Surgical Tables Market Size To Attain Around USD 2.7 Bn By 2030

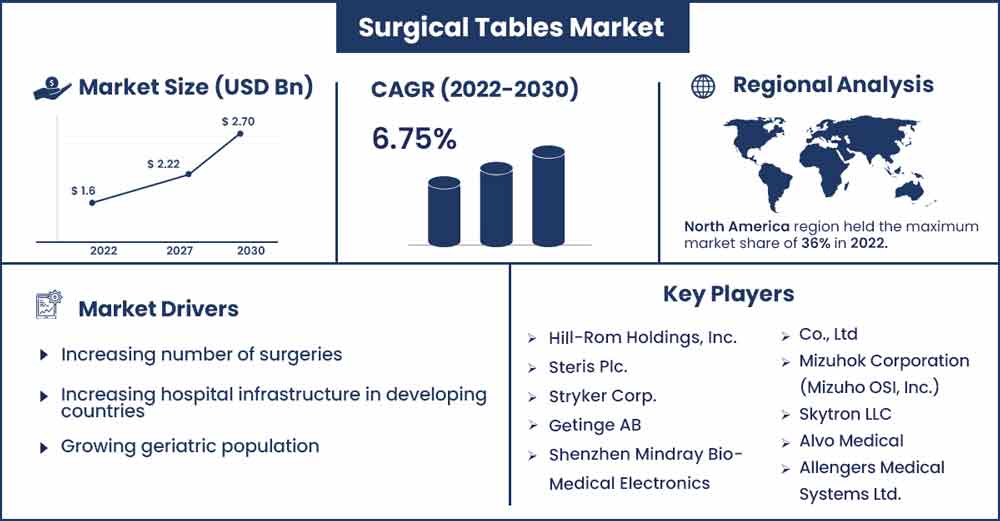

The global surgical tables market size was evaluated at USD 1.6 billion in 2022 and is expected to attain around USD 2.7 billion by 2030, growing at a CAGR of 6.75% from 2022 to 2030.

The increase in surgeries worldwide is the main element contributing to the market's expansion. This is a result of the rise in trauma and injury cases worldwide. Furthermore, as end-stage chronic diseases typically necessitate surgery, the rising burden of chronic disease around the world is another important reason driving up the demand for surgical tables. For instance, according to the American Health Association, operating rooms restarted their operations in 2022 and saw an increase in medical health treatments and surgeries.

As a result, the rate of surgery at the end of 2020 was only 10% lower than it was in 2022. Additionally, according to the Organization for Economic Cooperation and Development (OECD), Turkey reported performing 393,901 cataract operations in 2020. The same source estimates that 84,647 hip replacement surgeries and roughly 114,601 cesarean sections were performed in Italy in 2020. As a result, the rise in surgical procedures will probably lead to a rise in the demand for surgical tables, which would help the market grow.

Regional Snapshots:

The North American region held the largest market share in 2022. This can be due to the increase in chronic diseases such as those affecting the eyes, heart, and nervous system. Additionally, it is projected that the expansion of the regional market would be fueled by technical advancements and an increase in the number of surgical procedures. In addition, the presence of reputable hospitals and trauma centers as well as key firms operating in the U.S. are fostering market expansion. The second-largest market share was held by the Europe region, which is anticipated to expand at a noteworthy CAGR over the forecast period. According to estimates, market players would have profitable growth prospects as a result of the increased frequency of chronic diseases in European nations.

The demand for surgical tables is significantly increased by the growing elderly population, who frequently need procedures. In turn, it is projected that this will accelerate regional market expansion. During the forecast period, Asia Pacific is expected to develop at the quickest CAGR. The availability of a sizable patient pool in the area, together with rising disposable income, particularly in nations like China and India, are expected to promote market expansion. The need for surgical tables is increasing since more surgeries are being conducted as a result of an increase in the frequency of chronic diseases. Additionally, during the course of the projection period, rising healthcare costs in China and Japan are anticipated to fuel product demand.

Surgical Tables Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.71 Billion |

| Projected Forecast Revenue by 2030 | USD 2.7 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 6.75% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- Due to the rising number of surgeries, particularly in cardiovascular, ENT, gynecologic, and other general procedures, the general surgical tables category will have a bigger market share in the upcoming year. The prevalence of cardiovascular disorders (CVDs) is rising, which is also significantly driving up demand for operating tables.

- In 2022, the metal sector led the market in terms of materials. This segment's expansion is anticipated to be aided by increased adoption as well as rising demand for metal surgical tables due to their affordability and ease of availability. The market has also been divided into powered and non-powered surgical tables under the type category.

- In 2022, the powered category controlled the market and had the largest revenue share. Battery power is frequently used in powered surgical tables, eliminating the need for electrical wires on the floor.

- The hospital end-use category ruled the global market. Because hospitals are available for primary care in the majority of developing nations worldwide and have favorable payment policies, hospitals do more procedures than any other type of healthcare facility.

Market Dynamics:

Drivers:

Among the most frequent general procedures are those in the fields of cardiology, gastrointestinal, ENT, orthopedic, and gynecological. The need for general surgical tables is considerable due to the market's significant penetration of general operations. The general surgical tables are the ones that a patient lies on while undergoing surgery. Since they are utilized in more hospitals and in fewer cases than specialist tables, their demand is larger than that of specialty tables.

As a result, the market expansion accelerates along with the growth in surgical procedures. Studies of the market are another key in its expansion. For instance, according to a research study published in September 2020 titled "Estimation of the National Surgical Needs in India by Enumerating the Surgical Procedures in an Urban Community Under Universal Health Coverage," 3,646 surgeries would be needed each year to meet the surgical needs of the Indian population, as opposed to the 5,000 sutures estimated for the global population. As a result, the category will rise over the projection period due to the increasing demand for surgeries globally.

Restraints:

The expansion of the surgical table industry, however, may be hampered by a lack of qualified personnel to operate the sophisticated surgical tables. There is a sharp reduction in the number of trained experts handling the surgical table, primarily in emerging and underdeveloped countries, despite the increased number of surgeries due to different variables leading to an increase in healthcare expenditure around the globe. Additionally, the high price of composite surgical tables makes the market demand in less developed economies rather difficult.

Challenges:

The high price of composite surgical tables is a major challenge that is anticipated to impede the market's revenue growth. They are constructed of carbon fibers and are better than metallic surgical tables, but their high price and labor-intensive, highly specialized manufacturing methods are projected to restrain the market's ability to grow in terms of revenue. Additionally, for the optimal use of numerous features like as the sliding top, procedure-specific patient movement, spilt legs, and others, a technologically advanced surgical table demands a sufficient level of knowledge and ability. The market's predicted revenue growth would also be hampered by a lack of competent human resources, particularly in developing and underdeveloped nations, to operate these tables.

Recent Developments:

- In December 2021 - Stille and GE Healthcare collaborated to introduce the GS2 surgical table in the United States. In multifunctional surgery units like ambulatory surgical centres, GS2 is useful for surgical procedures. With this launch, the business was able to solidify its position in the American market, and the acquisition gave it a competitive advantage over other businesses.

Major Key Players:

- Hill-Rom Holdings, Inc.

- Steris Plc.

- Stryker Corp.

- Getinge AB

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Mizuhok Corporation (Mizuho OSI, Inc.)

- Skytron LLC

- Alvo Medical

- Allengers Medical Systems Ltd.

Market Segmentation:

By Product

- General Surgical Beds

- Specialty Surgical Beds

- Bariatric Surgical Beds

- Neurosurgical Surgical Beds

- Laparoscopic Surgical Beds

- Orthopedic Surgical Beds

- Radiolucent Surgical Beds

- Pediatric Surgical Beds

By Type

- Powered

- Electric

- Hydraulic

- Hybrid

- Non-powered

By Material

- Metal

- Carbon Composite

By End-Use

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics & Trauma Centers

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2267

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308