What is the RegTech Market Size?

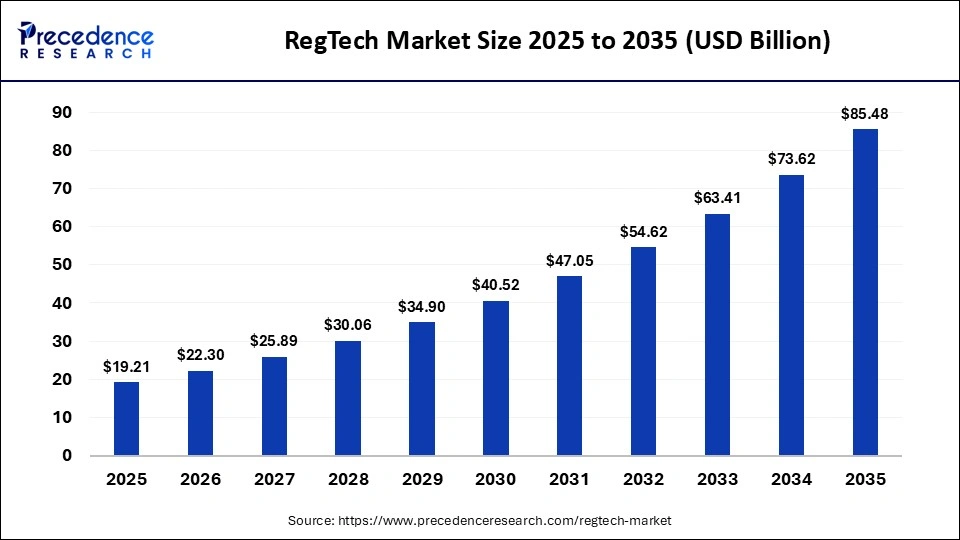

The global regtech market size was calculated at USD 19.21 billion in 2025 and is predicted to increase from USD 22.30 billion in 2026 to approximately USD 85.48 billion by 2035, expanding at a CAGR of 16.10% from 2026 to 2035.The primary reasons behind the market growth are rising complexity of regulations, increasing number of digital transactions, rising awareness regarding data privacy and the adoption of automation technology.

