What is the Stand-Alone Cloud Storage Market Size?

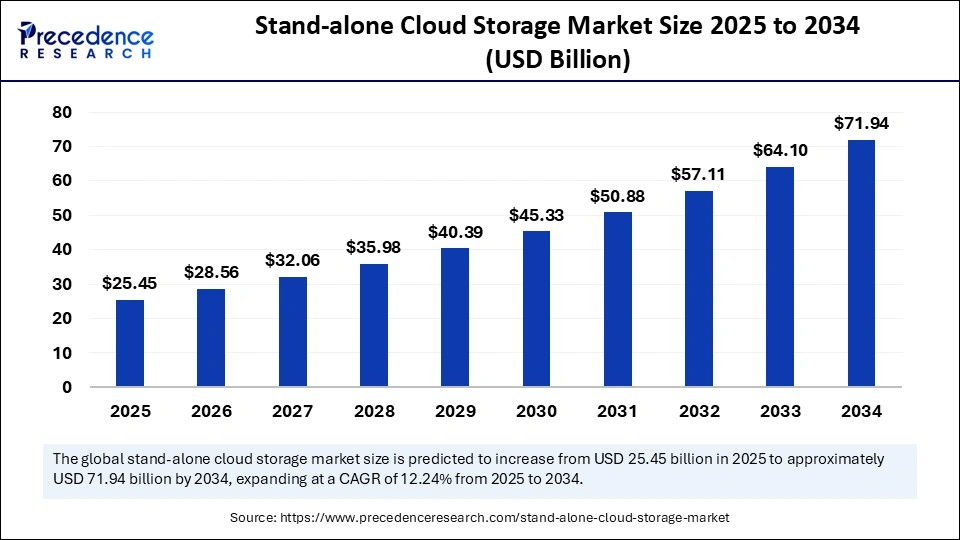

The global stand-alone cloud storage market size was calculated at USD 22.67 billion in 2024 and is predicted to increase from USD 25.45 billion in 2025 to approximately USD 71.94 billion by 2034, expanding at a CAGR of 12.24% from 2025 to 2034. This market is growing due to the increasing demand for secure, scalable, and cost-effective data storage solutions among businesses and individuals.

Market Highlights

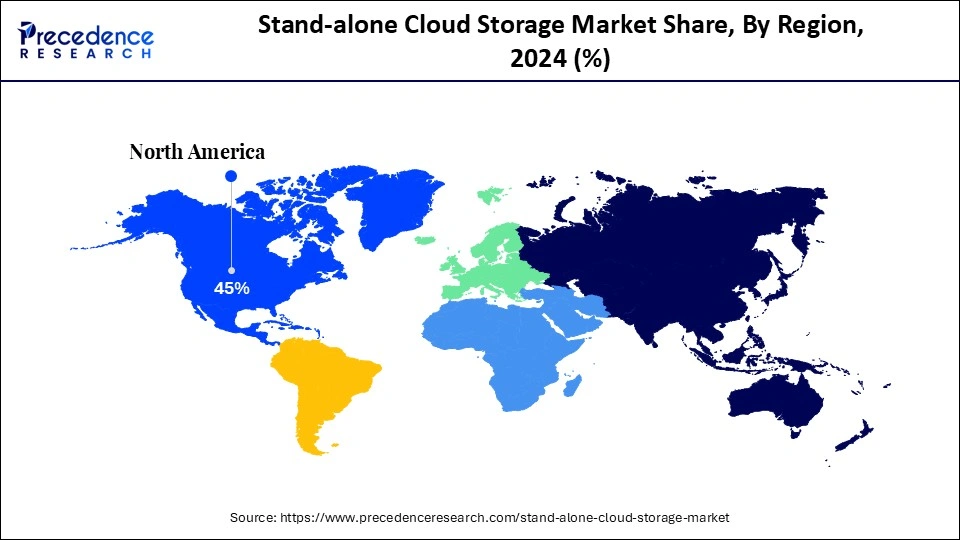

- North America dominated the market, holding the largest market share of 45% in 2024.

- Asia Pacific is expected to grow at a notable rate in share in the stand-alone cloud storage market.

- By deployment model, the public cloud storage segment held the largest share of the market in 2024.

- By deployment model, the hybrid cloud storage segment is expected to grow at the fastest rate during the forecast period.

- By component, the storage infrastructure segment held the largest market share in 2024.

- By component, the services segment is expected to grow at the fastest rate during the forecast period.

- By storage type, the object storage segment held the largest share in the stand-alone cloud storage market during 2024.

- By storage type, the archival/cold storage segment is expected to grow at the fastest rate during the forecast period

- By application, the data backup & recovery segment is expected to grow at the fastest rate in the stand-alone cloud storage market.

- By application, the big data & analytics segment held the largest share in the market in 2024.

- By end-user industry, the BFSI segment held the largest share in 2024.

- By end-user industry, the healthcare & life sciences segment is expected to grow at the fastest rate during the forecast period.

- By distribution channel, the direct sales segment held the largest market share in 2024.

- By distribution channel, the online/cloud marketplaces segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 22.67 Billion

- Market Size in 2025: USD 25.45 Billion

- Forecasted Market Size by 2034: USD 71.94 Billion

- CAGR (2025-2034): 12.24%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Stand-alone Cloud Storage Market?

The stand-alone cloud storage market is experiencing strong growth driven by the increasing demand for storage solutions that are independent, scalable, and secure. Individuals are seeking affordable and easily accessible data backup solutions, while organizations are increasingly separating storage from computation to enhance flexibility. The need for compliance with remote work and an increasing dependence on digital transformation are all driving adoption. To improve their market position, well-known tech companies that specialize in storage are constantly introducing new products.

- In January 2025, Synchronoss Technologies launched a next-generation Personal Cloud Platform at CES 2025, offering enhanced backup, AI tools, improved security, and user features for photos, videos, and files.(Source: https://www.nasdaq.com)

AI Shifts in Stand-alone Cloud Storage Market

AI-Driven Automation & Data Lifecycle Management

Automated lifecycle tasks with AI/ML are a popular trend. This includes automatically identifying anomalies, classifying data as hot or cold, transferring cold data to less expensive tiers, and even anticipating possible threats or failures. This lowers expenses and manual labor, particularly for big businesses handling petabytes of data. Without much assistance from humans, storage systems are becoming more intelligent. They can recognize usage trends, modify policies, and maximize performance.

Hybrid/Edge Architecture Optimized for AI Workloads

Storage architectures are shifting towards hybrid and edge deployments due to the growth of AI workloads, encompassing training, inference, and real-time data ingestion. To minimize latency, organizations prefer to store less important data in centralized cold storage and keep other data close to computation, offering storage classes or solutions that are especially suited for performance and closeness to GPU accelerator resources is being forced by AI onto providers.

Stand-alone Cloud Storage Market Outlook

- Industry growth overview: Businesses in media, IT, healthcare, and financial sectors are increasing demand for stand-alone cloud storage to effectively handle massive datasets. Companies are separating compute and storage to save money and increase flexibility. Industries handling high-value or sensitive data are particularly adopting.

- Sustainability Trends: To lower carbon footprints, providers are concentrating on green storage options and energy-efficient data centers. For companies that care about the environment, waste reduction and resource optimization are becoming top priorities. Pressure from consumers and regulations is also making sustainable storage methods more significant.

- Startup Ecosystem: With creative, affordable, and AI-enabled solutions, new startups are breaking into the cloud storage space. They are focusing on specialized markets, including high-performance object storage, localized compliance, and hybrid storage. The rapid growth and adoption of new technologies in this segment are being fueled by venture capital and strategic partnerships.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 22.67 Billion |

| Market Size in 2025 | USD 25.45 Billion |

| Market Size by 2034 | USD 71.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Component, Storage Type, Application, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Remote Data Accessibility and Collaboration

A major driver in the stand-alone cloud storage market is the growing demand for remote data accessibility and collaboration. As businesses increasingly adopt hybrid and remote work models, the need for secure, scalable, and easily accessible storage solutions has surged. Cloud storage enables users to access, share, and synchronize data across multiple devices and locations, improving productivity and efficiency. Additionally, advancements in data encryption and compliance with global privacy regulations have strengthened user trust in cloud solutions. The rapid growth of data generated by IoT devices, AI applications, and digital transformation initiatives further fuels the expansion of this market.

Restraint

Data Privacy and Regulatory Concerns

Strict data localization and privacy regulations are enforced by various regions, posing challenges for international standalone cloud storage providers. Compliance with regulations like GDPR and HIPAA is a requirement for organizations, making cross-border data storage more challenging and sometimes expensive. Adoption in regulated sectors, such as healthcare and finance, is slowed down by this, leading to obstacles for growth in the stand-alone cloud storage market.

- In September 2025, HERABIT announced plans to launch a dedicated cloud storage service with a focus on localized infrastructure, helping businesses meet regulatory requirements.(Source: https://blocksandfiles.com)

Opportunity

Opportunities in Hybrid and Multi-cloud Strategies

Organizations increasingly prefer hybrid or multi-cloud storage architectures to avoid vendor lock-in and enhance redundancy. Standalone cloud storage providers can offer flexible solutions compatible with multiple cloud ecosystems, creating strong business opportunities.

- 25 July 2025, IBM Cloud launched IBM Cloud Satellite Object Storage, a hybrid cloud solution enabling enterprises to store and manage data across multiple environments.

Segmental Insights

Deployment Model Insights

Why Did the Public Cloud Storage Segment Dominate the Stand-Alone Cloud Storage Market in 2024?

The public cloud storage segment dominated the market in 2024, driven by its cost efficiency, scalability, and global accessibility. Enterprises prefer this model due to the extensive infrastructure and compliance support offered by leading providers such as AWS, Microsoft Azure, and Google Cloud. The ability to quickly scale resources up or down further enhances its appeal. Additionally, a robust ecosystem of third-party integrations and tools continues to drive the adoption of public cloud storage.

The hybrid cloud storage segment is growing rapidly due to businesses' desire for flexibility between the scalability of public clouds and the control of on-premises data. The need for improved disaster recovery capabilities and less vendor lock-in is driving its uptake. Companies operating in regulatory sectors increasingly see hybrid models to strike a balance between innovation and compliance. Furthermore, hybrid approaches combine public and private infrastructure to optimize costs.

Component Insights

Why Did the Storage Infrastructure Segment Dominate the Market in 2024?

The storage infrastructure segment led the stand-alone cloud storage market in 2024, driven by its crucial role in providing the necessary networking and basic hardware for independent cloud storage. Businesses keep spending a lot of money on servers and sophisticated storage arrays to guarantee dependable data management at scale. High-performance systems that support workloads involving analytics and artificial intelligence are in high demand. Infrastructure leadership is also being strengthened by advancements in power efficiency and storage density.

Services are growing rapidly in the market owing to businesses increasingly outsourcing monitoring, security, and optimization tasks. The shift allows companies to reduce IT complexity and focus on core business operations. Providers offering 24/7 support and advanced analytics services are gaining strong traction, in addition to addressing in-house IT skill gaps.

Storage Type Insights

What Made Object Storage Dominate the Stand-Alone Cloud Storage Market in 2024?

The object storage segment is expected to dominate the market in 2024, driven by its ability to handle unstructured data, including backup videos and images, as well as its scalability and affordability. It is the foundation of cloud-native workloads due to its metadata-rich design and seamless retrieval capabilities. The growing uptake of digital content platforms and IoT devices further strengthens demand. Because it supports decentralized and distributed architecture, object storage is also preferred by businesses.

Archival/Cold storage is growing in demand due to the increasing need for low-cost, long-term storage of infrequently accessed data. Compliance regulations and the preservation of historical business records further support its growth. Governments and BFSI institutions, in particular, are leveraging cold storage for data retention mandates. Furthermore, cloud providers are introducing tiered cold storage solutions that enhance affordability and adoption.

Application Insights

What Made the Data Backup & Recovery Segment Dominate the Market in 2024?

The data backup & recovery segment is expected to dominate the stand-alone cloud storage market in 2024, driven by businesses' increased emphasis on cybersecurity disaster preparedness and data resilience. Platforms for standalone cloud computing offer dependable, scalable, and automated solutions that guarantee business continuity. Ransomware incidents and cyberattacks are becoming increasingly frequent, which in turn increases demand. Businesses are also being pushed toward reliable cloud backup solutions by regulatory requirements about data protection.

Big data & analytics are growing rapidly owing to the exponential rise in enterprise data usage for predictive modeling, AI, and machine learning applications. Industries such as retail, healthcare, and telecom are increasingly relying on cloud storage to manage these large datasets. The growing trend of real-time analytics is also fueling demand for high-performance cloud storage. Additionally, businesses are utilizing these solutions to gain a competitive advantage and drive innovation.

End User Industry Insights

Why Did the BFSI Segment Dominate the Stand-Alone Cloud Storage Market in 2024?

The BFSI segment led the market, driven by businesses' growing emphasis on cybersecurity, data resilience, and disaster preparedness. Business continuity is ensured by automated, scalable, and dependable solutions offered by a stand-alone cloud platform. Ransomware incidents and cyberattacks are becoming more frequent, which increases demand. Strong cloud backup solutions are also being pushed toward businesses by regulatory requirements about data protection.

The healthcare & life sciences segment is growing fastest, owing to the surge in patient data, medical imaging, and clinical research requirements. The demand for secure, HIPAA-compliant cloud storage solutions is expanding rapidly in this sector. Genomic research and telemedicine platforms are also generating massive amounts of data, requiring efficient storage. Additionally cloud cloud-based collaboration tools are enabling better sharing of healthcare insights and patient outcomes.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Market for Stand-Alone Cloud Storage?

The direct sales segment dominated the market in 2024, driven by businesses' preference for personalized storage solutions and direct communication with suppliers. Additionally, this channel guarantees more robust vendor-client relationships through customized support. Direct discussions are preferred for pricing and compliance, especially by large organizations. Direct sales also enable providers to offer enterprises specific innovations and bundled services.

The online/cloud marketplaces segment is growing rapidly due to ease of subscription-based models, instant deployment, and flexible scalability. These platforms enabled businesses to quickly test, adopt, and integrate storage services. SMEs benefit greatly from marketplaces that lower entry barriers with transparent pricing and a quick setup process. Additionally, marketplaces are becoming hubs for multi-cloud adoption, driving faster ecosystem expansion.

Regional Insights

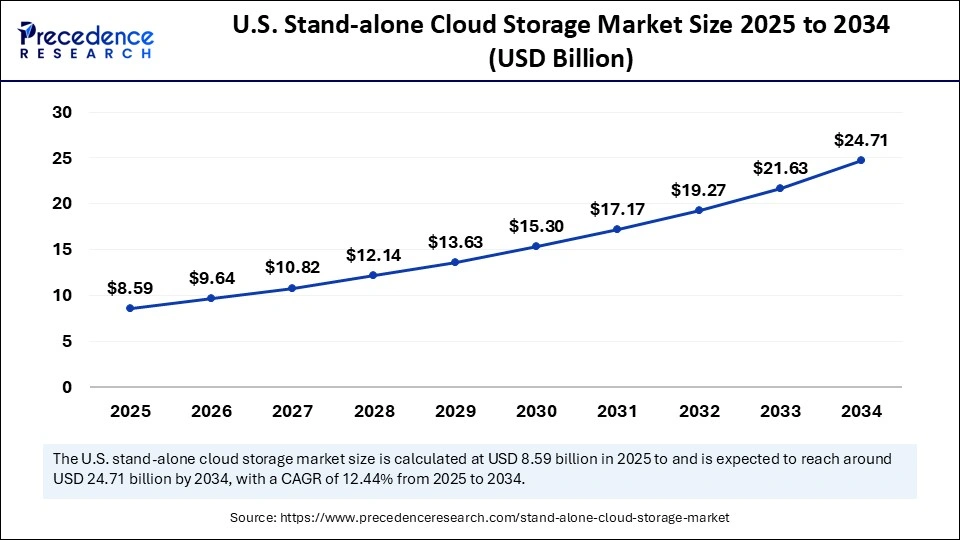

U.S. Stand-Alone Cloud Storage Market Size and Growth 2025 to 2034

The U.S. stand-alone cloud storage market size was exhibited at USD 7.65 billion in 2024 and is projected to be worth around USD 24.71 billion by 2034, growing at a CAGR of 12.44% from 2025 to 2034.

What Made North America Dominate the Stand-Alone Cloud Storage Market?

North America led the market in 2024, driven by its sophisticated IT infrastructure wide wide-ranging digital adoption across industries, and robust base of cloud service providers. Adoption of advanced technologies like analytics, IoT, and AI early on strengthens the region's leadership. Government data security programs and hyperscale data center investments are also important. Further propelling cloud innovations is robust venture capital support.

The Asia Pacific is growing rapidly in the stand-alone cloud storage market, driven by government-led digital initiatives, increasing cloud adoption among SMEs, and the rapid pace of digital transformation. Data center development and the expansion of cloud infrastructure are seeing significant investments in the region. Adoption is also being fueled by the rapidly expanding fintech and e-commerce industries. Additionally, companies are moving toward scalable cloud storage options as a result of growing internet and mobile penetration.

Country-Level Investments/ Funding Trends for Stand-alone Cloud Storage Market

| Country | Investment Trends | Funding Trends | Government Initiatives & Policies |

| U.S. | Focus on secure, high-performance, object storage and hybrid/multi-cloud solutions. | Funding supports research and development, AI integration, and global expansion. | CLOUD Act, "Cloud Smart" policy, and government as a major client shape practices. |

| Germany | Priority on data sovereignty and secure solutions for privacy compliance | Funding supports local cloud ecosystems and projects, such as Gaia-X. | Strict GDPR and data residency rules, with policies favoring in-country data storage. |

| India | Rapid investment in local data centers for e-commerce, expansion, and government programs. | Supports cost-effective, scalable solutions for SMEs and mobile-first users | The "MeghRaj" initiative and data localization mandates drive the development of domestic cloud infrastructure. |

| UAE | Investment in local data centers to support sensitive sectors, such as finance and healthcare. | Funding promotes governance, advanced security, and tech partnerships. | Data protection laws encourage in-country data storage and sustainable practices. |

Top Companies in Stand-alone Cloud Storage Market & their Offerings

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure (OCI)

- Alibaba Cloud

- Tencent Cloud

- Dell Technologies (EMC Cloud Storage)

- VMware Cloud

- Hewlett Packard Enterprise (HPE GreenLake)

- Dropbox, Inc.

- Box, Inc.

- NetApp, Inc.

- Hitachi Vantara

- Huawei Cloud

Recent Developments

- In October 2025, Amazon officially launched its new Vega OS with the Fire TV Stick 4K Select, introducing a custom Linux-based operating system to its streaming device lineup. To ensure a robust app library at launch, Amazon is employing a unique strategy: cloud-streaming popular Android Fire TV apps that haven't yet been ported to Vega.(Source: https://www.theverge.com)

- In October 2025, Amazon Web Services (AWS) entered a multi-year partnership with the NBA to develop and launch AI-powered features and data analytics tools. The platform named NBA inside the game will transform player and game data into real-time insights and interactive fan experiences.

(Source: https://www.reuters.com)

Segments Covered in the Report

By Deployment Model

- Public Cloud Storage

- Private Cloud Storage

- Hybrid Cloud Storage

- Multi-Cloud Storage

By Component

- Storage Infrastructure

- Software / Management Solutions

- Services (Consulting, Integration, Managed Services, Support & Maintenance)

By Storage Type

- Object Storage

- File Storage

- Block Storage

- Archival/Cold Storage

By Application

- Data Backup & Recovery

- File Storage & Sharing

- Disaster Recovery & Business Continuity

- Archiving & Compliance

- Big Data & Analytics

- Content Delivery & Media Workloads

By End-User Industry

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Media & Entertainment

- Manufacturing

- Education & Research

- Others (Energy, Utilities, Transportation)

By Distribution Channel

- Direct Sales (Cloud Providers to Enterprises)

- Managed Service Providers (MSPs)

- Value-Added Resellers (VARs)

- Online/Cloud Marketplaces

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting