What is the Small Molecule Drug Discovery Market Size?

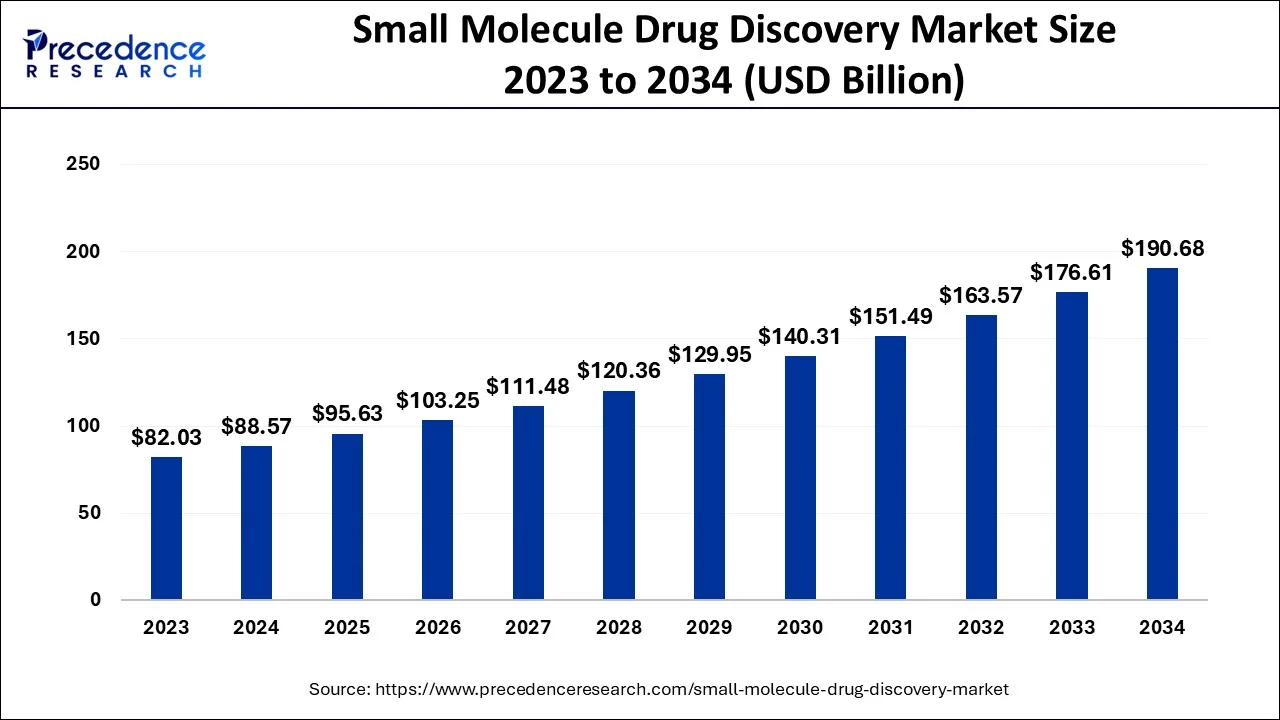

The global small molecule drug discovery market size is estimated at USD 95.63 billion in 2025 and is predicted to increase from USD 103.25 billion in 2026 to approximately USD 204.06 billion by 2035, expanding at a CAGR of 7.87% from 2026 to 2035.

Small Molecule Drug Discovery Market Key Takeaways

- By drug type, the small molecule drug segment was the market leader in 2025.

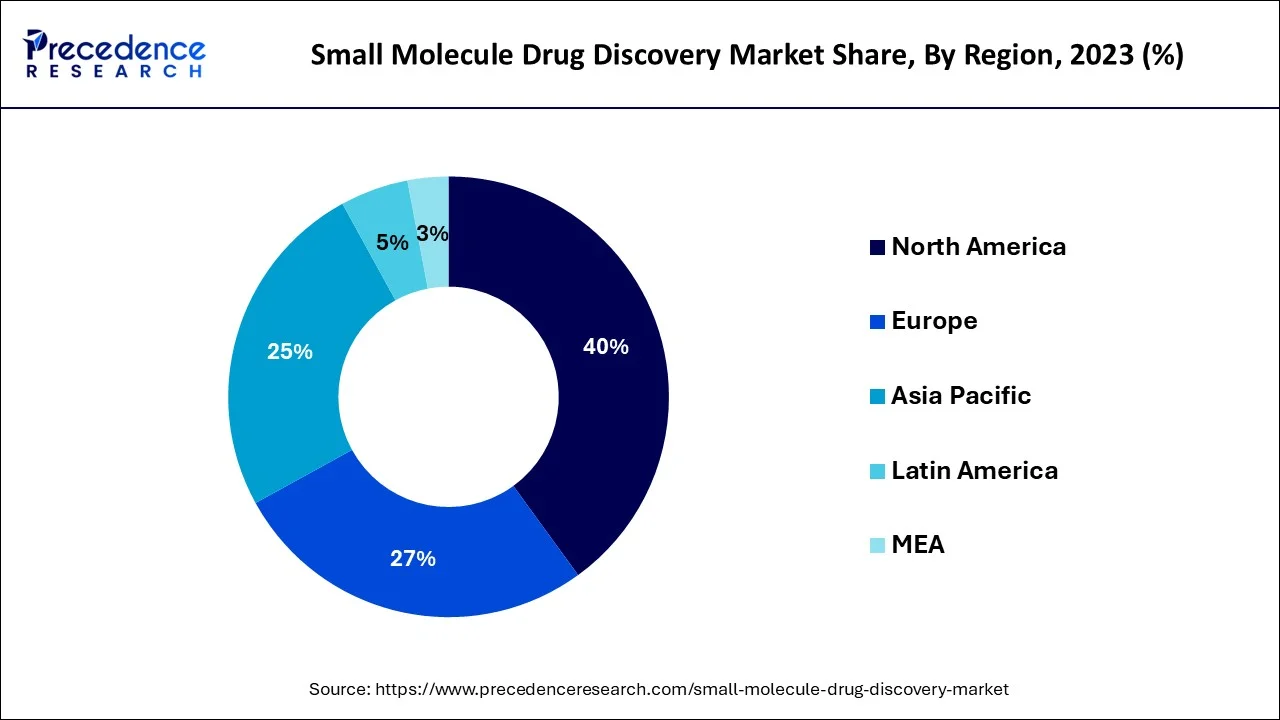

- By geography, North America dominated the market in 2025.

- By geography, the Asia Pacific is anticipated to be the most opportunistic market during the forecast period.

What is Small Molecule Drug Discovery?

Drug discovery, which takes place in the domains of pharmacology, biotechnology, and medicine, is the process of examining new potential medications. In the past, pharmaceuticals were either accidentally found, as was the case with penicillin, or they were discovered by figuring out what made them work. The process known as classical pharmacology was used to identify drugs that had the desired therapeutic effects by screening chemical libraries of made small molecules, natural products, or extracts in entire cells or organisms. The rise in R&D investment, prompted by the demand for various preclinical and clinical services during the drug discovery and development process, is one of the main drivers affecting the global small molecule drug discovery market.

Following this, the effectiveness of hits from these screens is evaluated in cells and then in animals. The process of modern drug discovery includes the identification of screening hits, medicinal chemistry, and optimization of those hits to increase affinity, selectivity (to reduce the danger of side effects), efficacy/potency, metabolic stability (to lengthen the half-life), and oral bioavailability. The process of creating new drugs can start after a molecule that satisfies all of these requirements has been identified. If the experiment is effective, clinical trials are created. As a result, current drug discovery is often a capital-intensive process involving large contributions from both national and pharmaceutical industry corporations.

How is AI contributing to the Small Molecule Drug Discovery Industry?

AI is a game-changer in the field of small-molecule drug discovery by analyzing complex datasets in a rapid manner. The process of uncovering drug targets, generating high-quality molecules, and the efficiency of virtual screening are all augmented by the application of AI in drug discovery. Drug pharmacokinetics, toxicity, and drug-target interactions are predicted more accurately, thereby allowing excellent lead optimization.

AI also directs and manages chemical synthesis, clinical trial design, and patient selection. This means the whole process of drug development is faster, cheaper, and more certain of success for the small-molecule candidates that show the most promise.

Small Molecule Drug Discovery Market Growth

The global small molecule drug discovery industry is expanding as a result of factors like the rising incidence of certain chronic diseases, rising healthcare expenditures, and the approaching patent expirations of some well-known pharmaceuticals. Worldwide, the incidence of conditions like cancer, diabetes, respiratory ailments, cardiovascular diseases, and neurological disorders is rising, which has a significant impact on the demand for unique and cutting-edge drugs. In the upcoming years, the small molecule drug discovery market is expected to be dominated by the pharmaceutical industry, which is rapidly growing due to the rapid development of biopharmaceuticals. The biopharmaceutical business is rapidly growing as a result of increased government and corporate investment in the development of innovative pharmaceuticals to treat chronic diseases.

The prevalence of numerous diseases like cancer/oncology, diabetes, and cardiovascular diseases is rising as a result of changing lifestyles, changing consumption patterns, poor eating habits, rising pollution levels, and physical inactivity. The International Agency for Research on Cancer estimates that there will be around 10.3 million cancer deaths and 19.3 million new cases of cancer worldwide in 2022. By 2045, it is predicted that 783 million people worldwide will have diabetes, according to the International Diabetes Federation.

Market Outlook

- Industry Growth Overview: The growth is still strong as the increasing need for therapy fuels the innovation of small molecules, and the development continues worldwide.

- Sustainability Trends: The adoption of green chemistry is the primary factor that results in less pollution and enables the use of renewable technologies in the production of medicines, a common practice in the industry.

- Global Expansion: North America and Europe are slowly but surely making progress, while Asia-Pacific is quickening its power gain, and this is all together making the global network of discovery and the distribution of therapeutic products more powerful.

- Major Investors: Pfizer, Merck, AstraZeneca, Johnson & Johnson, and Charles River Laboratories are the names that push the envelope on innovations in discovery and collaborations in the field.

- Startup Ecosystem: AI companies are helping to optimize drug design processes by developing computer-based models and creating professional partnerships with CROs to support high-quality discovery.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.63Billion |

| Market Size in 2026 | USD 103.25 Billion |

| Market Size by 2035 | USD 204.06 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.87% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Drug Type, By Technology, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

Growing Welfare Spending and Research and Development Expenditures for the Development of Novel Drug Molecules

Healthcare costs are the main driver of the small molecule drug discovery industry. By providing medicines and vaccines for various medical operations, the pharmaceutical industry contributes significantly to healthcare. Therefore, the annual healthcare spending from corporate companies and government budgets has a big impact on the expansion of the drug discovery process. Healthcare expenses are rising quickly globally as a result of expanding insurance coverage. Due to an increase in patients, hospitals are increasingly in demand.

The remarkable growth in healthcare spending and the development of a wide range of treatment options in hospitals and clinics for patients' well-being have boosted the demand for novel treatments. Consequently, it is projected that this component will accelerate market expansion. In February 2020, a study published in Pharmaceuticals claimed that the FDA had approved the active pharmaceutical ingredients (APIs) for three peptides. Using artificial intelligence for medication research in the pharmaceutical industry is growing swiftly, according to a study published in BioPharma Trend 2020. This aspect is expected to boost the significant investment in R&D activities for identifying innovative therapeutic targets that will fuel market expansion.

Market Restraints

Financial restrictions and strict government regulations

The cost of developing a drug is influenced by a wide range of variables, placing a significant financial burden on the companies involved in drug discovery and development. One of the main factors contributing to high costs is the expenditure of unsuccessful drug candidates during trial phases. Since the return on investment (ROI) is declining significantly, the pharmaceutical sector is under pressure to raise its success rate with limited resources to reduce the cost of failure. Long-term losses are experienced by large corporations. Nevertheless, small and medium-sized firms are significantly impacted by losses. As a result, the high capital expense needed for drug development and the low-profit margins presents a substantial barrier to the drug discovery sector.

Because of strict regulatory requirements, several nations have drawn-out clearance procedures for pharmaceuticals, notably for drugs that treat cancer. Regulatory bodies frequently have a big influence on how clinical research is designed. Due to the rigorous regulatory criteria set by the authorizing organizations, it is therefore projected that the drug discovery market would experience restraints over the forecast period.

Market Opportunities

Increasing numbers of market participants

The growing need for small molecule drugs is predicted to provide industry participants in the worldwide small molecule drug discovery market with appealing growth potential. To help international pharma companies find small molecule drugs more quickly, BioDuro-Sundia and X-Chem announced in August 2022 the introduction of DNA Encoded Compound Library (DEL) technology services in China. Chem is a pioneer in DEL technology, and X-libraries include more than 250 billion small molecules.

For companies in the small molecule drug discovery market, the rising number of contract research and development organizations is anticipated to present considerable potential prospects. For instance, PPD Inc. declared its growth in October 2020 when it opened a new multipurpose clinical research facility in Suzhou, China, to provide bioanalytical, biomarker, and vaccination services for clinical trials throughout all stages of pharmaceutical development.

Segment Insights

Drug Type Insight

In terms of drug type, the small molecule drug discovery market sector was the market leader in 2022. This is a result of the growing demand for small-molecule drugs among the populace. Small-molecule drugs are able to treat diseases and easily affect cells due to their small size and weight.

As a result of the growing understanding of the value of small-molecule medications, firms have boosted their spending in the development of such drugs. On the other hand, it is estimated that the large molecule or biologics segment will expand the fastest during the projected time. The expanding use of cutting-edge manufacturing techniques is boosting the production of biologics.

Technology Insights

High-throughput screening methods are frequently used in the pharmaceutical industry to quickly assess the biological or biochemical activity of multiple substances, frequently medications. These methods make use of automation and robots. They facilitate target analysis by allowing for quick and inexpensive screening of large chemical libraries. The rapid growth in funding for R&D and the advent of large market participants have sparked the need for high-throughput screening technology.

Biochips, bioinformatics, genomics, and a number of auxiliary technologies are examples of additional technologies. The development of genetic and genomic high-throughput systems for use in gene expression and regulatory analysis has been made possible by recent advancements in genomics, opening the door to the discovery of promising novel treatments for a variety of illnesses.

End-User Insights

The increasing demand for novel medicines for the treatment of numerous chronic conditions, which is anticipated to support the rise of the studied market, has motivated pharmaceutical companies to use a variety of cutting-edge technologies in drug discovery. Since pharmacogenomics enables pharmaceutical companies to produce drugs against specific targets, the majority of pharma businesses have been gravitating toward this drug development methodology.

The participation of pharmaceutical corporations in research and development activities to find novel compounds and improve existing treatments is expected to lead to an increase in the drug discovery market. The outsourcing of R&D activities by a number of pharmaceutical corporations to commercial and academic Contract Research Organizations (CROs) may help to reduce the time and expense associated with discovering and developing new medications. Additionally, the market for biological drugs is anticipated to grow significantly, hastening their development.

Regional Insights

What is the U.S. Small Molecule Drug Discovery Market Size?

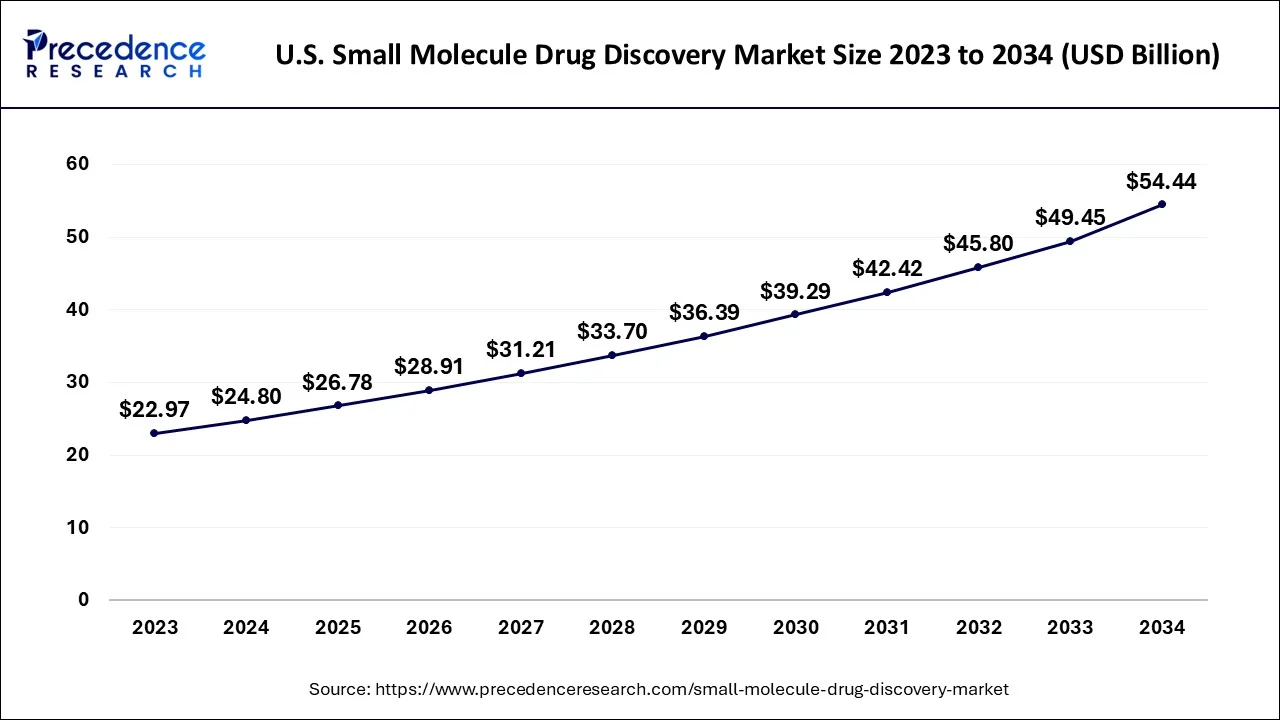

The U.S. small molecule drug discovery market size is estimated at USD 26.78 billion in 2025 and is expected to be worth around USD 58.54 billion by 2035, rising at a CAGR of 8.13% from 2026 to 2035.

The global small molecule drug discovery market was dominated by North America in 2022, according to geography. In terms of global spending on research and development, the US holds the top spot. Furthermore, the majority of the recently developed new pharmaceuticals are protected by US patents. Additionally, the rising frequency of chronic diseases has increased the demand for cutting-edge and novel medications, which has supported the expansion of the drug discovery market in North America. In the US, around half of the population has one or more chronic illnesses. As a result, the nation now spends a lot of money on healthcare. Additionally, the region's growing awareness of biologics is boosting the market's expansion.

How is North America leading in the Small Molecule Drug Discovery Market?

The North American market is at the forefront of drug development owing to its robust research capabilities, cutting-edge technologies, and high-level innovation. The region is a growing therapeutic demand hub, thus benefiting the development of specialized treatments and broadened discovery efforts across numerous therapeutic sectors.

U.S. Small Molecule Drug Discovery Market Trends

The U.S. is the main player in the market with its powerful capital investment, cutting-edge technology, and constant innovation in discovery. Besides, the strong demand for revolutionary therapy and focus on research methods push the development in oncology, neurology, and other specialized therapy segments.

The most opportunistic market is anticipated to be in Asia Pacific in the next years. This can be linked to the region's abundance of CROs. Additionally, nations like South Korea, India, and China are making significant investments in the expansion of the pharmaceutical sector, which is driving up demand for biopharmaceutical goods. In addition, given older individuals are more sensitive to chronic diseases, it is anticipated that the region's growing elderly population would boost drug demand in the near future. By 2050, 80% of the world's elderly people will reside in low- and middle-income nations, according to the UN. Consequently, the area is anticipated to see a jump in the growth of the drug discovery market.

China Small Molecule Drug Discovery Market Trends

China is on the fast track to becoming a major player in the market due to its investment in clinical research, growing innovation, and contract research capability. The country's involvement in the areas of cancer and infectious disease research is being further enhanced by the use of contemporary techniques and industry-academia collaboration.

What are the driving factors of the Small Molecule Drug Discovery Market in Europe?

Europe has a very strong and well-established environment for the discovery of small molecules backed by its excellent regulatory system and scientific know-how. The increase in therapeutic developments and innovations at a lower cost also supports development activities in the area.

Germany Small Molecule Drug Discovery Market Trends

Germany still plays a significant role in the pharmaceutical industry as a research powerhouse, by having biotechnology integrated to an advanced level and making therapeutic development continuously better. It has a strong focus on oncology and CNS-related treatments, which lead to the creation of new ideas, and these ideas, in turn, support the continuous discovery and development of small molecules.

Value Chain Analysis of the Small Molecule Drug Discovery Market

- R&D: Research and Development consists of new small-molecule drug candidates discovered and developed through basic research, hit identification, and optimization.

Key Players: Pfizer, Novartis, and Merck & Co. - Clinical Trials and Regulatory Approvals: Clinical trials and regulatory approvals have human studies evaluating safety and obtaining authorization from regulatory agencies as an effectiveness measure.

Key Players: IQVIA and Laboratory Corporation of America (LabCorp) - Formulation and Final Dosage Preparation: Formulation and final dosage preparation alter the active ingredient into stable, effective medicine forms that are suitable for patient administration.

Key Players: Catalent and Lonza - Packaging and Serialization: Packaging and serialization ensure final dosage forms and apply unique codes that guarantee quality, traceability, and supply chain security.

Key Players: West Pharmaceutical Services and Gerresheimer - Distribution to Hospitals, Pharmacies of Electronic Health Record Software:Distribution to hospitals and pharmacies guarantees the approved medicines through logistics networks that are efficient and patient-friendly.

Key Players: Cardinal Health, McKesson, and AmerisourceBergen

Small Molecule Drug Discovery Market Companies

- Pfizer Inc.: Pfizer is involved in the development of a wide range of small-molecule cancer therapies, investing heavily in the research of rare diseases and internal medicine.

- GlaxoSmithKline PLC: GSK combines small-molecule use and immunotherapy in the development of specialty medicines, using targeted research and innovation to enhance the drug availability of a new pipeline.

- Merck & Co. Inc.: Merck is dedicated to discovering small-molecule drugs with big impacts, concentrating on cancer treatment, and broadening its portfolio with new oral therapeutic candidates.

Other Major Key Players

- Agilent Technologies Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Abbott Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corp

Recent Development

- In September 2025, Eli Lilly is launching TuneLab, an AI and machine learning platform offering biotech companies access to drug discovery models based on extensive research data. This initiative aligns with the growing trend among drug developers to utilize AI for expedited and cost-effective discovery and safety testing, alongside the FDA's aim to minimize animal testing.(Source: https://pharma.economictimes.indiatimes.com )

- In April 2025, the Icahn School of Medicine initiated the AI Small Molecule Drug Discovery Center. The center blends AI with traditional methods to rapidly and accurately discover and design new small-molecule therapeutics.(Source: https://www.mountsinai.org/ )

- In November 2020, a multi-target drug discovery partnership between Genentech and Genesis Therapeutics was established, and AI technology was used to identify potential therapeutic candidates.

- In 2019, In order to introduce Ogivri, a cancer medication that is a biosimilar to Herceptin, in the US, Biocon teamed up with Mylan.

- In January 2020, Exscientia, a startup that uses artificial intelligence to find new drugs, and Bayer worked together to develop medications for ailments connected to the heart and cancer.

Segments Covered in the Report

By Drug Type

- Small Molecule Drugs

- Biologic Drugs

By Technology

- High Throughput Screening

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- Others

By End-User

- Pharmaceutical Companies

- Contract Research Organizations

- Others

By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting