Security and Vulnerability Management Market Size and Forecast 2025 to 2034

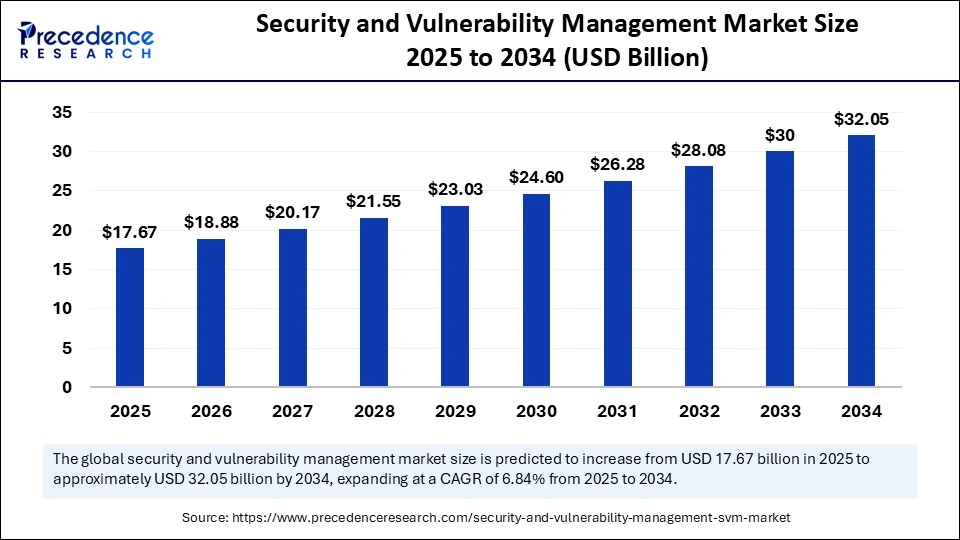

The global security and vulnerability management market size accounted for USD 16.54 billion in 2024 and is predicted to increase from USD 17.67 billion in 2025 to approximately USD 32.05 billion by 2034, expanding at a CAGR of 6.84% from 2025 to 2034. The market growth is attributed to the rising frequency of known-exploit cyberattacks and regulatory mandates demanding continuous vulnerability assessment and risk-based remediation.

Security and Vulnerability Management MarketKey Takeaways

- The global security and vulnerability management market was valued at USD 16.54 billion in 2024.

- It is projected to reach USD 32.05 billion by 2034.

- The market is expected to grow at a CAGR of 6.84% from 2025 to 2034.

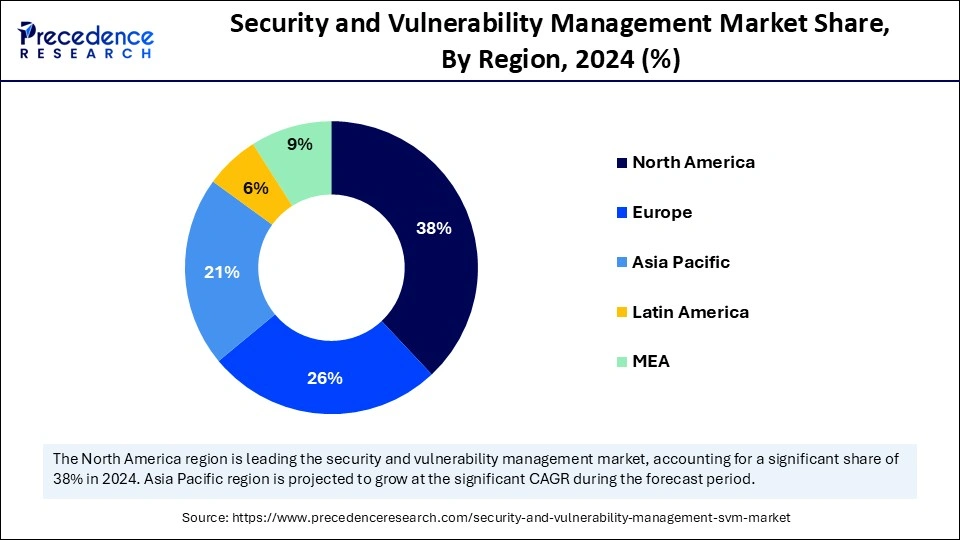

- North America dominated the global market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By component, the software segment held the major market share of 65% in 2024.

- By component, the service segment is projected to grow at the highest CAGR between 2025 and 2034.

- By type, the infrastructure protection segment contributed the biggest market share in 2024.

- By type, the cloud security segment is expanding at a significant CAGR between 2025 and 2034.

- By target, the content management vulnerabilities segment captured the highest market share in 2024.

- By target, the API vulnerabilities segment is expected to grow at a significant CAGR over the projected period.

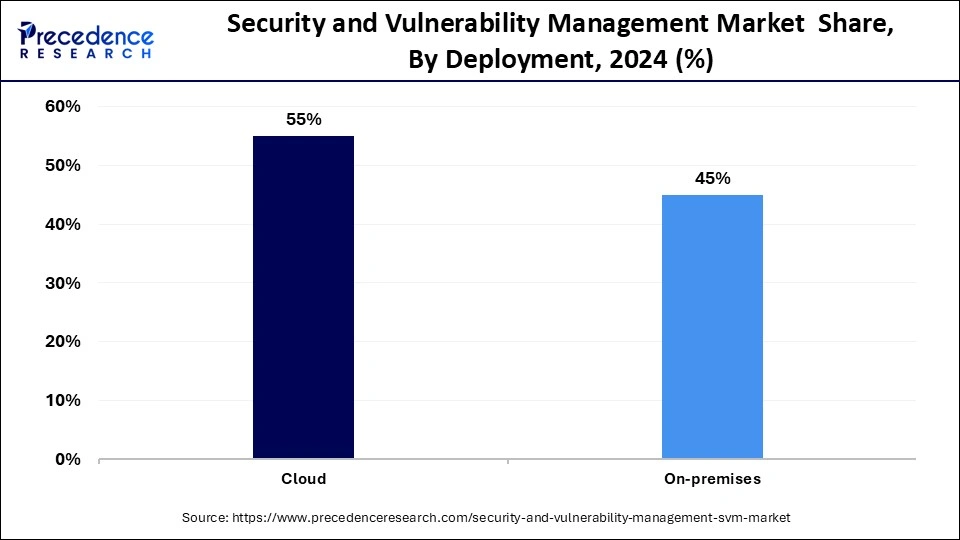

- By deployment, the cloud segment generated the major market share of 55% in 2024.

- By deployment, the on-premises segment is expected to grow at the fastest CAGR from 2025 to 2034.

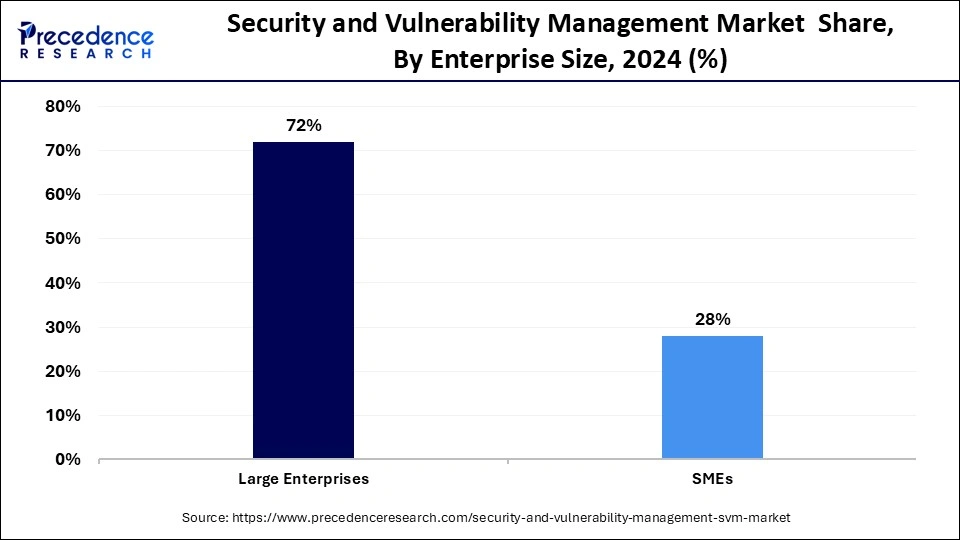

- By enterprise size, the large enterprises segment held the significate market share of 72% in 2024.

- By enterprise size, the SMEs segment is expected to grow at a notable CAGR from 20245 to 2034.

- By vertical, the defense/government segment led the market share in 2024.

- By vertical, the BFSI segment is projected to grow at the fastest CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Security and Vulnerability Management Market

Artificial intelligence is one of the ways of enhancing security and vulnerability management. This helps the organizations to be a step ahead of the prevailing changes in cyber threats. Organizations today are using AI-driven tools that track networks 24/7, crunch huge volumes of data that indicate an occurrence of vulnerability or breach. The smart systems detect patterns that were usually overlooked by the conventional tools, and security personnel could then rank the risks based on the real-time threat intelligence and impact. Furthermore, organizations also use AI to practice attacks, identify concealed vulnerabilities and speed up counteractions.

U.S. Security and Vulnerability Management Market Size and Growth 2025 to 2034

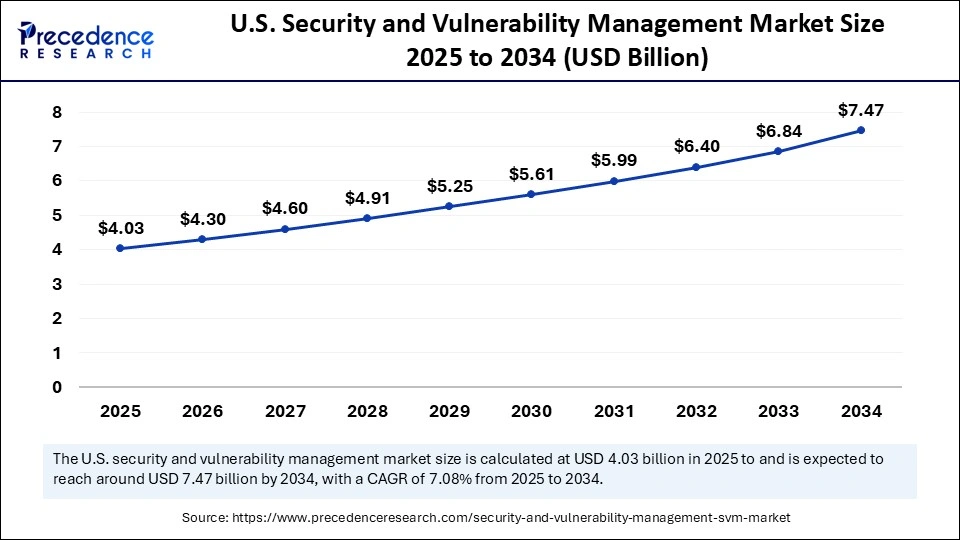

The U.S. security and vulnerability management market size was exhibited at USD 3.77 billion in 2024 and is projected to be worth around USD 7.47 billion by 2034, growing at a CAGR of 7.08%from 2025 to 2034.

North America dominated the security and vulnerability management market, capturing the largest revenue share in 2024, due to the inclusion of the strict security laws and salient breach disclosures that translate to a heightened security investment. The directives of CISA required federal agencies to implement continuous diagnostics and mitigation programs that coerced enterprises towards fully scanning and orchestration platforms of patches.

Larger financial institutions and Fortune 500 corporations located in the U.S. have their own security operation centers (SOC). They are taking DHS and FBI threat intelligence feeds and feeding them into their advanced security operation centers (SOCS). In 2024, the Internet Crime Complaint Center (IC3) of the FBI identified more than 21,000 ransomware attacks in the U.S., which is an indication that vulnerability scanning is going to be preemptive. Additionally, the focus on proactive asset management and ongoing risk exposure monitoring is expected to fuel the market in the coming years.

(Source: https://www.ic3.gov)

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the increasing frequency of cyberattacks and subsequent arising risk vectors that attack the various IT environments in the region. In 2024, the governments of India, Japan, and Australia initiated national cybersecurity frameworks; these included the Indian directives to CERT-In and Japanese JPCERT vulnerability catalog updates. This was expected to have harmonized vulnerability assessment practices between the public and private sectors in these countries.

The Chinese Ministry of Industry and Information Technology (MIIT) also hastened required security assessments on cloud service providers. This further demonstrated the need to have constant scanning and configuration management. The Cyber Security Strategy 2023-2030, released at the end of 2023 and implemented in 2024, provides investments on a large scale in matters of vulnerability intelligence and early warnings across the sector. Furthermore, there is massive growth in platform-based vulnerability management solutions in addition to fast-tracking the local vendor partnerships in the APAC region.

(Source: https://www.homeaffairs.gov.au)

Europe is expected to witness notable growth in the coming years, owing to regulatory frameworks and growing cooperation between the public and the private sector to manage emerging threats in the cyber-security arena. The issue of the NIS2 Directive, coming into force in October 2024, increased the cyber hygiene requirements of critical infrastructure sectors in EU member states. Firms involved in finance, transportation, healthcare, and the energy field are legally obligated to implement continuous vulnerability scanning, risk evaluation services, and incident notification methods. Furthermore, the next-generation API & software supply-chain vulnerabilities and stressing a need to address the third-party risks, thus further boosting the market in the coming years.

(Source: https://digital-strategy.ec.europa.eu)

Market Overview

Strict regulatory standards are likely to boost the adoption rates of security and vulnerability management technology in several industries. The contemporary solutions combine automated scanning agents, real-time patch orchestration, and a behavior-driven analytics approach to protect hybrid IT systems and respond to changing threats. In 2024, the European Union launched its European Vulnerability Database within the NIS2 Directive to assist member states during patch guidance and vulnerability notifications. ENISA noted that disruptive cyberattacks that hit the public administration and the infrastructure doubled in Q1 2024 relative to Q4 2023. The most of them deployed well known threats in their attack means that the importance of ongoing exposure assessment is acute. Furthermore, the growing complexity of cyber threats is also expected to lead to continuous investment in smart and automated vulnerability management systems.

(Source: https://www.enisa.europa.eu)

(source: https://www.enisa.europa.eu)

Security and Vulnerability Management MarketGrowth Factors

- Rising Adoption of Zero Trust Architectures: The shift toward identity-centric models is driving demand for continuous vulnerability assessment across segmented networks.

- Growing Complexity of Multi-Cloud Environments: Expanding hybrid infrastructures are fuelling the need for unified security and vulnerability visibility tools.

- Boosting Demand for Real-Time Threat Intelligence: Organizations are increasingly deploying automated feeds to support proactive risk prioritization and remediation workflows.

- Driving Integration of AI and Machine Learning: Advanced analytics capabilities are enhancing anomaly detection and accelerating incident response in vulnerability platforms.

- Surging Cyber Insurance Requirements: Coverage mandates for demonstrable vulnerability management practices are propelling platform adoption across regulated industries.

- Expanding IT/OT Convergence in Industrial Systems: Cross-domain threats are growing, pushing demand for integrated solutions capable of securing both IT and operational assets.

- Increasing Regulatory Scrutiny on Third-Party Vendors: Rising focus on supply chain vulnerabilities is boosting enterprise investment in extended detection and exposure risk tools.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.05 Billion |

| Market Size in 2025 | USD 17.67 Billion |

| Market Size in 2024 | USD 16.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Target, Deployment, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Sophistication of Cyberattacks

Increasing sophistication of cyberattacks is expected to drive the growth of the security and vulnerability management market. Cyberattacks are becoming more sophisticated, leading to a rise in demand of the advanced threat detection solutions. The techniques that modern threat actors use are very specific and elusive, such as use of zero-day exploits, fileless malware, and polymorphic attacks. Financial, medical and other vital industrial institutions deal with priorities real-time surveillance and automated defense mechanism to reduce the occurrence of damage and idle time. This creates the boom in endpoint protection products and threat intelligence feeds and constant vulnerability scanning tools.

According to CISA, in 2024, the number of intrusions on critical infrastructure within the environment increased by 38% due to more sophisticated tactics by state-sponsored and cybercriminal gangs. As ENISA Threat Landscape 2024 stated, ransomware and supply chain attacks were highlighted among the major five cyber security threats, with ransomware being revolutionized using the mechanisms of double extortion and stealth movement. Furthermore, the AI-enabled security ecosystems that are able to handle high-impact, high-frequency threats in real-time, thus further facilitating the market in the coming years.

(Source: https://www.cisa.gov)

(Source: https://www.enisa.europa.eu)

Restraint

High False Positive Rates

Enterprise confidence restraint on account of high false positive rates, which is expected to hinder the market growth. The constant alerts that security teams have on their hands, as scanning tools are often in excess and are either non-actionable or in average cases, irrelevant. The resulting result of this alert fatigue is desensitization in which kick teams ignore or give warning of possible fake threats more weight. The presence of such inefficiencies, in turn, likely raises the chance of a slow reaction to real exploits in high-pressure situations. Additionally, the organizations lose confidence in the toolsets, become unwilling to invest funds in their updates, and resort to manual work, eventually limiting their development on the market.

Opportunity

Rising Demand for Proactive Risk Management

Spurring demand for proactive risk management strategies is likely to create immense opportunities for the players competing in the market. An increase in demand of proactive risk management techniques probably enhance the position of predictive security analytics. Businesses also seek to get off the old reactive protection cycle to apply behavioral science analytics, threat modeling, and automated simulations to predict and nullify risk. These insights allow companies that work in high-risk sectors to distribute resources used to provide security more effectively and to increase overall resilience. In 2024, NIST revised its Risk Management Framework (RMF) and strongly recommended that it incorporate continuous diagnostics and mitigation (CDM) initiatives that incorporate predictive modeling to evaluate risk exposure in real-time. Additionally, the CERT/CC published the new 2024 guidance regarding the implementation of predictive threat intelligence feed, thus further fuelling the market.

(Source: https://www.cert-in.org.in)

(Source: https://www.nist.gov)

Component Insights

The software segment dominated the security and vulnerability management market with the largest revenue share in 2024. This is mainly due to the increased demand for automated security vulnerability scanning, threat prioritization, and patch management software. Companies started using sophisticated platforms, which combine applications of machine learning and behavior analytics to govern intricate IT environments in real-time. The increased need for automation further bolstered the adoption of software.

The popularity of cloud-native software solutions is expanding due to their scalability and the possibility of reaching hybrid infrastructures. The so-called CISA Known Exploited Vulnerabilities Catalog, which was extended in 2024, helped the software platforms prioritize the threats with regard to the active status of exploitation. Furthermore, the enterprise-level dependency on software-based threat analysis further created a demand for software-based security and vulnerability management solutions.

(Source:https://www.cisa.gov)

The service segment is projected to grow at the highest CAGR in the upcoming period, owing to the increased utilization of consulting, integration, and managed detection and response (MDR) services. Organizations are becoming dependent on outside experience who operate across multi-vendor security ecosystems. The potential risk complexity related to cyber risk and the worldwide lack of cybersecurity resources. This has prompted an outpour of outsourcing vulnerability assessments, penetration testing, and supporting remediation efforts. Moreover, the worldwide shortage of cybersecurity professionals is reported to have exceeded 4 million and this is fueling the need of external managed services, as revealed by (ISC) 2's Cybersecurity Workforce Study 2024.

(Source: https://www.isc2.org)

Type Insights

The infrastructure protection segment dominated the security and vulnerability management market with a major revenue share in 2024, driven by increased threats against IT and OT environments. This further increases the demand for more perimeter defense and network segmentation tools. Organizations now include infrastructure protection platforms alongside SIEM and EDR to acquire multi-layer persistence in cross-layer hybrid networks. Moreover, the aii these measures signal the hard turn into defense infrastructure due to attack surfaces blurring with IT-OT convergence, thus further boosting the segment.

The cloud security segment is expanding at a significant CAGR in the coming years, owing to the rapid growth of multi-cloud environments and increased transfer of vital workloads to cloud systems. Exposure risks prompted business enterprises to focus on the preservation of cloud-native applications, storage, and services. The Binding Operational Directive 25-01 issued by CISA in December 2024 emphasized cloud security. Through the Secure Cloud Business Applications (SCuBA) project, CISA has developed Secure Configuration Baselines to provide consistent, effective, and manageable cloud security configurations. Additionally, the manufacturers of automated cloud posture management systems confirmed their leadership with another boost, which was increased regulatory guidance by NIST and ENISA on investment-related matters.

(Source: https://www.cisa.gov)

Target Insights

The content management vulnerabilities segment dominated the security and vulnerability management market in 2024, driven by the proliferation of WordPress, Drupal, and Joomla and slow patching cycles. In the first half of 2024, VulnernCheck indicated that CMS systems were one of the top five products being used on the known exploited vulnerability (KEVs). Publishing firms, e-commerce companies, and education institutions tended to install third-party plugins. This increased the degree of threat and made robotic solutions to scan CMS necessary. Furthermore, the reduce injection-based and privilege escalation attacks on dynamic content of websites, security teams installed ongoing monitors and secured CMS settings.

(Source: https://vulncheck.com)

The API vulnerabilities segment is expected to grow at a significant CAGR over the projected period, owing to the fast expansion of APIs in microservices, mobile applications, and cloud-native architectures. In May 2024, CISA launched its Vulnrichment program, allowing to addition of contextual CVE information, such as API-specific CWE classification, to enhance the prioritization of exploits. The security experts noted increased API abuse by the developers who find it difficult to ensure authentication, rate constraint, and validation of input in the dynamic interfaces. Additionally, the increase in API-related misuse, which resulted in data breaches and unauthorized access, is expected to propel the market.

(Source: https://www.cisa.gov)

Deployment Insights

The cloud segment held the largest revenue share in 2024. This is mainly due to the increased need for scalable and agile vulnerability management capabilities across dynamic digital environments. According to Flexera, 89% of institutions in the world executed hybrid or full cloud security plans in their enterprises, which demonstrate the evolution towards elastic and multi-cloud infrastructures. Additionally, the advent of serverless computing and ephemeral infrastructure will continue to drive the demand for advanced and API-integrated cloud security architectures.

(Source: https://www.flexera.com)

The on-premises segment is expected to grow at the fastest rate during the forecast period, driven by regulatory compliance and the demand to maintain control over the infrastructure and data, especially in industries dealing with highly sensitive information. Organizations operating in sensitive infrastructure sectors, including the government, defense, and financial services, are likely to use on-premises frameworks to take advantage of transparency and the auditable nature of their behavior. The 2024 Threat Landscape Report by ENISA recorded increased targeted malware jabs on physical assets, SCADA systems, and on-site servers, thereby advancing endpoint detection systems and hardened segmentation protocols. Furthermore, the re-revival of on-premise deployments is also aided by increasingly tight IT and operational technology (OT) interdependencies especially in the case of cloud latency and data sovereignty being not negotiable.

(Source: https://www.enisa.europa.eu)

Enterprise Size Insights

The large enterprises segment dominated the security and vulnerability management market with the biggest market share in 2024 due to their wide IT systems, increased exposure to the targeted cyber threat, and strict regulatory needs. These entities implemented complex vulnerability management credentials linking asset discovery, risk prioritizing, automated correction, and threat data union to protect their operations that were remotely located.

CISA and ENISA together highlighted the importance of real-time threat detection in environments of scale, following on the heels of highly critical vulnerabilities, including the MOVEit exploit of file transfer programs, which hit numerous Fortune 500 companies and government agencies. Additionally, the need of enterprise-grade security management systems that have multi-tenancy capabilities is fuels the demand for security and vulnerability management solutions.

The SMEs segment is expected to grow at the fastest CAGR in the upcoming years, owing to the rising occurrences of supply chain and ransomware attacks affecting resource-crunched businesses the most. This trend increased the attention and need for cost-effective, automated vulnerability scanning and endpoint protection tools targeting SMEs.

As a solution to the problem of finding enough workers and the lack of in-house skills, it is thought that SMEs seek to adopt more cloud-based, managed vulnerability services and more MDR services. In 2024, ENISA published SME-specific guidelines to adopt secure software and vendor risk assessments, further stressing the importance of proactive risk identification and mitigation at smaller companies. Furthermore, a high number of cybersecurity vendors introduced subscription services targeting SMEs, which further boosted the market in the SME sector.

(Source: https://www.enisa.europa.eu)

Vertical Insights

The defense/government segment dominated the security and vulnerability management market with a major share in 2024, driven by growth in cyber warfare, geopolitical tensions, and growing targeting of the national infrastructure. Government agencies are supposed to increase expenditure in vulnerability management functions that meet up with a zero-trust requirement, continuous diagnostics and mitigation (CDM), and risk-based vulnerability prioritization.

Governments came up with Vulnerability Disclosure Programs (VDPs), Vulnerability Equities Processes (VEPs), and frameworks to share threats information on a public-private basis to fortify national security stance. European Union Agency for Cybersecurity (ENISA) has published in 2024 that the attacks against the networks in the public sector have risen by 58%. This compares the years regarding Europe, especially in remote access and threats to the firmware level. Furthermore, these frameworks are also expected to boost the use of critical infrastructure providers in sectors driving demand of scalable and compliance-ready vulnerability management solutions until the end of the decade.

(Source: https://www.enisa.europa.eu)

The BFSI segment is expected to expand at the fastest rate in the coming years, owing to its highly-valued data resources, regulatory risk, and its growing dependence on digital infrastructure. The financial institutions implemented well-developed vulnerability management apps to handle the risk posed by online banking, third constructions in fintech, and mobile applications. In 2023, FBI and CISA released several advisories that featured targeted phishing campaigns, credential stuffing, and unpatched system exploitation throughout financial organizations.

This led to BFSI organizations embracing continuous scanning of vulnerability and automated patch management frameworks rather than transaction systems. Furthermore, the dramatic increase in the number of software supply chain breaches against core banking vendors is expected to propel the segment in the coming years.

Security and Vulnerability Management Market Companies

- AT&T Intellectual Property.

- Cisco Systems, Inc.

- CrowdStrike

- Fortra, LLC

- IMB Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

Latest Announcement by Industry Leader

- In April 2025, N-able, Inc., a global leader in unified cyber resiliency software, announced the upcoming launch of its Vulnerability Management feature for its Unified Endpoint Management (UEM) solutions, N-central and N-sight. This new integrated capability enables IT teams to identify, prioritize, remediate, and report vulnerabilities across all major operating systems through a centralized interface. The built-in solution offers continuous visibility into endpoint vulnerabilities, streamlined prioritization based on risk, and automated workflows to accelerate remediation efforts. By consolidating these capabilities into a single unified platform, N-able empowers managed service providers (MSPs) and IT teams to respond faster to emerging threats while reducing overall business risk. “Our partners are thrilled with our new built-in capabilities to identify vulnerabilities within their applications and operating systems and remediate them, all through the UEM,” said Jim Waggoner, Vice President of Product Management at N-able. “This feature empowers them to offer enhanced services to their customers and significantly reduce business risk.” According to early insights from the feature's preview, customers identified an average of three vulnerable applications per endpoint, all of which are now manageable through N-able's automated remediation workflows. This enhancement not only boosts endpoint security but also helps create a more resilient and stable IT environment.”

(Source: https://www.n-able.com)

Recent Developments

- In April 2025, Black Kite, a leading provider of third-party cyber risk intelligence, launched its Vulnerability Intelligence Briefs (VIB), a solution designed to go beyond conventional Common Vulnerabilities and Exposures (CVEs) listings. The VIB offering equips security professionals with critical insights into vulnerability severity, exploitability, and real-world exposure within their vendor ecosystems. As reliance on third-party platforms grows, organizations face heightened risk from external systems that often fall outside traditional vulnerability management scopes. Black Kite's new solution addresses this blind spot by offering real-time visibility into external vulnerabilities that may otherwise go undetected, helping reduce the cascading risks associated with unpatched weaknesses in partner or vendor environments.

- In April 2025, N-able announced two significant upgrades to its cybersecurity portfolio, introducing integrated vulnerability management into its Unified Endpoint Management (UEM) tools and adding Adlumin's Microsoft 365 breach prevention capabilities to the Ecoverse platform. The vulnerability management functionality is now embedded within N-able's N-central and N-sight solutions, enabling managed service providers (MSPs) to gain a centralized view of vulnerabilities across all major operating systems. This integration empowers MSPs to seamlessly detect, prioritize, and remediate system vulnerabilities. Simultaneously, the Adlumin integration strengthens breach detection and prevention for Microsoft 365 environments, offering a layered security approach for businesses leveraging cloud-based productivity tools.

(Source: https://industrialcyber.co)

(Source: https://www.crn.com)

Segments Covered in the Report

By Component

- Services

- Software

By Type

- Application Security

- Cloud Security

- Data Security

- Endpoint Security

- Infrastructure Protection

- Network Security

- Others

By Target

- API Vulnerabilities

- Content Management Vulnerabilities

- IoT Vulnerabilities

- Others

By Deployment

- Cloud

- On-premises

- By Enterprise Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Defense/Government

- Energy

- Healthcare

- IT and Telecom

- Manufacturing

- Retail

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting