Rheumatoid Arthritis Drugs MarketSize and Forecast 2025 to 2034

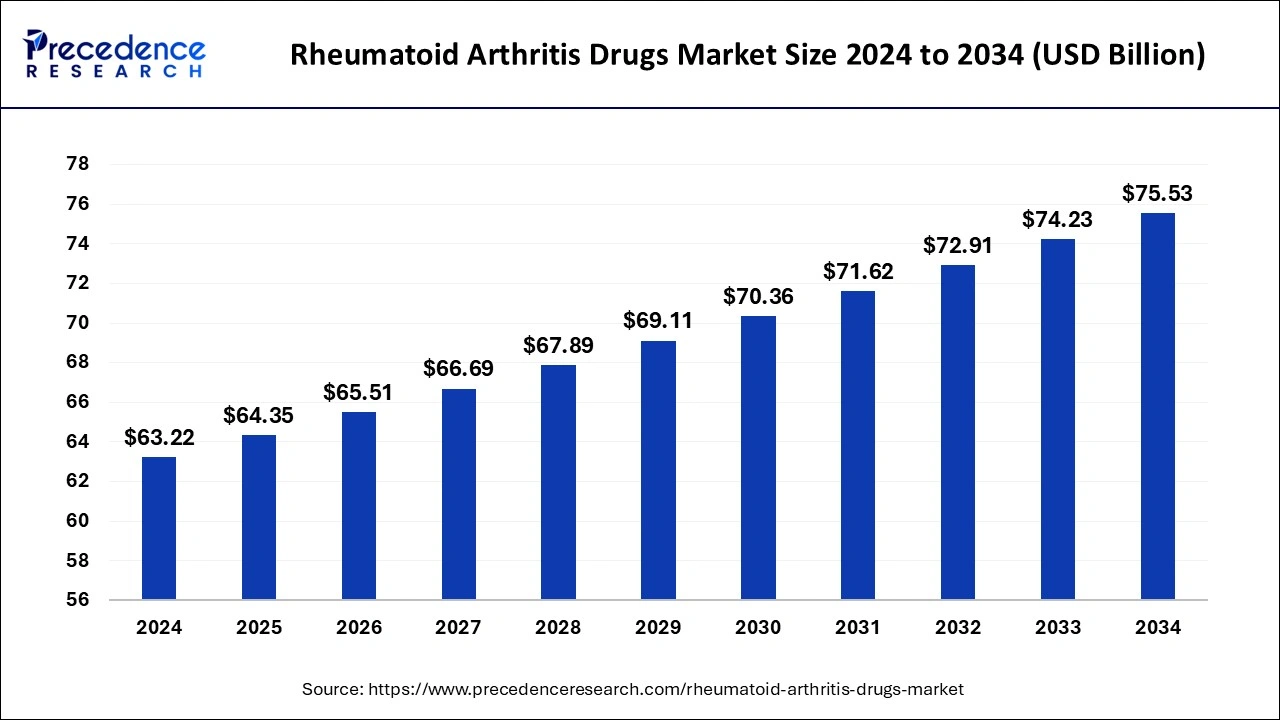

The global rheumatoid arthritis drugs market sizewas calculated at USD 63.22 billion in 2024 and is predicted to reach around USD 75.53 billion by 2034, expanding at a CAGR of 1.80% from 2025 to 2034.

Rheumatoid Arthritis Drugs Market Key Takeaways

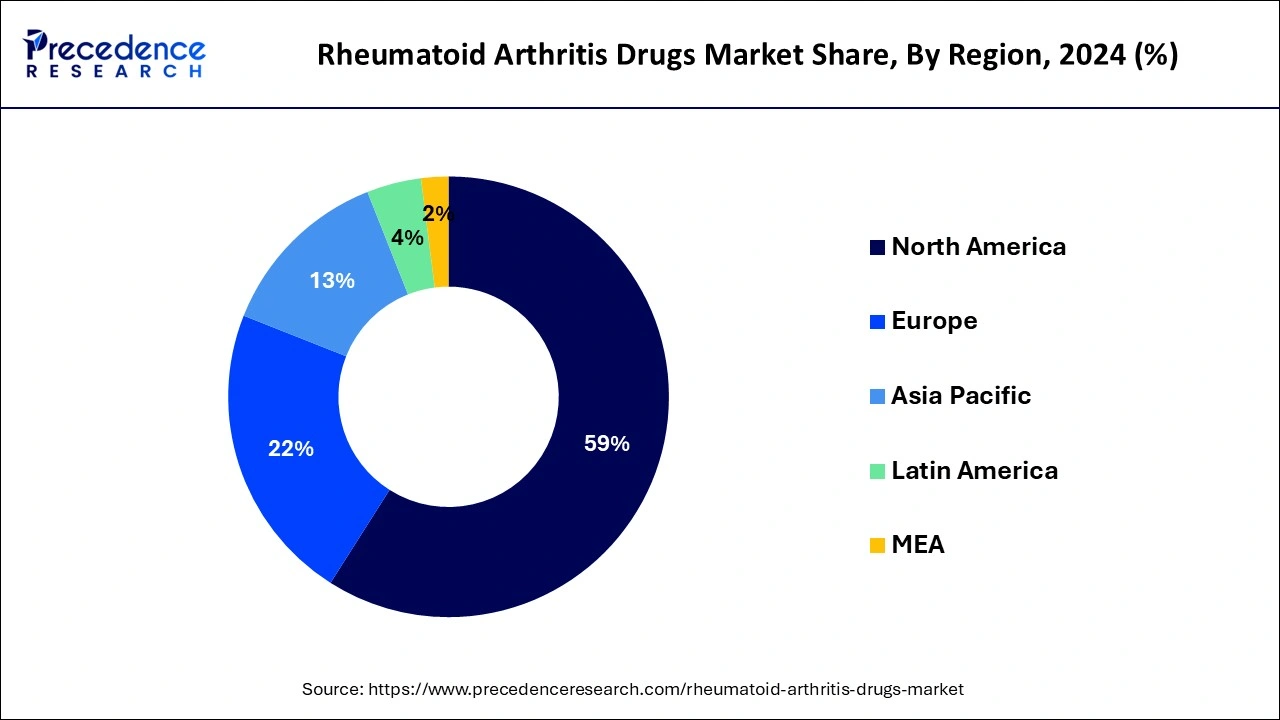

- North America led the global market with the highest market share of 58.25% in 2024.

- By drug type, the disease-modifying anti-rheumatic drugs (DMARDs) segment dominated the market with 64.10% in 2024.

- By drug type, the DMARDs (esp. Biologics & Targeted Synthetics) segment is expected to grow at the highest CAGR of 7.80% in 2024.

- By route of administration, the oral segment held a 57.30% market share in 2024.

- By route of administration, the parentral segment is expected to grow at the highest CAGR of 6.90% in 2024.

- By Distribution Channel, the hospital pharmacies segment led the market by holding 41.60% in 2024.

By Distribution Channel, the online pharmacies segment is expected to grow at the highest CAGR of 8.30% in 2024. - By patient type, the adult segment held a 94.20% market share in 2024.

- By patient type, the pediatric segment is expected to grow at the highest CAGR of 6.10% in 2024.

- By mode of purchase, the prescription-based segment dominated the market with 88.50% in 2024.

- By mode of purchase, the over-the-counter segment is expected to grow at the highest CAGR of 5.70% share in 2024.

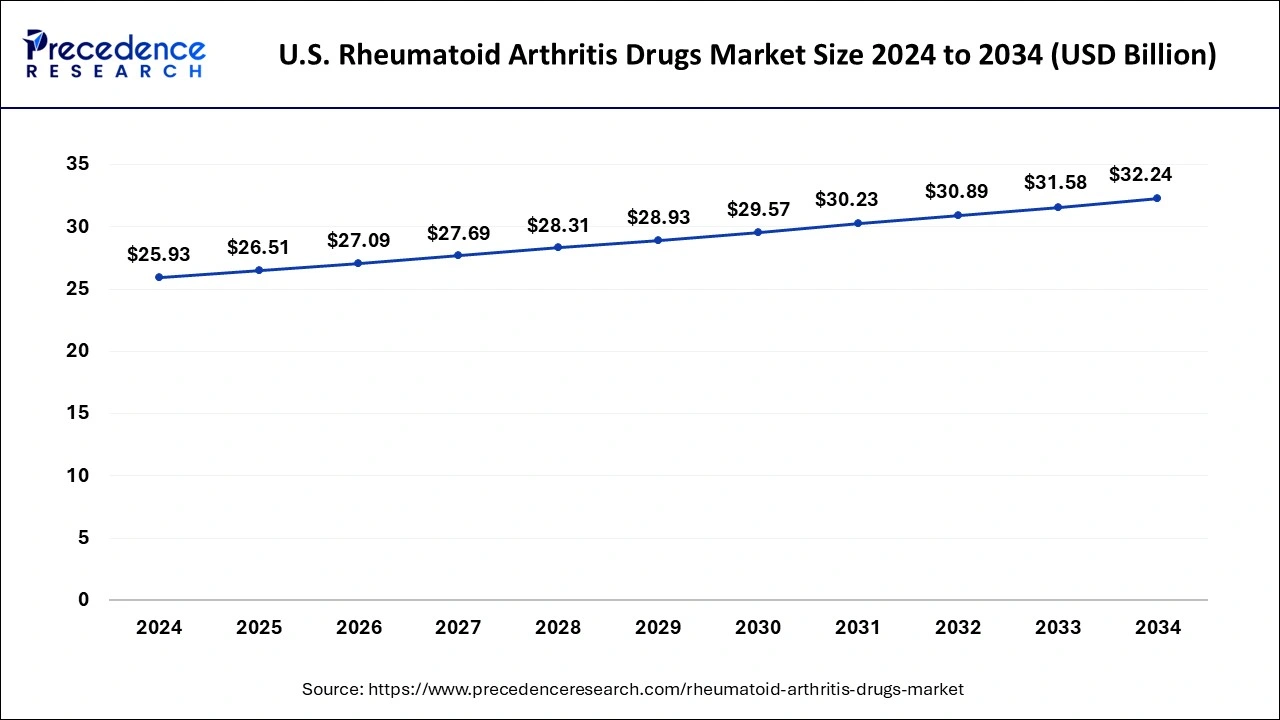

U.S. Rheumatoid Arthritis Drugs Market Size and Growth 2025 to 2034

The U.S. rheumatoid arthritis drugs market size was evaluated at USD 25.93 billion in 2024 and is projected to be worth around USD 32.24 billion by 2034, growing at a CAGR of 2.20% from 2025 to 2034.

North America region has garnered 58.25% revenue share in 2024. As per the Centers for Disease Control and Prevention, nearly one in every four individuals in the U.S. or 58.5 million people, has arthritis. Furthermore, the government of Canada estimates that 374,000 of Canadians aged 16 and up have rheumatoid arthritis. Due to this disease's widespread prevalence, more medicines will be used, resulting in rheumatoid arthritis drugs market expansion in the North America region. In addition, easy approvals by government agencies on pharmaceuticals and drugs are also driving the growth of North America rheumatoid arthritis drugs market.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The Asia-Pacific rheumatoid arthritis drugs market's expansion is being fueled by increased awareness of disease remission therapy, high public and private healthcare expenditure, and rising rheumatoid arthritis incidences. Furthermore, revenue growth in Asia-Pacific region is expected to be aided by simple access to high quality healthcare, a robust clinical product portfolio, advantageous reimbursement rules, and the approval of innovative pharmaceuticals. The acceptance of urban lifestyle is resulting in an increase in the number of patients in the region. This, together with rising healthcare spending, is likely to drive Asia-Pacific rheumatoid arthritis drugs market forward. The favorable regulatory rules for biosimilars are expected to improve demand for medicines are driving the overall growth of the market.

Rheumatoid Arthritis Drugs Market Growth Factors

One of the significant factors driving the growth of global rheumatoid arthritis drugs market is rising prevalence of rheumatoid arthritis. The worldwide prevalence of rheumatoid arthritis, based on a systematic review was predicted to be 0.46%, as per the study published in November 2020. As a result, more rheumatoid arthritis drugs will be adopted, propelling the rheumatoid arthritis drugs market forward.

The global rheumatoid arthritis drugs market is expected to benefit significantly from increased launches of innovative biologics and expanding generic medication penetration. In Japan, for example, Eli Lilly and Company's release of Olumiant in 2017 is expected to stimulate revenue growth. Likewise, AbbVie's Upadacitinib, a JAK1-selective inhibitor, is expected to be approved in 2019. Due to the favorable reimbursement landscape, recently authorized biologics like Kevzara and Xeljanz are expected to have a high market penetration.

Another factor driving the growth of global rheumatoid arthritis drugs market is growing patient awareness regarding rheumatoid arthritis disorders. In the U.S., 52.2 million persons affected with rheumatoid arthritis in 2013. Due to inadequate therapeutic benefits, the majority of patients diagnosed with Disease Modifying Antirheumatic Drugs remain dissatisfied. A combination of Disease Modifying Antirheumatic Drugs and biologics is more likely to provide therapeutic advantages for this patient population. Thus, there is a movement in the rheumatoid arthritis drugs market toward combination medicines that deliver better benefits for patients.

The growth of global rheumatoid arthritis drugs market is also being driven by growing constant efforts for development of rheumatoid arthritis drugs and medications by government agencies. The government is also taking assistance of major market players for development and growth of global rheumatoid arthritis drugs market. In addition, government agencies are also investing in innovative and latest technologies for the development of rheumatoid arthritis drugs in the global market. As a result, all of these aforementioned factors are boosting the growth of global rheumatoid arthritis drugs market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD64.35 Billion |

| Market Size by 2034 | USD75.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 1.80% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule, Sales Channel, and Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Molecule Type Insights

The biologics segment accounted revenue share of around 61% in 2023. The biopharmaceutical production capacity is expected to increase as manufacturing capabilities are improved. In the synthesis and processing of biopharmaceuticals, single use methods are also being used. In addition, researchers are looking towards more productive species and expression methods. Revenue generation is expected to be fueled by the development of reagents and cell lines that improve biological products output.

The biosimilars segment is fastest growing segment over the forecast period. The segment's expansion is aided by increased availability, low price, and favorable results. Their demand is considerable in emerging nations; however, because to the introduction of newer, more effective products, they are progressively gaining momentum in industrialized nations. Glenmark Pharmaceuticals released a biosimilar for Humira in India in January 2018. In upcoming years, new biosimilars are expected to cause a dramatic shift in prescription patterns.

Sales Channel Insights

The over-the-counter drugs (OTC) segment dominated the rheumatoid arthritis drugs market in 2023. The prescription drugs include a wide range of vaccinations and therapies for the treatment and diagnostics of rheumatoid arthritis. Many market companies are conducting clinical studies for the development of novel treatments for a variety of conditions, but the prescription drug landscape has changed dramatically as a result of the rising availability of generic medicines.

The prescription drugs segment is expected to witness strong growth from 2024 to 2033. The over-the-counter drugs are pharmaceuticals that are regarded safe to purchase without a prescription from a medical expert. These drugs are sold lawfully without a prescription in medical stores and hospital pharmacies.

Drug Type Insights

The disease-modifying anti-rheumatic drugs (DMARDs) segment dominated the market with 64.10% in 2024. The dominance of the segment can be attributed to the increasing prevalence of rheumatic diseases across the globe. Disease-modifying antirheumatic drugs are a class of drugs used to treat inflammatory arthritides such as psoriatic arthritis and rheumatoid arthritis.

The DMARDs (esp. Biologics & Targeted Synthetics) segment is expected to grow at the highest CAGR of 7.80% in 2024. The biopharmaceutical production capacity is expected to increase as manufacturing capabilities are improved. In the synthesis and processing of biopharmaceuticals, single-use methods are also being used. In addition, researchers are looking towards more productive species and expression methods. Revenue generation is expected to be fueled by the development of reagents and cell lines that improve the output of biological products.

Route of Administration Insights

The oral segment held a 57.30% market share in 2024. The dominance of the segment can be linked to the rising incidence of RA and the surge in geriatric populations. Also, Oral medications provide a sophisticated and pain-free way for patients to control their RA, which makes them a favoured choice for many, impacting segment growth soon.

The parentral segment is expected to grow at the highest CAGR of 6.90% in 2024. The growth of the segment can be driven by growing demand for effective treatments along with innovations in biosimilars and biologics. Moreover, parenteral administration, especially intravenous and subcutaneous routes, provides benefits such as precise dosage control and rapid onset of action.

Distribution Channel Insights

The hospital pharmacies segment led the market by holding 41.60% in 2024. The dominance of the segment can be credited to the growing use of disease-modifying antirheumatic drugs (DMARDs) and biologics and the rising incidence of RA. Furthermore, the geriatric population is more prone to RA, and raised awareness regarding early diagnosis and treatment is also impacting segment growth.

The online pharmacies segment is expected to grow at the highest CAGR of 8.30% in 2024. The growth of the segment is owing to the surge in online pharmacies offering these drugs along with the favorable reimbursement policies for biologics. The trend towards customised medicine, with catered treatment approaches for individual patients, is contributing to segment expansion further.

Patient Type Insights

The adult segment held a 94.20% market share in 2024. The dominance of the segment can be attributed to the innovations in drug development, the surge in prevalence of rheumatoid arthritis, and growing awareness about the disease. Also, innovations in diagnostic tools are allowing for more precise diagnosis of RA, which leads to better patient outcomes.

The pediatric segment is expected to grow at the highest CAGR of 6.10% in 2024. The growth of the segment can be credited to the growing incidence of juvenile idiopathic arthritis (JIA) and the development of targeted therapies. Furthermore, favorable regulatory policies such as Pediatric Investigational New Drug (PIP) are encouraging pharmaceutical companies to create test drugs for pediatric RA.

Mode of Purchase Insights

The prescription-based segment dominated the market with 88.50% in 2024. The prescription drugs include a wide range of vaccinations and therapies for the treatment and diagnosis of rheumatoid arthritis. Many market companies are conducting clinical studies for the development of novel treatments for a variety of conditions, but the prescription drug landscape has changed dramatically as a result of the rising availability of generic medicines.

The over-the-counter segment is expected to grow at the highest CAGR of 5.70% share in 2024. The over-the-counter drugs are pharmaceuticals that are regarded as safe to purchase without a prescription from a medical expert. These drugs are sold lawfully without a prescription in medical stores and hospital pharmacies.

Recent Developments

The global rheumatoid arthritis drugs industry is dominated by biopharmaceutical manufacturers. Due to the price sensitive population in emerging nations, only a few market players provide both generic and branded pharmaceuticals. To strengthen their market position, companies are working on developing unique chemical units and innovative compounds. The global rheumatoid arthritis drugs market is expected to become more competitive as new biologics are developed and a robust clinical pipeline is built. Because of the low entry barriers in the rheumatoid arthritis drugs industry, new market players are expected in the generic pharmaceuticals segment.

- Piroxicam Capsules for the treatment of rheumatoid arthritis and osteoarthritis gained Food and Drug Administration approval from Unichem Laboratories in April 2017.

- In April 2019, Cipla Ltd., bought a 30% share in Brandmed, a South African company, to expand its operations. The acquisition will strengthen Cipla Medpro's portfolio by combining the company's skills with Brandmed's innovative, patient centered health care strategy.

Rheumatoid Arthritis Drugs Market Companies

- AbbVie

- Boehringer Ingelheim GmbH

- Novartis AG

- Regeneron Pharmaceuticals, Inc.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- UCB S.A.

- Johnson & Johnson Services, Inc.

- Amgen, Inc.

Segments Covered in the Report

By Drug Type

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Ibuprofen

- Naproxen

- Diclofenac

- Indomethacin

- Corticosteroids

- Prednisone

- Methylprednisolone

- Dexamethasone

- Disease-Modifying Anti-Rheumatic Drugs (DMARDs)

- Conventional Synthetic DMARDs (csDMARDs)

- Methotrexate

- Sulfasalazine

- Leflunomide

- Hydroxychloroquine

- Biologic DMARDs (bDMARDs)

- TNF Inhibitors

- Etanercept

- Infliximab

- Adalimumab

- Certolizumab pegol

- Golimumab

- Non-TNF Biologics

- Abatacept

- Rituximab

- Tocilizumab

- Sarilumab

- TNF Inhibitors

- Targeted Synthetic DMARDs (tsDMARDs)

- Janus Kinase (JAK) Inhibitors

- Tofacitinib

- Baricitinib

- Upadacitinib

- Filgotinib (in some regions)

- Janus Kinase (JAK) Inhibitors

- Conventional Synthetic DMARDs (csDMARDs)

By Route of Administration

- Oral

- Parenteral

- Intravenous (IV)

- Subcutaneous (SC)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Patient Type

- Adult

- Paediatric

By Mode of Purchase

- Prescription-based

- Over the counter

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting