Retail Banking Market Size and Forecast 2025 to 2034

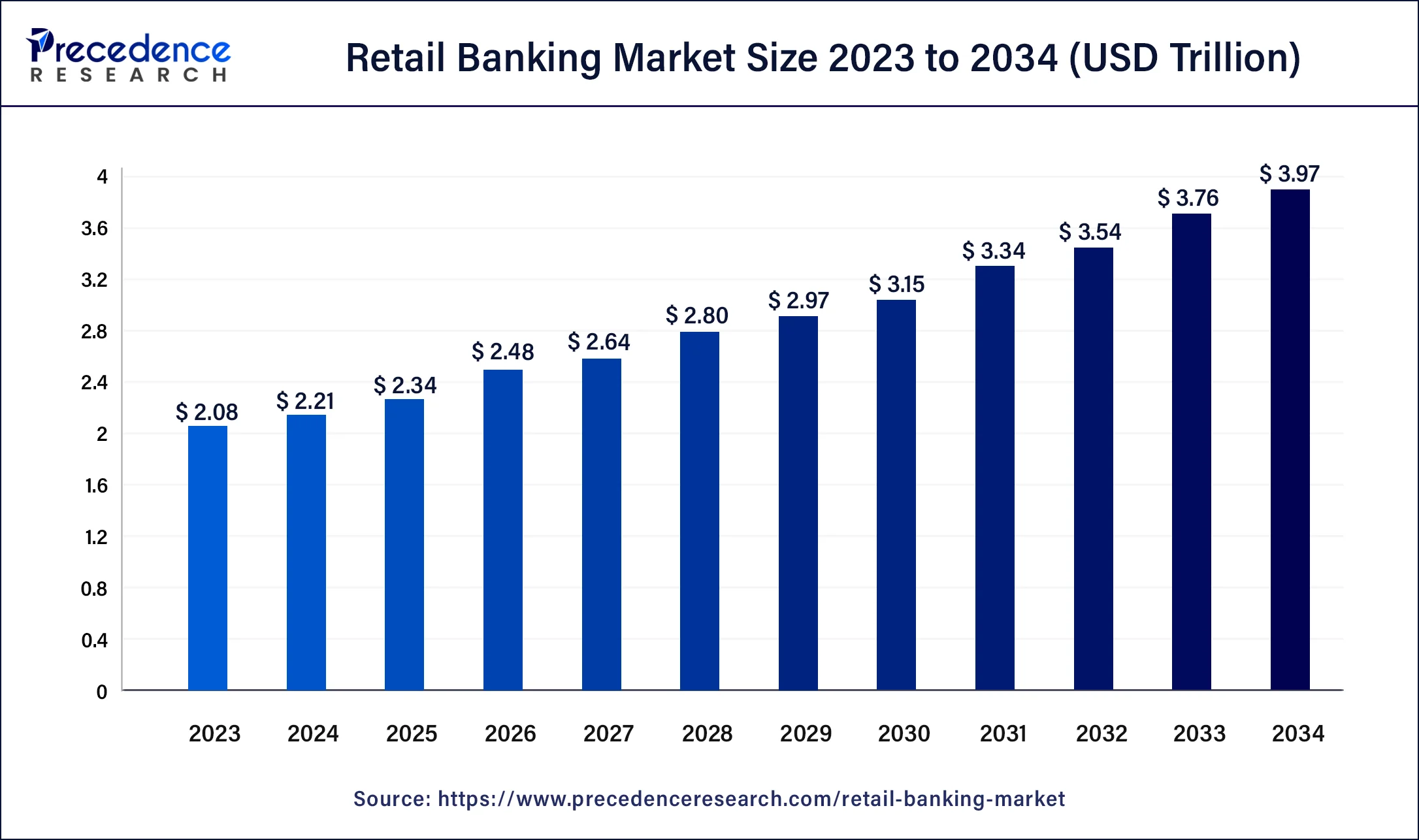

The global retail banking market size was calculated at USD 2.21 trillion in 2024, accounted for USD 2.34 trillion in 2025, and is expected to reach around USD 3.97 trillion by 2034, expanding at a CAGR of 6.03% from 2025 to 2034.

Retail Banking Market Key Takeaways

- In terms of revenue, the market is valued at $2.34 billion in 2025.

- It is projected to reach $3.97 billion by 2034.

- The market is expected to grow at a CAGR of 6.03% from 2025 to 2034.

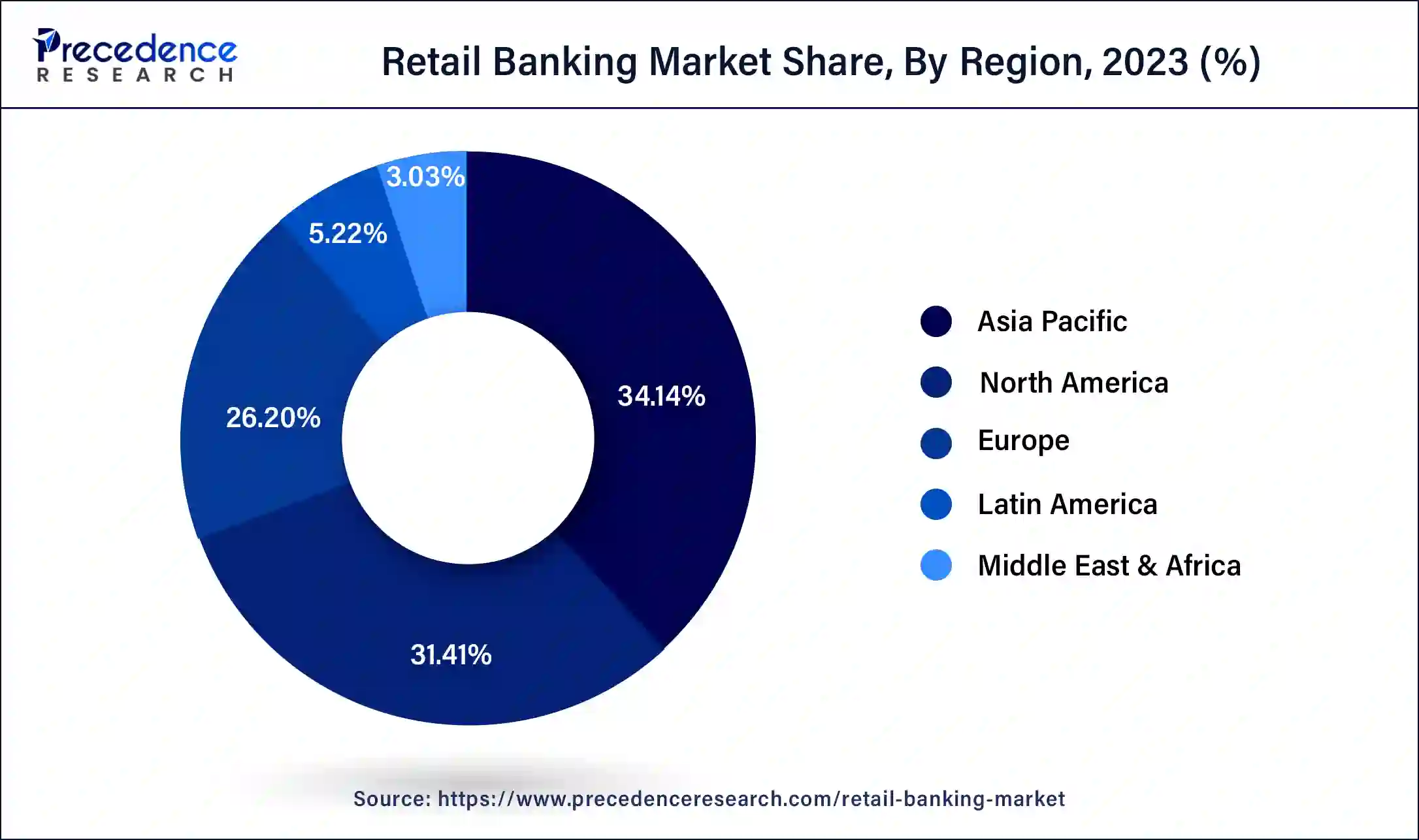

- Asia Pacific dominated the market with the largest share of 34.14% in 2024.

- North America is predicted to grow significantly during the forecast period.

- By Type, the private sector banks segment dominated the market with the highest market share of 30%in 2024.

- By Type, the public sector is anticipated to increase its market share from 2025 to 2034.

- By Service, the savings and account segment dominated the market with the largest market share of 21% in 2024.

- By Service, the debit and credit card segment is expected to increase its market share in from 2025 to 2034.

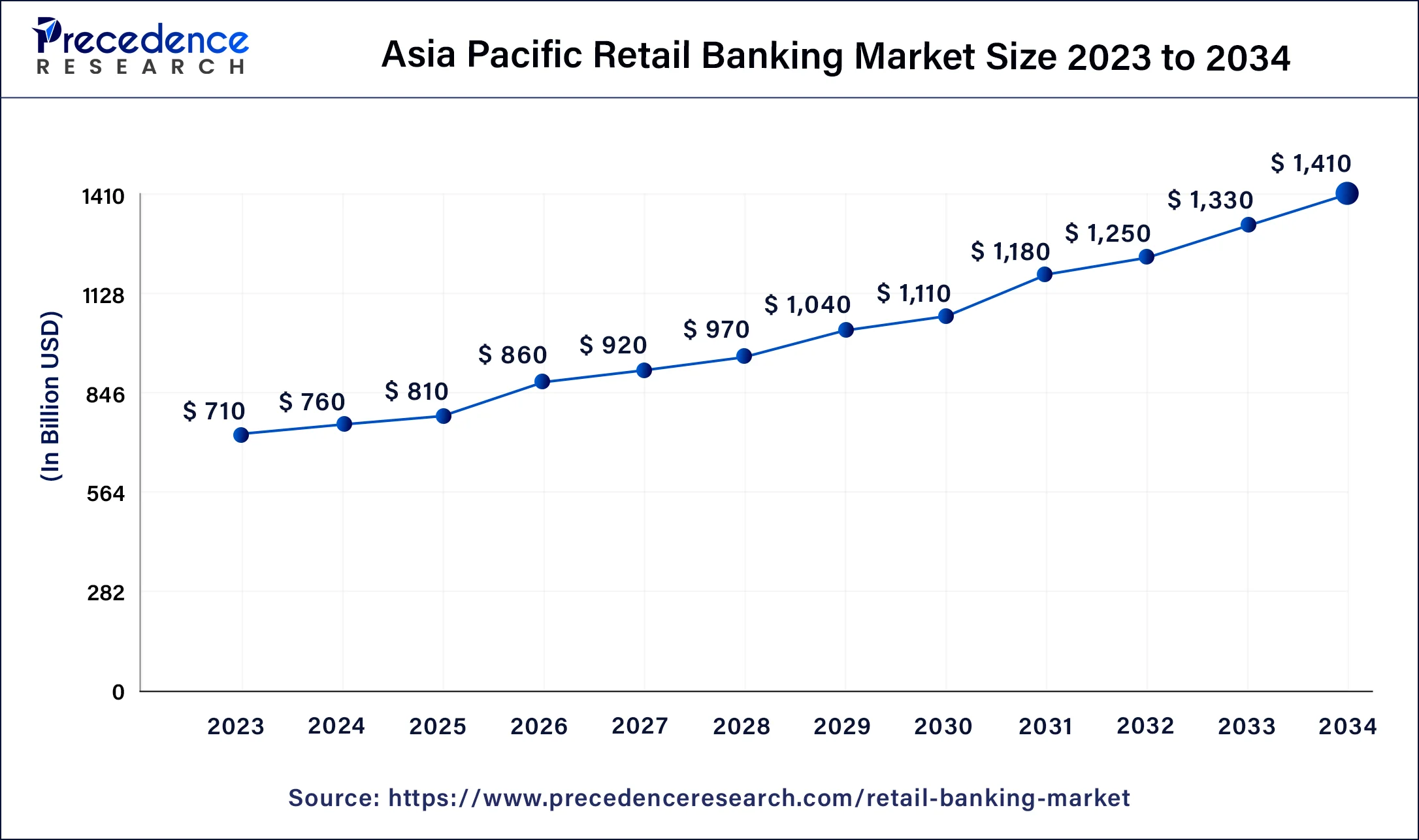

Asia Pacific Retail Banking Market Size and Growth 2025 to 2034

The Asia Pacific retail banking market size was estimated at USD 795.6 billion in 2025 and is predicted to be worth around USD 1,369.65 billion by 2034, at a CAGR of 6.19% from 2025 to 2034.

Asia Pacific dominated the market with the largest market share in 2024,the market will continue to grow at a significant rate during the forecast period. The growth of the market is attributed to the increase in the population in the region. The increasing disposable income in the middle and upper-middle-class category of the population will be intended to increase the demand for retail banking services.

The Asia Pacific retail banking market offers immense opportunities for banks to tap into a growing consumer base, embrace digital innovation, and cater to the evolving needs of retail customers. The Asia Pacific region is the largest and one of the fastest-growing retail banking markets globally. Each country in the Asia Pacific region has its own regulatory framework governing the banking sector. Regulatory bodies set guidelines and regulations to ensure consumer protection, financial stability, and fair competition. Banks operating in the Asia Pacific retail banking market need to comply with local regulations and adapt their strategies accordingly.

Technology has played a crucial role in transforming the retail banking landscape in India. With the rapid growth of digital banking, banks have invested in online and mobile banking platforms, providing customers with convenient access to their accounts, fund transfers, bill payments, and other services. India has witnessed a surge in digital payments, with initiatives like Unified Payments Interface (UPI) and mobile wallets driving the adoption of cashless transactions.

- India has witnessed 890 crore UPI transactions in April 2024. While comparing to UPI transactions in 2022, the rate has increased by 59%.

North America is expected to be the second-largest region for the retail banking market during the forecast period. Increasing consumer interest in personalized banking experiences will likely contribute to the market's growth. The retail banking market in North America is dominated by a few large banks. These banks have a wide network of branches and ATMs, extensive product offerings, and strong brand recognition. They cater to a significant portion of the retail banking customer base and have substantial market influence. The rising online transactions and availability of advanced online payment platforms for consumer convenience propel the growth of the market in North America.

- Headquartered in the United States, the Bank of America had 56 million verified digital users along with 11.6 billion digital logins in 2022.

Customer experience and personalization are key focus areas for banks in North America. Banks strive to provide personalized services, streamlined processes, and digital self-service options to meet the evolving needs and preferences of their customers. The use ofdata analyticsandcustomer relationship management(CRM) systems helps banks better understand their customers and deliver tailored solutions.

Market Overview

The retail banking market refers to the sector of the banking industry that focuses on providing financial services to individual consumers and small businesses. It encompasses a wide range of banking products and services that cater to the everyday banking needs of retail customers. Retail banks facilitate payment transactions for their customers, including electronic fund transfers, online bill payments, wire transfers, and issuing debit and credit cards. These services enable customers to make payments conveniently and securely.

The retail banking market plays a vital role in the economy by providing essential financial services to individuals and small businesses. Retail banks typically have a network of branches and ATMs to serve customers, along with online and mobile banking platforms for convenient access to services. They aim to meet the diverse banking needs of retail customers, offer personalized experiences, and foster long-term relationships.

- Bank of America opened 465,000 consumer investment accounts through its online investment platform in 2022. (Stated in Bank of America's annual report, 2022)

- In 2022, Bank of America even added 1,110 new commercial and corporate clients to the company while serving $10.4 billion in Global Transaction Services revenue.

Retail Banking Market Growth Factors

Banking sectors are changing with the changing consumer needs and preferences. Technological advancement in the banking sector is shaping the growth potential of the industry. Rising technological advancement creates habits for online and mobile banking in consumers. Consumer access each and every service at their fingertips on their mobile phones whether it is easy checking their money deposit or balance in their accounts, or any other service associated with their banking requirement. Increasing population across the world and rising disposable income in the middle-class and upper-middle-class population will be expected to propel the growth of the retail banking market.

In recent times, the consumer need for personalized banking solutions is observed to be a significant growth factor for the market. The demand for retail banking services is rising with the changing consumer mindset and the penetration of new technologies. The rising emphasis on imposing strict regulations for consumer finance protection will also fuel the growth of the market in the upcoming period.

Key Market Trends

- Digital-first banking: Retail banks are focused on digital platforms to accommodate increasing consumer demand for mobile and online banking, increasing the ease of banking while decreasing the use of physical branches and facilitating customer interaction.

- AI and automation: AI and automation could greatly enhance customer service experiences, fraud alert, and client financial advice to make banking more efficient, while providing more personal experiences for customers.

- Open banking integration: Open banking encourages banks to share client data with third-party providers securely and develop financial services for consumers without compromising integrity.

- Sustainability and ESG focus: Consumers are increasingly interested in ESG efforts made by their Banks. Banks are now interested in greener efforts, and consumers who don't want or are unable to pursue donations to charities are often tasked with the burden of finding ways for banks to pursue donations towards sustainable investments or loans.

- Expanded cybersecurity: An increase in digital services from traditional retail banks has forced many retail banks to ramp up advanced cyber. Safety efforts are needed as there is an increase in risks to client data safety and security, and scrutiny surrounding any failure to improve cybersecurity.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.97 Trillion |

| Market Size in 2025 | USD 2.34 Trillion |

| Market Size in 2024 | USD 2.21 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Service and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for personalized consulting services

Retail banks can capitalize on the growth opportunities driven by the demand for personalized consulting services and strengthen their position in the market. Retail customers are increasingly seeking personalized experiences and tailored financial solutions that address their unique needs and goals. The demand for personalized consulting services allows retail banks to provide a more comprehensive and customized approach to financial planning and advice. By offering personalized consultations, banks can build stronger relationships with customers and differentiate themselves from competitors. Personalized consulting services contribute to long-term customer loyalty and retention. When customers receive valuable advice and see positive outcomes from personalized consultations, they are more likely to remain loyal to the bank and continue using its products and services.

Restraints

Risk in public debts is restraining the market from expansion

High levels of public debt can undermine consumer confidence and negatively impact consumer spending patterns. When individuals perceive economic instability due to public debt risks, they may reduce their discretionary spending and become more conservative with their financial decisions. This can result in lower demand for retail banking products and services, such as loans, credit cards, and investment products. Reduced consumer spending can hamper the growth prospects of the retail banking market.

Public debt risks can influence overall market sentiment and investor confidence. If investors perceive a high risk of default or financial instability due to public debt levels, they may withdraw investments or become hesitant to invest in financial institutions, including retail banks. This can lead to a decrease in available funding for banks, making it more challenging for them to expand their lending activities and support the growth of the retail banking market.

Opportunity

Significant technological advancements

Public debt risks can influence overall market sentiment and investor confidence. If investors perceive a high risk of default or financial instability due to public debt levels, they may withdraw investments or become hesitant to invest in financial institutions, including retail banks. This can lead to a decrease in available funding for banks, making it more challenging for them to expand their lending activities and support the growth of the retail banking market.

In December 2022, a one-stop solution for digital banking service and solutions, Wells Fargo announced the launch of new artificial intelligence-drivenbanking platform ‘Vantage' to offer more effective financial services to commercial and corporate banking clients.

Technology enables retail banks to gather and analyze vast amounts of customer data, providing insights into individual preferences, behaviors, and needs. With this information, banks can offer personalized products, services, and recommendations to customers. Personalization enhances the customer experience, fosters customer loyalty, and increases customer satisfaction. Advanced analytics and artificial intelligence (AI) technologies enable banks to deliver targeted marketing campaigns, customized financial advice, and tailored product offerings. Overall, technological advancements have transformed the retail banking landscape, creating opportunities for banks to innovate, improve customer experiences, expand their reach, and optimize their operations.

Type Insights

The private sector banks dominated the market with the highest market share in 2024, the segment is expected to show a significant growth rate during the forecast period. The growth of the market is owing to the adapting flexibility and agility of the market conditions. The private sector comprises a large number of banks and financial institutions that actively compete for market share. Private banks often have a greater capacity to invest in technology, infrastructure, and marketing, allowing them to offer innovative products and services to attract customers. The intense competition within the private sector drives banks to continuously improve their offerings, customer experiences, and overall value proposition, which contributes to their dominance in the market.

The public sector banks segment is expected to increase their market share in the forecast period. State-owned banks often receive significant support from the government, including capital injections, regulatory advantages, and preferential treatment. This support can enable public sector banks to have a competitive position in the market.

Public sector banks may have access to extensive resources, such as government funds, infrastructure, and a large customer base. These resources can be leveraged to expand their presence, offer competitive products and services, and attract a significant market share.

Services Insights

The savings and checking accounts segment dominated the market with the largest market share in 2024. The savings and checking account segment as the basic of personal banking. Banking provides a secure place for deposits and manages their funds and essential transactions for their everyday goals. Everyday costs are paid for through a checking account, a sort of bank account. There are no withdrawal restrictions on these accounts, and they are simple to access. By making regular deposits into a savings account, you may save money and increase your wealth. It is a location where you may store money that you do not immediately require.

The debit and credit cards segment is expected to hold a significant market area in the forecast period. Debit and credit cards facilitate cashless transactions, eliminating the need to carry physical currency. With the increasing preference for digital payments and the declining use of cash, debit and credit cards have become integral to everyday financial transactions. The widespread acceptance of cards at point-of-sale terminals and the growth of e-commerce have made cards a preferred payment method for many consumers. The convenience and accessibility offered by debit and credit cards contribute to their dominance in the retail banking market.

Retail Banking Market Companies

- BNP Paribas

- Citigroup, Inc.

- HSBC Group

- ICBC

- JP Morgan Chase & Co.

- Bank of America Corporation

- Barclays

- China Construction Bank

- Deutsche Bank AG

- Mitsubishi UFJ Financial Group, Inc.

- Wells Fargo

Recent Development

- In April 2025, Q2 Holdings, Inc., a leading provider of digital transformation solutions for the financial services industry, announced that Signature Bank has launched Q2's Digital Banking Platform to accelerate its digital banking transformation.

- In January 2025, Federal Bank, the sixth-largest private sector bank in India, partnered with Nucleus Software to launch a new digital transaction banking platform, FedOne, powered by Nucleus Software. FinnAxia enables financial institutions to manage collections, payments, trade finance, liquidity, and financial supply chain management, and other transaction banking operations within a single platform.

- In July 2024, 10x Banking, the cloud-native core banking platform, announced the launch of a new category of core technology – a ‘meta core' designed to help banks and financial services accelerate towards full transformation.

- In October 2024, Aurionpro Solutions Limited announced a multi-million-dollar deal with a leading bank in Saudi Arabia. The bank has chosen Aurionpro's next-generation cash management and transaction banking platform to deliver a seamless and contextual customer experience to its corporate clients.

- In June 2023,as per Zee Business Research, Bajaj Finserv announced the launch of a mutual fund business in June 2023, the non-financial banking company get SEBI's approval for its MF business, and the business operated under the Bajaj Finserv Mutual Fund.

- In June 2023,India's leading financial institutions were awarded as the best digital bank “DBS Bank India” announced the launch of the DBS Vantage card. The metal card comes with benefits like fine dining, travel, and complimentary sessions of premium places.

- In May 2023,Wio Bank, a digital platform banking platform entered in a collaboration with the Abu Dhabi Development Company (ADQ), First Abu Dhabi Bank (FAB), Etisalat, and Alpha Dhabi Holding planning to launch its retail proposition by the end of H1 2023.

Segments Covered in the Report

By Type

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Community Development Banks

- Non-banking Financial Companies (NBFC)

By Service

- Saving and Checking Account

- Transactional Account

- Personal Loan

- Home Loan

- Mortgages

- Debit and Credit Cards

- ATM Cards

- Certificates of Deposits

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content