Retail Analytics Market Size and Forecast 2025 to 2034

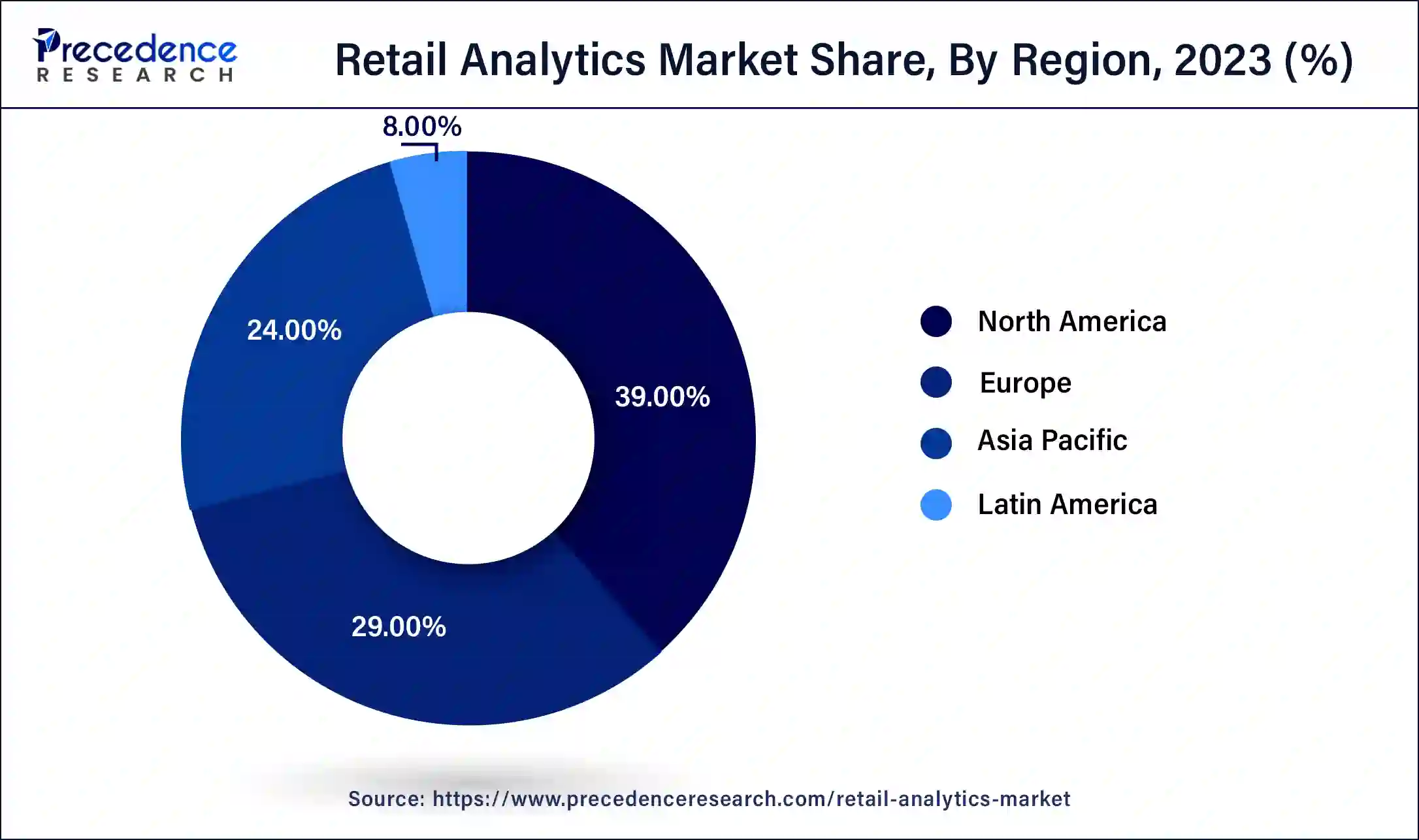

The global retail analytics market size was evaluated at USD 8.90 billion in 2024 and is anticipated to reach around USD 43.31 billion by 2034, growing at a CAGR of 17.14% over the forecast period 2025 to 2034. The North America retail analytics market size reached USD 3.47 billion in 2024. Increasing numbers of E-commerce platforms create a huge amount of data that needs to be managed, and leveraging data-driven insights to expand business is the major factor fuelling the market further. Also, the integration of data analytics and ML in the retail sector is expanding the retail analytics market on a global scale.

Retail Analytics Market Key Takeaways

- The global retail analytics market was valued at USD 8.90 billion in 2024.

- It is projected to reach USD 43.31 billion by 2034.

- The retail analytics market is expected to grow at a CAGR of 17.14% from 2025 to 2034.

- North America dominated the global retail analytics market with the highest market share of 39% in 2024.

- Asia Pacific is anticipated to showcase notable growth in the market during the forecasted years.

- By deployment, the cloud segment accounted for the largest share of the market in 2024.

- By deployment, the on-premises segment is expected to showcase notable growth in the market during the forecast period.

- By retail store type, the retail chains segment accounted for the largest share of the market in 2024.

- By retail store type, the hypermarkets & supermarkets segment is projected to grow at a significant rate in the market during the studied period.

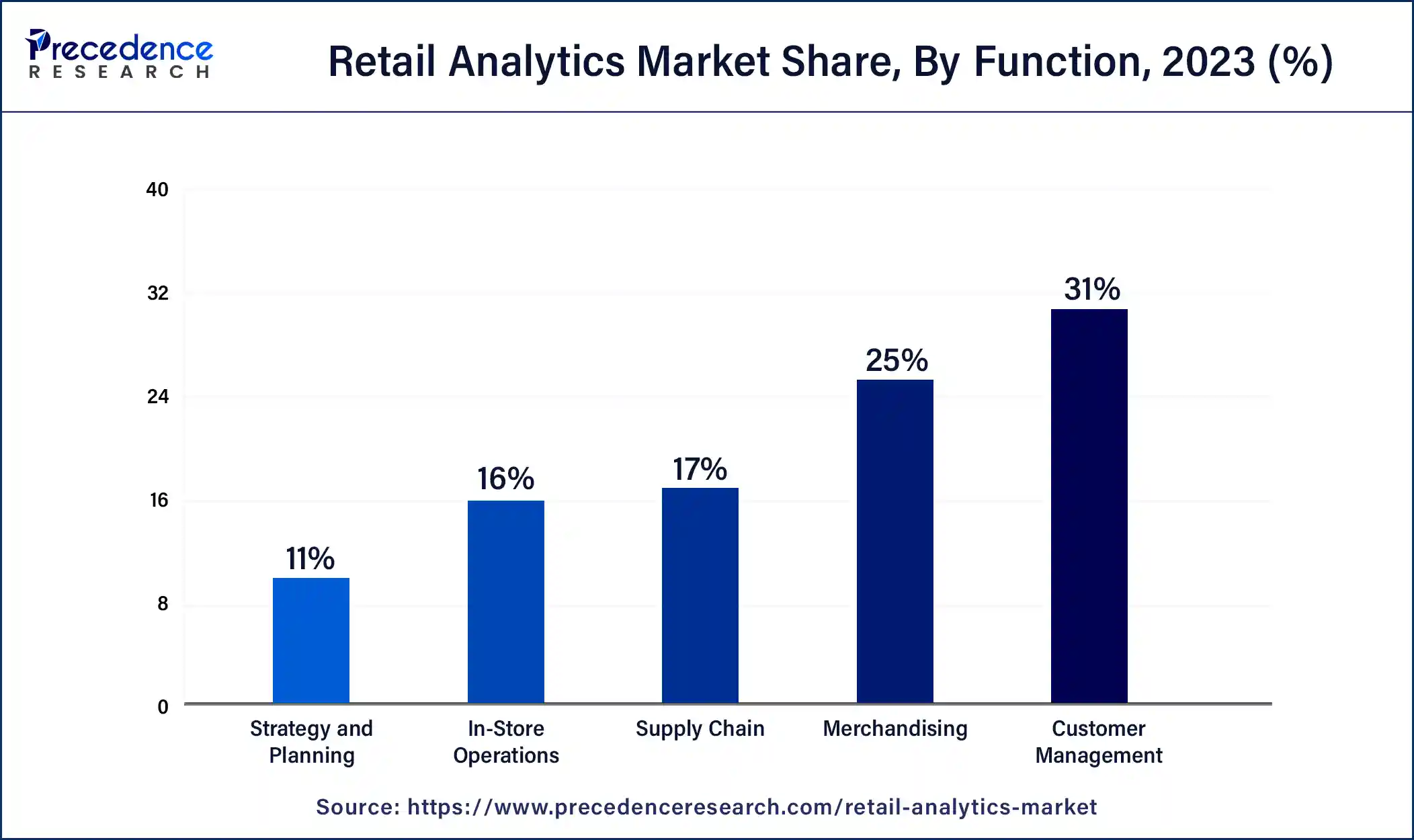

- By function, the customer management segment contributed the largest market share of 31% in 2024.

- By function, the strategy & planning segment will grow rapidly in the global market in the upcoming years.

AI Impact on the retail analytics market

AI has prominently impacted the retail analytics market in many ways. The incorporation of machine learning and data analytics with the help of deep learning algorithms is a current trend in the market. One of the significant applications of AI in the market is the image recognition process, which is revolutionizing the retail market by enhancing the store's ability to capture precise details of real-time visual data, fuelling the growth of the market again.

Image recognition, as the name suggests, uses deep learning algorithms to analyze the images and data, which are visual in nature, gathered from various sources to understand the patterns and gain insights from them. Algorithms are basically trained with huge datasets, enabling them to recognize and categorize objects like products and consumers' faces in the retail analytics market. Object detection and facial recognition are the major components of AI in retail analytics.

- In January 2023, AiFi, a startup that aims to enable retailers to deploy autonomous shopping tech, partnered with Microsoft to launch a preview of a cloud service called Smart Store Analytics. It provides retailers with AiFi's technology, including shopper and operational analytics, for their fleets of smart stores.

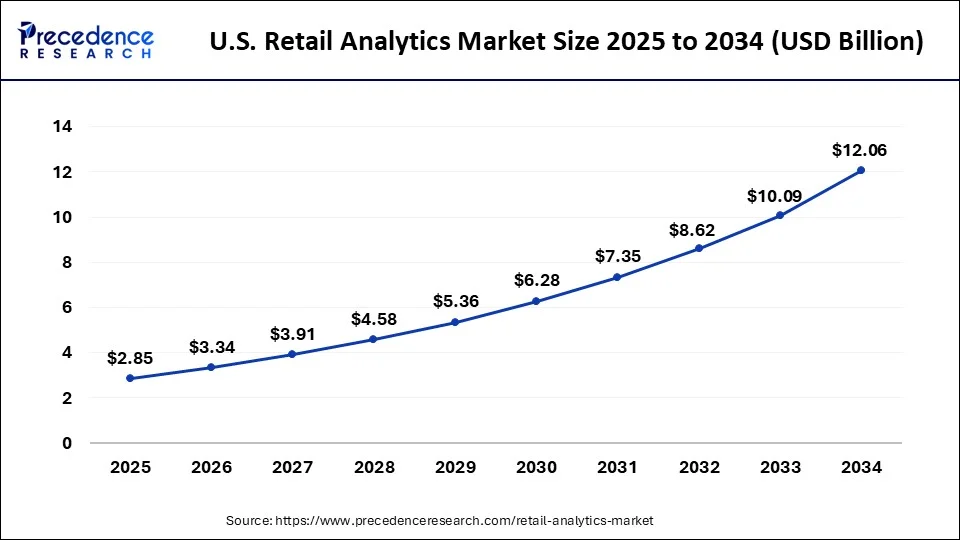

U.S. Retail Analytics Market Size and Growth 2025 to 2034

The U.S. retail analytics market size was exhibited at USD 2.43 billion in 2024 and is projected to be worth around USD 12.06 billion by 2034, poised to grow at a CAGR of 17.37% from 2025 to 2034.

North America dominated the global retail analytics market in 2024. The growth of this region is majorly due to leading countries like Canada and the U.S. The U.S. accounted for the highest share of the retail analytics market due to the presence of many physical retail stores that focus on the integration of next-generation technologies, changing customer behavior, and the Rising number of investments in retail analytics by major players. Also, the presence and availability of global brands are challenges due to the large competition from local and domestic brands.

- In March 2023, KPMG, one of the leading providers for professional service firm, announced the launch of innovative product to expand the retail analytics capacities for bolstering the business further. Key features of this product include advanced data analytics tools, machine learning algorithms, and predictive capabilities.

Asia Pacific is anticipated to showcase notable growth in the retail analytics market during the forecasted years. The region is proliferating easily due to the retailers in the region using internet connections largely and more frequently, which, in turn, helps marketers adopt analytics tools faster. Analytics helps retailers to understand the market's pattern and consumers' inclination accordingly to strengthen their roots while understanding areas of improvement. Asia Pacific is further proliferating in the retail analytics market due to the evolving countries like India, China, and Japan, where data analytics is frequently used by many marketers in various sectors, including the retail sector.

- According to the data published by the Retailers Association of India, PAN India sales have increased by up to 10% in the year 2022.

- Reliance Retail announced in February 2023 that it planned to open multiple Gap stores next year with an eye toward the country's mid-premium apparel market. Reliance Retail acquired the rights to sell American casual wear brand Gap in India last year.

- In October 2023, Criteo, the commerce media company, and GroupM, WPP's media investment group, announced the first Asia Pacific partnership to Unify product sales data with proximity-based insights, enable omnichannel commerce through in-store and retail media integration, and strengthen omnichannel commerce media capabilities for GroupM clients in the region.

Market Overview

The retail analytics market is proliferating for various reasons; one of them is that the huge generation of data from different sources is the major factor driving the market's growth. Exponential growth in the e-commerce platform and rising adoption of strategies like omnichannel retail strategy are also the causes of market growth. Retail analytics deals with data analysis with the help of computational techniques to gain insights from the datasets generated by various platforms.

The process of the retail analytics market involves the collection of data, processing it, and analyzing it from various sources, which include sales transactions, records for inventories, consumers' experience, and marketing strategies and their results. By analyzing this precise data, a business can better understand its ability to expand in the market and loopholes to avoid that cause barriers to market expansion, further enhancing the importance of retail analytics.

Retail Analytics Market Growth Factors

- Proliferation of the e-commerce industry in China and India.

- Increasing penetration of big data and IoT in the retail industry in the United States.

- Growing use of smartphones in Asia Pacific fuelling the retail analytics market further.

- Surge in the competition among retailers and increasing need for differentiation in North America.

- A new generation of highly informed and demanding customers across the globe, further expanding the market.

- Rising preferences for data analytics, particularly in Asia Pacific.

- Growing inclination towards the e-commerce sector.

- Expanding the retail sector on a global scale.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 43.31 Billion |

| Market Size in 2025 | USD 10.43 Billion |

| Market Size in 2024 | USD 8.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment, Retail Store, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Complexity of generated data

One of the key factors driving the retail analytics market growth is the increasing volume and complexity of data generated by the retail sector. Some of the major sources of data generation in the retail sector include online and offline transactions, customer interactions, supply chains, social media, and more. These data can be used by retailers to get a competitive edge in the market by gathering insights with the help of analytics.

Nearly 56% of consumers expect customized engagement with the help of retailers. It involves analyzing consumers' behavior, choices, preferences, financial ability to purchase the product, willingness to visit the store again or frequently, etc., to create consumer engagement to expand and strengthen their roots in the location where they are operating in the retail analytics market. Such a vast amount of data must be precisely analyzed if they want specific information or to gain business insights. The market can be a game changer as it enables a marketer to reflect on data left by the customers, like purchase history, browsing patterns, and social media interaction, so as to curate personalized recommendations.

Restraint

Privacy and security concerns

A significant restraining factor for the retail analytics market is the concern about data privacy and its security as it involves the personal data of individuals that get stolen by hackers or unauthorized entities for their benefit and creates a bad reputation for the shops from where data has been leaked. To avoid such a situation, marketers must follow regulatory compliances for the security of the data and privacy standards to keep their reputation and trustworthiness in the market. Since a huge amount of data has been recorded by data analysis tools, hackers get easy access to such sensitive data to manipulate it and threaten the individuals for financial transactions or marketers to hack their entire system.

Opportunity

The trend of e-commerce platforms

A major opportunity that the retail analytics market holds in the generation of E-commerce platforms by many key players owing to the increasing data generation, creating a lucrative option to proliferate the market. The increasing volume and variety of different data have the potential to create several benefits for retail businesses and consumers. Moreover, the surge in digital transformation and the growing trend of e-commerce platforms is likely to expand the adoption of retail analytics solutions and services among organizations.

To increase the conversational rates about specific products that are newly launched, marketers use personal recommendations with the help of data analysis tools to understand people's inclinations and opinions about the products on digital platforms. Retail analytics are made more accessible to users with the help of highly advanced technologies like bi-data analysis, machine learning, and integration of AI, further creating a lucrative opportunity for the proliferation of the retail analytics market.

Deployment Insights

The cloud segment accounted for the largest share of the retail analytics market in 2024. The growth of this segment is attributed to factors such as real-time assistance that led to data-based insights that proliferated the business further. Thus, cloud-based retail shopping can enhance users' shopping experience.

The on-premises segment is expected to showcase notable growth in the retail analytics market during the forecast period. Conventional on-premises also provides a number of benefits, like mitigating cyberattacks by deploying on-premises retail software, which is the major cause of this segment's adoption by many enterprises.

Retail Store Insights

The retail chains segment accounted for the largest share of the retail analytics market in 2024. The growth of this segment is due to the retail analytics solutions that help in supply chain management, in-store operations, and inventory management. Major key players in the retail sectors, such as D'mart, Walmart, and others, are enhancing their consumer experience with various methods to strengthen their roots in the market.

- In June 2022, Amazon Inc. unveiled the Store Analytics service for brands offering anonymized and compiled insights on performance, ad campaigns, and promotions.

The hypermarkets & supermarkets segment is projected to grow at a significant rate in the retail analytics market during the studied period. The growth of this segment is due to the shifting of supermarkets and hypermarkets to adopt data analytics tools to expand their business by analysing real-time data.

Function Insights

The customer management segment dominated the global retail analytics market in 2024. The market is further segmented into merchandising strategy, supply chain, and in-store applications. The evolving consumer need is the major key factor fuelling this segment's demand. Many retailers use a data analytics tool to understand and analyze consumers' preferences for goods and other services they provide so they can expand their business internationally on a larger scale.

The strategy & planning segment will grow rapidly in the global retail analytics market in the upcoming years. Strategy and planning are important aspects to help business optimize their in-store operations and help in fleet management plus logistics operations.

Retail Analytics Market Companies

- Microsoft Corporation (U.S.)

- HCL Technologies Limited (India)

- FLIR Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- QlikTech International A.B. (U.S.)

- Fractal Analytics Inc. (U.S.)

- Wipro Limited (India)

- Nielsen Consumer LLC (U.S.)

- EY (U.K.)

Recent Developments

- In September 2023, Oracle, in partnership with Uber, announced Collect and Receive, a new offering on the Oracle Retail platform connecting retailers and consumers to enhance and enrich last-mile delivery. Supported by the Oracle Retail Data Store and cloud platform technologies, retailers can link to Uber Direct, the company's delivery solution, through pre-integrated APIs.

- In June 2023, in partnership with Google, Salesforce expanded strategic partnerships to help businesses utilize data and AI to deliver more personalized customer experiences, better understand customer behavior, and run more effective campaigns at a lower cost across marketing, sales, service, and commerce.

- In September 2023, Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. In addition, Priority is expanding the scope of its Retail Management Products and delivering significant value to Retailers by integrating Retailsoft's solutions.

Segments Covered in the Report

By Deployment

- On-premises

- Cloud

By Retail Store

- Hypermarkets & Supermarkets

- Retail Chains

By Function

- Customer Management

- Supply Chain

- Merchandising

- Strategy And Planning

- In-Store Operations

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting