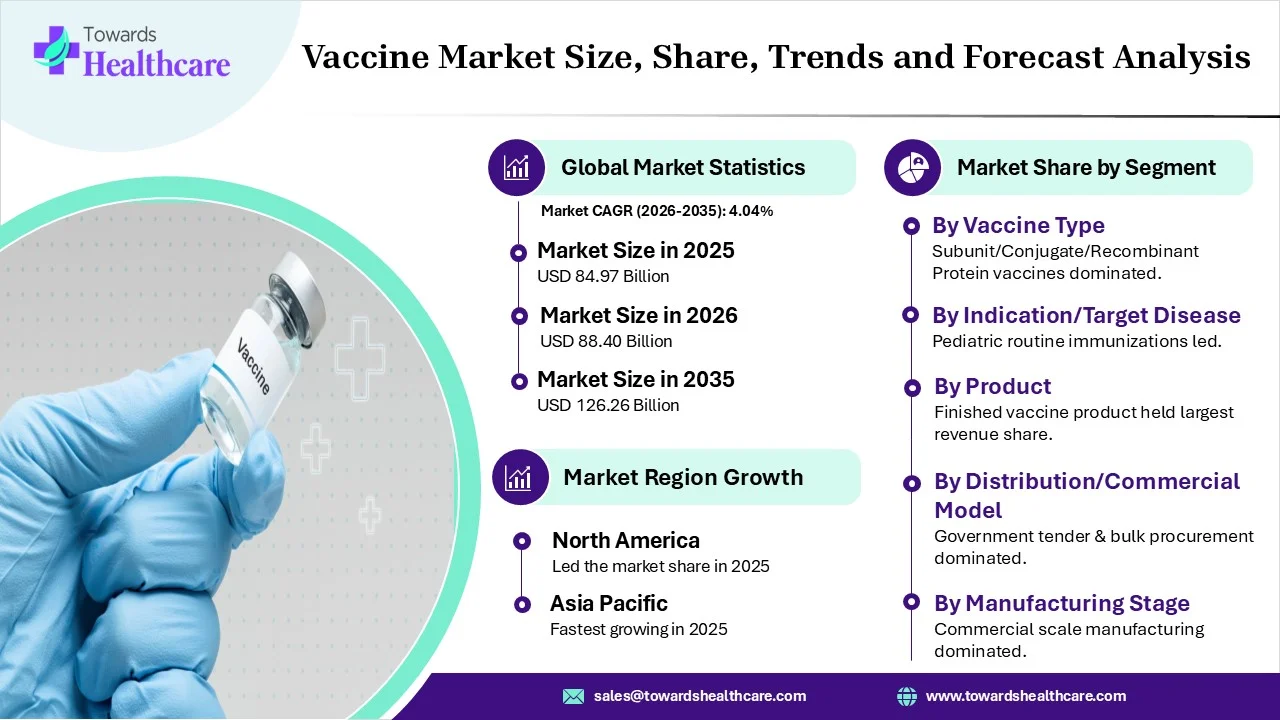

Vaccines Market to Grow at a 4.04% CAGR, Reaching USD 126.26 Billion by 2035, Driven by Rising Infectious Diseases and Strong Immunization Programs

The global vaccines market size is calculated at USD 84.97 billion in 2025, grew to USD 88.40 billion in 2026, and is projected to reach around USD 126.26 billion by 2035. The market is expanding at a CAGR of 4.04% between 2025 and 2034. Globally accelerating incidences of infectious diseases, greater demand for preventive healthcare, and prominent government encouragement in immunization programs are propelling the global market expansion.

Segmental Outlook

Which Vaccine Type Led the Vaccines Market in 2024?

In 2024, the subunit/conjugate/recombinant protein vaccines segment was dominant in the market. Their adoption is fueled by the fact that vaccines cannot replicate or cause disease, making them ideal for immunocompromised individuals. While recombinant technology is highly employed in the creation of VLPs that are non-infectious, immensely immunogenic, & mimic the structure of the virus.

The mRNA and other nucleic-acid vaccines segment will expand rapidly. This kind is stepping from traditional, pathogen-based vaccines to genetic instructions to enable host cells to develop antigens. Also, leaders are fostering self-amplifying RNA (saRNA) and Circular RNA (cRNA), with robust steps in advancing delivery solutions and stability approaches.

Why did the Pediatric Routine Immunizations Segment Dominate the Market in 2024?

The pediatric routine immunizations segment registered dominance in the market in 2024. This mainly focuses on BCG (TB), DTP (Dip-Tet-Pertussis), OPV/IPV (Polio), Hepatitis B, Measles/MR, Rotavirus (RVV), & Pneumococcal Conjugate Vaccine (PCV). Ongoing developments include the launch of hexavalent, i.e. 6-in-1 vaccines to lower clinic visits and injections.

The seasonal respiratory vaccines segment is estimated to expand fastest. It is driven by a rise in cases of influenza, COVID-19, and Respiratory Syncytial Virus (RSV), with strengthening steps into cell-based and mRNA technologies. The WHO and FDA are promoting trivalent (TIV) rather than quadrivalent (QIV) vaccines, eliminating the B/Yamagata lineage.

Which Product Led the Vaccines Market in 2024?

In 2024, the finished vaccine product segment registered dominance in the market. Its production has been boosted by using single-use technology (SUT), which reduces contamination risks, escalates facility setup, and allows smaller, more flexible production footprints. Also, researchers are emphasizing the revolution of thermostable formulations and newer delivery systems, like microneedle patches (MAPs).

How did the Government Tender & Bulk Procurement Segment Dominate the Market in 2024?

The government tender & bulk procurement segment led the market. Current notification includes Bharat Biotech will initiate supplying the world’s first malaria vaccine (RTS, S) to Gavi starting in 2026. Also, the ICMR has vegan Phase I trials for an indigenous vaccine against Kyasanur Forest Disease (KFD).

Moreover, the advance purchase agreements (APAs) & pandemic pre-buy mechanisms segment will expand rapidly. APAs are supporting manufacturers to bolster production & invest in R&D before clinical trial results are available. Innovative landscapes are using mechanisms to strongly serve Low- and Middle-Income Countries (LMICs), like utilizing option contracts instead of full commitments.

Why did the Commercial Scale Manufacturing Segment Lead the Market in 2024?

In 2024, the commercial scale manufacturing segment captured a major share of the market. Specifically, vaccine manufacturers are highly aligning with CDMOs to access specialized technology, raise efficiency, and minimize capital investment. To lower cross-contamination, they are widely using single-use bioreactors, mixers, and filtration systems.

However, the contract manufacturing segment will witness rapid growth. This enables companies to transition greater fixed capital expenditures into variable spending, using the developed, high-quality facilities of large-scale leaders, including Lonza and Samsung Biologics.

Regional Outlook

How did North America Dominate the Market in 2024?

North America led the vaccines market due to the deviating regulatory solutions to childhood immunizations, major investment in mRNA technology, and steps to highlight post-pandemic vaccine hesitancy. Alongside, all 50 U.S. states made school-entry vaccine mandatory, whereas only 3 of 13 Canadian provinces/territories have similar mandatory requirements.

How is the Asia Pacific Expanding Fastest in the Market?

APAC is highly promoting mRNA, viral vector, and therapeutic vaccine innovation, with cost-effective, high-volume production, like with COVAXIN & COVISHIELD. India has been exploring AI for vaccine discovery and escalating its capacity to develop advanced vaccines, especially rabies immunoglobulin, focused on Zero by 30.

Latest Launches

- In February 2026, Ghana’s Parliament officially introduced the Parliamentarian Caucus on Immunization to protect its children, revolutionizing immunization from a health service into a top-tier national health priority.

- In December 2025, the University of Oxford unveiled the world’s first Phase II clinical trial of a Nipah virus vaccine candidate.

Vaccine Market Key Players

- Pfizer/BioNTech

- Moderna

- Johnson & Johnson (Janssen)

- GlaxoSmithKline (GSK)

- Sanofi Pasteur

- Merck & Co. (MSD)

- AstraZeneca

- Novavax

- Sinovac Biotech

- Sinopharm (CNBG)

- Serum Institute of India (SII)

- CSL Seqirus

- Bharat Biotech

- Takeda Vaccines

- Valneva

- Bavarian Nordic

- Emergent BioSolutions

- CureVac/CureVac-type developers

- Bavarian Nordic

Segments Covered in the Report

By Vaccine Type

- Subunit/conjugate/recombinant protein vaccines

- mRNA & other nucleic-acid vaccines (mRNA, DNA)

- Live attenuated vaccines

- Inactivated/killed vaccines

- Viral-vector vaccines (replicating & non-replicating)

- VLPs (virus-like particles) & peptide vaccines

- Therapeutic vaccines (oncology, chronic infections)

By Indication/Target Disease

- Pediatric routine immunizations (MMR, DTP, polio, Hib)

- Seasonal respiratory vaccines (influenza, RSV, COVID variants)

- Travel & adult vaccines (hepatitis, typhoid, meningococcal)

- Emerging/infectious disease outbreak vaccines (Ebola, chikungunya)

- Oncology/therapeutic vaccines (neoantigen, viral antigen-based)

- Animal/veterinary (zoonotic control) - adjacent market

By Product

- Finished vaccine product (vials, prefilled syringes)

- Fill-finish & packaging (single dose, multi-dose, cold-chain packaging)

- Adjuvants & formulation components

- Ancillary supplies (syringes, diluents, safety boxes)

By Distribution/Commercial Model

- Government tender & bulk procurement (national immunization)

- Advance Purchase Agreements (APAs) & pandemic pre-buy mechanisms

- Private/commercial sales (retail, employer programs)

- CMO/CDMO supply contracts/B2B partnerships

By Manufacturing Stage

- Commercial scale manufacturing (antigen, fill/finish)

- Contract manufacturing (CDMO: antigen, mRNA lipid nanoparticles, fill-finish)

- Discovery & R&D (preclinical)

- Clinical manufacturing (GMP bulk antigen; clinical lots)

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardshealthcare.com/insights/vaccines-market-sizing