Market Highlights

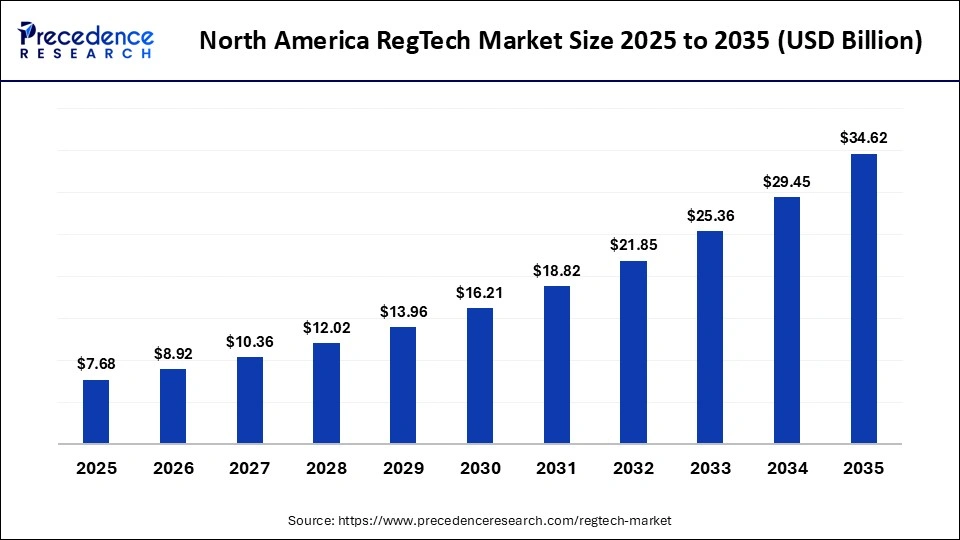

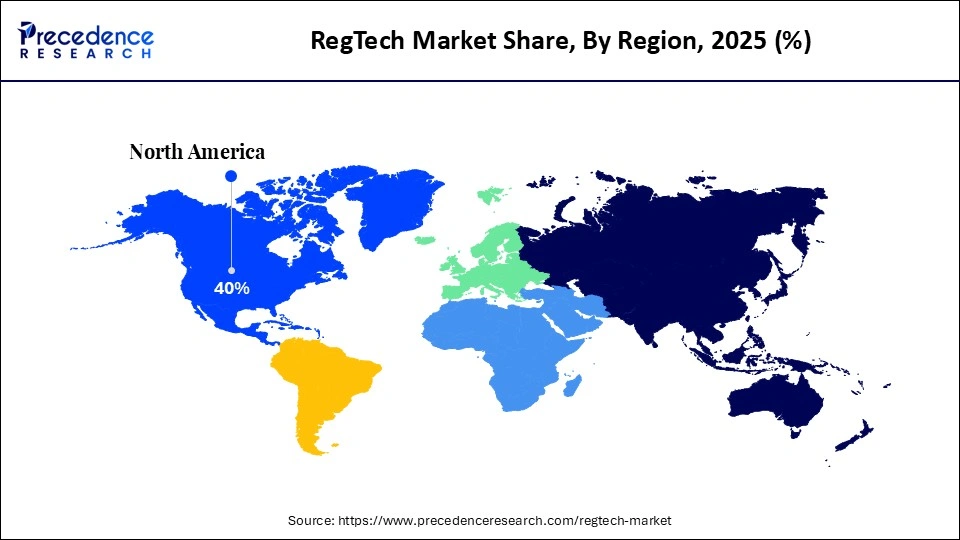

- North America led the RegTech market with the largest share of 40% in the global market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR of 18.5% during the forecast period.

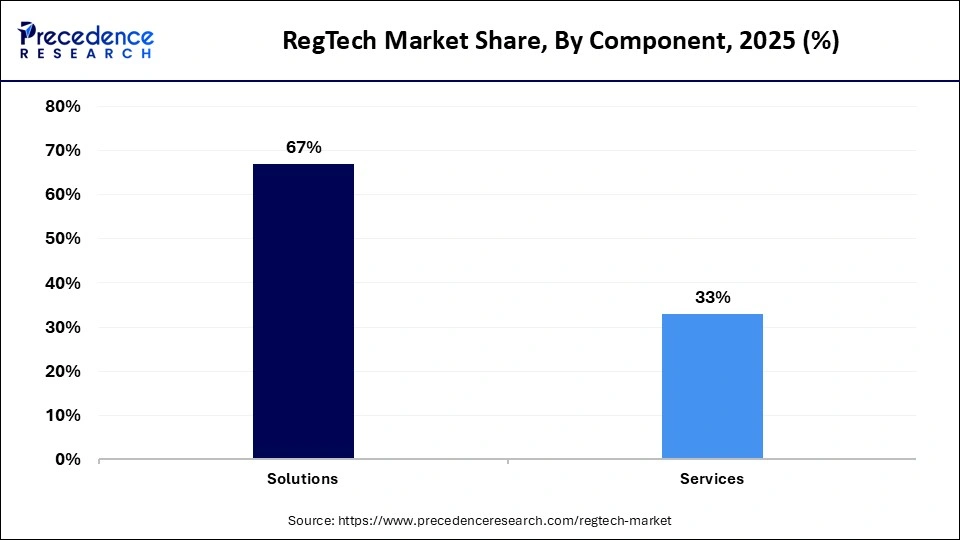

- By component type, the solutions segment led the market and held approximately 67% share in 2025.

- By component type, the services segment is expected to grow at the highest CAGR of 16.8% during the forecast period.

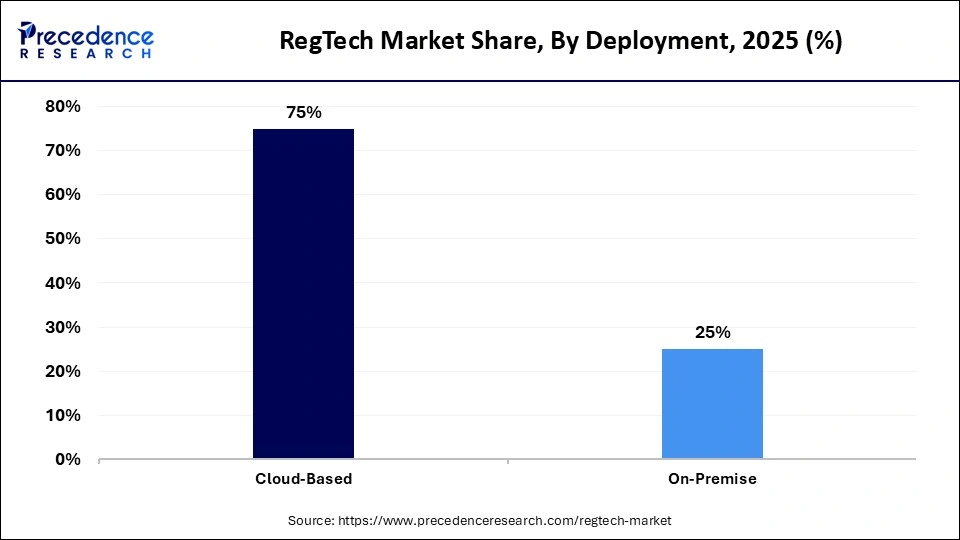

- By deployment type, the cloud-based segment dominated the market with approximately 75% share in 2025.

- By deployment type, the on-premise segment is expected to grow at a notable CAGR between 2026 and 2035.

- By application type, the risk and compliance management segment led the RegTech market and captured 34% share in 2025.

- By application type, the regulatory intelligence segment is expected to expand at the highest CAGR of 16.6% from 2026 to 2035.

- By end user type, the banking and financial services segment led the market and held approximately 50% share in 2025.

- By end user type, the FinTech and payments segment is expected to expand at the highest CAGR of 17% from 2026 to 2035.

What is the RegTech Market

RegTech (Regulatory Technology) refers to software, platforms, and services that help organizations streamline regulatory compliance, risk management, reporting, fraud prevention, and identity verification using automation, analytics, and emerging technologies like AI and blockchain. It is widely adopted across financial services, insurance, fintech, and other regulated industries to enhance accuracy, reduce costs, and manage complex changing regulations in real time. As regulatory demands increase globally, RegTech supports digital transformation and operational resilience while reducing compliance risk.

How is AI Contributing to the RegTech Market?

AI is transforming the RegTech industry by automating complex compliance processes. AI utilizes machine learning and natural language processing algorithms to monitor changes in regulations and provide accurate compliance reports. AI facilitates real time transaction monitoring to identify potential fraud, AML risks and compliance violations. Predictive analytics assist companies in identifying potential regulatory risks and negating them in advance. AI enhances KYC and identity verification processes by minimizing errors and false positives. AI is transforming RegTech from a reactive compliance tool to a proactive risk management solution.

RegTech Market Trends

- Collaborations & Partnerships: Regulatory technology organizations are collaborating with banks, FinTech companies and compliance teams to address complex regulatory issues. These collaborations aim to automate AML, KYC and transaction monitoring systems. For instance, NICE Actimize collaborated with TF Bank to implement its cloud-based AML solution and enhance financial crime detection and regulatory compliance.

- Government Initiatives: Governments and regulatory bodies are enforcing stricter compliance, data privacy and anti-money laundering regulations. These factors accelerate the adoption of RegTech solutions in the financial services industry. The regulatory bodies encourage continuous monitoring and digital regulatory reporting. For instance, U.S regulators incentivize financial institutions to implement advanced AML and KYC systems.

- Business Expansions: Companies are enhancing their regulatory technology offerings with AI-based analytics and cloud infrastructure. They are investing in scalable solutions that address multi region compliance challenges. This facilitates organizations to address regulatory challenges while optimizing their operational costs. For instance, Fenergo has introduced its RegTech solution globally to cater to the needs of financial institutions for end-to-end regulatory compliance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.21 Billion |

| Market Size in 2026 | USD 7.40 Billion |

| Market Size by 2035 | USD 85.48Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment,Application/Use Case , End-User/Vertical, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insight

Component Type Insight

How Did the Solutions Segment Dominate the RegTech Market?

The solutions segment led the market and held approximately 67% share in 2025. The market growth of this segment is because companies require integrated, technology-based compliance solutions. Regulatory technology solutions offer a comprehensive platform that integrates regulatory monitoring, risk management, fraud detection and audit management. This facilitates companies to manage complex and constantly evolving regulations effectively. This segment offers immediate operational value by providing automated support for manual compliance processes.

The services segment is expected to grow at the highest CAGR of 16.8% during the forecast period. The market growth of this segment can be attributed to rising demand for professional assistance in implementation and customization of regulatory technology solutions. The services offered include consulting, system integration, training and managed compliance. The market growth of this segment is further driven by increased adoption of RegTech solutions by SMEs as advisory services become increasingly important for companies.

Deployment Type Insight

How Did the Cloud-Based Segment Dominate the RegTech Market?

The cloud-based segment dominated the market with approximately 75% share in 2025. The market growth of this segment is due to its high scalability, flexibility and cost effectiveness. Cloud-based platforms facilitate organizations to update compliance and regulatory information without requiring complex IT infrastructure. This segment provides remote accessibility and monitoring capabilities for various locations. Cloud-based deployment enables rapid integration with data sources and analytics tools. The market growth of this segment is further driven by its widespread adoption in organizations dealing with dynamic jurisdictional regulations.

The on-premise segment is expected to grow at a notable CAGR between 2026 and 2035. The market growth of this segment can be attributed to rising demand for regulation and data protection. Many organizations opt for on premise deployment in order to have complete control over their sensitive data related to finance and compliance. This segment enables organizations to have stricter security policies and facilitates regulatory audits. The on-premise solution enables seamless integration with existing infrastructure. The market growth of this segment is further driven by its widespread adoption in prominent companies due to stability and control it provides over data and operations.

Application Type Insight

How Did the Risk and Compliance Segment Dominate the RegTech Market?

The risk and compliance management segment led the RegTech market and captured 34% share in 2025. The market growth of this segment can be attributed to increasing regulatory pressure and enforcement. Companies face the challenge of dealing with compliance across different jurisdictions. This segment facilitates constant monitoring of legal obligations and early risk detection to prevent any violations. This segment enables financial firms to improve their accuracy of reporting and auditing. The market growth of this segment is further driven by its widespread adoption in financial institutions as it helps them operate within legal norms and prevent monetary penalties.

The regulatory intelligence segment is expected to expand at the highest CAGR of 16.6% from 2026 to 2035. The market growth of this segment is due to constant changes in regulation laws leading to consultation requirement by companies regarding legal matters. Organizations need precise and up-to-date information about the effects of new laws on their business. This segment assists firms in transforming intricate law changes into actionable insights. Companies use these solutions to minimize risks and avoid last minute regulatory violations.

End User Type Insight

The banking and financial services segment led the market and held approximately 50% share in 2025. The market growth of this segment can be attributed to dependence of businesses and banks on regulatory compliance. Banks function in an environment where any failure, no matter how small, can cause significant financial and legal repercussions. They have to deal with risks associated with transactions, customers and internal controls. RegTech solutions help banks and financial firms achieve continuous monitoring rather than monitoring at intervals. The market growth of this segment is further driven by increased risks due to growth of digital payments and online banking.

The FinTech and payments segment is expected to expand at the highest CAGR of 17% from 2026 to 2035. The market growth of this segment is due to rapid rise in digitalization and constant changes in compliance norms. The adoption of RegTech solutions enables them to handle risks, identify fraud and comply with regulations without hampering the transaction process. AI and automation enables FinTech companies to make customer onboarding faster and monitor for any violations. The market growth of this segment is further driven by growth in e-commerce and digital payments.

Regional Insights

How Big is the North America RegTech Market Size?

The North America regtech market size is estimated at USD 27.68 billion in 2025 and is projected to reach approximately USD 34.62 billion by 2035, with a 16.25% CAGR from 2026 to 2035.

What Made North America the Leading Region in the RegTech Market?

North America led the RegTech market with the largest share of 40% in the global market in 2025. The market growth in this region can be attributed to strict regulations, adoption of advanced technology and presence of prominent financial institutions. This region has a well structured compliance environment that demands continuous monitoring and reporting. The financial institutions in North America were the first to adopt new technologies such as AI, machine learning and cloud-based solutions. The market growth in this region is further driven by significant investments in FinTech and digital banking by governments as well as private corporations.

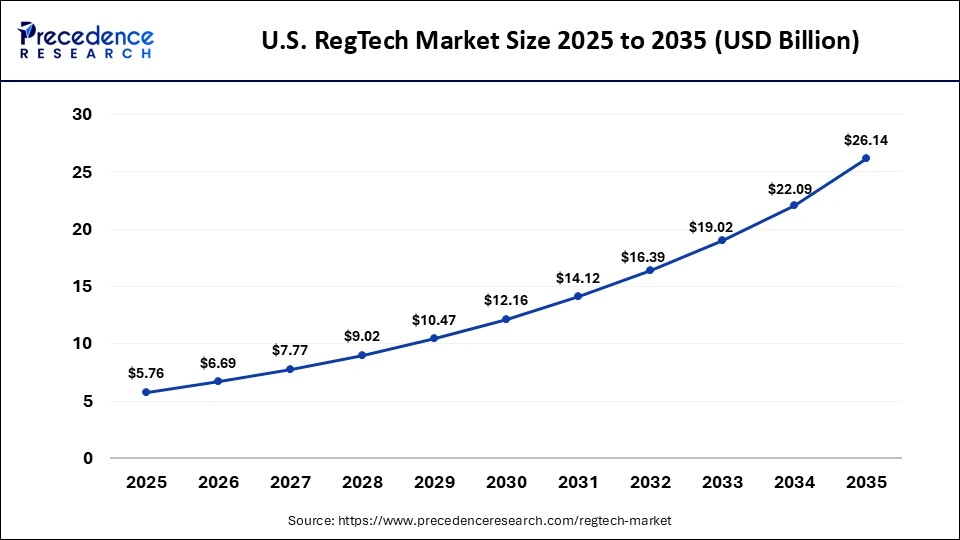

What is the Size of the U.S. RegTech Market?

The U.S. regtech market size is calculated at USD 5.76 billion in 2025 and is expected to reach nearly USD 26.14 billion in 2035, accelerating at a strong CAGR of 16.33% between 2026 and 2035.

U.S. RegTech Market Analysis

U.S. leads the market growth in the North American region because of its well developed and regulated financial industry. Financial institutions such as banks, insurance companies and FinTech businesses have to comply with strict rules and regulations set by organizations such as SEC, FINRA and CFPB. Significant investments on innovation and technology facilitates companies to leverage AI, cloud computing and big data analytics for risk management. The rising number of digital banking and payment systems are accelerating the adoption of automated compliance solutions.

Why is Asia-Pacific the Fastest-Growing Region in the RegTech Market?

Asia-Pacific is expected to grow at the highest CAGR of 18.5% during the forecast period. The market growth in this region can be attributed to increasing digitalization of the economy, the growth of financial services and the rising focus on regulatory norms. The governments and regulatory bodies in this region impose strict compliance norms in financial operations. The growth of FinTech, digital payments and online banking has boosted the demand for automated compliance solutions. The market growth in this region is further driven by economic growth and expansion of cross border operations.

Singapore RegTech Market Trends

Singapore leads the market in Asia Pacific because of its advanced financial system and progressive regulatory institutions. The Monetary Authority of Singapore(MAS) enforces compliance norms in the banking, insurance and FinTech companies. Government supports innovation through initiatives such as regulatory sandboxes, digital banking licenses and smart nation initiatives. The rising emphasis on data privacy, cybersecurity and transparency has accelerated the adoption of scalable and intelligent RegTech solutions.

Who are the Major Players in the Global RegTech Market?

The major players in the regtech market include Thomson Reuters, NICE Actimize, Wolters Kluwer, ACTICO GmbH, Adenza, ComplyAdvantag,e Fenergo, MetricStream , OneTrust, LLC, LSEG Data & Analytics, Trulioo, Accuity, Broadridge Financial Solutions, IBM, Ascent Technologies

Recent Developments

- In June 2025, Achilles launched Comply360 which is an AI-driven ESG and non-financial reporting solution. The product automatically extracts data from documents, generates sustainability reports and features an integrated carbon accounting engine to support CSRD, IFRS and GRI reporting.

- In June 2025, Datamaran launched Core Product, an AI powered risk and ESG insights solution. This product enables legal, sustainability and risk professionals to detect problems, analyze trends and perform disclosure and materiality analysis. This product integrates sophisticated benchmarking and monitoring in a single solution.

- In July 2025, Apex Compliance launched Meta Business Account Scan which uses computer vision and NLP to analyze Facebook and Instagram business content for potential compliance risks. This product detects problematic statements and provides color coded risk reports which facilitates brand monitoring.

Segments Covered in this Report

By Component

- Solutions

- Services

By Deployment

- Cloud-Based

- On-Premise

By Application / Use Case

- Risk & Compliance Management

- AML & Fraud Management

- Identity Management

- Regulatory Reporting

- Regulatory Intelligence

By End-User / Vertical

- Banking & Financial Services

- Insurance

- FinTech & Payments

- Healthcare & Pharmaceuticals

- Retail & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting