Stereotactic Surgery Devices Market To Attain Revenue USD 41.05 Bn By 2032

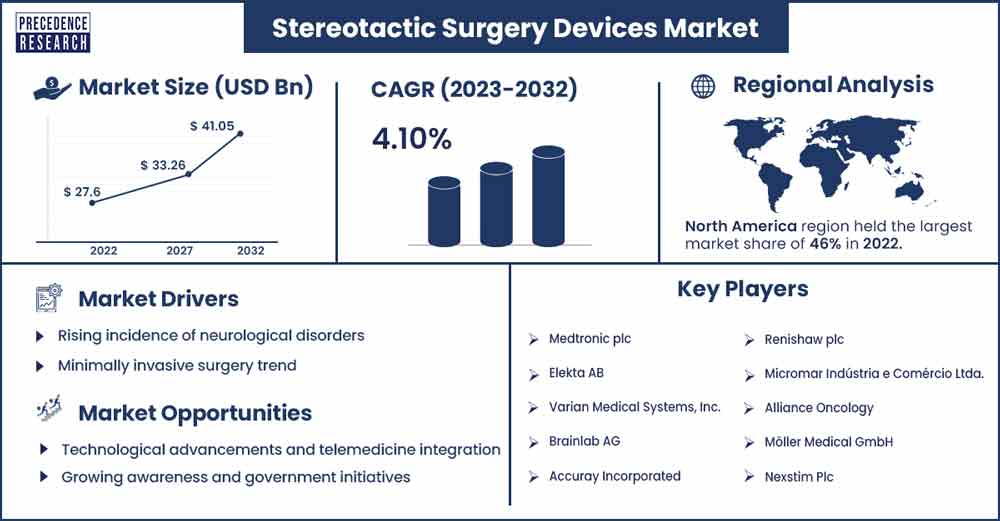

The global stereotactic surgery devices market revenue was evaluated at USD 27.6 billion in 2022 and is expected to attain around USD 41.05 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Market Overview

Stereotactic surgery refers to a minimally invasive form of surgical intervention that utilizes a three-dimensional coordinate system to precisely locate and target small areas within the body. This technique is often employed in neurosurgery to treat conditions within the brain. Stereotactic surgery devices are specialized tools and equipment designed to assist surgeons in performing these procedures with a high degree of accuracy. The applications of stereotactic surgery include the treatment of brain tumors, functional neurosurgery such as deep brain stimulation for movement disorders, epilepsy surgery, and biopsies of brain lesions.

The stereotactic surgery devices market is driven by various factors including rising incidence of neurological disorders, growing demand for minimally invasive procedures, advancements in imaging technology, increased understanding of brain function, collaboration between technology and healthcare and regulatory supports and standards. Furthermore, the growing product launch is expected to drive market expansion over the projected timeframe.

For instance, in August 2023, Mammotome announced the release of a novel HydroMARKTM Plus Breast Biopsy Site Marker that is intended to reduce displacement during surgical operations, increase ultrasound visibility, and make finding easier. The device is an excellent addition to the HydroMARKTM tissue marker line, which is among the best-selling breast biopsy marker brands globally.

- According to the U.S. Centers for Medicare & Medicaid Services, the average growth rate of the NHE (5.4%) is predicted to exceed the average GDP growth (4.6%) between 2022 and 2031, leading to a rise in the GDP share of health spending from 18.3 percent in 2021 to 19.6 percent in 2031.

- According to the World Health Organization, an estimated 5 million individuals receive an epilepsy diagnosis each year worldwide. An estimated 49 out of every 100,000 individuals are diagnosed with epilepsy in high-income nations each year. In nations with lower and moderate incomes, this number may reach up to 139 per 100,000. This is probably because there are more endemic diseases like neurocysticercosis and malaria; there are more traffic accidents and birth-related injuries; there are differences in the medical infrastructure; and there are less accessible treatment options and preventative health programs available. Nearly 80% of epileptics reside in low- and middle-income nations.

Regional Insights

North America is expected to hold the largest market share over the forecast period. The market growth in the region is attributed to the growing prevalence of neurological disorders. The region has a relatively high prevalence of neurological disorders, including brain tumors, Parkinson’s disease, and epilepsy. The demand for precise and minimally invasive surgical interventions to treat these conditions creates a favorable market for stereotactic surgery devices.

- For instance, according to a 2022 Parkinson's Foundation-sponsored research, around 90,000 Americans receive a Parkinson's disease diagnosis each year. Comparing this to the earlier predicted rate of 60,000 diagnoses yearly, there has been a sharp 50% rise. Furthermore, the same study projects that by 2030, 1.2 million Americans will have Parkinson's disease.

In the region, the US represents the largest market share over the forecast period. This is attributed to the presence of the developed healthcare infrastructure. The country boasts advanced healthcare infrastructure with state-of-the-art medical facilities, research institutions, and a skilled workforce. This infrastructure supports the adoption of cutting-edge technologies, including stereotactic surgery devices, in both academic and clinical settings. Additionally, the presence of relatively favorable reimbursement policies for medical procedures and devices in the country supports the adoption of stereotactic surgery. Reimbursement plays a crucial role in incentivizing healthcare providers to invest in and offer these advanced surgical techniques.

Stereotactic Surgery Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 28.59 Billion |

| Projected Forecast Revenue by 2032 | USD 41.05 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising incidence of neurological disorders

The increasing prevalence of neurological disorders, such as brain tumors, movement disorders, and epilepsy, drives the development of stereotactic surgery devices. These devices offer effective treatment options with reduced risks and faster recovery times compared to traditional open surgeries. For instance, according to the American Society of Clinical Oncology (ASCO), a projected 24,810 persons in the US (14,280 men and 10,530 women) will have an initial malignant tumor diagnosis in their brain or spinal cord in 2023.

Less than 1% of people will ever have this kind of tumor in their lives. 85% to 90% of primary cancers of the central nervous system (CNS) are brain tumors. 2020 saw an anticipated 308,102 cases of primary brain or spinal cord tumors identified worldwide. Furthermore, it is projected that in 2023, 5,230 children under the age of 20 will receive a CNS tumor diagnosis in the US.

Miniaturization and robotics

The trend towards miniaturization of surgical instruments and the integration of robotics contribute to the refinement and precision of stereotactic surgery. Miniaturized instruments enable less invasive procedures, while robotic assistance can provide surgeons with enhanced control and accuracy during surgery.

Restraints

Limited access to advanced healthcare facilities

The adoption of stereotactic surgery devices may be limited in regions with inadequate access to advanced healthcare facilities. Smaller hospitals or those in remote areas may face challenges in acquiring and maintaining the necessary infrastructure and expertise for stereotactic surgeries.

Risk of complications

While stereotactic surgery is generally considered minimally invasive, there are potential risks and complications associated with any surgical procedure. The precise nature of these procedures means that any error in planning or execution could have significant consequences. Concerns about potential complications may impact the acceptance of these devices. Thus, acting as a major restraint to the market growth.

Opportunities

Growing collaboration

The increasing collaboration is expected to propel the market growth over the forecast period. For instance, in April 2022, Elekta and GE Healthcare announced the signing of a global commercial partnership agreement in radiation oncology. This arrangement allows Elekta to provide hospitals with a full range of services, including imaging and treatment, for patients with cancer who require radiation therapy. Elekta and GE Healthcare want to address the significant need for radiation solutions in both established and developing countries as hospitals look for more adaptable and interoperable simulation and orient technologies.

Growing awareness and government initiatives

Educating healthcare professionals and patients about the benefits of stereotactic surgery can create opportunities for market growth. Awareness campaigns and training programs can help overcome the learning curve associated with these technologies, encouraging their adoption by surgeons and healthcare institutions. Moreover, government initiatives and funding for healthcare infrastructure development, research, and technology adoption can create a conducive environment for the growth of the stereotactic surgery devices market. Public-private partnerships and funding programs can support research and innovation in this field.

Recent Development

- In May 2023, the advantages of Accuray Incorporated's CyberKnife® and TomoTherapy® platforms, which include the most recent generation Radixact® System, were reaffirmed by fresh data that was presented at the European Society for Radiotherapy and Oncology (ESTRO) meeting. At the 2023 ESTRO annual congress in Vienna, Austria, more than 55 abstracts showcasing Accuray technologies were given. These abstracts enhanced the clinical evidence already in place and supported the systems' use in delivering (ultra) hypofractionated radiation treatments for the precise and customized treatment of a variety of cancers.

- In February 2023, Premier company Inter (PBI), Elekta's existing distributor of solutions and services in Thailand, agreed to sell company assets to Elekta. Elekta will be able to better serve its Thai clientele and solidify its place in a robust market with the potential to grow with this direct presence.

- In May 2022, the Austrian business medPhoton, which develops robotic imaging equipment for image-guided surgery and radiation therapy, was acquired by digital medical technology company Brainlab for a majority share.

Key Market Players

- Medtronic plc

- Elekta AB

- Varian Medical Systems, Inc.

- Brainlab AG

- Accuray Incorporated

- Renishaw plc

- Micromar Indústria e Comércio Ltda.

- Alliance Oncology

- Möller Medical GmbH

- Leica Microsystems (Danaher Corporation)

- Nexstim Plc

- FHC, Inc.

- Isomedix, Inc. (Sterigenics)

- Inomed Medizintechnik GmbH

- Monteris Medical Inc.

Market Segmentation

By Product

- Gamma Knife

- LINAC

- PBRT

- CyberKnife

By Application

- Liver

- Breast

- Prostate

- Lung

- Colon

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3330

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308