A Strategic Outlook to U.S. 503B Compounding Pharmacies Market

U.S. 503B Compounding Pharmacies Market Driven by Rising Demand for Sterile Outsourcing and Customized Therapies

The U.S. 503B compounding pharmacies market has entered a pivotal phase of transformation, driven by stringent quality standards, growing hospital dependence on sterile outsourcing and the expanding demand for customized therapeutic solutions. 503B outsourcing facilities, authorized under the Federal Food, Drug & Cosmetic Act occupy a crucial space between traditional compounding and pharmaceutical manufacturing.

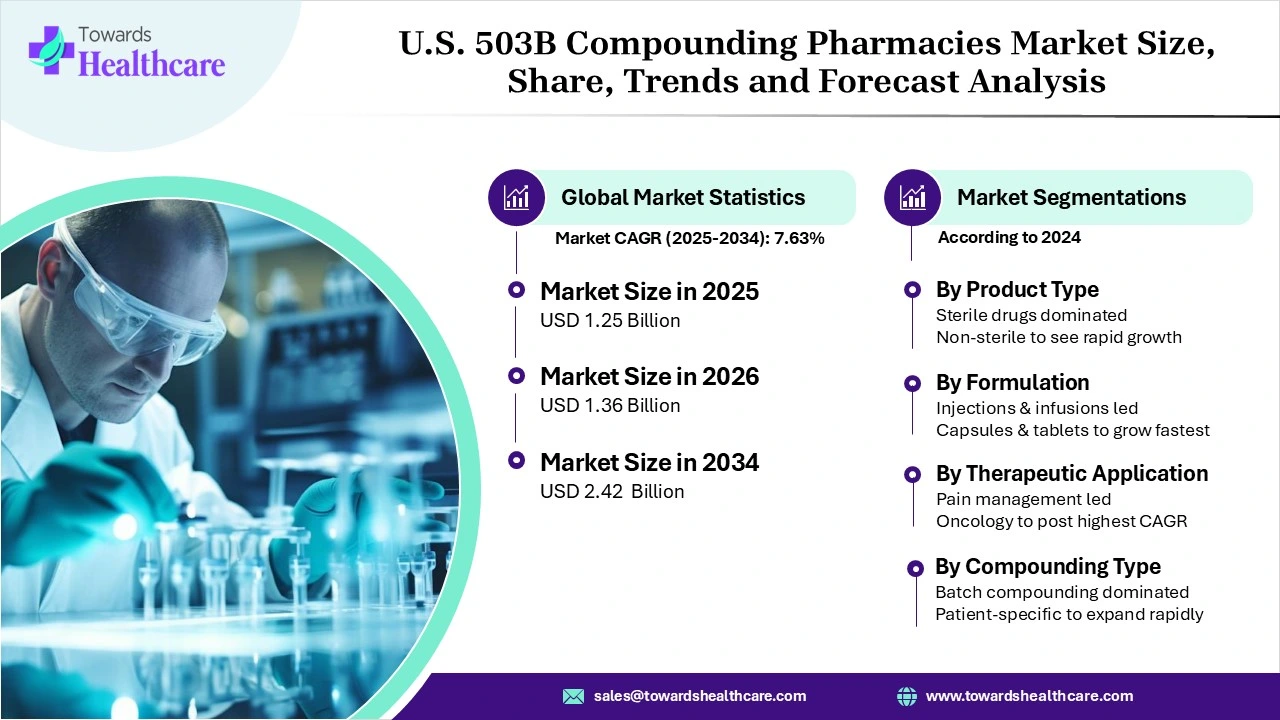

According to Towards Healthcare data, the U.S. 503B compounding pharmacies market size is predicted to expand from USD 1.25 billion in 2025 to USD 2.42 billion by 2034, growing at a CAGR of 7.63% during the forecast period from 2025 to 2034.

Key Market Trends Shaping 2025 and Beyond

1. Hospital Outsourcing on the Rise

Drug shortages in critical care, oncology, and anesthesia have pushed hospitals to rely on 503B providers for bulk, ready-to-use sterile injectables. This trend has solidified the role of 503B facilities as integral partners in hospital supply chains.

2. Automation and Digitalization

Advanced robotics, cleanroom monitoring, and real-time digital validation systems are transforming quality control. Facilities integrating automated compounding systems are reducing error rates by over 50%, improving sterility assurance, and enhancing production efficiency.

3. Non-Sterile Expansion

While sterile products dominate today, non-sterile compounding is accelerating with innovations in controlled environment processing and the growing use of oral dosage forms for personalized medicine and clinical trials.

4. Regional Performance

The Northeast U.S. continues to lead in total market revenue due to high hospital density and established pharmaceutical hubs, while the Southern region is projected to experience the fastest growth through 2034, fueled by new outsourcing facilities and supportive state-level incentives.

Strategic Outlook:

1. Ongoing Hospital Demand for Sterile Outsourcing

Recent surveys indicate that over 60% of U.S. hospitals now source sterile compounded medications externally to ensure compliance with cGMP standards and reduce internal operational burdens. This trend has particularly accelerated in high-demand therapeutic categories such as anesthesia, oncology, and pain management, where ready-to-administer sterile injectables and prefilled syringes help improve patient safety and workflow efficiency.

2. Integration of AI-Enabled Quality Control Systems

To meet FDA’s stringent cGMP standards, leading 503B facilities are adopting AI and digital automation tools for precision, sterility assurance, and predictive maintenance. AI systems monitor temperature, humidity, and particulate levels in cleanrooms in real time, automatically flagging deviations that could compromise batch quality.

3. Consolidation Among Outsourcing Facilities for Scalability and Compliance Efficiency

High operational costs, ongoing FDA audits, and expensive cleanroom infrastructure are driving consolidation across the 503B sector. The market, currently valued at USD 1.25 billion in 2025, is moderately fragmented, with about 50–60 large outsourcing facilities serving most U.S. hospitals.

Case Study – Empower Pharmacy (Houston, Texas):

Empower, one of the largest U.S. 503B outsourcing facilities, expanded its annual revenue from roughly USD 119 million in 2022 to over USD 370 million in 2024, largely due to strong demand for compounded injectables such as weight-management and hormone therapies. The company’s recent expansion into a 170,000 sq ft sterile manufacturing facility in New Jersey illustrates the industry’s growing scale and investment momentum.

Recent Developments and Strategic Announcements

- In October 2025, the U.S. 503B compounding market received fresh attention following major investment and capacity expansion announcements from several leading outsourcing facilities. The FDA also updated its guidance on compounded sterile preparation and quality audits, reinforcing stricter documentation and environmental monitoring protocols for outsourcing manufacturers.

- A notable regulatory milestone came in March 2025, when the FDA resolved the national shortage of semaglutide injection products and announced a phased discontinuation for compounding under 503A and 503B licenses by May 2025. This move highlighted the growing importance of responsive production planning and compliant sourcing within the sector.

Source: https://www.towardshealthcare.com/insights/us-503b-compounding-pharmacies-market-sizing