What is Tire Recycling Market Size?

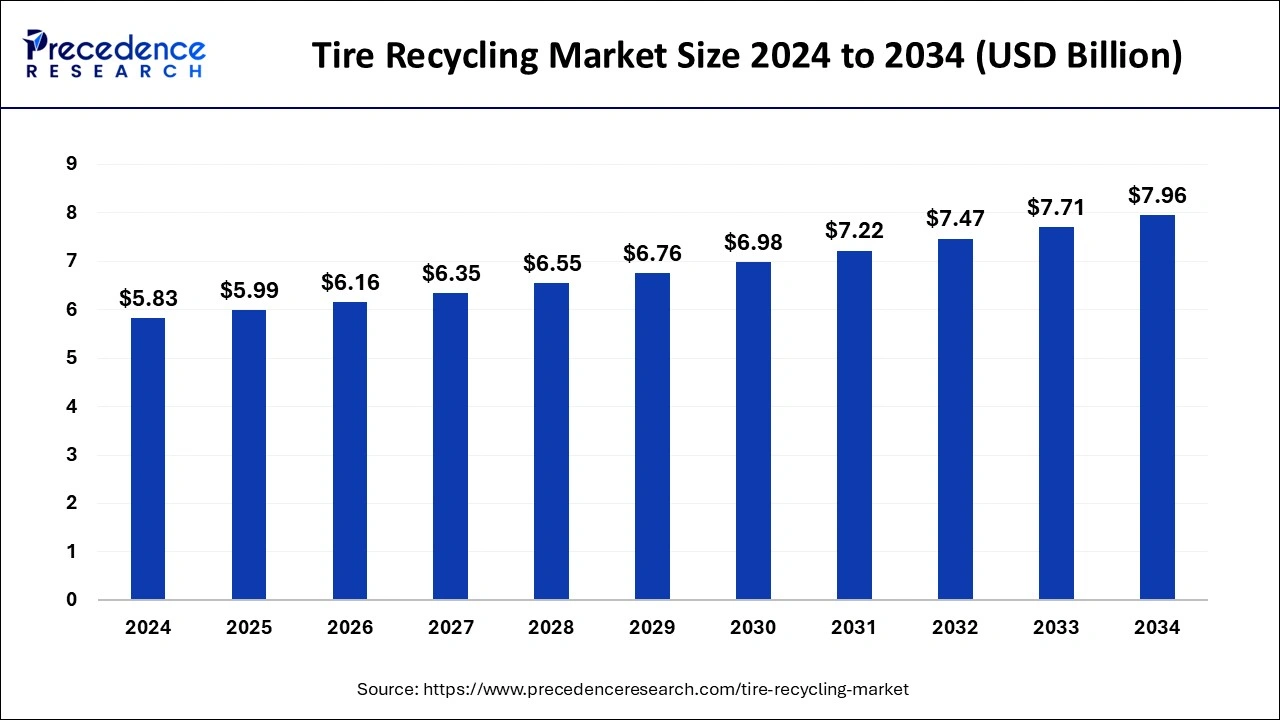

The global tire recycling market size accounted for USD 5.99 billion in 2025 and is predicted to increase from USD 6.16 billion in 2026 to approximately USD 7.96 billion by 2034, expanding at a CAGR of 3.16% from 2025 to 2034.

Market Highlights

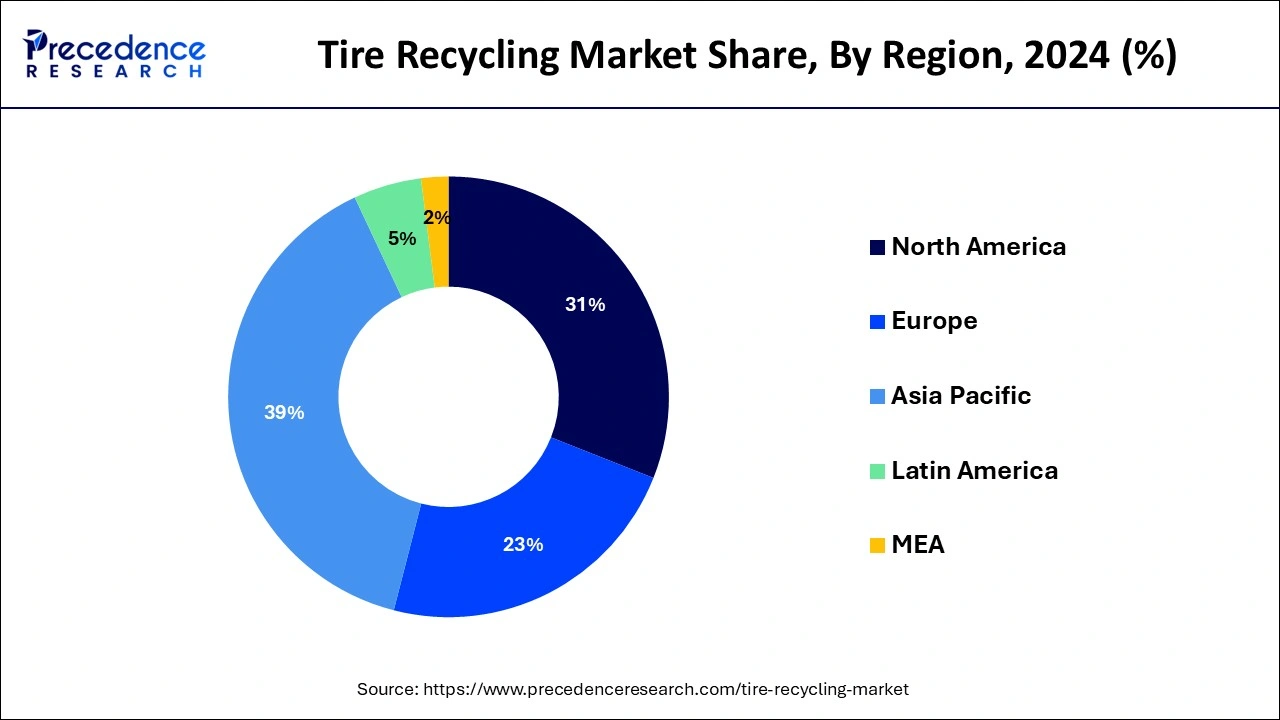

- Asia-Pacific contributed the highest market share of 39% in 2024.

- Europe is estimated to expand the fastest CAGR between 2025 and 2034.

- By process, the refurbishing segment has held the largest market share of 47% in 2024.

- By process, the pyrolysis segment is anticipated to grow at a remarkable CAGR of 4.8% between 2025 and 2034.

- By product, the refurbished commercial vehicle tires segment has held the largest market share of 41% in 2024.

- By product, the crumbed rubber segment is anticipated to grow at a remarkable CAGR of 4.3% between 2025 and 2034.

- By application, the automotive segment generated the highest revenue share of 40% in 2024.

- By application, the construction segment is expected to expand at the fastest CAGR of 4.7% over the projected period.

Market Overview

Tire recycling is the process of reusing, reprocessing, or repurposing used or discarded tires to prevent them from being disposed of in landfills or incinerated, which can have negative environmental consequences. The primary goals of tire recycling are to reduce waste, conserve resources, and minimize the environmental impact associated with the disposal of tires. Efforts to promote tire recycling have been growing due to its environmental and economic benefits. Various governments and organizations have established regulations and incentives to encourage the responsible disposal and recycling of tires, helping to reduce the negative environmental impact of discarded tires.

The tire recycling market refers to the commercial activities and industries involved in the collection, processing, and reutilization of used or discarded tires to create valuable products or materials. This market has developed in response to the environmental and economic challenges posed by the disposal of tires in landfills or their incineration, which can have adverse environmental impacts. The tire recycling market plays a significant role in addressing environmental issues associated with tire disposal, conserving resources, and reducing the carbon footprint of tire manufacturing. It also contributes to job creation and promotes sustainability in the automotive and construction sectors. As environmental concerns continue to grow, the tire recycling market is expected to expand, offering opportunities for innovation and the development of new, eco-friendly products.

Tire Recycling Market Growth Factors

- Environmental awareness: Growing awareness of environmental issues, including pollution and the need to reduce waste, has prompted individuals, businesses, and governments to seek sustainable solutions for tire disposal. This heightened awareness drives demand for tire recycling.

- Regulatory mandates: Government regulations and policies that promote responsible tire disposal and recycling play a significant role in the growth of the tire recycling market. These regulations encourage proper disposal and the development of recycling infrastructure.

- Economic incentives: Economic factors such as the rising cost of raw materials and the demand for sustainable products have created economic incentives for tire recycling. Recycling tires can be a cost-effective way to produce valuable materials and products.

- Technological advancements: Advancements in tire recycling technologies, including improved shredding, pyrolysis, and rubber processing methods, have made recycling more efficient and economically viable. These advancements expand the range of applications for recycled tire materials.

- Increased demand for sustainable products: As sustainability becomes a key consideration for consumers and businesses, there is a growing demand for products made from recycled tires, such as rubberized asphalt, crumb rubber products, and tire-derived fuel. This increased demand stimulates the growth of the tire recycling market.

- Infrastructure development: Investments in recycling infrastructure, such as recycling facilities and processing plants, contribute to the expansion of the tire recycling market. Improved infrastructure allows for more efficient tire collection and processing.

- Alternative fuel sources: The use of tire-derived fuel (TDF) in industrial applications, such as cement kilns and power generation, offers an alternative and sustainable energy source. As the demand for sustainable energy solutions grows, so does the demand for TDF, driving the tire recycling market.

- Sustainable construction practices: The construction industry has shown an increased interest in using tire-derived products, such as rubberized asphalt and tire-derived aggregate (TDA), for infrastructure projects. Sustainable construction practices drive demand for recycled tire materials.

Tire Recycling MarketTrends

- Tire recycling is gaining momentum as discarded tires are increasingly treated as valuable resources rather than waste, providing recycled rubber, carbon black, and fuel alternatives.

- Advanced recycling technologies are improving efficiency, with methods like pyrolysis and devulcanization allowing higher-quality recovered materials suitable for multiple applications.

- Recycled rubber is finding diverse uses, including in road asphalt, playground surfaces, sports tracks, and construction materials, expanding the market demand.

- Environmental regulations and sustainability initiatives are driving growth, as governments and industries aim to reduce tire waste in landfills and promote circular economy practices.

- Tire-derived fuel (TDF) is becoming more popular, offering industries such as cement and power a cost-effective and lower-emission energy source.

- Recovery of carbon black is increasing, enabling the reuse of this material in new rubber and plastic products while reducing reliance on virgin resources.

- Investments in recycling infrastructure are rising, with larger, more efficient plants being built to handle increasing volumes of scrap tires.

- Government incentives and public funding support collection and recycling programs, helping scale up the supply of tires for recycling.

Market Outlook

- Industry Growth Overview: As used tires are transformed into useful resources like recycled rubber, carbon black, and fuel made from tires, tire recycling is becoming more popular. The market is growing steadily due to rising scrap tire volumes and industrial demand for these materials.

- Sustainability Trends: The market is closely linked to environmental goals. Modern recycling technologies, such as pyrolysis and devulcanization, reduce landfill waste, decrease the need for virgin resources, and promote circular economy practices.

- Global Expansion: As governments and businesses invest in recycling infrastructure, the market is growing on a global scale. Collaborations among tire producers, recyclers, and consumers are facilitating the expansion of operations throughout North America, Europe, and developing nations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.99 Billion |

| Market Size in 2026 | USD 6.16 Billion |

| Market Size by 2034 | USD 7.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.16% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Product, and Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Energy efficiency and sustainability continue to drive demand for the tire recycling market.

As environmental concerns and sustainability objectives gain prominence, the tire recycling industry is evolving to align with these principles. Tire recycling has emerged as a more energy-efficient alternative to traditional tire manufacturing, where raw materials are extracted, processed, and shaped into new tires. The recycling process, including techniques like shredding, pyrolysis, and the production of tire-derived fuel (TDF), consumes fewer energy resources, thereby reducing the carbon footprint associated with tire production. Thus, the increasing emphasis on energy efficiency in the tire recycling process has become a significant driver for the tire recycling market.

In addition, energy-efficient approach appeals to various industries and businesses striving to minimize their environmental impact and lower energy costs. In a world increasingly focused on reducing greenhouse gas emissions and conserving energy, the adoption of tire recycling not only addresses the environmental challenges of tire disposal but also aligns with corporate sustainability goals and regulatory requirements. As a result, the demand for tire recycling services and recycled tire-derived products has grown, promoting a more sustainable and energy-efficient future for the tire industry while addressing the critical issue of waste reduction. This alignment with energy efficiency and sustainability continues to drive the expansion of the tire recycling market.

Restraint

Contamination of used tires can reduce the quality of recycled materials

Contamination refers to the presence of unwanted materials within the used tires, such as dirt, debris, or non-recyclable components, which can compromise the quality and integrity of the recycled materials. This issue hampers the efficient recycling of tires and creates several impediments for industry. Contamination may lead to a decrease in the quality of the recycled materials. When contaminants are introduced into the recycling process, they can result in impurities in the end products, such as crumb rubber or steel, diminishing their performance and durability.

This compromises the overall value and marketability of these recycled materials. Moreover, the presence of contaminants increases processing costs for tire recycling facilities. To ensure the removal of unwanted materials, additional steps and equipment are often required, leading to higher operational expenses. Additionally, contaminants can accelerate the wear and tear of recycling machinery, necessitating costly maintenance and repairs.

In addition, contamination also carries environmental concerns. It can lead to the release of harmful substances during the recycling process, potentially causing air or soil pollution. This poses regulatory challenges as well, as environmental standards often mandate limits on the levels of certain contaminants in recycled materials. Failure to meet these standards can result in fines or even the closure of recycling operations.

Furthermore, manufacturers may reject recycled materials that do not meet quality standards, limiting the market for tire-derived products and affecting the profitability of tire recycling operations. Addressing contamination challenges requires comprehensive solutions, including the implementation of effective inspection and separation processes to minimize contaminants.

This includes the use of advanced screening and cleaning equipment, as well as promoting best practices for tire collection, storage, and transportation to reduce the introduction of foreign materials. Public awareness campaigns can also play a vital role in promoting proper tire disposal practices, ultimately reducing contamination and supporting the quality and sustainability of the tire recycling market.

Opportunity

Innovative recycling technologies

Innovative tire technologies leverage advancements in science and engineering to unlock the full potential of discarded tires, addressing environmental concerns and bolstering the circular economy. The development of advanced pyrolysis processes is one of the most promising opportunities across the tire recycling market. It is a thermal decomposition method that can convert tires into valuable products, including liquid fuel, gas, and carbon black. These byproducts have applications in various industries, such as fuel production, energy generation, and manufacturing.

Furthermore, chemical recycling processes are emerging as a game-changer for the tire recycling market. These innovative approaches break down tires at a molecular level, enabling the extraction of high-quality raw materials, like monomers and polymers. These materials can be used in the production of new tires and other rubber-based products, reducing the dependence on virgin resources.

In addition to high-value products, these advanced recycling technologies open doors to sustainable energy sources. Tire-derived fuel (TDF), produced through cleaner and more efficient methods, can replace traditional fossil fuels in industrial processes, contributing to reduced greenhouse gas emissions and a circular approach to energy generation. The implementation of these technologies not only mitigates the environmental impact of tire disposal but also boosts economic prospects for the tire recycling market.

Moreover, these innovations facilitate the integration of recycled tire materials into diverse industries, reinforcing the concept of a circular economy and creating a greener, more sustainable future. As research and development in recycling technologies continue, the tire recycling market is poised for remarkable growth and a more prominent role in addressing the global challenges of waste management and resource conservation. For instance, in October 2023, Swedish Tire Recycling (SDAB) implemented the End-of-Life Tire Research Portal (ELTRP) with the support of international organizations in tire recycling, it is one of the world's first research portal for recycled tire rubber.

Segment Insights

Process Insights

According to the process, the refurbishing segment has held the highest revenue share of 47% in 2024. This is due to refurbishing is a cost-effective and sustainable approach for commercial fleets, contributing to cost savings and reduced environmental impact. Refurbishing or retreading is a process primarily applied to commercial vehicle tires. It involves repairing and re-treading the worn tire casings with a new layer of rubber. This process extends the lifespan of tires and reduces the need for manufacturing new tires, which conserves resources and reduces waste.

The pyrolysis segment is anticipated to expand fastest CAGR of 4.8% over the projected period. Pyrolysis is a thermal decomposition process that subjects tires to high temperatures in the absence of oxygen. This results in the breakdown of the tire's organic materials into valuable byproducts. Key byproducts include liquid fuel (pyrolysis oil), gaseous fuel (syngas), and solid carbon (carbon black). These products have applications in various industries, such as fuel production, energy generation, and the manufacturing of rubber and plastic products. It is seen as a way to convert used tires into high-value resources and reduce the environmental impact of tire disposal.

Product Insights

In 2024, the refurbished commercial vehicle tires segment had the highest market share of 41% on the basis of the product. This is due to refurbished commercial vehicle tires offering a cost-effective and sustainable solution for fleet operators, as they reduce the need for manufacturing new tires and conserve resources. It is also known as retreading, focuses on extending the lifespan of commercial vehicle tires. Worn tire casings are repaired, and a new layer of rubber is applied, restoring the tires to a serviceable condition.

The crumbed rubber segment is anticipated to expand fastest CAGR of 4.3% over the projected period. This is due to crumb rubber finds applications in a wide range of industries, including road construction (rubberized asphalt), sports and recreational surfaces (playground surfaces, athletic tracks), automotive components, and manufacturing processes (rubber products). It is a versatile product obtained through tire recycling. It involves shredding or grinding used tires into small, granulated rubber particles of various sizes.

Application Insights

In 2024, the automotive segment had the highest market share of 40% on the basis of the application. The automotive sector benefits from the use of recycled tire materials in various applications, such as the production of noise-reducing components, gaskets, seals, and underbody protection. These materials contribute to vehicle noise reduction, improved fuel efficiency, and enhanced safety features.

The construction segment is anticipated to expand fastest CAGR of 4.7% over the projected period. The construction industry represents a significant application area for tire-derived products, including rubberized asphalt, tire-derived aggregate (TDA), and other innovative materials. These recycled products are employed in road construction, drainage systems, embankments, and infrastructure development, offering sustainable solutions and enhancing the durability and performance of construction projects.

Regional Insights

Asia Pacific Tire Recycling Market Size and Growth 2025 to 2034

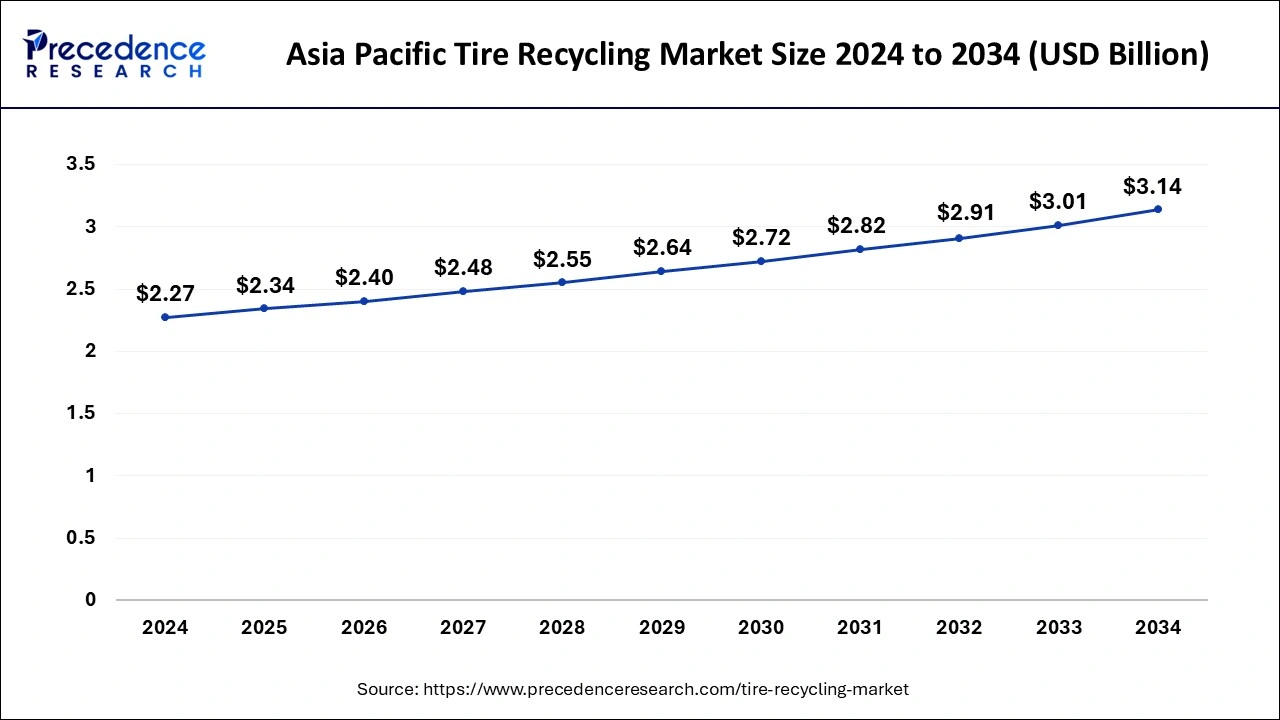

The Asia Pacific tire recycling market size is evaluated at USD 2.34 billion in 2025 and is projected to be worth around USD 3.14 billion by 2034, growing at a CAGR of 3.30% from 2025 to 2034.

Asia-Pacific has held the largest market share of 39% in 2024. Asia-Pacific has experienced significant industrial and economic growth, leading to higher vehicle ownership rates and tire consumption. This growth results in a greater need for responsible tire disposal and recycling. Many countries in the Asia-Pacific region have implemented government regulations and initiatives to promote responsible tire recycling. These regulations can encourage the growth of the tire recycling market.

Europe is estimated to observe the fastest expansion. Europe has some of the most rigorous environmental regulations and waste management standards in the world. This regulatory environment encourages responsible tire disposal and recycling practices. European countries have ambitious sustainability goals, including reducing waste and conserving resources. Tire recycling aligns with these goals by repurposing rubber and steel materials from used tires.

The North America tire recycling market is a vital sector within the broader waste management and recycling industry, focused on the responsible disposal and repurposing of used and discarded tires. This market encompasses various activities and processes designed to mitigate the environmental impact of tire waste while creating value-added materials and products.

Key Technological Shifts

|

Technology/ Shifts |

Impact |

|

Pyrolysis |

Converts old tires into oil, gas, carbon black, and steel, turning waste into valuable resources. |

|

Microwave / Ultrasonic Devulcanization |

Breaks sulfur bonds in rubber to restore flexibility with lower energy use and higher-quality output. |

|

Chemical Devulcanization |

Uses chemicals to recycle vulcanized rubber for high-performance applications. |

|

Cryogenic Grinding |

Freezes and grinds rubber into fine particles for asphalt, construction, and other uses. |

|

Plasma-Assisted Devulcanization |

Uses plasma to break rubber cross-links, producing highly elastic reclaimed rubber. |

|

AI & Robotics Sorting |

Smart sensors and robots separate rubber, steel, and other components efficiently. |

|

Blockchain Traceability |

Tracks tire lifecycle for transparency, compliance, and better resource management. |

|

Continuous Pyrolysis Reactors |

New reactor designs increase efficiency, scalability, and energy recovery. |

Tire Recycling Market Companies

- Continental AG

- reRubber, LLC.

- Entech Inc.

- Michelin Group S.A.

- Liberty Tire Services LLC (Lakin Tire)

- Green Distillation Technologies Corporation LTD.

- Tire Recycling Solutions SA

- Bridgestone Corporation

- Apollo Tyres Ltd.

- Tire Disposal and Recycling, Inc.

- Wastefront AS

- Contec S.A.

- Genan Holding A/S

- Emanuel Tire, LLC

- Re-Match Holding A/S

- Champlin Tire Recycling Inc.

Recent Developments

- In July 2023, VTTI announced that it will make an investment worth $43m in Wastefront, a waste tire recycling company, to support the construction of the first phase of its end-of-life tire (ELT) recycling plant in Sunderland, UK.

- In March 2023, Enviro partnered with Antin Infrastructure to create one of the first large-scale tire recycling group. It will provide end-of-life tire recycling plants across Europe to produce sustainable raw materials, including recovered carbon black and oils to be re-used in the tire and petrochemical industries.

Segments Covered in the Report

By Process

- Shredding

- Refurbishing

- Pyrolysis

By Product

- Refurbished Commercial Vehicle Tires

- Crumbed Rubber

- Tire Derived Fuel

- Others

By Application

- Automotive

- Manufacturing

- Construction

- Rubber Products

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting