Automotive Cabin Air Filter Market Size and Growth 2025 to 2034

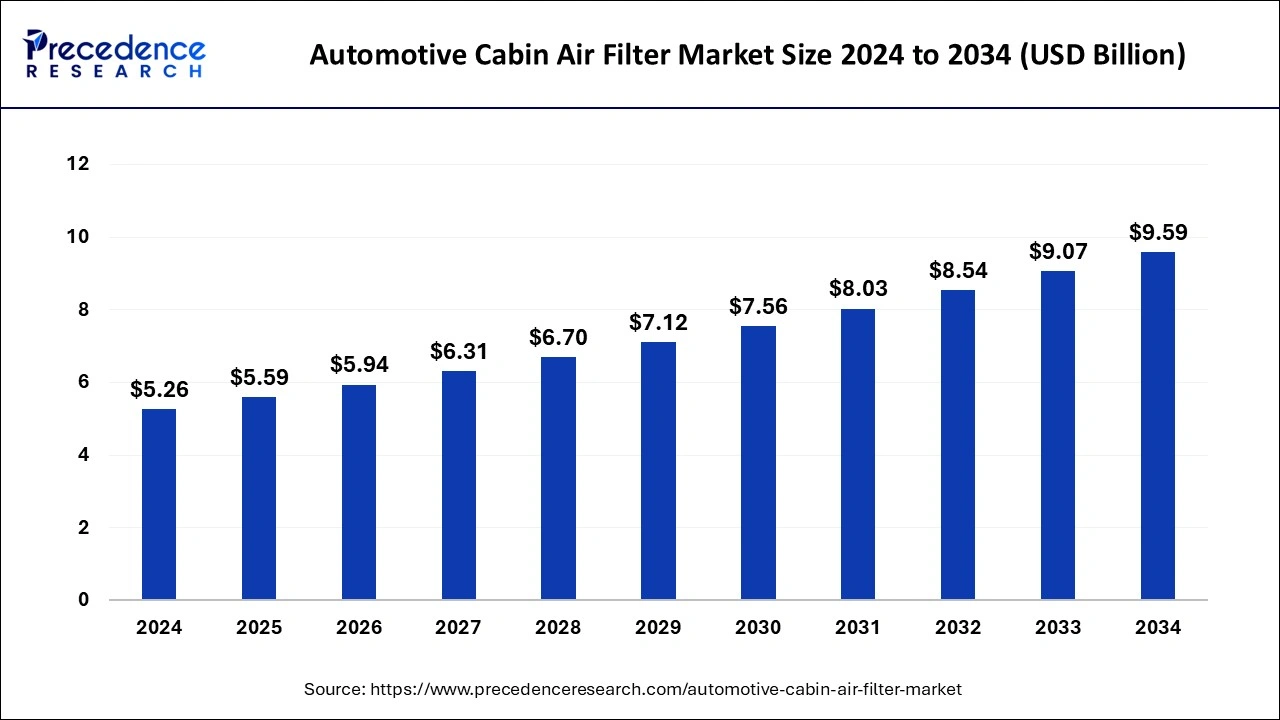

The global automotive cabin air filter market size was estimated at USD 5.26 billion in 2024 and is predicted to increase from USD 5.59 billion in 2025 to approximately USD 9.59 billion by 2034, expanding at a CAGR of 6.19% from 2025 to 2034. Rising vehicle production globally has led to increasing emissions of excessive greenhouse gases.to combat this, stringent regulations have been made by authorities for the maintenance of air quality, propelling the automotive cabin air filter market.

Automotive Cabin Air Filter Market Key Takeaways

- In terms of revenue, the global automotive cabin air filter market was valued at USD 5.26 billion in 2024.

- It is projected to reach USD 9.59 billion by 2034.

- The market is expected to grow at a CAGR of 6.19% from 2025 to 2034

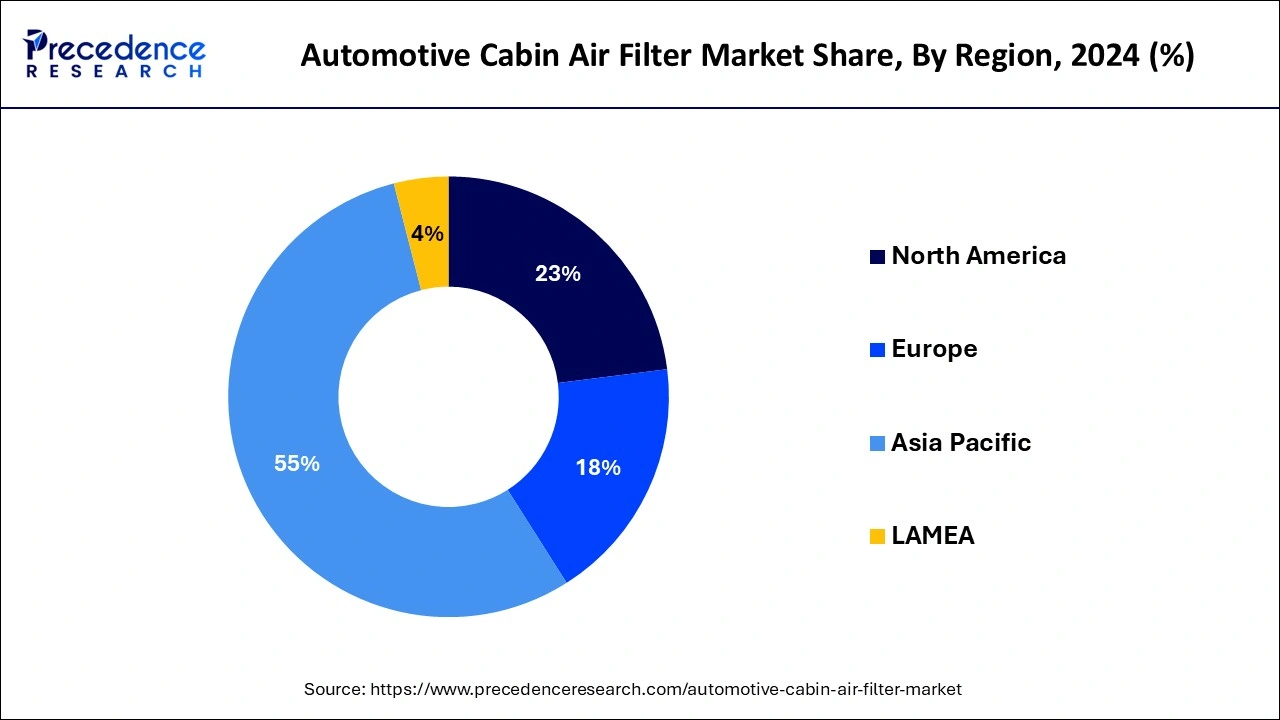

- Asia Pacific dominated the automotive cabin air filter market with the largest share of 55% in 2024.

- By vehicle type, the mid-sized passenger cars segment accounted for the largest market share in 2024.

- By filter medium, the synthetic filters segment dominated the market in 2024.

- By sales channel, the OEMs (original equipment manufacturers) segment dominated the market in 2024.

Asia Pacific Automotive Cabin Air Filter Market Size and Growth 2025 to 2034

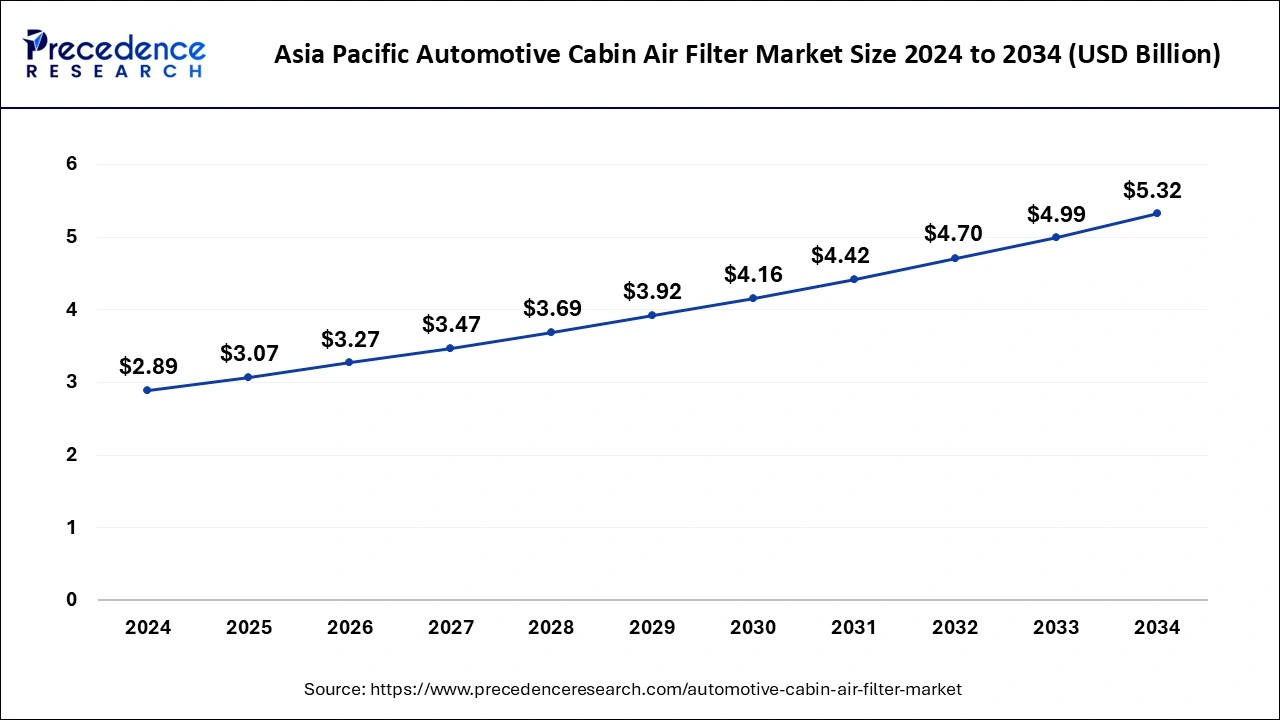

The Asia Pacific automotive cabin air filter market size was estimated at USD 2.89 billion in 2024 and is predicted to be worth around USD 5.32 billion by 2034 with a CAGR of 6.29% from 2025 to 2034.

Asia Pacific dominated the automotive cabin air filter market in 2024 due to the rising sales of electronic vehicles in this region. India, China, and Japan are the leading players in the automotive market and hold promising future opportunities for automotive cabin air filters. Rising demand for highly advanced and eco-friendly vehicles such as electric vehicles create a huge automotive market and expansion in India; this is a noteworthy factor that positively affects the growth of the automotive cabin air filter market in the Asia Pacific region.

Along with this, Asia Pacific has highly skilled automobile labors with economic costs further propelling the manufacturing sector of vehicles, which in turn impacts air cabin filters and their production in the region. The presence of research and development centers in Asian countries is notable, as it increases technological innovations in the automotive sector. Also, steel production in the Asian region is becoming more cost-friendly and available abundantly, further increasing the production of vehicles, in particular, electric vehicles, showing a surge in demand within countries such as India, Japan, and China owing to their eco-friendly nature.

North America had a significant share of the automotive cabin air filter market in 2024. This region's growth is owing to the rising number of vehicle parks and the increasing average yearly miles travelled within North American countries such as the U.S. and Canada. The U.S. is anticipated to hold the highest growth rate in the market among these leading countries.

The U.S. has traffic congestion concerns that require strict regulations due to the increasing exposure of vehicles to carbon emissions. Hence, authorities are compelled to implement stringent regulations to sustain environmental balance and the overall ecosystem. Hence, compliance with these standard rules is of utmost importance to vehicle owners and automotive manufacturers. This implementation is anticipated to play a key role in expanding the automotive cabin air filter market in North America.

- For instance, in February 2022, the Environmental Protection Agency, PA, signed a rule to mitigate air pollution from heavy-duty vehicles to protect against ozone depletion.

Market Overview

The automotive cabin air filter market is significantly growing due to the rising number of sales and manufacturing of automotive vehicles and growing awareness about air quality, which severely affects the health condition of individuals traveling through the vehicles. Implementing stringent regulations for carbon emission and high air quality maintenance is also responsible for the expansion of the market globally. In the past years, a prominent growth rate has been noted in the automotive market owing to technological advancements and the incorporation of AI tools to enhance the traveling experience, naturally propelling the necessity of cabin air filters. Thus, a newly launched vehicle edition has already equipped such an advanced filtration system with multimedia facilities to adjust it, accordingly, augmenting the market's reach on a wider scale.

Vehicles such as cars, trucks, and buses require air filtering as they are potentially susceptible to generating harmful air quality within the vehicle cabin, which affects the traveling experience of people inside the vehicle and the driver. To avoid this issue, it is of utmost importance as poor air quality not only affects the health of people but can also lead to brain fog, which may cause misfortunate events like accidents in the long run. Hence, the cabin air filter is specifically engineered to reduce dust, odors, allergens, and pollutant particles to keep the air quality of the vehicles' cabins fresh and comfortable to travel, leading to a healthy driving experience with less hustle.

Automotive Cabin Air Filter Growth Factors

- Increase in vehicle production globally.

- Regulations by authorities to adhere to the optimum air quality rate within vehicle cabins with low carbon emissions.

- Rising awareness about health concerns due to traveling with vehicles having low air quality and less ventilation.

- Increasing manufacturing of technologically advanced cars and its buyer's rate.

- People's inclination towards luxurious cars to enhance their traveling experience.

- Governments support the expansion of the automotive market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.59 Billion |

| Market Size by 2034 | USD 9.59 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.19% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Sales Channel, Filter Medium, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Sustainable, healthy traveling experience

The major driver of the automotive cabin air filter market is the heightened awareness about highly contaminated ventilation within vehicle cabins and its possible hazardous effects on travellers. More consumers have experienced the adverse effects of traveling with vehicles that have high carbon emissions and toxic ventilation within the vehicle's cabin. Pollutions such as allergens, noxious gases, and carbon dioxide are some examples of highly toxic pollutants that need to be eliminated to create a safer environment.

These are responsible for largely triggering and exacerbating respiratory illness among people. This state of mind has been recognized by the major market players in the automotive sector, which encourages them to develop technologically advanced solutions to expand their business globally and strengthen their roots in the automotive market while serving the best facilities to consumers that ensure their health and comfort first.

Restraint

Excessive installation cost

The major restraint that can hinder the growth of the market is a high initial cost to install the high-quality cabin air filter, and consumers with less budget would not opt for such expensive filters, resulting in ineffective filtration within the cabin and leading to entering the pollutant, causing serious health concerns.

Regular maintenance requires timely replacement of the cabin filters, which further increases expenses that may deter a few consumers from purchasing a high-quality cabin air filter, particularly a consumer with low economic backup. Thus, maintaining a high-quality cabin air filter is an expensive affair that may not be reasonable to every consumer and will impede the growth of the automotive cabin air filter market. Hence, the manufacturing of cost-effective yet high-quality air filters in the automotive market is required to overcome the high-cost issue, which will further propel the market growth exponentially.

Opportunity

Advanced technological integration with the automotive market

The major future opportunity an automotive cabin air filter market holds is highly advanced cabin air filters having technological features that support maximum elimination of allergens and pollutant capture by the vehicle cabin while traveling from one point to another. Moreover, the primary trend driving the market's growth and holding a potential opportunity for future growth is the customization of the automotive cabin air filter. Customization of air filters includes a layer of activated charcoal, which is capable of trapping the micro-particles in the air that are major causes of respiratory illness. This type of filter reduces even a subtle odor and enhances air quality overall in the vehicle's cabin. Hence, a key trend that holds the potential to expand the market is the customization of air filters by leveraging highly advanced technologies to strengthen the roots of the global automotive cabin air filter market.

- For instance, in January 2024, BOSCH launched an enhanced version of the regular cabin filter known as FILTER+PRO. It has gained excellence certification from the authority body OFI, CERT, based in Vienna.

Vehicle Type Insights

The mid-sized passenger vehicles segment dominated the automotive cabin air filter market in 2024. Mid-sized passenger vehicles like SUVs are among the most popular vehicles that people prefer to purchase as they offer a balance of space and comfort and come with affordable ranges. These are some of the factors appealing to the consumer, thus increasing its sales in the automotive market. Moreover, mid-sized vehicles are well suited, particularly in suburban and metro cities, in the context of road construction and traffic measures. Thus, looking at this trend, manufacturers of mid-sized vehicles are continuously improving technologies related to cabin air filtration to serve car owners and enhance the physical appearance of vehicles, further propelling this segment of mid-sized passengers in the global automotive cabin air filter market.

- For instance, in October 2022, AUDI, a leading provider in the automotive industry, entered a partnership with MANN+HUMMEL, which is a well-known automotive air filter manufacturer. They both aim to develop air filters for EV cabins to collect particulate matter while driving and charging EVs.

Filter Medium Insights

The synthetic filters segment dominated the market in 2024. Synthetic air filters are made up of polyester synthetic fibers and come up with different weights and thicknesses. Synthetic air filters are specifically designed to capture coarse particles and dust in the cabins of vehicles by taking advantage of the full depths of polyester material used to bond them. Moreover, the synthetic filters are designed in such a way that they typically allow for better airflow and ventilation within the cabin, which is the topmost priority of aware consumers before buying vehicles.

These filters also have a longer life and are more durable than any other filters as they resist humidity in the climate, which causes fast decaying of any material. Due to their advantages and despite the high initial cost but longer lifespan, synthetic filters are attractive filter choices for OEMs to comply with stringent regulations about air quality maintained by different vehicles.

Sales Channel Insights

The OEM (original equipment manufacturers) segment dominated the automotive cabin air filter market in 2024. The growth of this segment can be attributed to several factors, such as manufacturers' standards maintained according to their brand, integrated supply chains, warranty assurance, and brand loyalty to provide the best features to consumers. Many consumers prefer to purchase vehicles directly from manufacturers owing to their brand, affordability, and quality assurance, increasing the sales of vehicles by original equipment manufacturers.

Also, OEMs have a well-established supply chain structure and partnership with cabin air filter manufacturers, which, in turn, ensures a reliable supply of high-quality air filters for newly launched vehicles. Furthermore, OEMs provide comprehensive solutions to vehicle damage, including maintenance and replacement of parts, which often encourages vehicle owners to continue using OEM parts to maintain their vehicles. Hence, these are some of the major factors that are affecting market growth exponentially on a global scale.

Automotive Cabin Air Filter Market Companies

- Ahlstrom-Munksjo Oyj

- DENSO Corp.

- Donaldson Co. Inc.

- Freudenberg SE

- General Motors Co.

- MAHLE GmbH

- MANN+HUMMEL

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Sogefi Spa

Recent Developments

- In December 2023, UNO Minda and ROKI made a partnership to provide a spectrum of air filters for the automotive market, such as oil filters, air filters, and fuel filters, to be sold in the Indian aftermarket, which can be used in commercial vehicles.

- In January 2023, K&N Engineering announced that it had created a new industrial group aiming at the delivery of high-performance and sustainable air filtration solutions for various industrial applications.

Segments Covered in the Report

By Vehicle Type

- Compact Passenger Car

- Mid-Sized Passenger Car

- Premium Passenger Car

- Luxury Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Off-Road Vehicles

- Powersports

- Lawn Mowers

By Sales Channel

- OEMs (Original Equipment Manufacturers)

- OESs (Original Equipment Suppliers)

- IAM (Identify and Access Management)

By Filter Medium

- Synthetic Filters

- Cellulose Filters

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting