Solid Waste Management Market Size and Forecast 2025 to 2034

The global solid waste management market size was valued at USD 292.91 billion in 2024, and is expected to reach around USD 441.98 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034.

Solid Waste Management Market Key Takeaways

- The global solid waste management market was valued at USD 292.91 billion in 2024.

- It is projected to reach USD 441.98 billion by 2034.

- The solid waste management market is expected to grow at a CAGR of 4.20% from 2025 to 2034.

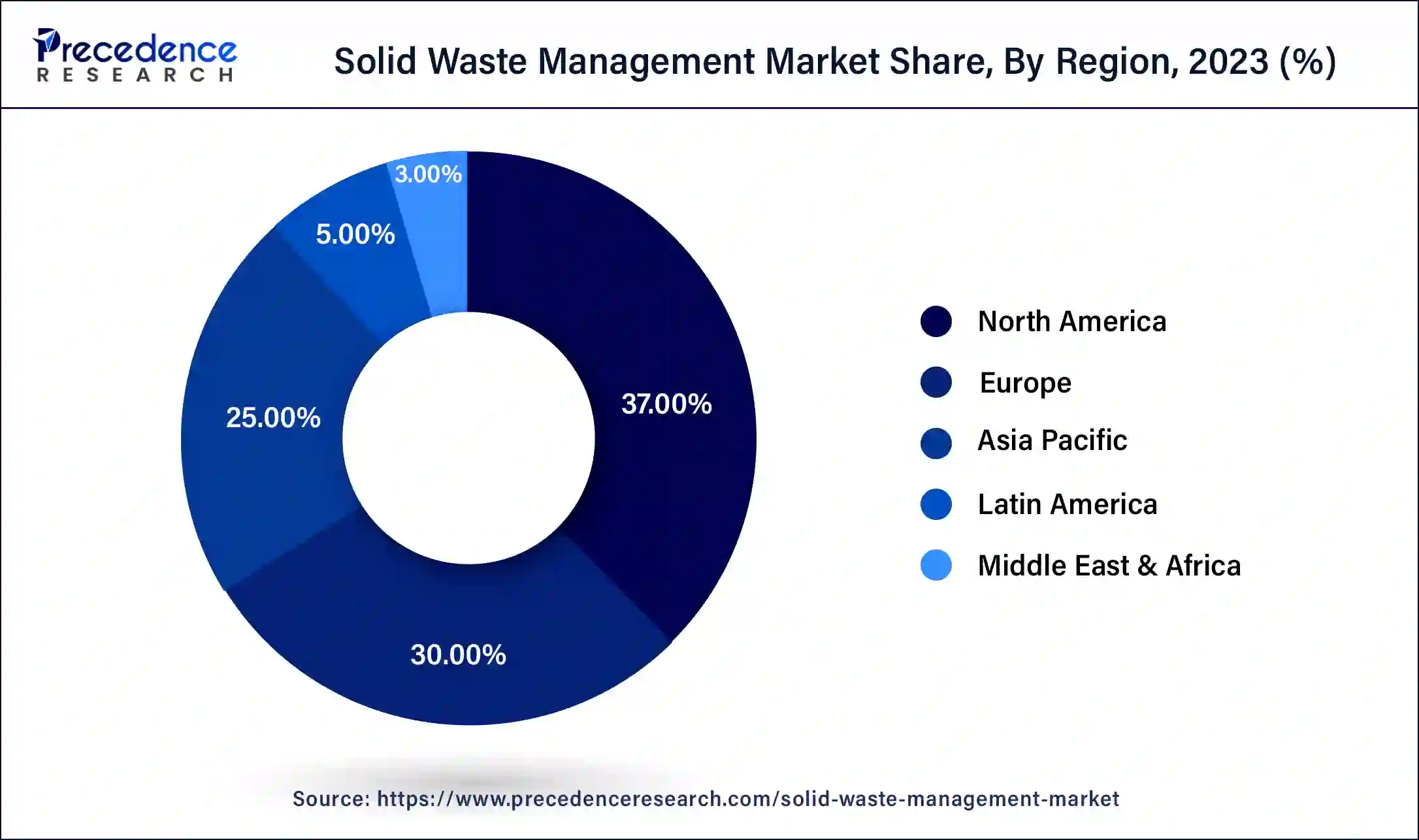

- North America contributed more than 36.50% of revenue share in 2024.

- Asia Pacific is estimated to witness the fastest CAGR between 2025 and 2034.

- By waste, the industrial segment has held the largest market share of 68% in 2024.

- By waste, the municipal segment is anticipated to grow at a remarkable CAGR of 6.2% between 2025 and 2034.

- By treatment, the disposal segment generated over 63% of revenue share in 2024.

- By treatment, the open dumping segment is expected to expand at the fastest CAGR over the projected period.

- By material, the paper & paperboard segment held the largest market share of 38% in 2024.

- By material, the plastic segment is expected to expand at the fastest CAGR over the projected period.

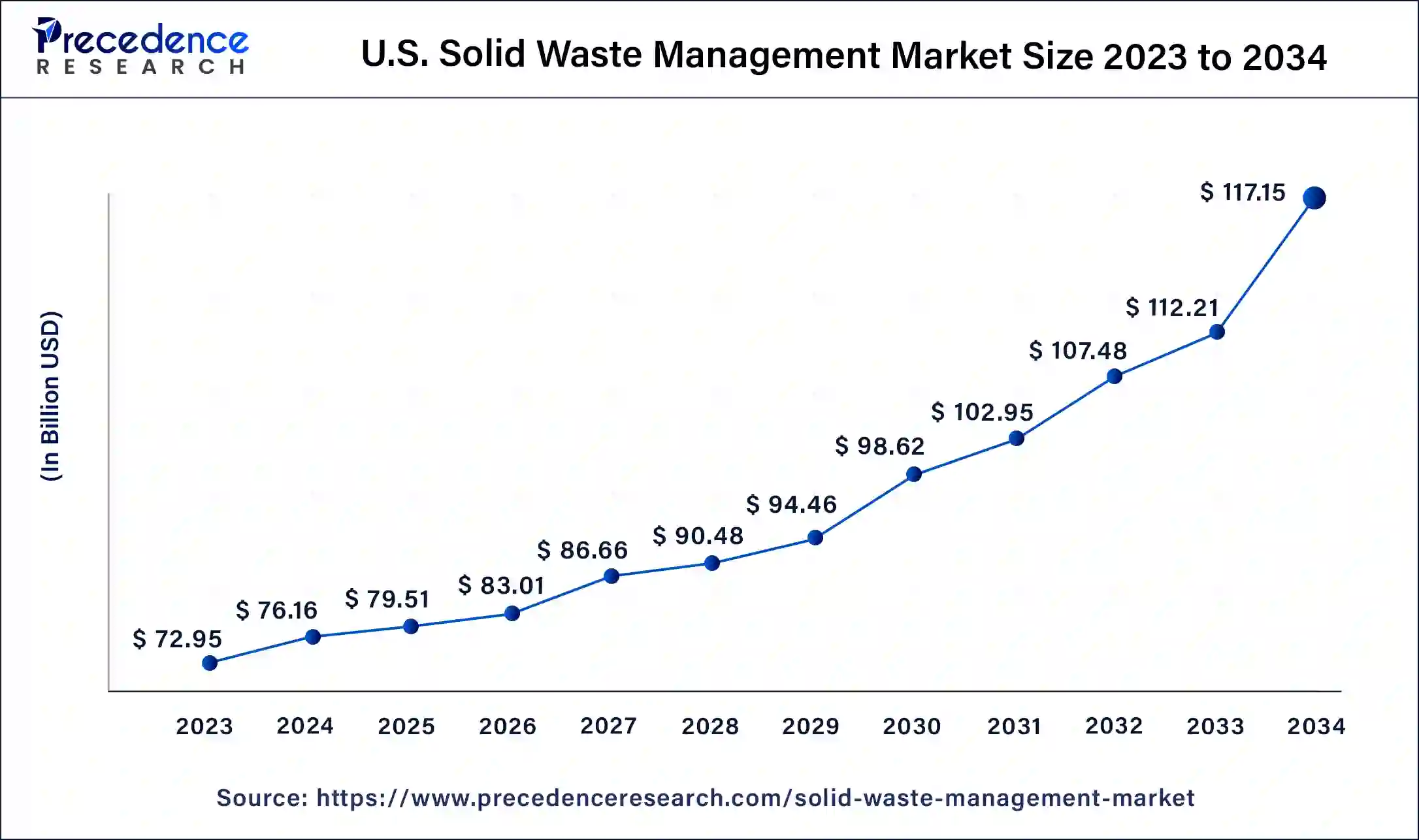

U.S. Solid Waste Management Market Size and Growth 2025 to 2034

The U.S. solid waste management market size was estimated at USD 76.16 billion in 2024 and is predicted to be worth around USD 117.15 billion by 2034, at a CAGR of 4.40% from 2025 to 2034.

North America has held the largest revenue share of 37% in 2024. In the region, rapid urbanization and industrialization drive robust trends in the solid waste management market. Growing populations in emerging economies contribute to increased waste generation, emphasizing the need for efficient waste disposal solutions. Governments are investing in smart waste management technologies, recycling infrastructure, and public awareness campaigns to address environmental concerns. The market in Asia-Pacific experiences dynamic growth, focusing on sustainable practices and innovations to manage the escalating volume of solid waste.

Asia Pacific is estimated to observe the fastest expansion. The region showcases advanced trends in the solid waste management market, marked by stringent environmental regulations and a strong emphasis on circular economy principles. The region leads in waste recycling and waste-to-energy initiatives, with a well-established infrastructure for efficient waste collection and disposal. Green infrastructure development and public-private partnerships characterize waste management strategies, emphasizing sustainability and resource recovery. Additionally, technological advancements in waste sorting and recycling technologies contribute to the region's leadership in responsible and eco-friendly solid waste management practices.

Market Overview

The solid waste management market involves the collection, transportation, disposal, and recycling of solid waste materials to minimize environmental impact. Fueled by urbanization, industrialization, and increasing waste generation, the market addresses sustainable waste solutions. Key components include waste collection systems, recycling facilities, and landfill management. Stringent environmental regulations and growing awareness drive innovations in waste-to-energy technologies and recycling processes. The market aims to optimize resource recovery, reduce landfill dependency, and promote circular economy principles, offering comprehensive waste management services to municipalities, industries, and communities worldwide.

Continuous advancements in waste-to-energy technologies, smart waste management systems, and sustainable practices contribute to the solid waste management market's evolution. The industry thrives on efficient waste sorting, recycling initiatives, and public engagement for sustainable waste reduction.

Solid Waste Management Market Growth Factors

- Urbanization Impact: Rapid urbanization contributes to increased solid waste generation, propelling demand for advanced waste management solutions.

- Environmental Regulations: Stringent environmental regulations worldwide drive the adoption of innovative waste management practices, emphasizing sustainability and eco-friendly solutions.

- Waste-to-Energy Technologies: Advancements in waste-to-energy technologies offer opportunities for converting waste into renewable energy, addressing both waste reduction and energy needs.

- Circular Economy Initiatives: Growing emphasis on circular economy principles encourages resource recovery, recycling, and waste minimization, fostering sustainable practices in waste management.

- Smart Waste Management Systems: The integration of smart technologies, such as IoT-enabled bins and real-time monitoring systems, optimizes waste collection routes and enhances operational efficiency.

- Increasing Waste Recycling: Rising awareness and governmental initiatives boost waste recycling trends, creating business opportunities for companies involved in recycling processes and facilities.

- Landfill Management Solutions: Innovations in landfill management, including advanced landfill technologies and rehabilitation practices, cater to the need for responsible waste disposal.

- Public Awareness and Engagement: Growing public awareness about environmental impact prompts increased citizen participation, leading to collaborative waste reduction efforts and community-based waste management initiatives.

- Waste Sorting Technologies: Technological advancements in waste sorting enhance the efficiency of recycling processes, reducing contamination and improving the overall quality of recycled materials.

- Global Expansion: The Solid Waste Management Market sees growth opportunities in expanding to emerging economies, where rapid industrialization and urbanization create a demand for efficient waste management solutions.

- Waste Reduction Strategies: Businesses focusing on waste reduction strategies, including source reduction and sustainable packaging, find opportunities in catering to environmentally conscious consumers and regulatory requirements.

- Innovative Waste Collection Methods: Exploration of innovative waste collection methods, such as autonomous vehicles and drone technologies, presents avenues for efficiency improvements and cost optimization.

- Bio-based Materials Utilization: Utilization of bio-based materials in waste management processes aligns with circular economy principles, promoting the use of renewable resources in waste treatment and disposal.

- Green Infrastructure Development: Opportunities arise in the development of green infrastructure, incorporating sustainable waste management practices into urban planning for enhanced environmental stewardship and resilience.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 292.91 Billion |

| Market Size in 2025 | USD 305.21 Billion |

| Market Size by 2034 | USD 441.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Waste, By Treatment, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Stringent environmental regulations and technological advancements in smart waste management

Stringent environmental regulations significantly drive the market demand for solid waste management by compelling industries and municipalities to adopt advanced waste disposal practices. Governments worldwide are imposing strict waste management policies to curb environmental pollution, necessitating the implementation of sustainable solutions. This regulatory environment creates a surge in demand for technologies that enable efficient waste sorting, recycling, and disposal, positioning the solid waste management market as a critical player in meeting compliance standards.

Technological advancements in smart waste management further boost market demand by providing innovative tools for optimizing waste collection routes and enhancing overall operational efficiency. IoT-enabled bins, real-time monitoring systems, and data analytics contribute to smarter and more sustainable waste management practices. The integration of these technologies not only aligns with environmental goals but also addresses the growing complexities of managing waste in urbanized and industrialized areas, driving increased adoption and investment in the solid waste management market.

Restraint

Land availability for landfills and infrastructure challenges

Land availability for landfills and infrastructure challenges pose significant restraints to the solid waste management market. The scarcity of suitable land for landfill sites, particularly in densely populated urban areas, limits the expansion of waste disposal capacity. This constraint forces waste management authorities to explore alternative solutions such as waste-to-energy technologies, recycling, and incineration, which may have higher upfront costs.

Moreover, infrastructure challenges, including outdated waste collection and treatment facilities, hinder the effective management of solid waste. Insufficient infrastructure can result in inefficiencies throughout the waste management process, affecting collection, sorting, and disposal activities. This, in turn, compromises the overall efficacy of waste management systems. To tackle these hurdles, significant investments are vital to update infrastructure, incorporate cutting-edge technologies, and adopt sustainable practices in waste management. These endeavors are indispensable, serving not just to protect the environment but also to uphold public health. A dedicated commitment to these investments is pivotal in building resilient, flexible waste management systems capable of addressing the needs of expanding urban communities and securing a cleaner, more sustainable trajectory for the future.

Opportunity

Advanced waste-to-energy technologies and green infrastructure development

The surge in market demand for the solid waste management market is notably propelled by the adoption of advanced waste-to-energy technologies. With an increasing focus on sustainable practices and renewable energy sources, these technologies facilitate the conversion of solid waste into valuable energy, addressing both waste reduction and energy needs. As governments and industries prioritize environmentally friendly solutions, the integration of advanced waste-to-energy processes becomes a key driver, positioning the market as an essential player in the broader sustainable energy landscape.

Additionally, the development of green infrastructure plays a pivotal role in surging market demand. Incorporating eco-friendly waste management practices into urban planning enhances environmental stewardship and resilience. Green infrastructure initiatives encompass waste reduction, sustainable packaging, and innovative waste collection methods, contributing to the overall growth of the solid waste management market as communities worldwide seek holistic and environmentally conscious solutions to address the challenges of waste management.

Waste Insights

According to the waste, the industrial segment has held a 68% revenue share in 2024. Industrial solid waste originates from manufacturing processes, construction activities, and industrial facilities. In the solid waste management market, there's a trend towards sustainable industrial practices, emphasizing waste reduction, recycling, and responsible disposal. Circular economy principles drive industrial waste management, encouraging resource recovery and minimizing environmental impact. Increasingly, industries are adopting advanced technologies for waste treatment and recycling to align with stringent regulations and enhance their environmental credentials.

The municipal segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. Municipal solid waste refers to the waste generated by households, institutions, and commercial establishments. This includes everyday items like packaging, food waste, and discarded goods. In the solid waste management market, there is a growing trend towards integrated waste management systems for MSW, incorporating recycling, composting, and waste-to-energy technologies. Smart waste management solutions, such as sensor-equipped bins and data analytics, optimize collection routes, reducing operational costs and enhancing sustainability.

Material Insights

Based on the material, the paper and paperboard segment held the largest market share of 38% in 2024. Paper and paperboard are key materials in the solid waste management market, encompassing products like newspapers, cardboard, and packaging materials. Trends in paper waste management involve increased recycling efforts driven by environmental awareness and regulatory measures. Technological advancements in paper recycling enhance efficiency, contributing to a circular economy. Sustainable sourcing practices and the development of bio-based alternatives further define trends, aligning with the market's commitment to responsible waste management.

On the other hand, the plastic segment is projected to grow at the fastest rate over the projected period. Plastic, a ubiquitous material, poses unique challenges in solid waste management. Trends in plastic waste involve a global shift towards reducing single-use plastics, promoting recycling infrastructure, and advancing plastic-to-fuel technologies. Circular economy initiatives aim to minimize plastic waste by encouraging reusability and eco-friendly alternatives. Regulatory measures addressing plastic pollution drive innovations in material design and waste recovery processes. The market sees an increasing emphasis on extended producer responsibility, pushing manufacturers to play a role in the end-of-life management of plastic products.

Treatment Insights

In 2024, the disposal segment had the highest market share of 63% on the basis of the end user. Disposal involves the final disposition of solid waste, typically in landfills or incineration facilities. Trends in disposal methods highlight a transition towards more environmentally friendly options, such as sanitary landfills with advanced leachate and gas collection systems. Additionally, waste-to-energy technologies are gaining prominence, transforming disposal into an energy generation opportunity. The solid waste management market increasingly emphasizes safe and sustainable disposal practices to minimize environmental impact, aligning with circular economy principles and fostering a responsible approach to waste management.

The open dumping segment is anticipated to expand at the fastest rate over the projected period. Open dumping refers to the indiscriminate disposal of solid waste in unauthorized areas, lacking proper containment or environmental controls. This outdated and environmentally harmful practice poses severe threats to ecosystems, public health, and air and water quality. Trends indicate a global shift away from open dumping, driven by stringent regulations, increased environmental awareness, and the adoption of sustainable waste management practices. Governments and industries are investing in alternatives to mitigate the environmental impact of open dumping and promote responsible waste disposal.

Solid Waste Management Market Companies

- Waste Management, Inc.

- Republic Services, Inc.

- Veolia Environnement S.A.

- Clean Harbors, Inc.

- Suez SA

- Biffa Group Limited

- Covanta Holding Corporation

- Renova AB

- Waste Connections, Inc.

- Stericycle, Inc.

- Advanced Disposal Services, Inc.

- Hitachi Zosen Corporation

- EnviroServ Waste Management (Pty) Ltd

- Remondis SE & Co. KG

- Bharat Heavy Electricals Limited (BHEL)

Recent Developments

- In 2021, Biffa Group announced the acquisition of Company Shop Group ('CSG'), the UK's premier redistributor of surplus food and household products. This strategic move enhances Biffa's position in sustainable waste management by incorporating CSG's expertise in reducing and repurposing surplus goods.

- In 2020, Valicor acquired Affiliated Wastewater Environmental Services, a strategic move aimed at expanding its U.S. network and solidifying its position as a leading provider of wastewater treatment services in the country. This acquisition enhances Valicor's capabilities and presence in the growing environmental services sector.

Segments Covered in the Report

By Waste

- Municipal

- Industrial

By Treatment

- Open Dumping

- Disposal

By Material

- Paper & Paperboard

- Plastic

- Metals

- Food

- Textiles

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content