What is the Single-use Bioreactors Market Size?

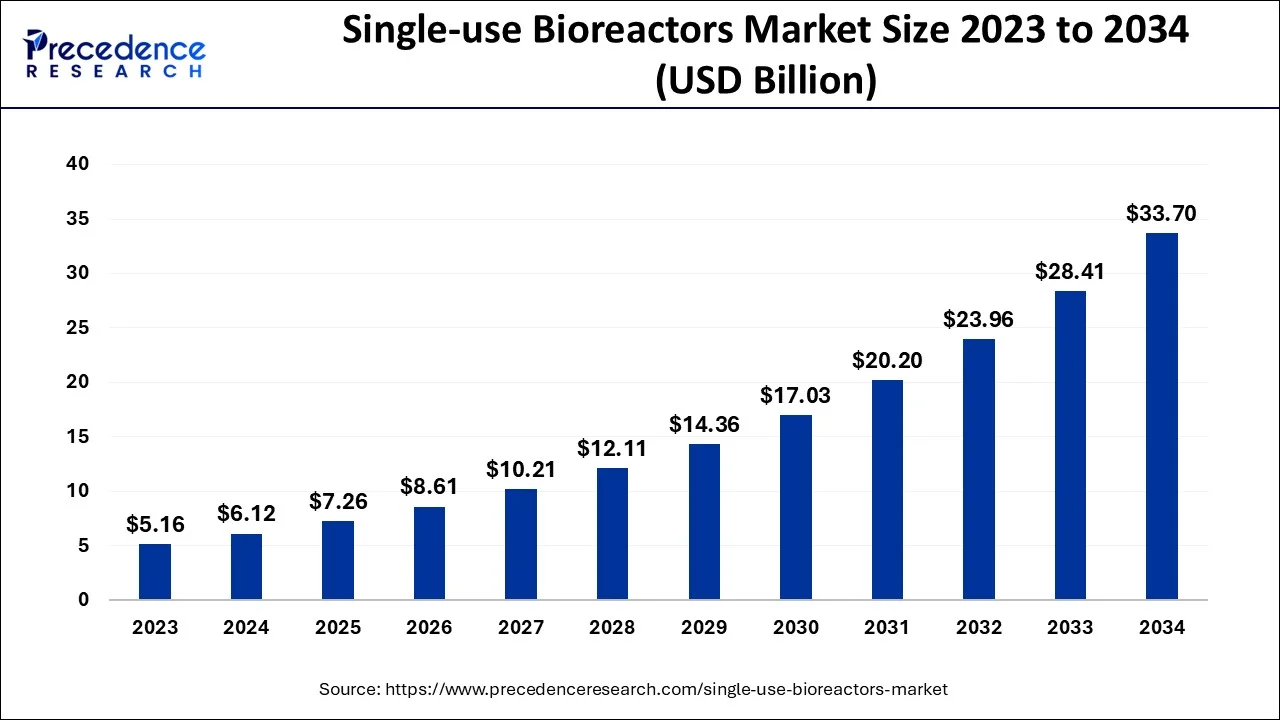

The global single-use bioreactors market size is valued at USD 7.26 billion in 2025 and is predicted to increase from USD 8.61 billion in 2026 to approximately USD 38.99 billion by 2035, expanding at a CAGR of 18.3% from 2026 to 2035.

Market Highlights

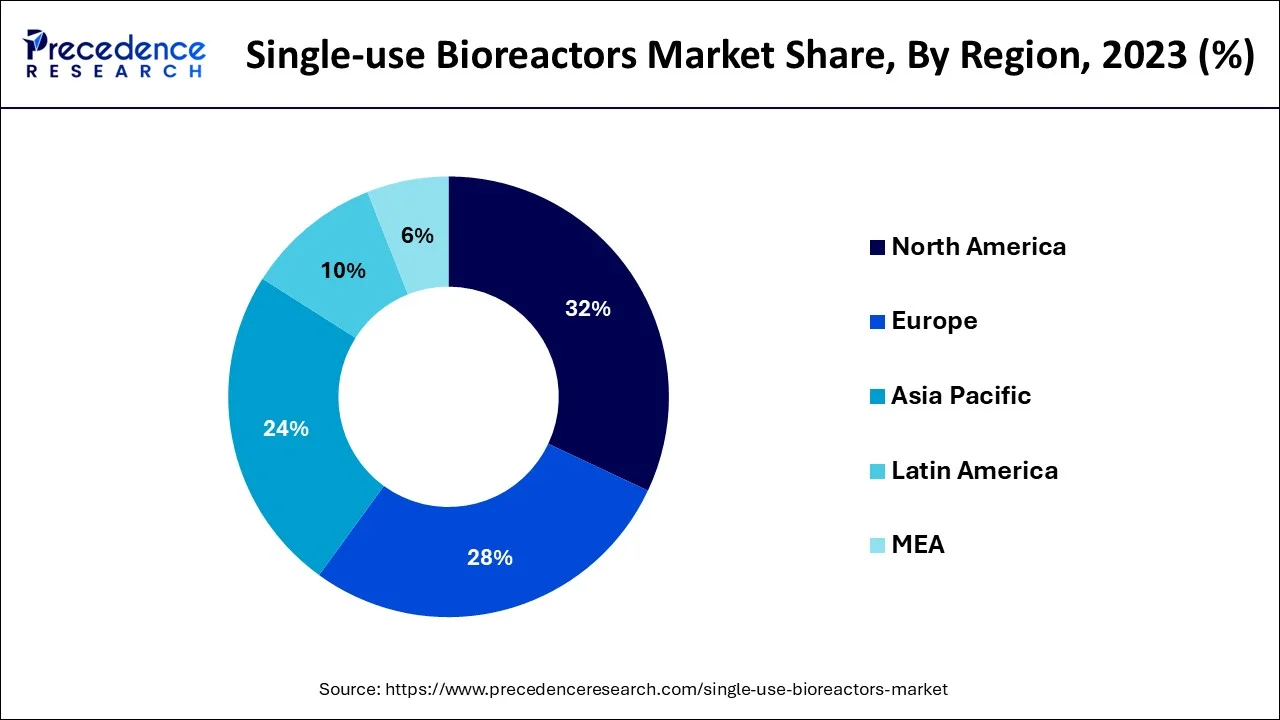

- North America has accounted highest revenue share of around 32% in 2025.

- By end use, the CMOs and CROs segment has captured 40% revenue share in 2025.

- By usage type, the lab-scale production segment has reached 37% revenue share in 2025.

- By application, the research and development (R&D)/process development segment has held 76% revenue share in 2025.

- By molecule type, the vaccines segment has accounted revenue share of around 26% in 2025.

- By type of cell, the mammalian cells segment accounted for 81% market share in 2025.

- By type, stirred tank bioreactors segment accounted for 82% of the total revenue share in 2025.

- By product, the single-use bioreactor systems segment has held an 80.6% revenue share in 2025.

What is the Single-use Bioreactors?

The single-use bioreactors market has shown a notable increase in sales despite the worldwide COVID-19 epidemic. As a result, the need for single-use bioprocesses has skyrocketed. The size of stainless-steel fermenters and associated high capital costs have become an issue due to the shifting market for pharmaceuticals. Due to their adaptability, SUBs have achieved successfully the rising need for pharmaceuticals while overcoming issues that are often connected with bioreactors. One of the main business drivers of investing in single-use biopharmaceutical technologies is acknowledged to be versatility.

How is AI contributing to the Single-use Bioreactors Industry/Process?

AI technology is used for the purpose of real-time sensor analytics and automated control in single-use bioreactors. Predictive modeling is capable of detecting anomalies early and dynamically adjusting the operating parameters to the optimum. Digital twins are assisting in faster and safer scale-up, besides process development. Automated data capture is contributing to compliance, traceability, and audit readiness. Resource optimization is reducing waste, downtime, and costs across the whole biopharmaceutical manufacturing process.

Single-use Bioreactors Market Growth Factors

The single-use bioreactors have the potential to lower the price of traditional bioprocesses. Disposable biofilters typically have lower investment costs than traditional stainless-steel biopharmaceutical devices. Therefore, the cost-saving benefits in terms of development, operation, and maintenance can be primarily responsible for the acceptance of these items. Cost, reaction size, ideal operating capacity, temperature control, and throughput are all factors to be taken into account when choosing a single-use culture system. Additionally, it is projected that in the upcoming years, the use of throwaway bioreactors will increase due to the increased demand for highly effective medicines on a global scale that doesn't necessitate a significant number of bioprocesses. Small-scale, bench-top SUBs reduce the requirement for assembly, washing, and thermal treatment, which results in a quicker turnaround time. Such reactors are regarded as the workhorses of method advancement and optimization, promoting the use of SUBs for the production of biopharmaceuticals.

Market Outlook

- Growth in the Industry: The market is growing rapidly due to the demand for biologics, production of vaccines, flexibility of operation, and cost booster.

- Sustainability Trends: Producers look into recyclable substances and energy-saving techniques to minimize the problem of plastic waste.

- Global Expansion: North America is the most adopting country, whereas Asia-Pacific is experiencing the most rapid growth with the increase in biomanufacturing investments.

- Major Investors: Sartorius AG, Danaher Corporation, Thermo Fisher Scientific, and Merck KGaA are market leaders.

- Startup Ecosystem: Startups and SMEs use single-use systems because they require less capital as compared to traditional equipment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.26 Billion |

| Market Size in 2026 | USD 8.61 Billion |

| Market Size by 2035 | USD 38.99 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.30% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Product,By Type, By Type of Cell,By Molecule Type,By Application,By End-Use,By Usage Type, and region |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa, and region |

Market Dynamics

Drivers

Rising R&D spending on biopharmaceuticals

- Because of the increasing elderly population's increased susceptibility to a variety of diseases, there has been a growing market for biopharma on such a global scale. Global corporations are concentrating on biomedical manufacturing and research for product innovation and enhanced production in response to this need. Workflows for producing biopharmaceuticals must include single-use technology. Single-use methods have become more popular in biomedical R&D because of their benefits over traditional biopharmaceutical methods. As a result, it is believed that increased R&D spending is a sign that the industry is expanding.

Challenges

Better single-use devices are utilized

- One of the main issues in the industry is the lack of accurate, dependable, and affordable sensors that can fulfil the requirements of SUBS. To order to administer the systems without compromising the sterile of substances, sensors utilized in SUBS must be consistent with the current SUB systems. Nevertheless, due to problems with removal from aqueous solutions and ethanolic extracts, the integrity of detectors that are currently on the market does not meet GMP requirements. However, there is room for advancement in this product category, including the creation of more precise and customized process detectors for parameter settings such as pH, flow measurement, temperature, and quality of products, that can then be integrated into the biocatalytic work process. The above poses a challenge during using SUBS.

Opportunities

- Developing Nations: The considerable development potential provided by developing nations like India, China, and Indonesia could be ascribed to strong growth in the individual pharmaceuticals and biotechnology industries because of the availability of low-cost, trained labour and far less restrictive regulatory laws. These nations serve as a hub for such exporting of bioprocesses due to their lower labour costs and skilled workforce. Single-use devices are expanding more quickly in emerging economies.

Segment Insights

Product Insights

Single-use fermenter systems are now widely used in pharmaceutical production methods that prioritize high production yield. Single-use bioreactors' versatility, cost-effectiveness, and rapidly increased manufacturing will increase demand, which will have an impact on economic growth. Due to these benefits, there will be greater demand for quick growth, higher production of novel therapeutic drugs including vaccines, enzymes, antibodies, and hormones, and larger product volumes that may be produced in these bioprocesses, all of which will help the market expand.

Additionally, growing interest from major players in offering small-scale culture systems will fuel the company's rise in the upcoming years. The accessibility of reusable biocatalytic bags in a variety of shapes for just a variety of uses, including the storing of chemicals, cell cultures, buffers, or sterilized media is predicted to drive market expansion. Single mainstream bags improve production repeatability by providing resilience, hardness, and heat resistance.

Type Insights

In 2025, mixed plate biofilters accounted for the biggest revenue proportion. The market development of continuous stirred tank bioprocesses is at its maximum level thanks to features supplied by such bioprocesses such as good oxygen transmission and liquid mixing capabilities, cheap operational costs, simple scale-up, conformity to cGMP criteria, and different propellers. In addition, it is projected that the increased use of continuous stirred-tank SUBs in huge production would spur market expansion in the upcoming years. The ability to scale up and down with ease has helped fulfil the demands of the current output.

Additionally, the availability of wave-induced separate bioreactors would increase in the coming years, boosting overall growth. For the past ten years, Waves Biotech AG has provided the first wave fermenter BIOSTAT RM. More lately, the business unveiled the second version, BIOSTAT RM II, which has upgraded capabilities and a better temperature regulation & propulsion system. During the projected period, these manufacturing improvements will fuel the demand for wave-induced solitary bioprocesses

Type of Cell Insights

In 2025, the sector of mammalian cells held the highest share. This might be due to the significant penetrating of these organisms in the creation of pharmaceutical therapies and the wide commercial successes of transgenic enzymes produced from human cells. 85% of pharmacological prospects in preclinical studies, according to Bioprocess Worldwide, are created in human cultured cells. Mammalian cell culture for the creation of recombinants has also swiftly advanced their use in clinical contexts. Another important aspect that is anticipated to have a considerable impact on market expansion in the forthcoming years is the expanding use of single-use bioprocesses for mammalian cultured cells in different research investigations.

Yeasts are dependable eukaryotic carriers again for the synthesis of fusion proteins and offer special benefits in the generation of medicinal homologous sequences. The increasing attention given by numerous research organizations and scientists to the use of the fermentation process in medical or medicinal contexts will hasten market expansion during the projected timeframe.

Molecule Type Insights

With a larger overall revenue in 2025, that vaccine category dominated the marketplace. This is mostly because of the Severe acute respiratory virus's widespread outbreak, which has created an immediate requirement for a pandemic vaccine. According to the COVID-19 Effects on Bioprocessing research by Bio Plan Partners, single-use solutions used in commercial production are predicted to rise sharply. These initiatives rely heavily on single-use bioprocesses because they are adaptable, economical, and less likely to cause cross-contamination.

The industry is expected to be driven by this steady rise in the consumption of single-use solutions. Additionally, the growing field of gene and cell therapy is anticipated to accelerate the uptake of SUBs throughout this market. Sartorius, as well as Rooster Bio, Inc., teamed up in Jan 2021 to improve the production capacities for cell and gene therapies. The partnership aims to increase the output of tissue regeneration. One of the major players in the marketplace for single-use bioprocesses is Sartorius.

Application Insights

The expansion of research and innovation processes accounted for the biggest revenue proportion. Single-use fermenter utilization in systems integration is a driving force behind the industry's expansion. For example, according to the article written by American Pharmacy, the business used this single-use bioreactor for systems integration.

Moreover, every component of the bioprocessing sector uses single-use devices. This demonstrates the predominance of single-use bioprocesses in clinical production and R&D. In the nearest term, it is projected that the bioproduction sector will see a rise in the use of these bioprocesses. Removable reactors are increasingly being used on a broad scale, first from the laboratory to the industry, as a result of substantial improvements in bioreactor layouts, sensor systems, film technology, and swirling motors.

End-Use Insights

The segment with the highest revenue share in 2025 more than 36% was CMOs & CROs. CMOS has a significant desire for more variable manufacturing capacity as well as fast program switchovers. They thus use a greater variety of single-use parts and systems. CMOS & CROs are increasingly inclined to use SUBs as a result of the rising tendency of outsourced.

This development is linked to the effectiveness and application of SUBs in managing various pharmaceutical commodities and shifting market needs. These elements result in substantial SUS gadget adoption enabling quicker CMO acceptance of new SUS technology. The sector is being driven by CMOs' dynamic processing line & capabilities as well as more consistent product designers for biotechnological processes machinery and infrastructure.

Usage Type Insights

In 2025, the research facility production sector had the biggest income proportion. In the pharmaceuticals sector, throwaway fermenters are frequently employed in preliminary and clinical studies. The company's growth is anticipated to be significantly impacted by the growing usage of single-use technologies in cell treatment studies and vaccine manufacture. Throughout the projected period, it is expected that the massive production category would experience significant expansion. This is due to the fast-increasing need for the commercial operations of biological goods and the increase of manufacturing capacity to satisfy the need. During the projection term, biotechnology and pharmaceutical businesses should experience profitable growth possibilities. The market expansion was further reinforced by strategic alliances among product producers and pharmaceutical firms.

Regional Insights

U.S. Single-use Bioreactors Market Size and Growth 2026 to 2035

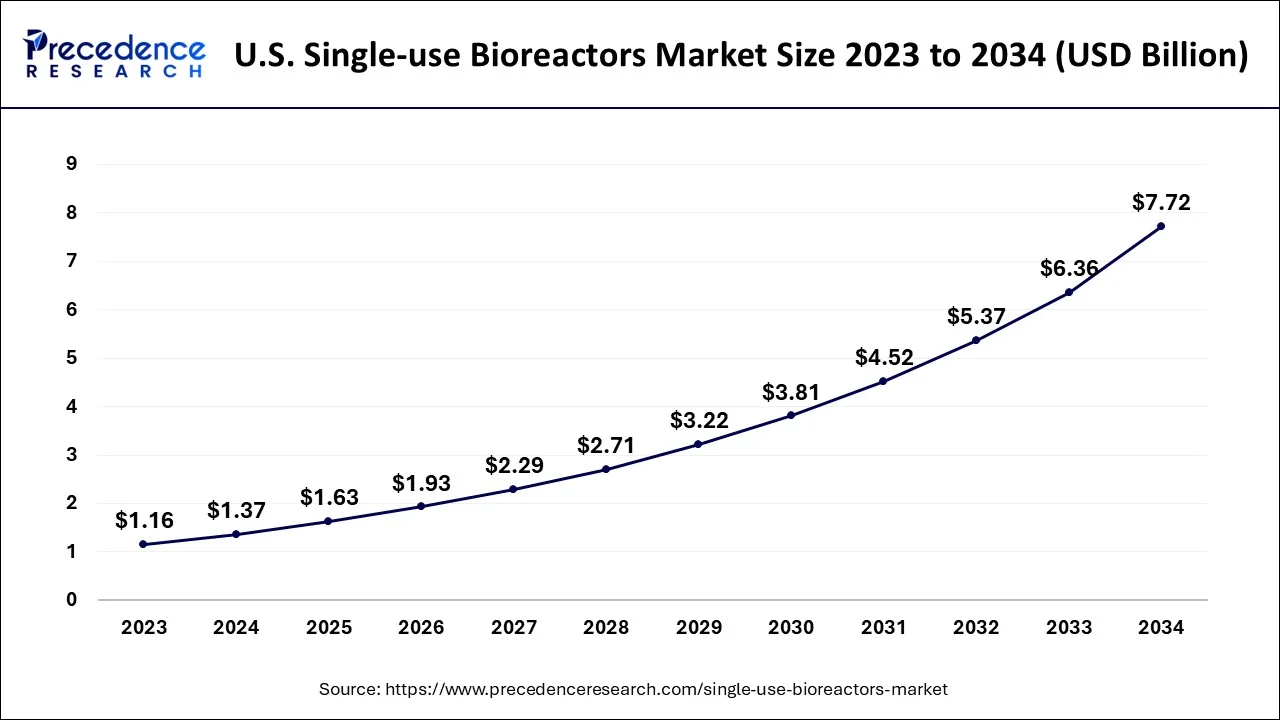

The U.S. single-use bioreactors market size is evaluated at USD 1.63 billion in 2025 and is predicted to be worth around USD 9.08 billion by 2035, rising at a CAGR of 18.74% from 2026 to 2035.

In 2025, North America's overall revenue was the highest. This is explained by the existence of significant operating firms and the country's well-established biotech industry. For example, Thermo Fisher Laboratories said in September 2021 that it intended to build a new production facility specifically for single-use bioprocessing solutions. During the projected timeframe, Asia Pacific is anticipated to have the fastest CAGR. According to estimates, Asian businesses, both domestic contenders and global behemoths are building around 50 per cent of the newest biorefinery facilities worldwide. In the coming years, this is anticipated to significantly drive the global market in Asia-Pacific. Due to its widespread usage of single-use technologies, China is predicted to be at the front.

U.S. Single-Use Bioreactors Market Analysis

The market in the U.S. is growing due to increasing demand for flexible and cost-effective bioprocessing solutions within the pharmaceutical and biotechnology sectors. Adoption of single-use bioreactors is being driven by the rapid growth of biologics production, the need to minimize high capital investments associated with stainless-steel fermenters, and the benefits of scalability and operational efficiency. Additionally, faster turnaround times and reduced contamination risks make single-use systems highly attractive for therapeutic and vaccine manufacturing.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is the fastest growing market for the single-use bioreactors market with a significant CAGR during the forecast period, propelled by the expanding pharmaceutical and biotechnology industries. Nations such as China, India, and South Korea are making significant investments in biologics manufacturing and research infrastructure. The increasing trend of outsourcing to contract manufacturing organizations (CMOs), along with heightened clinical trial activities and favorable regulatory environments, are also boosting growth. Local governments are promoting biotech innovation and production, establishing the region as a prime area for the adoption of single-use bioreactors. Furthermore, the need for flexible, scalable, and contamination-free systems in biologics production is generating considerable momentum across emerging Asian markets.

India

India is quickly emerging as a significant contributor to the single-use bioreactors market, driven by its expanding biosimilar manufacturing sector and increasing government backing for biopharmaceutical research and development. Indian pharmaceutical companies are utilizing single-use bioreactors to achieve cost-effective and accelerated biologics production. Moreover, the influx of foreign investments, enhanced regulatory clarity, and partnerships with international biotech companies are establishing India as a strategic center for flexible, single-use biomanufacturing solutions.

How is the Opportunistic Rise of Latin America in the Single-Use Bioreactors Market?

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by the region's robust biotechnology sector and the growing demand for biologics and cell therapies. Key countries like Germany and Switzerland are concentrating on advanced biomanufacturing, backed by strong collaboration between academic institutions and industries. The movement towards producing smaller batches and personalized medicine complements the flexibility offered by single-use systems. Additionally, the existence of numerous contract development and manufacturing organizations (CDMOs) and the region's commitment to sustainable, low-waste solutions have promoted the integration of disposable technologies throughout various phases of drug development and manufacturing.

Germany

Germany is at the forefront of Europe's single-use bioreactors market, benefiting from a strong pharmaceutical industry and a strong focus on innovation. The country has a solid infrastructure dedicated to biotech research and development, alongside effective collaborations between industry and academia that promote the quick adoption of new bioprocessing technologies. Germany's emphasis on automation, efficiency, and contamination control in biomanufacturing creates an ideal environment for single-use systems, particularly in vaccine and biologics production.

Biotech Goes Disposable: Latin America's Single-Use Bioreactor Boom

Latin America's biopharmaceutical sector is rapidly embracing single-use bioreactors as manufacturers seek faster, more flexible, and cost-efficient production solutions. The shift is driven by growing biologics demand, expanding vaccine production, and increased investment in local biomanufacturing capabilities. Single-use systems reduce contamination risk, lower capital expenditure, and shorten setup times, making them ideal for emerging and mid-scale biotech facilities across the region.

Brazil Single-Use Bioreactor Market Trends

Brazil's market is expanding as biopharmaceutical manufacturers increasingly adopt disposable systems to support flexible, cost-effective production of vaccines, monoclonal antibodies, and recombinant proteins. Demand is rising with the country's growing focus on local biomanufacturing capacity, driven by public health priorities and efforts to reduce dependency on imported biologics.

Value Chain Analysis

- Raw Materials Sourcing: This stage involves the sourcing of essential raw materials such as biopolymers, plastics, films, resins, sensors, and tubing used to manufacture single-use bioreactor components. manufacturing.

Key players: Dow Inc., SABIC, BASF SE, Celanese Corporation, and Eastman Chemical Company. - Component & Consumables Manufacturers: At this stage, raw materials are converted into specialized components such as disposable bags, filters, connectors, sensors, and tubing assemblies.

Key players: Entegris, Saint-Gobain Life Sciences, Parker Hannifin, Freudenberg Medical, and Repligen Corporation. - Single-Use Bioreactor System Manufacturers: This stage involves the design and production of complete single-use bioreactor systems, including control units, mixing systems, automation software, and integrated disposable assemblies.

Key players: Thermo Fisher Scientific, Sartorius AG, Cytiva (Danaher), Merck KGaA (MilliporeSigma), and Pall Corporation.

Top Companies Operating in the Market & Their Offerings

- Applikon Biotechnology B.V. – Supplies customizable single-use bioreactor systems like AppliFlex ST and Bio-One for lab-to-pilot bioprocessing with flexible configurations and accurate control for cell culture and fermentation.

- Aptus Bioreactors – Develops innovative bioreactor platforms and accessories, including systems for tissue-engineered heart valves and vascular bioreactors, aiding specialized biological growth and testing applications.

- Cellexus Ltd – Offers CellMaker single-use airlift bioreactor systems designed to simplify and accelerate cell culture and fermentation with efficient oxygen transfer and minimal contamination risk.

- Celltainer Biotech BV – Provides multi-purpose single-use bioreactor platforms featuring patented 2D rocking technology for uniform mixing and mass transfer in microbial, mammalian, and hybrid cell cultures.

- CESCO Bioengineering Co., Ltd. – Supplies customizable single-use bioprocessing equipment and bioreactor solutions for biotechnology and pharmaceutical research and production.

- Danaher Corporation – Offers a broad range of bioprocessing technologies through subsidiaries, including Pall single-use bioreactors that support scalable, contamination-reducing biomanufacturing.

- Distek Inc. – Manufactures BIOne single-use bioreactor systems with gamma-sterilized disposable liners, enabling easy, contamination-free cell culture and bioprocessing workflows.

Other Single-use Bioreactors Market Companies

- ABEC Inc.

- Able Corporation & Biott Corporation (Japan)

- Cell culture company

- ENDEL ENGIE

- Eppendorf AG (Germany)

- G&G Technologies Inc. (Australia)

- GE Healthcare

- Getinge AB (Sweden)

- GPC Bio

- Infors AG.

- Meissner Filtration Products Inc.

- Merck KgaA (Germany)

- New Horizon Biotechnology Inc.

- OmniBRx Biotechnologies

- Pall Corporation

- Parker-Hannifin Corporation,

- PBS Biotech Inc. (US)

- Pierre Guerin Technologies

- Sartorius Stedim Biotech (Germany)

- Satake Chemical Equipment Mfg., Ltd. (Japan)

- Solaris Biotechnology SRL

- Solida Biotech GmbH (Germany)

- Stobbe Pharma GmbH (Germany)

- Thermo Fisher Scientific (US)

Recent Developments

- In April 2025, Thermo Fisher Scientific launched the 5L DynaDrive Single-Use Bioreactor to enhance bioprocessing. It increases productivity, reduces time to market, and provides scalability from 1 to 5,000 liters, supporting the efficient development and commercialization of therapies with consistent reactor designs. (Source: https://www.biospectrumasia.com )

- In April 2025, AGC Biologics announced plans to deploy large-scale single-use technology at its new Yokohama, Japan facility. The site features two 5,000 L Thermo Scientific DynaDrive single-use bioreactors, positioning it among Japan's most advanced plants for large-scale mammalian biologics manufacturing.(Source: https://www.agcbio.com)

- In April 2025, WuXi Biologics completed its first commercial Process Performance Qualification (PPQ) campaign using three 5,000 L single-use bioreactors at its MFG20 facility in Hangzhou, China, marking a key milestone for large-scale drug substance production.

(Source: https://www.prnewswire.com) - In March 2024,Getinge launched the SUPR (Single-Use Production Reactor) system, offering enhanced scalability and flexibility for biomanufacturers in response to the increasing demand for high-quality, single-use solutions for both clinical and commercial biologics production.

- In April 2023, Merck unveiled Ultimus, a new single-use film engineered for improved durability and leak resistance in bioprocessing containers. This innovation promotes secure and effective biomanufacturing processes across global pharmaceutical operations.

- In May 2025, the French company eureKING acquired Skyepharma, aiming to enhance its biomanufacturing capabilities. This acquisition strengthens eureKING's standing in the European biologics production arena and supports the rising need for single-use bioreactor technologies.

- To integrate Pall Company's (US) iCELLis biopharmaceutical equipment into Freeline's (UK) adeno-associated viruses manufacturing platform, the two companies partnered in 2019. This collaboration seeks to produce AAV regenerative medicine viruses on a large scale and at a high standard.

- 2018 saw the acquisition of Applikon Biotech (Netherlands), a top supplier of biopharmaceutical systems, by Getinge (Sweden). In the marketplace for single-use bioprocesses, this purchase will improve Getinge's Biomedical Research business area.

- To deliver single-use solutions & biopharmaceutical product manufacturing, Samsung BioLogics from South Korea and Merck Millipore from Germany partnered in 2017.

- To facilitate the growth of the Chinese biopharma sector, Merck Millipore (Germany) constructed a Mobius single-use production plant in Wuxi in 2017.

Segments Covered in the Report

By Product

- Single-use Bioreactor Systems

- Up to 10L

- 11-100L

- 101-500L

- 501-1500L

- Above 1500L

- Single-use Media Bags

- 2D Bags

- 3D Bags

- Others

- Single-use Filtration Assemblies

- Other Products

By Type

- Stirred-tank SUBs

- Bubble-column SUBs

- Wave-induced SUBs

- Other SUBs

By Type of Cell

- Mammalian Cells

- Yeast Cells

- Bacterial Cells

- Others

By Molecule Type

- Monoclonal Antibodies

- Vaccines

- Stem Cells

- Gene Modified Cells

- Others

By Application

- Research and Development (R&D) or Process Development

- Bioproduction

By End-Use

- CROs & CMOs

- Pharmaceutical & Biopharmaceutical Companies

- Academic & Research Institutes

By Usage Type

- Pilot-scale Production

- Lab-scale Production

- Large-scale Production

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting