What is the Remotely Piloted Aircraft System Market Size?

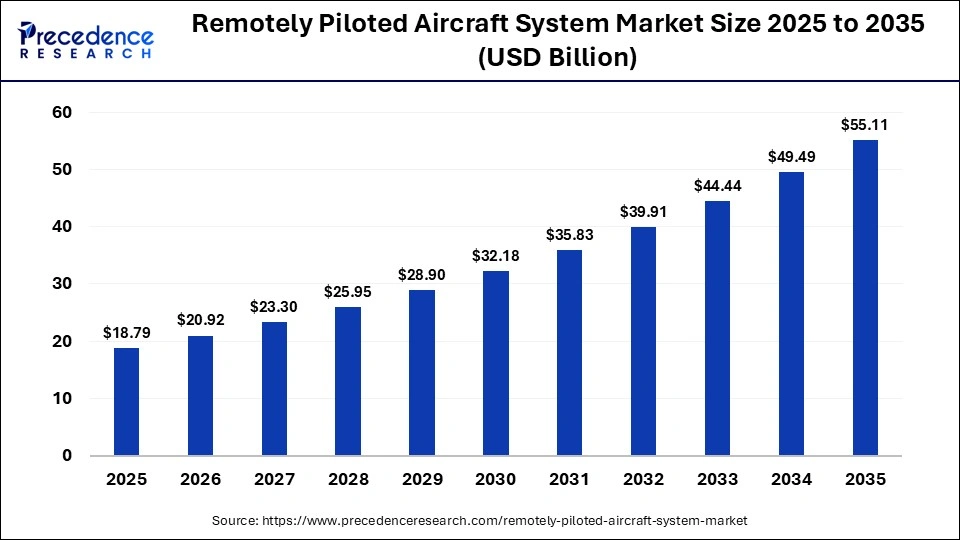

The global remotely piloted aircraft system market size was estimated at USD 18.79 billion in 2025 and is predicted to increase from USD 20.92 billion in 2026 to approximately USD 55.11 billion by 2035, expanding at a CAGR of 11.36% from 2026 to 2035. The remotely piloted aircraft system market is expanding rapidly due to rising defense modernization, increasing commercial UAV adoption for surveying and delivery, and advancements in autonomy and sensor technology, driving demand globally.

Market Highlights

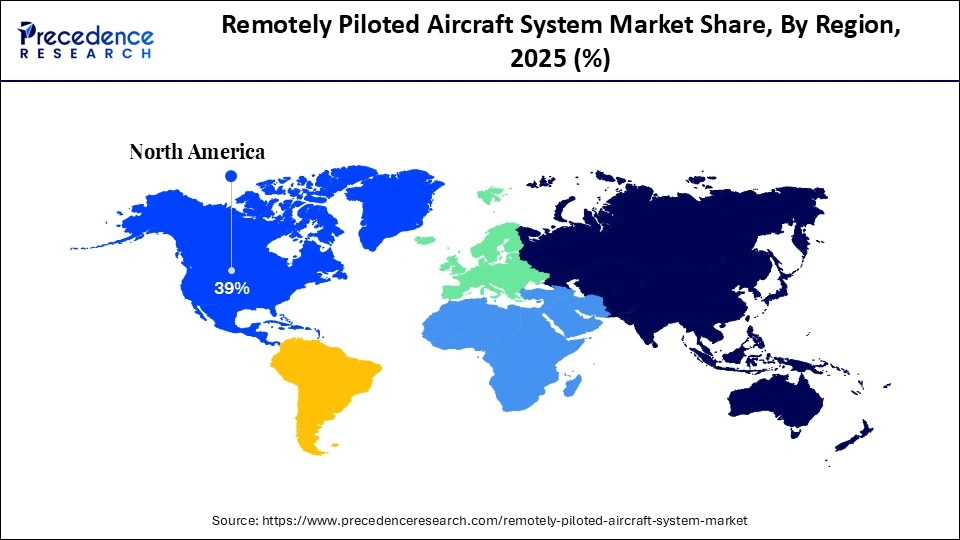

- North America led the remotely piloted aircraft system market in 2025.

- Asia Pacific is expected to expand the fastest CAGR in the market between 2026 and 2035.

- By component, the airframe segment dominated the market in 2025.

- By component, the avionics segment is expected to grow at the highest CAGR from 2026 to 2035.

- By type, the fixed-wing segment held a dominant market share in 2025.

- By type, the hybrid segment is projected to grow at the fastest CAGR between 2026 and 2035.

- By application, the military & defense segment led the remotely piloted aircraft system market in 2025.

- By application, the homeland security segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By end user, the government segment led the market in 2025.

- By end user, the commercial segment is expected to expand at the highest CAGR from 2026 to 2035.

Why are Remotely Piloted Aircraft Systems?

Remotely piloted aircraft systems (RPAS) are comprised of unmanned aerial vehicles operated from a distance by a pilot through a ground control station and supporting hardware. Each RPAS can operate independently of a pilot being on the plane at all times while still being able to provide aerial capabilities. The remotely piloted aircraft system market continues to grow rapidly due to increased interest in defense modernization programs, border security, and the growing demand for non-profit and commercial RPAS applications. Many countries have identified RPAS as an essential capability to provide intelligence, reconnaissance, and tactical support due to their versatility and ability to significantly mitigate the risk to personnel.

At the same time, businesses have identified RPAS as a means of increasing the efficiency of their operations, including agriculture monitoring, inspections on infrastructure, disaster management, and delivery logistics, by using the available technologies. The establishment of regulations, coupled with the growing investment in drone manufacturing within numerous countries, will continue to create an environment of opportunity that will support the growth of the RPAS market as a vital component of the future of aerospace and security systems.

AI-Powered RPAS Innovations to Enhance Autonomous Operations

With the advent of artificial intelligence technology, RPAS are utilizing AI advancements to create more resilient autonomous systems and enable real-time decision-making for commercial and military applications. AI-based navigation systems and perception systems are making it possible to operate drones independently and safely in areas where GPS is not available, or under GNSS Jammed conditions, thereby enhancing mission reliability and safety.

In October 2025, Tycho.AI publicly launched a $10 million Series A round to expand its business in the development of autonomous navigation software designed specifically for the fast, low-altitude operation of uncrewed aerial vehicles (UAVs) without the reliance on remote controllers and using only AI-based object detection and precise positioning technology.

Key Trends in the Remotely Piloted Aircraft System Market

- Multi-Use Platforms- More RPAS designs are becoming modular. Multi-mission RPAS designs enable the rapid payload exchange for missions such as surveillance, logistics, communications relay, and precision strikes. As a result, multi-mission aircraft are increasing the cost-effectiveness and expanding capabilities of military users as well as civilian users.

- Secured Connectivity- The increased emphasis on using encrypted data links, employing anti-jamming technology, and establishing resilient communication systems will improve the reliability of operations of RPAS in contested areas and in Beyond Line of Sight missions in remote environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.79 Billion |

| Market Size in 2026 | USD 20.92 Billion |

| Market Size by 2035 | USD 55.11 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.36% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What is the Reason for the Dominance of the Airframe Segment in the market?

Airframe

The airframe segment was the dominant segment in the remotely piloted aircraft system market in 2025, because they define the RPAS's payload capacity, endurance (how long it can be in the air), aerodynamic efficiency, and reliability for each mission. Continuous demand for airframes from defense, border protection, and long-duration missions will therefore result in ongoing procurement for airframes. The development of lightweight composite materials and modular designs has also continuously increased the durability and adaptability of airframes, making them the most expensive and frequently upgraded component within all military and commercial RPAS.

Avionics

The avionics segment is expected to be the fastest-growing segment in the remotely piloted aircraft system market. This is occurring because of the increasing need for autonomous navigation, collision avoidance, and real-time situational awareness. The technology associated with integrating artificial intelligence, advanced sensors, and high-performance microprocessors will continue to improve the flight precision and mission efficiency of each RPAS. Also, as more RPAS are operated beyond-visual-line-of-sight and have to comply with the regulatory requirements, investment in high-tech avionics systems is expected to increase.

Type Insights

What is it about the Fixed-Wing Segment that made it Dominant in the Market?

Fixed-Wing

The Fixed-wing segment accounted for the largest remotely piloted aircraft system market share in 2025 due to its ability to operate over a wider area for longer periods of time and its increased fuel efficiency compared to rotary-wing UAS. This has made them the most popular choice for military, commercial, and public sector applications that require expansive area surveillance. As a result of their extended flight endurance and ability to carry heavier payloads at higher altitudes, Fixed-Wing RPAS are deployed in many different strategic and industrial applications.

Hybrid

The hybrid segment is estimated to be the fastest-growing segment in the remotely piloted aircraft system market during the forecast period. These systems combine the vertical take-off capabilities and efficiencies of both rotary-wing and fixed-wing UAS, and allow for versatile use in urban areas for all of the same applications previously stated, and they also can take advantage of extended flight endurance through their increased endurance. The rapid increase in urban surveillance, logistics, and infrastructure inspection will only continue to expedite the development of Hybrid RPAS, due to advances in propulsion and flight control technology.

Application Insights

How is the Military & Defense Segment Dominating the Market?

Military & Defense

The military & defense segment held the largest remotely piloted aircraft system market share in 2025. The military uses RPAS extensively for ISR and tactical operations, taking advantage of the capabilities RPAS provide for reducing risk, providing continuous monitoring, and allowing for real-time communications in a hostile environment. Ongoing modernization programs, the continuing need for cross-border security, and the increasing integration of drone systems have created a continuously sustainable requirement for RPAS in defense organizations throughout the world.

Homeland Security

The homeland security segment is estimated to grow at the fastest CAGR in the remotely piloted aircraft system market during the forecast period, which is growing more rapidly than any other market segment. This growth is being driven primarily by increased emphasis on border monitoring, rapid disaster-response capabilities, crowd control, and critical infrastructure protection. Government agencies are also utilizing RPAS to obtain a more accurate picture of the situation in real-time for the purpose of executing rapid-response operations. Enhanced integration of sensors, the addition of night vision technology, and secure communications systems are expanding the operational capabilities of RPAS as they relate to domestic security missions.

End-User Insights

Which End User Segment Dominated the Market in 2025?

Government

The government segment accounted for the largest share of the remotely piloted aircraft system market in 2025, through significant utilization in the areas of defence, law enforcement, border control, and disaster management. Government agencies have high budget allocations, long procurement timelines, and provide funding for continued investment in the RPAS Market due to priorities related to national defence. In addition, government agencies also set operational and regulatory standards, thus reinforcing government dominance as the leading adopters of Remotely Piloted Aircraft Systems (RPAS) and the integration of RPAS with existing systems and processes.

Commercial

The commercial segment is estimated to grow at the fastest CAGR in the remotely piloted aircraft system market during the forecast period due it its uses in various industries such as agriculture, construction, distribution, media and environmental management, the continued growth of the commercial end-user market is driven by the continued expansion of RPAS technologies, lower costs associated with using drones, more accurate data collection, and improved worker safety through the integration of drones into the operational process. The expansion of these industries and the removal of various restrictions related to the use of drones and the growing availability of RPAS systems as a service by many companies have facilitated the rapid growth of RPAS commercial product adoption.

Regional Insights

How Big is the North America Remotely Controlled Aircraft System Market Size?

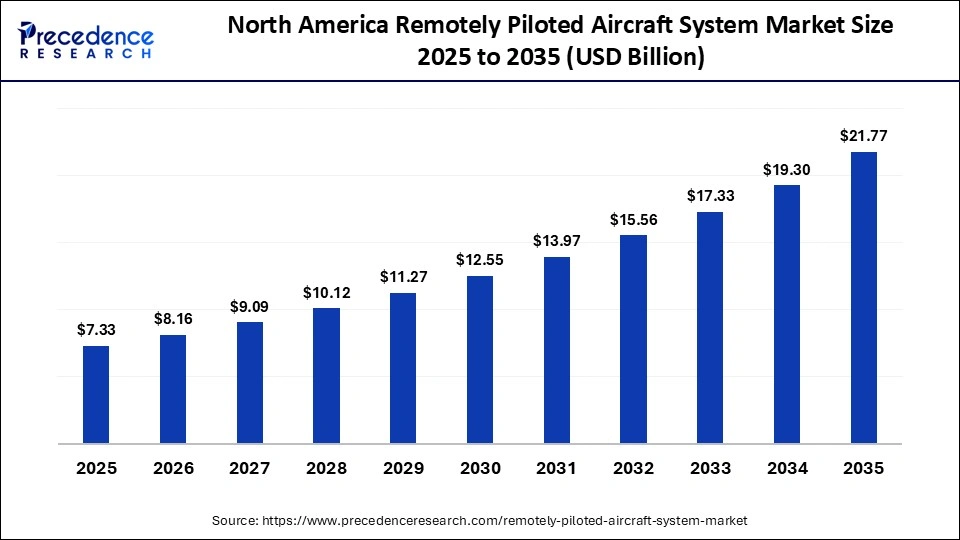

The North America remotely piloted aircraft system market size is estimated at USD 7.33 billion in 2025 and is projected to reach approximately USD 21.77 billion by 2035, with a 11.50% CAGR from 2026 to 2035.

Why is North America the dominant region for the Market?

North America dominated the remotely piloted aircraft system market in 2025 because the region has an established and advanced aerospace sector, along with high levels of defence modernization expenditure and the already high levels of integration of civil and commercial sectors with UAV technologies. Furthermore, North America possesses a full maturity level of established regulatory frameworks to encourage innovation, strong production ecosystems, and significant collaboration between businesses and research institutions.

These synergies drive rapid growth towards the use of sophisticated unmanned systems for surveillance, logistics, and environmental monitoring. Thus, North America has established itself as a global hub for technological development and operational deployment in the implementation of remotely piloted aircraft systems.

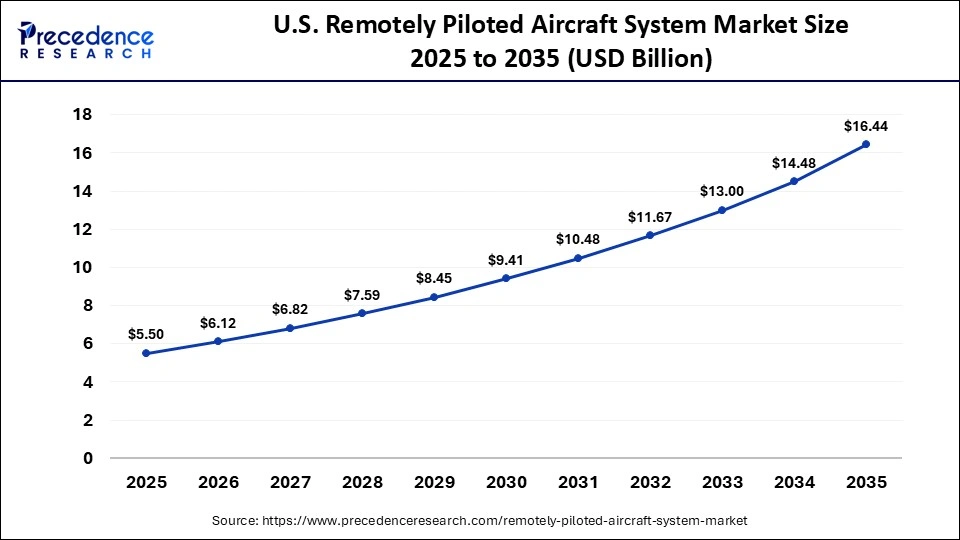

What is the Size of the U.S. Remotely Controlled Aircraft System Market?

The U.S. remotely piloted aircraft system market size is calculated at USD 5.50 billion in 2025 and is expected to reach nearly USD 16.44 billion in 2035, accelerating at a strong CAGR of 11.57% between 2026 and 2035.

U.S. Remotely Controlled Aircraft System Market Trend

The U.S. has established itself as a leader in the remotely piloted aircraft system market with extensive defence procurement, the development of the industry's vast production capabilities, and its leadership in innovation in autonomous systems. Further, the US government's agencies continue to invest in the development of next-generation platforms and sensor technology, as well as the private sector, which is creating opportunities for commercialisation across agriculture, energy, and public safety.

In January 2026, the U.S. Department of Homeland Security launched a new drone-focused office to oversee strategic investments in drone and counter-drone technologies ahead of major events like the FIFA World Cup 2026.

As a result, there is a constant evolution occurring, as government and industry continue to create opportunities for commercialisation of UAV Technology, making the US the world's leader in the applications and advances of Remote Piloted Aircraft Systems (RPAS).

Why is the Asia Pacific experiencing the fastest growth of the Remotely Controlled Aircraft System Market?

The Asia-Pacific region is the fastest-growing geographic area within the remotely piloted aircraft system market due to the rapid transformation in both the way we interact digitally and the expansion of Defence Modernization efforts. The growing demand for aerial solutions in logistics, agriculture, and disaster management will drive this market's growth. Additionally, investment in smart infrastructure, combined with national policies that support unmanned technologies, will continue to boost the region's adoption of RPAS. The region also exhibits a diverse manufacturing base with collaborations among countries, further improving its ability to innovate and provide scalable UAV solutions to both developed and emerging economies.

China Remotely Controlled Aircraft System Market Trend

China is the leader within the Asia-Pacific remotely piloted aircraft system market due to its considerable industrial scale, advanced state-of-the-art technology, and strategic focus on autonomous systems. The industry's ability to develop prototypes quickly, provide large-scale production facilities, and integrate cutting-edge sensors and artificial intelligence (AI) into their designs has positioned China to have a significant impact on how RPAS will be used commercially and globally. As more industries use RPAS for delivery, urban planning, and precision agriculture, the domestic market for these products has expanded. Additionally, extensive relationships with partners around the world and a robust export market have allowed China to greatly influence RPAS trends at both the regional and international levels.

Value Chain Analysis: Remotely Piloted Aircraft System Market

- Raw Material Sourcing

Suppliers provide composite metals, electronics, sensors, and propulsion materials, ensuring quality, traceability, compliance, sustainability, and cost control across supply networks.

Companies include Toray, Hexcel, Alcoa, TE Connectivity, Honeywell, and RTX suppliers.

- Component Manufacturing

Manufacturers integrate airframes, avionics, propulsion control systems, software payloads, and communications through precision fabrication, assembly, quality assurance, and production processes.

Companies include Boeing, Airbus, Northrop Grumman, Lockheed Martin, General Atomics, and DJI.

- Testing and Certification

Systems undergo ground flight environmental safety, reliability testing, documentation, audits, and regulatory approvals, validating performance, airworthiness compliance, interoperability, and readiness.

Companies include FAA, EASA, DGCA, TÜV Rheinland, UL Solutions, and specialized test ranges.

- Maintenance, Repair & Overhaul (MRO)

Operators perform inspections, diagnostics, repairs, overhauls, software updates, parts replacement, and fleet management to ensure availability, reliability, safety, compliance, and efficiency.

Companies include Lufthansa Technik, Air Works, AAR Corp, ST Engineering, and OEM service divisions.

- Supply to Governments and Airlines

Sales involve contracting, customization, training, logistics, financing, delivery, and program management, aligning missions, budgets, requirements, export controls, and support commitments.

Customers and suppliers include ministries of defense, NATO partners, civil authorities, Boeing, Airbus, and regional integrators.

- Aftermarket Services and Upgrades

Providers deliver spares training analytics connectivity payload enhancements software upgrades obsolescence management cybersecurity improvements and performance optimization, extending longevity value.

Companies include OEMs, system integrators, Thales, L3Harris, Collins Aerospace, and software vendors.

Who are the Major Players in the Global Remotely Piloted Aircraft System Market?

The major players in the remotely piloted aircraft system market include Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc., The Boeing Company, Lockheed Martin Corporation, Airbus S.A.S., Elbit Systems Ltd., BAE Systems plc, Thales Group, Saab AB, Textron Inc., Leonardo S.p.A., Israel Aerospace Industries Ltd, AeroVironment, Inc., DJI, Parrot SA, Kratos Defense & Security Solutions, Turkish Aerospace Industries, China Aerospace Science and Technology Corporation, Insitu Inc, and FLIR Systems, Inc.

Recent Developments in the Market

- In July 2025, French aerospace firms XSun and H3 Dynamics developed an unmanned aerial vehicle driven by a combination of solar energy, hydrogen fuel cells, and battery storage to deliver zero-emission, long-endurance unmanned flight.(Source: https://www.01net.it)

- In April 2025, Hanwha Aerospace and GA-ASI agreed to collaborate on developing and producing unmanned aircraft systems for global defense, building on successful at-sea launches and expanding Korea's UAS market presence.(Source: https://www.hanwha.com)

Segments Covered in the Report

By Component

- Airframe

- Payload

- Avionics

- Ground Control Station

- Data Link

- Software

- Others

By Type

- Fixed-Wing

- Rotary-Wing

- Hybrid

By Application

- Military & Defense

- Commercial

- Civil

- Homeland Security

- Others

By End-User

- Government

- Commercial

- Consumer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting