What is the Single-Use Assemblies Market Size?

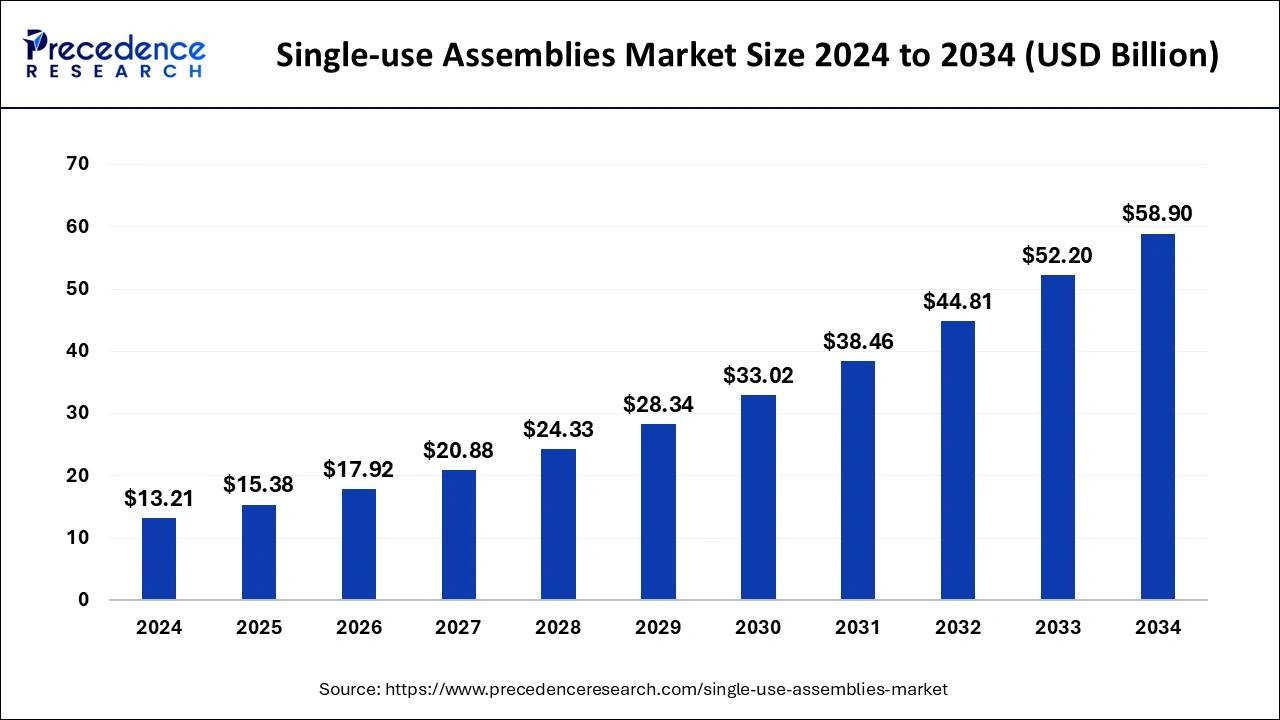

The global single-use assemblies market size was accounted for USD 15.38 billion in 2025, and is expected to reach around USD 66.06 billion by 2035, expanding at a CAGR of 15.38% from 2026 to 2035.Biopharmaceuticalproducers use single-use components to cut labor and energy costs, increase resource productivity, and limit the danger of contaminants. The demand for single-use assemblies has grown dramatically as the importance of keeping a sterile environment has expanded. Additionally, expanding pharma-academia partnerships will promote the usage of single-use components in research and academic institutions, which is projected to fuel desire and propel the industry's expansion.

Single-Use Assemblies Market Key Takeaways

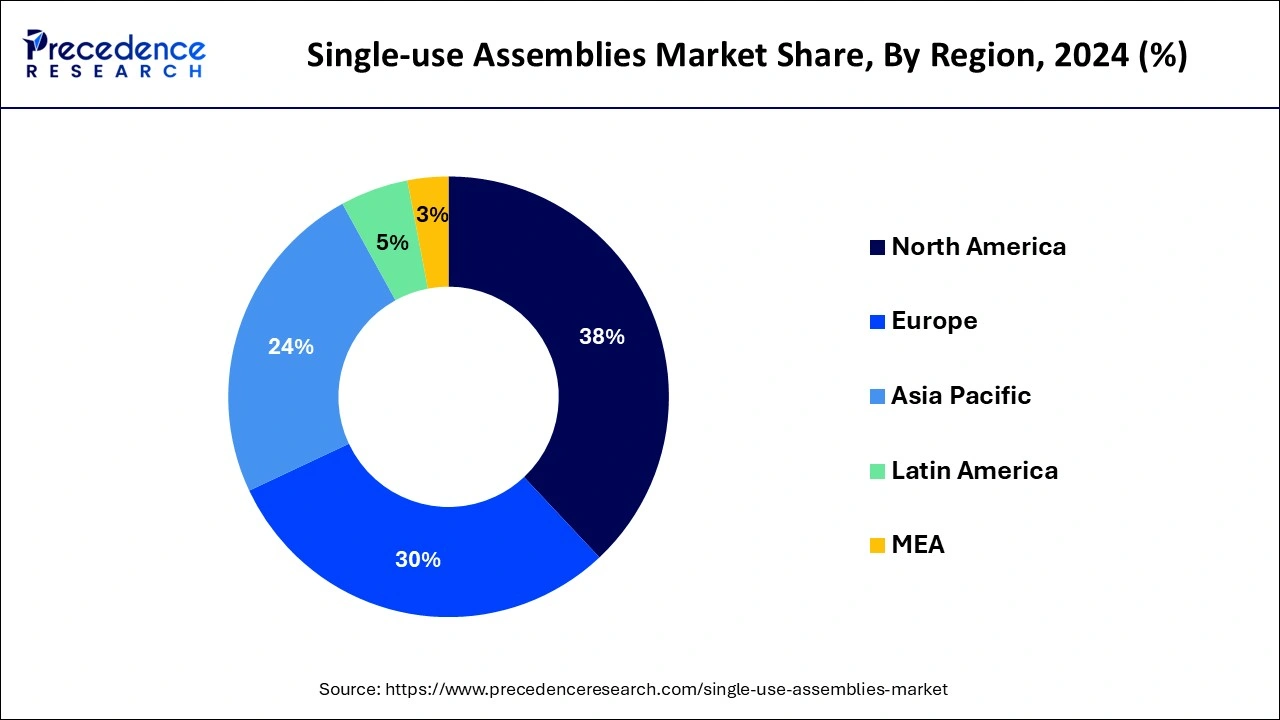

- North America captured around 38% revenue share in 2025.

- By geography, The Asia Pacific market is anticipated to rise at a faster CAGR from 2026 to 2035.

- By product, the filtration assemblies segment dominated the market with a significant revenue share during 2025.

- By application, the filtration segment dominated the market with a significant revenue share during 2025.

- By solution, the customized segment held the largest revenue share in 2025.

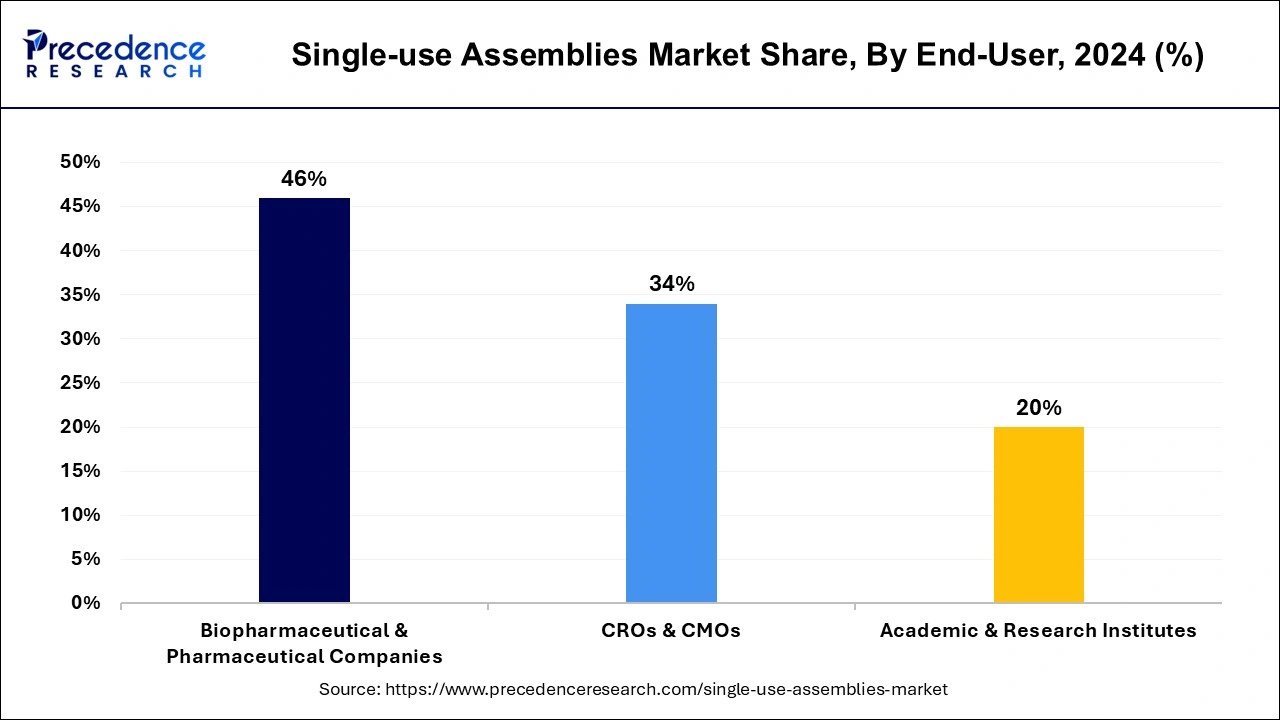

- By end-user, the biopharmaceuticals & pharmaceutical businesses segment held the major market share of around 46% in 2025.

How is AI contributing to the Single-Use Assemblies Industry?

AI can be used to advance the single use assemblies production through enhanced precision, consistency, and efficiency in operations. Computer vision allows for detecting defects online and checking components. Robotics control by AI automates difficult assembly processes. Predictive analytics decrease downtime of equipment. Digital twins maximize sealing and filling. Forecasting is enhanced by data. Traceability systems enhance compliance. The entire production is made quicker, cleaner, more flexible, and more dependable.

Single-Use Assemblies Market Growth Factors

Organizations in the life sciences are determined to avoid the expense and labor-intensive washing required using stainless steel. An environment for growth where unique, throwaway technology becomes more important has been given by the quicker rise of worldwide biotech companies. During the projected period, the market will enlarge at a faster amount as the pharmaceutical industry, suppliers, CDMOs, and producers hitch overdue the compensations of single-use components.

The consequence of single-use expertise in accelerating cutting-edge investigation into such disorders is anticipated to upsurge, driving industrial growth in fields like disease research and medicines for uncommon illnesses. Furthermore, SUTs are progressively used in profitable production facilities again for the creation of biopharmaceuticals to be utilized in clinical trials. In a related manner, they forecast that single-use constructions might be built in 1.5 yrs and will use partially as greatly water in addition to electricity to function. Since these assistances, single-use mechanisms are accepted further commonly, enhancing the business's continuous evolution.

- Growth in the population of chronic diseases that call for single-use assembly goods like from and sterile sacks has also led to an increase in the need for single-use assemblies such as disposable items in the pharmaceuticals and biotechnological industrial sectors.

- The development of this industry has also been aided by improvements made to biotechnological process systems, such as the synthesis of recombinants and the utilization of high-output equipment for biocatalytic optimization.

Market Outlook

- Growth in the Industry: Demand in the biopharmaceutical sector is increasing because of the need to move to faster, flexible, and contamination-reducing single-use assembly solutions.

- Sustainability Trends: The trend is towards using recyclable resources, circularity, energy reuse, and waste management.

- Key Investors: Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher Corporation, and Entegris Inc provide innovation.

- Startup Ecosystem: Ongoing reactors, continuous, and customized bioprocessing platforms, and active innovation in sustainable materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.38 Billion |

| Market Size by 2035 | USD 66.06 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.69% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Application, By Solution, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Market expansion is anticipated as biopharmaceutical R&D increases: The development and commercialization of technologically cutting-edge single-use assembly products with simplified workflows, simple operation, and quick deployment are increasing the attention of major players in the global single-use assembly market. Increased spending on pharmaceutical research & development activities for the product is related to the highly growing market for single-use assembly since they play a significant role in both small- and large-scale biopharmaceutical production. Single-use assemblies are growing in popularity because of their benefits such as reduced material cross-contamination risk and no need for extra sterilizing.

Increased deployment and lower risk of cross-contamination: Single-use assembly is becoming more and more common due to its tremendous advantages over traditional bioprocessing techniques. These include a lower chance of cross-contamination as well as a faster integration of single-use manufacturing elements into the biocatalytic cycle. Single-use components have inbuilt flow paths anatomically designed to contain them, enabling quicker installation and a reduced profile.

Worldwide emerging nations are developing rapidly: One of the main elements promoting the growth of these nations in the present period is industrialization, coupled with numerous other technical breakthroughs in various economies around the world. The number of developing nations has increased dramatically in recent years. Furthermore, it is projected that emerging markets would offer significant development opportunities for market companies engaged in single-use assembly. This is because their biopharmaceutical and pharmaceutical businesses have less stringent regulatory standards and employ a staff that is both inexpensive and well-trained.

Key Market Challenges

Extractable and leachable-related problems: Most end customers need numerous single-use components to concurrently conduct numerous research investigations and manufacturing processes, including big research centers and pharmaceutical corporations. For these trials and progressions, temperature upsurges and ecological circumstances are ignored.

A single-use assortment finished up of plastics also polymers comprehending innumerable stabilizers prospective to depreciate in trace expenses concluded extractable then before leachable. These posters proposition the opportunity of honest uncleanness. So, prevalent worries around materials that are leachable take begun the marketplace enlargement for single-use happens.

Key Market Opportunities

Emerging nations: Due to the compensations, single-use meetings have grown up in admiration finished the previous ten years. Around the beneficial controlling situation and the frugality of gage in emerging countries like India, China, and South Korea, many medicinal and bioengineering businesses anticipate mounting their single-use manufacturing plants to brand these nations as centers for biocatalytic insourcing. This is additionally stayed by the growing capacity of reserves complete in emergent countries by important marketplace companies. By cooperating with Wego Medicines to improve the situation of industrial volume in China, for occurrence, Cytiva was talented to advance its dispersal structure in the APAC zone.

Segment Insights

Product Insights

With a significant revenue share during 2025, the filtration assemblies segment dominated the worldwide single-use assemblies market, and it is projected that it will continue to do so during the projected timeline. In the biopharmaceutical business, the usage of medium bags and canisters offers inexpensive original investment, reduced waste emissions, and lower operating expenses.

The bag assemblies segment is poised to grow at the strongest CAGR from 2025 to 2034. The single mainstream bag and boxes also offer durability and good thermal stability. As a result, the widespread usage of medium bags and containers within the biopharmaceutical industry has contributed to the company's latest expansion.

Application Insights

With a notable profit share in 2025, the filtering category dominated the worldwide single-use biorefinery industry, and it's projected that it will continue to do so during the projected timeframe. Due to its effective filtering even at large scales, single-use bioreactor systems are becoming more and more popular in filtering. It is utilized for the filtration process, biomolecular cleaning, and the removal of bioburden.

The cell culture & mixing segment is projected to grow at the largest CAGR from 2026 to 2035.

Solution Insights

The customized solutions segment of the market with the biggest revenue share in 2025 was conventional solutions. Stock solutions were widely used in the biotechnology and pharmaceutical sectors because of the advantages they suggest, that as enhanced production procedure effectiveness with less capital and operating expense, better versatility as a result of using was before elements to assemble assembly, shorter implementation times, and greater production scheduling freedom.

End-User Insights

In 2024, the sector for biopharmaceuticals & pharmaceutical businesses held the biggest market share. Additionally, single-use biorefinery systems have been used by more than 80% of pharmaceutical firms because they are more affordable, effective, and dependable. Contract producers' significant and growing usage of single-use or throwaway products has accelerated the company's expansion. Additionally, the market is anticipated to rise in shortly the near future due to the rising need for single-use biorefinery systems across a variety of biorefinery solutions.

CROs & CMOs segment is projected to reach at the strongest CAGR over the forecast period. Increased price, easy implementation of such a production schedule for limited scale to big scale, and versatility in their use using pre-qualified parts from various assemblies all contribute to the higher acceptance of standard solutions. These are the driving forces behind the increasing demand for single-use components throughout this end-user group. Additionally, increasing pharmaceutical company spending on research activities helps market expansion.

Regional Inisghts

What is the U.S. Single-Use Assemblies Market Size?

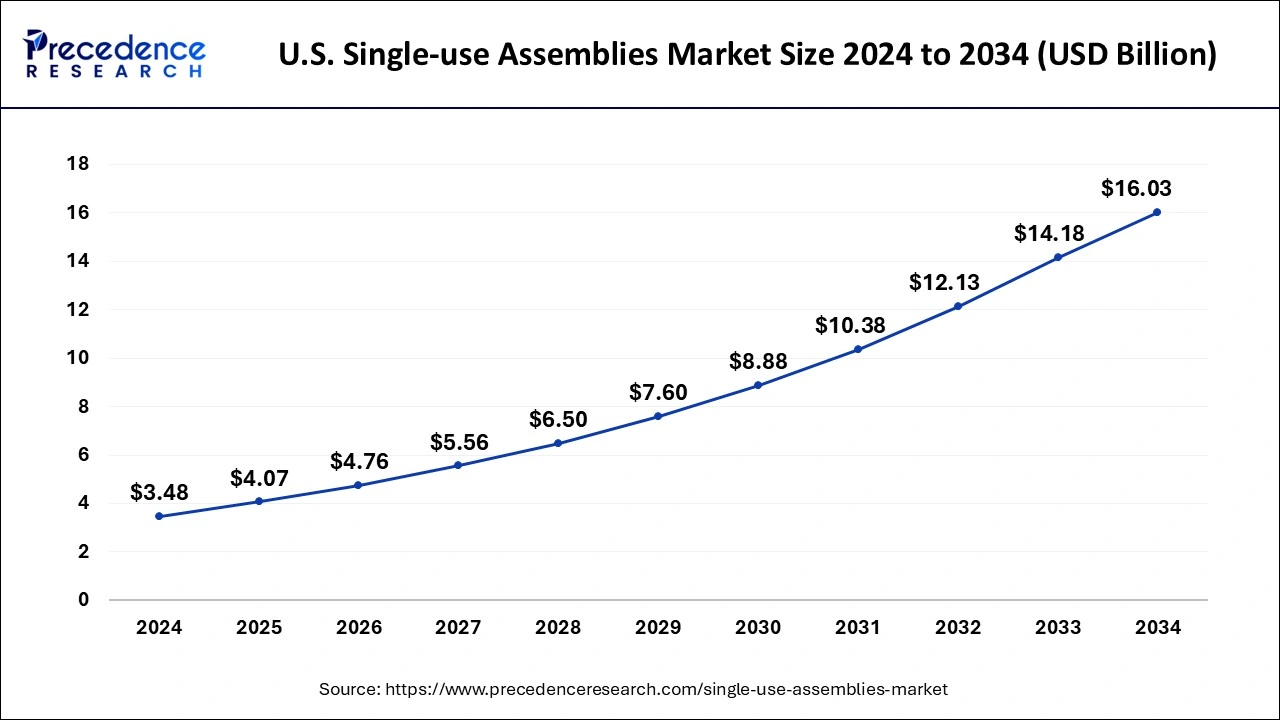

The U.S. single-use assemblies market size was estimated at USD 4.07 billion in 2025 and is predicted to be worth around USD 18.01 billion by 2035, at a CAGR of 16.04% from 2026 to 2035.

North America generated of around 38% revenue share in 2025, followed by Europe. Due to a variety of factors, including growing biosimilar and imitation production within the region and the presence of a significant number of major market companies with good infrastructures for a huge production, North America had a leading share.

U.S. Single-Use Assemblies Market Trends

The U.S. advantages are high biologics production and research ecosystems. Disposable hastens development cycles. Investment is made in sensor-enabled assemblies. Local production is helped by capacity growth. Innovation centers focus on speed, sterility, and process control in biologics and vaccine production.

The Asia Pacific market is anticipated to rise at a faster CAGR over the forecast period. The expansion of the single-use components in the region may be attributed to elements including the existence of a favorable corporate environment, higher capital expenditures in pharmaceutical Research & development activities, as well as life sciences research.

China Single-Use Assemblies Market Trends

China is a high-growth market that is characterized by the growing biopharmaceutical potential. Assemblies are locally sourced, and this lowers imports. Adoption favors the biosimilars and novel biologics. The contract manufacturers are scaled at a high speed. Single-use systems bring about flexibility, efficiency, and cost-aware manufacturing.

Value Chain Analysis of the Single-Use Assemblies Market

- R&D Discovery and preclinical development of chemical or biological entities. Laboratory research and preclinical testing.

Key Players: Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher (Cytiva/Pall) - Clinical Trials and Regulatory Approvals: Pre-clinical trials in which human testing is conducted to guarantee safety, efficacy, and approval by world health organizations.

Key Players: Sartorius, Lonza, PCI Pharma Services, WuXi Biologics - Preparation by Formulations: The development of active substances into stable, useful pharmaceutical products through the addition of excipients.

Key players: Merck KGaA (MilliporeSigma), Danaher (Pall), Thermo Fisher - Packaging and Serialization: Final assembly of products that are traceable and provide the security of the products and system.

Key Players: Saint-Gobain, Entegris, Corning Incorporated, Avantor - Single-Use Assemblies Distribution to Hospitals Pharmacies: Specialty logistics of ready-to-use kit distribution by regulated healthcare supply chains.

Key Players: Thermo Fisher, Sartorius, Movianto, Cardinal Health

Single-Use Assemblies Market Companies

- Antylia Scientific: Offers Masterflex peristaltic pump systems and manual sampling kits used in the achievement of the accurate transfer of fluids and the monitoring of bioprocesses.

- Avantor, Inc.: Offers developed single-use, engineered assemblies such as bioprocess bags and aseptic flow-path kits to facilitate end-to-end fluid management solutions.

- Corning Incorporated: Specializes in high-surface-area single-use cell culture systems and integrated tubing to scale up to sterile bioprocess.

Other Major Key Players

- Danaher Corporation

- Entegris

- Flexbiosys

- Kuhner AG

- Lonza

- Meissner Filtration Products

- Merck KGaA

- Newage Industries

- Pall Corporation

- Parker-Hannifin Corporation

- Repligen Corporation

- Romynox

- Saint-Gobain Performance Plastics

- Sartorius Stedim Biotech

- Thermo Fisher Scientific, Inc.

Recent Developments

- In February 2025, Sunflower Therapeutics formed a distribution agreement with PharmNXT Biotech to launch its Daisy Petal Perfusion Bioreactor System in Asia. This innovative system features a single-use assembly for easy installation and enhances volumetric productivity from bench to scale-up manufacturing.

(Source: https://www.biospectrumasia.com ) - In April 2024, SaniSure introduced Fill4Sure, a customizable single-use filling assembly aimed at accelerating drug market entry while enhancing security, efficiency, and repeatability. Addressing challenges like high costs and limited speed, Fill4Sure offers cost-effective, scalable solutions tailored to diverse industry needs during the fill-finish process. (Source: https://www.contractpharma.com )

- Sartorius and Sonderanlagenbau HOF, the completely integrated whole design and construction environment, partnered in December 2021. To provide a complete line of suitable freeze-thaw supplies and equipment, the firms would collaborate to integrate the vertical plates freeze-thaw machines into Sartorius' product line.

- Thermo Fisher scientific HyPeak chromatographic building, a sole-use chromatographic scheme for bioprocessing purposes, was released by Thermo Fisher in October 2021. The novel result was designed to function within the Emerson DeltaV automated network to allow installation for technology transfer while buffering usage during downstream activities to increase production yield.

- Parker Hannifin acquired Meggitt, a multinational British corporation, in September 2022. With this acquisition, the firm wanted to improve its capacity for growth, develop a more electrified portfolio, and provide more creative solutions for both advanced air mobility and clean technology.

- In August 2022, the science-based business Albumedix was fully acquired by Sartorius. With just this acquisition, the business hoped to boost and solidify its standing as a supplier of cutting-edge media containing media and essential supporting components.

- Max Analytic Solutions, a provider of FTIR-based gas measurement products, was purchased by Thermo Fisher in March 2022. With this acquisition, the business planned to increase and complete Thermo Fisher's FTIR equipment, services, and software range. Additionally, the breadth of microscopic observation solutions and services across a variety of industry categories would improve as a result of this purchase.

- Saint-Gobain purchased Equflow, a top supplier of Flowmeters, in September 2021. After this purchase, the corporation would integrate Equflow's fluid monitoring technologies across all of its companies to enhance its single-line abilities.

- Dec-2021, With the establishment of a brand-new single-use logistics center in Westminster, Avantor increased its global footprint in Massachusetts. The corporation wanted to bolster its worldwide biopharma supply chain after this regional expansion. The new location would also provide distribution and logistics administration, allowing the business to take advantage of its current assets across North America.

- Jun-2021 saw the acquisition of RIM Bio by Avantor, a pioneer in the production of single-use biocatalytic sacks & assembly. With the growth of its single-use production, marketing, and cleanroom abilities across the AMEA area, this transaction aims to help the business better serve its clients.

- Sartorius purchased Slovenian purification expert BIA Separations in November 2020. The corporation wanted to incorporate BIA Breakups into its subdivision, therefore it made this transaction.

- Repligen acquired the privately held business ARTeSYN Biosolutions in October 2020. The goal of this acquisition was to expand the company's line of hollow fiber devices while also enhancing its chromatographic & TFF filtering product lines.

- In April 2020, the American conglomerate Sartorius acquired several of Danaher's life science assets. The corporation wanted to broaden the downstream processing capacity of its Biocatalytic Involves Specific after this purchase.

Segments Covered in the Report

By Product

- Bag Assemblies

- Filtration Assemblies

- Tubing Assemblies

- Bottle Assemblies

- Others

By Application

- Filtration

- Storage

- Cell Culture & Mixing

- Fill-finish Applications

- Sampling

- Others

By Solution

- Customized

- Standard

By End-User

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting