What is the Pulmonary Arterial Hypertension Market Size?

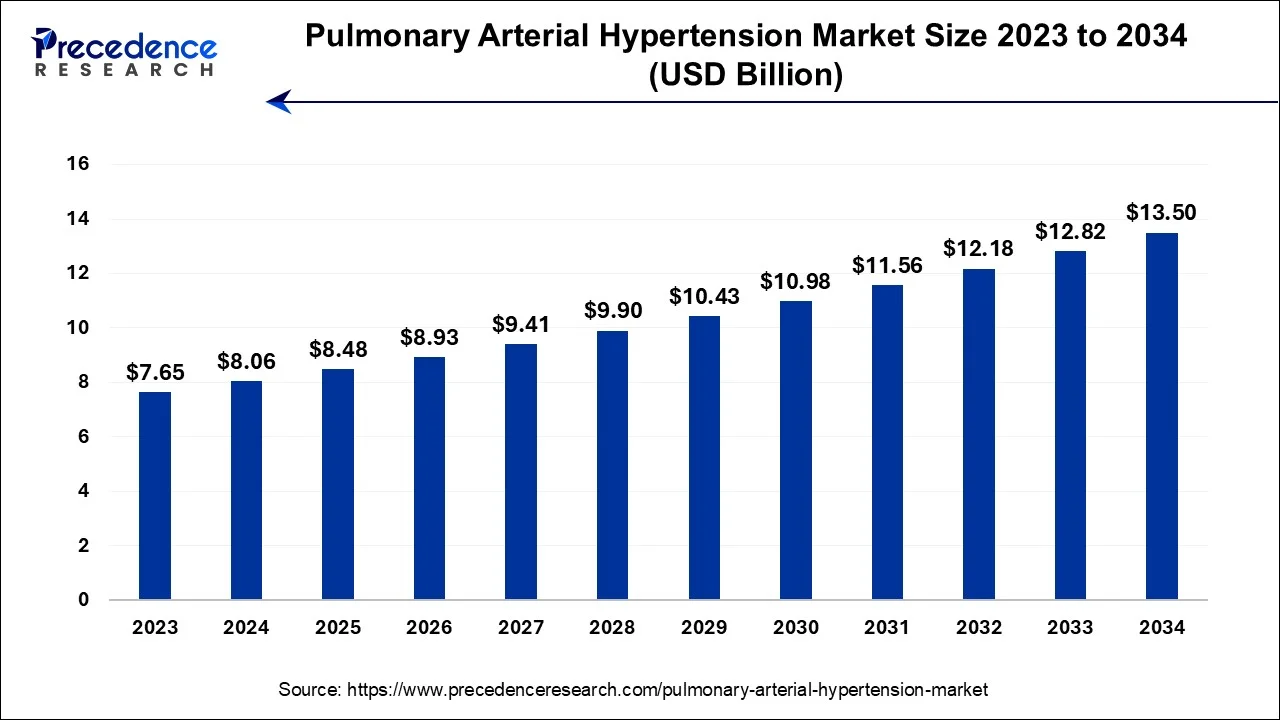

The global pulmonary arterial hypertension market size is calculated at USD 8.48 billion in 2025 and is predicted to increase from USD 8.93 billion in 2026 to approximately USD 13.50 billion by 2034, registering a notable CAGR of 5.30% between 2025 and 2034.

Pulmonary Arterial Hypertension Market Key Takeaways

- In terms of revenue, the market is valued at $8.48 billion in 2025.

- It is projected to reach $13.50 billion by 2034.

- The market is expected to grow at a CAGR of 5.30% from 2025 to 2034.

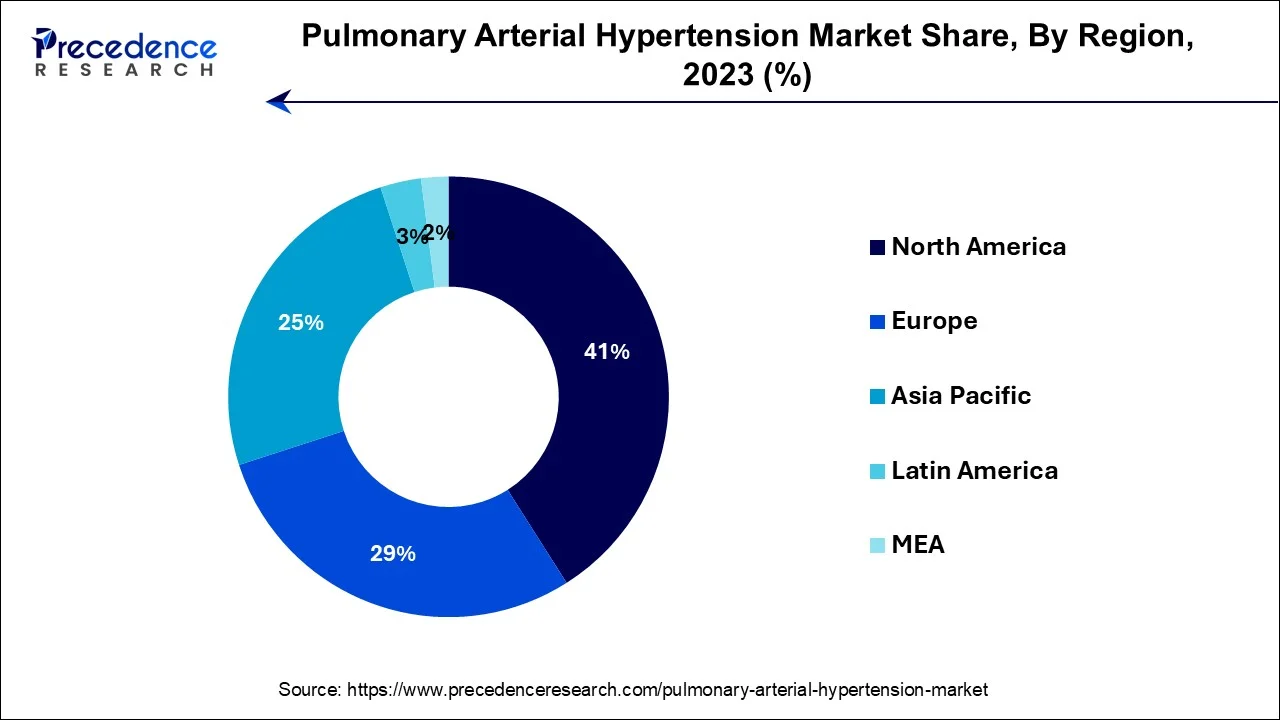

- North America led the market with the largest market share of 41% in 2024.

- Asia-Pacific is projected to grow at a notable CAGR of 13.3% during the forecast period.

- By Drug Class, the prostacyclin and prostacyclin analogs segment has held the major revenue share of 45% in 2024.

- By Drug Class, The SGC simulators segment is anticipated to grow at a CAGR of 5% during the projected period.

- By Type, the branded segment contributed more than 42% of revenue share in 2024.

- By Type, the generics segment is projected to grow at the fastest CAGR over the projected period.

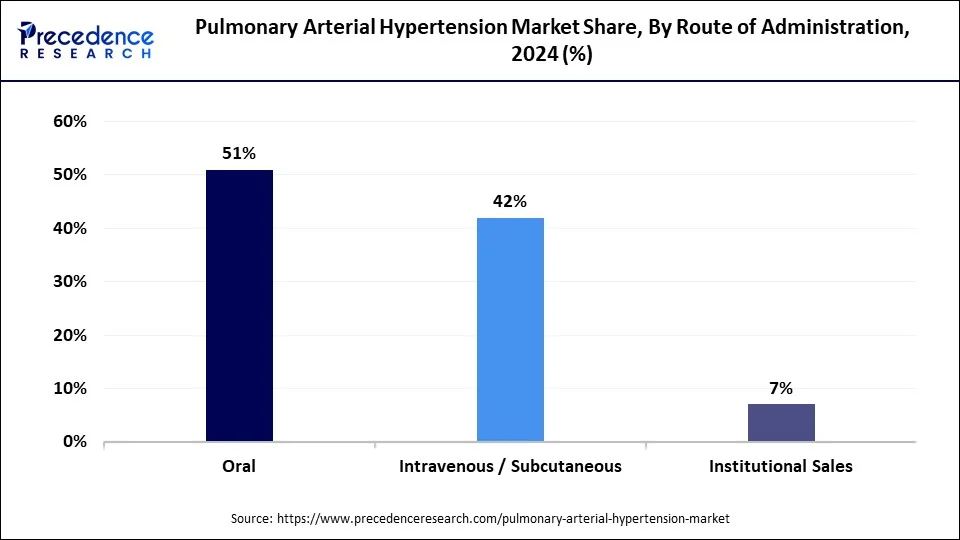

- By Route of Administration, the oral segment generated more than 51% of revenue share in 2024.

- By Route of Administration, the intravenous/ subcutaneous segment is expected to expand at the fastest CAGR over the projected period.

What is pulmonary arterial hypertension?

The pulmonary arterial hypertension (PAH) market encompasses the sector involving pharmaceuticals and therapies designed to address a rare and life-threatening condition where the pulmonary arteries narrow, causing elevated blood pressure. In recent years, this market has witnessed significant expansion owing to innovations in treatment options like prostacyclin analogs and endothelin receptor antagonists.

Market growth is propelled by heightened awareness, early diagnosis, and an expanding patient base. Nonetheless, it remains a fiercely competitive arena, with ongoing research and development endeavors aimed at enhancing patient outcomes and overall quality of life. This dynamic pharmaceutical sector remains of great interest to pharmaceutical companies.

What are the growth factors of the pulmonary arterial hypertension market?

The pulmonary arterial hypertension (PAH) market is a dynamic and evolving sector aimed at managing a rare yet life-threatening condition characterized by the constriction of pulmonary arteries, resulting in elevated blood pressure within the lungs. In recent times, the PAH market has undergone substantial growth, primarily propelled by breakthroughs in treatment options, including prostacyclin analogs and endothelin receptor antagonists. An increase in disease awareness and early detection efforts have contributed to the expansion of the patient population, making it a fiercely competitive landscape with lucrative prospects for pharmaceutical companies committed to enhancing patient outcomes and quality of life.

Within the PAH market, industry trends underscore the escalating demand for targeted therapies that offer more efficient and minimally invasive solutions. The introduction of advanced diagnostic techniques and biomarker-based approaches for early identification has enabled swifter intervention, ultimately improving patient prognoses. Furthermore, the ascent of precision medicine has enabled personalized treatments, reducing adverse effects and augmenting therapeutic effectiveness.

Critical growth drivers within the PAH market encompass the mounting incidence of the condition, attributable to factors like an aging demographic and enhanced diagnostic capabilities. A consistent stream of research and development initiatives is broadening the therapeutic repertoire, focusing on pioneering drug formulations and combination therapies. Additionally, the increasing healthcare expenditure, particularly in developed regions, bolsters market growth by ensuring greater patient access to advanced treatments.

Nevertheless, the PAH market encounters formidable challenges. The complex nature of the condition's pathophysiology, involving intricate genetic and environmental factors, poses obstacles to treatment development. Stringent regulatory requirements and the substantial cost associated with drug development can decelerate progress. Moreover, reimbursement complexities and disparities within healthcare systems may impede access to cutting-edge therapies for certain patient groups.

In the face of these challenges, the PAH market presents promising business opportunities for pharmaceutical enterprises capable of addressing unmet medical needs and introducing innovative therapies. With a continually expanding patient base, ongoing research breakthroughs, and the potential for more individualized treatment strategies, the PAH market remains an influential area of focus and investment for those aiming to make a substantial difference in patient care.

Pulmonary Arterial Hypertension Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the pulmonary arterial hypertension market is expected to see steady growth due to the rising prevalence of cardiovascular disorders and combination therapies being utilized more extensively. The expected growth is further fueled by advancements in drug development and enhanced patient access to medications, especially across North America and the Asia Pacific.

- Sustainable Trends: Sustainability impacted the evolution of the market, as pharmaceutical companies began to consider eco-friendly alternatives in manufacturing, while trying to minimize waste in the drug manufacturing process.

- Global Expansion: Leading companies continued to expand in high-demand areas such as Asia-Pacific, the Middle East, and Latin America to enhance patient access. Companies like United Therapeutics and Gilead expanded their distribution networks while forming alliances with local healthcare providers to offer affordable solutions and increase their global market presence.

- Major Investors: Because of the high unmet need and strong margins, venture capital and private equity firms ramped up their interest in rare disease treatment markets, including pulmonary arterial hypertension. Prominent investment firms, such as Bain Capital and TPG, invested in biotechnology companies researching next-generation therapies for pulmonary hypertension.

- Startup Ecosystem: The startup ecosystem in the pulmonary arterial hypertension space expanded quickly, bolstered by the maturation of biotechnology and AI-based drug discovery. Startups like Aerovate Therapeutics and Morphogen-IX generated investment attention by building novel oral and gene therapies, fostering safer and effective therapeutics for patients around the world.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.50 Billion |

| Market Size in 2025 | USD 8.48 Billion |

| Market Size in 2026 | USD 8.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Type, and Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing disease awareness

The surge in awareness about pulmonary arterial hypertension (PAH) is a fundamental catalyst driving the growth of its market. The heightened recognition of PAH among healthcare practitioners and the wider community has profound implications for market expansion. Primarily, this increased awareness leads to the early detection and timely intervention of PAH. With healthcare professionals becoming more informed about the condition, they can spot and diagnose PAH in its initial stages, a pivotal factor in elevating patient outcomes. Swift diagnosis allows for the prompt initiation of treatment, effectively halting disease progression and diminishing potential complications.

Moreover, public awareness campaigns and patient education initiatives empower individuals to identify PAH symptoms, motivating them to seek medical assistance sooner. Consequently, a larger group of patients is diagnosed, creating a surge in demand for PAH treatments and therapies. Furthermore, the escalation of disease awareness also encourages advocacy for broader treatment access. Patient support groups and healthcare organizations can influence healthcare policies, ensuring that PAH patients have improved access to state-of-the-art therapies. In essence, the surge in disease awareness not only enhances patient well-being but also propels the expansion of the PAH market by broadening the patient base and stimulating the demand for advanced treatment solutions.

According to an article published by The Lancet Respiratory Medicine in January 2025, there were an estimated 192,000 prevalent cases of PAH globally in 2021. Of these, nearly 119,000 were in females (62%) and 73,100 in males (38%). The age-standardised prevalence was 2·28 cases per 100,000 population. Prevalence increased with age, such that the highest prevalence was among individuals aged 75–79 years.

Restraints

Complex disease pathophysiology

The intricate and convoluted pathophysiology of pulmonary arterial hypertension (PAH) serves as a formidable obstacle to the market's expansion. PAH's complexity arises from a myriad of genetic, cellular, and environmental factors that collectively contribute to the elevation of blood pressure within the pulmonary arteries.

This intricate disease mechanism presents substantial challenges in comprehending the ailment and in the development of effective treatments. PAH's multifaceted pathophysiology entails abnormalities in the endothelium, smooth muscle cells, inflammatory responses, and the disruption of signaling pathways. Precisely targeting these intricate mechanisms demands a profound comprehension of their complex interactions, requiring customized approaches to treatment. This intricacy translates into a series of obstacles, prolonging the research and development process, which, in turn, extends timelines and increases associated costs.

Furthermore, it can obscure the identification of effective therapeutic targets, given the intricate nature of the disease, rendering it more challenging to develop treatments that achieve the desired outcomes. Consequently, the market grapples with the formidable task of unraveling and addressing this complexity to enhance treatment options for PAH patients.

Opportunity

Early diagnosis and biomarker development

Early detection and the evolution of biomarkers present exceptional prospects within the pulmonary arterial hypertension (PAH) market. The identification of PAH in its initial stages is a pivotal element in advancing patient outcomes, as it allows for timely intervention and the initiation of treatment. The advent of dependable biomarkers capable of recognizing the condition's emergence is a groundbreaking development. To begin, early diagnosis curtails the advancement of PAH, potentially avoiding severe complications and enhancing patients' quality of life, thereby fueling the demand for treatments and therapeutic approaches.

Moreover, the discovery and validation of distinctive biomarkers possess the potential to optimize the diagnostic process, rendering it more precise and efficient. Biomarkers can also aid in monitoring disease progression and gauging the response to treatment. Furthermore, early diagnosis and biomarker-guided methodologies empower the implementation of personalized medicine. Tailored treatments, tailored to an individual's unique biomarker profile, hold the promise of augmenting the effectiveness of treatment while minimizing adverse effects.

In the PAH market, these strides not only benefit patients by elevating their prognosis and overall well-being but also open up substantial avenues for pharmaceutical companies and healthcare providers to innovate diagnostic tools and specific therapeutic interventions. This underscores the critical role of early detection and biomarker development in propelling progress within the PAH market.

Drug Class Insights

According to the drug class, the prostacyclin and prostacyclin analogs segment has held 45% revenue share in 2024. The dominance of the prostacyclin and prostacyclin analogs segment within the pulmonary arterial hypertension (PAH) market can be attributed to their well-established track record in widening pulmonary blood vessels, alleviating arterial pressure, and enhancing patients' exercise capacity and overall well-being. These medications, frequently administered through various delivery methods, have traditionally held a central role in PAH treatment. Their effectiveness in mitigating symptoms and retarding the progression of the condition positions them as the preferred choice for many patients and healthcare providers, thus substantiating their substantial share in the PAH market.

The SGC simulators segment is anticipated to expand at a significantly CAGR of 5% during the projected period. The SGC (Soluble Guanylate Cyclase) simulators segment holds a significant growth in the pulmonary arterial hypertension (PAH) market due to its effectiveness in addressing the underlying molecular mechanisms of PAH. These simulators target the NO-sGC-cGMP pathway, a critical component in PAH pathophysiology. By promoting vasodilation and reducing vascular remodeling, they offer a promising approach to managing the condition. Furthermore, SGC simulators have demonstrated positive clinical outcomes, leading to their widespread adoption and contributing to their substantial market growth in the treatment landscape for PAH.

Type Insights

In 2024, the branded segment had the highest market share of 42% on the basis of the type. The branded segment holds a significant share in the pulmonary arterial hypertension (PAH) market due to several factors. First, branded medications often have a strong clinical track record, instilling trust among healthcare providers and patients. Second, pharmaceutical companies invest heavily in research and development to create innovative and effective branded therapies. Third, branding allows companies to differentiate their products in a competitive market, supporting premium pricing.

Additionally, the exclusive patents of branded drugs provide a monopoly for a period, contributing to a higher market share. These factors combined make the branded segment a dominant force in the PAH market.

The generics segment is anticipated to expand at the fastest rate over the projected period. Generics hold a significant growth in the pulmonary arterial hypertension (PAH) market primarily due to the expiration of patents on some branded PAH drugs. As patents have lapsed, generic versions of these medications have entered the market, offering cost-effective alternatives.

These generic options make PAH treatment more affordable and accessible to a broader patient population, especially in regions with limited healthcare resources or cost-conscious healthcare systems. This increased affordability and availability of generics have contributed to their major growth in the PAH market, catering to patients who may not have access to expensive branded alternatives.

Route of Administration Insights

In 2024, the oral segment had the highest market share of 51% on the basis of the route of administration. The significant dominance of the oral segment in the pulmonary arterial hypertension (PAH) market is attributed to its practicality and patient compliance. Oral medications are favored for their ease of administration compared to more invasive delivery methods like intravenous or inhaled treatments, making them the go-to option for long-term therapy. This non-invasive approach enhances patient comfort and adherence to treatment plans. Moreover, ongoing advancements in the development of oral PAH drugs, featuring enhanced efficacy and fewer side effects, further establish the prominence of this segment. As a result, oral treatments stand as a preferred choice for both patients and healthcare providers in the management of PAH.

The intravenous/ subcutaneous segment is anticipated to expand at the fastest rate over the projected period. The intravenous/subcutaneous segment commands a substantial share in the pulmonary arterial hypertension (PAH) market due to its effectiveness in delivering rapid and precise drug administration. This mode of treatment enables immediate relief from PAH symptoms, making it a preferred option for severe cases. Furthermore, intravenous/subcutaneous therapies are often used when oral medications prove insufficient. While they require professional administration, these methods offer a direct and consistent way to manage PAH, contributing to their significant market share, particularly in addressing the critical needs of patients with advanced stages of the disease.

In February 2025, Natco Pharma received U.S. Food and Drug Administration final approval for Bosentan tablets for oral suspension, 32mg, its generic version of Actelion Pharmaceuticals US Inc.'s pulmonary arterial hypertension drug Tracleer.

Regional Insights

U.S. Pulmonary Arterial Hypertension Market Size and Growth 2025 to 2034

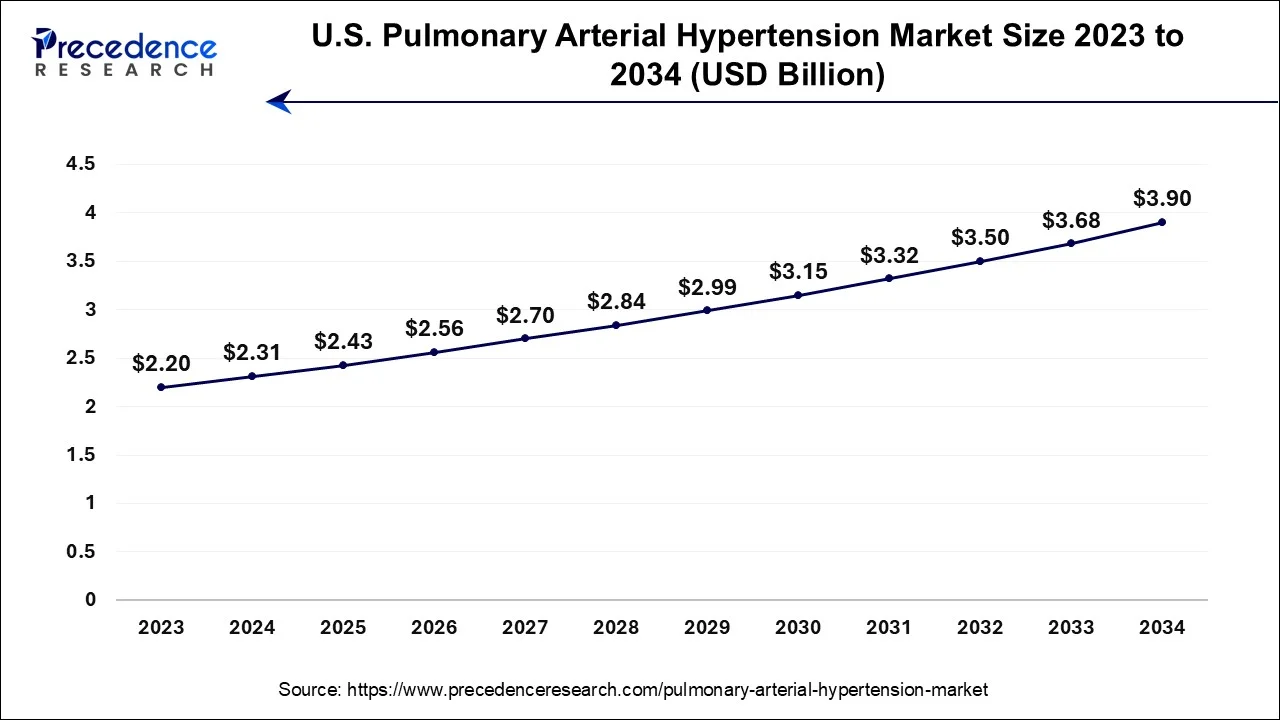

The U.S. pulmonary arterial hypertension market size accounted for USD 2.43 billion in 2025 and is expected to be worth around USD 3.90 billion by 2034, growing at a CAGR of5.37% from 2025 to 2034.

PAH: The North American Advantage

North America has held the largest revenue share 41% in 2024. North America holds a significant share in the pulmonary arterial hypertension (PAH) market due to several key factors. The region boasts a well-established healthcare infrastructure and advanced research capabilities, fostering the development of innovative PAH treatments. Additionally, high healthcare spending and insurance coverage enhance patient access to expensive PAH therapies.

A greater prevalence of risk factors, such as obesity and cardiovascular diseases, also contributes to a larger patient pool in North America. Furthermore, robust patient advocacy efforts, clinical trials, and early diagnosis initiatives help maintain North America's prominent position in the PAH market.

Pulmonary arterial hypertension (PAH) is a rare, progressive form of pulmonary hypertension that causes increased blood pressure in the lungs due to an obstruction in the organ's small arteries. The causes of this serious health condition are often unknown, although about 15% to 20% of cases are inherited. The disease is estimated to affect around 40,000 people in the U.S., and it disproportionately affects women between the ages of 30 and 60, especially those of Black and Hispanic descent.

In November 2024, Merck joined the American Lung Association in raising awareness of pulmonary arterial hypertension. Merck is continuing its work to improve awareness of and education around the rare disease. The organization's new Merck-supported campaign aims to improve education around the early signs of PAH to speed up the diagnosis rate. It'll also provide resources to those already diagnosed with PAH to make them and their caregivers aware of available treatments and other strategies to manage symptoms.

U.S. Pulmonary Arterial Hypertension Market Trends

The U.S. market is experiencing steady growth, driven by expansion is fueled by the introduction of novel therapies, including activin-signaling inhibitors and advanced combination treatments that enhance patient outcomes. Increasing awareness, improved screening programs, and early diagnosis are further supporting market growth by broadening the treatable patient population.

The Pacific Boom: How Asia Is Reshaping the PAH Landscape

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 13.3% during the forecast period. The Asia-Pacific region commands a substantial share in the pulmonary arterial hypertension (PAH) market due to several factors. A growing population, increasing healthcare expenditures, and improving healthcare infrastructure have expanded the market's potential. Additionally, a rise in the incidence of PAH, driven by factors like pollution and changing lifestyles, has boosted the demand for treatments.

The presence of a large, underserved patient population, coupled with a surge in awareness and diagnosis, further contributes to the region's market share. Pharmaceutical companies are also increasingly focusing on this region, underscoring its significance in the global PAH market.

According to the data published by the World Health Organization (WHO), roughly 270 million Chinese people are suffering from hypertension, with only 13.8% of the patients having their condition under control.

According to the article published in November 2024, the National University Heart Centre, Singapore (NUHCS) will start using sotatercept (Winrevair) to treat high blood pressure due to constricted lung arteries, a rare illness that affects one in 5,000 Singaporeans.

China, Germany Pulmonary Arterial Hypertension Market Trends

The market in China is witnessing strong expansion, growth is primarily driven by rising disease prevalence due to an aging population, increasing cases of chronic heart and lung conditions, and heightened awareness of PAH diagnosis and management. Government initiatives to enhance healthcare accessibility, along with regulatory support for faster drug approvals, are accelerating the availability of advanced therapies across the country.

Why did the pulmonary arterial hypertension market grow rapidly in Europe?

The pulmonary arterial hypertension market in Europe has exhibited beneficial growth due to improved healthcare policies in Europe, drug development, and reimbursement systems. The growth of the market is likely to proceed due to advances in personalized medicine, patient awareness, and collaboration amongst stakeholders in the industry. New opportunities in the market include research and development in gene therapy, innovation in treatment, and cross-border healthcare programs that enhance access.

Germany Pulmonary Arterial Hypertension Market Trends

Germany led the regional market due to its advanced medical technology, strong R&D systems, and high level of expenditure in healthcare. Its focus on innovative therapies and specialized hospitals has enabled early diagnosis and treatment of pulmonary arterial hypertension. Moreover, its advanced infrastructure fosters collaborations between bioscience companies and universities to improve research and drug development, and more importantly, patient outcomes.

How did Latin America grow steadily in the pulmonary arterial hypertension market?

The pulmonary arterial hypertension market in Latin America has been growing steadily due to rising healthcare spending globally, improved awareness, and access to new medications and treatments. The public sector has increased its focus on improving access to treatment and training in medical professional degrees, which has led to an improved rate of diagnosis. Opportunities existed with regard to public-private partnerships, developing affordable medicine, and additional channels of the distribution network.

Brazil Pulmonary Arterial Hypertension Market Trends

Brazil was the largest market in Latin America, with increases in health care reforms, hospital development, and publicly funded programs for rare disease treatment. Increasingly, Brazil's collaborations with global pharmaceutical companies and their established research institutions have also assisted in improving drug access to the market and the stability of pharmaceuticals in the country.

What made the Middle East & Africa region grow significantly in the pulmonary arterial hypertension market?

The Middle East & Africa region experienced significant growth driven by better healthcare infrastructure, expanding medical tourism, and greater recognition of pulmonary arterial hypertension. The inclination of governments to invest in state-of-the-art hospitals and bring in therapies has opened doors for global companies. Growth in the market was driven by early detection programs and increased health insurance coverage.

The UAE Pulmonary Arterial Hypertension Market Trends

The UAE stands out in the region, with significant healthcare spending, modern diagnostic centers, and support for rare disease treatments. The government's strong commitment to providing high-quality healthcare and engaging with international pharmaceutical companies propelled the market in a positive direction.

Pulmonary Arterial Hypertension Market Companies

- Actelion Pharmaceuticals (now part of Janssen Pharmaceuticals)

- Gilead Sciences

- United Therapeutics Corporation

- GlaxoSmithKline

- Bayer

- Pfizer

- Arena Pharmaceuticals

- Reata Pharmaceuticals

- Lung Biotechnology

- Acceleron Pharma

- Liquidia Technologies

- SteadyMed Therapeutics (acquired by United Therapeutics)

- Complexa Inc.

- Bellerophon Therapeutics

- Innoven Life Sciences.

Recent Developments

- In May 2025, Liquidia Corporation, a biopharmaceutical company developing innovative therapies for patients with rare cardiopulmonary disease, announced that the U.S. Food and Drug Administration (FDA) has approved YUTREPIA inhalation powder, a prostacyclin analog for adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD) to improve exercise ability.

- In March 2024, Merck, known as MSD outside of the United States and Canada, announced today that the U.S. Food and Drug Administration (FDA) has approved sotatercept-csrk (U.S. Brand Name: WINREVAIR, for injection, 45mg, 60mg) for the treatment of adults with pulmonary arterial hypertension. WINREVAIR is a breakthrough biologic for this rare, progressive disease.

- In May 2024, Chiesi Group and Gossamer Bio have announced a global collaboration and license agreement to develop and commercialise seralutinib to treat respiratory diseases. Gossamer's seralutinib is designed to treat pulmonary arterial hypertension and other indications. Chiesi will support Gossamer's ongoing work for seralutinib in pulmonary arterial hypertension (PAH), as well as its development in pulmonary hypertension associated with interstitial lung disease (PH-ILD). Predicted to affect up to 50,000 people in the US, it is estimated that PH-ILD affects up to 100,000 patients in the US.

- In July 2023, Novartis and the Novartis US Foundation expanded their collaborative initiative, Beacon of Hope. This program, which has been running for a decade, aims to address disparities in health and education while promoting diversity, equity, inclusion, and trust within the research and development sector. Beacon of Hope will now encompass a range of clinical trials, including those focused on pulmonary arterial hypertension, hypertension, urticaria, giant cell arteritis, and breast cancer studies.

- In April 2021, the United Therapeutics Corporation made a significant announcement regarding the FDA's approval and subsequent market launch of Tyvaso for the treatment of Pulmonary Hypertension Associated with Interstitial Lung Disease (PH-ILD). This development represents a notable advancement in treatment options, offering hope for patients with PH-ILD and presenting a strategic growth opportunity for the company within the pulmonary hypertension market.

Segments Covered in the Report

By Drug Class

- Endothelin Receptor Antagonists (ERAs)

- PDE-5 Inhibitors

- Prostacyclin and Prostacyclin Analogs

- SGC Stimulators

By Type

- Branded

- Generics

By Route of Administration

- Oral

- Intravenous/ subcutaneous

- Inhalational

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting