Wireless Sensor Market Revenue, Top Companies, Report 2033

Wireless Sensor Market Revenue and Trends

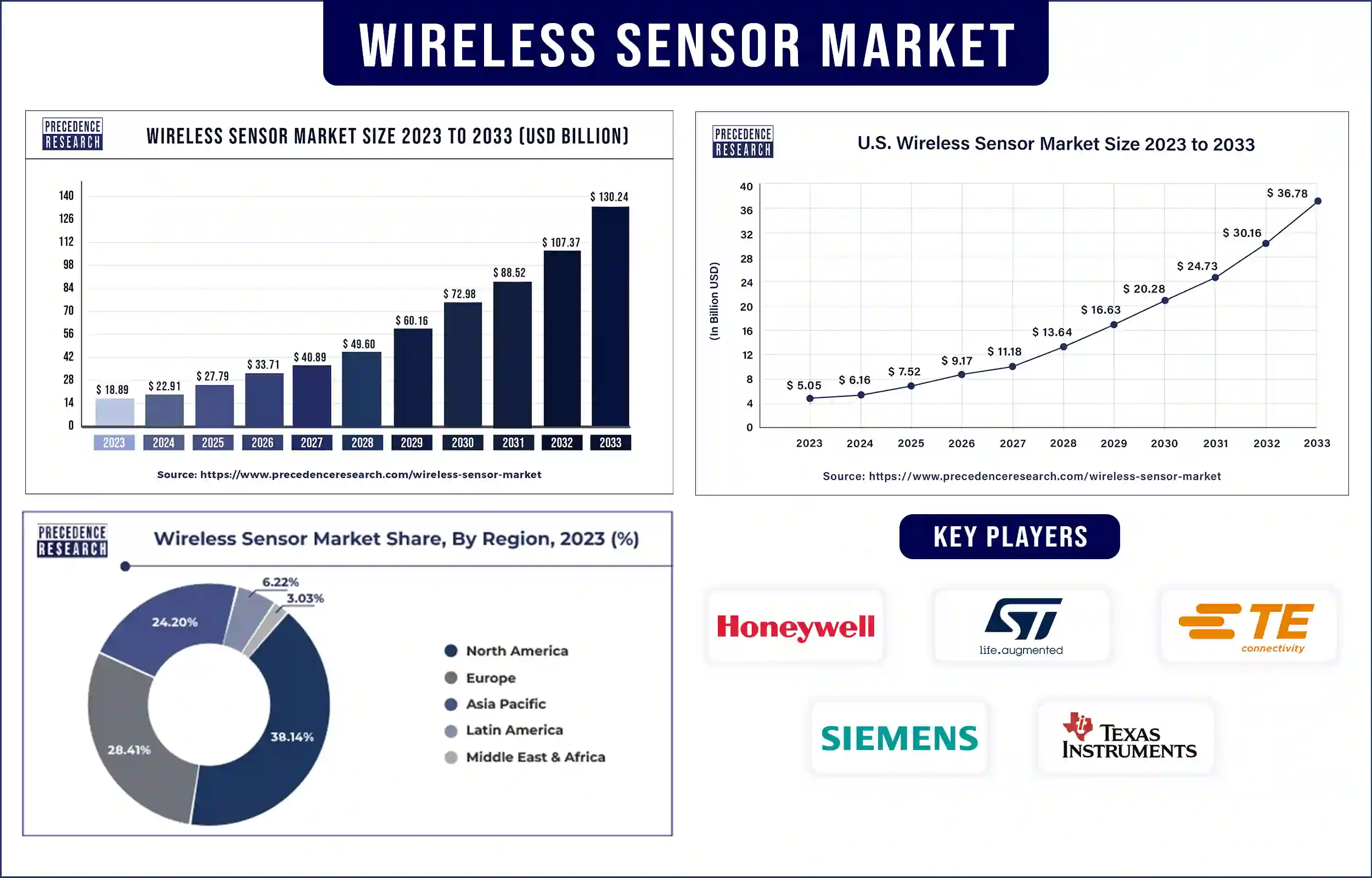

The global wireless sensor market revenue was valued at USD 18.89 billion in 2023 and is poised to grow from USD 22.91 billion in 2024 to USD 130.24 billion by 2033, at a CAGR of 21.3% during the forecast period 2024 – 2033. The increasing sales of IoT-connected devices such as smart speakers, wearables, and others are expected to drive the demand for the wireless sensor market.

Market Overview

The wireless sensor market deals with an enhanced recording and monitoring tool coupled with computing and sensing systems, power components, and radio transceivers. The wireless sensors can calculate real-time physical conditions such as humidity, pollution level, and temperature and share this data with the mainframe to be measured and analyzed.

Additionally, wireless sensors such as monnit sensors and WI-FI sensors are electronic devices that transmit and collect data wirelessly to a computer system or remote receiver. The increasingly strict government norms concerning workforce safety across industries such as energy transmission, oil & gas, and mining, increasing high adoption of IoT in the construction and building sector, and rising development of factories, buildings, and smart cities are expected to drive the market growth. In addition, increasing demand for remote monitoring is further expected to drive the growth and demand for the wireless sensor market over the forecast period.

Wireless Sensor Market Trends

- The rising demand for industrial automation to enhance automation processes and efficiency fuels market growth.

- The rising ongoing developments in communication technologies, such as 5G, are expected to drive market growth.

- The growing trend of smart cities and smart homes and increasing precision in agriculture adoption are anticipated to drive the demand for wireless sensors.

Flexibility, cost-effectiveness, and portability of wireless sensors to fuel the market growth

As compared to wired sensors, wireless sensors are more flexible, as they do not need physical connections between the central control system and sensors. This enables deployment and easier installation, as well as high flexibility in the placement of the sensors. In addition, wireless sensors are typically more cost-effective to maintain and install than any other sensor networks. Wireless sensors do not need installation, and the purchase of wireless infrastructure and expensive cabling is not needed.

Furthermore, as compared to wired sensor networks, wireless sensors are more portable and scalable. They can be easily reduced and expanded in size to address changing needs. This makes them perfect for applications that may need a large number of sensors. These are the major driving advantages that are expected to enhance the growth of the wireless sensor market.

However, the increasing privacy and security concerns may restrain the growth of the market. The increasing high risk associated with security and data privacy-related concerns is one of the major factors that hinder the global market of wireless sensors. If there are no backup or hardcore rules to protect the security and privacy concerns, it may be very difficult for the market to grow significantly. In addition, with a lack of data security, anyone can steal the data and misuse the confidential information related to various organizations and sectors. That's why these restraining factors may hinder the growth and demand for the wireless sensor market.

Wireless Sensor Marke Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 22.91 Billion |

| Market Revenue by 2033 | USD 130.24 Billion |

| Market CAGR | 21.3% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wireless Sensor Market Top Companies

- Sensirion AG

- Versuni

- AMETEK AMS

- IBM Corporation

- Infineon Technologies AG

- Analog Devices, Inc.

- General Electric company

- Schneider Electric SE

- NXP Semiconductors

- Bosch Sensortec

- ABB Ltd.

- Emerson Electric Co.

- Texas Instruments Incorporated

- Siemens AG

- TE Connectivity Ltd.

- STMicroelectronics

- Honeywell International Inc.

Recent Innovation in Wireless Sensor by AMETEK AMS

- In May 2024, Level Measurement Solutions, AMETEK, launched a state-of-the-art wireless Industrial Internet of Things (IIoT) solution with the name BrightTEK. This advanced IIoT solution is specially designed to redefine operational cost-effectiveness and efficiency in various industries.

Recent Innovation in Wireless Sensor by Versuni

- In January 2024, home to some of the world’s most renowned domestic appliance brands, Versuni announced the launch of the Philips Home Safety 5000 series. This safety appliance is dedicated to making sure that loved ones feel homely. The range includes motion sensor plugs, a wireless video doorbell, and a wireless spotlight camera featuring the world's first combined thread sensing and WIFI technology.

Regional Insights

Asia Pacific is expected to grow fastest during the forecast period. The increasing government initiatives to promote digitalization, the rising deployment of wireless sensors in developing countries, the growing demand for manufacturing automation and smart infrastructure, increasing rapid proliferation of IoT applications, technological advancements, and industrialization across diverse sectors are expected to drive the growth of the wireless sensor market in Asia Pacific. China, India, Japan, and South Korea are the major countries in this market.

China is experiencing rapid economic growth, and the advances in wireless sensors have made it easier to deploy low-cost networks to meet many challenges in China. Recent advances in electronics, implanted wireless communication, and systems have made it practical to establish low-power wireless sensors for real-time monitoring. For detecting chemical warfare agents, Chinese scientists claim to have successfully developed a new wireless sensor. Chinese scientists manufacture compact, highly sensitive, and have a rapid response to wireless sensors, which makes it better for early analysis of CWAs remotely. These are the major factors expected to drive the growth of the Asia Pacific market.

North America dominated the wireless sensor market in 2023. The rising degree of industrial automation, widespread adoption of IoT applications, and increasing robust technological infrastructure are anticipated to accelerate the growth of the North American market. In addition, the increasing demand for wireless sensors in various sectors, such as manufacturing, agriculture, and healthcare, as well as increasing research and development activities, are further expected to drive the growth of the market in this region. The U.S. and Canada are the major countries in North America.

The U.S. has the largest market share in this market. The rising adoption of the Internet of Things and increasing growth in IoT-connected devices are the major driving factors in the U.S. market. Major companies such as Phoenix Sensors are the major suppliers of wireless sensors in the automotive industry. These are the major factors expected to drive the demand for the wireless sensor market in North America.

Market Potential and Growth Opportunity

Growing use of autonomous vehicles

With the future of innovations, such as self-driving cars and electric cars, the demand for these wireless sensors is expected to increase in the automotive industry. Broadcasting applications represent more than fifty percent of the business, followed by security and safety, with tire pressure management systems being the major significant single automotive applications. Enhanced by automation and carbon dioxide emission, wireless pressure sensors will be highly used and adopted in the future. These opportunities are expected to accelerate the growth of the wireless sensor market in the coming years.

Wireless Sensor Market News

- In April 2024, a provider of industrial IoT solutions, Advantech, launched the EVA-2000 series. This new series was a new line of smart wireless sensors incorporating LoRaWAN technology. This series marks a significant advancement in the industrial field sensing applications and offers high-quality data transmission combined with improved power efficiency.

- In April 2024, a leader in strategic water management for commercial farmers, GroGuru, launched a fully integrated wireless soil sensor probe for constant root field monitoring of yearly field crops. This initial probe has six wireless sensors at various soil depths that measure temperature and soil moisture.

Market Segmentation

By Product Type

- Biosensors

- Temperature Sensor

- Pressure Sensor

- Humidity Sensors

- Gas Sensors

- Flow Sensors

- Level Sensors

- Motion and Positioning Sensors

- Others

By Industry Vertical

- Consumer Electronics

- Industrial

- Automotive and Transportation

- Aerospace and Defense

- Healthcare

- Agriculture

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3621

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308