What is Small Molecule Immunomodulators Market Size?

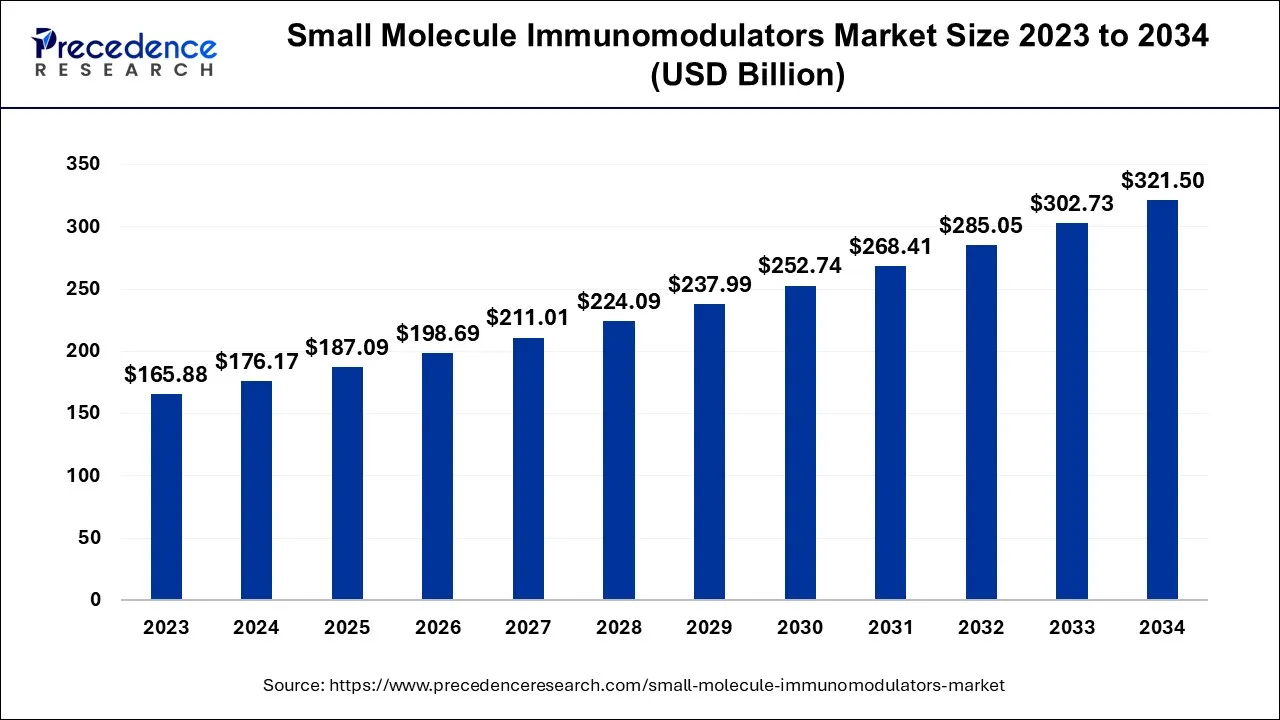

The global small molecule immunomodulators market size is expected to be valued at USD 187.09 billion in 2025 and is anticipated to reach around USD 339.54 billion by 2035, expanding at a CAGR of 6.14% over the forecast period from 2026 to 2035

Market Highlights

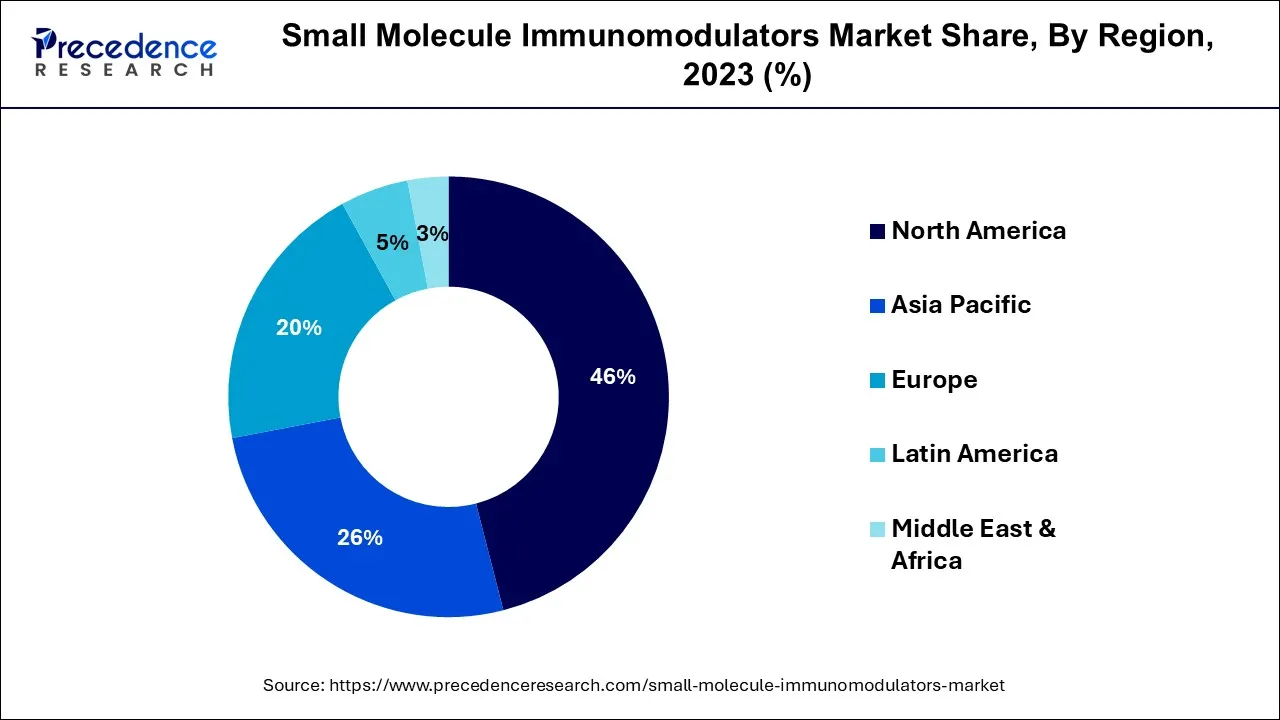

- North America contributed more than 46% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035

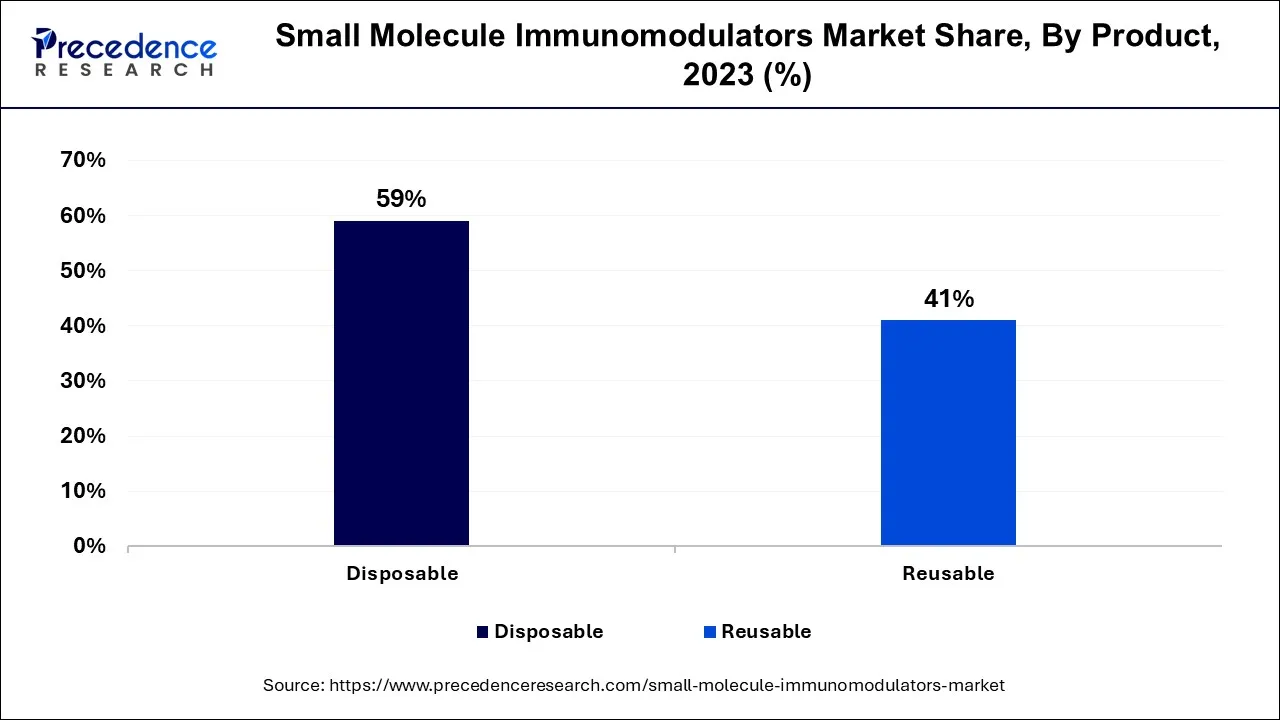

- By product, the disposables segment has held the largest market share of 59% in 2025.

- By product, the reusable segment is anticipated to grow at a remarkable CAGR of 12.8% between 2026 to 2035

- By application, the orthopedic segment generated over 23% of revenue share in 2025.

- By application, the cardiac surgery segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the hospitals segment had the largest market share of 52% in 2025.

- By end-user, the ambulatory surgical centers segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The small molecule immunomodulators market refers to a specialized segment within the medical industry that offers customized sets of medical instruments, supplies, and accessories tailored to specific medical procedures or surgeries. These kits streamline healthcare processes by ensuring all necessary items are readily available, enhancing efficiency, and minimizing the risk of error.

The market's nature is dynamic, driven by the increasing demand for personalized medical solutions, cost-effective healthcare delivery, and the continuous advancement of medical technologies, reflecting the industry's commitment to optimizing patient care and operational efficiency.

Small Molecule Immunomodulators Market Growth Factors

The small molecule immunomodulators market is a specialized sector within the healthcare industry that provides tailored sets of medical instruments and supplies for specific medical procedures or surgeries. These kits are designed to streamline healthcare processes, ensuring the availability of essential items while reducing the risk of errors. As the healthcare landscape evolves, the demand for customized medical solutions is on the rise, making this market increasingly vital for healthcare facilities seeking operational efficiency and improved patient care. Several trends and growth drivers are shaping the small molecule immunomodulators market.

Firstly, there's a growing focus on cost-effective healthcare delivery, prompting healthcare providers to seek efficient solutions like custom procedure kits. Additionally, advancements in medical technology are enabling the development of more specialized kits, further driving market growth. Moreover, the rising trend of outpatient surgeries and the need for infection control measures are boosting the adoption of custom kits.

The small molecule immunomodulators market does face some challenges, including the need for stringent quality control and regulatory compliance. Ensuring that each kit meets rigorous quality standards can be complex, requiring close collaboration with regulatory bodies.

Another challenge is the customization process itself, which demands precise coordination between healthcare providers and kit manufacturers to tailor each kit to the specific needs of different procedures. In this evolving landscape, there are significant business opportunities within the market. Companies that can provide cost-effective, high-quality custom kits while staying compliant with regulatory requirements are projected to witness growth.

Expansion into emerging markets and diversification of product offerings are other avenues for business development. As the healthcare industry continues to prioritize efficiency and patient safety, custom procedure kits play a pivotal role in delivering on these objectives, offering opportunities for innovation and growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 187.09 Billion |

| Market Size in 2026 | USD 198.69 Billion |

| Market Size by 2035 | USD 339.54 Billion |

| Growth Rate from 2026 to 2035 | 6.14% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Application, By End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advanced medical technology and outpatient surgery trend

The surge in market demand for custom procedure kits is attributed to advanced medical technology. Innovations in medical devices and surgical instruments enable the creation of highly specialized and efficient custom kits. Healthcare providers seek these kits to ensure they have access to the latest, state-of-the-art tools, promoting superior patient outcomes and safety. This increased reliance on advanced technology within custom kits has become a pivotal driver in meeting the evolving needs of modern healthcare and surgical practices.

Moreover, the outpatient surgery trend has significantly boosted demand for the small molecule immunomodulators market. As more surgical procedures shift from traditional inpatient settings to outpatient facilities and clinics, there's a growing need for efficient, compact, and procedure-specific custom kits. These kits streamline the surgical process, ensuring that all necessary supplies are readily available, contributing to shorter turnaround times, cost savings, and improved patient throughput. As outpatient surgeries become more prevalent, the demand for custom procedure kits continues to surge, making them an essential component of modern healthcare settings.

Restraint

Initial investment and surgical complexity

Developing and implementing a customized kit system often necessitates a significant upfront investment in technology, personnel training, and infrastructure within healthcare facilities. For some providers, this initial financial commitment may appear daunting, particularly if they are accustomed to existing procurement methods. However, it's essential to recognize that the long-term benefits, including cost savings and improved efficiency, typically outweigh these initial investment concerns, making custom kits a valuable addition to modern healthcare practices.

Moreover, surgical complexity restrains the demand for the small molecule immunomodulators market as highly intricate and specialized procedures may not lend themselves well to standardization within custom kits. These complex surgeries often require a wide range of unique instruments and supplies, making it challenging to create one-size-fits-all kits. Consequently, healthcare facilities may opt for traditional procurement methods, hindering the broader adoption of custom kits. Customization limitations in addressing intricate surgical needs can limit market demand, particularly in specialized medical fields.

Opportunity

Technological advancements and diversification of offerings

Technological advancements are propelling demand for the small molecule immunomodulators market by enhancing kit efficiency and traceability. Integration of technologies like RFID tracking and data analytics streamlines inventory management, reducing errors and costs. Custom kits can now be equipped with smart components, offering real-time data on item usage and expiration dates. This level of customization and sophistication aligns with the growing need for precision in healthcare, making technologically advanced custom procedure kits an attractive choice for healthcare providers seeking improved patient outcomes and operational efficiency.

Moreover, diversification of offerings in the small molecule immunomodulators market can significantly boost market demand by catering to a broader range of medical needs. By expanding beyond surgical kits to include specialized diagnostic kits, emergency response kits, or kits for non-surgical medical procedures, manufacturers can tap into new market segments. This diversification addresses evolving healthcare demands and allows healthcare providers to source a wide array of customized solutions from a single supplier, simplifying procurement and increasing the appeal of custom kits across various healthcare specialties.

Segment Insights

Product Insights

According to the product, the disposables segment has held 59% revenue share in 2025. Disposables in the custom procedure kits industry refer to single-use medical products and supplies included in customized kits. These items are designed for one-time use during medical procedures to maintain sterility and reduce infection risks. Recent trends in disposable custom procedure kits include an increased focus on sustainability.

Manufacturers are exploring eco-friendly materials and recyclable options to address environmental concerns. Additionally, there is a growing emphasis on incorporating disposable components that are user-friendly and ergonomically designed, enhancing ease of use for healthcare professionals while maintaining stringent infection control measures.

The reusable segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. In the custom procedure kits industry, reusable refers to kits designed with components that can be cleaned, sterilized, and safely used in multiple medical procedures. These kits are eco-friendly and cost-effective, making them an attractive choice for healthcare facilities aiming to reduce waste and optimize resources.

Trends in reusable custom procedure kits include the integration of innovative materials that enhance durability, advancements in sterilization techniques, and the development of user-friendly, modular designs. These trends reflect the growing emphasis on sustainability and cost-efficiency in modern healthcare practices.

Procedure Insights

Based on the procedure, the orthopedic segment is anticipated to hold the largest market share of 23% in 2023. Orthopedic procedures involve the diagnosis and treatment of musculoskeletal conditions and injuries, including surgeries on bones, joints, muscles, ligaments, and tendons. In the small molecule immunomodulators market, there's a growing trend towards specialized orthopedic kits.

These customized kits contain instruments and supplies tailored to specific orthopedic procedures, such as joint replacements or spinal surgeries. This trend reflects the increasing demand for precision and efficiency in orthopedic surgeries, driving the market's expansion as healthcare facilities seek custom solutions to optimize patient outcomes and operational workflows.

On the other hand, the cardiac surgery segment is projected to grow at the fastest rate over the projected period. Cardiac surgery involves surgical procedures performed on the heart and blood vessels to treat various cardiovascular conditions. Custom procedure kits tailored for cardiac surgeries include specialized instruments, implants, and supplies required during procedures like coronary artery bypass grafting and heart valve repair or replacement.

Recent trends in the small molecule immunomodulators market for cardiac surgery encompass the incorporation of advanced materials and technologies, such as minimally invasive surgical tools and 3D-printed implants. These kits are designed to enhance precision, reduce surgical time, and improve patient outcomes in the ever-evolving field of cardiac surgery.

End-user Insights

In2025, the hospitals segment had the highest market share of 52% on the basis of the end user. Hospitals, as key end users in the custom procedure kits industry, refer to healthcare institutions where patients receive comprehensive medical care. These facilities require custom procedure kits to streamline surgical and medical procedures, ensuring efficient patient care, reduced costs, and improved infection control.

Hospitals often seek customizable solutions that cater to various departments, such as surgery, emergency, and intensive care units. Recent trends include an increased focus on infection control measures within hospitals, driving the demand for custom kits designed for sterile and aseptic procedures. Additionally, as healthcare facilities strive to optimize resource utilization, there is a growing trend toward adopting standardized custom kits across hospital networks, enhancing operational efficiency while maintaining high-quality patient care. Moreover, technological advancements and the integration of data-driven customization are shaping the future of custom procedure kits in hospitals, aligning them with evolving healthcare needs.

The ambulatory surgical centers segment is anticipated to expand at the fastest rate over the projected period. Ambulatory surgical centers (ASCs) are healthcare facilities that provide same-day surgical procedures to patients who do not require hospitalization. These centers offer a cost-effective and convenient alternative to traditional hospital-based surgery, focusing on outpatient care and rapid patient recovery.

In the small molecule immunomodulators market, there is a growing trend of tailoring kits to the unique needs of ASCs. These kits are designed to optimize efficiency and resource utilization in outpatient settings, ensuring that ASCs have access to specialized instruments and supplies for various procedures. This trend reflects the increasing importance of ASCs in modern healthcare delivery, driving customization and innovation in custom procedure kits to meet the specific demands of these facilities.

Regional Insights

U.S. Small Molecule Immunomodulators Market Size and Growth 2026 to 2035

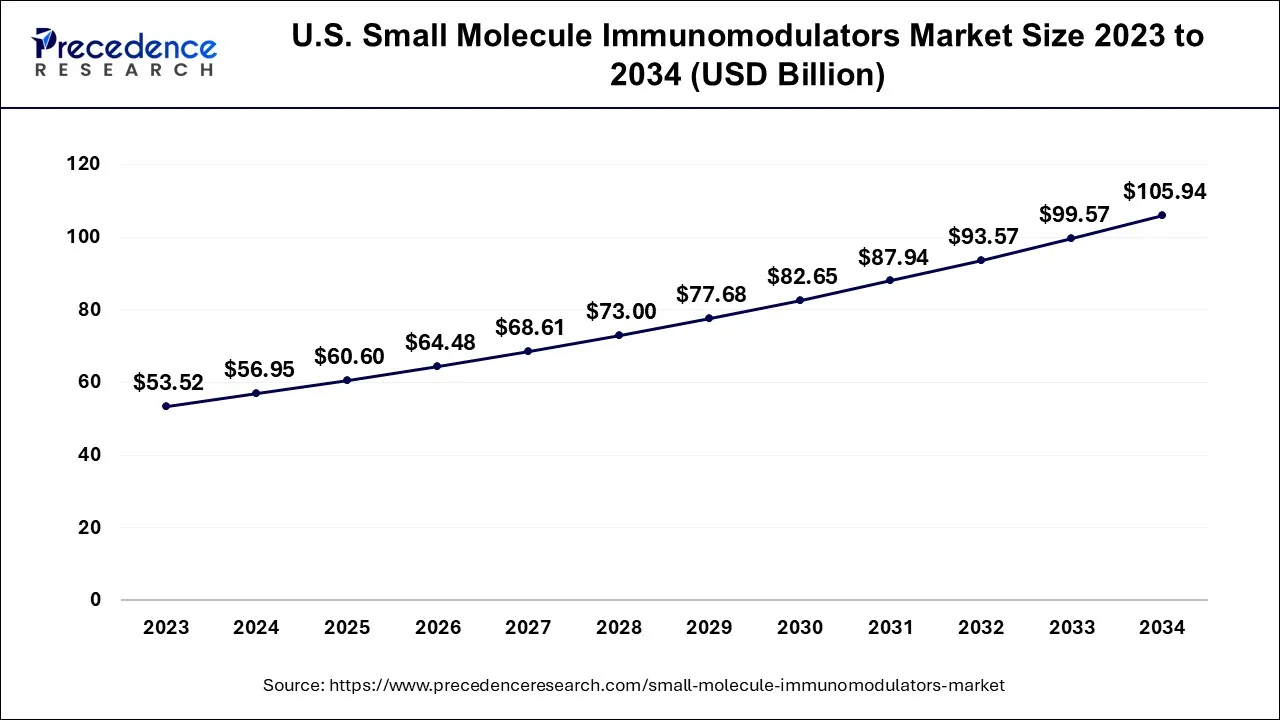

The U.S. small molecule immunomodulators market size is calculated at USD 60.60 billion in 2025 and is projected to be worth around USD 112.06 billion by 2035, poised to grow at a CAGR of 6.34% from 2026 to 2035.

U.S. Small Molecule Immunomodulators Market Analysis

The market in the U.S. is growing due to the rising prevalence of autoimmune and inflammatory diseases, which is driving demand for effective and targeted therapies. Strong investment in pharmaceutical research and development, along with rapid advancements in drug discovery and precision medicine, is accelerating the development of novel small molecule immunomodulators. Additionally, supportive regulatory frameworks and increasing adoption of oral immunomodulatory therapies over biologics are contributing to the market's expansion in the country.

North America has held the largest revenue share 46% in 2025. In North America, the small molecule immunomodulators market is experiencing several notable trends. Increased adoption of outpatient surgical procedures and the growing emphasis on cost-effective healthcare delivery are driving the demand for customized kits. Advanced healthcare infrastructure and a strong focus on infection control measures further stimulate market growth.

Additionally, partnerships between kit manufacturers and healthcare facilities are fostering innovation and customization. The market in North America continues to evolve as healthcare providers seek efficient, patient-centric solutions, making it a dynamic and crucial segment within the healthcare industry.

Why is Asia Pacific Considered the Fastest-Growing Market?

Asia Pacific is estimated to observe the fastest expansion. In the region, the custom procedure kits industry is witnessing notable trends. As healthcare infrastructure expands and access to medical services improves, the demand for customized procedure kits is on the rise. Countries like India and China are experiencing a surge in outpatient surgeries and specialized medical procedures, creating opportunities for custom kit providers.

Moreover, the adoption of advanced healthcare technologies and the growing awareness of infection control measures are influencing the market's growth in the Asia-Pacific, making it a region of significant potential for custom procedure kits.

India Small Molecule Immunomodulators Market Analysis

India's market is growing due to expanding healthcare infrastructure, increased access to specialized medical procedures, and a rise in outpatient surgeries. Adoption of advanced medical technologies, growing awareness of infection control, and the need for cost-effective, customized procedure kits are driving demand for small molecule immunomodulators, creating significant opportunities for manufacturers in the rapidly developing Indian healthcare sector.

How is the Opportunistic Rise of Europe in the Small Molecule Immunomodulators Market?

Europe is expected to grow at a lucrative rate in the market due to its advanced healthcare system, increasing demand for personalized medicine, and strict infection control protocols. Adoption of innovative medical technologies, emphasis on cost-effective and patient-centric solutions, and strong collaborations between healthcare providers and kit manufacturers are likely to drive market growth during the forecast period.

UK Small Molecule Immunomodulators Market Analysis

The market in the UK is growing due to a rising prevalence of autoimmune and inflammatory diseases, which is increasing demand for effective and targeted treatment options. Strong investment in pharmaceutical research, clinical trials, and drug development is driving innovation in novel small molecule therapies. Additionally, supportive government policies, regulatory frameworks, and the adoption of advanced precision medicine approaches are further boosting market growth in the country.

Value Chain Analysis

- R&D

This stage involves the identification of potential immunomodulatory small molecules through target identification, high-throughput screening, and preclinical studies.

Key Players: Roche, Bristol Myers Squibb, Novartis, Sanofi, Nurix Therapeutics. - Preclinical & Clinical Development

In this stage, candidate molecules undergo rigorous preclinical testing followed by phased clinical trials to evaluate safety, efficacy, and dosage.

Key players: Johnson & Johnson, AbbVie, Merck & Co., AstraZeneca. - Distribution & Supply Chain

Distribution includes the logistics of delivering finished immunomodulator products to hospitals, pharmacies, and healthcare providers.

Key players: McKesson, AmerisourceBergen, Cardinal Health.

Top Companies Operating in the Market & Their Offerings

- Medline Industries, Inc.: Provides custom procedure kits, medical supplies, and infection prevention solutions that improve efficiency, reduce waste, and support patient safety across healthcare settings.

- Teleflex Incorporated: Offers specialized medical devices and procedure kits focused on anesthesia, vascular access, urology, and critical care to enhance clinical outcomes.

- Boston Scientific Corporation: Develops advanced medical devices and procedure-specific kits for minimally invasive surgeries across cardiology, endoscopy, and urology applications.

- BD (Becton, Dickinson and Company): Supplies medical devices, diagnostic systems, and customized procedure kits emphasizing safety, precision, and infection control in healthcare delivery.

- Owens & Minor, Inc.: Provides healthcare logistics, custom procedure trays, and medical supplies to improve supply chain efficiency and procedural consistency for hospitals.

- 3M: Delivers medical solutions including sterilization products, wound care, and infection prevention systems supporting safe, efficient surgical and procedural environments.

Other Small Molecule Immunomodulators Market Companies

- Molnlycke Health Care

- Cardinal Health, Inc.

- B. Braun Melsungen AG

- Halyard Health, Inc.

- Smith & Nephew plc

- Thermo Fisher Scientific Inc.

- Terumo Corporation

- Mölnlycke Health Care AB

- Johnson & Johnson Services, Inc.

Recent Developments

- In April 2024, precision oncology company Flindr Therapeutics B.V. announced a €20 million Series A funding round to advance its pipeline of first-in-class small molecule cancer therapies. The round was led by V-Bio Ventures, with participation from Johnson & Johnson Innovation (JJDC), QBIC Fund, Flanders Future Tech Fund, Curie Capital, and existing investors including Oncode Oncology Bridge Fund, Swanbridge, and BOM.

- In 2022,Medline Industries, as part of the European Commission's rescEU program, donated 59 pallets containing 14 tons of medical supplies to Ukraine. The contribution included essential items like delivery kits, oxygen therapy equipment, scrub suits, and scalpels & sutures, aiding healthcare efforts in the country.

- McKesson Medical-Surgical sponsored seven NHCW 2022 events at Community Health Centers: Community Health Association of Spokane, Cumberland Family Medical Centers, East Boston Neighborhood Health Center, Eisner Health, Sun River Health, Tampa Family Health Centers, and Terry Reilly Health Centers.

Segments Covered in the Report

By Product

- Disposable

- Reusable

By Application

- Colorectal

- Thoracic

- Orthopedic

- Ophthalmology

- Neurosurgery

- Cardiac Surgery

- Gynecology

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting