Rapid Diagnostics Market Size and Forecast 2025 to 2034

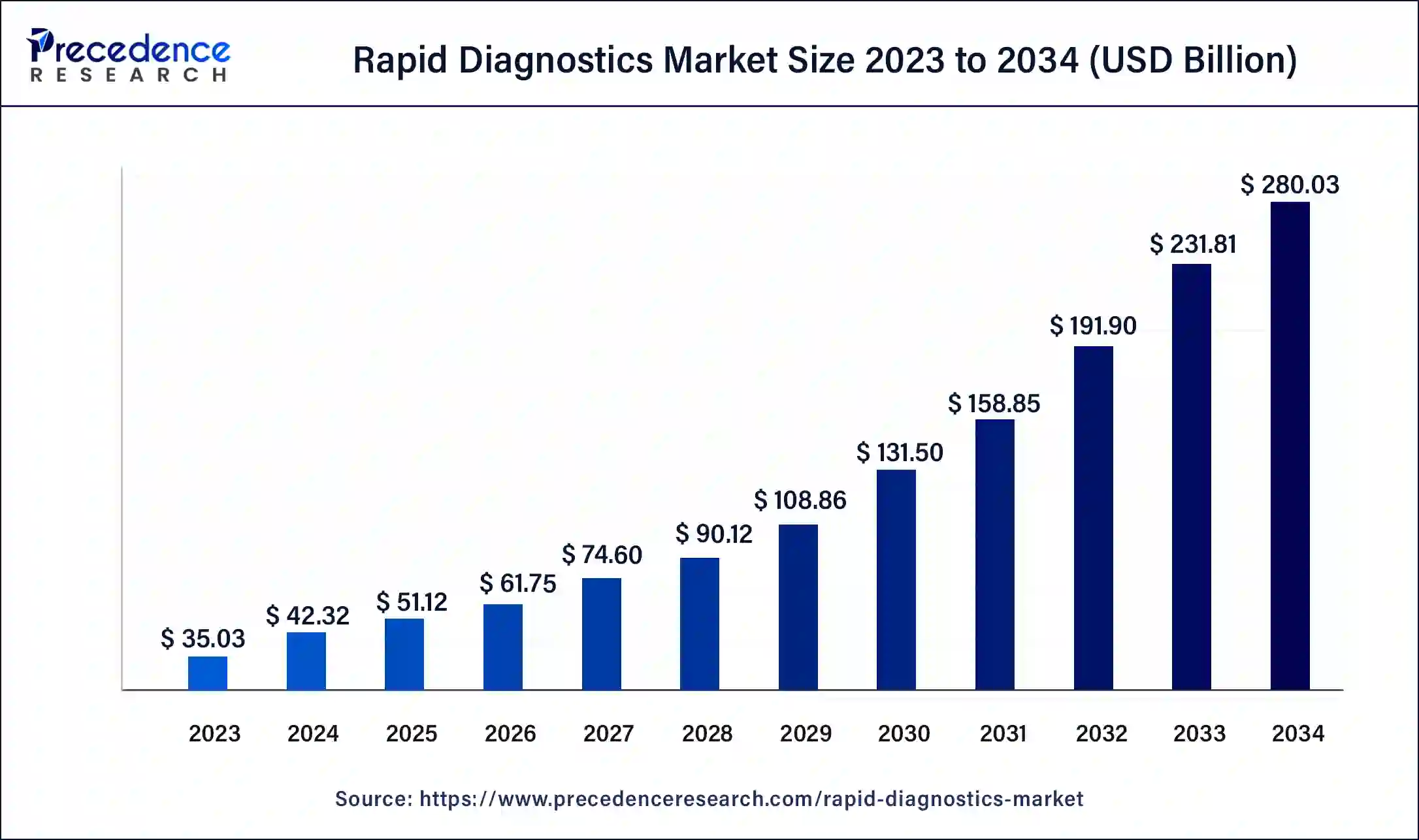

The global rapid diagnostics market size was estimated at USD 42.32 billion in 2024 and is predicted to increase from USD 51.12 billion in 2025 to approximately USD 280.03 billion by 2034, expanding at a CAGR of 20.80% from 2025 to 2034.

Rapid Diagnostics Market Key Takeaways

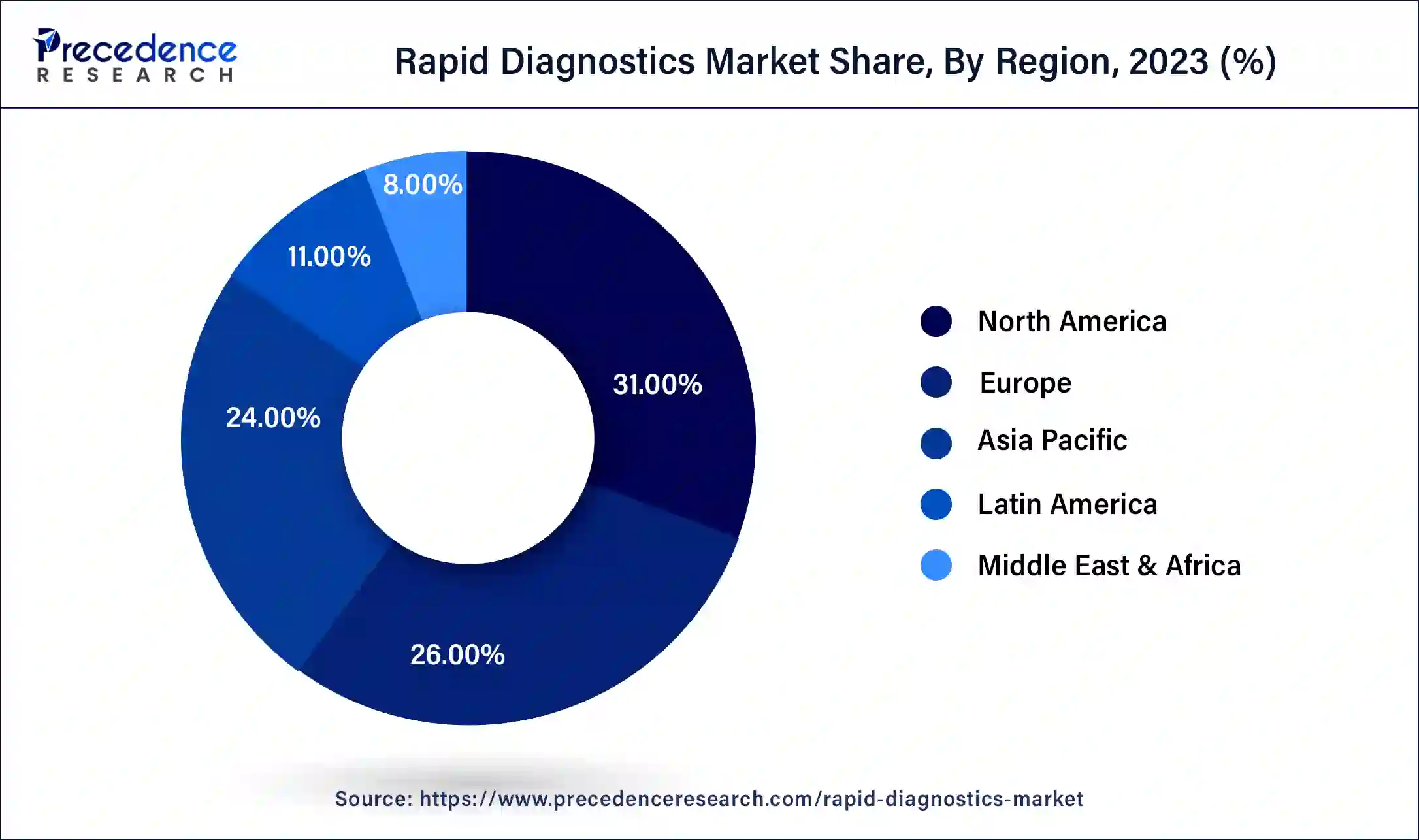

- North America led the global market with the highest market share of 31% in 2024.

- By product, the consumables segment held a 63.40% market share in 2024.

- By product, the software & mobile apps segment is expected to grow at the highest CAGR of 9.80% over the forecast period.

- By technology, the lateral flow assays (LFA) segment dominated the market with 41.60% share in 2024.

- By technology, the molecular diagnostics segment is expected to grow at a high CAGR of 10.40% in 2024.

- By application, the infectious diseases segment led the market by holding 36.90% share in 2024.

- By application, the oncology segment is expected to grow at the highest CAGR of 10.10% in 2024.

- By end user, the hospitals & clinics segment led the market by holding 38.70% share in 2024.

- By end user, the home care settings segment is expected to grow at the highest CAGR of 10.60% in 2024.

- By mode of testing, the professional testing segment dominated the market with a 58.90% share in 2024.

- By mode of testing, the over-the-counter (OTC)segment is expected to grow at the highest CAGR of 9.90% in 2024.

- By distribution channel, the direct sales segment held a 32.40% market share in 2024.

- By distribution channel, The E-commerce platforms segment is expected to grow at the highest CAGR of 11.20% in 2024.

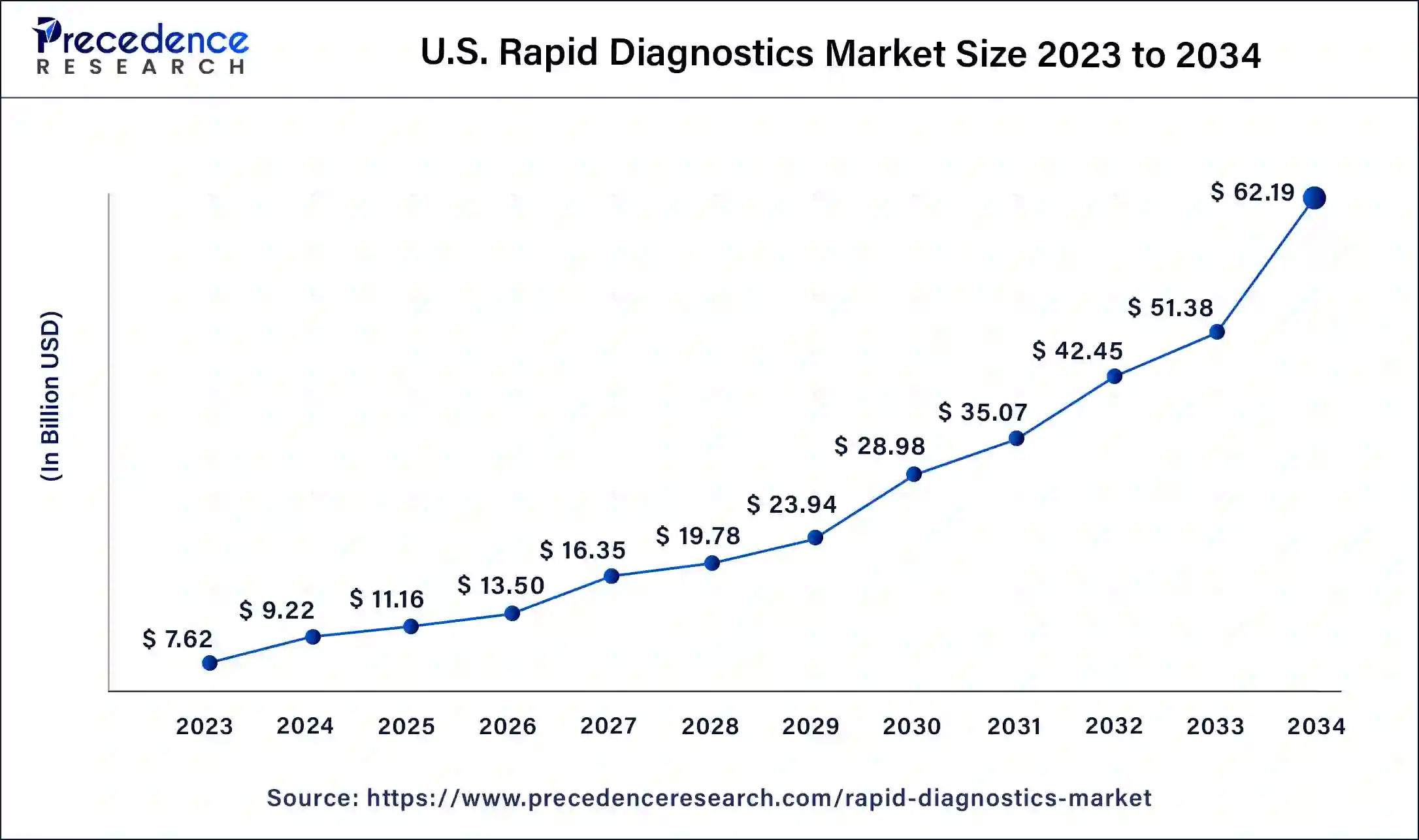

U.S. Rapid Diagnostics Market Size and Growth 2025 to 2034

The U.S. rapid diagnostics market size was estimated at USD 9.22 billion in 2024 and is predicted to be worth around USD 62.19 billion by 2034, at a CAGR of 21% from 2025 to 2034.

North America overwhelmed the market in 2024 with a portion of over 31% and is supposed to keep up with its lead from 2024 to 2034. The U.S. rised as the key income-creating portion in 2023. Various diagnostics organizations are engaged with the improvement of novel COVID-19 quick demonstrative tests and are endeavoring to acquire endorsement from the FDA to send off these tests in the U.S.

Latin American region is projected to select the most raised advancement during the figure time given government tries to increase care about the early disclosure of ailments and standard prosperity check-ups, further propelling sign of-care devices. Likewise, growing clinical benefits utilization, extending the number of crisis facilities and clinical demonstrative labs, and growing coordinated endeavors among players in the district is moreover expected to drive market improvement.

- In 2024, the World Health Organization (WHO) approved the packaging and shipping of a prequalified HIV rapid test at an African manufacturing site, enhancing regional access to diagnostics.

Latin American region is projected to select the most raised advancement during the figure time given government tries to increase care about the early disclosure of ailments and standard prosperity check-ups, further propelling sign of-care devices. Likewise, growing clinical benefits utilization, extending the number of crisis facilities and clinical demonstrative labs, and growing facilitated endeavors among players in the district is moreover expected to drive market improvement.

The Latin American market integrates Brazil, Mexico, and other Latin American countries like Argentina, Chile, Peru, Colombia, Venezuela, and Bolivia. The speedy advancement of geriatric people in a couple of Latin American countries is one of the main issues supporting the improvement of the PoC diagnostics market in Latin America. Moreover, the pace of a couple of overpowering diseases, similar to wilderness fever, flu, and AIDS, is extending around here. This, subsequently, is empowering a strong interest in overwhelming disorder diagnostics.

Rapid Diagnostics Market Growth Factors

The market for rapid diagnostics is set to pick up speed before long inferable from the rising need and mindfulness concerning the fast clinical assessment of constant sicknesses, developing interest for point of care (POC) diagnostics, a high convergence of convenient fast testing gadgets on the lookout, ascend in the number of irresistible infection cases, and extending geriatric populace base. The European Center for Disease Prevention and Control, the WHO, and the CDC effectively participated in planning information on the occurrence and predominance of irresistible sicknesses to methodically control the illness. Cooperative endeavors of the public authority bodies with nearby specialists to accomplish general control of treatment and the board of infectious illnesses are supposed to enhance the reception of fast tests.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD42.32 Billion |

| Market Size in 2025 | USD 51.12 billion |

| Market Size by 2034 | USD280.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 20.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Type Insights

The consumables segment held a 63.40% market share in 2024. The dominance of the segment can be attributed to the surge in incidence of chronic and infectious diseases and growing demand for rapid & precise diagnoses. Advancements in biosensors, microfluidics, and multiplexed testing platforms are driving the development of rapid diagnostic tests.

The software & mobile apps segment is expected to grow at the highest CAGR of 9.80% over the forecast period. The growth of the segment can be credited to the increasing adoption of telemedicine and the rising demand for remote patient monitoring. Moreover, the extensive use of smartphones and the app-based nature of various diagnostic tools are impacting positive segment growth soon.

Technology Insights

The lateral flow assays (LFA) segment dominated the market with a 41.60% share in 2024. The low advancement cost and simple assembling of horizontal stream examines have prompted the extension of these tests into a few quick testing applications. Lateral flow tests are generally embraced across subjective and quantitative ID of explicit antigens, quality intensification items, and antibodies in clinics, facilities, and symptomatic research centers, further adding to the fragment development.

The molecular diagnostics segment is expected to grow at a high CAGR of 10.40% in 2024. The growth of the segment can be linked to the rapid innovations in molecular diagnostic technologies like PCR, along with the rising need for point-of-care and at-home testing. Also, the surge in personalized medicine is contributing to segment growth further.

Application Insights

The infectious diseases segment led the market by holding 36.90% share in 2024. The outbreak of the novel COVID-19 has encouraged a pressing interest in its fast demonstrative arrangements as it is a foundation of the administration of the COVID-19 pandemic. Mass testing has expanded to deal with this pandemic. To satisfy this developing need, various diagnostics organizations are zeroing in on R&D activities for the advancement of novel COVID-19 rapid diagnostic units and acquiring approval from various regulatory bodies.

The oncology segment is expected to grow at the highest CAGR of 10.10% in 2024. The growth of the segment can be driven by the rising need for early cancer detection, a rapid surge in global cancer burden, and advancements in diagnostic technologies. Minimally invasive biopsy techniques are increasingly gaining traction.

End-use Insights

The hospitals & clinics segment led the market by holding 38.70% share in 2024. They act as essential consideration settings for determination and treatment, everything being equal. Moreover, expanding hospitalization because of the flare-up of COVID-19 is supposed to help section development. Consistent changes in the medical care industry have prompted an expansion in the requirement for emergency clinics with improved symptomatic services.

The home care settings segment is expected to grow at the highest CAGR of 10.60% in 2024. Most fast flu analytic packs that are Clinical Laboratory Improvement Amendments (CLIA) postponed are ordinarily utilized in POC settings. A horizontal stream fast antigen measurement that distinguishes pregnancy at home is generally utilized, hence driving the interest in home use units. Blood glucose testing strips are likewise usually utilized at home, which is a safe, simple, and reasonable method for actually looking at diabetes. The previously mentioned factors are cooperatively set to add to the development of the home consideration end-user section.

Mode of Testing Insights

The professional testing segment dominated the market with 58.90% share in 2024. The dominance of the segment can be attributed to the rise in incidence of infectious and chronic diseases along with the increasing demand for point-of-care testing (POCT). Furthermore, an increase in the geriatric population, who are more prone to chronic and infectious diseases, can fuel segment growth further.

The over-the-counter (OTC)segment is expected to grow at the highest CAGR of 9.90% in 2024.. This is credited to the way that these tests are not difficult to use in the "close understanding setting" and are a financially smart option in contrast to costly research center testing. These tests are regularly utilized in home care settings, providing a simple and cost-effective alternative to research facility testing. Fast Diagnostic Tests (RDTs) generally utilize saliva, urine, and blood to analyze infections.

Distribution Channel Insights

The direct sales segment held a 32.40% market share in 2024. The dominance of the segment can be attributed to the rapid innovations in diagnostic technologies, coupled with the increasing emphasis on decentralized healthcare. Additionally, these technologies have enhanced the speed and accuracy of rapid diagnostic tests, which makes them more user-friendly.

The E-commerce platforms segment is expected to grow at the highest CAGR of 11.20% in 2024. The growth of the segment can be linked to the raised awareness of personalized medicine and the increasing demand for home-based testing kits. The surge in e-commerce platforms, especially in the Asia Pacific, is enabling rapid diagnostic tests to be more accessible.

Rapid Diagnostics Market Companies

- ACON Laboratories, Inc.

- Abbott Laboratories

- Artron Laboratories Inc.

- Alfa Scientific Designs, Inc.

- Becton, Dickinson, and Company

- BTNX, Inc.

- bioMérieux SA

- Cardinal Health

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Creative Diagnostics

Recent Developments

-

In May 2024, during an exclusive chat with BioSpectrum, Sriram Natarajan, Director and Chief Executive Officer of Molbio Diagnostics, revealed the company's future plans. Diagnostics is projected to play a larger role in patient care in the near future. Notably, molecular diagnostics has seen rapid advancement and expansion over the past decade with new complex tests and the adoption of advanced technologies, both in India and globally. The application of molecular diagnostics has notably enhanced detection efficiency. Several rapid multiplex PCR tests are now commercially available, capable of simultaneously identifying up to 18 or more viruses.

-

In September 2024, Roche introduced the cobas Respiratory flex test, marking the first application of its innovative proprietary TAGS (Temperature-Activated Generation of Signal) technology. Developed by Roche's scientific team, TAGS combines multiplex polymerase chain reaction (PCR) with color, temperature, and data processing to detect as many as 15 pathogens in one test. Typically, high-throughput PCR tests can identify only four results per test — TAGS boosts this capability to fifteen. This allows syndromic panel testing on Roche's cobas 5800, 6800, and 8800 platforms, which is crucial when overlapping symptoms are linked to different pathogens.

-

In December 2024, as part of its 100th anniversary celebrations, the Institut Pasteur de Dakar (IPD) will open the new diaTROPIX diagnostic production site in Mbao. This site is among the few in the region with high-volume output and ISO 13485 certification for rapid diagnostic tests and is pursuing WHO quality endorsement. The facility, supported by FIND and Unitaid financially and technically, is designed to expand access to superior diagnostics. “This initiative aligns with FIND's Diagnostics For All vision and blends three vital pillars—innovation, local manufacturing through tech transfer, and regional collaboration,” says Dr. Ifedayo Adetifa, Chief Transformation Officer/CEO of FIND.

-

In August 2024, MP Biomedicals expanded its portfolio of in vitro diagnostic tools for infectious diseases by launching new qualitative rapid tests based on immunochromatography. The latest diagnostic kits from MP Biomedicals incorporate advanced technology to produce accurate outcomes, allowing clinicians quick and reliable identification of Helicobacter pylori, Salmonella typhi, and Vibrio cholerae serogroups O1 and O139. These advanced diagnostic products are poised to transform gastrointestinal diagnostics, equipping medical professionals with dependable solutions for early detection and significantly enhanced patient outcomes.

Segments Covered in the Report

By Product Type

- Consumables

- Test Strips

- Reagents & Kits

- Swabs & Sampling Devices

- Instruments/Devices

- Lateral Flow Readers

- Digital Rapid Testing Devices

- Handheld Analyzers

- Software & Mobile Apps

- Diagnostic Apps

- Integration with Electronic Health Records (EHR)

By Technology

- Lateral Flow Assays (LFA)

- Sandwich Assays

- Competitive Assays

- Agglutination Assays

- Immunoassays

- Fluorescence Immunoassays

- Enzyme Immunoassays (EIA)

- Solid-phase Assays

- Molecular Diagnostics

- Isothermal Nucleic Acid Amplification

- PCR-based Rapid Testing

- Microfluidics

- Biosensors

- Electrochemical Biosensors

- Optical Biosensors

By Application

- Infectious Diseases

- Respiratory Infections (e.g., COVID-19, Influenza)

- Gastrointestinal Infections

- Sexually Transmitted Diseases (HIV, Chlamydia, Syphilis)

- Tropical Diseases (Malaria, Dengue, Zika)

- Hepatitis

- Cardiology

- Troponin Test

- D-dimer Test

- BNP Test

- Oncology

- Tumor Marker Detection

- Liquid Biopsy (Rapid formats)

- Diabetes

- Glucose Monitoring

- HbA1c Rapid Tests

- Pregnancy & Fertility

- Pregnancy Test Kits

- Ovulation Tests

- Drug of Abuse Testing

- Urine Drug Screening Kits

- Saliva Test Kits

- Blood Glucose Testing

- Other Chronic Conditions

- Kidney Function

- Liver Function

By End User

- Hospitals & Clinics

- Home Care Settings

- Diagnostic Laboratories

- Pharmacies & Retail Clinics

- Others (Ambulatory Surgical Centers, Veterinary Clinics, Academic & Research Institutes)

By Mode of Testing

- Professional Testing

- Self-Testing / Over-the-Counter (OTC)

By Distribution Channel

- Direct Sales

- Retail Pharmacies

- E-commerce Platforms

- Hospital Pharmacies

- Wholesalers/Distributors

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting