What is the SaaS-based Core Banking Software Market Size?

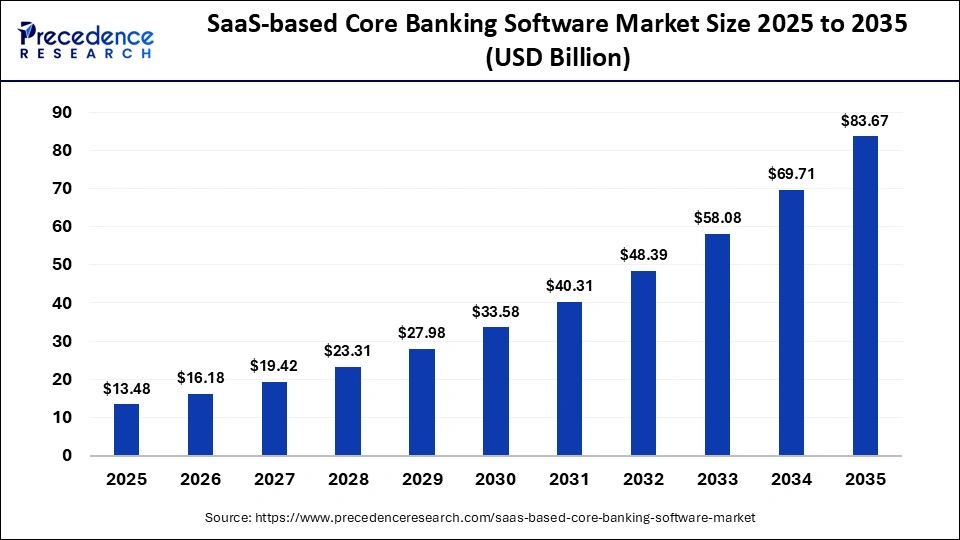

The global SaaS-based core banking software market size accounted for USD 13.48 billion in 2025 and is predicted to increase from USD 16.18 billion in 2026 to approximately USD 83.67 billion by 2035, expanding at a CAGR of 20.03% from 2026 to 2035. The market is witnessing substantial growth driven by the increasing demand for financial institutions to modernize their legacy systems and meet the rising demand for scalable, flexible, and cost-effective solutions. This growth is further attributed to the shift from substantial upfront capital expenditures to predictable subscription-based operational expenses, which eliminates the need for heavy investments in hardware and ongoing maintenance costs.

Market Highlights

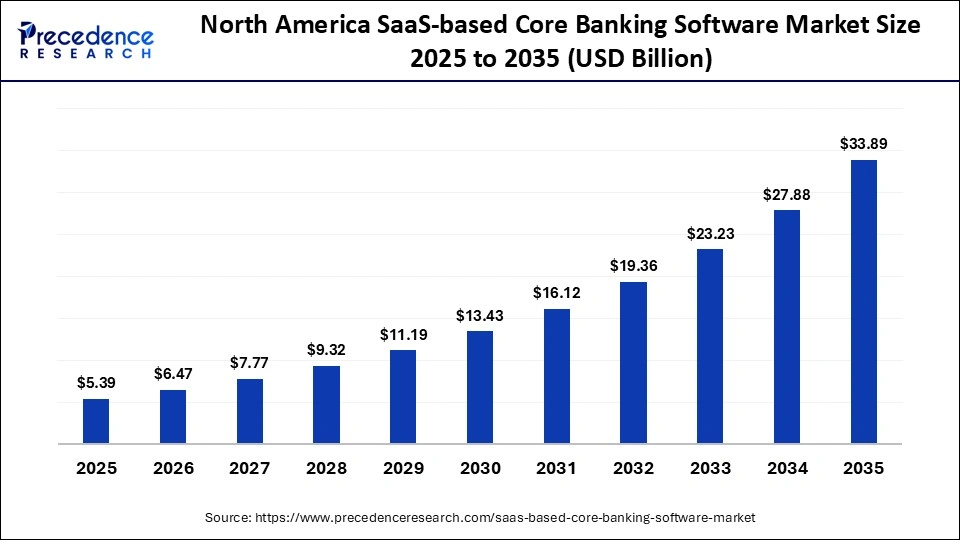

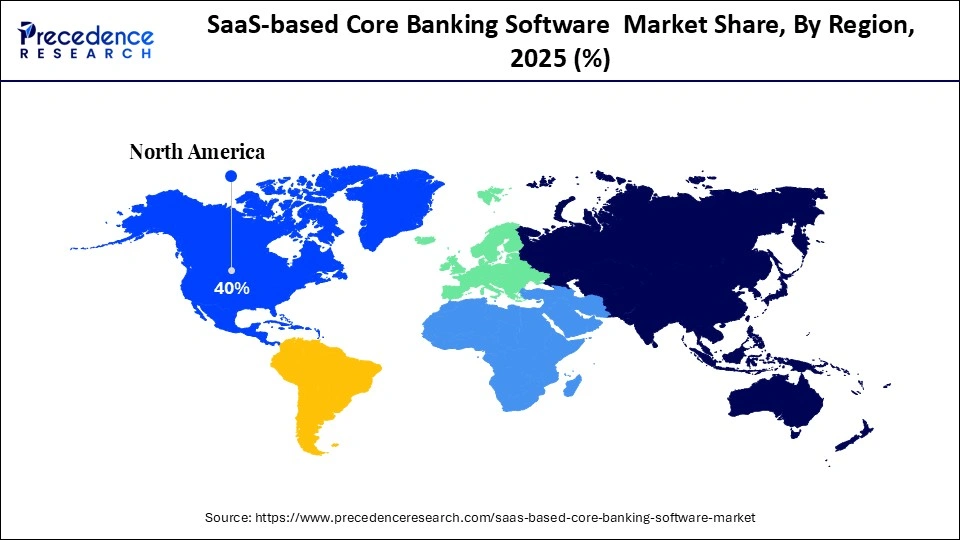

- North America accounted for the largest market share of 40% in 2025.

- The Asia Pacific is expected to grow the fastest CAGR of 26% between 2026 and 2035.

- By deployment model, the public cloud SaaS segment held the major market share of 48% in 2025.

- By deployment model, the hybrid cloud SaaS segment is poised to grow at a healthy CAGR of 24% from 2026 to 2035.

- By solution type, the core deposits management segment contributed the biggest market share of 35% in 2025.

- By solution type, the API & open banking integration segment is expanding at a double-digit 28% CAGR from 2026 to 2035

- By organization size, the large banks segment generated the biggest market share of 42% in 2025.

- By organization size, the neobanks and challenger banks segment is growing at a notable 29% from 2026 to 2035.

- By end-user, the retail banking institutions segment held the largest market share of 45% in 2025.

- By end-user, the digital-only banks segment is expected to grow at the fastest CAGR of 30% between 2026 and 2035.

- By service model, the subscription/SaaS model segment led market with more than 55% of the market share in 2025.

- By service model, the consumption/usage-based pricing segment is growing at a strong CAGR of 27% from 2026 to 2035.

What is the SaaS-based core banking software market?

The global SaaS-based core banking software market comprises cloud-hosted, subscription-delivered core banking platforms designed to support retail, corporate, and SME banking operations through centralized and continuously updated systems. These platforms manage core functions including deposit and lending products, customer account management, transaction processing, payments, general ledger operations, regulatory reporting, and embedded analytics, delivered through either multi-tenant or single-tenant SaaS architectures depending on institutional risk and compliance requirements.

The shift toward SaaS-based core banking solutions is driven by banks' need for greater operational agility and cost optimization. Subscription-based delivery models significantly reduce upfront capital expenditure associated with legacy on-premise infrastructure, while enabling faster implementation cycles, elastic scalability, and continuous feature upgrades. Real-time processing capabilities and API-driven architectures further allow banks to modernize product offerings, shorten time-to-market, and respond more effectively to changing customer and regulatory demands.

Regulatory compliance and resilience requirements also support SaaS adoption. Modern cloud-native core banking platforms are increasingly built with embedded compliance controls, auditability, data security frameworks, and localization capabilities to support evolving regulatory standards across jurisdictions. These features help financial institutions maintain compliance while reducing the operational burden of system maintenance and regulatory change management.

How Can AI Impact the SaaS-Based Core Banking Software Market?

Artificial intelligence (AI) is reshaping the global SaaS-based core banking software market by automating operational processes, personalizing customer interactions, and strengthening security controls, resulting in higher efficiency and measurable cost savings for financial institutions. AI models continuously analyze transaction flows and customer behavior in real time, enabling early detection of anomalies that may indicate fraud, cyber threats, or money laundering activity. This capability supports proactive risk mitigation while improving compliance monitoring across high-volume banking operations.

AI is also widely applied to process automation within core banking environments. Through robotic process automation and intelligent workflow engines, tasks such as data entry, document verification, loan origination, reconciliation, and account servicing are increasingly automated. This reduces manual intervention, minimizes processing errors, and shortens turnaround times, which is particularly valuable for SaaS-based platforms operating at scale across multiple institutions.

In credit and risk functions, AI enhances decision-making by improving credit scoring accuracy, predicting customer churn, and supporting dynamic risk assessment. By integrating structured and unstructured data sources, including transaction history and behavioral signals, AI-driven models help banks manage credit exposure more effectively while adapting to evolving regulatory requirements.

SaaS-based Core Banking Software Market Outlook

- Industry Growth Overview: The SaaS-based core banking software market is set for robust growth from 2025 to 2035. This expansion is primarily driven by the imperative for digital transformation, the demand for cost-efficiency, and increasing consumer demand for seamless digital and real-time banking services.

- Rapid Shift to Cloud-Native, API-Rich, Modular Systems: This trend is driven by demand for cost efficiency, scalability, and hyper-personalized customer experiences, while integrating AI/ML for automation & analytics, RegTech for compliance, and open banking for innovation, moving banks from IT-centric to business-focused agility.

- Global Expansion: The worldwide market is expanding rapidly, with North America currently dominating the market due to its advanced financial infrastructure, and the Asia-Pacific region, however, is projected to be the fastest-growing market. Emerging regions like Europe, Latin America, and the Middle East & Africa also offer significant opportunities for affordable banking solutions.

- Major Investors: Many companies like Temenos, FIS, Fiserv, Mambu, and nCino, along with prominent financial technology providers, are primary investors. These companies actively engage in strategic partnerships and mergers to enhance their product offerings and expand market reach.

- Startup Ecosystem: Various startup ecosystems are focusing on disruptive, cloud-native innovations, particularly modular and composable banking platforms. Companies such as Mambu, Thought Machine, Tuum, and nCino have attracted significant funding to develop agile solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.48 Billion |

| Market Size in 2026 | USD 16.18 Billion |

| Market Size by 2035 | USD 83.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 20.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Model, Solution Type, Organization Size, End-User, Service Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Model Insights

What Made the Public Cloud SaaS Segment Dominate the SaaS-Based Core Banking Software Market in 2025?

Public Cloud SaaS: The segment held about 48% of the market in 2025, mainly because it provides banks with scalability, cost-efficiency, faster deployment, and improved disaster recovery. The subscription model shifts large capital expenses to operational costs, lowering barriers for smaller banks and reducing overhead for larger banks. Quick setup and access to advanced technologies enable banks to innovate faster and compete with bigger institutions.

Hybrid Cloud SaaS: This segment is expected to grow fastest, with a CAGR of around 24%, as it balances banks' needs effectively. Sensitive data remains secure on private infrastructure, while non-critical functions can be moved to public clouds, fostering innovation in a controlled manner. This approach offers the flexibility of public clouds and the security of private clouds, helping banks meet compliance requirements like data sovereignty and adopt new tech such as AI/ML rapidly.

Solution Type Insights

How Will the Core Deposits Management Segment Lead the SaaS-Based Core Banking Software Market in 2025?

Core Deposits Management: The segment led the market with about 35% share, owing to the stability and low cost of core deposits as funding sources. Efficient SaaS management of these deposits enhances a bank's net interest margin and overall profitability by automating essential processes, reducing manual work, errors, and operational costs. This automation increases customer engagement and retention through streamlined operations.

API & Open Banking Integration: The API & open banking integration segment is projected to grow fastest, with a CAGR of approximately 28%, driven by APIs' role as the foundation for flexible, cloud-native systems. They enable the quick development of new digital services and allow banks to integrate technologies like AI, real-time payments, and services efficiently, bypassing slow legacy upgrades. Open APIs also facilitate collaboration with third parties, creating unified customer experiences with services such as budgeting, lending, and embedded finance.

Organization Size Insights

Why Did the Large Banks Segment Lead the SaaS-Based Core Banking Software Market in 2025?

Large Banks: The segment accounted for around 42% of the market in 2025. They handle high transaction volumes, require complex integrations, and use advanced analytics for hyper-personalization. With large budgets for ongoing modernization, they heavily invest in updating legacy systems for omnichannel, personalized, and real-time services. Cloud-native SaaS solutions are ideal for their needs, supporting millions of customers and vast transaction flows with scalable, robust core systems.

Neobanks/Challenger Banks: The segment is expected to see the fastest growth, with a CAGR of about 29%. SaaS solutions remove traditional barriers, providing the agility, scalability, and cost-efficiency essential for digital-first banking. Modular, API-first architectures enable scalable growth as customer bases expand. They focus on delivering superior, mobile-first experiences, with features like instant account setup, real-time alerts, and integrated budgeting tools for hyper-personalized services.

End-User insights

How Will the Retail Banking Institutions Segment Dominate the SaaS-Based Core Banking Software Market in 2025?

Retail Banking Institutions: This segment dominated with approximately 45% market share in 2025, primarily due to their focus on enhancing customer experience, managing high transaction volumes, and operational efficiency. SaaS solutions help retail banks offer seamless, personalized, and digital-first experiences by integrating analytics and CRM tools, boosting customer engagement and retention. Their operation volume necessitates cloud-native SaaS platforms, providing the necessary scalability to handle peak demands.

Digital-Only Banks: The segment is experiencing the fastest growth, with a CAGR of around 30%. They leverage cloud-native, API-driven platforms for agility, cost savings, and hyper-personalization, catering to mobile-first Millennials and Gen Z. These platforms allow rapid deployment of new features and easier scaling. Open APIs facilitate seamless integration and new partnerships, while the absence of physical branches reduces overhead, enabling digital banks to offer better rates and fees to attract customers and grow.

Service Model Insights

What Made the Subscription/SaaS Model Segment Dominate the SaaS-Based Core Banking Software Market in 2025?

Subscription/SaaS Licensing: The subscription/SaaS model dominated the market with around 55% market share in 2025. This is mainly stemming from massive cost savings, enhanced flexibility, faster innovation like AI integration, better security/compliance, and predictable recurring revenue that attracts investment. Cloud-based models easily scale with demand, offering agility to adapt to market changes and new banking products. Enables rapid deployment of new features, AI/ML integration, and digital services, along with offering better security, robust governance, and easier adherence to strict data regulations.

Consumption/Usage-Based Pricing: This segment is experiencing the fastest growth with a CAGR of about 27%. This is mainly because it aligns costs with value, offers flexibility to scale with digital, reduces upfront costs, and improves retention. Banks pay for actual transactions, API calls, or data processed, directly tying software cost to the value received, unlike flat-fee models, where value might not match spend. Reduced upfront investment makes SaaS core banking more accessible for smaller institutions, bypassing complex procurement for smaller budgets.

Regional Insights

How Big is the North America SaaS-Based Core Banking Software Market Size?

The North America SaaS-based core banking software market size is estimated at USD 5.39 billion in 2025 and is projected to reach approximately USD 22.89 billion by 2035, with a 20.18% CAGR from 2026 to 2035.

How Will North America Dominate the SaaS-Based Core Banking Software Market in 2025?

North America is projected to dominate the market with approximately 40% share by 2025, supported by its advanced financial infrastructure, rapid pace of digital transformation, and concentration of leading banking technology providers. Financial institutions in the region have consistently invested in modernizing legacy systems, creating favorable conditions for the adoption of cloud-native and SaaS-based core banking platforms.

The presence of major core banking and financial technology vendors such as FIS, Fiserv, Oracle, and Jack Henry & Associates strengthens the region's leadership position. These companies play a central role in driving product innovation, cloud migration strategies, and ecosystem integration, offering scalable and regulation-ready solutions for banks of all sizes.

The United States and Canada have historically been early adopters of digital banking, open banking frameworks, and cloud technologies. This early adoption has eased the transition toward SaaS-based core banking by familiarizing banks with API-driven architectures, real-time processing, and third-party fintech integration.

What is the Size of the U.S. SaaS-Based Core Banking Software Market?

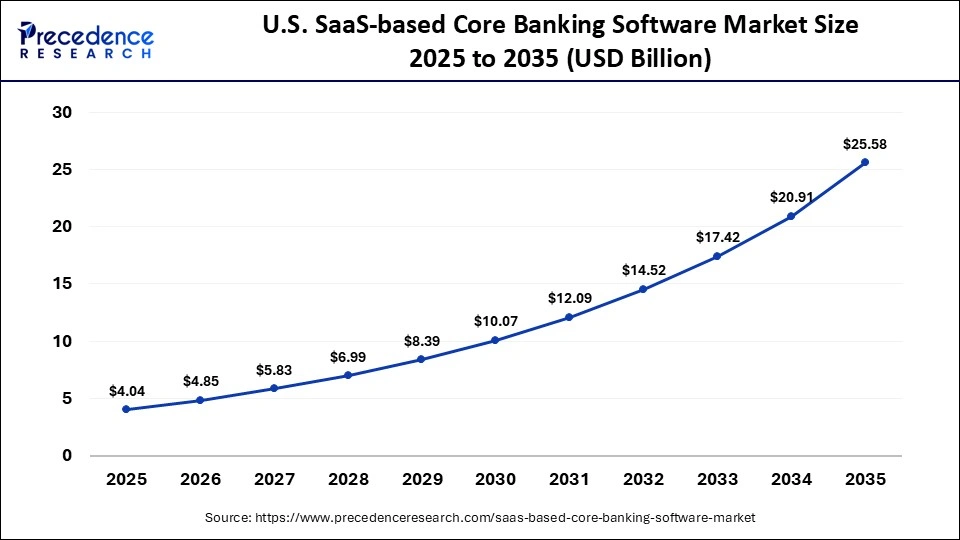

The U.S. SaaS-based core banking software market size is calculated at USD 4.04 billion in 2025 and is expected to reach nearly USD 25.58 billion in 2035, accelerating at a strong CAGR of 20.27% between 2026 and 2035.

The U.S. SaaS-based Core Banking Software Market Trends

The U.S. stands out as the leading and most developed market, primarily due to its high adoption rates of digital and mobile banking, substantial investments in fintech, and the presence of major technology vendors like Oracle, Fiserv, and FIS. U.S. banks are actively upgrading their legacy systems to AI-integrated, cloud-native platforms to enhance efficiency and improve customer experience, further promoting the adoption of advanced core banking software.

Why Did Asia Pacific Consider the Fastest Growing Region in the SaaS-Based Core Banking Software Market in 2025?

The Asia Pacific region is anticipated to exhibit the fastest growth, with a CAGR of around 26%, driven by rapid digital transformation initiatives, expanding smartphone and internet penetration, and supportive government policies focused on financial inclusion. A large unbanked and underbanked population across several markets continues to create strong demand for scalable, cloud-native core banking platforms that can be deployed quickly and cost-effectively.

Governments and regulators in countries such as Singapore and India are actively fostering digital banking innovation. Policy measures, including digital banking licenses, regulatory sandboxes, open banking frameworks, and incentives for cashless transactions, are accelerating the shift away from legacy core systems toward modern SaaS-based architectures.

In Singapore, digital-only bank licensing frameworks and strong regulatory clarity have encouraged banks to adopt cloud-first core platforms capable of rapid product iteration and fintech integration. In India, large-scale financial inclusion programs, real-time payment infrastructure, and pro-digital policy alignment are pushing banks and non-bank financial institutions to modernize core systems to handle high transaction volumes and real-time processing requirements.

India SaaS-based Core Banking Software Market Trends

India is emerging as a significant player in the global market, driven by the swift adoption of digital banking and government initiatives aimed at financial inclusion. The development of core banking software, particularly cost-effective, cloud-based solutions tailored for emerging economies, is also a focus. Indian IT giants such as Infosys and Tata Consultancy Services are major global providers of core banking platforms, contributing significantly to market expansion.

Why Will Europe Emerge in the SaaS-Based Core Banking Software Market in 2025?

Europe is expected to experience notable growth in the near future, driven by increasing regulatory pressure to modernize legacy core banking systems and rising demand for real-time, customer-centric digital banking solutions. Regulatory expectations around operational resilience, data transparency, and system interoperability are encouraging banks to replace or augment aging infrastructure with cloud-native and SaaS-based core platforms.

The region benefits from relatively high cloud adoption rates across financial services and a mature digital infrastructure that supports scalable deployment of modern banking systems. Europe is also home to a strong ecosystem of established core banking vendors and innovation-led fintech hubs, which accelerates technology diffusion and lowers adoption barriers for financial institutions undergoing core transformation.

Countries such as the United Kingdom, Germany, and the Nordic markets are particularly influential. These markets host a high concentration of digital-first challenger banks and fintech startups that operate on modern cloud-native cores. Their ability to launch products quickly, personalize services, and operate at a lower cost is placing competitive pressure on incumbent banks.

Germany SaaS-based Core Banking Software Market Trends

Germany is a key player in the European core banking software market, supported by its strong financial sector and focus on industrial digitalization. German banks prioritize secure, compliant, and scalable cloud-based platforms to meet stringent EU regulations like GDPR. Similar to the U.S., German institutions are actively modernizing their legacy infrastructure to incorporate automation and AI.

What Has Caused the Emergence of Latin America in the SaaS-Based Core Banking Software Market?

Latin America is an important contributor to the global SaaS-based core banking software market, supported by a rapidly expanding fintech ecosystem, an urgent need to replace outdated legacy banking infrastructure, and a large unbanked and underbanked population. A tech-savvy, mobile-first consumer base across the region is accelerating demand for digital banking services that are accessible, scalable, and cost-efficient, which aligns closely with cloud-native core banking adoption.

Regulatory developments are playing a decisive role in market momentum. Authorities in countries such as Brazil and Mexico are implementing open banking frameworks designed to increase competition, improve data portability, and encourage innovation within the financial sector. These frameworks are prompting both new entrants and incumbent banks to adopt modern core platforms that support API-based integration and real-time data exchange.

Brazil SaaS-based Core Banking Software Market Trends

Brazil is particularly significant in Latin America, experiencing regional expansion and digital transformation. The Brazilian financial services sector is undergoing a substantial digital shift, with banks prioritizing digital initiatives and cloud adoption to enhance efficiency and customer engagement. Brazil's strategic location and diverse economy position it as a gateway for SaaS companies to expand into other markets.

Why Will the Middle East and Africa Surge in the SaaS-Based Core Banking Software Market in 2025?

The Middle East and Africa region is an emerging contributor to the global SaaS-based core banking software market, driven by a large and increasingly tech-savvy population, strong government backing for digital transformation, and a clear need to modernize legacy banking systems to advance financial inclusion. Many countries across the region are prioritizing digital financial services as a means to expand access to banking, improve efficiency, and reduce reliance on traditional branch-based models.

The region's youthful demographic profile, combined with rising smartphone and internet penetration, is generating sustained demand for seamless, digital-first banking experiences. Consumers increasingly expect mobile onboarding, real-time transactions, and always-on access to financial services, which is encouraging banks and non-bank financial institutions to adopt cloud-native core platforms capable of rapid deployment and continuous innovation.

Government-led initiatives play a central role in accelerating adoption. Countries such as the United Arab Emirates and Saudi Arabia have launched national digital transformation and financial sector modernization programs aimed at promoting digital banking, improving financial inclusion, and supporting economic diversification beyond oil-dependent revenue models. These initiatives often include regulatory reforms, fintech-friendly frameworks, and investment in digital infrastructure.

UAE SaaS-Based Core Banking Software Market Trends

The UAE is an emerging region in the global market with a strong focus on high-tech, government-led digital initiatives. The market is propelled by government visions and strategies like the UAE's Smart Government Initiative, which pushes banks towards rapid digitalization. Additionally, financial institutions in the UAE are investing in cost-efficient, agile, and consumer-centric financial services, leveraging SaaS solutions.

SaaS-based Core Banking Software Market Value Chain

- Research and Development

This involves the continuous ideation, design, and development of the core banking platform.

Key Players: Mambu, Thought Machine, Finxact, Oracle (FLEXCUBE), Infosys (Finacle), Temenos.

- Marketing & Sales

This stage focuses on attracting and acquiring banking customers, creating awareness, generating leads, and managing the sales cycle to secure subscriptions.

Key Players: Microsoft Dynamics 365, Oracle, and Zoho CRM.

- Customer Onboarding & Implementation

This involves a smooth transition for the client bank from legacy systems to the new SaaS platform.

Key Players: Mambu, Temenos, Capgemini, and TCS.

- Service Delivery & Infrastructure Management

This involves the ongoing hosting, management, and continuous updates of the software solution in the cloud.

Key Players: Amazon AWS, Microsoft Azure, and Google Cloud.

Top Companies for the SaaS-Based Core Banking Software Market and Their Offerings

Recent Developments

- In January 2024, Temenos launched Enterprise Services on Temenos Banking Cloud, enabling banks to deploy software solutions in 24 hours and reduce modernization costs. With over 120 pre-packaged products and 700 pre-configured APIs, the services facilitate rapid business line launches and modernization of legacy systems while offering continuous updates, high-performance SLAs, and regulatory compliance.(Source: https://www.temenos.com)

- In May 2025, nCino, Inc. unveiled AI-powered innovations at its nSight Conference, highlighting enhancements to the nCino Platform. CEO Sean Desmond emphasized the company's evolution into a leader in data and intelligence, marking "a new era in financial services" driven by advanced AI and automation capabilities.(Source: http://ncino.com)

Segments Covered in the Report

By Deployment Model

- Public Cloud SaaS

- Private Cloud SaaS

- Hybrid Cloud SaaS

By Solution Type

- Core Deposits Management

- Loan & Credit Management

- Payments & Transfers Module

- Customer Information & KYC Module

- Risk & Compliance Management

- Analytics, Reporting & Insights

- API & Open Banking Integration

By Organization Size

- Large Banks

- Mid-Sized Banks

- Small/Community Banks

- Neobanks/Challenger Banks

By End-User

- Retail Banking Institutions

- Corporate & Commercial Banks

- Digital-Only Banks

- Microfinance & Cooperative Banks

- Credit Unions

By Service Model

- Subscription/SaaS Licensing

- Consumption/Usage-Based Pricing

- Managed Services & Support

- Professional Services (implementation, customization)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting