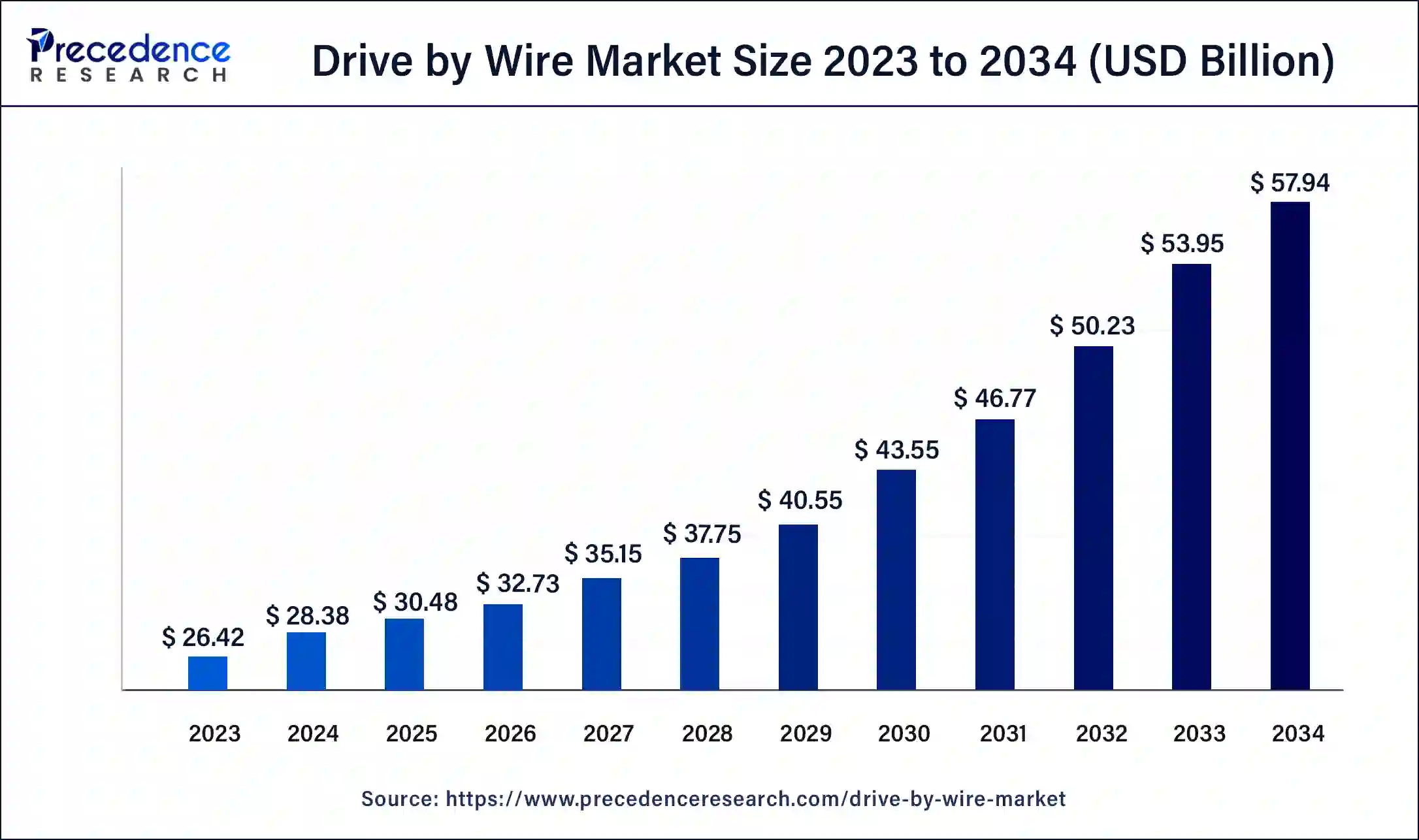

The global drive-by-wire market size is accounted at USD 30.48 billion in 2025 and predicted to increase from USD 32.73 billion in 2026 to approximately USD 57.94 billion by 2034, representing a CAGR of 7.40% from 2025 to 2034.

Drive by Wire Market Key Takeaways

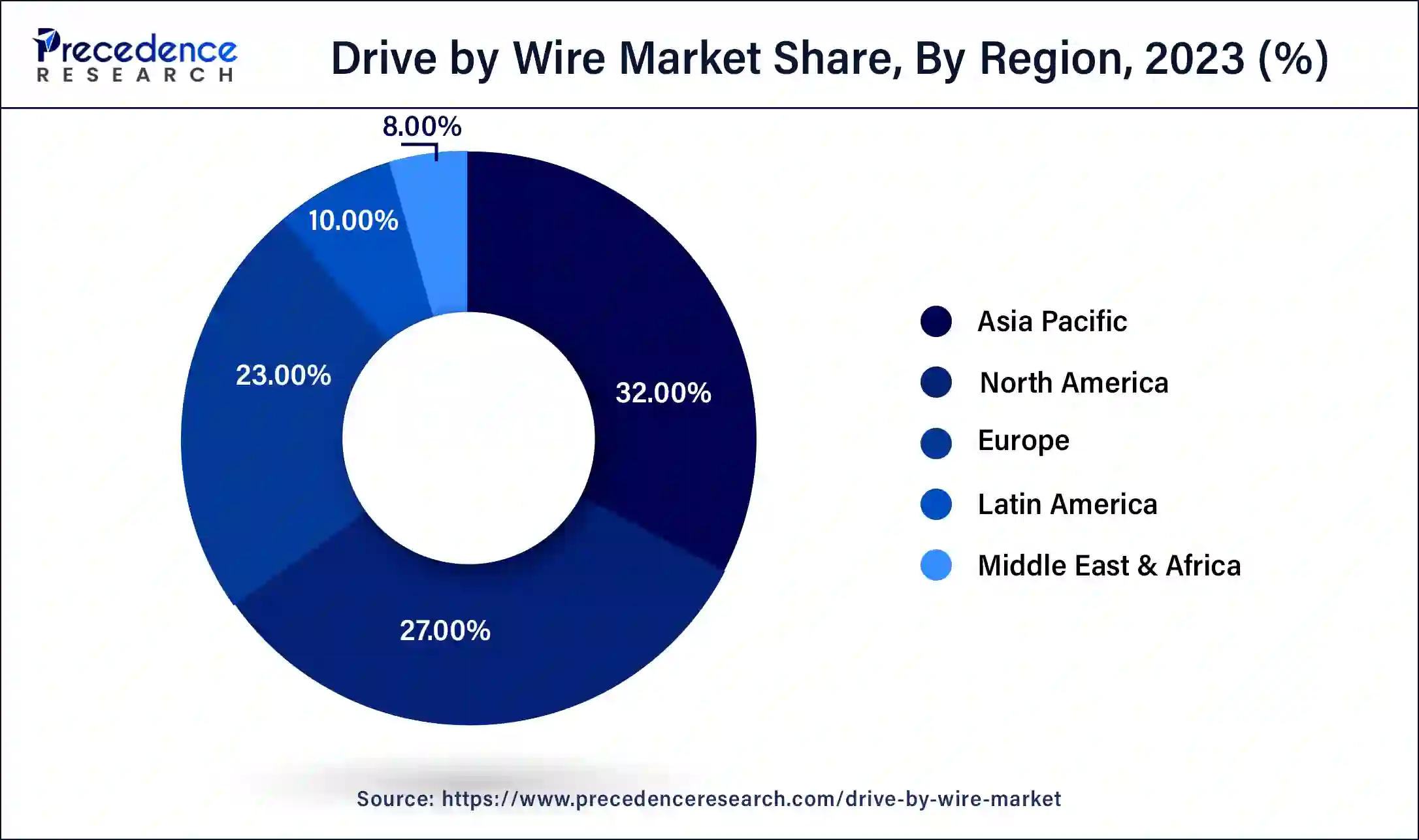

- Asia Pacific led the global market with the largest market share of 32% in 2024.

- By Solution, the shift-by-wire segment has held the largest revenue share in 2024.

- By Component, the electronic transmission control unit segment has held the highest market share in 2024.

What is a drive-by-wire?

Globally numerous environmental guidelines such as the Paris Agreement 2015 and the Kyoto Protocol 1998 were executed in order to reduce vehicle emissions and achieve the greenhouse gas emission norms. Over the past few years, researchers and manufacturers have been incorporating electronics and computers into the modern automobiles in order to facilitate the drivers to get accustomed to the technology. The drive-by-wire arrangement has the ability to increase safety, functionality, and comfort through the drive. Sensors and computers that are employed in these systems evaluate commands and send instructions to vehicles on precisely what to do. Such systems have an environmental approach, too, since the expertise could advance fuel economy and lessen engine emanation. The automobiles with drive-by-wire technology rely largely on electronics to regulate a wide variety of vehicle actions, including braking and acceleration. The drive-by-wire expertise is regarded as an environmental-friendly option. With better fuel range to lap up, the automobile owners can contribute to reduction in carbon emissions, which is certainly better for helping protect the environment that is sure to display a positive effect on the progress of market in the estimate period.

Market Outlook

- Industry Growth Overview: The drive-by-wire market is growing, driven by rising adoption of electric and autonomous vehicles, stringent government regulations on safety and emissions, and customer demand for advanced driver-assistance systems (ADAS).

- Global Expansion:The drive-by-wire market is experiencing global expansion, as governments' investments are enacting stricter safety and emission standards, which accelerate the adoption of drive-by-wire systems as a way to meet these needs. Asia Pacific is a dominant market due to rising demand for both commercial EVs and vehicles.

- Major investors:Major investors in drive-by-wire technology are primarily automotive manufacturers and their Tier 1 technology suppliers, who are investing heavily in research and development, collaboration, and manufacturing.

Drive by Wire Market Growth Factors

- There was a noticeable electrification trend in the automobile sector, with an increasing focus on electric and hybrid cars. They are vital parts as drive-by-wire systems substitute electronic control systems for conventional mechanical connections in these cars.

- Autonomous vehicle development and testing were increasing. Drive-by-wire systems are essential to autonomous driving because they allow for precise control and seamless integration with various sensors and control algorithms.

- Safety features in automobiles were becoming more and more important to consumers. Advanced safety features like traction control and electronic stability control (ESC) are partly developed because of drive-by-wire systems. The need for Drive-by-Wire technology was being driven by the growing use of ADAS, which includes functions like automated parking, lane-keeping assistance, and adaptive cruise control.

- Automotive manufacturers were compelled to adopt technology that improves fuel efficiency due to governments and regulatory agencies enforcing strict criteria for emissions and fuel efficiency.

- Drive-by-wire technologies enhance fuel efficiency by providing better control and system optimization for vehicles. Developments in sensor technologies have a direct bearing on the expansion of Drive-by-Wire technology.

- Drive-by-wire systems perform better overall when sensors such as accelerometers, gyroscopes, and position sensors are integrated. This enables more precise control and feedback. Drive-by-wire technologies help reduce the total weight of vehicles by substituting lightweight electronic systems for bulky mechanical components. This is essential to achieving fuel economy targets and enhancing the efficiency of electric cars.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 30.48 Billion |

| Market Size in 2026 | USD 32.73 Billion |

| Market Size by 2034 | USD 57.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Components, Solution |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Driver

Emergence of in-vehicle digitalization

In-vehicle digitalization is anticipated to rise as people spend additional time in their private vehicles. Popular linked features include Wi-Fi hotspot, digital keys, and navigation. Between these, digital keys will exhibit a high requirement in the approaching years owing to its low-cost execution. Voice recognition, virtual assistant, gesture control, and personalization will also experience augmented demand on rising concerns over surface contamination. Digitalization in automobiles will receive a boost from COVID-19 pandemic with people accepting a digital lifestyle that endorses hygiene, social distancing, efficiency, and tracking. Features and services permitting these lifestyle changes will exhibit growing popularity amongst car-buyers.

Restraint

Cost of Implementation and Maintenance

Costs may vary depending on how difficult it is to incorporate drive-by-wire technology into new or old car architectures. It is necessary to consider safety features, communication protocols, and compatibility with other electronic systems. The kind of vehicle and the planned use can affect implementation costs.

More complex drive-by-wire solutions may be needed for high-performance automobiles or sophisticated autonomous systems, which would raise prices. Costs increase when safety and legal requirements are met. To guarantee that drive-by-wire systems achieve the necessary safety levels, they must adhere to local and industry safety requirements. Software updates, sensor calibration, and possible hardware repairs are all included in the cost of ongoing maintenance. Regular maintenance is essential for drive-by-wire systems to continue operating safely and effectively.

Opportunity

Innovation in Electric and Hybrid Vehicles

Steer-by-wire systems are frequently found in electric and hybrid vehicles, which do away with the requirement for a physical connection between the steering wheel and the wheels. This allows for incorporating advanced driving assistance systems (ADAS) and building cars with greater freedom. Throttle-by-wire systems use electronic sensors and actuators instead of the traditional mechanical linkage between the engine and the accelerator pedal. Drive-by-wire systems are an essential component in the creation and application of autonomous driving technology. Advanced driver-aid features like automated parking, adaptive cruise control, and lane-keeping assistance can be seamlessly integrated with these systems.

Segmental Insights

Components Insights

Vehicle electronic control unit segment holds the largest share in the drive-by-wire market. In the drive-by-wire market, the electronic control units overseeing and regulating the many operations of a drive-by-wire system are referred to as vehicle electronic control units or ECUs. These ECUs are in charge of processing sensor data, making decisions based on that information, and instructing actuators to perform vital operations for the vehicle. Controls the engine's air intake by managing the electronic throttle control system, which gets data from the accelerator pedal sensor and sends signals to the throttle actuator. Regulates the electronic braking system by deciphering the information from the brake pedal sensors and figuring out how much brake force should be put on each wheel.

Oversees the electronic power steering system, interprets steering angle sensor data, and directs the steering actuator to provide steering assistance or control. Determines the ideal shift locations and gear ratios by gathering data from multiple sensors and controlling the electronic transmission system. Controls electronic suspension systems to improve handling and ride comfort by modifying damping rates and other settings in response to sensor inputs. Combines and synchronizes the control of several drive-by-wire systems to provide safe and efficient operation. The vehicle's various ECUs, such as those in charge of engine control, safety systems, and advanced driver assistance systems (ADAS), frequently require communication and coordination with the vehicle's ECU.

Solution Insights

Brake-by-wire segment holds the largest share of the drive-by-wire market. The electronic control of braking systems is the specific focus of brake-by-wire. The brake system in conventional cars is usually controlled by a hydraulic system that applies force to the brakes using a brake pedal. Brake-by-wire systems do not require a direct mechanical connection between the brake pedal and the braking components since they use electronic sensors and actuators to manage the braking operations. The central control unit calculates the proper braking force by analyzing data from multiple sensors. These sensors monitor several variables, including wheel speed, vehicle speed, brake pedal position, and other pertinent information.

The amount of force applied to each wheel during braking is managed by electronic actuators. Advanced communication networks are frequently used in brake-by-wire systems to enable quick and accurate data transfer between various components. Brake-by-wire systems frequently include redundant parts and systems to improve safety and dependability because of how vital braking is. Advanced control systems can improve vehicle safety by enabling electronic stability control and enhancing braking performance. Brake-by-wire can enhance total fuel efficiency by connecting with other vehicle control systems. Brake-by-wire systems eliminate the requirement for a direct mechanical connection between the brake pedal and the braking components, giving designers of vehicles greater design freedom.

Regional Insights

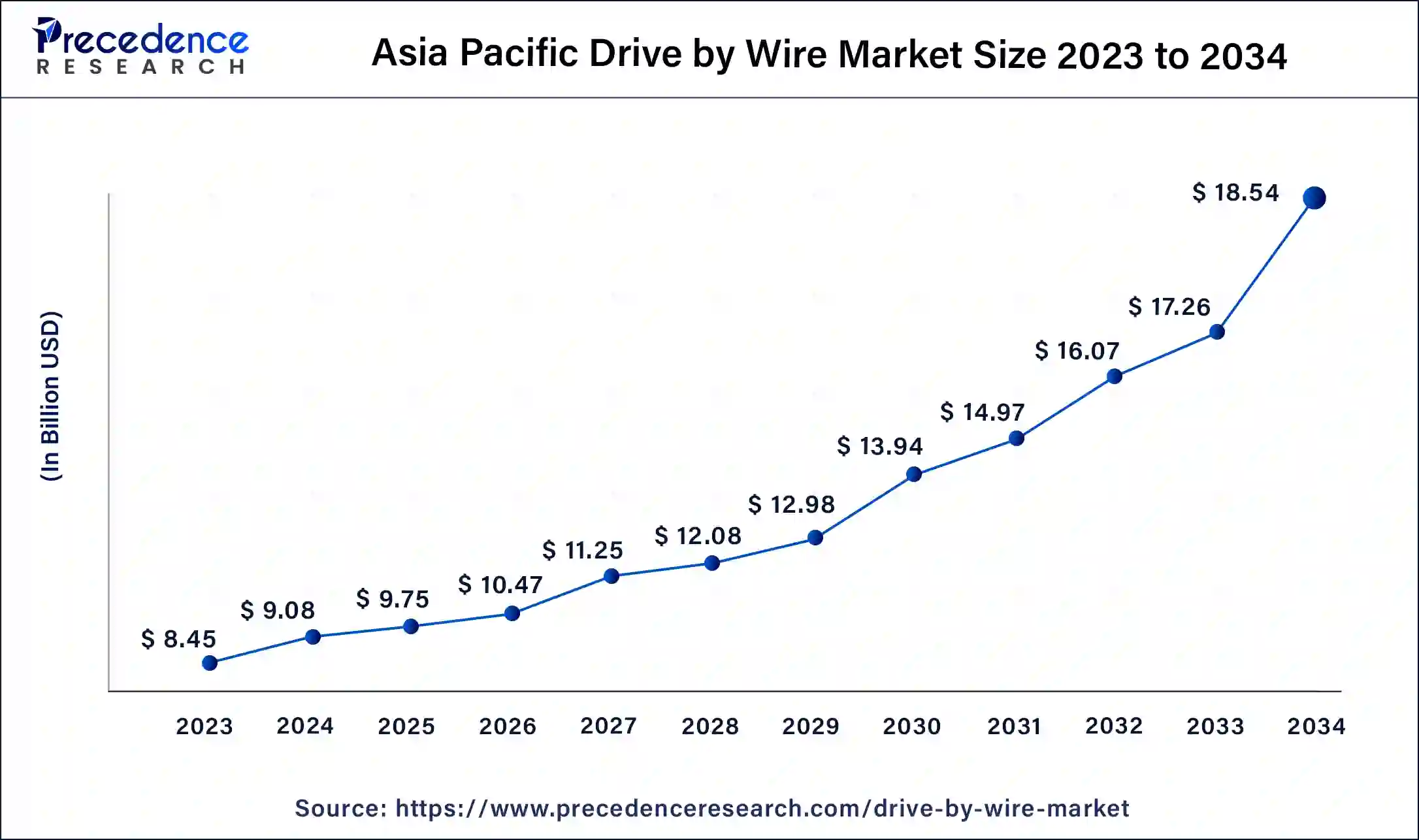

Asia Pacific Drive by Wire Market Size and Growth 2025 to 2034

The Asia Pacific drive by wire market size is estimated at USD 9.75 billion in 2025 and is predicted to be worth around USD 18.83 billion by 2034, at a CAGR of 7.57% from 2025 to 2034.

Asia Pacific dominates the drive by wire market and is observed to sustain the position in the upcoming years. Consumers in Asia Pacific exhibit a strong inclination toward vehicles equipped with advanced features and technologies, such upcoming technological innovations are observed to supplement the market in the forecast period. Drive-by-wire systems, known for their enhanced safety, control, and automation features, align with the preferences of tech-savvy consumers in the region. Asia Pacific has witnessed a surge in the electric vehicle (EV) market. Drive-by-wire systems play a crucial role in electric vehicles, offering precise control and contributing to the overall electrification of vehicles. The region's focus on sustainable transportation solutions further propels the adoption of drive-by-wire.

China: Skilled labor and low costs

In China, heavy government spending in its increasing electric vehicle (EV) industry, fast expansion of smart mobility, and strong government helps for strategic technologies. China's strong base in electronics production offers a readily available supply chain for the electronic components that are central to drive-by-wire systems.

North America: Advancement in electronic components

North America is the fastest growing in the market a strong automotive ecosystem, significant spending in autonomous vehicles (AVs) and electric vehicles (EVs), and a helpful government environment. The presence of favorable government bodies, like the National Highway Traffic Safety Administration (NHTSA), is establishing policies and certifications for the deployment of autonomous and progressive electronic systems.

U.S.: Support for sustainable energy

In the U.S. strong automotive environment, early acceptance of autonomous driving (AD) technology, the presence of major tech organizations and automakers spending heavily in R&D, and helpful government initiatives. The U.S. is a hub of major key players such as General Motors, Ford, Tesla, NVIDIA, and Ghost Autonomy that are spending heavily in the research and development of steer-by-wire and brake-by-wire services.

Europe: Autonomous Vehicle Development

Europe is experiencing substantial growth in the market due to increasing government support, such as the European Union (EU) has imposed aggressive CO2 emissions targets and safety standards on vehicle manufacturers, driving them to accept advanced electronic control systems like DbW, which are essential for reducing weight and improving fuel effectiveness. Europe is actively spending in the advancement of autonomous driving systems (ADS) and Advanced Driver-Assistance Systems (ADAS)

UK: Industry Collaboration and R&D

The UK's ambitious targets to ban new petrol and diesel car sales are speeding up the transition to electric vehicles (EVs). EVs heavily rely on DBW systems for effective power management and seamless processes, thereby increasing demand for these technologies. Strong collaboration among the automotive companies, academic institutions, and R&D centers, often driven by government-backed programs such as the Advanced Propulsion Centre UK (APC)

Value Chain Analysis – Drive by Wire Market

Raw Material

The raw materials include metals such as aluminum, steel, and Copper, plastics and polymers like polyvinyl chloride, nylon, and teflon, and other materials like glass and petroleum products.

- Key Players: Nexteer Automotive and Kongsberg Automotive

Chemical Synthesis and Processing

Drive-by-wire (DbW) systems rely on highly engineered materials for their actuators, sensors, wiring, and Electronic Control Units (ECUs), with chemical synthesis and manufacturing focused on achieving particular material properties such as electrical conductivity, durability, and resistance.

- Key Players: ZF Friedrichshafen

Compound Formulation and Blending:

The specific compounds and their combination are engineered to meet stringent automotive needs like flame retardancy, thermal stability, abrasion resistance, and long-term reliability.

- Key Players:Bosch and Continental

Top Vendors in the Drive-by-Wire Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Blacksburg, Virginia |

Data and Testing Infrastructure |

In June 2025, Torc Announces New Engineering Center in Ann Arbor, Michigan, to Further Fuel Autonomous Vehicle Innovation. |

|

|

Germany |

Highest safety standards |

Mobil Elektronik GmbH (ME) is a pioneer in steer-by-wire technology for commercial and special-purpose vehicles. |

|

|

Danaher Motion |

United States |

Extensive application expertise |

The DDS Direct Drive Steering System IP67-rated intelligent electric system is designed to replace hydraulic steering systems while reducing complexity and providing significant advantages to vehicle designers |

|

Robert Bosch GmbH |

Germany |

Strong innovation |

A Bosch development team successfully tested the new hydraulic brake-by-wire system from Bosch for the first time on public roads. |

|

SKF Group |

Sweden |

Deep Engineering Expertise |

In October 2025, SKF announced the launch of SKF Ventures, a new initiative aimed at accelerating innovation, exploring emerging. |

Other Major Key Players

- Audi

- RLP Engineering

- Peugeotm

- Nissan

- TRW

Recent Developments

- In September 2023, A new steer-by-wire system was unveiled by Titan, a UK-based developer and manufacturer of steering systems for electric vehicles. Light commercial vehicles, trucks, and supercars are just a few low-volume vehicles that can utilize the system. Titan offers power steering systems with steer-by-wire, manual, electric (EPAS), and hydraulic options.

- In July 2023, The Sprinklr Unified Partners Program was introduced today by Sprinklr (NYSE: CXM), the unified customer experience management (Unified-CXM) platform for contemporary businesses. The upcoming iteration of the Sprinklr partner program incorporates several new partner categories, such as independent consultants, business process outsourcing (BPO) partners, referral partners, and technological solution brokers (TSBs).

Major Market Segments Covered

By Component

- Vehicle Electronic Control Unit

- Actuator

- Engine Control Module

- Electronic Transmission Control Unit

- Feedback Motor

- Sensors

- Others

By Solution

- Brake by Wire

- Steer by Wire

- Throttle by Wire

- Shift by Wire

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content