Pharmaceutical Rapid Microbiology Testing Market Size and Forecast 2025 to 2034

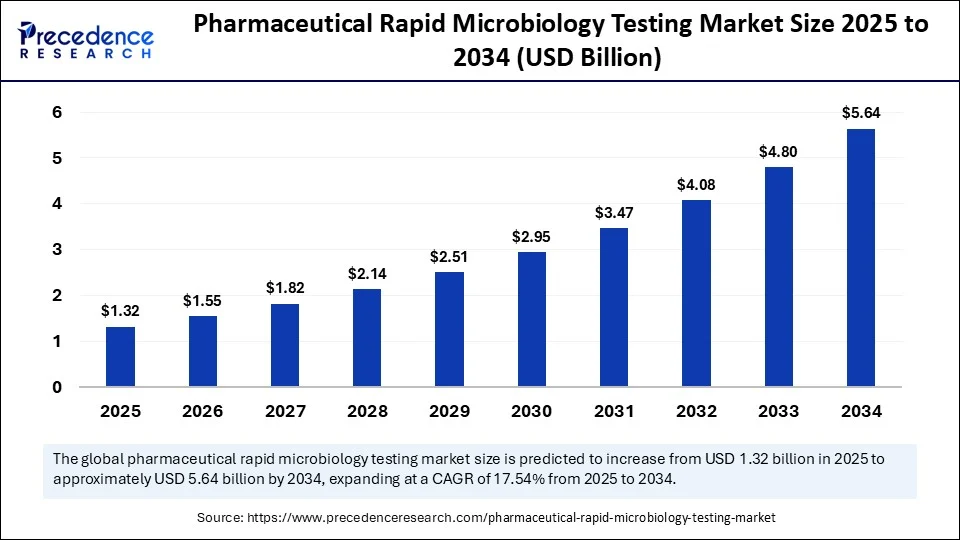

The global pharmaceutical rapid microbiology testing market size accounted for USD 1.12 billion in 2024 and is predicted to increase from USD 1.32 billion in 2025 to approximately USD 5.64 billion by 2034, expanding at a CAGR of 17.54% from 2025 to 2034. This market is growing due to the increasing demand for faster, more accurate, and regulatory-compliant microbial testing solutions in pharmaceutical and biopharmaceutical manufacturing.

Pharmaceutical Rapid Microbiology Testing MarketKey Takeaways

- In terms of revenue, the global pharmaceutical rapid microbiology testing market was valued at USD 1.12 billion in 2024.

- It is projected to reach USD 5.64 billion by 2034.

- The market is expected to grow at a CAGR of 17.54% from 2025 to 2034.

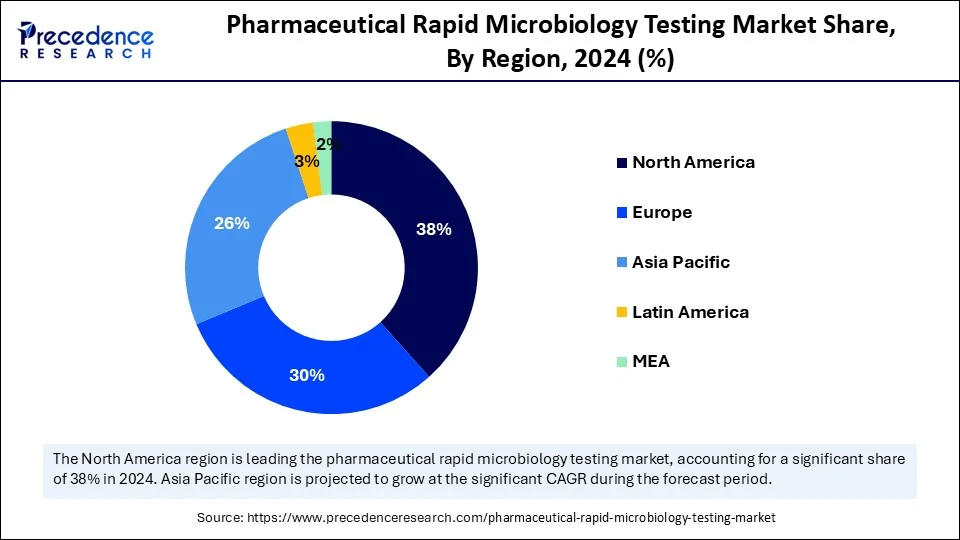

- North America dominated the pharmaceutical rapid microbiology testing market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By technology type, the polymerase chain reaction (PCR) segment held the biggest share in 2024.

- By technology type, the flow cytometry segment is observed to grow at the fastest CAGR during the forecast period.

- By product type, the instruments segment led the market in 2024.

- By product type, the software & services segment is expected to grow at the fastest CAGR in the coming years.

- By application, the biopharmaceuticals segment captured the highest market share in 2024.

- By application, the vaccines segment is emerging as the fastest-growing segment during the forecast period.

- By microorganism type tested, the bacterial segment generated the major market share in 2024.

- By microorganism type tested, the viruses segment is expected to expand at the fastest CAGR during the projection period.

- By end-user, the pharmaceutical and biotechnology companies segment held the significant market share in 2024.

- By end-user, the contract manufacturing organizations (CMOs) segment is observed to grow at the fastest CAGR during the forecast period.

- By testing type, the sterility testing segment accounted for major market share in 2024.

- By testing type, the environmental monitoring segment is emerging as the fastest-growing segment.

How is Artificial Intelligence Enhancing the Efficiency of Pharmaceutical Rapid Microbiology Testing?

Artificial intelligence is revolutionizing the pharmaceutical rapid microbiology testing (RMT) market by enhancing data accuracy, reducing turnaround times, and enabling real-time decision-making. By quickly analyzing intricate microbiological data, AI algorithms can enhance contaminant detection while reducing false positives and negatives. AI enhances operational efficiency by automating repetitive tasks, such as sample handling and colony counting, through integration with automated systems. Proactive quality controls are also supported by AI-powered predictive analytics, which helps detect microbial hazards before they affect production.

AI is a vital component of contemporary pharmaceutical microbiological testing, as these developments not only speed up batch release but also ensure adherence to strict regulatory requirements. The production of biologics and sterile drugs is increasing, and contamination risks are becoming a more significant concern. Advanced technologies, such as automation, biosensors, and AI-based analytics, are being adopted, driving the market forward. The need for RMT solutions is anticipated to grow gradually in international markets, as pharmaceutical companies place a higher priority on cost-effectiveness and quality assurance.

U.S. Pharmaceutical Rapid Microbiology Testing Market Size and Growth 2025 to 2034

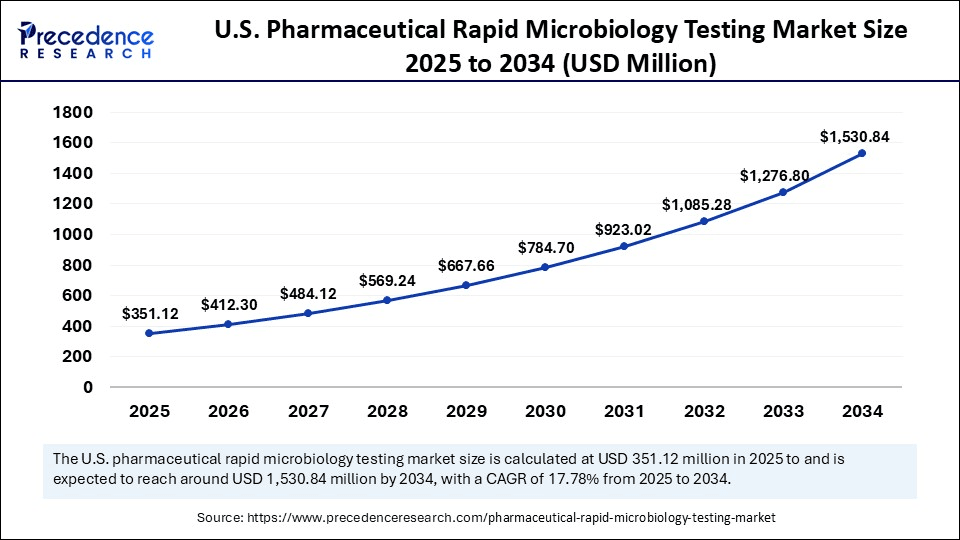

The U.S. pharmaceutical rapid microbiology testing market size was exhibited at USD 297.92 million in 2024 and is projected to be worth around USD 1,530.84 million by 2034, growing at a CAGR of 17.78% from 2025 to 2034.

What made North America the dominant region in the pharmaceutical rapid microbiology testing market in 2024?

North America dominated the market by capturing the biggest revenue share in 2024. This is primarily due to its robust regulatory environment, well-established pharmaceutical sector, and rapid adoption of new technologies. Rapid testing platforms are being widely adopted due to the presence of major pharmaceutical companies and proactive organizations like the FDA, which support alternative microbial detection techniques. Its leadership is further cemented by early adoption of innovative solutions and ongoing R&D investment. The U.S. is a major player in the market. The area boasts a technological and operational edge, thanks to regular product innovation and a well-developed biopharmaceutical industry. There is a high demand for biologics, supporting market expansion.

What opportunities exist in the pharmaceutical rapid microbiology testing market within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by the rapid expansion of contract manufacturing organizations. Local businesses are investing more in automation and compliance-driven microbiology laboratories to meet global quality standards. Additionally, the biopharmaceutical industry in the region is expanding rapidly, especially in the production of vaccines and biologics, which necessitates strict and immediate microbial quality control. The adoption of rapid microbiology testing technology is also being accelerated by growing government support for regional manufacturing infrastructure development and digital transformation. The rising production of personalized medicine further contributes to regional market growth.

Market Overview

Pharmaceutical Rapid Microbiology Testing (RMT) refers to innovative testing methods designed to quickly detect, identify, and quantify microbial contamination in pharmaceutical products, manufacturing environments, and raw materials. Unlike traditional microbiological methods, which are often time-consuming (taking several days), RMT employs advanced technologies such as molecular diagnostics, biosensors, and automated systems to reduce testing time, sometimes providing results within hours drastically. This enables pharmaceutical companies to accelerate product release, improve manufacturing efficiency, comply with stringent regulatory requirements, and ensure product safety and quality.

The pharmaceutical rapid microbiology testing (RMT) market is experiencing significant growth in response to the growing demand for microbial detection techniques in pharmaceutical manufacturing that are quicker, more precise, and more effective. Due to the labor-intensive and time-consuming nature of traditional microbiological methods, there is a growing trend toward rapid methods that offer improved sensitivity, faster turnaround times, and better compliance with stringent regulatory requirements. The production of biologics and sterile drugs is increasing, and contamination risks are becoming a more significant concern. Advanced technologies, such as automation, biosensors, and AI-based analytics, are being adopted, driving the market forward. The need for RMT solutions is anticipated to grow gradually.

Pharmaceutical Rapid Microbiology Testing MarketGrowth Factors

- Increasing Demand for Fast and Accurate Results: Pharmaceutical manufacturers require faster microbiological data to support timely batch release and reduce production delays. Traditional methods can take days, whereas rapid tests provide results in hours, thereby improving operational efficiency.

- Regulatory Emphasis on Quality Assurance: Stringent guidelines from agencies such as the FDA, EMA, and WHO encourage the adoption of RMT to ensure better quality control, detect contamination, and comply with Good Manufacturing Practices.

- Rising Incidence of Contamination Recalls: Frequent recalls due to microbial contamination have pushed companies to adopt rapid microbiology solutions for real-time detection, preventing costly disruptions and safeguarding public health.

- Technological Advancements in Testing Methods: Innovations such as PCR, ATP bioluminescence, flow cytometry, and microelectronic biosensors have enhanced test accuracy, speed, and sensitivity, driving their widespread adoption.

- Growing Biopharmaceutical and Vaccine Production: The growth in complex biologics, cell and gene therapies, and vaccine manufacturing requires more precise and faster microbial monitoring to ensure product safety and sterility.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.64 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2024 | USD 1.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Product Type, Application, Microorganism Type Tested, End User, Testing Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Faster Turnaround Times

The rising demand for faster turnaround times in testing is driving the growth of the pharmaceutical rapid microbiology testing market. Testing in conventional microbiology can take several days, which increases the cost of maintaining inventory and delays batch release. RMT technologies enable real-time decision-making in manufacturing processes by providing results in a matter of hours. Time savings have a direct impact on profitability in high-throughput production settings, making speed essential. Lean manufacturing and just-in-time production models are also supported by faster testing. To increase overall operational efficiency and streamline workflows, pharmaceutical companies are increasingly implementing RMT.

Growing Biologics and Sterile Drug Production

The rise of biologics, biosimilars, and sterile injectables has heightened the need for precise microbial control, given their sensitivity to contamination. Biologics, in contrast to conventional small-molecule medications, are often produced using living organisms, which raises the possibility of contamination at every stage. Rapid microbiological detection and real-time insights are provided by RMT techniques, which are essential in these high-risk settings. With cell and gene therapies, where product shelf life is constrained, this is particularly crucial. RMT adoption is expected to grow in tandem with the expansion of biopharmaceutical production.

Restraints

Integration Challenges with Existing Systems

RMT technologies must be compatible with existing laboratory information management systems (LIMS), quality control protocols, and manufacturing workflows to ensure seamless integration. Integrating new platforms into legacy systems can be complex, time-consuming, and expensive. Mismatches in data formats, process requirements, or IT security protocols often cause delays. Companies may also face internal resistance to change, especially in facilities with long-established SOPs. These integration issues can lead to inefficiencies, compliance concerns, or delays in decision-making.

Limited Technical Expertise and Trained Workforce

Implementing and managing RMT systems requires specialized knowledge in microbiology, instrumentation, software analytics, and compliance. Many pharmaceutical facilities lack adequately trained personnel to operate and interpret results from advanced technologies, such as flow cytometry or PCR. The shortage of technical expertise can lead to operational errors, misinterpretation of data, or underutilization of the system without continuous training and support; even well-equipped labs may struggle to maintain efficiency and compliance.

Opportunities

Growing Adoption of Personalized and Biologic Therapies

There is a growing need for accurate and real-time microbiological monitoring, driven by the global shift toward personalized medications, biologics, and cell and gene therapies, which creates immense opportunities in the pharmaceutical rapid microbiology testing market. These treatments need strict sterility guidelines and frequently have shorter shelf lives. It is crucial in this field to have quick microbiology testing to enable quicker product release and quality control. Microbial testing technologies that are responsive and agile will become more and more necessary as biopharmaceutical pipelines expand. RMT is well-positioned to establish itself as a common tool in workflows related to biological manufacturing. Furthermore, small-batch production is frequently required for personalized therapies, where rapid-release testing is crucial. Businesses in this growing therapeutic market that offer quick and precise solutions will succeed.

Supportive Regulatory Push and Industry Guidelines

International regulatory organizations are progressively promoting the use of rapid testing techniques to improve quality assurance rules like USP. 1223 Ph. Eu. 5 point 1.6 RMT use is encouraged by the FDA's PAT (Process Analytical Technology) framework. Rapid techniques are also promoted by trade associations, such as the Parenteral Drug Association (PDA). Early adopters are less at risk due to this regulatory support, which also enhances industry compliance and accelerates the adoption of rapid methods of acceptability worldwide. Vendors that provide verified and internationally recognized solutions benefit from this.

Technology TypeInsights

Why did the polymerase chain reaction (PCR) segment dominate the pharmaceutical rapid microbiology testing market in 2024?

The polymerase chain reaction (PCR) segment dominated the market with the largest share in 2024 due to its unmatched sensitivity, speed, and accuracy in detecting microbial DNA or RNA. It enables accurate and timely detection of contaminants, which is essential for guaranteeing the safety of pharmaceutical products. Since any microbial presence can have major repercussions in the manufacturing of biologics and sterile products, PCR is frequently used in sterility testing for contamination checks and environmental monitoring. Its dominance is further reinforced by its integration into automated workflows. Additionally, it is a popular option in pharmaceutical labs all over the world due to its broad regulatory acceptance and compatibility with multiplex testing.

The flow cytometry segment is expected to grow at the fastest rate during the forecast period due to its ability to deliver real-time microbial detection and viability assessments. Unlike traditional culture-based methods, flow cytometry can analyze thousands of particles per second, enabling faster decision-making in quality control. Pharmaceutical companies seek to minimize product release times. The shift toward real-time. Label-free detection with high throughput is driving increased adoption of this technology. The integration of fluorescent staining and automation has further expanded its role in process monitoring, especially for biologics and cell therapy products.

Product Type Insights

How does the instruments segment dominate the market in 2024?

The instruments segment dominated the pharmaceutical rapid microbiology testing market in 2024 due to the fact that they serve as the foundation for rapid microbial testing systems. PCR systems, endotoxin analyzers, and flow cytometers are examples of equipment that are essential for carrying out accurate and effective microbial detection procedures. The main area of investment for pharmaceutical companies is in them since their incorporation into cleanroom settings and production lines allows for quicker testing, less manual intervention, and improved adherence to cGMP regulations. Modern instruments are also more useful and relevant in regulated environments because they can be linked to digital platforms for real-time data tracking and sharing.

The software & services segment is emerging as the fastest-growing segment as pharmaceutical companies focus on automation, data analytics, and regulatory compliance. These offerings enhance the performance of instruments through real-time monitoring, data management, and AI-powered analytics. Additionally, outsourcing microbiological testing to specialized service providers is on the rise due to cost advantages and faster turnaround, further accelerating this segment's growth. Cloud-based platforms for sample tracking, automated audit trails, and predictive maintenance are further driving demand for software and service integration in microbiological QC labs.

Application Insights

What made biopharmaceuticals the segment in the pharmaceutical rapid microbiology testing market in 2024?

The biopharmaceuticals segment dominated the market with a major revenue share in 2024, as biopharmaceuticals require sophisticated quality control procedures and are extremely vulnerable to microbial contamination. These products' complexity and strict international regulations necessitate accurate and timely microbial detection in order to prevent batch losses and guarantee product efficacy. Rapid microbiology tools are becoming more and more important as more biotech companies concentrate on monoclonal antibody vaccines and cell therapies. To meet quick clinical and commercial deadlines, increase productivity, and preserve batch consistency, biopharmaceutical companies also make significant investments in cutting-edge QC techniques.

The vaccines segment is expected to grow at the fastest rate during the projected timeframe because of the need for quicker product releases and the rise in worldwide immunization campaigns. Since COVID-19, vaccine production has increased, and manufacturers are under pressure to meet deadlines while maintaining product safety and sterility. Faster batch releases are made possible by rapid microbiological techniques, particularly for mass vaccination campaigns and emergency-use authorizations, which support the segment's expansion. Governments and international health organizations are also investing in infrastructure upgrades, which promote the use of state-of-the-art microbial testing techniques in vaccine production.

Microorganism Type Tested Insights

Why did the bacterial segment dominate the market in 2024?

The bacteria segment dominated the pharmaceutical rapid microbiology testing market in 2024 due to the high risk they pose to product safety, especially in injectable and ophthalmic drugs. Regulatory agencies mandate thorough bacterial contamination testing using rapid methods, such as PCR, LAL assays, and flow cytometry. Given their ubiquity and potential to proliferate in pharmaceutical environments, bacterial detection remains the focal point of quality assurance. Furthermore, regular testing of raw materials, water systems, and finished products for bacterial presence is a compliance necessity in all pharma production lines.

Viruses are emerging as the fastest-growing segment due to growing concerns about viral contamination in advanced therapies and biotechnology. The need for high-throughput, sensitive viral detection techniques has increased with the popularity of gene and cell therapies. Manufacturers are adopting rapid viral detection technologies due to the increasing requirement for viral safety in raw materials and finished goods, particularly in treatments produced using human cells. The significance of prompt and precise viral testing throughout drug development pipelines has been further underscored by regulatory pressure and global events, such as pandemics.

End-User Insights

How does the pharmaceutical & biotechnology companies segment dominate the market in 2024?

The pharmaceutical and biotechnology companies segment dominated the pharmaceutical rapid microbiology testing market with the largest share in 2024, as they are the primary producers of high-risk goods, such as vaccines, biologics, and injectables. These businesses must adhere to strict regulatory requirements, which compel them to make substantial investments in rapid microbiological testing equipment to ensure product safety, sterility, and expedited release cycles. Strong quality control systems are necessary due to their high production volumes and ongoing innovation. Higher budgets and specialized QC and QA departments also enable these businesses to implement cutting-edge testing platforms more easily.On 15 January 2025, Merck expanded its microbiological QC solutions for biologics manufacturers with faster environmental and sterility testing instruments.

The contract manufacturing organizations (CMOs) segment is expected to grow at the highest CAGR in the up[upcoming period due to pharmaceutical companies outsourcing manufacturing and quality testing more often in order to focus on research and development and lower operating costs. To satisfy the quality requirements of numerous clients, provide faster turnaround times, and maintain their competitiveness, CMOs use rapid microbiology testing tools. The growing need for biologics and adaptable manufacturing capacity hastens this transition even more. To provide end-to-end services that adhere to regulatory standards in Europe, North America, and Asia, many CMOs are investing in state-of-the-art technologies, which will increase their attractiveness in international pharmaceutical markets.

Testing typeInsights

Why is the sterility testing segment dominating the pharmaceutical rapid microbiology testing market?

Sterility testing continues to dominate the market, as it is essential for ensuring that parenteral and ophthalmic products are free from viable microorganisms. Regulatory mandates across the globe require validated sterility testing before product release. Rapid sterility testing using advanced methods like ATP for bioluminescence and PCR significantly reduces time-to-market, making it indispensable for pharmaceutical manufacturers. Manufacturers benefit from faster batch release and enhanced safety, leading to better compliance and reduced production costs over time.

Environmental monitoring is emerging as the fastest-growing segment, as businesses strive to maintain aseptic conditions in their manufacturing environments. Businesses are being compelled to implement real-time monitoring systems due to heightened regulatory scrutiny of cleanroom contamination and air and water quality. Rapid techniques facilitate the early detection of microbial hotspots, enabling remedial measures to prevent costly shutdowns or batch failures, particularly in the production of biological products. The rapid expansion of this market is also being driven by the increasing adoption of wireless detection platforms, biosensors, and automated air samplers.

Pharmaceutical Rapid Microbiology Testing Market Companies

- Thermo Fisher Scientific Inc.

- Merck KGaA (MilliporeSigma)

- Bio-Rad Laboratories, Inc.

- Lonza Group AG

- Charles River Laboratories International, Inc.

- 3M Company

- Hamilton Company

- Microbiological Solutions (a part of Pall Corporation)

- Pall Corporation

- Pall Life Sciences

- Qiagen N.V.

- PerkinElmer, Inc.

- Eurofins Scientific

- IDEXX Laboratories, Inc.

- BioMérieux SA

- Neogen Corporation

- Agilent Technologies, Inc.

- Nova Biomedical Corporation

- LuminUltra Technologies Ltd.

- Accelerate Diagnostics, Inc.

Recent Developments

- On March 4, 2025, Nelson Labs launched its rapid sterility testing at three sites (Salt Lake City and Itasca, U.S., and Wiesbaden, Germany), reducing incubation times from 14 days to as little as 6 days while maintaining USP <71> compliance.

(Source: https://www.pharmtech.com) - On April 22, 2025, Redberry successfully validated a 4-day rapid sterility test for pharmaceutical products, reducing the usual 14-day compendial release time while still ensuring compliance and microbial identification.

(Source: https://www.rapidmicrobiology.com) - On January 16, 2025, Rapid Infection Diagnostics Inc. (RID) launched its BSIDx system for bloodstream infections, delivering pathogen identification and antibiotic sensitivity testing in under 5 hours, approximately 30 hours faster than conventional methods.

(Source: https://www.biospace.com)

Segments Covered in the Report

By Technology Type

- Polymerase Chain Reaction (PCR)

- ATP Bioluminescence

- Flow Cytometry

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chromatography

- Biosensors & Bioassays

- Impedance Microbiology

- Others (e.g., Microfluidics, Microarray)

By Product Type

- Instruments

- Reagents & Consumables

- Software & Services

By Application

- Biopharmaceuticals

- Small Molecule Pharmaceuticals

- Vaccines

- Contract Research Organizations (CROs)

- Academic & Research Institutes

By Microorganism Type Tested

- Bacteria

- Fungi (Yeast and Mold)

- Viruses

- Mycoplasma

- Endotoxins

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

By Testing Type

- Sterility Testing

- Environmental Monitoring

- Bioburden Testing

- Raw Material Testing

- Water Testing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting