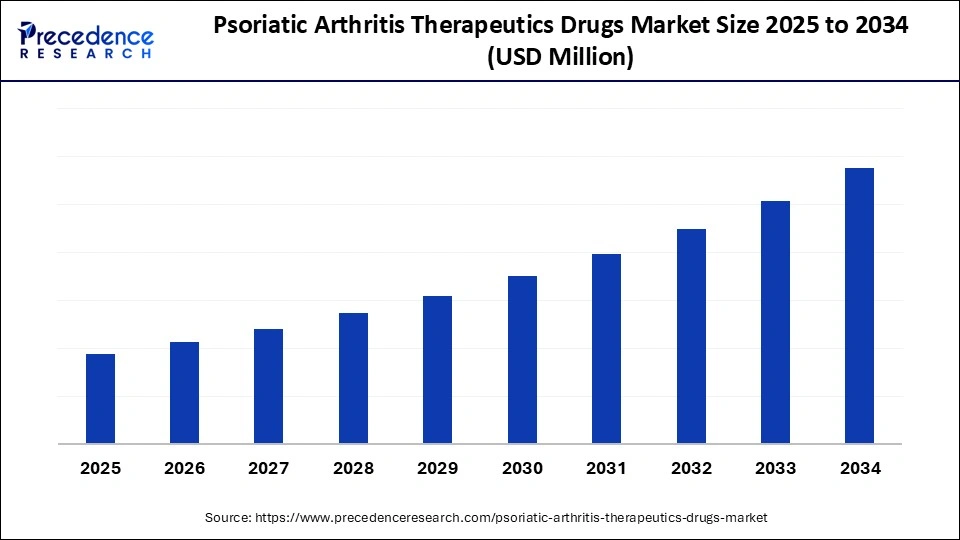

Psoriatic Arthritis Therapeutics Drugs Market Size and Forecast 2025 to 2034

The psoriatic arthritis therapeutics drugs market is evolving rapidly with innovation in biosimilars, small molecules, and personalized medicine improving treatment outcomes. The market growth is attributed to rising psoriatic arthritis prevalence, expanding access to biologics and targeted oral therapies, and supportive regulatory approvals enhancing treatment adoption.

Psoriatic Arthritis Therapeutics Drugs Market Key Takeaways

- North America dominated the global psoriatic arthritis therapeutics drugs market with the largest share of 45% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By drug class, the biologics segment held the major market share of 60% in 2024.

- By drug class, the targeted synthetic DMARDs segment is projected to grow at a CAGR between 2025 and 2034.

- By route of administration, the injectable segment contributed the biggest market share of 55% in 2024.

- By route of administration, the oral segment is expanding at a significant CAGR between 2025 and 2034.

- By patient type, the adult segment held the largest market share of 90% in 2024.

- By patient type, the paediatric segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, hospital pharmacies generated the major market share of 65% in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Psoriatic Arthritis Therapeutics Drugs Market

Artificial intelligence (AI) is facilitating the value chain of the psoriatic arthritis therapeutics drugs market by automating all steps, including research and commercialization. Scientists use digital platforms driven by AI to comb through genetic clinical information that results in precision medicine to treat psoriatic arthritis. Moreover, by using AI models, clinical trial teams find the appropriate patient groups and predict patient responses to treatment, thus reducing trial failures.

Market Overview

Rising cases of psoriatic arthritis drive the use of superior therapies. In 2024, approximately 112 per 100,000 adults in the world are affected by it, which speaks in favor of expanding the already large number of patients and negotiating an innovation. People with psoriasis are prone to developing psoriatic arthritis, a factor that highlights high intersections among dermatology and rheumatology stages of care. Biologics and other targeted therapies such as IL-17, IL-23, and JAK/TYK2 appear to provide targeted immune modulation, enhancing both joints and skin outcomes in a pathway-specific manner.

Other market players are also developing oral TYK2 inhibitors, such as Zasocitinib (TAK-279) in Phase 2b tests, or providing patients with non-injectable and convenient solutions Wikipedia. Such integrated care models combine diagnostic systems and therapeutic capabilities, aiming at early intervention with targeted agents in order to prevent long-term disability and increase the quality of life. Furthermore, the increasingly prevalent treatment increases both treatment innovation and accessibility, leading to an increasingly able market to respond to patient needs.

Psoriatic Arthritis Therapeutics Drugs Market Growth Factors

- Driving Innovation in Personalized Medicine:Precision-based therapies targeting individual genetic and immunological profiles are fueling treatment adoption.

- Boosting Clinical Trial Advancements: Expanding late-stage pipelines and positive trial outcomes are propelling next-generation drug launches.

- Rising Adoption of Digital Health Solutions: Integration of telemedicine and remote monitoring in rheumatology practice is enhancing patient access and continuity of care.

- Fuelling Demand for Early Diagnosis Programs: National screening and awareness campaigns are driving timely disease detection and treatment initiation.

- Growing Pipeline of Targeted Oral Therapies: Advancements in JAK inhibitors and TYK2 inhibitors are strengthening therapeutic options beyond biologics.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Route of Administration, Patient Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Rising Prevalence of Psoriatic Arthritis Shaping Demand for Next-Generation Therapies?

The increasing prevalence of psoriatic arthritis is expected to drive the market in the coming years. The global prevalence of the increasing cases of the condition is due to genetic predisposition, autoimmune diseases, and lifestyle-related, inflammatory conditions, attracting a high patient population. According to the National Psoriasis Foundation's 2022 report, psoriasis affects approximately 125 million individuals globally, representing about 2–3% of the world's population. Increased patient population and the need to satisfy the latter compel drug developers to enhance their innovation pace and increase access to biologic agents and small-molecule inhibitors. The rise of awareness among patients and physicians promotes earlier screening and diagnosis of psoriasis patients are ultimately diagnosed with psoriatic arthritis, which promotes clinical urgency.

According to the EULAR, the untreated Psoriatic arthritis aggravates the structural damage of joints and causes complete disability in patients, thus giving a stronger assertion about the need for therapy at an early stage. Pharmaceutical innovators, such as AbbVie, Novartis, and Eli Lilly, expanded their PsA trial program in 2024, focusing on earlier intervention studies targeting the next-generation therapies against the established references. Furthermore, the growing adoption of biologics and targeted therapies is anticipated to strengthen market growth.

Restraint

Safety Concerns Over Long-Term Adverse Effects

High-cost biologic treatments and targeted therapies impose significant financial challenges in both developed and emerging healthcare systems, thus hindering the market. These economic barriers slow down the rate of adoption and limit the reach of the therapy to the wider population of patients. Furthermore, the safety concerns about long-term adverse effects are anticipated to influence prescriber behavior, further hampering the market in the coming years.

Opportunity

Will Surging Investments in Research and Development Accelerate Innovation in Psoriatic Arthritis Care?

Surging investments in research and development are projected to fuel therapeutic innovation. Major players in the pharmaceutical industry also spend huge budgets on new molecular discovery, advanced biologic product platform exploration, and combination regimen tests that enhance the efficacy of treatment. Pipeline activity includes new IL-23 inhibitors, TYK2 inhibitors, and others with simultaneous inhibition of multiple inflammatory pathways. The long-term investments provide diversity in the treatment and contribute to the long-term growth of the market.

The clinical partnerships between pharmaceutical companies and universities hasten the process of converting research innovations into medicine that can be commercialized. Innovation can also be promoted through government and privately funded programs, lessening the monetary risk to the innovators. The National Psoriasis Foundation has set aside 40% of its research awards in 2024 to fund research in psoriatic arthritis with the aim of promoting novelty across translational programs and early-career grants. U.S.NIAMS was under an enacted FY 2024 funding level of about USD 685 million, providing psoriasis and arthritis related research infrastructure and grants. Furthermore, the growing adoption of biologics and targeted therapies is anticipated to strengthen market growth.

Drug Class Insights

The biologics segment dominated the psoriatic arthritis therapeutics drugs market in 2024, accounting for an estimated 60% market share, due to the unwavering efficacy in managing both musculoskeletal and cutaneous spectrum. The Agents targeting TNF-alpha, IL-17, and IL-23 pathways showed further advantage in dactylitis, enthesitis, and axial involvement, reinforcing their status as an efficacy gold standard in moderate-to-severe disease.

FDA approval of ustekinumab in pediatric PsA in December 2024 and interchangeability decisions in 2025 are further estimated to help drive uptake into additional patient groups. The updated treatment recommendations of the ACR and EULAR in 2024 put biologics at the forefront of treatment in the context of severe joint and skin manifestations, a move likely to reinforce first-line biologic use in bio-naive and refractory patients. Additionally, these factors were likely to sustain biologics as the anchor in the management of psoriatic arthritis over the medium term.

The targeted synthetic DMARDs segment is expected to grow at the fastest rate in the coming years, as they are administered orally and do not require the extensive infusion infrastructure comparable to conventional DMARDs. Furthermore, the use of oral DMARDs in 2024 has been recognized by health technology assessments in agencies, including NICE and EMA, which further facilitates the segment growth.

Route of Administration Insights

The injectable segment held the largest revenue share in the psoriatic arthritis therapeutics drugs market in 2024, accounting for 55% of the market share, due to the growing preference for injectable products. The disease control in the recommended subcutaneous and intravenous biologics was comparable for joint, skin, enthesitis, and axial manifestations. This was reflected in the continued preference of prescribers to moderate-severe-affected patients. Moreover, the widespread acceptance of such drug injections in guidelines and formulary coverage is expected to fuel the segment in the coming years.

The oral segment is expected to grow at the fastest CAGR in the coming years, owing to the patient convenience and simplified delivery logistic issues of oral agents. The inadequate access to primary care and smaller infusion capacity in most areas is likely to provide an advantage to oral adoption. This allows earlier use in the community setup and alleviates clinic overload. Furthermore, the life in oral regimens is likely to support payment determinations and speed up adoption in various geographies, thus propelling the segment.

Patient Type Insights

The adult segment dominated the psoriatic arthritis therapeutics drugs market in 2024, which held a market share of about 90%, as adults comprise the largest number of reported and managed cases both in rheumatology and dermatology practice.

According to the NIH 2024 report, registry-level analyses and national surveys revealed the proportion of psoriatic arthritis (PsA) diagnoses in adults between 30-60 years of age. Additionally, the growing adult-oriented education and multidisciplinary clinics aim to enhance psoriatic arthritis information, further boosting the demand for therapeutic solutions in this age group.

The pediatric segment is expected to grow at the fastest rate in the coming years, owing to the increased regulatory approvals and wider pediatric evidence as sponsors are completing the pediatric development programs and the label is extended.

Regulatory activity since 2024-2025 has seen several biologics approved to treat pediatric psoriatic arthritis, including the FDA expansion of ustekinumab to 6-17 years of age in 2024. This is expected to enhance confidence even among clinicians and formalize dosing regimens in children. Furthermore, the increasing preferences for early diagnosis and treatment of those with psoriatic diseases are expected to facilitate the market growth.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share in the psoriatic arthritis therapeutics drugs market in 2024, accounting for an estimated 65% market share, as hospitals harbor specialty clinics, infusion facilities, and other multidisciplinary teams to handle initiation and monitoring of advanced therapies. Complex distribution also supports specialty dispensing protocols, on-site infusion services, and other situations. Additionally, the infusion capacity has increased in hospitals across Europe to cater rising demand for advanced injectable treatments, fuelling the segment growth.

The online pharmacies segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing acceptance of online pharmacies within the home, automatic order refills, and telehealth patients. Digital dispensing platforms have been designed to be integrated with specialty pharma services and electronic health records, and patient support programs. This is expected to eliminate the clinic visit burden and improve medication adherence among stable patients.

According to the 2024 NIH report, many consumers now prefer to purchase drugs online, including 61.4% in the United States, 57.4% in the UK, 51.6% in Spain, 49.2% in France and Poland, and 47.8% in Australia and Germany. Portfolio coupling of specialty pharmacies, telemedicine providers, and manufacturers has resulted in bundled services that are projected to improve online drug purchasing. Furthermore, the Regulators and payers developed policies around remote dispensing, cold-chain logistics, and adherence verification, further facilitating the segment growth in the coming years.

Regional Insights

North America led the psoriatic arthritis therapeutics drugs market, capturing the largest revenue share in 2024, due to high diagnosed prevalence, established specialty care networks, and payer coverage extending early access to advanced therapies. According to the National Psoriasis Foundation's 2022 report, current studies estimate that more than 8 million Americans are living with psoriasis.

Academic medical centers and large integrated health systems have well-developed psoriatic arthritis therapeutics services, which are expected to facilitate high rates of utilization of these types of services. Furthermore, patient advocacy organizations, such as GHLF and Arthritis Foundation, are also conducting awareness campaigns to increase early diagnosis and patient access to state-of-the-art therapies, which further strengthen the market in this region.

(Source:https://www.psoriasis.org)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increasing investment levels in healthcare and improving access to biologics. Biologics or biosimilars have been approved in regulatory agencies across the region through 2024, with the possibility of easing cost barriers to introducing more psoriatic arthritis therapeutic drugs in the coming years. Additionally, the Increased involvement of regional pharmaceutical players like Sun Pharma, Dr. Reddy Laboratories, and Takeda Pharmaceutical to introduce cost-efficient arthritis drugs is also poised to boost the growth of the market in the Asia-Pacific region.

Psoriatic Arthritis Therapeutics Drugs Market Companies

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- Bayer AG

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Celgene Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Galapagos NV

- Horizon Therapeutics

- Johnson & Johnson (Janssen)

- Novartis AG

- Pfizer Inc.

- Pfizer/BioNTech

- Regeneron Pharmaceuticals

- Samsung Bioepis

- Sanofi

- Takeda Pharmaceutical Company

- UCB Pharma

Recent Developments

- In July 2025, Johnson & Johnson announced the submission of a supplemental Biologics License Application (sBLA) to the U.S. Food and Drug Administration (FDA) seeking approval to update the label of TREMFYA (guselkumab) for inhibition of structural damage progression in adults with active psoriatic arthritis (PsA). The submission is based on positive Phase 3b APEX study results, where TREMFYA achieved its primary endpoint of reducing joint symptoms (ACR20) and its key secondary endpoint of slowing radiographic progression, measured by change in the modified van der Heijde-Sharp (vdH-S) score at 24 weeks versus placebo in bio-naïve patients. These findings were presented at the European Alliance of Associations for Rheumatology (EULAR) 2025 Congress.(Source: https://www.jnj.com)

- In July 2025, the U.S. Food and Drug Administration (FDA) accepted for review a supplemental New Drug Application (sNDA) for deucravacitinib in treating adults with active PsA. Deucravacitinib, a selective tyrosine kinase 2 (TYK2) inhibitor, is already marketed as Sotyktu for adults with moderate-to-severe plaque psoriasis who are candidates for systemic therapy or phototherapy. (Source: https://www.empr.com/)

- In July 2025, Sun Pharma reported positive topline results from the INSPIRE-1 (NCT04314544) and INSPIRE-2 (NCT04314531) Phase III trials evaluating Ilumya (tildrakizumab) in adults with active PsA over 24 weeks. Ilumya previously gained FDA approval in March 2018 for moderate-to-severe plaque psoriasis based on the reSURFACE one and reSURFACE two clinical programs. Data from the new INSPIRE trials demonstrated significant improvements in PsA patients at a 100 mg dose compared to placebo. (Source:https://www.appliedclinicaltrialsonline.com)

- In September 2024, the FDA approved BIMZELX (bimekizumab-bkzx) for treating adults with active PsA, ankylosing spondylitis (AS), and non-radiographic axial spondyloarthritis (nr-axSpA) with objective signs of inflammation. This approval follows BIMZELX's earlier indication for moderate-to-severe plaque psoriasis. The decision was supported by Phase 3 BE OPTIMAL and BE COMPLETE trials, where the therapy achieved the primary endpoint of ACR50 at Week 16 versus placebo, with sustained efficacy through Week 52 and extension phases. (Source: https://www.psoriasis.org)

- In July 2025, Bristol Myers Squibb announced FDA acceptance of its sNDA for deucravacitinib in adults with active PsA, with a Prescription Drug User Fee Act (PDUFA) target date of March 6, 2026. Deucravacitinib represents a potential first-in-class TYK2 inhibitor for PsA treatment. The therapy has also received regulatory review acceptance in China, Japan, and Europe, further expanding its global development beyond its current approval under the brand name Sotyktu for plaque psoriasis.(Source: https://www.hcplive.com)

Latest Announcements by Industry Leaders

- In July 2025, Announcement - Bristol Myers Squibb announced that the U.S. Food and Drug Administration (FDA) has accepted for review the supplemental New Drug Application (sNDA) for Sotyktu (deucravacitinib) for the treatment of adults with active psoriatic arthritis (PsA). The FDA has assigned a Prescription Drug User Fee Act (PDUFA) target action date of March 6, 2026. This development follows a series of global regulatory milestones. China's Center for Drug Evaluation of the National Medical Products Administration and Japan's Ministry of Health, Labour and Welfare have both accepted sNDA submissions for Sotyktu in PsA, while the European Medicines Agency (EMA) has validated a Type II variation application to expand the therapy's approved indications to include this disease. Commenting on the announcement, Roland Chen, MD, Senior Vice President, Drug Development, Immunology and Cardiovascular, Bristol Myers Squibb, said: “There is a significant need for additional oral treatment options for individuals living with psoriatic arthritis, and today's milestone brings us one step closer to meeting that need. We are eager to continue discussions with the FDA and other global regulatory authorities to advance Sotyktu as a differentiated, first-line systemic treatment for psoriatic arthritis, while also pioneering its development across other severe rheumatic conditions.”

(Source: https://news.bms.com)

Segments Covered in the Report

By Drug Class

- Conventional DMARDs (cDMARDs)

- Methotrexate

- Leflunomide

- Sulfasalazine

- Hydroxychloroquine

- Biologics

- TNF Inhibitors

- Adalimumab

- Etanercept

- Infliximab

- Certolizumab

- IL-17 Inhibitors

- Secukinumab

- Ixekizumab

- IL-12/23 Inhibitors

- Ustekinumab

- Other Biologics

- Golimumab

- Abatacept

- TNF Inhibitors

- Targeted Synthetic DMARDs (tsDMARDs)

- Apremilast

- Tofacitinib

- Upadacitinib

- Others

- NSAIDs

- Corticosteroids

By Route of Administration

- Oral

- Conventional DMARDs

- tsDMARDs

- Injectable

- Biologics

- Corticosteroids

By Patient Type

- Adult

- Pediatric

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting