What is the Small Molecule Innovator CDMO Market Size?

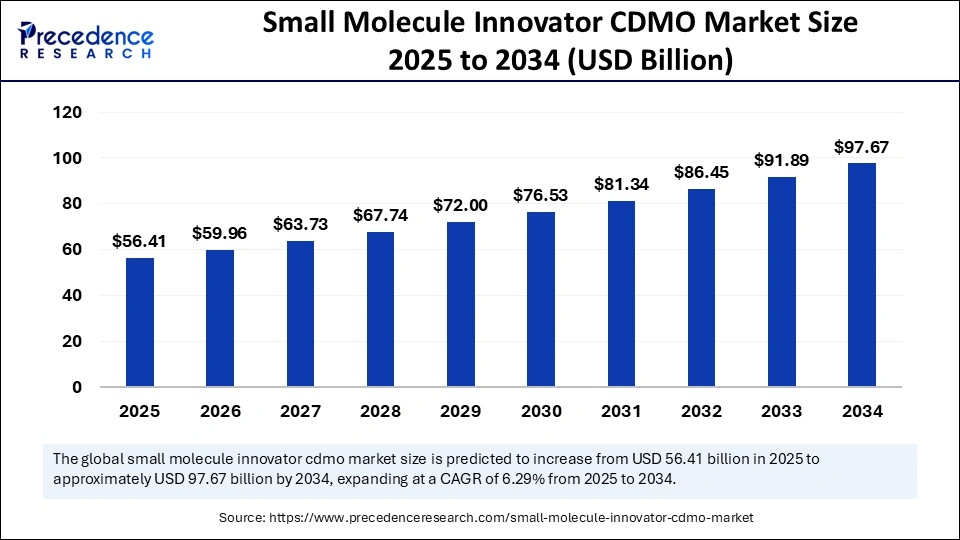

The global small molecule innovator CDMO market size is calculated at USD 56.41 billion in 2025 and is predicted to increase from USD 59.96 billion in 2026 to approximately USD 97.67 billion by 2034, expanding at a CAGR of 6.29% from 2025 to 2034. Increasing R&D investments are fuelling growth in the market, as pharmaceutical companies seek specialized partners for advanced development, regulatory compliance, and efficient manufacturing solutions.

Small Molecule Innovator CDMO Market Key Takeaways

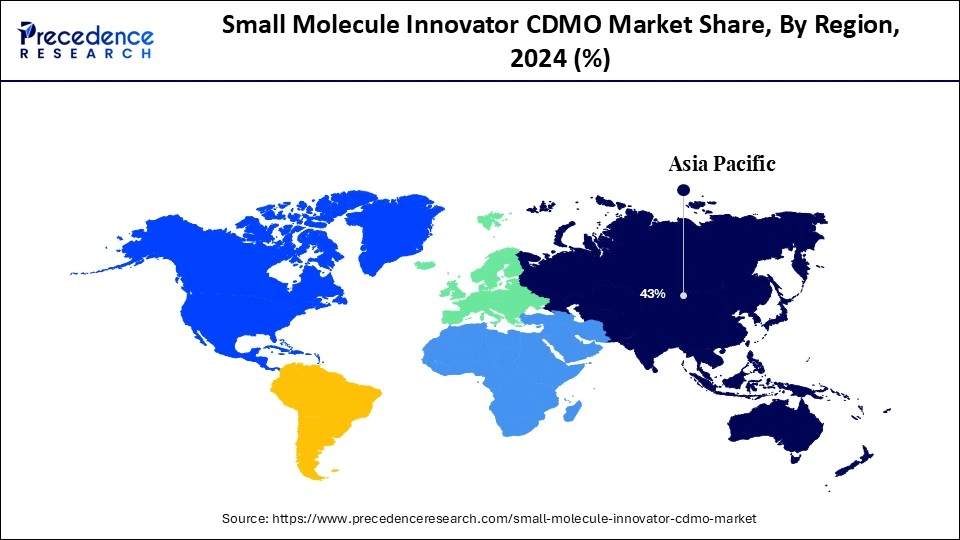

- Asia Pacific led the global market with the highest share of 43% in 2024.

- North America is estimated to grow at a CAGR of 6% between 2025 and 2034.

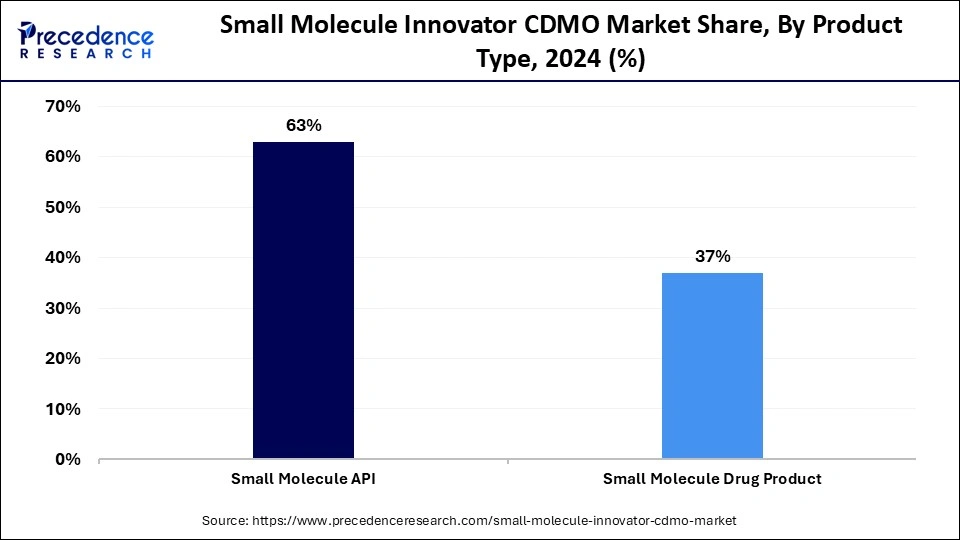

- By product, the small molecule API segment held the largest market share of 63% in 2024.

- By product, the small-molecule drug product segment is expected to grow at a CAGR of 5.8% between 2025 and 2034.

- By stage type, the clinical segment captured the biggest market share of 56%in 2024.

- By stage type, the commercial segment is projected to grow at a notable CAGR of 7% over the projected period.

- By therapeutic area, the oncology segment held the biggest market share of 43% in 2024.

- By therapeutic area, the infectious disease segment is projected to expand at a notable CAGR of 7.04% over the projected period.

- By customer type, the pharmaceutical segment contributed the highest market share of 94% in 2024.

- By customer type, the biotechnology segment is growing at a CAGR of 5% over the projected period.

Market Overview

A small molecule innovator CDMO is a type of specialized service that provides pharmaceutical companies with end-to-end services for the development and manufacture of active pharmaceutical ingredients (APIs) used in innovative small-molecule drugs. These CDMOs assist drug developers by providing firms with a continuum of support in process research, scale-up, manufacturing, and regulatory compliance, allowing for more rapid and efficient drug development while lowering the cost of goods and time to market.

The small molecule innovator CDMO market is an important part of the pharmaceutical supply chain, as pharmaceutical companies outsource drug manufacturing services to CDMOs. As pharmaceutical companies focus more on their primary processes, such as drug discovery and commercialization, they will begin to work more with CDMOs to execute the more burdensome and complex procedures for the development of APIs in commercial drug manufacturing. The growth of this market is driven by several factors, including increased demand for innovative small-molecule drugs, increased investment in R&D spending, and the need for more sophisticated and advanced manufacturing processes and capabilities.

Artificial Intelligence (AI) in Small Molecule APIs

Artificial intelligence is reshaping the manufacturing of small-molecule innovator active pharmaceutical ingredients (APIs) via optimization of efficiency, consistency, and quality. AI technologies can drive improvements in drug discovery, process development, and production by synthesizing large datasets, predicting the interaction of molecules, and automating processes for workflows. This decreases both time to market and process production costs while maximizing outcomes and maintaining quality.

The competitiveness of the pharmaceutical industry is leading companies to integrate AI with workflows to streamline operations, improve scalability, and maintain regulatory compliance. Advanced computational tools, including machine learning and quantum computing , are innovating further than obvious product development by allowing advanced molecular modeling and predictive analytics . Ongoing advancements in AI and the digitalization of small molecule API manufacturing will have a positive and profound impact on drug development, and ultimately achieve better patient outcomes and newer, better therapies or medicines.

What Is Fueling the Rapid Expansion of the Global Small Molecule Innovator CDMO Market?

The Small Molecule Innovator CDMO market is experiencing rapid growth as an increasing number of pharmaceutical companies are outsourcing complex drug development and manufacturing programs to specialized providers. A number of drivers are stimulating growth in the market, including increased demand for cost-effective development options, an increase in the number of small molecule drug pipelines, and the increased demand for advanced formulation capabilities. Organizations such as Lonza, Catalent, and Thermo Fisher Scientific are critical to shortening timelines and scaling innovators across the international marketplace.

Market Outlook

- Industry Growth Overview: The market is expected to continue to grow steadily as pharmaceutical innovators rely on third-party partners to provide specialized chemistry, speed timelines, and take on heavy operational involvement. A steady increase in small-molecule approvals and growing complexities in development will continue to elevate the overall role of Contract Development and Manufacturing Organizations (CDMOs) across the globe.

- Sustainability Trends: Sustainability continues to be at the forefront, with CDMOs investing in green chemistry, energy-saving manufacturing, and waste-reducing technologies, as well as production with environmentally friendly materials, biodegradable solvents, or completely eco-label products. Sustainable and green approaches are becoming increasingly common, compelling companies to take longer-term ESG commitments toward environmentally sustainable production models.

- Global Expansion: CDMOs are expanding and increasing their global footprint by developing newer facilities and entering strategic partnerships in Asia, Europe, and Latin America. Innovators use this expansion to develop a diversified supply chain, mitigate risks, and expedite drug launches in multiple regions.

- Startup Ecosystem: Startups are increasingly entering into collaborative relationships with CDMOs based on small-batch synthesis of new drug candidates, formulation, and rapid clinical material production. By relying on CDMOs to support early-stage drug development, CDMOs value their ability to offer and create flexibility and innovative ways to support customer operations and continuously innovate for biotech and pharmaceutical startups.

Small Molecule Innovator CDMO Market Growth Factors

- Growing demand for innovative drugs- An increased prevalence of chronic disease and a continued need for new therapies are driving demand for small-molecule APIs and pushing pharma companies to source their development and manufacturing to specialized CDMOs.

- Technical advancements in manufacturing- Within production, advances in artificial intelligence, automation, and continuous manufacturing are driving efficiencies, minimizing waste, and allowing for optimized manufacturing processes, making CDMOs an attractive partner for small molecule API development and manufacture.

- Growth of biopharma and emerging markets- The biopharma sector expansion, along with increasing API export markets such as Asia-Pacific and Latin America, is increasing the demand for API CDMO services, due to the desire for global manufacturing partners and lower-cost manufacturing options.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 97.67 Billion |

| Market Size in 2026 | USD 59.96 Billion |

| Market Size in 2025 | USD 56.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.29% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Stage Type, Indication, Therapeutic Area, Customer Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

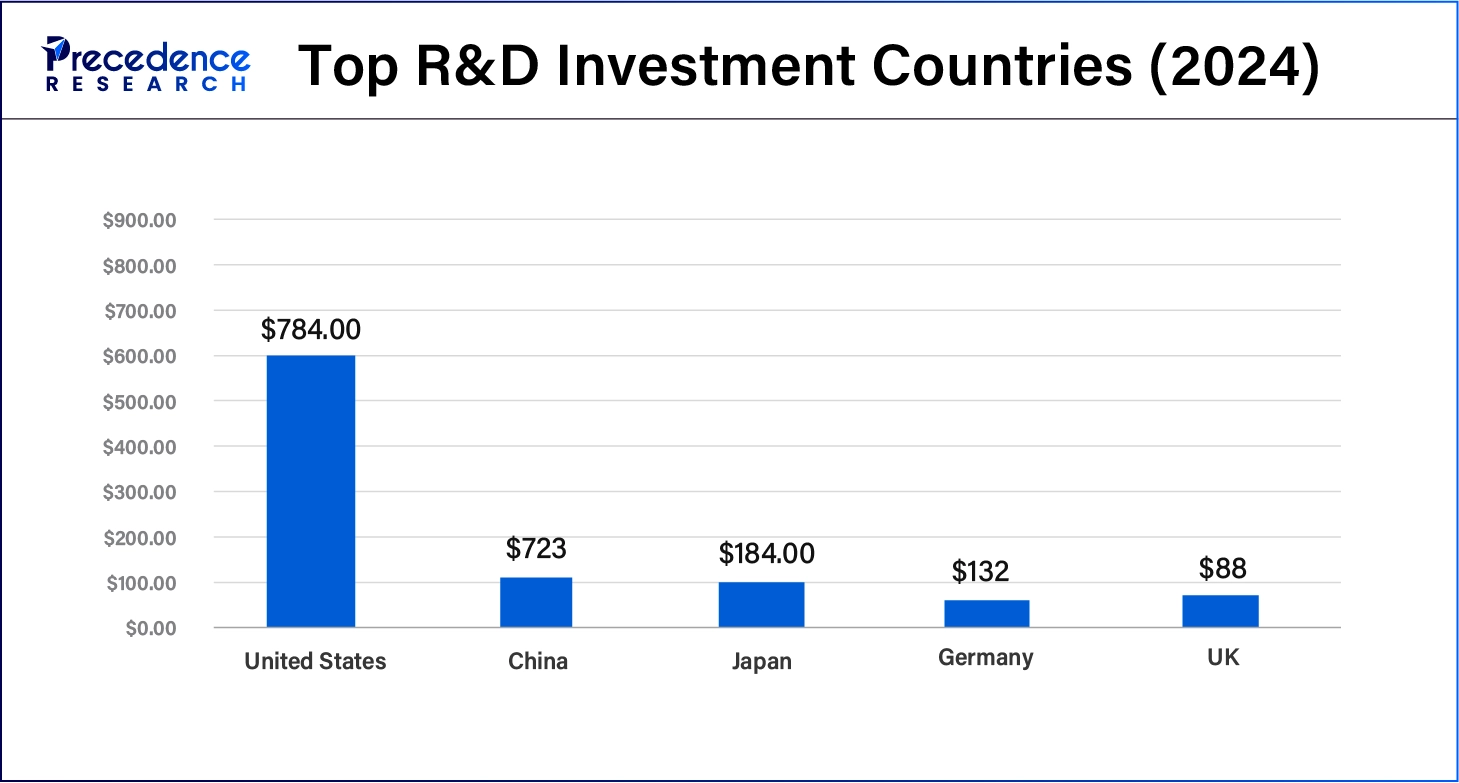

Escalating R&D investments

Increased research and development (R&D) spending is a major catalyst for growth in the small molecule innovator CDMO market. Pharmaceutical and biotechnology companies are making substantial investments in R&D in order to foster innovation and speed the drug discovery process. Broadly speaking, pharma giants spend between 14% and 30% of their revenues on R&D, highlighting the industrys reliance on R&D. As a point of reference, the European Federation of Pharmaceutical Industries and Associations (EFPIA) report that in 2022, total pharma spending on R&D in Europe was USD 44,500 million, up from USD 42,533 million in 2021.

Additionally, pharma investment in R&D in the U.S. continues to increase, reflecting the global expectation for drug innovation. This shift to increased investment in R&D will lead to greater dependency on CDMOs for specialized services, process development, validation, and regulatory assurance. Generally speaking, when biotechnology or pharmaceutical companies utilize CDMO competency, they are able to substantially lower costs, reduce risk, and accelerate the time-to-market for new small-molecule therapies that improve the quality of patient outcomes on a global scale.

- In September 2024, SK Pharmteco is investing USD 260 million to expand its global small molecule and peptide production with a new state-of-the-art facility in Sejong, South Korea.

Restraint

Regulatory burden

The significant regulatory restraints and compliance requirements are one of the biggest constraints in the Small-Molecule Innovator CDMO market. Regulatory context, with entities like the FDA and EMA, marks clear guidelines for drug development through approval for manufacturing and quality control, translating into long timelines for approval, and expenses like time and financial capacity, that can be laborious outside of compliance. The cost of non-compliance can be proportional to the edge case that regulatory agencies choose to apply.

In addition to regulations evolving, for example, the EUs Annex 1, revised on sterile drug manufacturing, will require an investment in new infrastructure and technologies for CDMOs to act in compliance with baseline regulations. This compliance burden could be a significant cap on any potential growth in the small-molecule innovator CDMO market, while smaller CDMO innovators suffer as having capital equity restraints as well as operational implementation complications.

Opportunity

Chronic Disease Surge

The increasing incidence of chronic diseases has created a tremendous opportunity for the small molecule innovator CDMO market. For the purpose of this research, chronic diseases are diseases that last one year or longer and require continuous medical care. Chronic diseases are increasingly being identified globally. In 2022, cardiovascular diseases alone accounted for approximately 944,652 deaths in the United States, more than cancer and all other chronic respiratory diseases combined. Diabetes, cancer, and respiratory diseases are also trending upward, and projections indicate increased incidence rates through the year 2025.

The increased burden of chronic disease will result in increased need for innovative small-molecule drug therapies. Small Molecule Innovator CDMOs play an integral role in the development and manufacture of these drugs for pharmaceutical/biotech companies. As chronic disease incidence increases, these CDMOs are in a strong position to grow their contributions to the healthcare sector, thereby supporting the enablement of new treatments to meet healthcare needs on a global scale.

Segment Insight

Product Insights

In 2024, the small molecule API segment held the largest small molecule innovator CDMO market share. This dominance is attributed to both the demand for innovative small-molecule therapies and the ongoing approvals of new APIs by regulatory agencies, such as the U.S. FDA, which is expected to continue this trend. For example, in 2024, the FDA granted approvals for 50 new drugs, which included 31 small molecules, 19 biologics, and 24 first-in-class drugs, which is also equal to 50 new molecular entities (NMEs). Approvals like this are likely to expand and continue in the upcoming years.

Additionally, the small-molecule drug product segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 as it continues to adapt with innovations in drug delivery and more regulators standards to improve quality and efficacy. However, not every company has developed the capability to manufacture these products commercially at scale, which makes it tough for them to comply with their regulations. There are many companies that have been able to mitigate this through an understanding with CDMO companies, which have experience in manufacturing, state-of-the-art GMP facilities, regulatory expertise, and reliable quality systems. These CDMO companies can help many organizations create seamless compliance and reduce compliance risk in this segment.

Stage type Insights

The clinical segment captured the biggest small molecule innovator CDMO market share in 2024, due to the significant number of small-molecule drugs in the pipeline and increasing R&D expenditure. The global pharmaceutical R&D expenditure in 2024 exceeded USD 276 billion, demonstrating the industrys continued focus on innovation and drug development. The sustained increase in R&D expenditure is expected to spark increased development of novel therapies and solidify the clinical-stage segment. The rise in clinical-stage drug pipeline development is also attributed to increasing collaboration among biotech companies, pharmaceutical companies, and research institutions.

The commercial segment is expected to grow at a notable CAGR over the projected period, due to the growing trend of small and mid-size pharmaceutical companies outsourcing their operations. Companies with substantial numbers of commercially available small-molecule innovator drugs are increasingly partnering with specialized CDMOs and outsourcing their manufacturing needs in order to focus on their core competencies. Utilizing specialized CDMOs also allows for compliance with a complex regulatory environment and increasing efficiencies in their operations, enabling pharmaceutical companies to reallocate resources toward drug development and marketing.

Therapeutic Area Insight

The oncology segment captured the biggest small molecule innovator CDMO market share in 2024 because of the increasing global cancer burden, which reached over 20 million new cases and 9.7 million deaths in 2022. The burden of cancer is expected to increase by 77% by 2050. This increase will create demand for novel anti-cancer treatments and CDMO services in this area. The increasing development of HPAPIs will further bolster the leadership of this segment, along with the rising adoption of targeted therapies.

The infectious disease segment is projected to expand at a notable CAGR over the projected period, stemming from the immediate need for new antibiotics , antiviral drugs, and preparedness for pandemics. Because of increased antimicrobial resistance and new infectious disease emergence, R&D in this area has gained rapid momentum, resulting in pharmaceutical companies partnering with CDMOs for efficient API development. The increase in a required global move to shore up healthcare capability and preparedness for future outbreaks has, in addition to the above, created a higher level of investment and rate of growth in the infectious diseases category.

Customer Type Insight

The pharmaceutical captured the biggest small molecule innovator CDMO market share in 2024 because of the ongoing reliance on small-molecule medications in the treatment of chronic and acute diseases. Major pharmaceutical manufacturers often outsource API production to Contract Development and Manufacturing Organizations (CDMOs) for cost-effectiveness, regulatory approaches, and leverage specialization. Furthermore, the established supply chains, quality practices, and the growing demand for generic and branded small-molecule drugs solidify the segments position.

Meanwhile, the biotechnology segment is expected to grow at a notable CAGR over the projected period due to innovation in therapeutics being driven by new investments in research and development (R&D) and the increase in the number of biotech startups focused on therapeutics. As the expansion of targeted therapies, personalized medicine, and biologics continues to grow, the need for specialized CDMO partnerships for these products has followed suit. In addition to biologics, advancements in synthetic biology and complex molecule synthesis are driving the growth of this segment, as biotech companies are looking for CDMOs with niche expertise and high-value API manufacturing for the development of unprecedented treatments.

Regional Insights

Asia Pacific Small Molecule Innovator CDMO Market Size and Growth 2025 to 2034

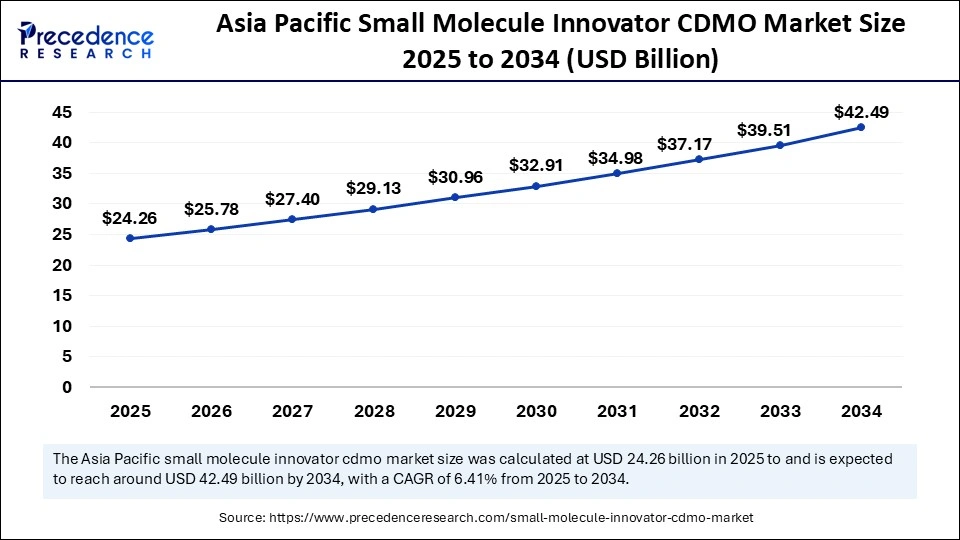

The Asia Pacific small molecule innovator CDMO market size is exhibited at USD 24.26 billion in 2025 and is projected to be worth around USD 42.49 billion by 2034, growing at a CAGR of 6.41% from 2025 to 2034.

Asia Pacific: The Epicenter of Rapid API Innovation

Asia Pacific held the largest share of the small molecule innovator CDMO market in 2024. The largest contributors to this dominance is led by India and China, which are backing strong investments in R&D, establishing low-cost manufacturing capabilities, and pursuing regulatory policies to produce APIs and modernize their regulations to rely less on imported APIs.

- In August 2024, Indias Rashtriya Vigyan Puraskar (RVP) award program was launched to reward excellence and innovations among its young scientists domestically, while companies such as Anthem Biosciences led the way towards innovation and significant business developments, such as their IPO filing with the U.S. SEC of USD 397 million in December 2024. The combined openness of policies and incentives will train India to become a key player in the global market for API production.

Meanwhile, China continues to advance the development of APIs, with an R&D spend increase to 8.3% that has reached approximately USD 500 billion in 2024. Companies such as Akeso are beginning to achieve substantial breakthroughs, and the government is reinforcing its position and urgency of improving domestic pharmaceutical manufacturing capabilities to promote reliance on domestically produced APIs and minimize on imported APIs.

North America: Fastest Growing till the Predicted Timeframe

North America is seen to grow at the fastest rate during the forecast period. North America remains at the forefront of research and development concerning small-molecule APIs, supported by considerable investment and considerable existing pharmaceutical infrastructure. The emphasis on innovation in North America has fostered the research and development of small molecules that are highly potent and effective in treating various chronic diseases. Research on APIs is stimulated through collaborations between pharmaceutical manufacturers, academic institutions, and government entities.

U.S. and Canada Small Molecule Innovator CDMO Market Trends

The U.S. leads North America in the small molecule innovator CDMO market. This is driven by a solid base of pre-established pharmaceutical and biotechnology companies, the surging demand for new drugs, and expanding R&D activities. The large uptick in approvals for small-molecule drugs, including 50 novel drug approvals from the FDA in 2024, is an indicator of leadership within drug innovation. In addition, clinical trials are on the rise, with over 66,000 active clinical trials and ongoing innovation across the medical research arena. The U.S. continues to lead growth in the North American pharmaceutical industry.

In Canada, government funding, combined with supportive policies, has further strengthened pharmaceutical research, including the small molecule innovator CDMO market. Research funding is supplemented by numerous public-private partnerships that improve drug discovery and development, which is a further indication of Canadas commitment to supporting innovation. As a result of these efforts, Canada has emerged as a significant player in the North American API market, and policy initiatives aimed at fostering this environment for pharmaceutical innovation are in place.

- In September 2024, Eurofins CDMO announced plans to construct a USD 64 million biologics manufacturing facility in Ontario, backed by funding from Canadas Strategic Innovation Fund (SIF). This government-supported investment aims to enhance the countrys biopharmaceutical capabilities, reinforcing its position in global biologics production.

The European Market Advancing with a Thriving Pharma Landscape

The small molecule API CDMO market in Europe is characterized by a strong focus on R&D amidst many rules and regulations from the pharma ecosystem. Europe maintains some of the strictest quality requirements in the world through the EMA, leading to the production of high-purity APIs. The regulatory structure has enabled Europe to supply over 70% of the worlds exported APIs. Germany holds the most substantial amount of pharma innovation, home to more than 500 manufacturers of pharmaceuticals, with many of these preparing APIs for the most cutting-edge research and development. The emphasis on advanced manufacturing has earned European APIs a reputation for reliability and quality.

Germanys pharmaceuticals sector is fueled by a strong research and development ecosystem and high standards of regulatory compliance that encourage the small molecule innovator CDMO market development. Germany boasts one of the highest concentrations of pharmaceutical manufacturers in Europe, at around 500, all yielding a consistently high-quality product compliant with EMA and GMP.

With an increase in patents applied for in relation to APIs and 1,200 clinical trials in progress, Germany is one of the leading countries for pharmaceutical research and innovation. Collaboration between industry and academia, supported by Government initiatives, reinforces Germany as a leader in the sector against a backdrop of EU pharmaceutical funding, which further adds to the governmental support for research and development of small-molecule APIs.

- In February 2025, German CDMO Axplora announced a € 50 million expansion at its French production facility, boosting API and ADC manufacturing capacity.

According to WIPO, the top global R&D spenders, led by the U.S. and China, are heavily investing in innovation. This increasing R&D expenditure is driving the growth of the small molecule innovator CDMO market, accelerating advancements in pharmaceutical development.

Why Is Latin America Growing as a Viable Competitor in CDMO Services?

Latin America is seeing a rapid growth of investment into pharmaceutical outsourcing because local and international companies are finding it to be a place to produce pharmaceuticals quite cheaply. Countries like Brazil and Mexico are also improving their regulatory bodies (CROs) and infrastructure, as well as their GMP compliance.

Many national governments support and facilitate the business of domestic pharmaceuticals; moreover, there are increased activities for clinical research. All of this makes Latin America a competitive alternative for innovators seeking early-stage development, formulation services, and small-batch production.

Brazil Small Molecule Innovator CDMO Market Trends

Brazil's market is expanding rapidly, driven by increasing pharmaceutical R&D and rising demand for outsourcing of small-molecule APIs to optimize development and reduce costs. Local CDMOs are investing in advanced manufacturing technologies, including single-use systems and continuous processing, to improve efficiency and remain competitive globally. Growth in small-molecule drug discovery outsourcing is also fueling the expansion of services from early-stage research to full development solutions.

Value Chain Analysis

What Value Chain Elements of Small Molecule Innovator CDMOs Contribute to the Global Development of Drugs?

The Small Molecule Innovator CDMO value chain covers early discovery, API synthesis, formulation development, process improvement, and manufacture at a commercial scale. Companies like Lonza, Piramal Pharma Solutions, and Cambrex leverage their advanced chemistries, automation, and regulatory know-how to increase speed, quality, and compliance with regulatory requirements along the entire value chain.

As the market for high-potency APIs, complex molecules, and rapid clinical trial supply increases, CDMOs have developed from single-point suppliers to full-service partners offering an end-to-end product lifecycle management approach. CDMOs are a very important partner in global pharmaceutical pipelines by closing innovation gaps, addressing manufacturing bottlenecks, and reducing overall R&D costs.

Key Elements of the Value Chain

- Advanced API Manufacture: CDMOs offers specialized synthesis capabilities for an array of small molecules, including high-potency and multi-step chemistry, but highly regulated, highly pure, and quality-controlled manufacture is of particular interest for innovators. When high-potency or multi-step chemistry is required, these assurances are needed by innovators to establish reliable processes.

- Final Product Formulation & Analytical Testing: With the benefit of formulation labs and analytical testing platforms that CDMOs possess, the CDMOs are equipped and can ensure compliance of the final products made from APIs that have bioavailability and stable formulations with EMA, FDA, and country standards and regulations.

- Regulatory Support for Commercialization:For the commencement of sales, leading CDMOs assist companies with filing applications and/or preparing dossiers; some can file or prepare submissions, or support the company through the filing and application process. Once products are in human studies, the manufacture grows into the late stage, and they address scale-up to commercial manufacture and supply of the new small-molecule therapies.

Small Molecule Innovator CDMO Market Companies

- Boehringer Ingelheim

- Cambrex Corporation

- Catalent Inc.

- CordenPharma International

- Labcorp Drug Development

- Lonza

- Pantheon (Thermo Fisher Scientific)

- Piramal Pharma Solutions

- Recipharm AB

- Siegfried Holding AG

- Wuxi AppTec

Latest Announcements by Industry Leaders

- In January 2025, Iktos and Cube Biotech announced a strategic collaboration to leverage AI and membrane protein technologies for discovering novel small-molecule agonists of the Amylin Receptor. Through our collaboration with Iktos, we aim to leverage our advanced protein stabilization and structural analysis technologies to validate and accelerate the discovery of novel small-molecule agonists. Together, we are setting a new standard for efficiency and innovation in drug discovery, said Dr. Barbara Maertens, Co-founder and COO of Cube Biotech.

- In October 2024, Thermo Fisher Scientific announced the launch of Accelerator Drug Development, aimed at revolutionizing drug development and manufacturing. Thermo Fisher is transforming drug development and manufacturing processes to support customers as they move critical programs forward to tackle global health challenges with speed, quality, and efficiency. Michael Shafer, Executive Vice President and President of Biopharma Services at Thermo Fisher, commented.

Recent Developments

- In January 2025, BioCina and NovaCina, two global CDMOs, announced a strategic merger to strengthen their presence in small-molecule and biopharmaceutical contract manufacturing.

- In February 2025, Enzo announced the launch of new small molecules designed to drive advancements in cell therapy , enhancing therapeutic development and innovation in the field.

Segments Covered in the Report

By Product Type

- Small Molecule API

- Small Molecule Drug Product

- Oral solid dose

- Semi-Solid Dose

- Liquid Dose

- Others

By Stage Type

- Preclinical

- Clinical

- Phase I

- Small

- Medium

- Large

- Phase II

- Small

- Medium

- Large

- Phase III

- Small

- Medium

- Large

- Phase I

- Commercial

By Indication

- Chronic Sinusitis

- Nasal Polyposis

By Therapeutic Area

- Cardiovascular disease

- Oncology

- Respiratory disorders

- Neurology

- Metabolic disorders

- Infectious disease

- Others

By Customer Type

- Pharmaceutical

- Small

- Medium

- Large

- Biotechnology

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting