What is Saliva Collection and Diagnostics Market Size?

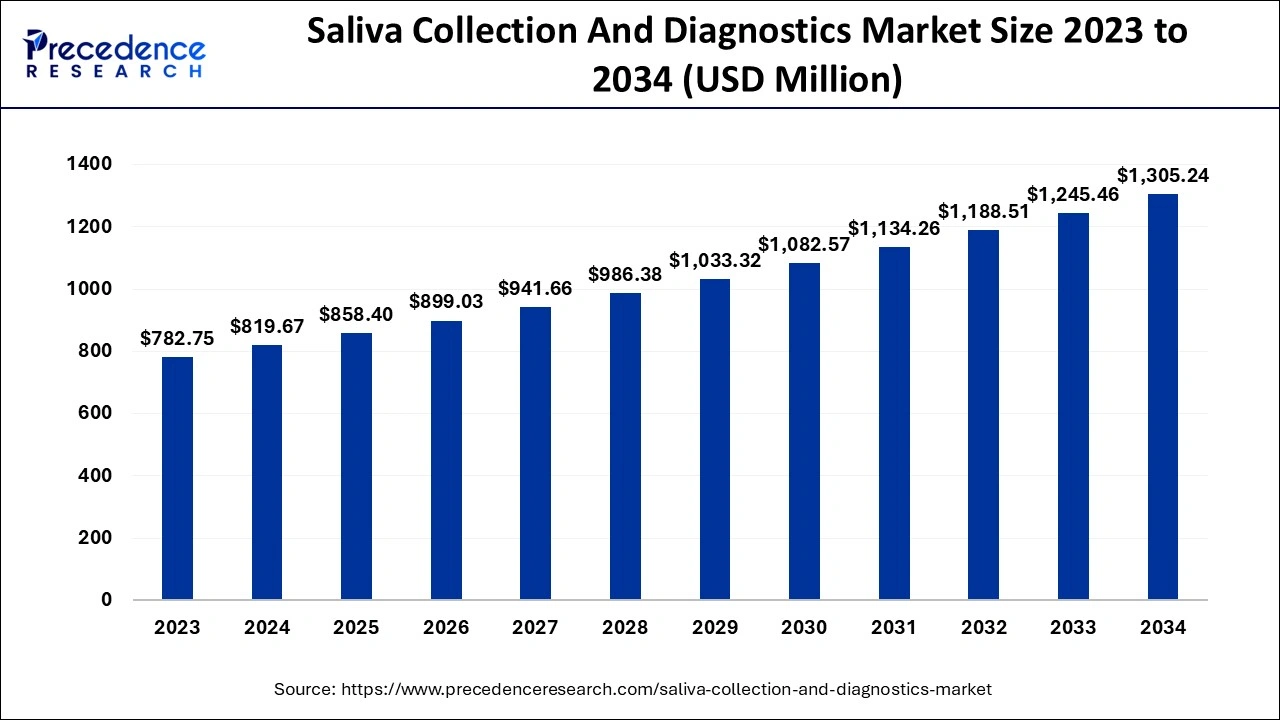

The global saliva collection and diagnostics market size is calculated at USD 858.40 million in 2025 and is predicted to reach around USD 1,305.24 million by 2034, expanding at a CAGR of 4.76% from 2025 to 2034. Increasing demand for quick diagnoses of diseases is the key factor driving the growth of the saliva collection and diagnostics market. Also, rising public awareness regarding safe diagnostic solutions coupled with the innovations in infant sample collection technology, can fuel market growth further.

Market Highlights

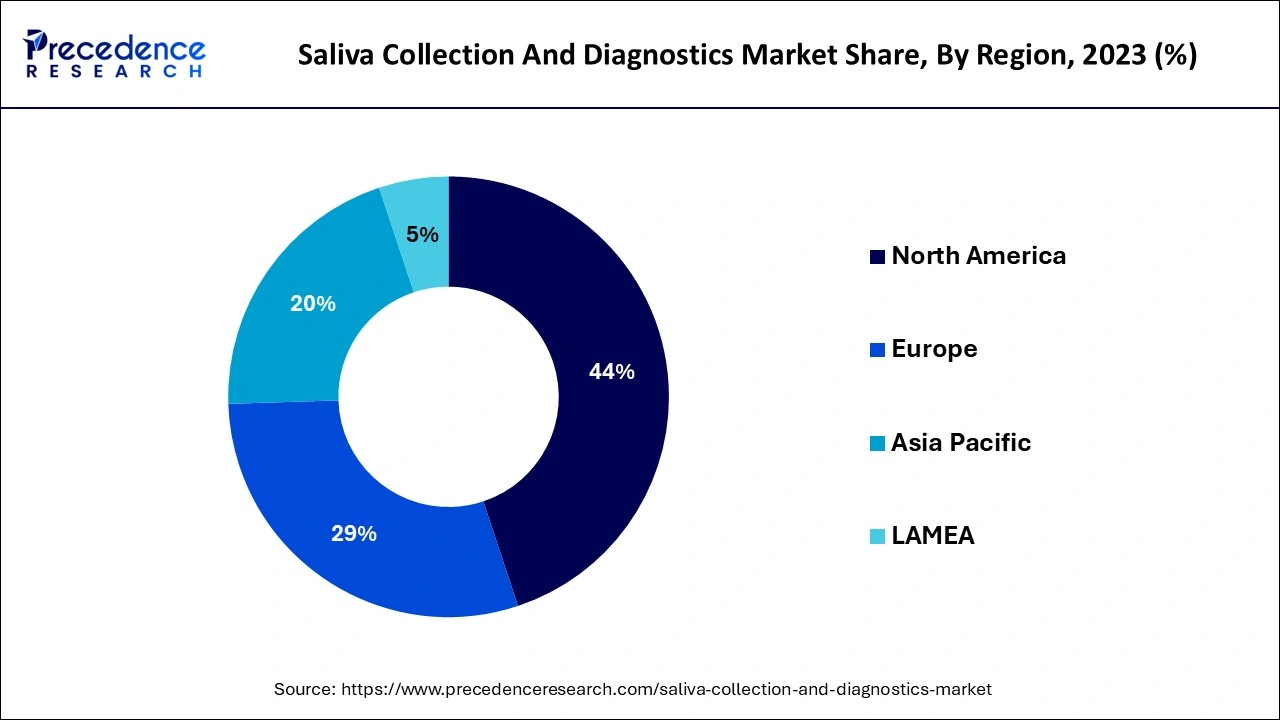

- North America dominated the global market with the largest market share of 44% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By site of collection, the submandibular/sublingual gland collection segment captured the biggest market share of 50% in 2024.

- By site of collection, the parotid gland collection segment is anticipated to grow at the fastest CAGR in the forecast period.

- By application, the disease diagnostics segment generated the major market share of 91% in 2024.

- By application, the forensic segment is expected to show the fastest growth in the forecast period.

- By end use, the diagnostic laboratories segment has held the largest market share of 80% in 2024.

- By end use, the pharmaceutical and biotechnology companies segment is expected to grow significantly during the forecast period.

What is the Role of AI in the Saliva Collection and Diagnostics Market?

Artificial intelligence (AI) can play a substantial role in the saliva collection and diagnostics market by enhancing the efficiency, precision, and duration of disease diagnosis and monitoring. It can use diagnostic images and clinical data to help diagnose oral conditions such as oral cancer, dental caries, and periodontal disease. Furthermore, AI can optimize the ability of salivary biomarkers to manage and diagnose maxillofacial diseases.

- In July 2024, OVUL announced the launch of its saliva-based AI fertility tracker. A groundbreaking tool created to help women accurately monitor their ovulation cycles with ease and accuracy. This cutting-edge device combines the simplicity of a three-step process with advanced AI technology, turning daily health tracking into a quick and enjoyable moment.

What is Saliva Collection and Diagnostics?

The saliva collection and diagnostics market encompasses the collection, analysis, and interpretation of saliva samples for health care and research purposes. It also involves the use of saliva for biomedical research, diagnosing diseases, and non-invasive drug testing. Saliva is an important source of bodily information because it contains biomarkers like DNA and proteins that can help detect the presence of certain diseases like specific cancers and cardiovascular diseases. Also, saliva can show the body's physiological state, including endocrinal, nutritional, emotional, and metabolic variations.

Mouth and oral cancer rates in 2022

| Country | Number |

| India | 1,43,759 |

| China | 37,208 |

| United States of America | 27,750 |

| Bangladesh | 16,083 |

| Pakistan | 15,915 |

| World | 3,89,846 |

What are the Growth Factors in the Saliva Collection and Diagnostics Market?

- The rising prevalence of infectious diseases is expected to fuel saliva collection and diagnostics market growth shortly.

- Increasing the utilization of non-invasive saliva testing can boost market growth further.

- Ongoing innovations in non-invasive testing technologies will likely propel the saliva collection and diagnostics market growth soon.

Saliva Collection and Diagnostics Market Outlook

- Industry Expansion Overview: The saliva diagnostics and testing industry is poised for rapid growth from 2025 to 2030 because of increased demand for painless, rapid point-of-care tests, as well as home collection options. Healthcare providers and patients alike are adopting these methods due to their speed and simplicity, particularly throughout North America and the Asia Pacific.

- Sustainable Trends: The industry is shifting toward the development of eco-friendly saliva test kits by reducing the amount of plastic used in packaging and increasing the use of recycled raw materials. Companies have developed a more environmentally friendly approach to creating saliva collection kits by investing in biodegradable materials and low-waste assay formats.

- Global Expansion: The major players in this market are expanding into Southeast Asia, Eastern Europe, and the LATAM region to capitalize on the growing demand for on-site testing capabilities. By establishing new laboratories or automated testing facilities and forming partnerships with local healthcare systems, these companies can expand their market share and deliver faster testing results.

- Major Investors: High net worth entities, private equity or strategic investors, increased investment in saliva-based diagnostics. The rapid adoption of preventive healthcare systems, coupled with a high margin composite of saliva-based diagnostics, aided in the investment increase made by high-net-worth entities into Companies designing rapid molecular testing, along with the AI diagnostic platform.

- Startup Ecosystem: Saliva testing startup companies focusing on molecular saliva testing and microfluidic cartridges gained traction through strong investment from venture capitalists due to the potential for growth in the marketplace. Startups in the APAC region have been able to attract significant venture capital funds due to their ability to provide accurate, low-cost, at-home testing kits, providing a viable alternative to traditional laboratory testing and the associated costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 858.40 Million |

| Market Size in 2026 | USD 899.03 Million |

| Market Size by 2034 | USD 1,305.24 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Site of Collection, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Cost-effective collection and diagnostic offering

Collecting saliva DNA is not that expensive compared to other kinds of testing, such as blood and urine tests. Saliva samples do not need specific transportation and storage facilities from collection to processing. However, the blood samples need freezers, dry ice, and overnight shipping, while samples of saliva can easily be stored at the current temperature and transported via conventional methods, which makes the whole saliva collection process cheap.

- In November 2022, Quest Diagnostics announced the completion of its previously announced acquisition of select assets of LabCare Plus, the outreach laboratory services business of Summa Health, a big integrated healthcare organization.

Restraint

Complex sample treatment

Saliva is a high blend of many substances such as proteins, enzymes, nucleic acids, and other hormones. The complexity of this mixture can make it difficult to characterize and isolate salivary EVs, which sometimes can show different detection results. Moreover, there are many hurdles in reliably supplying the required materials for saliva collection and diagnostics.

Opportunity

Advancements in saliva-based POCT devices

The requirement for the advancement of saliva-based POCT devices is because of the ability of saliva the rapidly detect systemic and oral diseases like cancers, fungal and bacterial infections, and genetic disorders. Furthermore, the growing R&D in disease prediction by testing providers offers numerous opportunities for key players to enter the global saliva collection and diagnostics market.

- In November 2023, PCL, a Kosdaq-listed in vitro diagnostic medical device company, declared that its AI-based point of care testing (POCT) device, Pclok II Prep Universal, distinguished by the ability to diagnose various cancers, viruses, chronic diseases, and infectious diseases, has received U.S. FDA clearance.

Segment Insights

Site of Collection Insights

The submandibular/sublingual gland collection segment dominated the saliva collection and diagnostics market in 2024. The dominance of the segment can be attributed to the increasing cases of sialolithiasis across the globe due to poor dieting habits along with the side effects of certain medications. Additionally, this disease is most prevalent among middle-aged adults. Also, the family history of stone diseases can raise the potential risks of these diseases, contributing to segment growth further.

- In August 2024, Lord's Mark Microbiotech announced the launch of a saliva-based organ age test. This test, based on epigenetics, will assess the biological age of a patient's organs compared to their chronological age, offering insights for health interventions.

The parotid gland collection segment is anticipated to grow at the fastest rate in the saliva collection and diagnostics market over the forecast period. The growth of the segment can be linked to the growing incidence of rare salivary gland cancer, which often shows symptoms such as a noticeable lump or unease swallowing. Diagnosis of this disorder mostly relies on biopsies and imaging tests, including (PET) scans, CT scans, and MRIs.

Application Insights

The disease diagnostics segment dominated the saliva collection and diagnostics market. The dominance of the segment can be linked to the advancements in saliva diagnostic technology which makes it easier for the early detection of chronic diseases such as cancer and cardiovascular disease. Moreover, this method of testing is beneficial for diagnosing an extensive range of rare disease conditions like hormonal imbalances and certain infections.

The forensic segment is expected to show the fastest growth in the saliva collection and diagnostics market over the projected period. The growth of the segment can be driven by increasing innovations in DNA analysis coupled with the non-invasive nature of the sampling process. Saliva possesses proteins, DNA, and biomarkers that can give crucial data in forensic investigations like toxicology testing and individual identification. Furthermore, the raised demand for precise, rapid, and less invasive methods in forensic science has boosted the utilization of saliva-based diagnostics.

End-Use Insights

The diagnostic laboratories segment held the largest share of the saliva collection and diagnostics market in 2024. The dominance of the segment can be credited to the rising demand for diagnostic laboratories from customers across the globe. In addition, diagnostic laboratories use advanced analytical methods for the early detection of diseases and customized treatment for each patient. Diagnostic labs utilize automation and digitalization to test more samples in much less time.

- In November 2022, Quest Diagnostics announced that it had completed its previously declared acquisition of select assets of LabCare Plus, the outreach laboratory services business of Summa Health, an extensive integrated healthcare organization.

The pharmaceutical & biotechnology companies segment is estimated to grow at the fastest rate in the saliva collection and diagnostics market over the projected period. The growth of the segment is due to the ongoing partnerships and number of product launches by key market players. Partnerships between commercial enterprises and research organizations also propel innovation, leading to further segment expansion. Also, the biotechnology segment is anticipated to grow because of surging biotech product pipelines.

Regional Insights

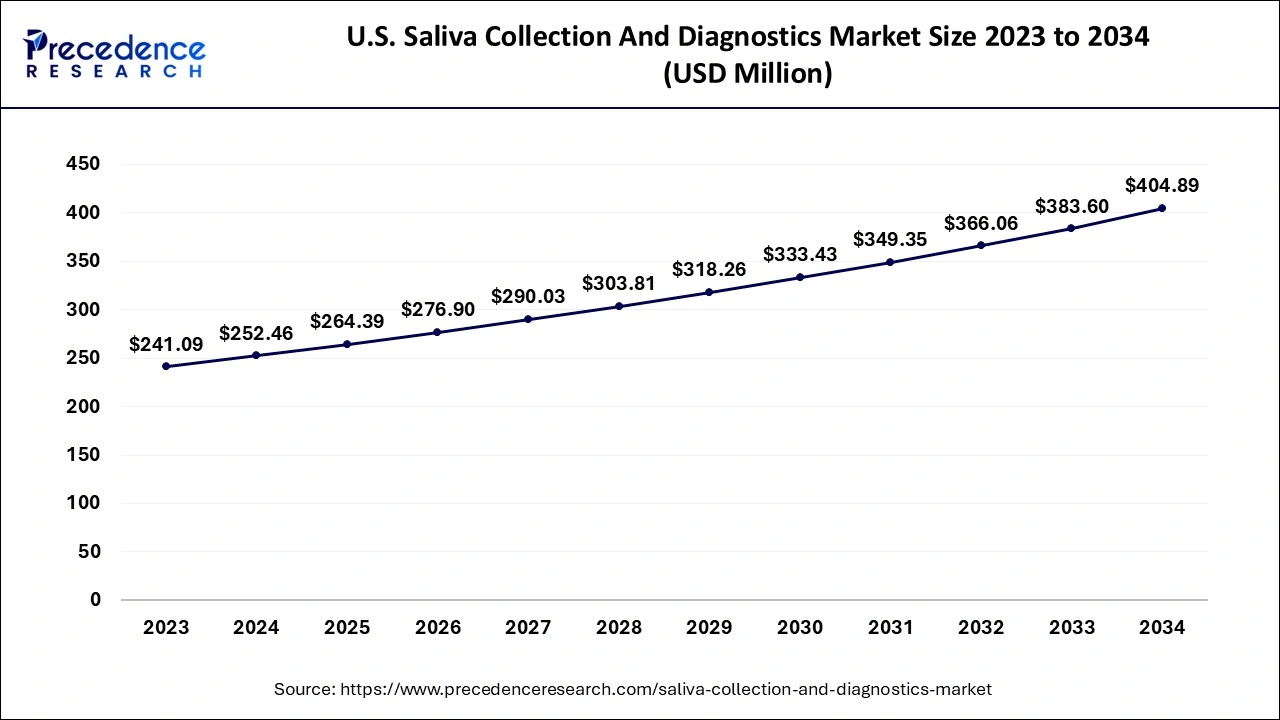

U.S. Saliva Collection and Diagnostics Market Size and Growth 2025 to 2034

The U.S. saliva collection and diagnostics market size is evaluated at USD 264.39 million in 2025 and is projected to be worth around USD 404.89 million by 2034, growing at a CAGR of 4.84% from 2025 to 2034.

North America dominated the saliva collection and diagnostics market in 2024. The dominance of the region can be attributed to the increasing preference for saliva-based tests and the rise in cases of infectious diseases across the globe. Furthermore, in the region, the U.S. led the market owing to the growing demand for non-invasive testing methods offered by saliva sampling methods. Also, the strong presence of a healthcare infrastructure is supporting market expansion further.

- In August 2024, Mark Microbiotech announced the launch of a saliva-based organ age test. This epigenetics-based test marks the growth of the company's business into a saliva-based genetic tests business.

Asia Pacific is anticipated to grow at the fastest rate in the saliva collection and diagnostics market during the forecast period. The growth of the segment can be linked to the rising incidence of infectious diseases where these tests are necessary. Moreover, saliva testing has gained huge acceptance because of its ease of collection and non-invasive nature. In the region, China is projected to show the fastest growth due to clear guidelines established by regulatory authorities.

Asia Pacific: China Saliva Collection and Diagnostics Market Trends

China's market is expanding as non-invasive, easy-to-use saliva-based testing gains popularity for infectious diseases, chronic conditions, genetic analysis, and wellness screening. Technological advances in molecular diagnostics, biosensors, and high-sensitivity assays are enabling faster, more accurate detection and broadening clinical applications. The rise of telehealth, home-based testing, and remote patient monitoring is further boosting adoption, making saliva testing more accessible outside traditional healthcare settings.

Why did Europe grow at a significant rate in the Saliva Collection and Diagnostics Market?

The European market is continuously expanding due to its commitment to advancing non-invasive testing through more efficient usage of raw materials for producing sustainable diagnostic products and funding research to promote early detection of disease. Regulations that require companies to produce safe and effective kits for saliva-based testing were also a key factor in the growth of this market. The rise of at-home testing for both infections and genetic testing is creating additional opportunities for companies offering these types of diagnostics in Europe.

Germany Saliva Collection and Diagnostics Market Trends

Germany led the European market because of its high levels of trust in testing performed early on and the country's substantial medical research capabilities and well-developed laboratory infrastructure. Saliva testing is an accepted practice at hospitals and clinics for both disease and wellness screening. Moreover, companies have invested heavily in R&D to deliver faster and more accurate results from testing their products.

The German government's commitment to supporting the development of digital health solutions and maintaining high standards of safety has positioned Germany as a leader in the European market and enabled it to adopt new saliva-based diagnostic technologies more quickly than most other countries in the region.

Why did Latin America grow at a significant rate in the Saliva Collection and Diagnostics Market?

The growth of Latin America can be attributed to the expansion of healthcare access and the need for low-cost and simple testing methods. Saliva tests have become popular because they provide a viable solution for mass screening within schools, public health clinics, and workplaces. Following COVID-19, governments around the world invested in better methods for diagnosis, while companies from other countries sought to enter the market with affordable kits. Demand for the detection of infectious diseases, mobile diagnostic units, and community health programs that require quick and painless saliva diagnostics has risen dramatically.

Brazil Saliva Collection and Diagnostics Market Trends

Brazil has emerged as the largest market in the region, given its size, increasing access to healthcare, and the presence of diagnostic companies. Saliva tests are extensively utilized in both public and private laboratories for diagnostic purposes as well as for genetic screening. Increased awareness of preventive care has enabled a growing number of people to seek out non-invasive diagnostic methods.

In addition to a large market for such tests, Brazil is also an emerging biotechnology leader, as evidenced by investments in research and development for new testing methodologies and a rapidly growing healthcare network that is providing access to these products.

Why did the Middle East & Africa experience moderate growth in the Saliva Collection And Diagnostics Market?

The Middle East & Africa experienced moderate growth in their healthcare systems through improved early disease detection. Governments began to invest in developing and implementing state-of-the-art diagnostic laboratories and encouraged the use of saliva-based testing methods to facilitate quick and safe screening. Many countries implemented saliva testing kits in schools, airports, and public health initiatives. In these regions, there are numerous opportunities for businesses that provide testing for infectious diseases, travel health examinations, and mobile healthcare clinics.

The UAE Saliva Collection and Diagnostics Market Trends

The United Arab Emirates has become the dominant player in the region due to its substantial investments in innovative technologies and advanced diagnostic facilities. Saliva-based tests are now utilized by hospital and private sector laboratories to allow for rapid diagnosis and sample analysis for screening programs.

Saliva Collection and Diagnostics Market Companies

- Thermo Fisher Scientific, Inc.

- Neogen Corporation

- Abbott

- Sarstedt AG & Co.KG

- Autogen, Inc.

- Oasis Diagnostics

- Porex

- Salimetrics, LLC

- Takara Bio, Inc.

- Arcis Bio

- Orasure Technologies

Latest Announcements by Market Leaders

- In September 2024, Thermo Fisher Scientific announced the expansion of its global laboratory services with a new bioanalytical lab in GoCo Health Innovation City in Gothenburg, Sweden, that will serve pharmaceutical and biotech customers with cutting-edge laboratory services.

- In October 2024, Neogen Corporation, an innovative leader in food safety solutions, announced that it had appointed Thierry Bernard as a director to its Board, effective November 1, 2024.

Recent Developments

- In February 2024, Zymo Research received U.S. Food and Drug Administration (FDA) clearance for its DNA/RNA Shield SafeCollect Saliva Collection Kit for microbial nucleic acid storage and stabilization. The clearance enables the product to be used as a Class II in-vitro diagnostic (IVD) device for saliva collection and transport.

- In January 2024, Isohelix announced the introduction of the SaliFix Saliva Swab DNA Collection Kit, which can be used at home, in the clinic, or at any remote location.

- In October 2023, Salignostics, a startup based in Israel, created a saliva-based pregnancy test, which TIME magazine selected for the best innovation nomination in 2023.

Segments Covered in the Report

By Site of Collection

- Parotid Gland Collection

- Submandibular/Sublingual Gland Collection

- Others

By Application

- Disease Diagnostics

- Forensic Applications

- Research

By End-Use

- Dentistry

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies

- Research Institutes

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting