What is Sterilization Pouches Market Size?

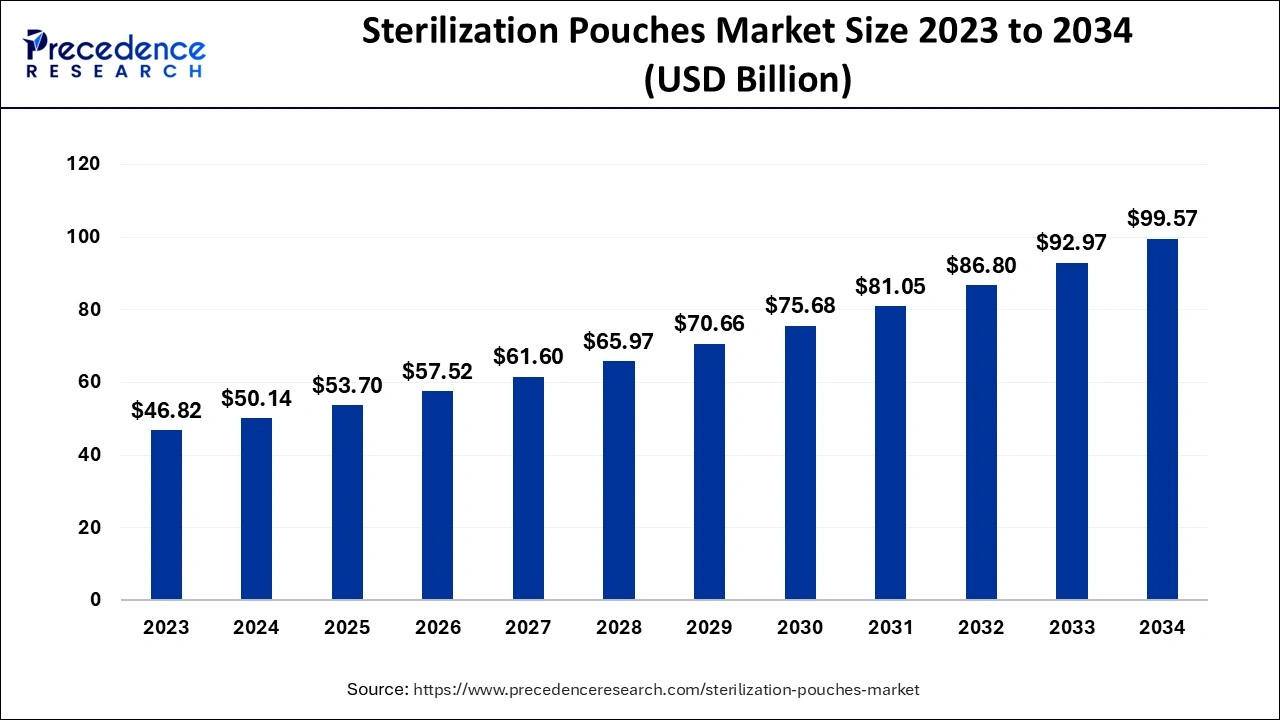

The global sterilization pouches market size is estimated at USD 53.70 billion in 2025 and is anticipated to reach around USD 105.88 billion by 2035, expanding at a CAGR of 7.02% between 2026 to 2035

Market Highlights

- North America and Europe accounted for 70% of revenue share in 2025.

- By application, the hospital segment has counted 52% revenue share in 2025.

- The Clinics segment has captured revenue share of over 22% in 2025.

- The others application segment has held 16% revenue share in 2025.

Sterilization pouches are packaging materials used in the medical and healthcare industries to sterilize and store medical devices, instruments, and supplies. They are made from medical-grade materials that are resistant to high temperatures, pressure, and moisture. Sterilization pouches come in different sizes and are available in various types, including self-sealing pouches, heat-sealable pouches, and indicator pouches.

The sterilization pouch market is driven by the growing demand for sterilization pouches in the healthcare industry. The rise in the number of surgical procedures, the increasing prevalence of hospital-acquired infections, and the growing awareness about the importance of sterilization in the healthcare industry are some of the factors driving the growth of the sterilization pouch market.

In addition, the increasing adoption of single-use sterilization pouches is also contributing to the growth of the market. Single-use sterilization pouches are more convenient and cost-effective compared to reusable pouches, as they eliminate the need for cleaning and sterilizing equipment after use.

Sterilization Pouches MarketGrowth Factors

- Introduction of reusable medical equipment to boost product adoption

- Increase in healthcare savings by the use of sterilization pouches

- Development of customized engineered solutions to boost the market

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.70 Billion |

| Market Size in 2026 | USD 57.52 Billion |

| Market Size by 2035 | USD 105.88 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.02% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By End-Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Introduction of reusable medical equipment to boost product adoption

It is not practical to utilise brand-new medical gadgets for every patient because they are quite pricey and require sterilization. Pouches used to sterilize medical equipment make it possible for the equipment and instruments to be reused repeatedly without endangering the hygiene and health of the patient. This makes it possible for patients to make the most use of the resources that are available to them, and it also supports the healthcare system by lowering costs. Some of the premium sterilization pouches, for instance, can resist more than 100 sterilization cycles before being discarded.

Increase in healthcare savings by the use of sterilization pouches

By the use of efficient sterilization, safe handling procedures, and pouches, healthcare systems save a sizable sum of money every year. The higher price makes it next to impossible to limit the usage of medical equipment to a single patient. If each patient had to pay for every new equipment and medical device used in their care, the expense of medical care would increase rapidly, making healthcare facilities inaccessible and out of reach for the majority of people. By adopting these pouches, healthcare facilities can save a sizable sum of money, lowering treatment costs and putting in place a long-lasting national healthcare system.

Key Market Challenges

Infectious illness risk is rising due to faulty container design and complex instrumentation

The healthcare sector makes substantial use of sterilization techniques. The medical equipment and tools used in healthcare institutions have advanced along with the healthcare sector. As a result, thorough sterilization of these intricate medical devices frequently requires more than the usual sterilization rounds. Some healthcare professionals may fail to properly sterilize the instrument or devices because they are not aware of the special sterilization cycle or method that is required for specific medical equipment.

This increases the danger of infection spreading from one patient to another. Moreover, these pouches' incorrect packaging arrangement can occasionally lead to inadequate sterilant penetration, which resulted in poor sterilization of the involve devices, leaving them contaminated. Also, this raises the possibility of an illness spreading from patient to patient. Hence, these undesirable practices and the deteriorated quality of packaging configurations are projected to hinder the growth of the sterilizing pouches market over the forecast period.

High cost of sterilization pouches

Sterilization pouches are made from medical-grade materials that are resistant to high temperatures, pressure, and moisture, which can make them expensive. This could limit their adoption, particularly in developing countries with limited healthcare budgets. There are alternative sterilization methods available, such as radiation sterilization and gas plasma sterilization, which may provide a cost-effective and efficient alternative to traditional steam sterilization. These alternative methods could reduce the demand for sterilization pouches.

Increasing demand for sterilization pouches in emerging markets

The healthcare industry is growing rapidly in emerging markets, driven by population growth, increasing income levels, and improving healthcare infrastructure. This is creating significant opportunities for the sterilization pouch market, particularly as awareness of the importance of sterilization in preventing infections increases in these markets. Along with this Sterilization, pouches are also used in non-medical industries, such as food and beverage production and laboratory settings. As awareness of the importance of sterilization in these industries increases, there may be growing demand for sterilization pouches in these markets.

Advancements in packaging technology

There are ongoing advancements in packaging technology that could improve the performance and efficiency of sterilization pouches. For example, the development of new materials that are biodegradable or more eco-friendly could help to address environmental concerns and drive demand for sterilization pouches.

Segment Insights

Type Insights

On the basis of type, the sterilization pouches market is segmented into sterilization pouches, sterilization wrappings, sterilization containers, and others. The sterilization pouches segment is further bifurcated into paper pouches and plastic pouches. With an increasing demand for small instruments and medical equipment in clinics and hospitals, the paper and plastic-based category is predicted to develop at the quickest rate in the market.

The packaging and healthcare industries have established rules for how these pouches must be made. Sterilization wrappings can be employed as needed by the end user and come in custom sizes on the market. These wrappings should allow for proper sterilization to happen and should not be overly tight or loose around the medical instruments. In CSSDs and other sizable healthcare institutions where sterilization occurs on a bigger scale, sterilization containers are typically employed.

Application Insights

On the basis of application, sterilization pouches market is segmented into Hospitals, CSSDs, Clinics and others. Hospitals are the biggest users of sterilization pouches owing to a huge number of patients they serve along with the huge number of medical activities fulfilled in these facilities. Surgical procedures performed on patients use sterilized medical equipment and instruments.The second-largest customers of these pouches are small medical facilities that provide patients with minor aesthetic surgical operations. Another identifiable source of this usage is the central sterile services departments (CSSDs).

End-Use Insights

On the basis of sterilization method, the sterilization pouches market is segmented into steam sterilization, ethylene oxide (ETO) sterilization, gamma sterilization, and other. The steam sterilization is the dominant method used in the sterilization pouch market. This is primarily due to its reliability, effectiveness against a broad range of microorganisms, and widespread use in healthcare facilities.

In addition, steam sterilization is a cost-effective method that does not require the use of hazardous chemicals. However, other sterilization methods, such as ethylene oxide (ETO) sterilization and gamma sterilization, are also commonly used in the sterilization pouch market. ETO sterilization is often used for heat-sensitive items that cannot withstand high temperatures, while gamma sterilization is often used for large batches of disposable medical products.

Regional Insights

North America Leads the Way: Dominance in the Sterilization Pouches Market Driven by Healthcare Innovation

North America dominates the market in 2025. North America is a mature and technology-driven market, supported by strict infection prevention regulations, high surgical procedure volumes, and widespread use of single-use medical consumables. Advanced sterilization protocols across hospitals, dental practices, and outpatient centers continue to sustain steady demand for high-quality sterilization packaging solutions.

U.S. Sterilization Pouches Market Trends

The US dominates the regional market due to strong regulatory oversight from healthcare authorities, extensive use of disposable sterilization products, and high awareness of hospital-acquired infection prevention. Growth is reinforced by rising ambulatory surgical centers, dental procedures, and continuous innovation in medical packaging materials.

The Asia-Pacific region is expected to exhibit the highest growth rate due to the increasing demand for healthcare services and rising awareness about the importance of sterilization in preventing infections. Additionally, the growth of medical tourism in the region is expected to drive demand for sterilization pouches. Other regions, such as Latin America and the Middle East and Africa, are also expected to exhibit significant growth in the coming years due to increasing investments in healthcare infrastructure and rising awareness about the importance of infection control.

Asia Pacific on the Rise: Fastest Growth in the Sterilization Pouches Market Fueled by Expanding Healthcare Infrastructure

Asia Pacific is anticipated to experience significant growth in the forecast period. Asia Pacific represents a high-growth region for sterilization pouches, driven by expanding healthcare infrastructure, rising surgical volumes, and increasing awareness of infection control standards. Growth is further supported by medical tourism, rapid hospital expansion, and stronger regulatory emphasis on sterilization compliance across emerging economies.

China Sterilization Pouches Market Trends

China plays a central role in the Asia Pacific market due to its large hospital network, growing domestic medical device manufacturing, and increasing adoption of standardized sterilization practices. Government investments in healthcare modernization, rising outpatient procedures, and expanding dental and surgical clinics are accelerating demand for sterilization pouches.

Europe Making Strides: Notable Growth in the Sterilization Pouches Market Driven by Advanced Healthcare Adoption

Europe is expected to experience notable growth in the market. Europe's market growth is driven by stringent medical device regulations, standardized sterilization guidelines, and well-established healthcare systems. Increasing focus on patient safety, sustainability, and compliance with EU medical packaging standards supports consistent demand across hospitals, laboratories, and dental clinics.

Germany Sterilization Pouches Market Trends

Germany leads the European market owing to its advanced healthcare infrastructure, strong medical device industry, and strict sterilization protocols. High surgical volumes, extensive dental care services, and emphasis on quality-certified medical packaging contribute significantly to the adoption of sterilization pouches across healthcare facilities.

Sterilization Pouches Market Companies

- Amcor plc

- Mondi Group

- Berry Global

- YIPAK

- 3M

- Dynarex Corporation

- PMS Healthcare Technologies

- Getinge Group

- Smurfit Kappa

- STERIS

- Certol International

- Wihuri

- Shanghai Jianzhong Medical Equipment Packing Co., Ltd.

- Prompac

- Cardinal Health

- AMD Medicom Inc.

- STERIMED

Recent Developments

- In November 2025, Zydus Lifesciences and SIG partnered to introduce single-serve spouted pouches for liquid cough and cold medicine in India, featuring SIG's StrawCap 30 Linked tethered spout. This packaging solution provides pre-portioned doses, reduces plastic waste compared to conventional caps, and utilizes SIG's Motion Servo 3.2 filling technology.

- In October 2025, ALCA Corp was the first company to utilize SIG's Prime 55 In-Line Aseptic spouted pouch system, which sterilizes pouches during production rather than requiring external pre-sterilization. This in-line process is intended to lower operational costs and simplify the supply chain.

- In June 2025,Solventum launched the Attest Super Rapid VH2O2 Clear Challenge Pack (1295PCD) for low-temperature medical instrument sterilization. This preassembled, FDA-cleared system combines biological and chemical indicators in a single-use transparent pack to simplify sterile processing workflows.

- In August 2025, Mars Petcare launched its first "designed to be recyclable" mono-material pouches for the Whiskas brand in the UK and Germany. The new mono-polypropylene (PP) pouches replace traditional multi-layer materials, reducing the packaging's carbon footprint by 46% while maintaining necessary high-temperature resistance

Segments Covered in the Report

By Type

- Sterilization Pouches

- Paper Pouches

- Plastic Pouches

- Sterilization Wrapping

- Sterilization Containers

- Others

By Application

- Hospitals

- CSSDs

- Clinics

- Others

By End-Use

- Food & Beverages

- Healthcare

- Cosmetics

- Household Goods

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting