What Spatial Computing Market Size?

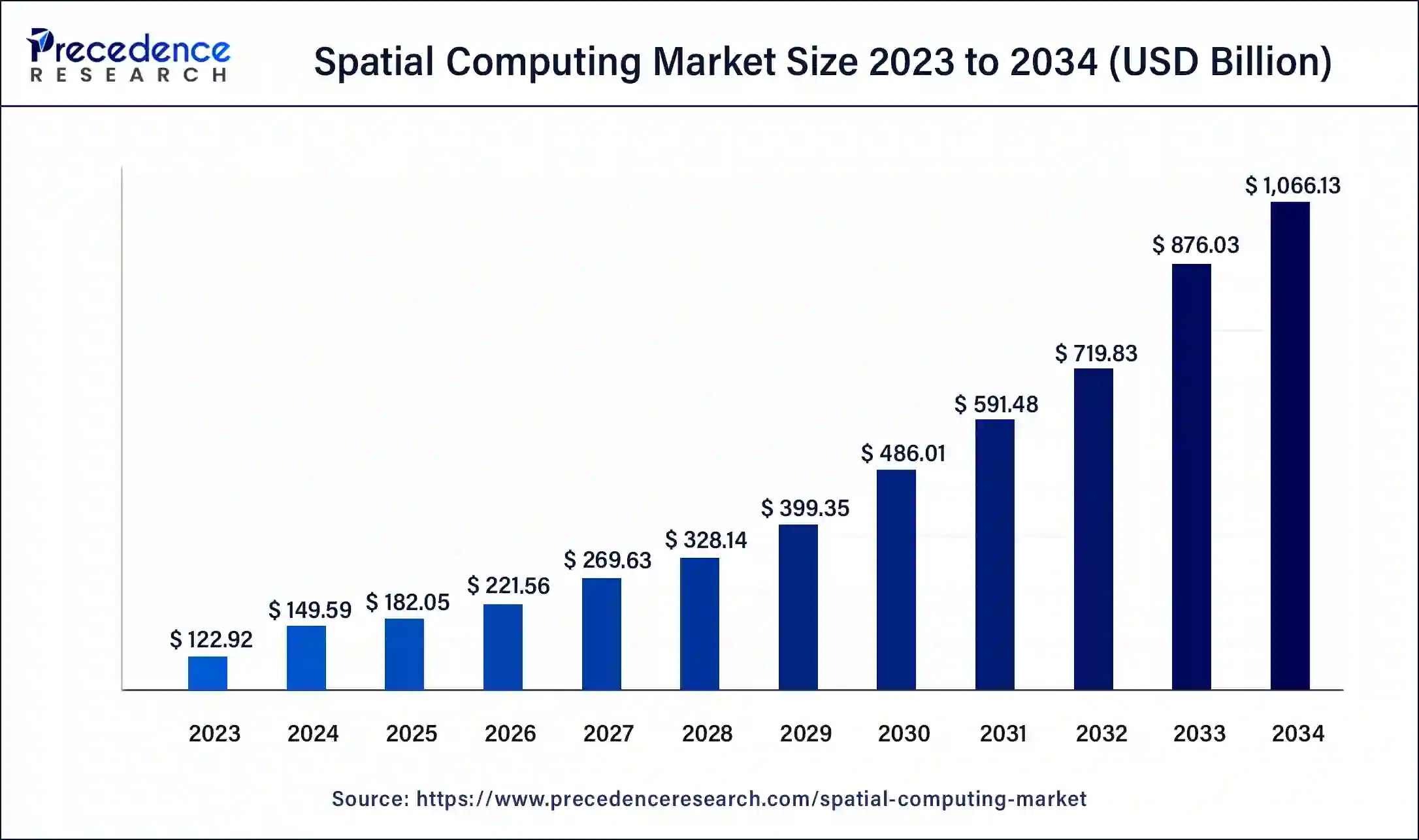

The global spatial computing market size is accounted at USD 182.05 billion in 2025 and predicted to increase from USD 221.56 billion in 2026 to approximately USD 1,066.13 billion by 2034. The market is expanding at a solid CAGR of 21.7% over the forecast period 2025 to 2034.

Spatial Computing Market Key Takeaways

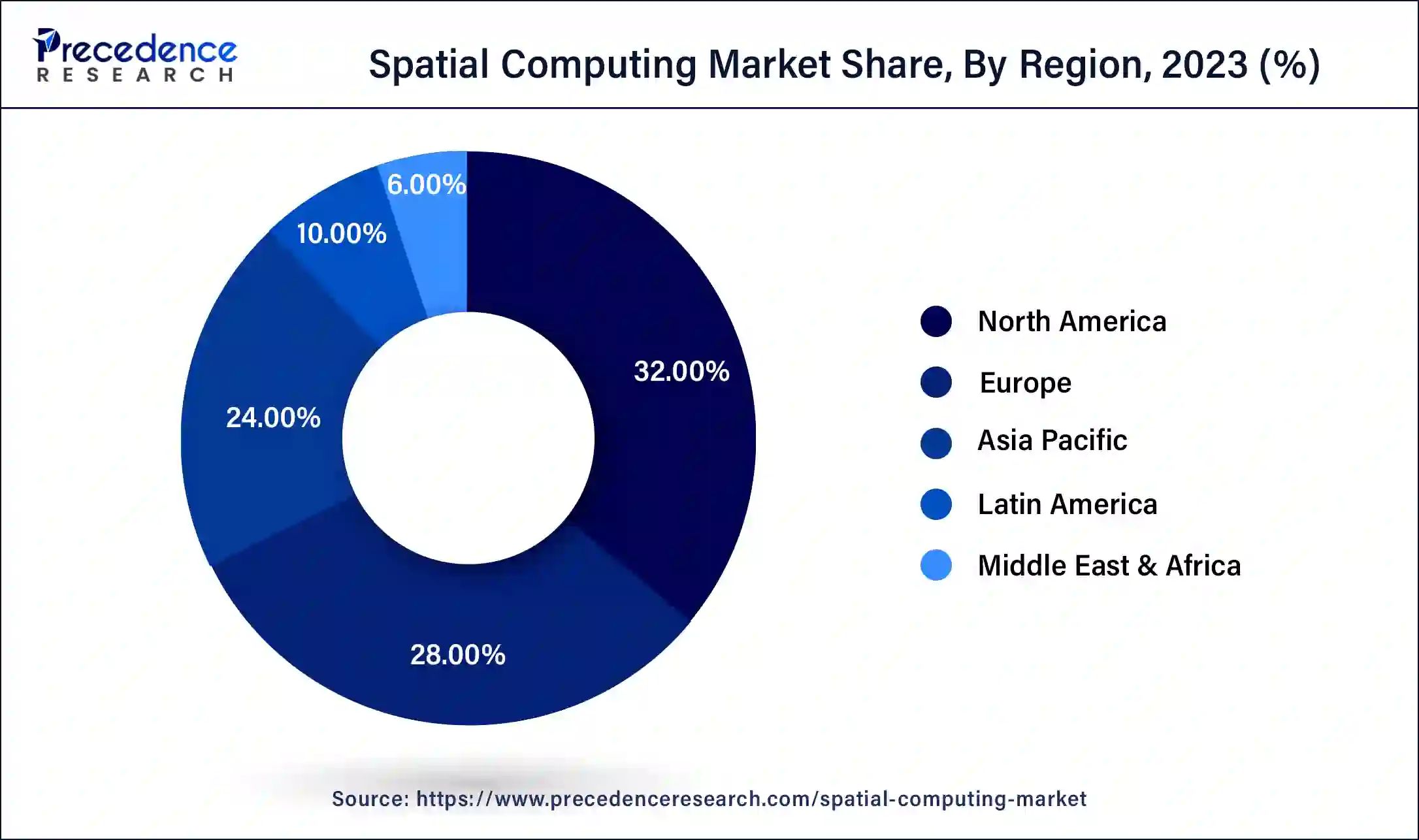

- North America dominated the market with a 32% share in 2024.

- Asia Pacific is expected to expand at a CAGR of 22.2% during the forecast period.

- By component, the software segment is expected to grow at a CAGR of 21.1% during the forecast period.

- By technology, the Augmented Reality segment held the largest share of 22% in 2024.

- By end user, the healthcare segment dominated the market with the largest share in 2024.

Spatial Computing Market Overview: Highlighting the Growth Trends

The spatial computing market refers to the use of digital technologies to process and interact with information in a three-dimensional space. It involves the integration of virtual or augmented elements into the physical world, creating an immersive and interactive environment. Spatial computing leverages technologies like augmented reality (AR), virtual reality (VR), and mixed reality (MR) to blend the digital and physical worlds, allowing users to engage with computer-generated content more naturally and intuitively.

Spatial Computing Market Growth Factors

- Increased adoption of AR and VR technologies across industries, including gaming, healthcare, education, and manufacturing, has fueled the demand for spatial computing solutions.

- The growing demand for location-based services, navigation assistance, and location-based marketing has driven the adoption of spatial computing technologies.

- The gaming and entertainment industry has been a significant driver for spatial computing. AR and VR gaming experiences, as well as interactive entertainment content, contribute to the spatial computing market's growth.

- The increasing demand from the healthcare industry as this technology finding applications in healthcare for medical training, surgical planning, and patient education. The ability to visualize and interact with 3D medical data in a spatial context enhances medical procedures and training.

Spatial Computing Market Outlook: The Road Ahead

- Industry Growth Overview: Growing advancements in AR, VR hardware, enhancing applications, and the development of robust software platforms are driving the industry growth. Additionally, growing innovations and adaptations are also contributing to their growth.

- Global Expansion: The global expansion of the market is driven by robust tech companies and R&D investments. Moreover, the rapid technological advancements and increasing demand for immersive user experiences are driving the global expansion of the market.

- Major Investors: Tech Giants and venture capital firms are the major investors in the market. Meta, Apple, Microsoft, Andreessen Horowitz, the Venture Reality Funds, and many others are the major investors.

- Startup Ecosystem: The startup ecosystem is focusing on the development of hardware solutions and software applications for enterprise use. Matterport, OpenSpace, Varjo, and Niantic are some of the startups actively participating in the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.7% |

| Market Size in 2025 | USD 182.05 Billion |

| Market Size in 2026 | USD 221.56 Billion |

| Market Size by 2034 | USD 1,066.13 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Technology, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for consumer electronics in the education sector

The usage of consumer gadgets in classrooms, such as tablets and laptops, is growing. Educational materials and apps for spatial computing can provide students with immersive learning opportunities. As a result, by 2030, the consumer electronics sector will account for around one-fifth of the market. Educational materials and apps for spatial computing can provide students with immersive learning opportunities. AR glasses like Google Glass, VR headsets like Oculus Rift and HTC Vive, and AR glasses like Microsoft HoloLens have all been released by consumer electronics firms. Innovation is driven by investment in creating hardware and applications for spatial computing, as well as by customer desire for more immersive and interactive experiences. Thus, this is expected to drive the spatial computing market's growth over the forecast period.

Restraint

Regulatory and ethical issues

Technologies for spatial computing employ cameras and sensors to gather and interpret environmental data about the user. Building user trust and resolving any privacy-related issues depend on ensuring the security and privacy of this data. Devices for spatial computing frequently gather information about users' interactions, actions, and surroundings. Images, videos, and sensor measurements are all included in this data. It is essential to safeguard consumers from unlawful monitoring and data breaches by guaranteeing the privacy of this data. As a result, ethical and legal issues provide significant barriers that may prevent the spatial computing market from expanding and being adopted.

Opportunity

Rising partnership

The increasing partnership in the industry is expected to offer a lucrative opportunity to the spatial computing market during the forecast period. For instance, in July 2022, NavVis, a German technology business that specializes in indoor mapping and navigation solutions for a range of sectors, and Magic Leap, Inc. partnered together. By working together, the two businesses want to enhance augmented reality (AR) applications in the industrial and automotive sectors by providing precise and in-depth 3D digital twin data.

Component Insights

The software segment is expected to grow at a rate of 21.1% over the forecast period. A key element of spatial computing is augmented reality (AR) software, which enables the overlay of digital data on the physical world. This covers apps for smart glasses, headsets, and mobile devices. Numerous industries, including retail, navigation, healthcare, and education, employ augmented reality software. Furthermore, users can explore realistic, computer-generated settings made possible by VR software.

Applications for virtual reality (VR) include training simulations, virtual meetings, and games and entertainment. The VR software industry is influenced by VR development platforms, VR gaming engines, and content production tools. Besides, the hardware segment is expected to grow at the fastest rate over the forecast period. It describes technological advancements that allow real-time interaction between the digital and physical worlds, resulting in immersive user experiences. The rise of the industry has been largely attributed to head-mounted displays, such as augmented reality glasses and virtual reality headsets.

By superimposing digital material over the actual world or by building a completely virtual environment, these gadgets provide consumers with immersive visual experiences. Beyond head-mounted displays (HMDs) and motion controllers, wearable technology may be integrated into the spatial computing ecosystem through smartwatches, fitness trackers, and even clothes with sensors built in. These gadgets can record users' biometric information, such as their bodily motions and pulse rate, giving computing applications more input and allowing more individualized experiences.

Technology Insights

The Augmented Reality segment held the largest share of 22% in 2024.By superposed digital content such as text, photos, videos, or 3D objects—over the user's field of vision, augmented reality (AR) improves the physical world. AR glasses or mobile devices are usually used for this purpose. AR has been widely available to a large user base due to the growing uses of tablets and smartphones along with advanced sensors and cameras.

The growing popularity of mobile AR applications, including utility apps, games, and social media filters, is propelling the AR market's expansion. With specialized AR glasses, users can effortlessly superimpose digital material onto their field of vision for a hands-free, immersive AR experience. Lightweight and more aesthetically pleasing AR glasses have been developed as a result of technological advancements and miniaturization.

Leading companies in the industry, such as Google (Google Glass), Microsoft (HoloLens) and Apple (VisionPro), are making investments in AR glasses, which is driving the market's expansion. On the other hand, the mixed reality segment is expected to grow rapidly over the forecast period. Mixed reality has gained significant adoption in enterprise settings. Industries such as manufacturing, healthcare, and design use MR for applications like virtual product prototyping, remote assistance, and training simulations. Thereby, driving the spatial computing market growth.

End User Insights

The healthcare segment held the largest share of the spatial computing market in 2024. Healthcare practitioners can practice complex procedures and scenarios in a safe and controlled virtual environment because of spatial computing, which includes VR, AR and MR. This technology offers a variety of functions and advantages in the field of healthcare. Healthcare professionals may improve their skills and knowledge without endangering patient safety by using MR and VR simulations to provide training, patient examinations, and medicinal procedures.

Through the use of MR or AR headsets, CR scans and MRI images are examples of medical imaging data that surgeons can superimpose on a patient's body while operating, aiding in surgical planning and guidance. This technology allows surgeons to visualize patient-specific anatomical data in a 3D virtual environment. This enhances surgical results, lowers risks, and improves accuracy. Thus, this is expected to drive the segment expansion.

Regional Insights

U.S. Spatial Computing Market Size and Growth 2025 to 2034

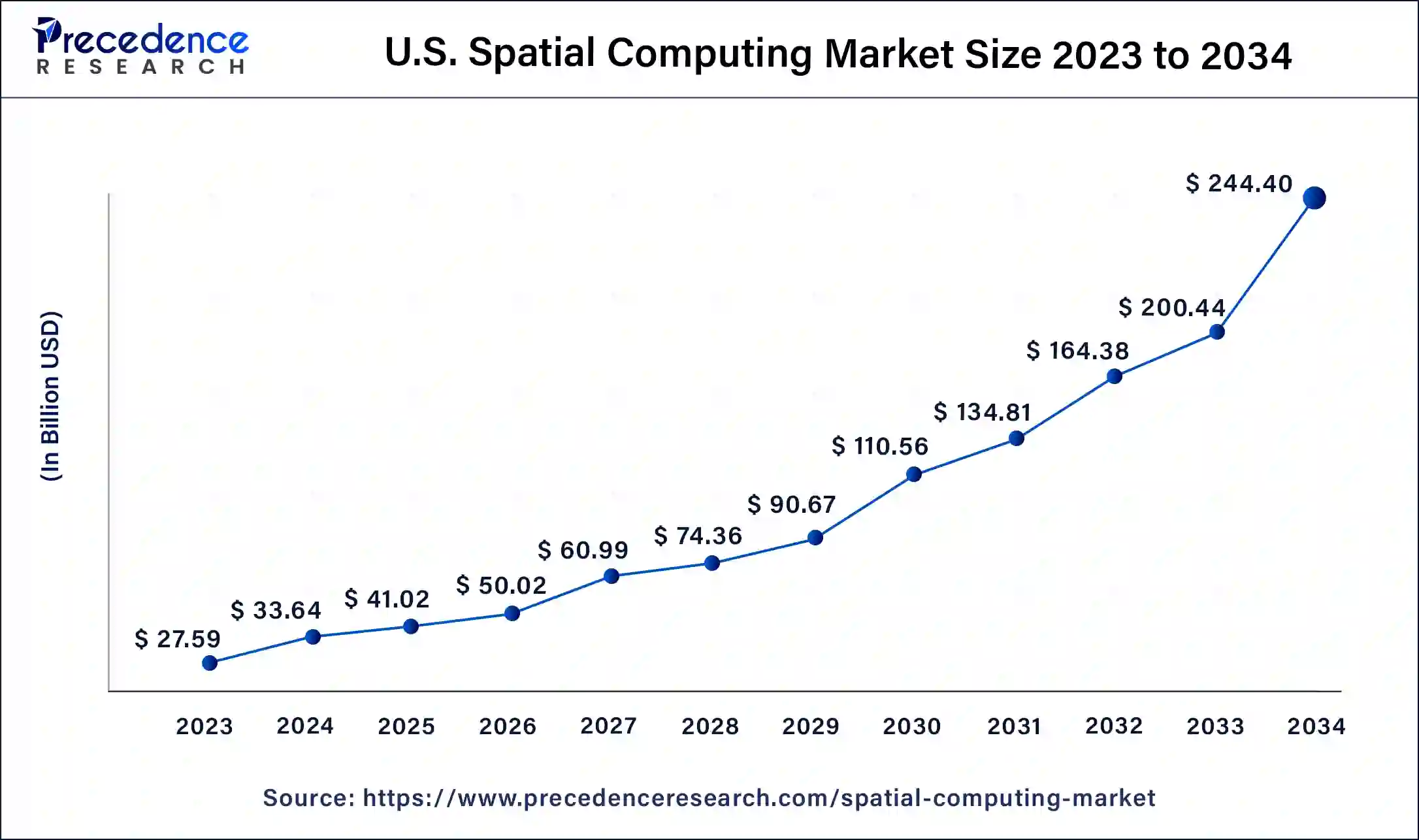

The U.S. spatial computing market size is estimated at USD 41.02 billion in 2025 and is predicted to be worth around USD 244.40 billion by 2034, at a CAGR of 21.9% from 2025 to 2034.

Technical Advancements Boost North America

North America held the largest share of 32% in 2024. The area is a major center for technical advancement, R&D, and the commercialization of spatial computing technology. Numerous industry-leading businesses and research facilities that propel market improvements are based in the region. Leading companies in the development of hardware, software, and platforms for spatial computing include Microsoft, Google, Apple, Facebook, and Magic Leap.

These developments have provided cutting-edge goods and experiences, which have propelled the market's expansion. Particularly in major hotspots like Silicon Valley, Seattle, and Greater Boston, the area has a thriving startup scene. Technology-focused startups have surfaced and gained momentum, introducing new concepts, advancements, and competition to the market. These startups frequently push the limits of these technology applications, developing novel uses and stimulating the market.

Asia Pacific Driven by High Smartphone Penetration

Asia Pacific is expected to grow at the highest CAGR of 22.2% during the forecast period. High smartphone penetration rates in countries like China and India create a favorable environment for mobile-based spatial computing applications. Mobile AR experiences and applications are becoming increasingly popular. This is expected to drive market growth in the region during the forecast period.

Major Tech Hubs Facilitate U.S.

The presence of advanced major tech hubs is increasing the production of spatial computing in the U.S. The growing investments are also promoting their innovations, which are increasing their adoption across the healthcare and gaming sectors. New collaborations among the industries and institutions are also advancing their innovations.

Growing Advanced Technology Adoption Drives China

China is experiencing a rise in the adoption of advanced technologies, which is increasing the demand for spatial computing. At the same time, the government initiatives are also increasing their adoption, moving towards the digital economy. This is driving the development of new devices.

Robust Industrial Base Propels Europe

Europe is expected to grow significantly in the spatial computing market during the forecast period, due to a robust industrial base. This is increasing the use of spatial computing across the automotive, aerospace, and healthcare sectors. The industries are also contributing to their increased R&D, which is being supported by government funding. Thus, these advancements are promoting the market growth.

Government Initiatives Transform the UK

The government initiatives in the UK are encouraging the use of spatial computing across various sectors. At the same time, the presence of advanced tech hubs is driving their development and innovations, which is enhancing their adoption rates. Furthermore, the growing smartphone penetration and development of smart cities are also contributing to their increased demand and innovations.

Spatial Computing Market Innovators: Key Players' Offering

- Microsoft Corporation: HoloLens 2 is provided by the company.

- Google LLC: ARCore and Android XR are provided by the company.

- HTC Corporation: The company provides HTC Vive, Vive Elite XR, and Vive Focus.

- Magic Leap, Inc.: Magic Leap 1 is provided by the company.

- Apple Inc.: The company provides Apple Vision Pro

- NVIDIA Corporation: Omniverse and CloudXR are provided by the company.

Spatial Computing Market Companies

- Microsoft Corporation

- Lenovo Group Limited

- Blippar Group Limited

- Seiko Epson Corporation

- Google LLC

- HTC Corporation

- Avegant Corporation

- Magic Leap, Inc.

- Apple Inc.

- NVIDIA Corporation

Recent Developments

- In June 2023, Apple introduced the Apple Vision Pro, a ground-breaking spatial computer that allows users to remain in the moment and socially engaged while blending digital material with the real environment. With Vision Pro, programs can operate on an unlimited canvas that extends beyond the confines of a conventional display. It also offers a completely three-dimensional user interface that can be operated by the most instinctive and natural input methods imaginable: the user's hands, eyes, and voice. With Vision Pro, users can engage with digital information as if it were physically present in their location thanks to visionOS, the first spatial operating system in history. The ground-breaking Vision Pro design includes bespoke Apple silicon in a novel dual-chip architecture, an ultra-high-resolution display system that packs 23 million pixels over two panels, and other technologies that guarantee every experience seems like it's happening in front of the user's eyes in real-time.

- In February 2023, Google LLC entered into a partnership with Qualcomm, a leading global semiconductor and telecommunications equipment company, known for its innovations in mobile technology and wireless communications, and Samsung, a multinational conglomerate renowned for its diverse range of products and services, including electronics, smartphones, appliances, and semiconductor manufacturing. Using this collaboration, every company would pool their resources to construct a Mixed-Reality Platform.

- In August 2023,Lenovo Group Limited and VMware, a pioneer in virtualization and cloud computing technologies globally, partnered to provide organizations with IT infrastructure management and optimization solutions. Through this cooperation, both businesses will be able to invest in the critical infrastructure required to enable cutting-edge applications, like generative AI, and help enterprises of all sizes on their road toward digital transformation.

- In September 2023, the next generation of mixed reality (MR), virtual reality (VR), and smart glasses will be made possible by the two new spatial computing platforms that Qualcomm Technologies, Inc. announced: the Snapdragon XR2 Gen 2 and Snapdragon AR1 Gen 1.

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Technology

- Augmented Reality

- Virtual Reality

- Mixed Reality

- Artificial Intelligence

- Digital Twins

- Internet of Things (IoT)

- Others

By End User

- Aerospace & Defense

- Healthcare

- Automotive

- Gaming

- Energy & Utilities

- Consumer Electronics

- Architecture, Engineering, and Construction (AEC)

- Government and Public Sector

- Information Technology

- Education

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting