Wireless Network Security Market Revenue, Top Companies, Report by 2033

Wireless Network Security Market Insights

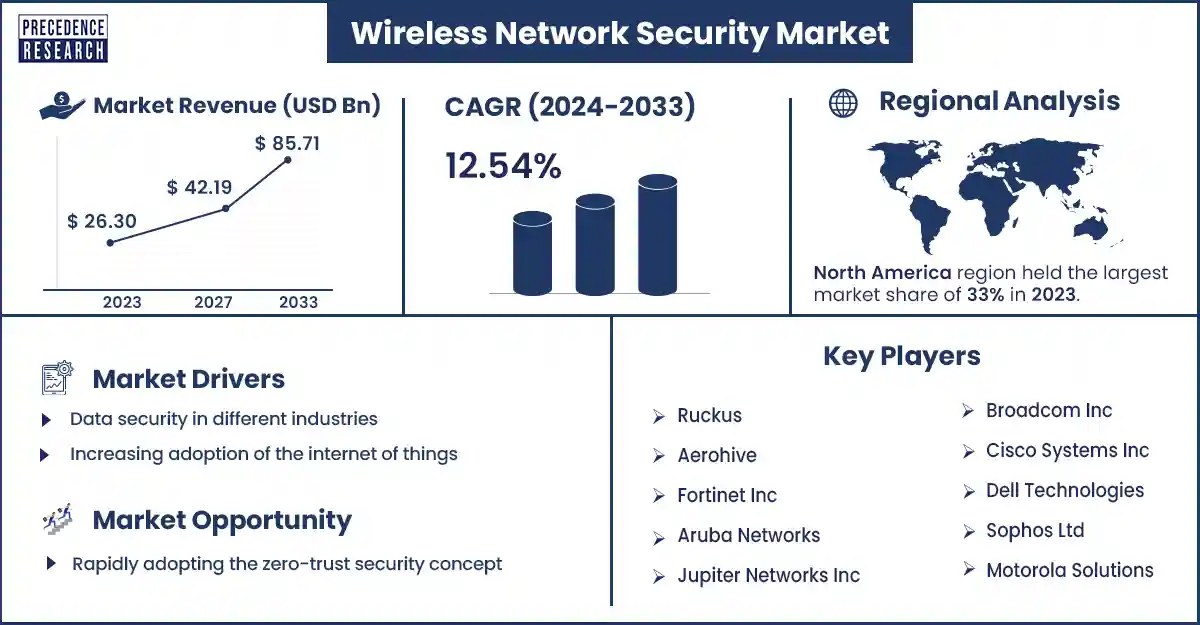

The global wireless network security market revenue was valued at USD 26.30 billion in 2023 and is poised to grow from USD 29.60 billion in 2024 to USD 85.71 billion by 2033, at a CAGR of 12.54% during the forecast period 2024 - 2033. The use of wireless in various industries is driving the growth of the market.

Market Overview

The wireless network security market provides different solutions to data and networks used in different industries, including IT, telecommunications, healthcare, finance, the government sector, and so on. The major factors driving the market include the growing telecommunication sector and the rising adoption of the Internet of Things. The rising trend of bringing your own device (BYOD) and increasing implementation of advanced network technologies across various organizations is creating a positive scope for market growth. Organizations tend to implement a Bring Your Own Device (BYOD) policy to enhance the efficiency and productivity of employees at the workplace.

Protection against cyber-attacks fuels market growth

Though wireless networks have various benefits, they can also create various security issues. This acts as a major driver of wireless network security market growth. Incidents of hacking accounts, data breaches, and other malware practices have increased considerably in the past few years. This enhances the requirement for an enhanced wireless network security solution in various companies. Wireless network security solutions help prevent cyber criminals from stealing personal data and sensitive information and gaining unauthorized access to user’s accounts. The wireless network security software must be updated from time to time as per the latest security requirements.

Growing adoption of BYOD policy across various organizations

Due to the Bring Your Own Device (BYOD) policy, employees are able to carry their own personal devices, such as tablets and laptops. Employees can use these personal devices to get access to corporate data. The rise in cloud-based computing has made the adoption of Bring Your Own Device (BYOD) much easier. This is because the data on the cloud is accessible from anywhere and at any time. BYOD policy tends to reduce infrastructure costs and expenditures.

However, as the BYOD trend is becoming popular, the security of confidential information has become a serious matter of concern. This has compelled organizations to seek highly efficient wireless network security solutions and services. According to reliable statistics from ZIPPIA, 75% of employees use their cell phones for work, and 83% of companies have a BYOD policy of some type as of October 2022. Thus, the rapidly growing BYOD market drives the demand for various wireless network security services and solutions.

However, one significant drawback of wireless security systems over wired alternatives is signal interference from nearby connected devices, which is a restraint for the wireless network security market. Due to a lower connection quality, your wireless security system may become hacked or unreliable if too many devices compete for the same bandwidth and signal strength. Furthermore, there's always a chance that someone may compromise your wireless security system. These systems may be susceptible to outside interference if the necessary precautions are not taken to preserve cybersecurity.

Wireless Network Security Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 26.30 Billion |

| Projected Forecast Revenue by 2033 | USD 85.71 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wireless Network Security Market Top Companies

- Ruckus

- Fortinet Inc

- Aerohive

- Jupiter Networks Inc

- Aruba Networks

- Broadcom Inc

- Sophos Ltd

- Cisco Systems Inc

- Motorola Solutions

- Dell Technologies

Recent Development by Fortinet Inc.

- In May 2024, the industry's first generative AI IoT security assistant, as well as new improvements to its generative AI (GenAI) portfolio to improve network and security operations, were launched today by Fortinet Inc., a global cybersecurity pioneer driving the convergence of networking and security.

Recent Development by HPE Aruba Networks

- In April 2024, Wi-Fi 7 access points (APs) from Hewlett Packard Enterprise (NYSE: HPE) will offer up to 30%* greater wireless traffic capacity than competing devices. The new APs also enhance network security and location-based services to offer connections for demanding business AI, the Internet of Things (IoT), location, and security applications.

Regional Snapshots

Asia Pacific is expected to be the fastest-growing region during the forecast period. China is the major contributor to the wireless network security market, followed by Japan, India, and South Korea. The Chinese Ministry of Industry and Information unveiled a strategy to strengthen data security in the nation's industrial sector by the end of February. By the end of 2026, the plans seek to eliminate "major risks successfully." Data security training and emergency simulations that mimic ransomware attacks are two of the precautions.

They will submit applications to over 45,000 industrial businesses. India and Japan held important discussions in 2023 that offered a tactical chance for improved cyber cooperation. Examining developments in cybersecurity and cutting-edge technology such as 5G, the discussion creates opportunities for mutual development. Developing connections in Information and Communication Technologies (ICT) provides India with a great chance to benefit from common knowledge and developments. Furthermore, India is positioned as a worldwide leader because of its technical breakthroughs, particularly in AI, telecommunications, and new technologies.

North America dominated the wireless network security market in 2023. The two major countries that contribute to the growth of the North American region are the U.S. and Canada. The region is a leader in the adoption of cutting-edge technologies. The market is expanding due to the existence of major organizations, the frequency of network attacks, and the rise in hosted servers in the United States. Additionally, the area has a considerable presence of important market sellers. Among them are Symantec Corporation, Cisco Systems, Juniper Networks, Inc., and Fortinet, Inc.

Furthermore, there has been a noticeable increase in cyberattacks in North America, particularly in the U.S.. Due mainly to the region's fast-growing number of linked gadgets, they have hit an all-time high. Public clouds are used by Americans, and many mobile applications come pre-installed with personal data for ease of use in banking, shopping, communication, and other areas. As smart home environments proliferate in the US, so does the potential for security and privacy risks brought on by malevolent hackers.

Market Potential and Growth Opportunity

Zero trust architecture

The corporate community is rapidly adopting the zero-trust security concept. This method is predicated on the idea that all connections should be confirmed and that no user, device, or network can be considered trustworthy by nature. Network security is greatly increased by using a zero-trust design, which restricts possible sites of attack and mandates stringent access restrictions.

Wireless Network Security Market News

- In February 2024, AT&T launched the first network with integrated security controls; AT&T Dynamic DefenseTM serves as the company's first line of protection. Security is built right into the network without the need for additional hardware, and our on-demand solution gives clients access to security features in minutes rather than weeks or months.

- In June 2023, Verizon Business announced that it would elevate its fixed-wireless business internet offering with a cloud-based router management dashboard and all new native security features. This new development gives customers remote self-service capability to address security, performance, and visibility needs in a centralized location. The company’s fixed-wireless internet solutions are available to businesses of all sizes. Verizon’s wireless security solutions are simple to install and require no special equipment or in-house IT support.

Market Segmentation

By Solutions

- Firewall

- Encryption

- Intrusion Detection System

- Identity & Access Management

- Unified Threat Management

By Services

- Consulting Services

- Security Operations

- Managed Security Services

By End User

- Small & Medium Enterprises

- Large Enterprises

By Industry Vertical

- Government

- IT & Telecommunications

- Aerospace & Defense

- Healthcare

- Retail & E-Commerce

- Manufacturing

- BFSI

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4321

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308