What is Reconciliation Software Market Size?

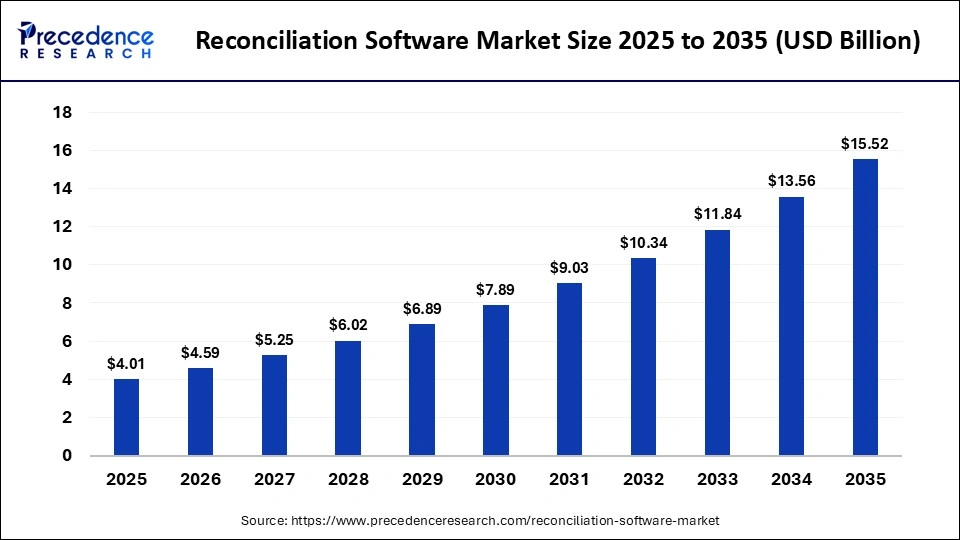

The global reconciliation software market size was calculated at USD 4.01 billion in 2025 and is predicted to increase from USD 4.59 billion in 2026 to approximately USD 15.52 billion by 2035, expanding at a CAGR of 14.50% from 2026 to 2035. The market is driven by the increasing data volume & complexity, demand for real-time insights, adoption of cloud-based solutions, and global digital transformation initiatives.

Market Highlights

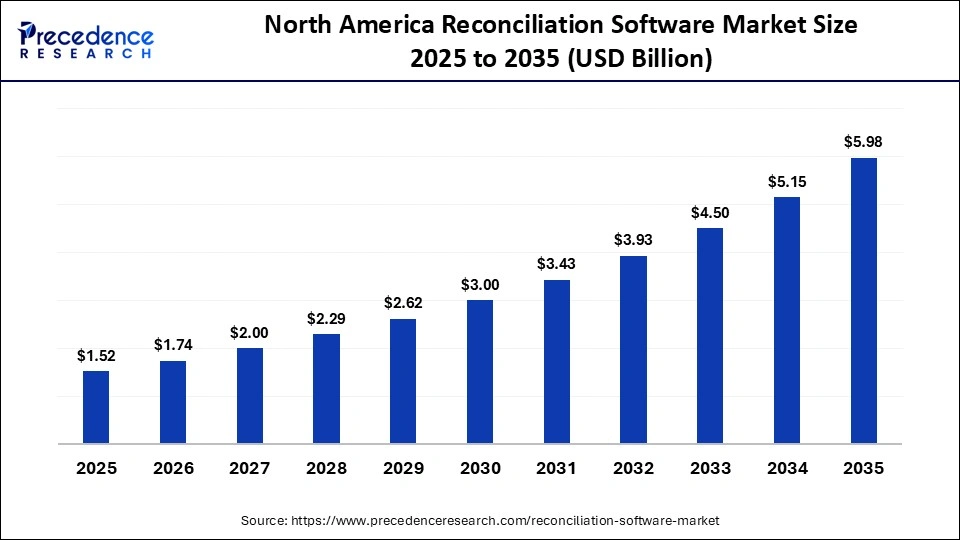

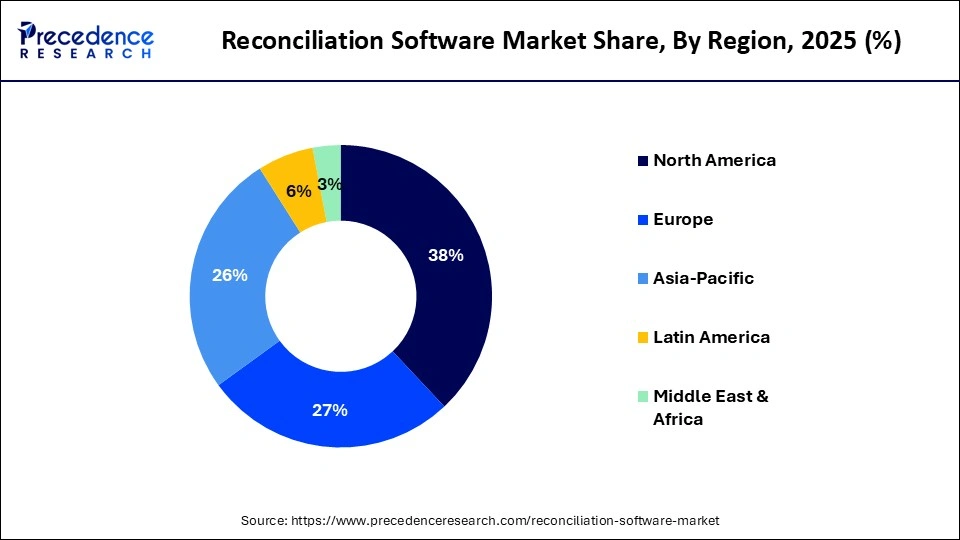

- North America led the reconciliation software market with a share of approximately 38% in 2025.

- Asia-Pacific is expected to expand at the highest CAGR in the market between 2026 and 2035.

- By component, the software/platforms segment held a dominant revenue share of approximately 69% in the market in 2025.

- By component, the services segment is expected to grow at the highest CAGR between 2026 and 2035.

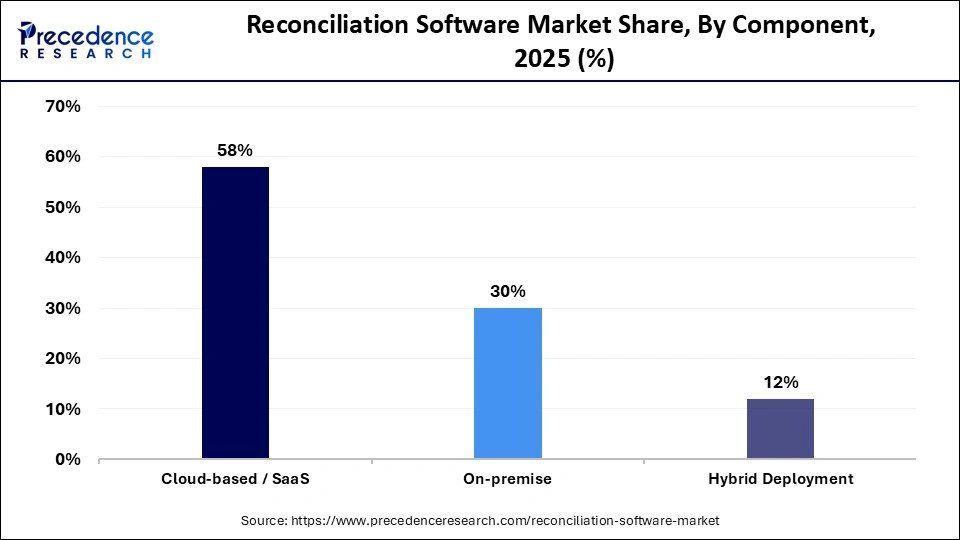

- By deployment mode, the cloud-based/SaaS segment dominated the market with a market share of approximately 58% in 2025.

- By deployment mode, the hybrid deployment segment is expected to expand at the fastest CAGR during the forecast period.

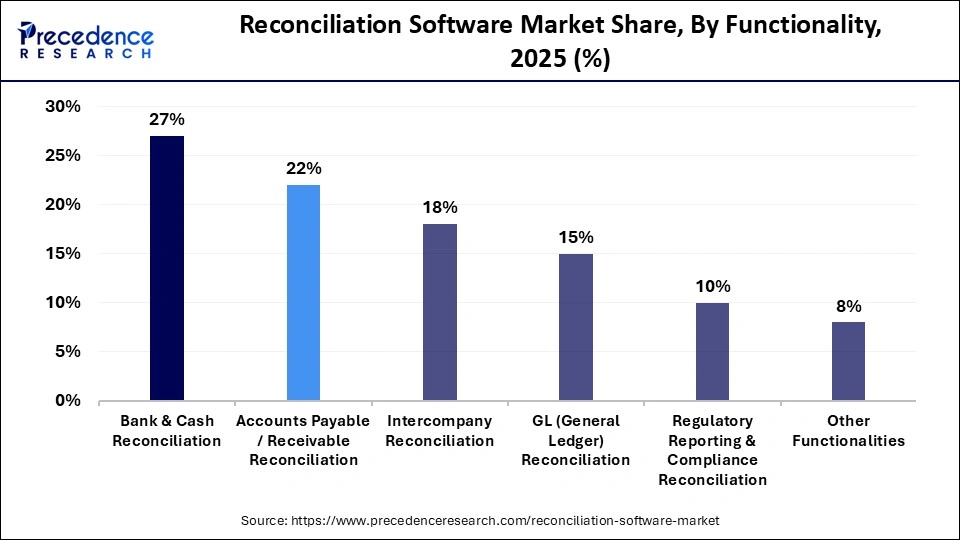

- By functionality, the bank & cash reconciliation segment held a dominant market share of approximately 27% in 2025.

- By functionality, the intercompany reconciliation segment is expected to grow rapidly in the coming years.

- By end-user industry, the BFSI (banking, financial services & insurance) segment held a major revenue share of approximately 23% in the market in 2025.

- By end-user industry, the healthcare & life sciences segment is expected to account for the highest growth over the studied period.

Why is the Reconciliation Software Market Gaining Strategic Importance?

Reconciliation software is a digital solution that automatically matches and verifies financial records from multiple sources to identify discrepancies and ensure data accuracy. The market is gaining strategic importance due to rising transaction volumes, increasing regulatory compliance requirements, demand for error reduction, adoption of automation and AI, growth of digital payments, and the need for real-time financial visibility across banking, retail, and enterprise operations.

How Is AI Reshaping the Reconciliation Software Industry?

Artificial Intelligence integration can significantly improve the reconciliation software market by automating time-consuming tasks, enhancing accuracy, and offering real-time financial insights. In 2026, AI-powered tools use machine learning to match complex transactions across systems, detect anomalies, and reduce manual errors, enabling faster closes and continuous reconciliation rather than month-end crunches. Advanced AI also predicts potential mismatches and generates intelligent audit trails, freeing finance teams to focus on strategy instead of repetitive checks.

- In June 2025, SmartStream launched SmartStream Air, an AI-powered reconciliation platform, into the insurance sector to help firms address fragmented data, cut operational costs, and improve compliance. The platform can reconcile and manage large volumes of data, including payments, reimbursements, and claims.

Primary Trends Influencing the Reconciliation Software Market

- Growing Adoption of Cloud-Based Solutions

Cloud-based reconciliation software is gaining traction due to its scalability, cost efficiency, and real-time accessibility. Organizations benefit from faster deployments, seamless updates, and easier collaboration across departments. Cloud platforms also support remote work models and enable integration with multiple financial systems without heavy IT infrastructure. - API-Led and ERP Integration Capabilities

Modern reconciliation tools increasingly offer API-driven integration with ERP systems, banking platforms, and payment gateways. This ensures seamless data flow across financial ecosystems, reduces data silos, and accelerates reconciliation cycles. Enhanced interoperability supports end-to-end financial automation and improves overall process transparency. - Shift Toward Real-Time and Continuous Reconciliation

Businesses are moving from periodic reconciliation to real-time or continuous reconciliation to gain instant visibility into transactions. This trend helps organizations detect discrepancies early, minimize financial risks, and support faster decision-making, particularly in industries handling digital payments, e-commerce, and high transaction volumes. - Focus on Predictive Analytics and Exception Management

Reconciliation software is increasingly incorporating predictive analytics to anticipate mismatches and identify potential risk areas. By analyzing transaction patterns, these tools help finance teams proactively manage exceptions, improve compliance readiness, and optimize reconciliation workflows while reducing operational delays and audit challenges.

Market scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.01 Billion |

| Market Size in 2026 | USD 4.59 Billion |

| Market Size by 2035 | USD 15.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | ByComponent,Deployment Mode,Functionality,End-User Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Which Component Segment Dominated the Reconciliation Software Market?

The software/platforms segment held a dominant position in the market with a share of approximately 69% in 2025 due to increasing automation needs, advanced analytics capabilities, and integration with enterprise systems like ERP and banking platforms. Growing demand for real-time transaction monitoring, error reduction, and compliance with financial regulations further drives adoption. Additionally, user-friendly interfaces and cloud-based deployment options enhance efficiency and scalability for businesses of all sizes.

The services segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to rising demand for expert implementation, customization, and support services. Organizations increasingly seek managed services and consulting to optimize reconciliation processes, ensure compliance, and reduce operational risks. Additionally, the complexity of integrating software with existing financial systems and the need for ongoing maintenance and training further fuel the segment's growth.

Deployment Mode Insights

Why Did the Cloud/SaaS Segment Dominate the Reconciliation Software Market?

The cloud/SaaS segment accounted for a considerable revenue share of approximately 58% in the market in 2025 due to lower upfront costs, faster deployment, and minimal IT infrastructure requirements. Easy scalability, automatic software updates, remote accessibility, and seamless integration with ERP and banking systems further drive adoption. Enhanced data security, real-time processing, and support for high transaction volumes also make cloud solutions more attractive than on-premise alternatives.

The hybrid deployment segment is expected to grow with the highest CAGR in the market during the studied years because it combines the flexibility and scalability of cloud solutions with the control and data security of on-premises systems. This appeals to organizations with strict compliance needs or sensitive data, enabling gradual cloud adoption while protecting legacy investments. The hybrid approach also supports customizable workflows and improved business continuity, helping firms optimize operations without fully relying on a single deployment model.

Functionality Insights

Which Functionality Segment Led the Reconciliation Software Market?

The bank & cash reconciliation segment led the global market with a share of approximately 27% in 2025 because it addresses core financial control needs by ensuring accuracy between bank statements and internal records. High transaction volumes, regulatory compliance pressures, and the need to prevent fraud make automated reconciliation essential. Its broad applicability across industries, improved liquidity visibility, and reduction of manual errors further drive widespread adoption.

The intercompany reconciliation segment is expected to expand rapidly in the market with the fastest CAGR in the coming years because rapidly expanding multinational operations increase intra-group transactions, requiring accurate alignment of records across subsidiaries. Automation reduces complex manual adjustments, enhances transparency, and improves compliance reporting. Demand for unified financial views and faster close cycles further accelerates adoption across global enterprises.

End-User Industry Insights

Which End-User Segment Dominated the Reconciliation Software Market?

The BFSI (banking, financial services & insurance) segment held the largest revenue share of approximately 23% in the market in 2025 because financial institutions handle massive transaction volumes and must meet strict regulatory, audit, and compliance requirements. Automated reconciliation reduces errors, enhances risk management, and accelerates financial closing processes. Demand for real-time visibility, fraud detection, and integration with core banking systems also drives widespread adoption in banking, insurance, and capital markets.

The healthcare & life sciences segment is expected to gain the highest share of the market between 2026 and 2035 due to complex financial workflows involving insurance claims, reimbursements, patient billing, and supplier payments. Growing digitalization, higher transaction volumes, and strict regulatory compliance requirements are increasing the demand for automated reconciliation to improve accuracy, reduce revenue leakage, and enhance financial transparency across healthcare organizations.

Regional Insights

How Big is the North America Reconciliation Software Market Size?

The North America reconciliation software market size is estimated at USD 1.52 billion in 2025 and is projected to reach approximately USD 5.98 billion by 2035, with a 14.68% CAGR from 2026 to 2035.

Why North America Dominated the Reconciliation Software Market?

North America dominated the market with a share of approximately 38% in 2025 due to the early adoption of advanced financial technologies, high digitization levels, and the presence of major global banks and enterprises. Strict regulatory and compliance requirements, increasing transaction volumes, and demand for real-time financial visibility drive adoption. Additionally, strong IT infrastructure and a focus on process automation support the region's leadership in this market.

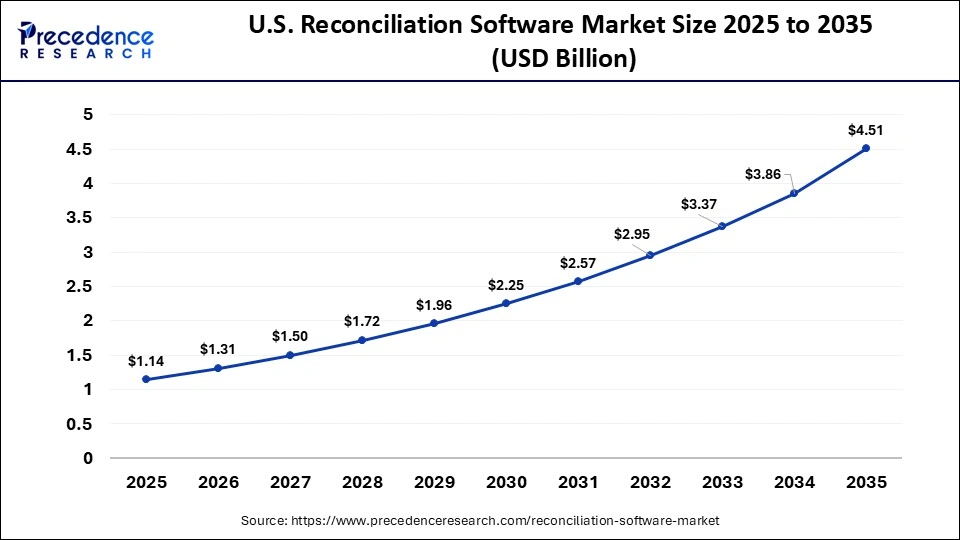

What is the Size of the U.S. Reconciliation Software Market?

The U.S. reconciliation software market size is calculated at USD 1.14 billion in 2025 and is expected to reach nearly USD 4.51 billion in 2035, accelerating at a strong CAGR of 14.74% between 2026 to 2035.

U.S. Reconciliation Software Market Trends

The U.S. market is driven by the growing demand for automation, real‑time transaction matching, and AI‑powered anomaly detection, which drives adoption. Organizations increasingly prefer cloud and hybrid solutions for scalability, integration with ERP systems, and enhanced security. Additionally, stricter financial regulations and rising digital payment volumes push businesses to adopt advanced reconciliation tools that improve accuracy, reduce manual effort, and support faster financial closes.

Why is Asia-Pacific Experiencing the Fastest Growth in the Reconciliation Software Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to rapid digitalization, growing adoption of cloud and automated financial solutions, and the expansion of fintech and banking sectors. Rising digital payment volumes, increasing demand for accurate financial reporting, and supportive government initiatives for modern financial infrastructure are driving organizations across the region to implement advanced reconciliation tools.

China Reconciliation Software Market Trends

The Chinese market is evolving, focusing on automation, AI-powered transaction matching, and faster exception handling. Cloud-based solutions and integration with financial systems are increasingly adopted to improve efficiency. Greater emphasis is placed on security and data transparency, while innovations for managing complex and unstructured financial data are being implemented.

Will Europe Grow in the Reconciliation Software Market?

Europe's market is expected to grow at a notable CAGR due to the region's high regulatory intensity and strong emphasis on financial transparency across banking, payments, and enterprise accounting functions. Complex cross-border and multi-currency transactions within the European Union increase the need for automated, error-free reconciliation.

Widespread digital banking adoption, expansion of real-time payment systems, and growing reliance on cloud-based financial platforms are further driving demand for scalable reconciliation solutions that support audit readiness, data accuracy, and operational resilience across industries.

UK Reconciliation Software Market Trends

In the UK, the reconciliation software industry is growing because the country has a strong banking and financial services sector that handles a large number of daily transactions. Companies are focusing more on accuracy, transparency, and automation to reduce manual errors and save time. The rise of digital payments, online banking, and cloud-based accounting systems is encouraging organizations to use reconciliation tools that support faster processing and easier financial control.

Who are the major players in the global reconciliation software market?

The major players in the reconciliation software market include BlackLine, Trintech, AutoRek, Oracle, SAP SE, Fiserv, ReconArt, Broadridge Financial Solutions, HighRadius, SmartStream Technologies, Xero, DUCO, Cashbook, Datalog Finance, FIS Intellimatch, Treasury Software, FloQast, Sage, SolveXia, and Gresham Technologies

Recent Developments in the Reconciliation Software Market

- In December 2025, Digits announced the launch of Ask Digits, an AI‑powered assistant designed to offer real time support for reconciliation and general ledger tasks. The assistant helps users query financial data, automate routine queries, and trigger reconciliation actions, enabling businesses stay current with transaction reviews and resolve discrepancies faster than traditional manual methods. (Source: https://www.cpapracticeadvisor.com)

- In November 2025, Digits launched AI Bank Reconciliations as part of its Agentic General Ledger platform. This new capability automates the reconciliation of bank statements by extracting data, matching transactions, and verifying balances without the configuration of manual rules. Early results show firms can dramatically reduce reconciliation time, freeing accountants for higher‑value advisory work.(Source: https://www.cpapracticeadvisor.com)

- In October 2025, Oracle Corporation launched new enhancements to its enterprise reconciliation tools that embed AI for transaction matching and assignment assistance. These features automate manual tasks by predicting match attributes and reducing administrative overhead, allowing finance teams to focus on exception review rather than routine processing.(Source: https://www.oracle.com)

Segments Covered in the Report

By Component

- Software/Platforms

- Core reconciliation engines

- APIs & connectors

- Analytics modules

- Services

- Implementation & integration

- Customization & consulting

- Training & support

By Deployment Mode

- Cloud-based/SaaS

- On-premise

- Hybrid Deployment

By Functionality

- Bank & Cash Reconciliation

- Accounts Payable / Receivable Reconciliation

- Intercompany Reconciliation

- GL (General Ledger) Reconciliation

- Regulatory Reporting & Compliance Reconciliation

- Other Functionalities

By End-User Industry

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing & Supply Chain

- Government & Public Sector

- Energy & Utilities

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting