What is Special Mission Aircraft Market Size?

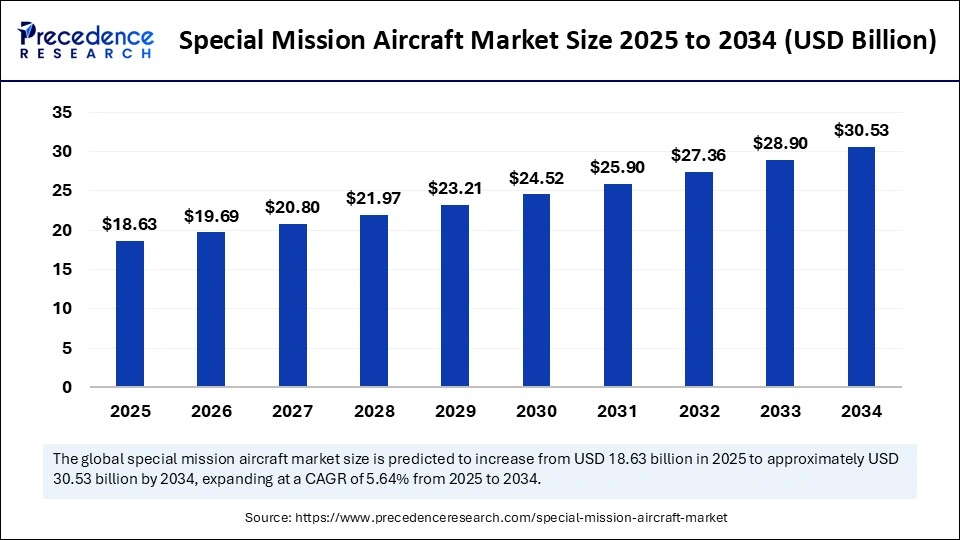

The global special mission aircraft market size accounted for USD 18.63 billion in 2025 and is predicted to increase from USD 19.69 billion in 2026 to approximately USD 30.53 billion by 2034, expanding at a CAGR of 5.64% from 2025 to 2034. The growth of the market is attributed to rising global security concerns and increasing demand for advanced surveillance and reconnaissance capabilities.

Market Highlights

- North America dominated the special mission aircraft market with the largest share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By platform, the military aviation segment held a significant share in 2024.

- By platform, the unmanned aerial vehicle segment is projected to grow at a rapid pace in the coming years.

- By application, the intelligence, surveillance, and reconnaissance segment dominated the market with the largest share in 2024.

- By application, the air/rocket launch segment is expected to grow at the fastest CAGR in the upcoming period.

- By component, the communication suite segment captured the biggest market share in 2024.

- By component, the sensors segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By end-user, the defense segment generated the major market share in 2024.

- By end-user, the commercial & civil segment is expected to grow at the fastest CAGR during the projection period.

- By point of sale, the OEM segment held the biggest market share in 2024.

- By point of sale, the aftermarket segment is expected to grow at the fastest CAGR in the coming years.

Artificial Intelligence: The Next Growth Catalyst in Special Mission Aircraft

The capabilities, effectiveness, and efficiency of special mission aircraft are being greatly increased by artificial intelligence (AI), which is revolutionizing the market for these aircraft. Advanced data processing, real-time decision-making, and predictive analytics are made possible by AI-powered systems that enhance situational awareness and mission accuracy. AI algorithms, for instance, can swiftly analyze enormous volumes of sensor data, enabling quicker target identification and threat detection. AI also facilitates autonomous or semi-autonomous operations, which lessens pilot workload and allows for complex missions in difficult conditions. This change also affects maintenance as AI-powered predictive maintenance lowers operating expenses and downtime. All things considered, integrating AI is spurring innovation and improving intelligence and reconnaissance missions.

Strategic Overview of the Global Special Mission Aircraft Industry

Special mission aircraft are becoming more important in today's defense operations because they provide critical capabilities like real-time surveillance, intelligence gathering, and electronic warfare that conventional aircraft cannot perform, helping militaries respond quickly to evolving threats and complex missions. The special mission aircraft market is experiencing robust growth, driven by rising concerns about border security, rising defense expenditures, and an increasing demand for specialized operations like electronic warfare search and rescue surveillance and reconnaissance. These aircraft are outfitted with cutting-edge technologies that improve operational effectiveness, such as communication suites, mission-specific payloads, and high-resolution sensors. Modernization projects, fleet upgrades, and the incorporation of unmanned systems for longer and more affordable missions are also supporting the market's expansion.

- On 25 March 2025, Bombardier Defense announced the delivery of two Challenger 650 special mission aircraft to Australian-based principal finance for intelligence, surveillance, and reconnaissance (ISR) operations. The aircraft are scheduled for delivery in 2026. (Source: https://www.janes.com)

Special Mission Aircraft MarketGrowth Factors

- Increasing Defense Budget: Rising military expenditure worldwide enables procurement and modernization of specialized aircraft.

- Rising Security Threats: Growing geopolitical tensions, terrorism, and border security concerns drive demand for advanced surveillance and reconnaissance platforms.

- Technological Advancements: Innovations in sensors, communication systems, and unmanned aerial vehicles (UAVs) improve mission capabilities and operational efficiency.

- Expansion of ISR Missions: Increasing need for real-time intelligence, surveillance, and reconnaissance in military and civilian applications.

- Modernization Programs: Governments are upgrading existing fleets with enhanced avionics and payload systems to extend operational life.

- Multi-Mission Capabilities: Special mission aircraft are increasingly equipped to perform a wide variety of tasks, enhancing their utility and cost-effectiveness.

- Rising variety in Non-Military Applications: Growing applications in disaster management, border control, and environmental monitoring also fuel market growth.

Market Outlook

- Market Growth Overview: The Special Mission Aircraft market is increasing defense budgets, rising geopolitical tensions, and the need for enhanced ISR capabilities. The integration of AI and UAV technology to boost efficiency and the use of multi-role platforms with modular designs for greater flexibility.

- Sustainability Trends: Sustainability trends involve adoption of sustainable aviation fuels, sustainable manufacturing practices, and eco design and technological innovation.

- Major Investors: Major investors in the market include Lockheed Martin, Boeing, Northrop Grumman, General Dynamics, and BAE Systems.

- Startup Economy: The startup economy in AI and machine learning for ISR, autonomy and unmanned systems, and startups are creating innovative sensor payloads, including hyperspectral imaging, miniature synthetic aperture radars (SAR), and advanced electronic warfare systems, which are smaller, lighter, and more capable than traditional systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.63 Billion |

| Market Size in 2026 | USD 19.69 Billion |

| Market Size by 2034 | USD 30.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Application,Component, End-User, Point of Sale, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Defense Expenditure

The budget for defense is rising in many nations to upgrade their armed forces and meet emerging security threats. The increased defense budget enables the purchase of specialized aircraft outfitted with cutting-edge technologies for reconnaissance and surveillance. The need for advanced special mission aircraft to improve national security is rising, driving the growth of the special mission aircraft market.

- On 15 March 2025, Lockheed Martin announced the delivery of an upgraded C-130J Super Hercules special mission aircraft to the U.S. Air Force, enhancing ISR capabilities for global operations.

Rising Security Concerns

The rising terrorism and regional conflicts have heightened the need for specialized aircraft capable of conducting ISR, electronic warfare, and rapid response missions. Special mission aircraft provide critical situational awareness to counter these threats effectively, making them indispensable for modern defense. On 20 May 2025, Anduril Industries launched its autonomous Fury drone designed to work alongside manned special mission aircraft to strengthen battlefield surveillance and threat detection.

Restraints

Limited Production and Supply Chain Constraints

Intricate supply chains can cause production delays and disruptions, particularly during geopolitical unrest or supply chain interruptions. The dependence on specialized parts and a small number of suppliers increases susceptibility to shortages of raw materials and delays in transportation. Global crises like pandemics or regional conflicts can also cause delays in the final assembly and sourcing of components. These difficulties may impact project timelines for both commercial and defense operators, leading to longer production times and higher costs.

Competition from Alternative Technologies

Some of the tasks that special mission aircraft have historically performed can be completed by emerging technologies like satellites, high-altitude drones, and ground-based sensors, which will lower demand in some markets. These substitutes frequently provide more affordable and labor-efficient options for monitoring and surveillance. Traditional airborne platforms are becoming increasingly threatened by these technologies' growing range resolution and real-time capabilities. Because these alternatives are easier to deploy and require less maintenance customers may prefer them in specific use cases.

Opportunities

Rising Demand for UAVs and Autonomous Systems

A growing interest in unmanned and autonomous aerial systems gives manufacturers the chance to create next-generation drones and special mission aircraft that can be piloted optionally, lowering operational costs and human risks. In hostile or remote environments, these systems can conduct extended missions without experiencing fatigue, allowing for continuous surveillance. Defense forces around the world are drawn to the integration of AI for data analysis and autonomous decision making which further improves mission effectiveness.

Increasing Need for Maritime Surveillance

The rising use of special mission aircraft in maritime surveillance creates immense opportunities in the special mission aircraft market. This aircraft is used in operations like coastal security and naval operations to monitor large oceanic areas. By assisting in the detection of illicit fishing and smuggling, these aircraft support both economic security and national security. Improved surveillance capabilities are also in high demand due to increased offshore resource exploration and maritime disputes.

- On 10 April 2025, PteroDynamics introduced the Transwing VTOL drone to provide flexible ISR and maritime patrol capabilities.

businessinsider.com

Segment Insights

Platform Analysis Insights

Why Did Military Aviation Lead in 2024?

The military aviation segment dominated the special mission aircraft market with a significant share in 2024 owing to its essential role in defense operations all over the world. Strong government funding and modernization initiatives support the widespread use of special mission aircraft for tactical surveillance and reconnaissance missions. Increased government funding in modernizing military infrastructure bolstered the growth of the segment. In addition, the rising demand for modern warfare and growing concerns about national security sustain the long-term growth of the segment.

On the other hand, the unmanned aerial vehicle segment is projected to grow at a rapid pace in the coming years. They are becoming more and more popular for intelligence and surveillance missions, particularly in contested or dangerous environments, because of their capacity to operate remotely and perform sophisticated operations without endangering the lives of pilots. The adoption of UAVs is being accelerated by innovations in battery technology and improved payload capacity. Rising geopolitical tensions and border security concerns further boost the demand for UAVs.

Application Analysis Insights

Why Did ISR Dominate the Market in 2024?

The intelligence, surveillance, & reconnaissance segment dominated the special mission aircraft market with the largest share in 2024, driven by the increased demand for precise and timely information in military and security operations. Counterterrorism, border security, and national defense all depend on these missions. Investment in ISR capabilities has increased as a result of the need for constant real-time data collection. ISR is a key component of contemporary defense plans since it facilitates multinational missions and joint operations.

On the other hand, the air/rocket launch segment is expected to grow at the fastest rate in the upcoming period, driven by the growing importance of space-based surveillance, the need for more responsive and nimble launch platforms, and the quick deployment of payloads. Innovation in the integration of launch vehicles has been sparked by the growing commercialization of space and military satellite deployment. Additionally, the rising space operations have prompted investments in rocket systems, bolstering the growth of the segment.

Component Analysis Insights

What Made Communication Suites the Dominant Segment in 2024?

The communication suit segment dominated the special mission aircraft market in 2024 because it offers essential connectivity for sharing data command and control throughout operations. Coordinating complex missions and maintaining situational awareness in real-time depend on effective communication. These suites combine data links radio and satellite, among other communication technologies. Interoperable, secure, and robust communication systems are essential in the dynamic battlefield environment.

On the other hand, the sensors segment is expected to grow at the fastest rate in the upcoming period. Sensors facilitate signal processing. More accurate tracking detection and intelligence gathering in a variety of mission environments are made possible by improved sensor capabilities. Electronic warfare sensors, synthetic aperture radar (SAR), and hyperspectral imaging are examples of innovations that are increasing operational possibilities. Improvements in sensor technology further contribute to segmental growth.

End-User Analysis Insights

Why Did the Defense Segment Dominate in 2024?

The defense segment dominated the special mission aircraft market in 2024 due to increased governments' priorities to strengthen surveillance, reconnaissance, and combat capabilities. Defense agencies invest heavily in procuring and upgrading aircraft to enhance surveillance and reconnaissance capabilities. National security concerns and the rise of asymmetric threats continue to drive defense spending. Collaborative defense programs among allied nations also boost segmental growth.

On the other hand, the commercial & civil segment is expected to grow at the fastest rate in the coming years. The growth of the segment is attributed to the rising application of special mission aircraft in border security, environmental monitoring, and disaster management. Another factor driving the segment's growth is the emergence of smart cities and infrastructure surveillance. Special mission aircraft are also being used by NGOs and private businesses for jobs like wildlife protection and pipeline monitoring.

Point of Sale Analysis Insights

What Led to OEM Segment Dominance in 2024?

The OEM segment dominated the special mission aircraft market in 2024. OEMs supply complete aircraft systems and mission solutions directly to defense and commercial customers. OEMs play a key role in innovation and system integration. Their close relationships with government agencies and prime contractors secure long-term contracts. OEMs also invest in research and development to keep pace with evolving mission requirements.

The aftermarket segment is expected to grow at the fastest rate during the forecast period. The aftermarket segment provides opportunities for customers to customize their aircraft. Customers are repairing their current fleets to last longer and perform better. The rising need to increase mission readiness is driving the growth of the segment. A robust aftermarket demand is also a result of aging aircraft and growing fleet sizes.

Regional Insights

Why Did North America Dominate the Market in 2024?

North America dominated the special mission aircraft market in 2024. This is mainly due to the strong presence of top aerospace and defense companies, significant defense budgets, and cutting-edge technological infrastructure. There is increased integration of advanced technologies to enhance military capabilities. The demand for special mission aircraft has increased in the last few years for surveillance and reconnaissance operations. The existing special mission aircraft fleet is aging, creating the need for upgrade and repair services.

U.S. Special Mission Aircraft Trends:

The U.S. special mission aircraft market is driven by the focus on intelligence, surveillance, and reconnaissance, integration of AI and autonomy, and growth in unmanned aerial vehicles. The shift towards modular open-systems avionics architectures allows for quick reconfiguration with different sensor payloads and communication systems.

Asia Pacific is expected to grow at the fastest rate in the upcoming years, driven by higher defense spending and rising geopolitical tensions. To improve capability for surveillance and reconnaissance operations, nations in the region are aggressively updating their military fleets. Additionally, regional security alliances, domestic manufacturing initiatives, and quick technical breakthroughs are speeding up the use of special mission aircraft. The need for multipurpose airborne platforms in the region is further increased by the rising demands for maritime patrol, disaster response, and border security.

- In June 2024, Hindustan Aeronautics Limited (HAL) achieved a successful maiden flight of its new surveillance and reconnaissance special mission aircraft. This development is part of India's initiative to update its military aircraft and is projected to be operational by early 2025.(Source: https://hal-india.co.in)

Europe is expected to grow at a considerable growth rate in the upcoming period. The region's commitment to enhancing surveillance and reconnaissance capabilities contributes to the regional market growth. Rising security concerns and geopolitical tensions are driving the growth of the market. Additionally, the rising modernization of the existing fleet and focus on homeland security contribute to the growth of the market in the region.

- In March 2025, Saab advocated for Nordic countries to adopt its GlobalEye surveillance aircraft for collective patrols, emphasizing its advanced capability to cover extensive air and ground surveillance needs. This initiative aims to strengthen regional security through collaborative surveillance strategies.

China Special Mission Aircraft Market Trends:

China's indigenous production and self-reliance, focus on ISR, maritime patrol, and AEW&C, and technological trend is the integration of cutting-edge systems, including artificial intelligence, high-performance sensor suites, and advanced electric warfare modules. Rise of unmanned aerial vehicles and enhanced operational reach.

Germany Special Mission Aircraft Trends:

Germany's special mission aircraft market has undergoing major modernization, fueled by the "Zeitenwende" €100 billion special defense fund and NATO spending commitments. The focus is on acquiring advanced platforms like the P-8A Poseidon and F-35 jets to enhance intelligence, surveillance, and maritime patrol capabilities in response to current geopolitical threats.

Special Mission Aircraft Market Value Chain Analysis

- Research & Development (R&D) and Design This initial, capital-intensive stage involves developing the aircraft platform, often a modified commercial or military variant, and the specialized systems required for specific missions like ISR or maritime patrol.

Key Players: Lockheed Martin Corporation, The Boeing Company, Northrop Grumman Corporation, Airbus SE, General Dynamics Corporation, BAE Systems plc. - Platform Manufacturing

This stage involves the physical production and assembly of the core aircraft airframe, a process governed by stringent aerospace quality and safety standards.

Key Players: Lockheed Martin Corporation (F-35, C-130 variants), The Boeing Company (P-8A, E-7), Airbus SE, Bombardier Inc., Embraer S.A. - Mission System Integration

This highly specialized stage is where the core aircraft is transformed into a special mission asset by integrating complex sensor suites, communication systems, electronic warfare equipment, and mission-specific software.

Key Players: L3Harris Technologies, Inc., Raytheon Technologies Corporation (now part of RTX Corporation), Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Saab AB. - Sales & Distribution (Procurement)

This stage involves direct sales to government and defense agencies, which is a complex process involving tenders, long negotiation cycles, and adherence to specific national security and export regulations.

Special Mission Aircraft Market Companies

- The Boeing Company (US) manufactures and modifies commercial aircraft platforms into special mission variants, such as the P-8A Poseidon for maritime patrol and the E-7 Wedgetail for airborne early warning.

- Lockheed Martin (US) contributes through its expertise in complex system integration and the modification of platforms like the C-130 into a wide array of special mission variants, including intelligence, surveillance, and reconnaissance (ISR) and maritime patrol aircraft.

- Dassault Aviation SA (France) contributes to the special mission aircraft market with its high-end business jets, particularly the Falcon family, which are modified for surveillance, maritime patrol, and reconnaissance roles.

- Textron Aviation (US) leverages its broad portfolio of aircraft brands, including Cessna and Beechcraft, to provide versatile platforms for special missions. The company modifies business jets like the Citation Longitude and turboprops like the Grand Caravan EX for roles including ISR, air ambulance, and utility transport, offering reliable and adaptable solutions with lower operating costs.

- Northrop Grumman Corporation (US) designs, builds, and supports some of the most advanced special mission aircraft, such as the E-2D Advanced Hawkeye for airborne early warning and control. They also integrate cutting-edge mission systems, including AI-powered analytics and cybersecurity technologies, onto various platforms to enhance surveillance and intelligence operations.

Latest Announcements

- On 5 April 2025, Northrop Grumman announced the successful flight testing of its upgraded E-2D Advanced Hawkeye radar system. Kathy Warden, CEO of Northrop Grumman, stated that this upgrade significantly enhances airborne early warning and control capabilities, providing improved threat detection and situational awareness for defense operations.

- On 7 May 2025, Airbus Defense and Space introduced the C295W variant featuring improved avionics and mission systems designed specifically for special operations and surveillance roles. Guillaume Faury, CEO of Airbus, stated that the C295W enhances operational efficiency and mission versatility, supporting a wide range of special operations and surveillance needs (Source: https://www.airbus.com)

Recent Developments

- On 25 March 2025, General Atomics Aeronautical Systems completed the fight-flight of Belgium's MQ-9B SkyGuardian remotely piloted aircraft at their Desert Horizon Flight Operations Facility in California. This drone variant features extended endurance and advanced sensor payloads, enhancing ISR (intelligence, surveillance, reconnaissance) mission capabilities.

https://www.ga-asi.com/ga-asi-completes-first-flight-of-belgium-s-mq-9b-skyguardian?utm_ - On 11 June 2024, Leonardo completed the first ship trail campaign of its AW609 tiltrotor special mission aircraft. This milestone marks significant progress toward deploying the AW609 for rapid deployment and multi-role surveillance operations, combining the capabilities of both helicopters and fixed-wing aircraft.

https://www.leonardo.com/en/press-release-detail/-/detail/26-06-2024-aw609-tiltrotor-successfully-completes-first-ship-trial-campaign?utm_ - On 3 April 2025, Boeing was awarded a $135.5 million contract by the U.S. Navy to provide Phase 2 software development, integration, and device installation support for the P-8A Poseidon training systems. This contract supports enhanced training for maritime patrol and anti-submarine warfare missions. (Source: https://www.govconwire.com)

Segments Covered in the Report

By Platform

- Military Aviation

- Commercial Aviation

- Unmanned Aerial Vehicle

By Application

- Intelligence, Surveillance, & Reconnaissance

- Command and Control

- Combat Support

- Emergency Services

- Transportation

- Air/Rocket Launch

- Scientific Research and Geological Surveys

- Other Applications

By Component

- Sensors

- Communication Suite

- Protection Suite

- Others

By End-User

- Defense

- Commercial & Civil

- Space

By Point of Sale

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting