What is the Printing Packaging Market Size?

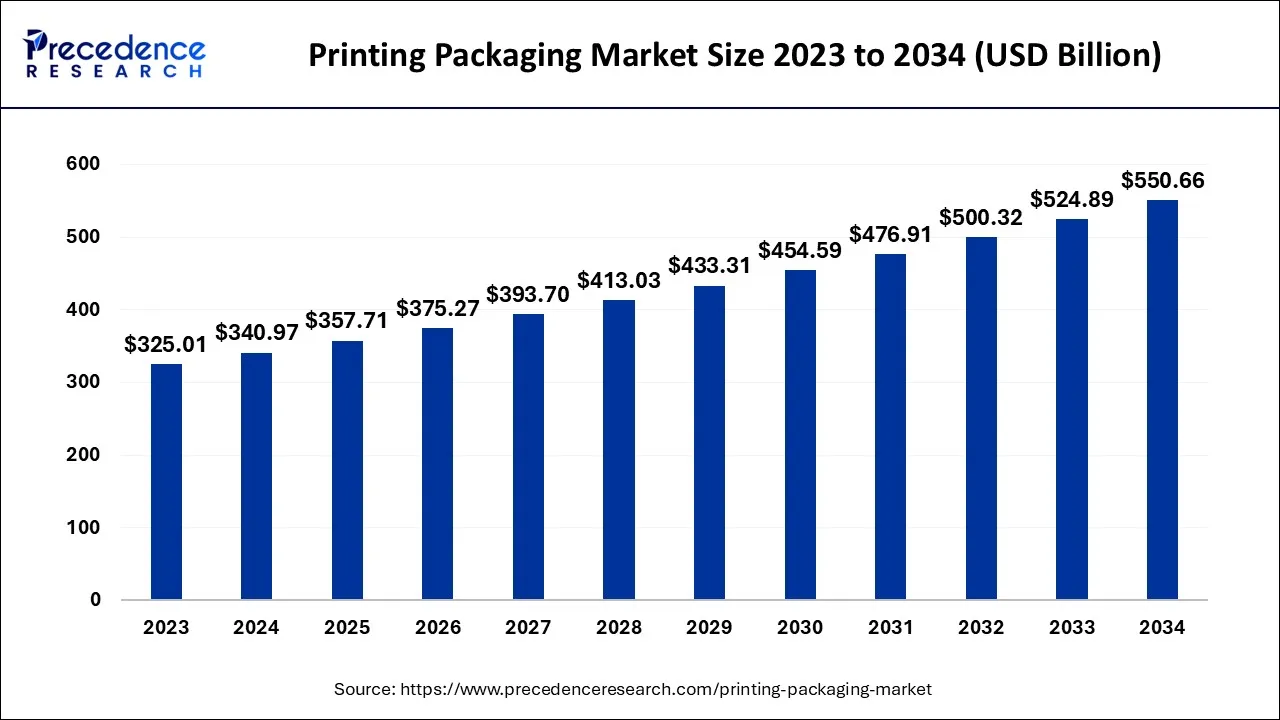

The global printing packaging market size was valued at USD 357.71 billion in 2025 and is predicted to increase from USD 375.27 billion in 2026 to approximately USD 575.63 billion by 2035, expanding at a CAGR of 4.87% over the forecast period from 2026 to 2035.

Printing Packaging Market Key Takeaways

- In terms of revenue, the printing packaging market is valued at $357.71 billion in 2025.

- It is projected to reach $575.63 billion by 2035.

- The printing packaging market is expected to grow at a CAGR of 4.87% from 2026 to 2035.

- Asia Pacific dominated the market in 2025.

- By Type, the corrugated segment dominated the market and generated to largest market share in 2025.

- By Printing Technology, the flexography segment captured the maximum market share in 2025.

- By Ink, the aqueous segment recorded the maximum market share and is expected to expand at the fastest CAGR between 2026 to 2035.

- By Application, the food & beverages segment generated to the largest share in 2025.

Market Overview

Packaging is any lithographic, flexographic, gravure, or letterpress printing that identifies or beautifies paper, paperboard, or cardboard products for use as containers, enclosures, wrappings, or boxes. Factors such as Growing demand for innovative printing and the rapid rise in digital print technology drive the market.

Market Outlook

- Industry Growth Overview: The printing and packaging market is experiencing robust growth, driven by e-commerce, consumer demand for appealing and sustainable packaging, and tech advancements.

- Major investors: Major investors in the market include large multinational corporations such as Smurfit WestRock, Amcor, and Mondi, as well as private equity firms like Blackstone and H.I.G. Capital.

- Global Expansion: A major global trend in the market is the shift towards eco-friendly and sustainable packaging, using recyclable, biodegradable, and water-based inks and materials, which is driven by consumer awareness and stringent regulations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 357.71 Billion |

| Market Size in 2026 | USD 375.27 Billion |

| Market Size by 2035 | USD 575.63 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.91% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Printing Technology, Ink, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Shift to 3D printing in the packaging printing industry

One of the significant trends in the global packaging printing market is the increasing shift of packaging manufacturers toward 3D printing. It generates an unimaginable physical object of any shape or geometry from a digital 3D model or electronic data sources, increasing the aesthetic value of packaging pictorial Compared to other techniques; 3d printing allows for faster manufacturing and the production of models and prototypes at a lower cost.

It enables the creation of s customized package design-based company's needs company. The growing demand for custom plans, particularly in the food and beverage and personal care industries, is expected to significantly impact printing packaging demand in the coming years.

The increasing influence of digital in the package printing market

The utilization of digital printing has become increasingly prevalent in the manufacturing of packaging due to its ability to provide cost and time-efficient solutions. One of the major benefits of digital printing is its capacity to save time, as there is no need to change plates continually, unlike conventional printing methods. In addition, the technology's plateless nature makes it an environmentally friendly option.

For instance, flatbed printing produces fewer waste cartridges and generates less air pollution, leading to a smaller carbon footprint than traditional printing methods. As a result, the implementation of digital printing in packaging production offers an eco-friendly solution that benefits both businesses and the environment.

Restraint

Rising raw material prices

The global surge in petrochemical raw material prices has impacted various industries that rely on these materials for their products. The price hike has affected several derivatives, such as UV resins, polyurethane resins, solvent glycols, and acrylic resins. Additionally, the skyrocketing prices of pigment raw materials, including titanium dioxide (TiO2), have added to the challenges faced by manufacturers worldwide.

The closure of polyester resin factories in Singapore and Sweden and an explosion at a Chinese factory have further compounded the issue, leading to a diversion of products to local markets and contributing to the escalation of prices. As a result of these challenges, the prices of printing inks, coatings, and laminating adhesives, widely used in packaging and printing applications, have also surged significantly.

The current scenario of rising raw material prices and changing freight rates has made the situation even more challenging for the packaging industry, where ocean freight rates are continuously fluctuating. Overall, the market is experiencing an unprecedented surge in the prices of primary feedstocks, and the situation is rapidly worsening, affecting various industries globally.

Opportunity

Increasing demand for sustainable printing

Printing sustainably can positively impact the environment by reducing the use of non-renewable resources and reducing waste. Utilizing process-free plates like cold press plates can aid in the elimination of volatile compounds that are harmful to the environment. The use of digital printers eliminates the need for plate replacement, thus conserving time and resources.

In addition, the use of water-based and UV-curable inks in printing can significantly reduce the emissions of volatile organic compounds. The increasing demand for environmentally conscious printing methods creates new prospects in the packaging printing market, providing a significant opportunity for the industry to meet the growing demand for sustainable and eco-friendly printing practices.

Segment Insights

Type Insights

The global printing packaging market is segmented based on the type into corrugated, flexible, folding cartons, labels & tags, and others. The corrugated segment dominated the market in 2024 with a maximum share. Corrugated containers are a versatile packaging solution used in the shipping, warehouse, distribution, and logistics markets. Given its high strength-to-weight ratio, it is an ideal option for these applications.

Demand for corrugated packaging is expected to rise due to advanced technologies. Corrugated packaging software is customized for one-of-a-kind packaging applications such as cutting and printing custom designs. Vendors are looking for innovative packaging and POS display techniques as competition heats up. As a result, they prefer customized designs, which can be accomplished with specialized software.

Printing Technology Insights

Based on the printing technology, the global printing packaging market is segmented into flexography, gravure, offset, screen printing, and digital. The Flexography segment accounts for the largest market share in2024 and is expected to grow faster during the forecast period. The application of flexography technology in packaging printing is highly advantageous due to its versatility. It is commonly used in various industries, including newspaper and print media, self-adhesive labels, flexible packaging, food packaging, and medical packaging.

The growth of automation in flexography has significantly contributed to its development. Although skilled operators were previously responsible for ensuring quality results in flexography, recent advancements now allow OEMs to collaborate throughout the entire process, from file preparation to finishing. Automation trends in flexo presses are being driven by the rapid evolution of techniques, makeready, and plate preparation, resulting in faster turnaround times. Manufacturers are seeking to provide operators with an almost fully integrated solution. Another factor driving the growth of flexography is market volatility.

As demand shifts towards alternative packaging formats and electronic media, traditional flexographic print production markets such as newspapers, envelopes, bags, and sacks are experiencing a decline, highlighting a shift in demand in its core global regions.

The packaging sector, which represents flexography's core activities and volume, is under pressure due to changing consumer habits. To meet the changing demand for lower volume runs, flexography is expected to adapt and provide efficient changeover processes.

Ink Insights

Based on the ink segment, the global printing packaging market is segmented into solvent-based, UV-based, aqueous, and others. In2024, the aqueous segment held the largest market share and is expected to grow faster during the forecast period. This segment is expected to grow significantly during the forecast period owing to the increasing demand for aqueous printing packaging.

One of the primary reasons for the growth of the aqueous segment is the rising awareness among consumers about the environmental hazards associated with volatile organic compounds (VOCs). Aqueous inks have emerged as a better alternative to solvent-based inks as they help in reducing VOC emissions, promote better health and safety practices in the manufacturing process, and contribute to long-term sustainability.

Furthermore, switching to aqueous inks has proved to be a cost-effective solution for many manufacturers in the printing packaging industry. This is due to the advancements in printing equipment and the development of new liquid resin chemistry, which has resulted in the formulation of a high-performance aqueous ink system.

Application Insights

Based on the application, the market is segmented into food & beverage, household & cosmetics, pharmaceutical, and others. In2024, the food & beverages segment dominated the market with a maximum share. The market is witnessing an upsurge in demand for printing in food packaging due to changing consumer eating habits and lifestyles. The high barrier properties, extended shelf life, and safety of food products make them popular.

An increase in per capita disposable income and population growth is expected to boost the market demand. Printed packaging materials are used to convey product information and market products to consumers. Packaging printing can be done directly on a variety of materials such as plastics, paper, board, and cork. Consumers now demand more transparency in food packaging, leading to a surge in demand for packaging printing in the food sector.

The demand for minimally processed, natural, and high-quality food products that have a longer shelf life and do not contain preservatives is high. Packaged food products offer various benefits such as contamination protection, convenience, portion control, and sustainability, which reduce food waste and loss by preventing food-borne diseases and chemical contamination while preserving food quality.

Regional Insights

Asia Pacific dominated the global printing packaging market, with diverse printing technologies and applications catering to various industries. The growth of the packaging industry in countries like Japan, China, India, and South Korea, along with the rising demand for packaging printing, has boosted the market's prospects in the region.

- In March 2025, China's Beijing Institute of Graphic Communication (BIGC) and the All-India Federation of Printers and Packagers (AIFPP) came to a cooperation agreement. This partnership between AIFPP and BIGC marks a significant milestone in the printing and packaging industry. The agreement seeks to promote global cooperation in printing, packaging, and publishing education, enhancing both academic and industry connections between India and China.

China is the third-largest producer and exporter of food processing and packaging machinery, alongside Germany and Italy. Since 2014, Chinese exports have more than doubled from 2.1 billion euros to 5.7 billion euros in 2023. The global exports of food and packaging machinery to Asia have amounted to between 9 and 10 billion US dollars annually. With a consumption of 104 billion liters in 2024, China is the world's second-largest market for soft drinks, after the United States, and the number one consumer market in Asia. By 2028, an 18 percent increase in consumption to 123 billion liters is forecast for China. Bottled water, with 59 billion liters, will account for more than half of sales in 2024, and its consumption is expected to increase by a further 23 percent to 72 billion liters by 2028

The increasing number of nuclear families, changing packaging materials, growing customer preferences, and an aging population are some of the factors driving the packaging industry's growth. With the increasing demand for packaged beverages like bottled water, alcoholic drinks, and carbonated soft drinks, the demand for packaging printing is also expected to rise.

The packaging printing market is further driven by sustainable printing practices, cost-effectiveness, reduced packaging waste, and the popularity of flexible packaging solutions. Additionally, the convenience offered by packaging in the healthcare sector is expected to contribute to the market's growth.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the increasing consumer demand for customized and sustainable products, along with the robust expansion in the healthcare and food & beverage industries. Moreover, rapid advancements in AI, digital printing, and automation improve overall quality, efficiency, and customization, driving investment.

U.S. Printing Packaging Market Trends

In North America, the U.S. dominated the market owing to rapid advancements in smart packaging and automation, coupled with the surge in online shopping. Also, major brands are heavily investing in cutting-edge printing for brand recognition, improving the whole customer experience and satisfaction.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the increasing demand for convenience, personalized products, and premium branding, which fuels innovations in advanced printing. Furthermore, the strong presence of major luxury brands in emerging economies leads to tech development.

Germany Printing Packaging Market Trends

In Europe, Germany led the market due to the surge in online shopping, which increases demand for visually appealing, durable, and brand-focused packaging products to safeguard goods and improve consumer experience during transit. In addition, the country's strong manufacturing sector promotes innovation in cutting-edge printing technologies and materials.

Printing Packaging Market-Value Chain Analysis

- Raw Material Sourcing

It is the first stage of detecting, evaluating, and procuring essential materials like polymers, metals, and inks to produce packaging and printed products.

Major Players: Smurfit WestRock, Amcor. - Material Processing and Conversion

It is the essential industrial process of converting raw materials into finished, functional, and printed packaging products.

Major Players: Blackstone, Mondi. - Logistics and Distribution

Logistics involves the planning and management of the entire supply chain from raw materials to the final product, while distribution is the specific function of moving finished goods to consumers or retailers.

Major Players: Graphics Packaging Holding Company, Amcor plc - Recycling and Waste Management

It involves a detailed system of reducing, reusing, and processing waste materials to lessen environmental impact and boost a circular economy.

Major Players: HP Inc., Canon

Printing Packaging Market Companies

- Amcor plc: A global leader offering a broad array of flexible and rigid packaging solutions, including specialty cartons, for the food and beverage, healthcare, and personal care industries.

- Huhtamaki Oyj: Offers a wide range of sustainable primary packaging and labeling solutions for food and beverage, pharmaceuticals, and personal care products.

Other Major Key Players

- Mondi

- Sonoco Products Company

- Graphics Packaging International LLC

- Quantum Print and Packaging Store

- WS Packaging Group

- Duncan Printing Group

- Ahlstrom-Munksjo

- Autajan CS

- Avery Dennison Corporation

Recent Developments

- In April 2025, AstroNova, a data visualisation technology provider, announced the launch of a direct-to-package printer and digital label presses at the FESPA Global Print Expo 2025 in Berlin, Germany. The company's new VP-800 direct-to-package printer has been designed for eco-friendly packaging materials.

- In November 2024, Sealed Air announced the launch of a new flexible printing solution for e-commerce packaging. Sealed Air developed a new on-demand printing system for late-stage, customised printing on protective packaging. The company also stated that its new solution, AutoPrint, can provide logistics and fulfilment operators with a flexible and efficient method of meeting customer demand for personalised on-box branding and messaging.

- In September 2024, the Department of Printing and Packaging Technology at Central University of Haryana (CUH), Mahendragarh, and Offset Printer's Association (OPA), Ludhiana, renewed their Memorandum of Understanding (MoU) to continue their collaborative efforts in research, innovation, and training for printing and packaging technology.

- In 2022, Avery Dennison Graphics Solutions announced a partnership with Siser North America to enter the DIY/crafter market. Siser has been in the consumer craft market for over 40 years as a market leader in heat-transfer vinyl and a specialist in personalization and modification.

- In 2019, Mondi Plc. Launched myMomdi.net, a web platform for outstanding print and design to distinguish their uncoated fine paper (UFP) brands. It informs professionals in the printing and design industries about high-quality paper brands, as well as paper recommendations, local distributor contact information, and multimedia content about packaging printing.

Segments Covered in the Report

By Type

- Corrugated

- Flexible

- Folding Cartons

- Label & Tags

- Others

By Printing Technology

- Flexography

- Gravure

- Offset

- Screen Printing

- Digital

By Ink

- Solvent-based

- UV-based

- Aqueous

- Others

By Application

- Food & Beverage

- Household & Cosmetics

- Pharmaceutical

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting