What is the Quantum Photonics Market Size?

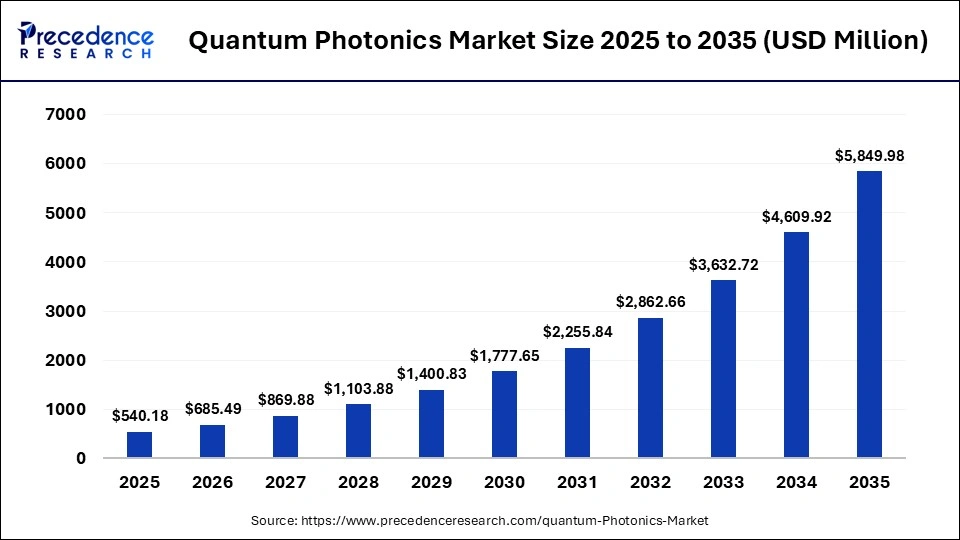

The global quantum photonics market size was calculated at USD 540.18 million in 2025 and is predicted to increase from USD 685.49 million in 2026 to approximately USD 5849.98 million by 2035, expanding at a CAGR of 26.9% from 2026 to 2035. The market growth is attributed to increasing government investments and national initiatives in quantum research that accelerate photonic technology development and deployment worldwide.

Market Highlights

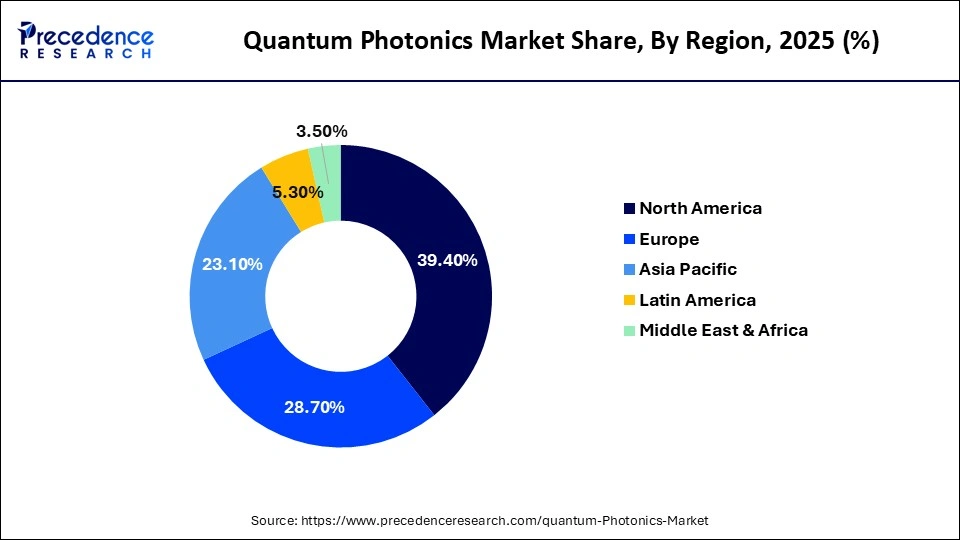

- North America dominated the market with 39.4% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 27.8% between 2026 and 2035.

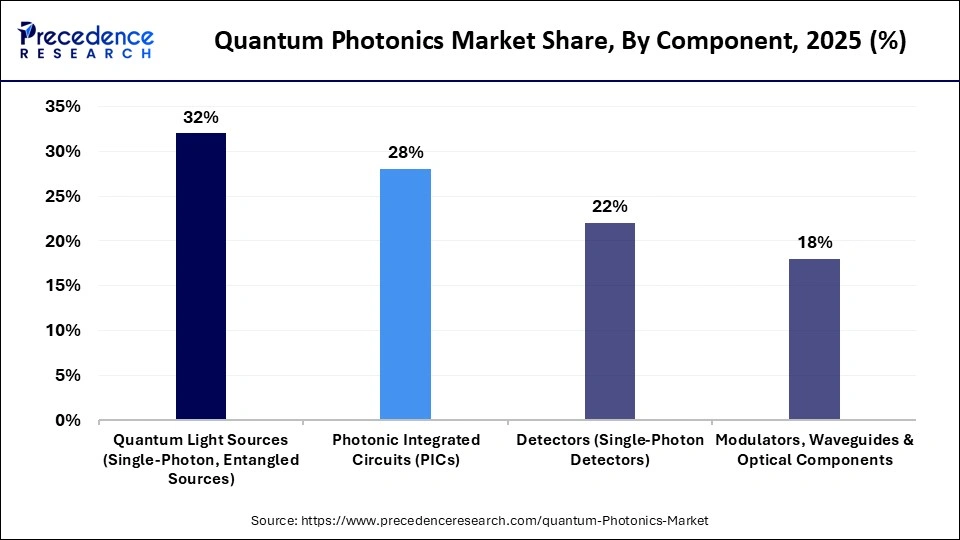

- By component, the quantum light sources (single-photon, entangled sources) segment contributed the highest market share of 31.6% in 2025.

- By component, the photonic integrated circuits (PICs) segment is growing at a strong CAGR of 26.1% in the quantum photonics market between 2026 and 2035.

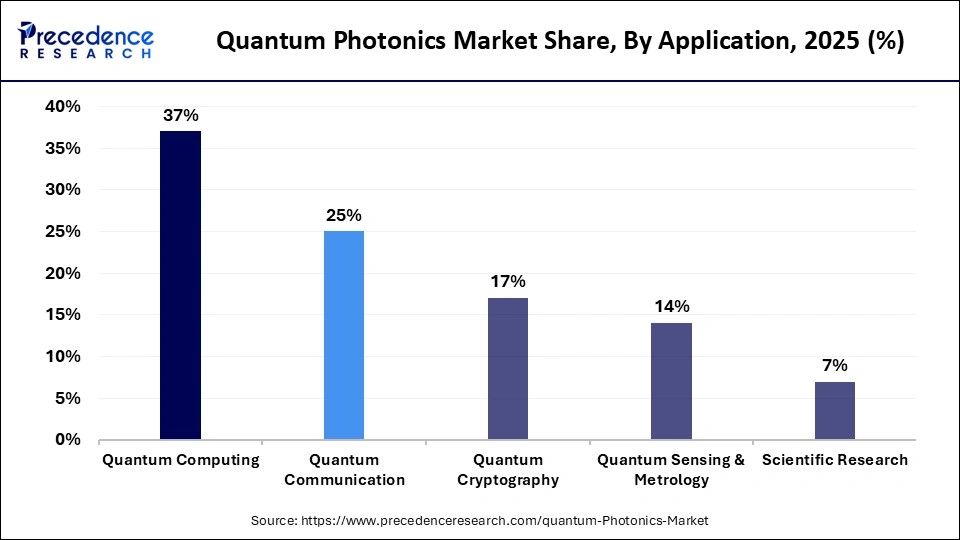

- By application, the quantum computing segment held a major market share of 36.8% in 2025.

- By application, the hybrid deployment segment is expected to expand at a notable CAGR of 23.6% from 2026 to 2035.

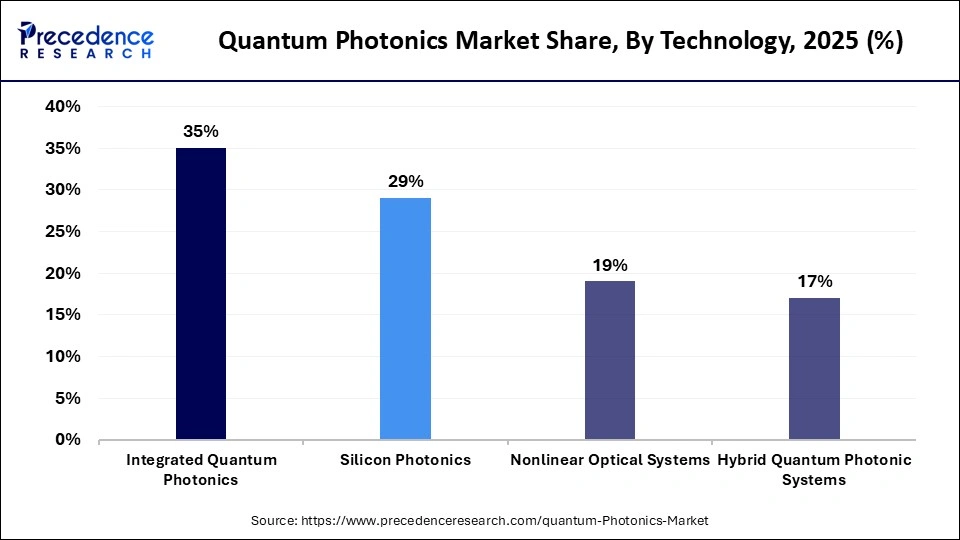

- By technology, the integrated quantum photonics segment captured the highest share of 34.9% in the quantum photonics market during 2025.

- By technology, the silicon photonics segment is poised to grow at a healthy CAGR of 25.1% between 2026 and 2035.

- By end user, the research institutes and universities segment generated the biggest market share of 33.7% in 2025.

- By end user, the quantum computing companies segment is expanding at the fastest CAGR of 28.3% between 2026 and 2035.

- By deployment, the laboratory/research use segment accounted for the largest share of 61.9% in the quantum photonics market in 2025.

By deployment, the commercial & industrial use segment is projected to grow at a solid CAGR of 27.6% between 2026 and 2035.

Market Overview

The quantum photonics market growth is driven by strong government-backed initiatives accelerating the transition of quantum technologies from research to deployment. Quantum photonics is based on the idea that photons are carriers of information and that quantum characteristics of superposition and entanglement. They are used to realize ultra-secure communication and architectures of computing that are scalable. Additionally, the continued government investment supporting quantum-secure infrastructure and photonic-based quantum computing development is expected to fuel the market growth.

Public programs such as the European Union's Quantum Flagship and the U.S. National Quantum Initiative are funding photonic quantum processors, secure optical networks, and component-level manufacturing capabilities. National laboratories and research agencies are prioritizing photonic platforms due to their compatibility with existing fiber-optic infrastructure and room-temperature operation, which lowers deployment barriers compared to other quantum approaches.

Early deployments are concentrated in quantum key distribution networks, photonic integrated circuits, and quantum sensing applications for defense, telecommunications, and critical infrastructure monitoring.

Impact of Artificial Intelligence on the Quantum Photonics Market

AI is changing the quantum photonics industry dramatically to maximize the design of devices, increase the speed of prototyping, and enhance operational efficiency. By using AI-based simulation to simulate the behavior of photons in more complicated circuits, researchers can minimize experimental trials and development time. Manufacturers use machine learning models to improve the accuracy of the fabrication of photonic integrated circuits, improving their yield and making them consistent across batches of production.

Quantum Photonics Market Growth Factors

- Rising Demand for Secure Communication Networks: Global cybersecurity concerns are driving the adoption of quantum photonic technologies for unbreakable encryption.

- Advancements in Integrated Photonic Circuits: Continuous innovation in on-chip photonics is boosting scalability and performance across quantum computing and sensing applications.

- Increasing Adoption of Quantum Computing Solutions: Demand from tech companies and cloud service providers is propelling the integration of photonic-based quantum processors.

Global Policy, Investment, and Industrial Momentum Shaping the Quantum Photonics Market

- China and other Asian manufacturers accounted for more than 65% of global photonics production, with China specifically leading at about 32% of photonics component manufacturing output and the broader ecosystem that underpins quantum photonic component production.

- China is the largest filer of quantum technology patents (including quantum photonics relevant inventions), accounting for approximately 32% of global quantum patent filings in 2024.

- The United States ranks second globally in quantum technology patent filings in 2024, holding roughly 19% of the world's quantum patent share and serving as a primary source of patents in quantum computing and integrated photonics hardware.

- The EU Quantum Flagship Program continues to coordinate major infrastructure investments with combined funding of €1 million (USD 1.07 million) dedicated to quantum technologies, including integrated photonics laboratories, quantum networking testbeds, and cross-border research infrastructure through 2026.

- Department of Energy's Quantum Leadership Act of 2025, the U.S. government allocated USD 500 million specifically for quantum network infrastructure development across fiscal years 2026-2030.

- Public funding commitments for quantum technology, encompassing grant programs, national labs, and government-backed co-investment schemes, totaled roughly USD 680 million in 2024.

quantum photonics market Trends

- PhotonSync Enabled Long Distance Quantum Networks: The stabilization of optical fibers during long-distance quantum communication is leading to the growth of safe networking and experimentation of feasible infrastructure. Such a trend is generating more interest in practical applications of quantum networks

- Cryogenic Signal Innovations: Emerging low-heat photonic devices are boosting efficiency and signal integrity in quantum hardware. In laboratories and pilot projects, scalable, high-fidelity systems are getting the priority of researchers and developers

- Integrated Photonic Platforms for Real World Systems: Development of programmable, chip-based photonic circuits is rising, bridging the gap between laboratory demonstrations and practical applications. These platforms are being used in industries for scalable quantum technologies. Industry engagement at major conferences is boosting cross-sector exchange and accelerating the transfer of laboratory advances into prototype deployments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 540.18 Million |

| Market Size in 2026 | USD 685.49 Million |

| Market Size by 2035 | USD 5849.98 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 26.9% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application,Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did Quantum Light Sources Dominate in the Quantum Photonics Market During 2025?

Quantum light sources (single-photon, entangled sources) segment dominated the quantum photonics market in 2025, accounting for an estimated 31.6% market share, as they underpin the creation and manipulation of quantum states used in communication, sensing, and computation. These sources produce non-classical light, which is highly pure and indistinguishable. They are important to quantum key distribution, entanglement-based protocols, and advanced interferometric experiments, which were the priority of researchers and early adopters last year. Furthermore, the sustained focus on improving the quality and reliability of quantum light emitters helped them dominate component-level activity across quantum photonics R&D and early commercial prototypes.

The photonic integrated circuits (PICs) segment is expected to grow at the fastest rate in the coming years, accounting for 26.1% of CAGR, as they provide the scalability and integration density required to bring quantum photonics out of the single-system demonstrations in the laboratory to the real world. The integration is able to put several functions, such as generation, routing, modulation, and detection, on a single chip. This minimizes loss, increases stability, and makes it more manufacturable compared to discrete bulk optical systems. Additionally, the necessity to incorporate complex photonic circuits that process entangled states, high-dimensional encoding, and error correction teams in small modules is also a contributing factor to the future growth of PICs.

Application Insights

Why Did Quantum Computing Lead in the Quantum Photonics Market During 2025?

Quantum computing segment held the largest revenue share in the quantum photonics market in 2025, which held a market share of about 36.8%. Due to the fact that major research institutes and technology firms announced new record improvements in both hardware and algorithm performance that outperformed classical computation in doing certain tasks.

- In 2024, real-world performance improvements with the 105 qubit Willow chip, designed by Google, helped validate the practical potential of quantum systems. Moreover, the increase in error reduction limits and expandable interconnections ensured that computing tasks became more dependable every year, further supporting the segment growth in the coming years.

Quantum communication segment is expected to grow at the fastest growth rate in the coming years, accounting for 23.6% CAGR, owing to its advanced stability and long-distance fiber applications. This capability increases the possibility of real-world applications in the secure transmission of data, which is an urgent requirement in the areas of defense, finance, and large companies.

- In 2026, Indian scientists invented a technology known as PhotonSync, which stabilizes optical fiber to transmit quantum over more than 1,000 km. That overcomes most critical difficulties, such as phase noise, and allows quantum-grade secure channels to be formed within existing infrastructure. Additionally, the standardization and hybridization of quantum communication with classical telecom infrastructure is expected to minimize barriers to the adoption and implementation of quantum layers by operators of existing fiber networks.

Technology Insights

Why Did Integrated Quantum Photonics Dominate in the Quantum Photonics Market?

The integrated quantum photonics segment dominated the quantum photonics market in 2025, accounting for an estimated 34.9% market share, due to its need to create well-integrated devices that co-locate quantum sources, detectors, interferometers, and optical circuits on single-chip technologies. They dramatically increased the compactness and stability of the systems. Furthermore, the integrated quantum photonics is the default platform for cutting-edge implementations, thus boosting its demand in the coming years.

The silicon photonics segment is expected to grow at the fastest rate in the coming years, accounting for 25.1% of CAGR, owing to the fact that it leverages existing CMOS foundry platforms. They offer a cost-effective, repeatable channel to high-volume production of photonic devices needed in future quantum systems. Moreover, the developments boost confidence that silicon photonics' scalability and wide adoption in classical optical systems further drive the segment growth.

End User Insights

Why Did Research Institutes & Universities Lead the Quantum Photonics Market in 2025?

The research institutes and universities segment held the largest revenue share in the quantum photonics market in 2025, which held a market share of about 30%. Due to their major involvement in scientific discoveries and initial prototypes that propelled essential technological improvements in quantum photonics devices. Peer-reviewed articles on entanglement optimization, low-loss waveguides, and the architecture of photonic integrated circuits were regularly published by academic labs. Additionally, these research activities by these institutions continued to shape the priorities of public investment in research and industrial roadmaps, thus propelling the market in the coming years.

The quantum computing companies segment is expected to grow at the fastest CAGR in the coming years, accounting for 28.3% CAGR, as they are moving research foundations into industrial-grade systems. They are creating collaborations to help them implement their technologies commercially faster than in the lab.

- In 2025, companies like PsiQuantum topped up with substantial capital, raising a USD 1 million Series E round to value it at USD 7 million. This supports the development of integrated photonic quantum computers in Brisbane and Chicago. Moreover, the companies also pursue bold acquisition and integration strategies to strengthen their end-to-end capabilities, further facilitating this segment growth in the coming years.

Deployment Insights

Why Did Laboratory/Research Use Segment Dominate the Quantum Photonics Market?

The laboratory/research use segment dominated the quantum photonics market in 2025, accounting for an estimated 61.9% market share, as academic and institutional settings continued to act as the primary validation ground for quantum photonics during 2024–2025. The deployment of laboratories remained important since, under controlled conditions, sensitive quantum components could be tested repeatedly. The first commercial sources of entangled photons were proven in research laboratories. Furthermore, the Laboratory use remained the primary engine of technical maturity in recent years, thus facilitating the segment growth.

The commercial & industrial application segment is expected to grow at the fastest CAGR in the coming years, accounting for 27.6% of the CAGR, as organizations take quantum photonics out of the laboratory. Companies are anticipated to scale chip-based photon sources and detectors for field compatibility. Industrial players are projected to prioritize systems that integrate with existing telecom and data-center infrastructure. Additionally, the industrial deployment growth of these technologies is also projected to benefit from maturing supply chains in the coming years.

Regional Insights

How Big is the North America Quantum Photonics Market Size?

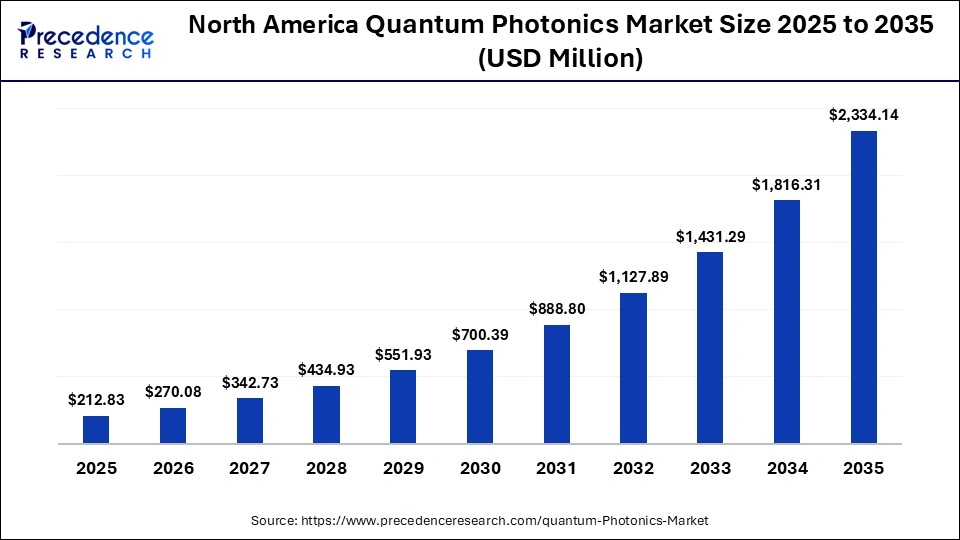

The North America quantum photonics market size is estimated at USD 212.83 million in 2025 and is projected to reach approximately USD 2,334.14 million by 2035, with a 27.06% CAGR from 2026 to 2035.

Why Is North America Leading in the Quantum Photonics Market in 2025?

North America led the quantum photonics market, capturing the largest revenue share in 2025, accounting for an estimated 39.4% market share. Due to the region's strong funding, institutional support, and coordinated government efforts on the industry over 2024 and 2025. U.S. national programs, including state-level programs such as the Quantum Moonshot program in New Mexico, are competing for up to 160 million dollars in 2025 for support funding through the National Science Foundation. This creates quantum infrastructure, which has been a focus of aggressive regional efforts to transform foundational science into technology leadership by 2033. Furthermore, the U.S. and Canadian semiconductor and photonics giants invested in silicon photonics and quantum chip foundry infrastructure, which strengthened market growth in the coming years.

What is the Size of the U.S. Quantum Photonics Market?

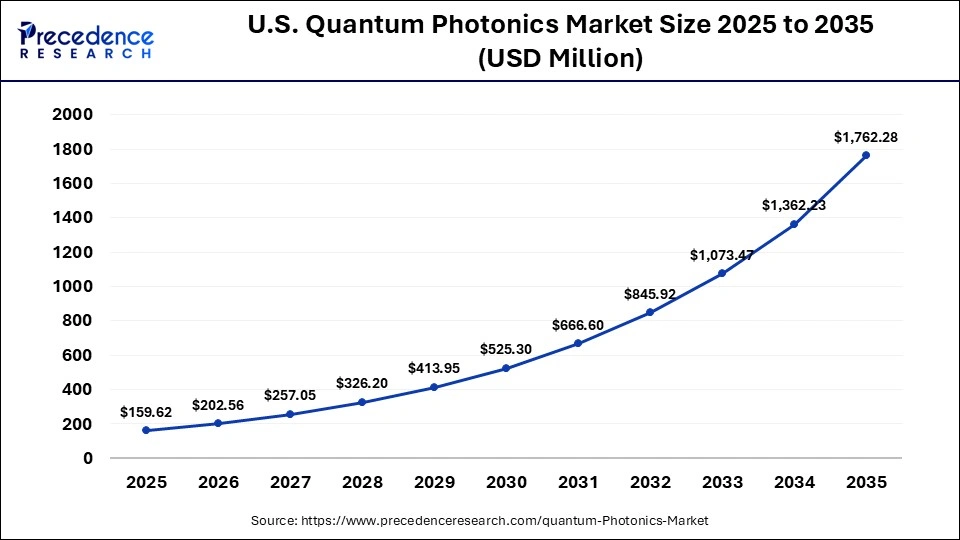

The U.S. quantum photonics market size is calculated at USD 159.62 million in 2025 and is expected to reach nearly USD 1,762.28 million in 2035, accelerating at a strong CAGR of 27.14% between 2026 and 2035.

U.S. North America's Leading Country in Quantum Photonics

The U.S. leads the market in North America with large-scale government programs and high-impact industry programs that run the spectrum from basic research to commercialization. Quantum hardware and photonic systems are getting coordinated investment with federal support via the National Quantum Initiative Act. In 2025, the U.S. National Quantum Virtual Laboratory (NQVL) of the U.S. National Science Foundation granted USD 16 million to multi-institutional teams that develop networked photonic quantum platforms. Moreover, the growing R&D efforts by national laboratories, universities, and commercial organizations further fuel the market in this country.

Why Is Asia Pacific Expected to Grow Strongly in the Coming Years in the Quantum Photonics Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for 27.8% of CAGR, as governments, research organizations, and MNCs continue to grow in quantum photonics development and implementation within the region. National programs like the 14th Five-Year Plan of China and the National Quantum Mission of India highlight the importance of strategic investments in quantum research output and the commercialization pipeline. Additionally, the combined government strategy, academic depth, rising industrial participation, and regional ecosystems are expected to shift a growing share of global photonics deployment in this region.

China: Asia Pacific's Leading Country in Quantum Photonics

China is leading the charge in the Asia Pacific market, due to high national investments and early industrialization that goes further than basic research and includes infrastructure and factory-building plans. Regional estimates have shown that China has invested USD 10 million to USD 15 million in national quantum R&D funding by 2025, which impacts photonic quantum technologies, architectures, and innovations. Furthermore, China solidifies its dominance in the region and speeds up the overall growth of the entire Asia Pacific in terms of quantum photonics applications, deployment, and commercialization through a coordinated public investment.

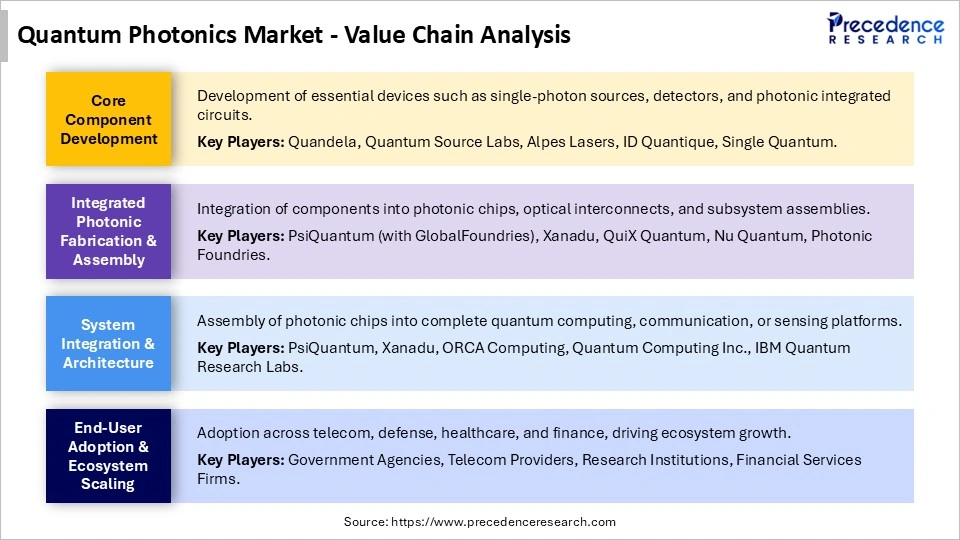

Quantum Photonics Market Value Chain Analysis

Who are the Major Players in the Global Quantum Photonics Market?

The major players in the quantum photonics market include Amazon Web Services, Inc., ID Quantique, M Squared, Microchip Technology, Inc., NEC Corporation, Nordic Quantum Computing, ORCA Computing, PsiQuantum, Quandela, Xanadu

Recent Developments

- In January 2026, Photonic Inc., a global leader in distributed quantum computing, announced that it had secured CAD 180M (USD 130M) in the first close of its latest investment round, led by Planet First Partners and joined by new investors Royal Bank of Canada (RBC), TELUS, and others. This substantial raise highlights strong investor confidence and the company's rapid expansion. Existing backers, including BCI and Microsoft, also participated in this round, bringing the company's total funding to CAD 375M (USD 271M).(Source: https://photonic.com)

- In October 2025, Rydberg Technologies Inc. announced the launch of Rydberg Photonics GmbH, a Berlin-based spin-off from the Ferdinand-Braun-Institut (FBH). The new company aims to deliver next-generation, compact, micro-integrated photonic engines to power the global quantum technology ecosystem at scale.

Segments Covered in the Report

By Component

- Quantum Light Sources (Single-Photon Sources, Entangled Photon Sources)

- Photonic Integrated Circuits (PICs)

- Detectors (Single-Photon Detectors)

- Modulators, Waveguides & Optical Components

By Application

- Quantum Computing

- Quantum Communication

- Quantum Cryptography

- Quantum Sensing & Metrology

- Scientific Research

By Technology

- Integrated Quantum Photonics

- Silicon Photonics

- Nonlinear Optical Systems

- Hybrid Quantum Photonic Systems

By End User

- Research Institutes & Universities

- Government & Defense Organizations

- Quantum Computing Companies

- Telecommunications Providers

- Industrial Technology Developers

By Deployment

- Laboratory/Research Use

- Commercial & Industrial Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content