What is the Probiotic Cosmetics Market Size?

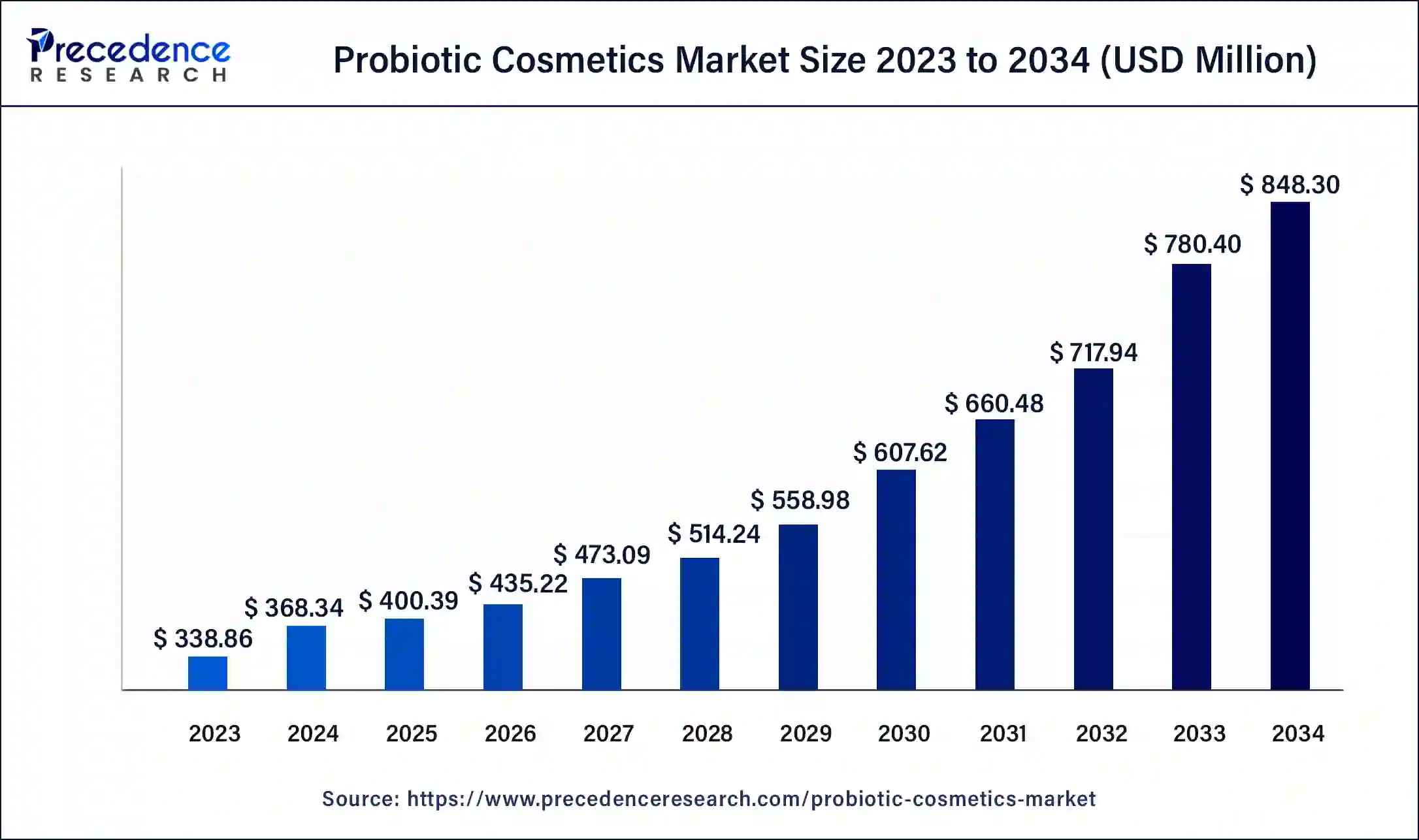

The global probiotic cosmetics market size was USD 400.39 million in 2025, accounted for USD 435.22 million in 2026, and is expected to reach around USD 912.57 million by 2035, expanding at a CAGR of 8.59% from 2026 to 2035. The North America probiotic cosmetics market size reached USD 125.38 million in 2025.

Probiotic Cosmetics Market Key Takeaways

- In terms of revenue, the market is valued at $400.39 million in 2025.

- It is projected to reach $912.57million by 2035.

- The market is expected to grow at a CAGR of 8.59% from 2026 to 2035.

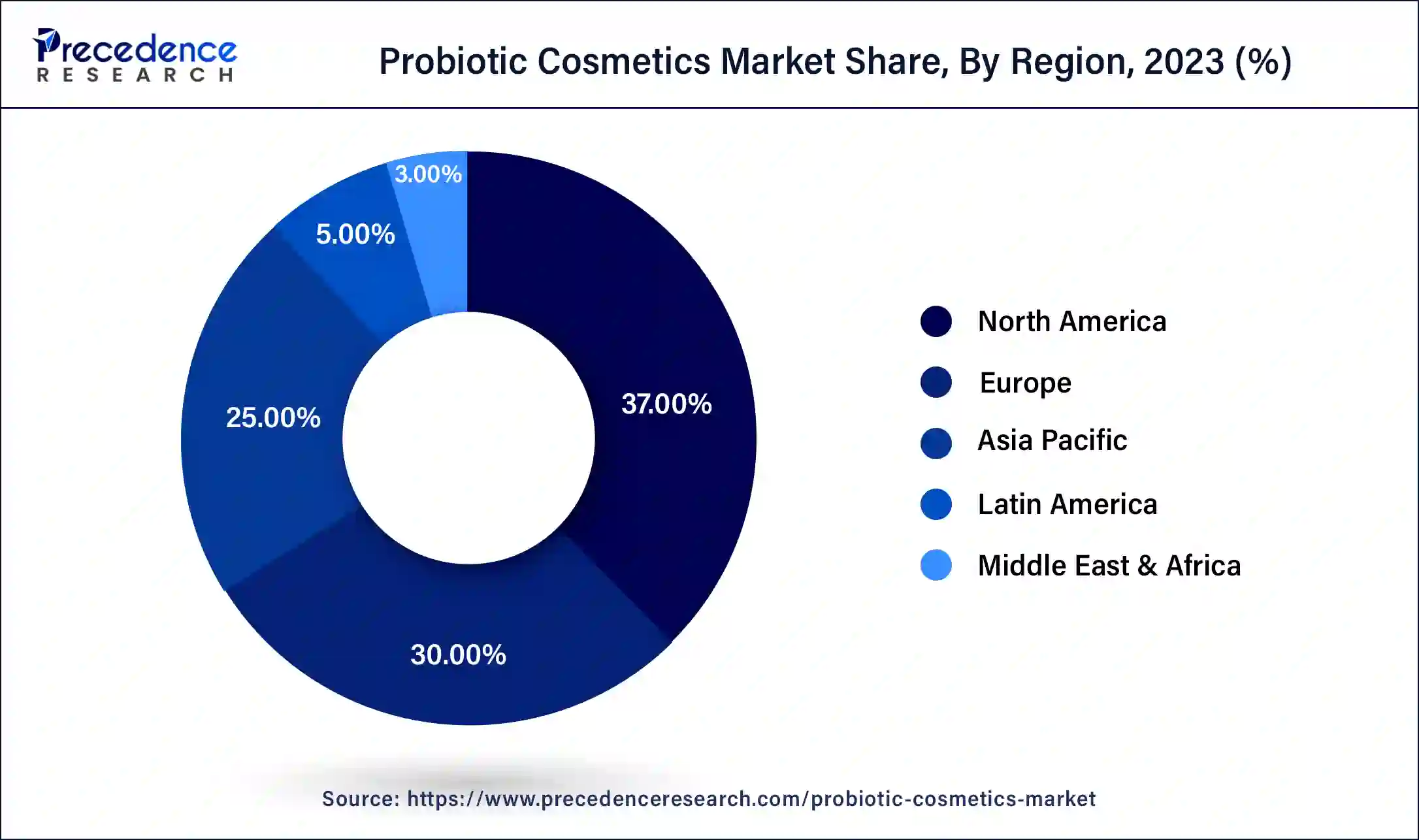

- North America held the maximum revenue share of 37% in 2025.

- By Product, the skin care segment has generated the largest revenue share in 2025.

- By Distribution Channel, the e-commerce segment held the highest revenue share in 2025.

Market Overview

Probiotic cosmetics refers to topical applications most usually associated with anti-ageing, skin hydration, spots, acne, and redness (rosacea). Probiotic cosmetics are proving to be a preferred alternative that can provide relief to numerous adverse skin conditions across various age groups around the world. Probiotics are live microorganisms that tend to yield a positive impact on the skin-related framework.

The growing advancements in the medical and healthcare setup and the increasing acceptance of probiotics are anticipated to emerge as key drivers for the global probiotic cosmetics market growth. Developing an inclination towards personal health, appearance, and wellness across every population age group boosts the requirement for respective probiotic cosmetics.

The prevalence of skin ailments such as eczema (atopic dermatitis) and several allergies is rising in both developing and developed countries. The reasons behind various skin problems include genetic issues, hygiene habits, improper diets, and environmental factors. For instance, around 20% of children and infants contract eczema in many nations. The British Skin Foundation estimates that about 3 out of 5 people will have some form of skin disease during their lifetime. Such a high affection rate tends to enhance the demand for probiotic cosmetics.

Our probiotic cosmetics report includes an in-depth analysis of the recent market situation. The report covers numerous factors such as key players, competitive landscape, ongoing trends, and regional analysis. The analytical research on the impact of the COVID-19 situation helps in determining the effects on the supply and demand side. The segmental analysis provides a clear view of various probiotic cosmetics variants and particular distribution channels.

- According to the American Academy of Dermatology Association, Acne is the most common skin condition in the United States, affecting up to 50 million Americans annually. Adult acne continues to increase and affects up to 15% of women. Nearly 85% of people between the ages of 12 and 24 experience at least minor acne.

How is AI Influencing the Probiotic Cosmetics Industry?

Artificial Intelligence is transforming the probiotic cosmetics industry by changing it from generic, trial-and-error formulations toward greatly personalized, data-driven, and scientifically validated skincare. AI improves the entire lifecycle of probiotic products, from identifying beneficial bacteria and even optimizing fermentation to determining individual skin microbiomes for customized recommendations. Firms use AI-powered apps to determine a user's skin type, tone, and even texture, suggesting specific probiotic-infused products.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 912.57 Million |

| Market Size in 2025 | USD 400.39 Million |

| Market Size in 2026 | USD 435.22 Million |

| Growth Rate from 2026 to 2035 | CAGR of 8.59% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

The probiotic cosmetics market is expected to witness considerable growth during the study period prominently due to the growing popularity of probiotics as a key ingredient in cosmetic products.

The probiotic cosmetics market involves local as well as international players. These players tend to pose a cut-throat competition for acquiring a dominant market share. In order to gain a competitive edge over other competitors, market players in the probiotic cosmetics market are aiming to develop cost-effective products.

Investment in research and development (R&D) activities is expected to enhance the product quality. Acquisitions and mergers can prove to be a prominent growth strategy and support strengthening the position of the new market players. Key players involved in the probiotic cosmetics market include Aurelia Skincare Ltd.; Esse Skincare; and L'Oreal S.A.

Moreover, in order to gain further access to the regional markets, companies can undertake various strategic initiatives including the expansion of existing product portfolio. These initiatives may result in more intensive rivalry over the forecast period. Additionally, rapidly evolving probiotic cosmetic offerings make the existing offering obsolete very soon. This further intensifies the market competition among the prominent players.

Since the count of probiotic cosmetics providers (manufacturers) is much less in comparison to the count of buyers, the bargaining power of suppliers is considerably higher as compared to the bargaining power of buyers. Owing to considerable profit margins, the threat of new entrants in the probiotic cosmetics market is moderate.

In June 2022, S-Biomedic raised €4 million ($4.20 million) in a Series A funding round. This amount will be utilized for the development of probiotic treatments for acne. In June 2022, SkinBioTherapeutics got an investment of €1.7 million ($1.78 million). This fund will aid the development of probiotic treatments with respect to skin conditions and cosmetics. Rising funding and increasing investment in the probiotic cosmetics market are anticipated to drive the market growth promisingly in the near future.

Segment Insights

Product Insights

The global probiotic cosmetics market is segmented intoskincare and hair care. The skin care segment had the highest revenue share in 2024 and is expected to dominate the market during the study period.

There has been a rise in the demand for specialized cosmetics products, including creams and serums. The young, as well as the old population, are inclined towards purchasing probiotic moisturizer face cream. Owing to prevalent issues such as skin tone, wrinkles, acne, and inflammation, the demand for probiotic skin care productsis predicted to rise exponentially.

Lactobacilli probiotic bacteria strains are known for strengthening the skin microbiome. Thus, Lactobacilli probiotic bacteria strains are helpful in supporting the body's ability to grow thick and healthy hair. Increasing stress levels are happening to be a major reason for hair fall problems all over the world. Rising hair fall issues enhance the requirement for various probiotic hair cosmetics such as Onesta Probiotic Protein Treatment Spray ($17.99), Mother Dirt Probiotic Hydrating Hair Wash ($15), Tela Probiotic Hair Mask ($48), and Yoghurt of Bulgaria Probiotic Anti-Hair Loss Shampoo ($3.99).

Distribution Channel Insights

Based on distribution channels, the global probiotic cosmetics market is segmented into pharmacy and drug store, hypermarkets and supermarkets, e-commerce, and other distribution channels. The e-commerce segment held the largest revenue share in 2024 and is expected to hold a significant market share during the forecast period. Among the mentioned distribution channels, the inventory holding capacity of the e-commerce giants is substantially high. In the coming years, the e-commerce segment is predicted to hold a high share owing to an increasing trend of online shopping.

- India's e-commerce industry, valued at INR 10,82,875 crore (USD 125 billion) in FY24, is projected to grow to INR. 29,88,735 crore (US$ 345 billion) by FY30, reflecting a compound annual growth rate (CAGR) of 15%.

Regional Insights

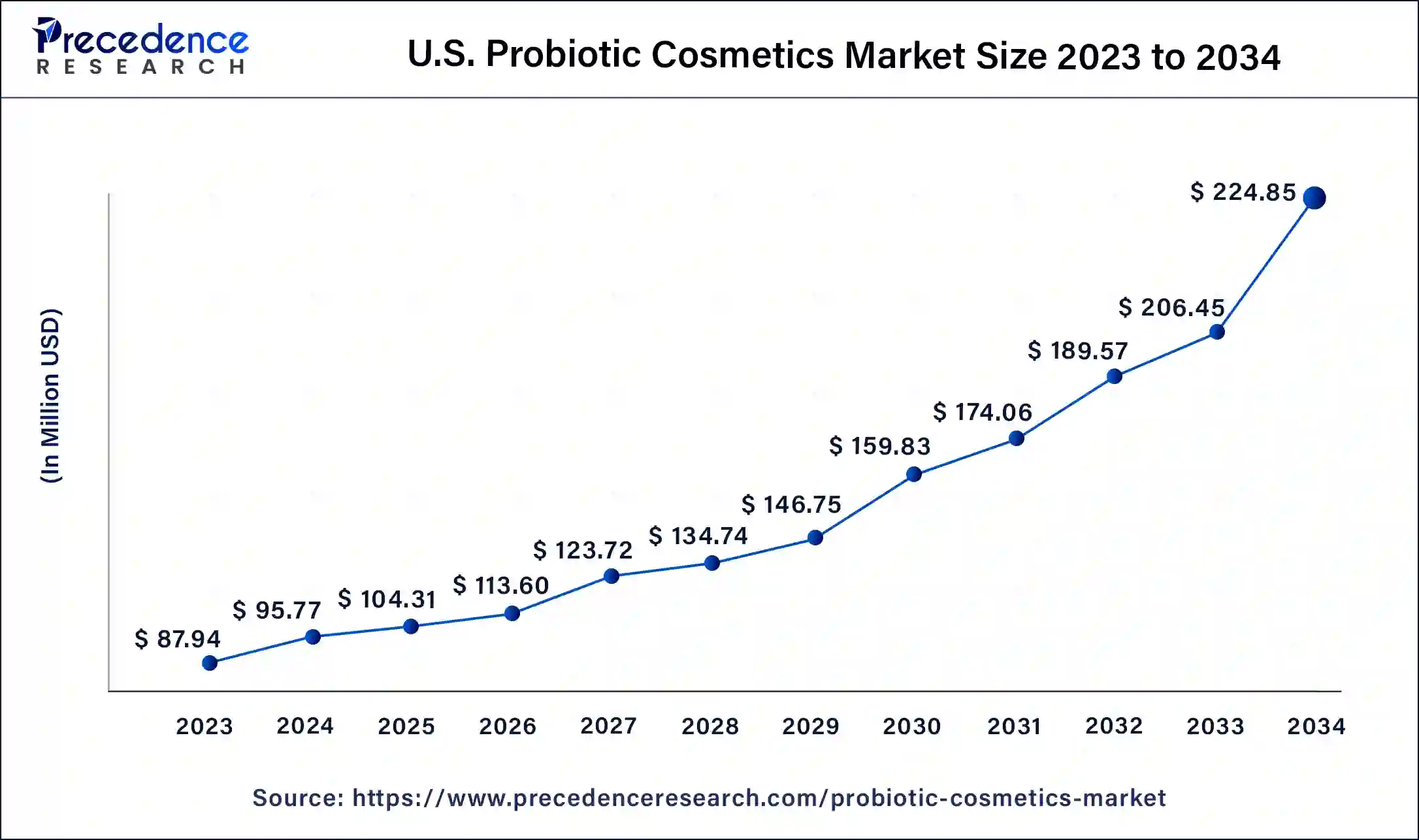

What is the U.S. Probiotic Cosmetics Market Size?

The U.S. probiotic cosmetics market size was estimated at USD 104.31 million in 2025 and is predicted to be worth around USD 242.24 million by 2035, at a CAGR of 8.79% from 2026 to 2035.

The probiotic cosmetic market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. In 2024, North America held the largest revenue share in the probiotic cosmetics market. North America is the most developed continent owing to the presence of nations featuring early adoption of probiotic cosmetics and high gross domestic product (GDP).

The rising preference of people towards enhanced appearance is boosting the demand for probiotic cosmetics in the European region. The rising use of probiotic cosmetics among millennials is expected to support growth prospects for the probiotic cosmetics market in the Asia Pacific (APAC) region.

Due to low literacy, uncertainty, and civil war in African countries, the probiotic cosmetics market in Africa is expected to grow at a comparatively slow rate. In March 2024, it was reported that 11% of adults and 24% of adolescents in the UAE suffer from ill effects of Eczema. Owing to high disposable income and growing hair fall problems, the probiotic cosmetics market is expected to grow notably in the Middle East region in the coming years.

Aging is increasingly becoming the major reason for stress among nearly half of the American women. According to the article published in September 2024, A survey commissioned by NEOSTRATA reveals that 56% of Gen Z women and 57% of millennials feel stressed about aging, with only 17% of respondents paying attention to neck care, highlighting the lucrative opportunities for innovation in cosmetic products.

Value Chain Analysis for the Probiotic Cosmetics Market

- Product Conceptualization and Design

It provides the necessary innovation to overcome formulation, stability, and regulatory challenges while meeting increasing consumer need for personalized, "clean beauty" solutions.

Key Players: L'Oréal S.A., Esse Skincare, Aurelia London - Raw Material Procurement

It is a vital, high-value function that produces stabilization of specialized ingredients, ensures product efficacy, and enables compliance with increasing "clean beauty" trends.

Key Players: DuPont, Kerry Group, Lallemand, Chr. Hansen - Manufacturing and Assembly

They are vital components that bridge the gap between scientific research and even consumer products, aiming heavily on maintaining the stability, viability, and even efficacy of microorganisms.

Key Players: BioGaia AB, Lactobio, AB-BIOTICS, Winclove Probiotics

Probiotic Cosmetics MarketCompanies

- Glowbiotics, Inc.: Glowbiotics, Inc. is a pioneer in the probiotic cosmetics market, aiming for microbiome-friendly, "clean" skincare which leverages probiotics, prebiotics, and even targeted bioactive ingredients to enhance skin health.

- Esse Skincare: Esse Skincare leads the probiotic cosmetics market by using live probiotics and prebiotic nutrients to "rewild" the skin microbiome, boosting immunity, decreasing inflammation, and even restoring barrier function. Their range features certified organic, vegan, and cruelty-free products, including a live probiotic serum and sustainable, specialized, and eco-friendly skincare.

- Eminence Organic Skincare: Eminence Organic Skincare works with probiotic cosmetic market trends by providing a specialized Clear Skin Probiotic Collection along with a Kombucha Microbiome Collection. Their products, featuring pre-, pro-, and postbiotics, aim to balance the skin microbiome to treat acne, enhance hydration, and reduce inflammation, meeting the need for natural, organic, and multifunctional skincare solutions.

Other Major Key Players

- Tula Life, Inc.

- The Clorox Co.

- L'oreal S.A.

- LaFlore Probiotic Skincare

- BIOMILK Probiotic Skincare

- Aurelia Skincare Ltd.

- Andalou Naturals Inc.

Recent Developments

- In December 2023, L'Oréal?announced the acquisition of Lactobio, a leading probiotic and microbiome research company based in Copenhagen. The strategic acquisition builds on 20 years of advanced research by L'Oréal into the microbiome scientific territory, deepening its knowledge of the microorganisms that live on the skin's surface and reinforcing the Groupe's leadership in this field.

- In January 2025, Shiseido unveiled a new anti-aging serum, a refillable anti-aging serum. The launch aligns with Shiseido's strategic focus on skin care, building on and enhancing the J-beauty giant's established Ultimune line. ULTIMUNE produced remarkable results in both clinical tests and consumer tests, proving that it slows the skin aging cycle by reducing aging factors.

- In October 2022, S-Biomedic announced the launch of the skin care active CutiNaturalis probiotic acne, a live bacterial strain that is found on the skin and isolated from healthy individuals. The active helps to restore the natural balance of the facial skin microbiome when it has been altered by external factors, including environmental stressors, the use of harsh compounds, or the use of certain cosmetics.

- In April 2022, fragrance supplier Symrise and probiotics manufacturer Probi launched SymFerment. SymFerment is a skincare ingredient that is prepared from Probi's upcycled Lactiplantibacillus (Lactobacillus) fermentation. SymFerment (INCI: Lactobacillus Ferment (and) Lactic Acid (and) Pentylene Alcohol (and) Sodium Benzoate (and) 1,2-Hexanediol (and) Caprylyl Glycol) is a new-generation moisturizer that is based on probiotic technology.

- In September 2021, Lac2Biome, an Italian microbiome health startup launched a white-label skincare blend that contained hyaluronic acids and live probiotics. InfiniteSkin Microbiome Serum is prepared from a clinically studied blend of proprietary live probiotic strain m.biomeLiveSkin88 and hyaluronic acids.

Segments Covered in the Report

By Product

- Skin care

- Hair care

By Distribution Channel

- Pharmacy and Drug Store

- Hypermarket and Supermarket

- E-commerce

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting