What is the Steel Wire Market Size?

The global steel wire market size is calculated at USD 116.75 billion in 2025 and is predicted to increase from USD 121.77 billion in 2026 to approximately USD 175.69 billion by 2035, expanding at a CAGR of 4.17% from 2026 to 2035.

Steel Wire Market Key Takeaways

- In terms of revenue, the market is valued at $116.75 billion in 2025.

- It is projected to reach $175.69billion by 2035.

- The market is expected to grow at a CAGR of 4.17% from 2026 to 2035.

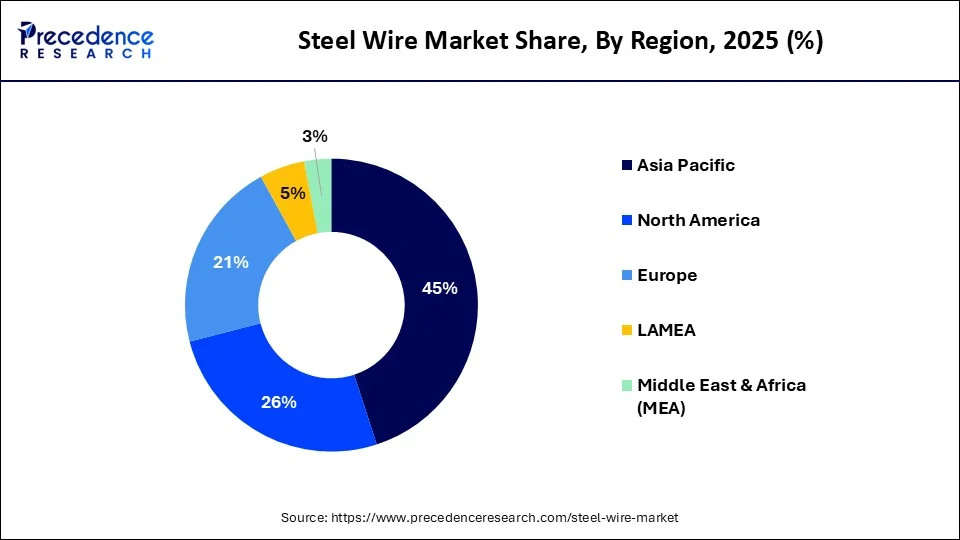

- Asia-Pacific generated more than 45% of revenue share in 2025.

- By Material, the carbon steel segment has contributed more than 63% of revenue share in 2025.

- By Material, the stainless-steel segment is expected to expand at the fastest CAGR of 6.7% from 2026 to 2035.

- By Application, the construction segment accounted for the highest market share of 35.8% in 2025.

- By Application, the energy segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

The steel wire market is a dynamic global industry centered on the production, distribution, and trade of various types of steel wires. These wires serve as indispensable materials with versatile applications across sectors like construction, automotive, manufacturing, and infrastructure development. This market's dynamism is chiefly influenced by factors including industrial demands, technological innovations, and economic conditions, making it a multifaceted arena for businesses and investors.

Several key trends and growth drivers are propelling the steel wire market forward. First and foremost is the ever-growing demand for steel wires in infrastructure development projects worldwide. This surge is attributed to the need for robust, long-lasting materials, particularly in rapidly urbanizing regions. Furthermore, the automotive industry's continuous expansion fuels the demand for steel wires, used in components like tire reinforcement and suspension systems. The advent of electric vehicles (EVs) is also a noteworthy trend, as they require specialized steel wires for batteries and other components. Additionally, technological advancements in steel wire production, such as high-strength wires for lightweight construction, contribute to market growth.

While opportunities abound, the steel wire industry also faces significant challenges. One of the primary concerns is environmental sustainability. Environmental regulations are becoming increasingly stringent, pressuring manufacturers to adopt eco-friendly production processes and materials. Moreover, market volatility due to fluctuating steel prices and global economic conditions poses risks to industry stability. Additionally, competition from alternative materials, like aluminum and composite materials, presents a challenge, as industries seek lighter and more corrosion-resistant options.

Despite these challenges, there are compelling business opportunities within the steel wire market. Companies can explore innovative recycling technologies to reduce waste and lower environmental impact, aligning with sustainability goals. As the renewable energy sector expands, steel wires are crucial for wind turbine production, presenting a growing market segment. Moreover, the escalating adoption of advanced manufacturing techniques, including 3D printing, may furnish fresh avenues for steel wire applications, particularly in aerospace and analogous domains. In conclusion, the steel wire market, characterized by its dynamism and adaptability, remains an essential player in the global materials landscape, boasting enduring relevance across various sectors.

In conclusion, the steel wire market is a dynamic and versatile industry with substantial growth potential. Industry trends are shaped by factors like infrastructure development, automotive demands, and technological advancements, while challenges include environmental sustainability and market volatility. Businesses can capitalize on opportunities by embracing sustainability, exploring emerging sectors like renewable energy, and diversifying into niche markets. Overall, the steel wire market remains a critical player in the global materials industry with enduring relevance across various sectors.

Steel Wire Market Growth Factors

- The steel wire market encompasses the global trade of steel wires, encompassing their manufacture, distribution, and commercial exchange. These steel wires are highly versatile materials with extensive applications spanning the construction, automotive, manufacturing, and infrastructure sectors.

- Prominent industry players include steel manufacturers, wire producers, and distribution entities. The market's expansion often closely aligns with infrastructure development, automotive manufacturing, and industrial production sectors.

- Furthermore, environmental considerations and innovations in wire production methods, such as recycling initiatives, are increasingly influencing the industry landscape, reflecting a growing emphasis on sustainability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 116.75 Billion |

| Market Size in 2026 | USD 121.77 Billion |

| Market Size by 2035 | USD 175.69 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.17% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Infrastructure development

Infrastructure development serves as a pivotal force propelling the expansion of the steel wire market. Across the globe, substantial investments by governments and private sectors in infrastructure projects fuel the surge in demand for steel wires. These wires, valued for their robustness, endurance, and adaptability, find indispensable utility in a diverse array of applications within the construction realm. They reinforce structures, ensuring the requisite structural integrity to withstand diverse loads and environmental conditions, facilitating the construction of bridges, buildings, highways, and railways. Moreover, the telecommunication sector relies on steel wires for the efficient installation of overhead cables and transmission lines, facilitating seamless connectivity.

With burgeoning urbanization and population growth, particularly in emerging economies, the imperative for novel infrastructure becomes pronounced, spurring heightened construction activities and consequently elevating the consumption of steel wires. Furthermore, infrastructure development acts as a potent economic stimulant, engendering a virtuous cycle wherein heightened economic activity begets more infrastructure ventures, thereby catalyzing and sustaining the upward trajectory of the steel wire industry.

Restraints:

Fluctuating steel prices

The erratic oscillations in steel prices present a formidable constraint on the growth of the steel wire market. These price fluctuations, driven by variables such as raw material expenses, global economic dynamics, and trade intricacies, introduce a level of uncertainty that hampers manufacturers' ability to plan production and pricing strategies effectively. When steel prices surge steeply, manufacturers grapple with heightened production costs, which can compress profit margins and erode competitiveness. Conversely, when steel prices plummet, manufacturers may witness reduced revenues even in the face of consistent or increased production volumes, creating financial instability. This rollercoaster ride in steel prices not only introduces market uncertainty but also disrupts supply chains, affecting inventory management and complicating the ability to meet customer demands in a timely manner. Consequently, the relentless volatility in steel prices serves as a deterrent to potential investors and poses a substantial obstacle to the sustained expansion of the market.

Opportunity

Renewable energy

Renewable energy is a significant catalyst for creating opportunities in the steel wire market. As the world accelerates its transition towards cleaner energy sources, the demand for steel wires has surged within the renewable energy sector, particularly in wind energy applications. Wind turbines, crucial for harnessing wind power, rely extensively on steel wires for their construction and operation. These wires are used for structural reinforcement, supporting the immense weight and forces experienced by the turbines. Additionally, steel wires are employed in the transmission of electricity generated by wind turbines to power grids.

As governments and organizations worldwide invest heavily in renewable energy projects to reduce carbon emissions and combat climate change, the steel wire market stands to benefit immensely. The continued expansion of wind energy, coupled with potential growth in solar power infrastructure, offers a promising avenue for steel wire manufacturers. Moreover, innovations in steel wire materials and designs tailored for renewable energy applications can unlock further opportunities in this evolving and environmentally critical sector.

Segment Insights

Material Insights

According to Material, the carbon steel sector held a 63% revenue share in 2025. The carbon steel segment holds a major share in the steel wire market due to its widespread use across various industries. Carbon steel wires are known for their high strength, durability, and cost-effectiveness, making them a preferred choice in construction, automotive, and manufacturing sectors. Additionally, they offer excellent corrosion resistance when properly coated. Their versatility, coupled with competitive pricing, has contributed to their dominant market position. While specialty alloys and materials are gaining prominence, carbon steel wires remain a staple due to their reliability, meeting the diverse needs of industries, and maintaining a substantial market share.

The stainless steel sector is anticipated to expand at a significantly CAGR of 6.7% during the projected period due to its remarkable attributes. Stainless steel wires are prized for their outstanding corrosion resistance, rendering them indispensable in demanding settings like marine, chemical, and food processing industries. Their robustness and endurance ensure prolonged service life, making them a preferred choice across diverse applications, from construction to automotive components. Furthermore, stainless steel's aesthetic appeal and hygienic properties enhance its popularity in architectural and healthcare applications. Its adaptability, coupled with an extensive array of grades, solidify stainless steel's commanding position within the steel wire market.

Application Insights:

In 2025, the construction sector had the highest market share of 35.8% on the basis of the Application. The construction segment holds a significant share in the steel wire market due to its wide-ranging applications in the construction industry. Steel wires are crucial for reinforcing concrete structures, providing durability and structural integrity in buildings, bridges, and infrastructure projects. The robust demand for construction materials, driven by urbanization, infrastructure development, and renovation projects globally, sustains the market's growth. Additionally, steel wires are indispensable in areas prone to seismic activity, further amplifying their importance in construction. As a result, the construction sector's reliance on steel wires cements its dominant position within the market.

The Energy segment is anticipated to expand at the fastest rate over the projected period. The energy segment holds a significant growth in the steel wire market due to its integral role in various energy-related applications. Steel wires are essential components in renewable energy sectors, especially wind energy, where they are used in the construction and reinforcement of wind turbines. Additionally, steel wires are crucial for power transmission lines, supporting the reliable distribution of electricity. The global shift towards cleaner and sustainable energy sources has fueled substantial investments in energy infrastructure, driving the demand for steel wires. This, in turn, has made the Energy segment a major contributor to the market's overall growth.

Regional Insights

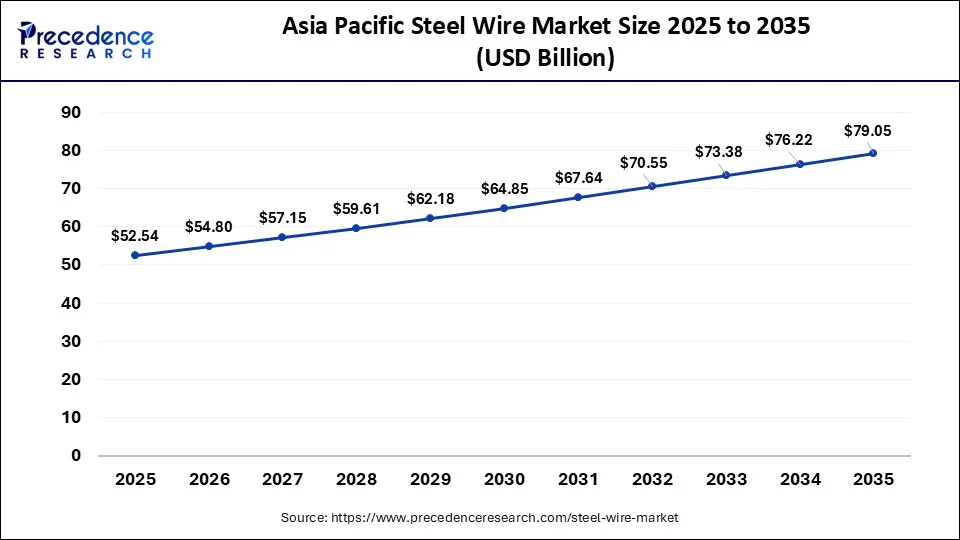

What is the Asia Pacific Steel Wire Market Size?

The Asia Pacific steel wire market size is estimated at USD 52.54 billion in 2025 and is predicted to be worth around USD 79.05 billion by 2035, at a CAGR of 4.17% from 2026 to 2035.

Asia-Pacific has held the largest revenue share 45% in 2025.

- The region's rapid urbanization and infrastructure development, particularly in countries like China and India, have driven substantial demand for steel wires in construction and manufacturing.

- Additionally, the automotive industry's robust growth in Asia-Pacific has further increased the need for steel wires in vehicle production. Moreover, the expanding renewable energy sector, including wind power, has bolstered demand for steel wires in the region.

North America is estimated to observe the fastest expansion.

- The region boasts a robust construction and infrastructure sector, continually driving the demand for steel wires in various applications. Additionally, the automotive industry, a major consumer of steel wires, remains well-established in North America.

- Furthermore, stringent quality standards and technological advancements in steel wire manufacturing contribute to the region's dominance. Government initiatives promoting infrastructure development and renewable energy projects further bolster the market.

What are the Advancements in the Steel Wire Market in Europe?

Europe is recognized as a significant region in the global steel wire market, thanks to its well-established automotive and construction industries. The region's stringent environmental regulations are also driving innovation toward sustainable practices. Major steel producers, such as ArcelorMittal and Bekaert, are investing heavily in research and development to strengthen their global supply chains, highlighting the competitive landscape of the region. European governments are implementing policies to reduce emissions, compelling steel wire manufacturers to adopt eco-friendly technologies and practices.

Germany Steel Wire Market Trends: The country is investing heavily in modernizing infrastructure, including roads, bridges, and railways. These projects require large volumes of steel wire, especially when it comes to urban development and the renovation of aging structures. The rise in residential and commercial construction in the region also ensures consistent demand for steel wires.

What are the Key Trends in the Steel Wire Market in Latin America?

Latin America also plays a crucial role in the global steel wire market, with Brazil serving as a key player in both production and consumption within the region. The market is driven by growth in the construction, automotive, and industrial manufacturing sectors, alongside increased demand for renewable energy systems. The automotive industry in Latin America contributes to the steel wire market, with steel wire used in vehicle components such as springs, cables, and fasteners. Additionally, other countries like Argentina, Chile, Colombia, and Mexico are also important players in the steel wire market.

Brazil Steel Wire Market Trends: The country's market landscape is growing due to rising construction and infrastructure projects. The government is increasingly investing in public infrastructure and housing, which thus increases the demand for steel wires. Urban expansion and upgrades are also supporting market growth.

How is the Middle East and Africa Growing in the Steel Wire Market?

The Middle East and Africa are set to experience steady growth in the market and are expected to maintain this growth trajectory in the upcoming years. This growth and development are due to a rising demand for transmission and ground wires. Moreover, the rising number of mining and mineral exploration activities in various countries is expected to propel the market further.

Saudi Arabia Steel Wire Market Trends: The country is actively seen investing in smart cities, highways, airports, and large commercial projects as part of its national development plan. As urbanization efforts increase and new housing developments expand across the region, the demand for steel wires will continue to rise.

Value Chain Analysis of the Steel Wire Market

- Raw Material Sourcing:This stage deals with the procurement of raw materials needed to make steel wires, primarily iron ores, coking coal, scrap steel, and alloying elements like carbon or manganese.

Key Players: Tata Steel, Nippon, Nucor - Manufacturing Process:This stage deals with the production of steel wires, where steel billets are rolled into wire rods and then processed through pickling, coasting and multi-stage cold drawing.

Key Players: Bekaert, Kiswire, Kobe Steel - Distribution Process:In this stage, the finished steel wires are packaged and distributed through OEM supply contracts, industrial distributors, and regional wholesalers.

Key Players: Hilti, Fastenal, Wurth Group

Steel Wire Market Companies

- Arcelor Mittal

- Bekaert

- JFE Steel Holdings

- Kobe Steel Limited

- LIBERTY Steel Group

- Nippon Steel Corporation

- Tata Steel Limited

- VAN MERKSTEIJN INTERNATIONAL

- Henan Hengxing Science & Technology Co., Ltd.

- Tianjin Huayuan Metal Wire Products Co.Ltd.

Recent Developments

- In December 2024, Bansal Wire Industries Limited officially launched an innovative new product, the IIose Wire (Brass Coated Hose Reinforcement Wire). This product offers the perfect solution for hose reinforcement, providing exceptional resistance to corrosion and wear while ensuring optimal strength and durability. This cutting-edge addition is set to transform the industry with its superior quality and enhanced performance.

- In September 2024, the Board of Directors of Bansal Wire Industries Limited approved the plan to establish a wholly owned subsidiary, BWI Steels Pvt. Ltd. This subsidiary will be a related party to the parent company, although the promoter group has no other interests in this transaction. BWI Steels will operate in the iron and steel industry, focusing on the manufacturing of steel wire rods and wires.

- In 2022:Kobe Steel purchased 25% of Millcon Steel's issued share in Kobelco Millcon Steel Co., Ltd. (KMS), a Thai company that produces wire rods. In the ASEAN region, KMS is the only manufacturer of special steel wire rods.

- In 2020:Insteel Industries, Inc. invested USD 22.5 million to acquire the assets of strand-tech manufacturing, which produces prestressed concrete strands, particularly for concrete construction applications.

- In 2022,Bridon-Bekaert Ropes Group (BBRG) announced the acquisition of VisionTek Engineering Srl. This acquisition was an important strategic step towards in developing and providing advanced services in the steel wire and rope market.

- In 2018, Bekaert SA reached to and acquisition agreement with Bridon-Bekaert Ropes Group and took full ownership. The company adopted this strategy to grow their business globally and to create significant value over the period.

Segments Covered in the Report

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Construction

- Automotive

- Energy

- Industrial

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting