What is the Small Caliber Ammunition Market Size?

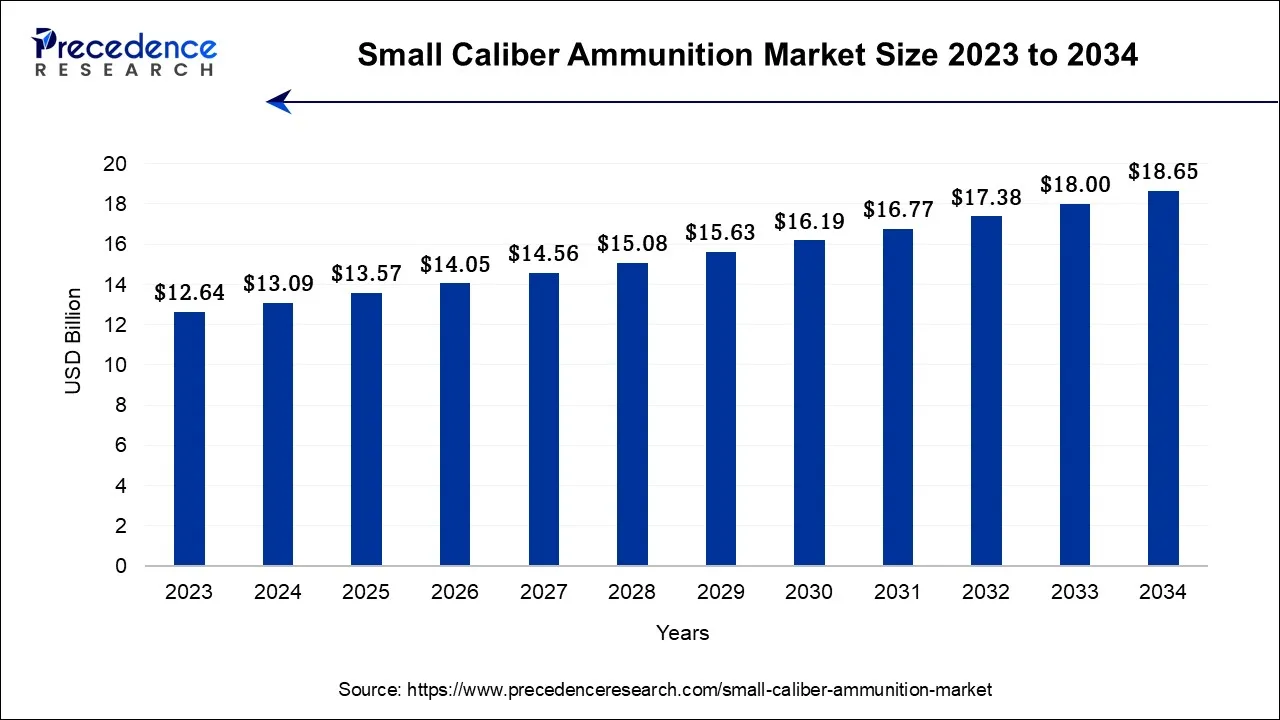

The global small caliber ammunition market size is expected to be valued at USD 13.57 billion in 2025and is predicted to increase from USD 14.06 billion in 2026 to approximately USD 19.28 billion by 2035, expanding at a CAGR of 3.57% over the forecast period from 2026 to 2035.

Small Caliber Ammunition Market Key Takeaways

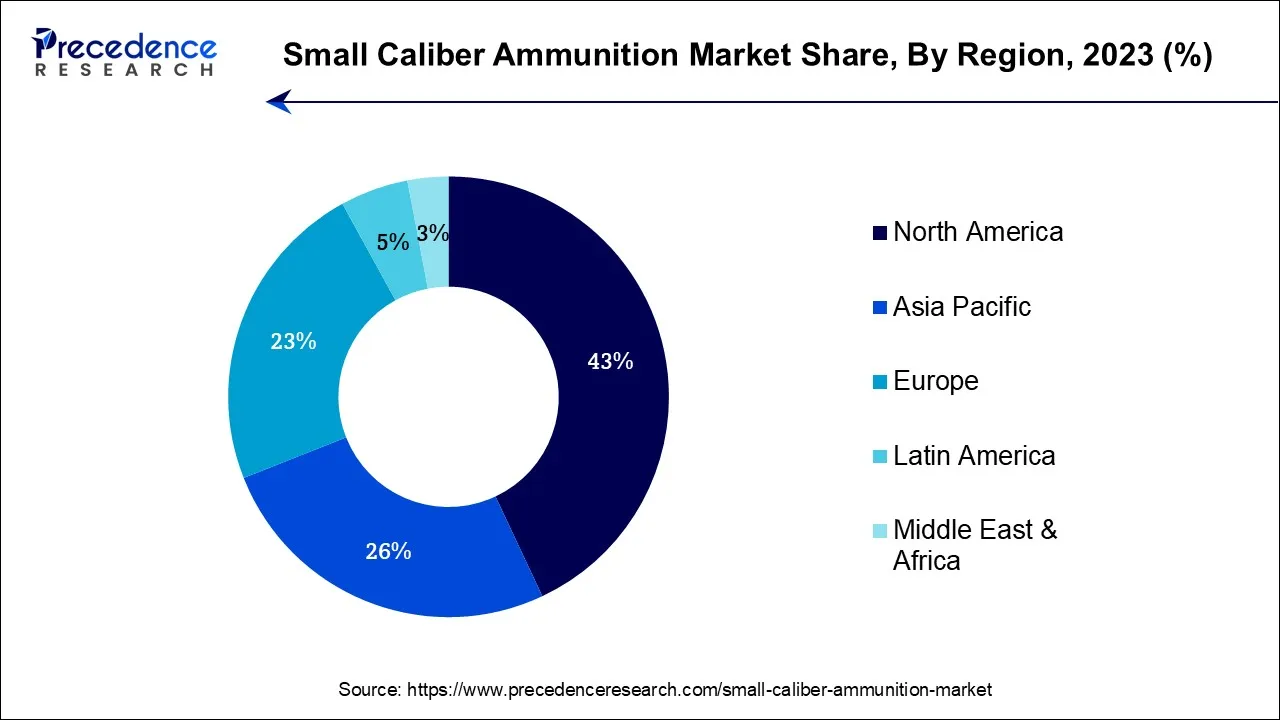

- North America has held the biggest revenue share of 43% in 2025.

- By Size, the 7.62mm segment contributed the largest revenue share of 38.5% in 2025.

- By Size, the 5.56mm segment is expected to expand at a significant CAGR of 5.8% between 2026 and 2035.

- By Applications, the military segment captured the largest market share of 49.3% in 2025.

- By Applications, the civilian segment is predicted to grow at the fastest CAGR over the projected period.

- By Casing Type, the brass segment registered the highest market share of 56.8% in 2025.

- By Casing Type, the steel segment is anticipated to grow at the fastest CAGR over the projected period.

What is Small Caliber Ammunition?

The small caliber ammunition market encompasses the production, distribution, and sale of ammunition designed for firearms with relatively small-bore diameters, typically below .50 caliber. These ammunitions are used for various purposes, including civilian firearms, military and law enforcement applications, and sports shooting.

The small caliber ammunition market nature is characterized by its sensitivity to geopolitical factors, military modernization efforts, and civilian gun ownership trends. Demand fluctuates based on defense budgets, civilian gun sales, and global security concerns, making it a dynamic and responsive sector within the broader ammunition industry.

How is AI contributing to the Small Caliber Ammunition Industry?

AI has a major role in the entire process of ammunition design and manufacturing, logistics, training, and finally, by allowing inspection to be carried out automatically, maintenance to be predicted, the optimization of trajectories, management of smart inventory, simulations, rolling, analyzing, and so on. This is accomplished by improving the accuracy, reliability, safety, and efficiency of the entire development, production, deployment, and operational training processes over the entire globe.

Small Caliber Ammunition Market Growth Factors

The small caliber ammunition market revolves around the production and distribution of ammunition designed for firearms with bore diameters typically below 50 calibers. It serves a diverse range of users, including civilian gun owners, law enforcement agencies, and military forces.

This small caliber ammunition market dynamics are shaped by various factors, including geopolitical developments, global security concerns, and civilian gun ownership trends. Several key trends and growth drivers are influencing the market.

One significant trend is the rising demand for self-defense ammunition among civilian consumers, driven by concerns about personal safety. Additionally, military modernization efforts across the globe are fueling demand for technologically advanced small caliber ammunition. The increasing popularity of sport shooting and competitive shooting events is another factor contributing to market growth.

Moreover, there are opportunities for businesses in the small caliber ammunition market. Investments in research and development to create innovative and eco-friendly ammunition can set companies apart in a competitive market. Expanding into emerging markets with growing security concerns and military needs offers a pathway for growth. Collaboration with law enforcement agencies to develop specialized ammunition for their specific requirements can be a lucrative opportunity.

Market Outlook

- Industry Growth Overview: The military modernization, new defense budgets raised, and more and more civilian shooting participants are the drivers for the market to expand further.

- Sustainability Trends: The focus is changing to green ammunition, lead-free projectiles, alternative materials, etc., all of which are reducing environmental impact issues.

- Global Expansion: Growth is still global, with North America and the Asia Pacific defense procurement being the regions with the strongest momentum.

- Major Investors: Olin Corporation, General Dynamics, Northrop Grumman, BAE Systems, Nammo, and Elbit Systems are some of the major investors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.57 Billion |

| Market Size in 2026 | USD 14.05 Billion |

| Market Size by 2035 | USD 19.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Size, By Applications, and By Casing Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Military modernization and sport shooting

Military modernization initiatives worldwide are propelling the small caliber ammunition market's growth. As armed forces upgrade their weaponry, there's a heightened demand for advanced small caliber ammunition. These modernization efforts prioritize ammunition with improved accuracy, ballistics, and versatility to enhance soldier performance. Consequently, manufacturers are developing cutting-edge rounds to meet these requirements, driving demand in the civilian and military sectors, and fostering innovation in the small caliber ammunition market.

Moreover, Sport shooting has significantly boosted the small caliber ammunition market by driving demand for high-quality ammunition. Enthusiasts participating in competitive shooting events, such as target shooting and practical shooting sports, require precise and reliable ammunition to enhance their performance. This demand has led to the development of specialized small caliber rounds, propelling manufacturers to produce innovative, accurate, and consistent ammunition to cater to the growing sport shooting community, thereby increasing overall market demand.

Restraints

Regulatory restrictions and safety concerns

Regulatory restrictions act as a significant restraint on the small caliber ammunition market. Stringent firearms regulations and legal limitations in various regions can impede market access, sales, and growth potential. These restrictions often result in increased compliance costs, reduced market size, and complexities in navigating the legal landscape. As a result, manufacturers and suppliers in the small caliber ammunition market must contend with a challenging regulatory environment that affects demand and profitability.

Moreover, Safety concerns can significantly restrain market demand in the small caliber ammunition market. Increased safety regulations and public awareness regarding the potential hazards associated with ammunition use and storage can lead to reduced consumer interest and sales. Additionally, stringent safety standards can increase manufacturing and compliance costs, impacting pricing and profitability. These concerns can influence both civilian and government procurement decisions, affecting the overall market demand for small caliber ammunition.

Opportunities

Diversification, innovation and technology

Diversification in the small caliber ammunition market can boost market demand by expanding product offerings beyond ammunition. Companies can introduce complementary products such as firearms accessories, optics, and gear, attracting a broader customer base. This approach not only increases revenue streams but also strengthens brand loyalty and customer retention. Diversification reduces dependency on a single product category and makes businesses more resilient, enhancing their overall competitiveness and market demand.

Moreover, Innovation and technology advancements have a profound impact on the small caliber ammunition market, driving increased demand. Consumers and military forces seek ammunition with improved accuracy, reduced recoil, and enhanced terminal ballistics. Manufacturers that invest in innovative bullet designs, propellants, and production techniques can offer superior products, appealing to both civilian and military markets. Technological innovations propel market growth by satisfying the demand for more effective and efficient small caliber ammunition.

Segment Insights

Size Insights

According to the size, the 7.62mm segment has held 38.5% revenue share in 2025. The 7.62mm caliber, a standard for rifles and machine guns, represents a significant segment of the small caliber ammunition market. Its versatility makes it widely used in military and civilian applications. In the Small Caliber Ammunition Market, trends indicate a consistent demand for 7.62mm ammunition due to its role as a standard NATO caliber. In terms of market trends, the demand for 7.62mm ammunition has remained robust due to military modernization efforts and civilian firearm ownership. Recent trends indicate a shift towards enhanced ballistic performance, precision, and environmentally friendly options within the 7.62mm caliber range, reflecting the broader industry focus on innovation and sustainability.

The 5.56 mm segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The 5.56 mm ammunition, often used in military and civilian rifles, is characterized by its caliber size, representing the bullet's diameter. In the small caliber ammunition market, the 5.56 mm cartridge has shown consistent demand due to its versatility, commonly used in military and sporting applications. Recent trends indicate a focus on developing eco-friendly and lead-free variants of 5.56 mm ammunition to align with sustainability goals. Additionally, advancements in bullet design and propellants aim to enhance accuracy and reduce environmental impact, driving innovation in this caliber segment.

Applications Insights

Based on the application, the military segment is anticipated to hold the largest market share of 49.3% in2025. The military application in the small caliber ammunition market pertains to the supply of ammunition for armed forces. This includes infantry and special forces using small caliber ammunition for various firearms, ensuring national security and defense. Trends in this sector involve a growing demand for technologically advanced ammunition, including armor-piercing and precision rounds. Military modernization efforts drive procurement, while sustainability considerations increasingly influence procurement decisions, leading to the development of eco-friendly options. Additionally, geopolitical tensions and international conflicts continue to fuel demand for small caliber ammunition in military applications.

On the other hand, the Civilian segment is projected to grow at the fastest rate over the projected period. In the small caliber ammunition market, the civilian application refers to ammunition designed for civilian use, including self-defense, recreational shooting, and hunting. This segment is witnessing a significant trend characterized by an increased demand for self-defense ammunition, fueled by a heightened emphasis on personal safety. Moreover, the surge in popularity of sport shooting and competitive events has led to a growing need for precision-focused, high-quality ammunition. Customization is also gaining traction, with manufacturers offering specialized rounds tailored for specific civilian needs, reflecting the evolving preferences and priorities of civilian firearm owners.

Casing Type Insights

In2025, the Brass segment had the highest market share of 56.8% on the basis of the installation. In the small caliber ammunition market, brass refers to the material used in cartridge cases, offering durability, corrosion resistance, and ease of reloading. A notable trend is the increasing use of brass cartridge cases due to their reloadability, resulting in cost savings for civilian shooters. Additionally, manufacturers are developing innovative brass case designs, optimizing internal and external ballistics for improved accuracy and performance. This trend reflects the market's ongoing pursuit of ammunition that balance's reliability, cost-effectiveness, and performance for various shooting applications.

The steel segment is anticipated to expand at the fastest rate over the projected period. Steel casings in the small caliber ammunition market refer to cartridge cases made primarily from steel. These casings offer durability, cost-efficiency, and reliability, making them a popular choice, especially for practice and training ammunition. A notable trend is the increasing use of steel casings due to their economic benefits. However, steel casings may be less suitable for certain firearm types, such as those with unsupported chambers, which can limit their applicability. Despite this, their cost-effectiveness and recyclability continue to drive their adoption in the small caliber ammunition market.

Regional Insights

What is the U.S. Small Caliber Ammunition Market Size?

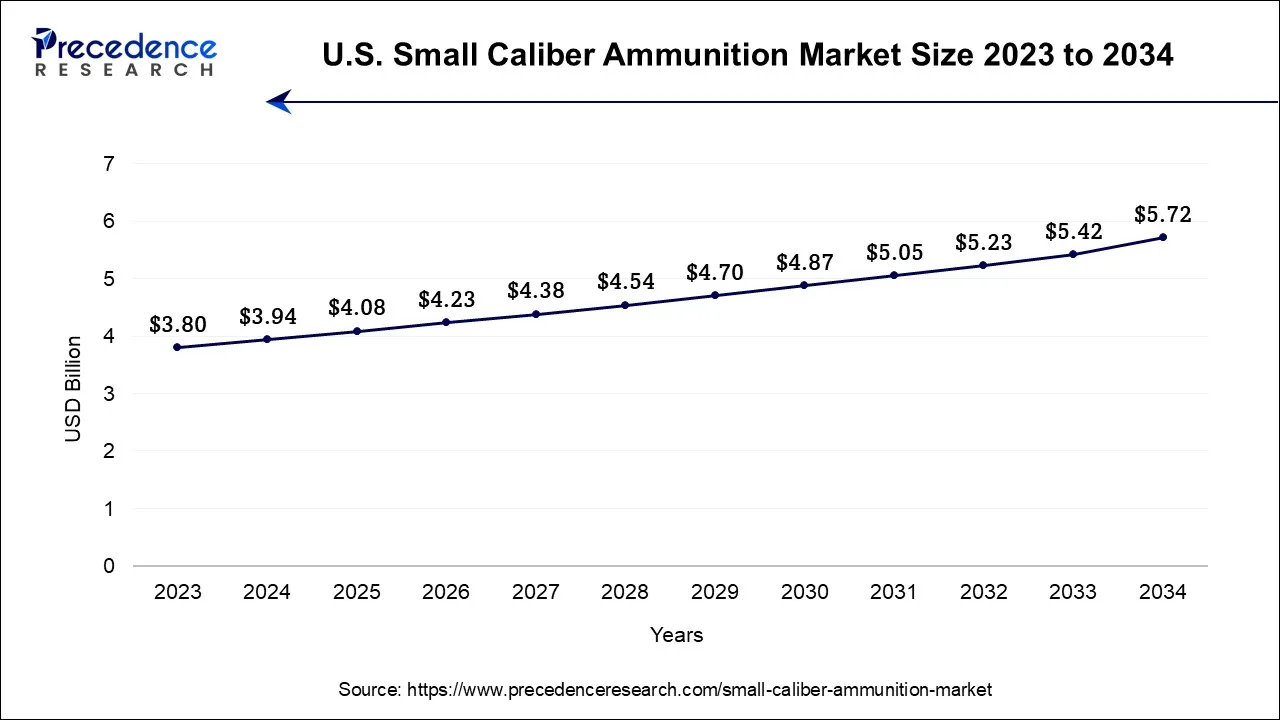

The U.S. small caliber ammunition market size is accounted for USD 4.08 billion in 2025 and is projected to be worth around USD 5.95 billion by 2035, poised to grow at a CAGR of 3.85% from 2026 to 2035.

North America has held the largest revenue share 43% in 2025. In North America, the small caliber ammunition market is characterized by several prominent trends. There's a sustained demand for self-defense ammunition driven by personal safety concerns. Additionally, the market has seen a surge in civilian gun ownership, particularly during periods of uncertainty. Innovations in bullet design and materials are gaining traction, enhancing ammunition performance. The region also faces regulatory changes and safety concerns, prompting manufacturers to focus on compliance and safety features in their products, reflecting evolving consumer needs and government regulations.

U.S. Small Caliber Ammunition Market Trends

The U.S. Market opportunities revolve around military next-gen ammunition, and demand for non-lead products because of environmental regulations is one of the strongest factors driving the commercial side of the market. In turn, advanced manufacturing adoption, supply chain modernization, and procurement across defense and law enforcement activities are made possible by environmental regulations facilitating the procurement process.

What are the Major Drivers for the Fastest Growth of the Asia Pacific in the Small Caliber Ammunition Market?

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region,the small caliber ammunition market is witnessing several trends. Increased military modernization efforts in countries like India and China are driving the demand for technologically advanced ammunition. Moreover, the rising popularity of sport shooting and recreational shooting activities is boosting the market for small caliber rounds. Additionally, growing concerns about personal safety have led to increased civilian demand for self-defense ammunition. These trends, coupled with geopolitical factors, are shaping the dynamic landscape of the small caliber ammunition market in the Asia-Pacific region.

India Small Caliber Ammunition Market Trends

India is the country where national self-reliance schemes constantly import and create new suppliers for ammunition-making companies and localization, giving up the nation's and border security requirements, on a demand-based procurement modernization and capacity building of the security forces and police.

How does Europe make notable progress in the Small Caliber Ammunition Market?

In Europe, the small caliber ammunition market is characterized by a growing emphasis on precision and accuracy. Sport shooting and competitive shooting events have gained popularity, driving demand for high-quality ammunition. Additionally, there is a strong focus on regulatory compliance and environmental sustainability, leading to increased research and development in eco-friendly ammunition solutions. Geopolitical factors also influence the market, with countries seeking to bolster their military capabilities, contributing to steady demand for technologically advanced small-caliber ammunition.

Germany Small Caliber Ammunition Market Trends

Germany is committed to R&D for lead-free ammo that is safe for the environment and that conforms to European standards. In addition to this, it supports domestic military law enforcement and sport shooting markets while retaining stringent quality controls and advanced manufacturing capabilities across regulated defense supply networks.

Expansion of Small Caliber Ammunition Industry in Latin America

Latin America is expected to grow at a significant rate in the market due to increasing security concerns, military modernization programs, and investments in manufacturing facilities. In this region, the U.S. funds physical security and stockpile management programs, focusing on releasing land, securing weapons and ammunition, and promoting environmental resilience.

- In February 2025, the Central American States and the Dominican Republic adopted a roadmap to prevent the proliferation and illicit trafficking of ammunition and explosives, and firearms to ensure a safer future for all.

Brazil Small Caliber Ammunition Market Analysis

Brazil advances with military and police modernization programs, expanded export capacity, and sustained civilian demand. The New Industry Brazil (NIB) celebrated its first anniversary with investments in the defense industry and the launch of goals for Mission 6.

Middle East and Africa Expanding the Small Caliber Ammunition Industry

The Middle East and Africa are expected to grow at a lucrative rate in the market, owing to the increased focus on upgrading military infrastructure, increasing defense budgets, and law enforcement. The international partnerships focus on long-term business cooperation and creating manufacturing facilities. Rising defense spending, heightened national security priorities, and increased procurement for law enforcement and border security are key demand drivers, supported by ongoing geopolitical tensions in the region.

Saudi Arabia Small Caliber Ammunition Market Trends

Saudi Arabia experiences robust border security measures and a high demand for small-caliber ammunition for both internal security forces and military operations. Saudi Arabia's military equipment manufacturing sector is expanding under the Saudi Vision 2030, which aims to build a defense powerhouse.

Small Caliber Ammunition Market-Value Chain Analysis

- Feedstock Procurement: sourcing, purchasing, managing logistics, raw materials, ammunition production

Key players: Olin Corporation (Winchester Ammunition), Thales - Chemical Synthesis and Processing: executing reactions of materials into ammunition components

Key players: Incitec Pivot, Chemring Group, Hanwha Corp - Compound Formulation and Blending: combining propellants, primers, proportions safety characteristics

Key Players: D&M Holding Company (White River Energetics), Thales (Australian Munitions/ADI Powders) - Quality Testing and Certification: conducting evaluations, ensuring safety regulatory compliance

Key players: Elbit Systems Ltd. (in-house testing), Thales (Australian Munitions) - Packaging and Labelling of Small Caliber Ammunition: storage, distribution, compliance

Key Players: D&M Holding Company (solutions provider for packaging cells), Remington Ammunition, Hornady Manufacturing Company

Small Caliber Ammunition Market Companies

- Northrop Grumman Corporation: Northrop Grumman Corporation brings to the market state-of-the-art small and medium caliber ammunition that is accurate-reliable-performance consistent with the modern warfare requirements for the forces.

- General Dynamics Corporation: General Dynamics Corporation has a wide variety of ammunition ready to supply, as well as providing innovative ordnance solutions through its specialized divisions, all tailor-made to support the military's operational needs worldwide.

- BAE Systems PLC: BAE Systems PLC manufactures and sells small arms ammunition that is produced using very sophisticated manufacturing processes, and the supply chains that are very reliable, compliant, and supportive of the defense industry all over the globe.

Other Major Key Players

- Denel SOC Ltd

- Remington Arms Company LLC

- CBC Global Ammunition

- RUAG Group

- MESKO

- Nammo AS

- Olin Corporation

- CCI Ammunition

- Elbit Systems Ltd

- Ordnance Factory Board (OFB)

- PT Pindad

Recent Developments

- In June 2025, Polish manufacturer Mesko quintupled small-caliber ammunition production capacity from 20 million to 250 million rounds annually by launching four new lines. The company is now achieving one million cartridges daily. (Source:https://militarnyi.com/)

- In January 2025, Belgium's FN Herstal launched the SAAT project on 6 January 2025, a four-year initiative with a European consortium to create a common standard for small arms ammunition. The launch is enhancing interoperability and strategic autonomy in defence. (Source: https://euro-sd.com/)

- In 2023, Vista Outdoor's Sporting Products division has unveiled a new name as it approaches separation from the parent company. The rebranding reflects the division's evolving identity and strategic focus in the outdoor sporting goods industry.

- In 2022, Sig Sauer has secured a contract to manufacture the Next-Gen Squad Weapon (NGSW). This significant achievement positions Sig Sauer as a key player in supplying advanced firearms for the military's next-generation infantry squad.

- In 2021, India has signed a significant deal with Russia to procure AK-203 assault rifles. This agreement aims to enhance the country's military capabilities and replace older weapons with more modern and efficient firearms.

- In 2021, Indonesia's PT Pindad has embarked on exporting small arms munitions. This strategic move aims to expand the company's international presence and contribute to global security by providing high-quality small arms ammunition to interested markets.

- In 2021, Philippines awarded a contract to Brazilian arms manufacturer Taurus Armas to fulfill a requirement for more than 12,000 new Taurus T4 5.56 x 45mm automatic rifles. In 2019, SIG Sauer USA was awarded a contract to deliver 2,702 SIGM400 rifles.

Segments Covered in the Report

By Size

- 5.56mm

- 7.62mm

- 9 mm

- 50 caliber

- Shotshells

By Applications

- Military

- Civilian

- Law Enforcement Agencies

By Casing Type

- Brass

- Steel

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting