What is the Recycling Equipment Market Size?

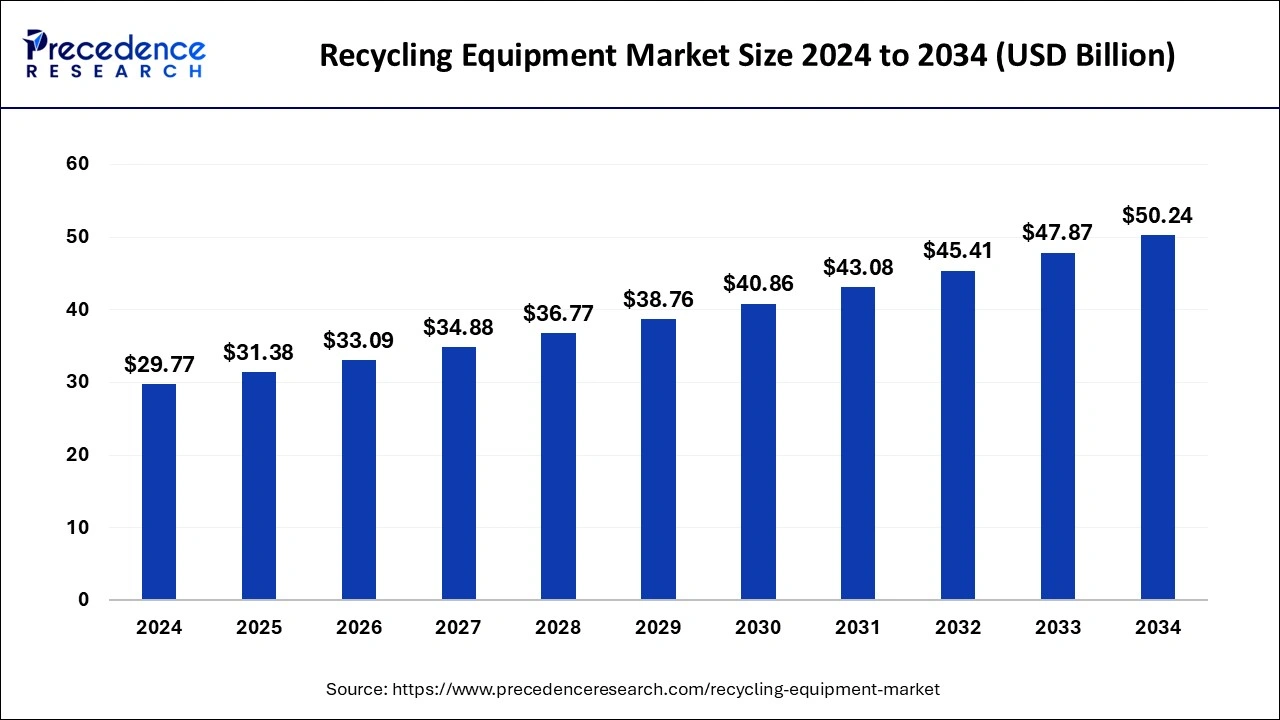

The global recycling equipment market size is calculated at USD 31.38 billion in 2025 and is predicted to increase from USD 33.09 billion in 2026 to approximately USD 50.24 billion by 2034, expanding at a CAGR of 5.37% from 2025 to 2034.

Recycling Equipment Market Key Takeaways

- The global recycling equipment market was valued at USD 29.77 billion in 2024.

- It is projected to reach USD 50.24 billion by 2034.

- The market is expected to grow at a CAGR of 5.37% from 2025 to 2034.

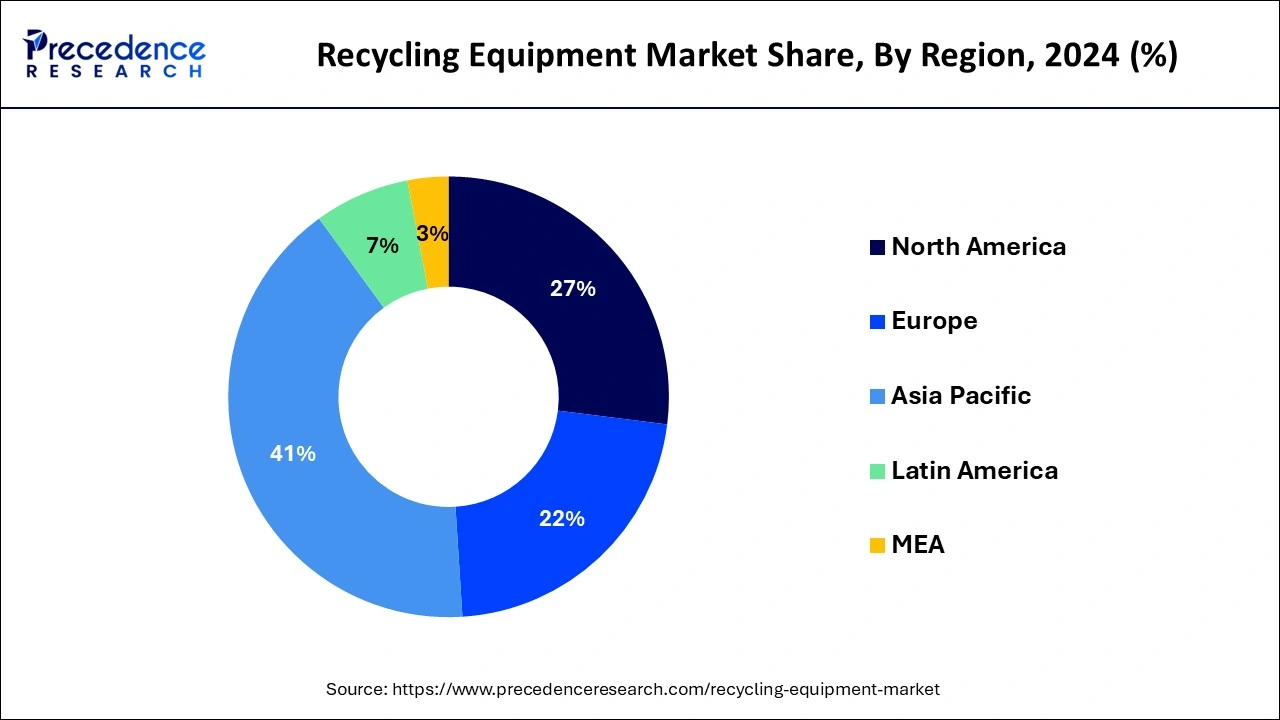

- Asia Pacific dominated the market with the major market share of 41% in 2024.

- In the North America, the U.S. has recorded for more than 77% of the market share in 2024.

- By equipment, the baler press segment has held the largest market share in 2024.

- By equipment, the separator segment is expected to grow at a significant rate equipment during the forecast period.

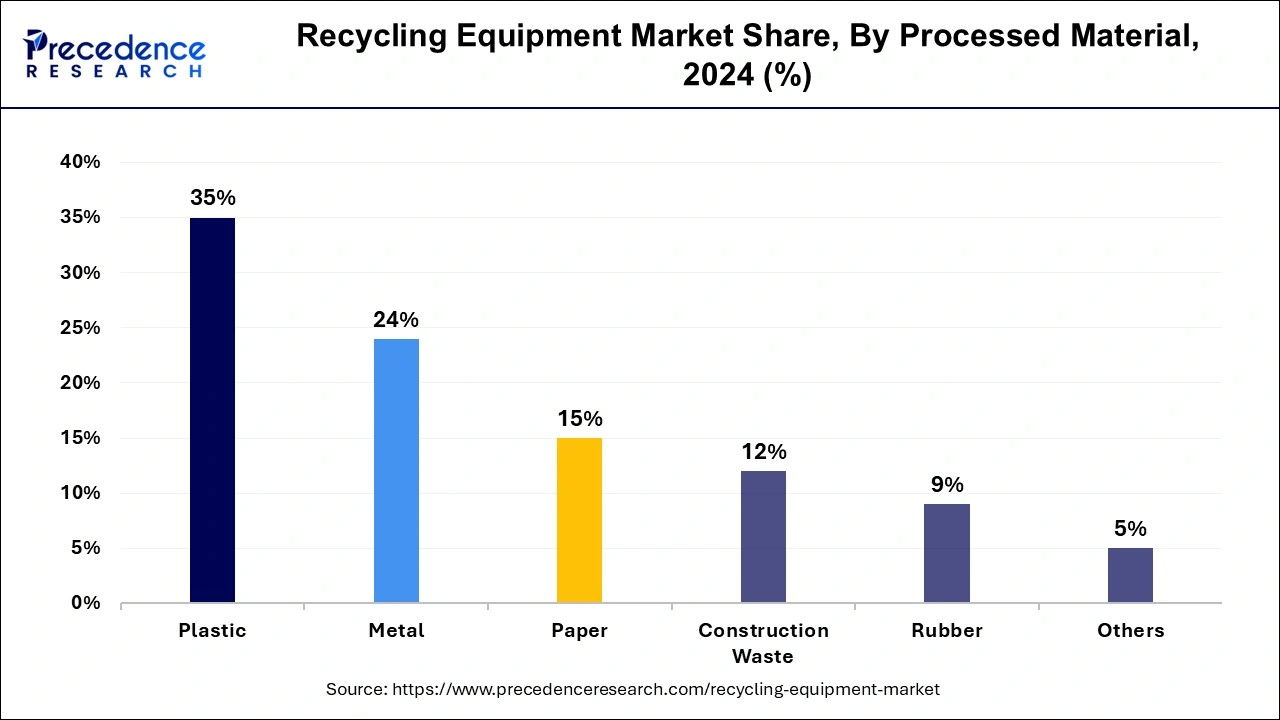

- By processed material, the plastic segment has contributed more than 35% of market share in 2024.

- By processed material, the rubber segment is expected to expand rapidly during the forecast period.

Market Overview

The recycling equipment market refers to the industry that offers equipment that is used to recycle waste materials into useful products. The recycling equipment includes devices that help in the separation and arrangement of recyclable materials such as paper, plastic, rubber, glass, and metal for additional processing and reuse. The recycling equipment includes baler presses, shredders, granulators, agglomerators, shears, separators, extruders, etc.

The recycling equipment market is driven by the rise in the usage of recycled materials, rising concern about waste management, and the collaboration of technical companies with waste material management companies can be the opportunity to boost the market.

The recycling equipment market is fragmented with multiple small-scale and large-scale players such as Recycling Equipment Manufacturing, The CP Group, American Baler, Kiverco, General Kinematics, MHM Recycling Equipment, Marathon Equipment, Ceco Equipment Ltd., Danieli Centro Recycling, ELDAN Recycling, Metso, Suny Group, Forrec Srl Recycling, BHS Sonthofen, LEFORT GROUP.

Recycling Equipment Market Growth Factors

- The rise in the usage of recycled materials boosts the recycling equipment market.

- The collaboration of a technical company with a waste material management company can be the opportunity to boost the recycling equipment market.

- The rising concern about waste management can boost the recycling equipment market.

Recycling Equipment Market Outlook

- Industry Growth Overview:

The recycling equipment market is expected to grow rapidly as governments, manufacturers, and waste-management operators intensify their shift toward circular-economy systems. The growing volumes of waste, such as electronic waste, plastics, and construction waste, are also straining facilities to replace manual sorting with high-capacity automated sorting equipment. Furthermore, landfill restrictions and increased recycled-content requirements are expected to boost the adoption of technology-intensive recycling facilities in both developed and developing economies. - Sustainability Trends:

Sustainability is becoming the key force in the recycling equipment industry as operators face stricter emissions standards and extended producer responsibility (EPR) rules. To reduce electricity consumption and operational emissions, manufacturers are developing energy-efficient shredding machines and low-heat metal processing units. Additionally, innovation focused on sustainability is enabling recyclers to handle difficult streams of waste and multi-layer plastics more safely and efficiently. - Global Expansion:

Major equipment manufacturers are expanding their global presence to access rapidly growing recycling markets in Southeast Asia, the Middle East, Eastern Europe, and Latin America. These regions are experiencing significant waste infrastructure development driven by urbanization, industrial growth, and stricter environmental regulations. To meet the rising demand for customized modular recycling plants, companies like Kiverco and Forrec Srl are establishing new distribution and service centers. Additionally, this geographic diversification is strengthening global supply chains, and the standardization of equipment in emerging markets is accelerating. - Major Investors:

The recycling equipment sector is drawing significant interest from private equity, infrastructure funds, and strategic corporate investors because of its strong resilience and long-term ESG alignment. Equipment OEMs, automation-platform companies, and integrated recycling-technology vendors are all being explored by firms such as Blackstone, Brookfield, KKR, and Macquarie. Metal scrap processing, e-waste recovery, and plastic reprocessing have become profitable businesses and are now attractive investment targets. Green financing, recycling incentives, and carbon-reduction schemes are also boosting investor confidence in equipment-based circular-economy infrastructure. - Startup Ecosystem:

The ecosystem of recycling equipment startups has expanded significantly with advances in AI robotics and separation technology. These startups include AMP Robotics (U.S.), BornAgain Technologies (Israel), and other innovators across Asia, which are developing scalable, energy-efficient systems. They improve the accuracy and speed of material recovery. Additionally, support from venture capital and strategic investors is poised to boost global productivity and sustainability in recycling.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.37% |

| Market Size in 2025 | USD 31.38 Billion |

| Market Size in 2026 | USD 33.09 Billion |

| Market Size by 2034 | USD 50.24 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Equipment, and By Processed Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising the usage of recycled material

The rise in the usage of recycled materials boosts the recycling equipment market. The demand for recycling equipment in the electric and electronics sector will soar due to the growing use of recycled materials in a variety of end-user industries, such as packaging, building and construction, electrical and electronics, automotive and pharmaceuticals, etc. Recycled materials are widely used in the production of wire and cable insulation, refrigerators, TV cabinets, laptops, bodies, and cell phones.

Rising concern about waste management

The rising concern about waste management can boost the recycling equipment market. Governments, industries, and consumers are placing a higher priority on recycling and appropriate waste management techniques as environmental awareness rises. In order to handle recycling equipments efficiently, this trend has raised demand for recycling equipments including shredders, crushers, and sorting machines.

- In September 2023, the EPA announced the selectees for the Solid Waste Infrastructure for Recycling grants for Communities and the recipients of the recycling grants for States and Territories. Then, on November 15, 2023, EPA announced the selectees for the Solid Waste Infrastructure for Recycling Grants for Tribes and Intertribal Consortia.

Restraint

Environmental impact

The environmental impact may slow down the recycling equipment market. Recycling e-waste has an impact on the environment even though it lessens the requirement for landfill space and the extraction of new raw materials. Energy is needed for the recycling process itself, which might produce pollutants. For example, the process of shredding e-waste might result in dust particles that aggravate air pollution. In a similar vein, wastewater that needs to be cleaned before being discharged into the environment can result from using water during the recycling process.

Opportunity

Collaborative activities between companies

The collaboration of a technical company with a waste material management company can be the opportunity to boost the recycling equipment market. This collaboration combines technical expertise with waste management knowledge, which results in more effective and innovative solutions for sorting e-waste to recycling with a rising demand for advanced waste management technology.

- In January 2024, Recycleye, a technology company specializing in AI-powered automated sorting for waste and materials management, has partnered with SWEEEP Kuusakoski, a company specializing in the recycling of waste electrical and electronic equipment (WEEE). Together, they deployed an optical sorter that uses AI and machine learning to sort e-waste for recycling. The technology can detect specific items such as printed circuit boards (PCBs) in WEEE and multi-material batteries, improving the sorting process and enabling the extraction of valuable materials for recovery.

Equipment Insights

The baler press segment dominated the recycling equipment market by equipment in 2024. The baler press device is used to compress and bind materials into small, controllable bundles. The baler press is widely utilized for cleaning products, including plastic, paper, rubber, and construction waste, as well as for simpler recycling storage and transportation in industries, manufacturing facilities, and recycling centers. Additionally, the baler press reduces the volume of simpler handling, storage, and transportation by effectively compressing materials into compact bundles. The baler presses simplify the recycling process and cut down on the amount of material effort required, which helps industries save labor costs.

The separator segment is expected to grow at a significant rate in the recycling equipment market by equipment, during the forecast period. The separator is a part of equipment used in recycling that divides materials according to their characteristics, such as size, density, or magnetic susceptibility. The separator helps in the separation of items like paper, plastic, rubber, and metals, improving safe recycling procedures. Industries and governments are investing more in recycling infrastructure as environmental concerns grow and the rules harden. By automating the sorting process and enhancing material purity, separators are essential for increasing the efficacy and efficiency of recycling equipment.

Processed Material Insights

The plastic segment dominated the recycling equipment market by processed material, in 2024. Last week, it was the industry leader in recycling equipment for a number of reasons. The recycling efforts heavily target plastic waste due to its vast global generation. Additionally, recycling plastic materials is now more practical and effective because of technological improvements. Also, there is a growing need for recycling equipment designed specially to manage plastic waste due to increased awareness of the adverse environmental impact of plastic pollution.

The rubber segment is expected to expand rapidly in the market by processed material during the forecast period. There is a growing need across a range of industries, including consumer goods, construction, and automotive, for recycled rubber materials. Additionally, manufacturing and recycling rubber products is now more financially feasible because of advancements in recycling technologies. Rubber waste recycling is becoming more popular as sustainability and minimizing environmental effects become more important. All these factors support the expected growth of rubber in the recycling equipment market.

Regional Insights

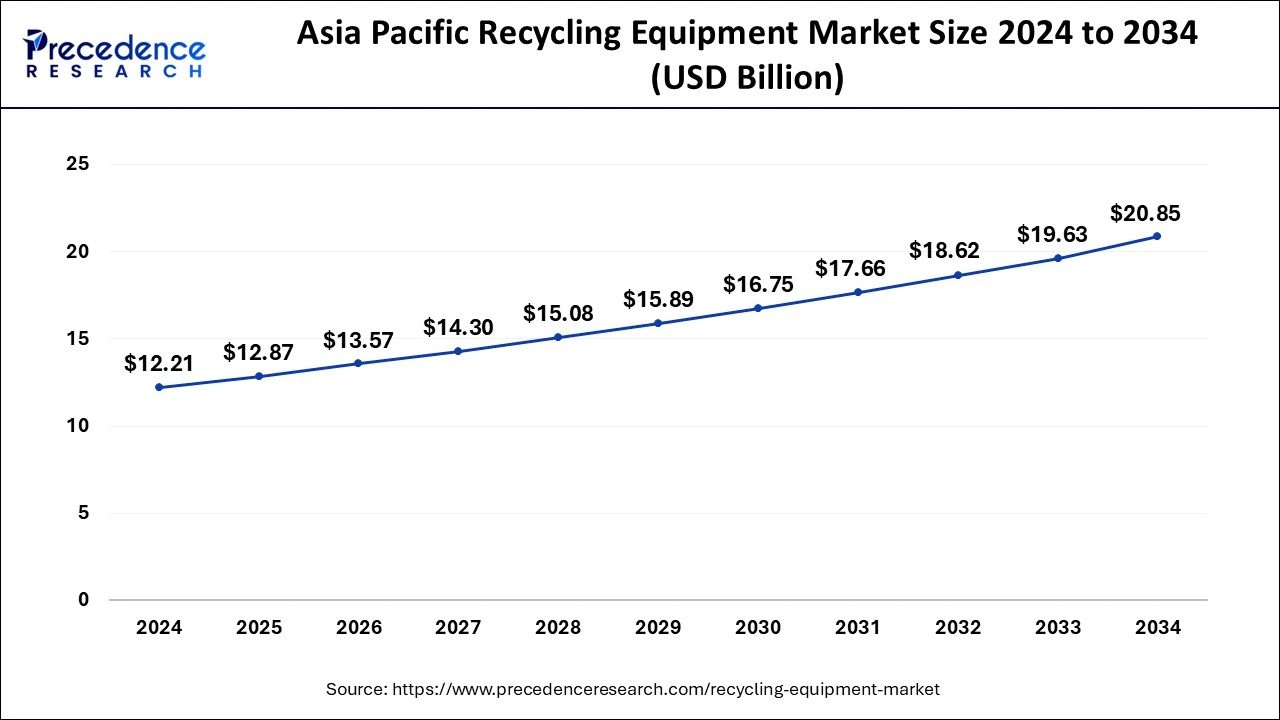

Asia PacificRecycling Equipment Market Size and Growth 2025 to 2034

The Asia Pacific recycling equipment market size reached USD 12.87 billion in 2025 and is predicted to be worth around USD 20.85 billion by 2034, at a CAGR of 5.50% from 2025 to 2034.

Asia Pacific has held the largest market share in 2025. Due to a number of factors, including expanding urbanization, environmental awareness, stricter government regulations, and growing investment in suitable development efforts, the market is likely to rise in the Asia Pacific region. In order to manage waste efficiently and sustainably, the region's fast industrialization and growing manufacturing sector also increase the need for recycling technology.

India's environment ministry has proposed a new draft under which the government will be focusing on recycling in the automobile sector. The newly draft policy seeks establishment of 20 official vehicle dismantlers across the country.

- In India, November 2022 market the beginning of new e-waste management rules. All manufacturer, recyclers and producers are required to register with the central pollution control board.

- From 2011 to 2022, China has recycled 170 million tons of plastic waste.

What Potentiates the Growth of North America in the Market?

North America is observed to grow at a significant rate in the recycling equipment market by region, during the forecast period. The recycling equipment is in high demand due to the strict management and recycling requirements in North America. The area has a competitive advantage in the worldwide market thanks to the numerous creative businesses that are creating cutting-edge machinery there. The business has been further stimulated by significant investments made by North American nations in recycling infrastructure, including structures and machinery.

- In 2023, TOMRA, Canada announced that it will be supplying advanced collection, sorting and processing equipment for new recycling depots in Quebec. 1,350 machines will be installed as a part of the deal with local producer in the country.

U.S. Recycling Equipment Market Analysis

The U.S. accounts for the largest share of the North American market due to its advanced recycling infrastructure and quick adoption of AI-based sorting and robotic pickers. The federal government supports recycling of batteries, e-waste, and plastics, which has led to faster deployment of high-capacity shredders and optical sorters. The increasing use of high-speed MRF upgrades is likely to strengthen the country's leadership throughout the forecast period.

What Drives the Recycling Equipment Market in Europe?

The market in Europe is expected to grow at a significant rate in the coming years due to aggressive circular-economy policies and advanced recycling standards enforced by the European Union. Plants in Germany, France, the Netherlands, and the Nordic regions are incorporating high-speed optical sort systems, robots, and energy-saving shredding systems to meet the increasing requirements for recycled content. The growth is expected to be supported by high investments in waste management systems for packaging, WEEE, ELV, and battery recycling to meet the goals of the EU Green Deal.

Germany Recycling Equipment Market Analysis

Germany leads the regional market due to strict circular economy regulations and widespread use of automated sorting equipment. Robotics-driven sorting systems are expected to be in high demand as recyclers aim for higher material purity to meet the goals of the EU Green Deal. Additionally, strong government support for decarbonization is likely to keep Germany as one of the main markets in Europe.

How is the Opportunistic Rise of Latin America in the Recycling Equipment Market?

Latin America is expected to see steady market growth due to improving waste-management laws and increasing private-sector involvement in recycling efforts. Countries like Brazil, Mexico, and Chile are upgrading their recycling systems by using balers, compactors, and optical sorting units to handle rising volumes of municipal solid waste. The rising need for automated sorting and metal-processing systems that handle mixed waste streams also drives regional market growth.

Brazil leads the Latin American market due to expanding waste-management laws and the modernization of municipal systems. Federal and state-level green compliance is expected to boost investment in automation equipment.

What Factors Contribute to the Market in the Middle East & Africa?

The market in the Middle East & Africa is driven by infrastructure development, waste-diversion initiatives, and emerging recycling mandates. Rising industrial operations are expected to increase the demand for scrap-metal recovery machines and commercial scrap recycling. International cooperation and government-business programs are projected to enhance technology and support the market's growth in the long term in MEA.

UAE Recycling Equipment Market Analysis

UAE is considered a major player in the market in the MEA due to large-scale sustainability programs and the rapid expansion of advanced waste-processing plants. High-capacity sorting systems, metal shredders, and plastic reprocessing facilities are being installed to increase the nation's waste diversion targets. The industrial clusters are also expected to adopt new recycling technologies to manage the growing volumes of construction and manufacturing waste.

Recycling Equipment Market – Value Chain Analysis

Raw Material Sourcing

- The recycling equipment value chain begins with sourcing industrial-grade steel, motors, hydraulics, automation components, wear-resistant alloys, and electronic sensors for manufacturing shredders, balers, sorting systems, and conveyors. These raw materials form the mechanical and structural foundation of recycling machinery.

Key Players: ArcelorMittal, Nippon Steel, ABB, Schneider Electric

Component Fabrication

- Raw materials are converted into machine-ready components, including cutting blades, rotors, magnetic separators, vibratory drives, compaction chambers, conveyor belts, optical sorting units, and control panels. This stage ensures durability, precision, and high-performance processing.

Key Players: Eriez, STEINERT, Martin Engineering, Voith

Equipment Manufacturing

- Manufacturers assemble complete recycling machines, including shredders, balers, crushers, compactors, eddy-current separators, MRF systems, and e-waste processing lines, in accordance with strict engineering and safety standards. This stage also includes PLC integration, automation programming, and quality testing.

Key Players: Metso, The CP Group, Danieli Centro Recycling, ELDAN Recycling, LEFORT GROUP, American Baler, General Kinematics, Forrec Srl

System Design & Plant Integration

- Assembled machines are configured into full recycling lines, integrating conveyors, sorting systems, robotics, and plant-wide automation. This step focuses on layout engineering, throughput optimization, energy efficiency, and compliance with waste-management regulations

Key Players: Kiverco, BHS Sonthofen, Marathon Equipment, Suny Group, MHM Recycling Equipment

Distribution to End Users

- Completed recycling systems and machinery are delivered to waste-management operators, municipal authorities, industrial recyclers, MRF operators, and metal-scrap processors for direct implementation into recycling workflows.

Key Players: Metso (global distribution), The CP Group (turnkey systems), Forrec Srl (international delivery), LEFORT GROUP (global scrap-equipment distribution)

Top Companies in the Recycling Equipment Market

- Recycling Equipment Manufacturing (U.S.): Specializes in heavy-duty recycling machinery, including shredders, conveyors, and material-handling systems for metal, plastic, and waste processing industries.

- The CP Group (U.S.): A global leader in advanced sorting systems, offering turnkey material recovery facilities (MRFs), optical sorters, and automation-driven recycling technologies.

- American Baler (U.S.): Manufactures high-capacity balers engineered for paper, plastics, metals, and OCC recycling with a strong focus on durability and throughput efficiency.

- Kiverco (UK): Provides modular and static recycling plants designed for construction waste, municipal solid waste, and commercial waste processing.

- General Kinematics (U.S.): Known for vibratory equipment and sorting systems that improve material flow, screening efficiency, and resource recovery across recycling operations.

- MHM Recycling Equipment (UK): Offers balers, shredders, and waste-handling machinery tailored for paper, cardboard, and plastic recycling facilities.

- Marathon Equipment (U.S.): Produces industrial compactors, balers, and recycling systems widely used in commercial recycling and solid-waste management.

- Ceco Equipment Ltd. (UK): Manufactures compact, user-friendly balers and waste-reduction equipment suited for small and mid-scale recycling operations.

- Danieli Centro Recycling (Italy): Supplies high-performance scrap-processing machinery, including shears, balers, and shredders designed for metal recycling.

- ELDAN Recycling (Denmark): A global leader in tyre, cable, and electronic waste recycling equipment offering complete, energy-efficient processing lines.

- Metso (Finland): Delivers robust shredders, crushers, and metal-recycling systems engineered for high-volume scrap processing and resource recovery.

- Suny Group (China): Specializes in e-waste, lithium-battery, and PCB recycling equipment with integrated separation and recovery technologies.

- Forrec Srl Recycling (Italy): Manufactures shredders, grinding mills, and turnkey recycling plants for MSW, plastics, WEEE, and industrial waste.

- BHS Sonthofen (Germany): Known for advanced shredding, separation, and filtration technologies supporting efficient metal, battery, and waste recycling.

- LEFORT GROUP (Belgium): A major producer of heavy scrap-processing machinery, including shears, balers, and shredders for metal-recycling operations.

Recent Developments

- In February 2024, Lidl launches a city-wide drinks packaging recycling scheme. The launch of the scheme is intended to go some way to preparing customers for Scotland's nationwide deposit return scheme (DRS) for drinks packaging, which was due to be launched last August but was delayed until March 2024.

- In November 2023, Tomra Recycling Sorting, a business unit of Norway-based Tomra, launched the Innosort Flake for high throughput purification of plastic flakes. The Innosort Flake enables simultaneous flake sorting by color, polymer, and transparency, the company says. “The new Innosort Flake is designed to sort any color, any polymer, at the same time,” says Alberto Piovesan, global segment manager of plastics at Tomra Recycling Sorting. “It levels the playing field for recyclers and gives them maximum flexibility to respond to the respective market demands.

- In August 2023, Genius Machinery announced its highly sophisticated plastic washing recycling machine line. The plastic washing recycling machine line includes rigid washing plants as well as film washing plants. The rigid washing plants are designed to recycle post-consumer hard materials such as bottles, injection molding waste or scrap, pipes, e-waste, and other rigid materials. These systems produce uniform plastic flakes with high purity and low moisture content.

- In October 2022, the EREMA Group company was offering not only previously owned, customized plastics recycling machines but also a new machine that is made to stock and is therefore readily available at short notice. Launched in K 2022, the READYMAC system handles many standard applications in the post-consumer recycling segment and is an attractive option for customers who need a recycling solution on short notice without custom configuration.

Segments Covered in the Report

By Equipment

- Baler Press

- Shredders

- Granulators

- Agglomerators

- Shears

- Separators

- Extruders

- Others

By Processed Material

- Metal

- Plastic

- Construction Waste

- Paper

- Rubber

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting