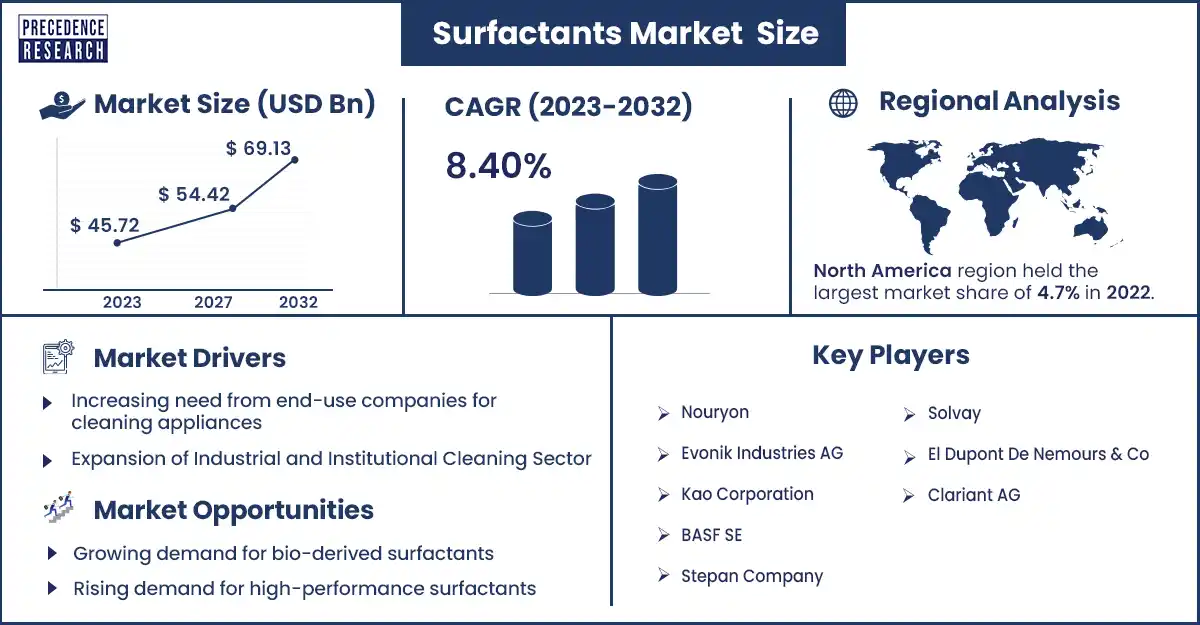

Surfactants Market Size to Attain USD 69.13 Billion by 2032

The global surfactants market size was evaluated at US$ 45.72 billion in 2023 and is expected to attain around US$ 69.13 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Market Overview

The surfactants market refers to the industry that produces chemicals used in products such as detergents and personal care items. Surfactants are the most significant products of the chemical industry. They are frequently used in every industrial area, fluctuating from household detergents to drilling muds and food and beverage items to pharmaceutical companies. Surfactants are found naturally in traditional plant-based detergents. They play a significant role in cleaning, dispersing, wetting, emulsifying, foaming, and anti-foaming agents. They are used in agrochemical formulations such as insecticides, pesticides, and sanitizers, as well as personal care products such as cosmetics, shower gel, shampoos, and hair conditioners. Sometimes surfactants are used in car engine lubricants, which significantly helps to keep particles away from sticking to the engine parts. There are so many factors that may be responsible for the growth of the surfactant market.

Regional Snapshot

North America dominated the surfactants market in 2023. This region has the largest share in the global market in recent years. The market is expected to increase during the forecast period due to an increase in demand. There is an increase in biochemical-based surfactants in North America.

A similar arrangement was made with surfactants ferment specialist Locus Performance Ingredients to supply Dow with chlorolipids for the home and personal care sectors. The agreement's scale-up distribution feature, according to Isabel Alimiro do Vale, Dow's global marketing director for personal care, will allow for democratic access to chlorolipids.

Competitor to Sasol in North America, BASF, has an agreement with Holiferm and a controlling stake in Alliened Carbon Solutions, a Japanese manufacturer of sophorolipids. Vice President of BASF's North American personal care business management, Nader Mahmoud, told the company he planned to take the lead in biosurfactants.

Asia Pacific is the fastest growing in the forecast period. In India, China, and Japan, there is increasing demand for household care and personal care products. Due to lower production costs and worker costs in the APAC region, the requirement is expected to grow. The European market is also undergoing market growth due to a rise in the demand for household care and personal care products. Due to the biggest fashion industry in Europe, there is an increase in cosmetics and textile companies, thereby leading to rising demand for the surfactants market. For instance;

- In Egypt and India, U Shekhar, the MD of Galaxy Surfactants' founder and promoter, stated that the company's capacity to recognize and seize opportunities is demonstrated by the company's expansion in Egypt and consistent success in India.

Surfactants Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 45.72 Billion |

| Projected Forecast Revenue by 2032 | USD 69.13 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.7% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing need from end-use companies for cleaning appliances

In companies such as retail businesses, healthcare, hospitality, cosmetics, personal care, and various institutions, there is a straight client interaction; thus, these companies and institutions concentrate on cleanliness. Moreover, surfactant plays a significant role in cleaning products as it is extensively used in so many products and formulations to develop the benefits of cleaning solutions. Therefore, the demand for surfactants in the market is increasing in end-use industries.

Restraint

Encounter competition from rival formulations

The products that are made from natural surfactants, polymers and enzymes are shows improved performance than surfactants. These products are eco-friendly and affordable in rates. They can create a restraint for surfactants. Because of these substitutes requirement for surfactants cab reduce, which is might control the growth and act as challenge on the growth of the surfactants market.

Opportunities

Growing demand for bio-derived surfactants

Bio-derived surfactants have been studied to be more naturally friendly as compared to traditional surfactants. Also, the rising essentiality for bio-derived surfactants permits substantial possibilities for producers working in the surfactants market. In addition, many regions have permitted regulations managing the use of bio-derived surfactants due to their low eco-friendliness and toxicity. This has led to an increase in demand for surfactants, which generates an opportunity for manufacturers to tap into this growing market.

Rising demand for high-performance surfactants

There is an increasing demand for surfactants that can offer highly superior performance in a variety of applications. For instance, the requirement for surfactants that can be used in cold water washing machines is increasing, as customers are vastly looking for ways to save or restore energy. Producers that can develop and create high-performance surfactants will be able to order at an affordable price. This factor might be responsible for driving the growth of the surfactants market.

Recent Developments

- In September 2023, with the introduction of EcoSense 2470 surfactants by Dow, the company gave customers a sustainable way to meet their formulation goals while addressing cutting-edge carbon capture technology for the home care industry. This surfactant, which they developed in partnership with Lanza Tech Global Inc., helps to promote a circular carbon economy without compromising performance. The carbon reuse industry converted waste carbon into sustainable raw resources.

- In February 2023, in an effort to swap out toxic components for organic, plant-based alternatives. The agricultural firm Pangaea Biosciences Ltd. has introduced a novel plant-based surfactant formulation method designed to preserve soil health and biodiversity. When these surfactants are applied to plants, they kill the fungi and bacteria in the soil, which lowers soil fertility and overall health.

- In February 2022, Clariant introduced polyethylene glycol and a 100% biochemical-based surfactant called Vita. By removing fossil carbon from the value chain, it contributes to the direct labeling of climate change. The whole range of polyethylene glycols and Vita surfactants is reliant on sustainable, bio-based carbon derived from plants.

Key Market Players

- Nouryon

- Evonik Industries AG

- Kao Corporation

- BASF SE

- Stepan Company

- Solvay

- El Dupont De Nemours & Co

- Clariant AG

Market Segmentation

By Type

- Anionic Surfactants

- Linear alkyl benzene

- Fatty alcohol ether sulfates

- Fatty alcohol sulfates

- Sulfosuccinates

- Others

- Non-ionic Surfactants

- Fatty Alcohol Ethoxylates (FAE)

- Alkyl Phenol Ethoxylates (APE)

- Others

- Cationic Surfactants

- Amphoteric Surfactants

- Others

By Origin

- Synthetic Surfactants

- Bio-based Surfactants

- Chemically Synthesized Bio-based Surfactants

- Biosurfactants

By Application

- Home Care

- Personal Care

- Oilfield Chemicals

- Food & Beverage

- Agrochemicals

- Textiles

- Plastics

- Industrial & Institutional Cleaning

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1728

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308