What is the Stethoscopes Market Size?

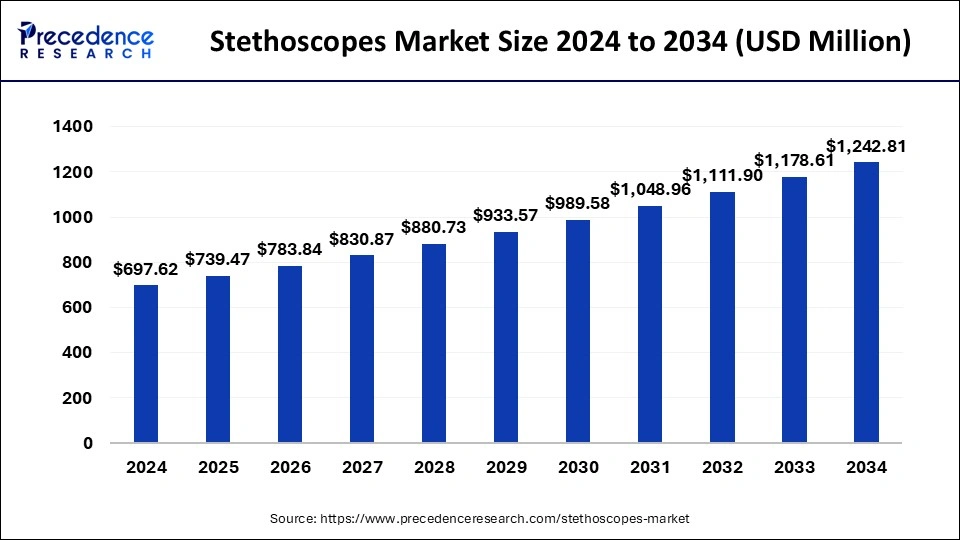

The global stethoscopes market size is calculated at USD 739.47 million in 2025 and is predicted to increase from USD 783.47 million in 2026 to approximately USD 1,308.68 million by 2035, expanding at a CAGR of 5.87% from 2026 to 2035.

Stethoscopes MarketKey Takeaways

- The global stethoscopes market was valued at USD 739.47 million in 2025.

- It is projected to reach USD 1,308.68 million by 2035.

- The stethoscopes market is expected to grow at a CAGR of 5.87% from 2026 to 2035.

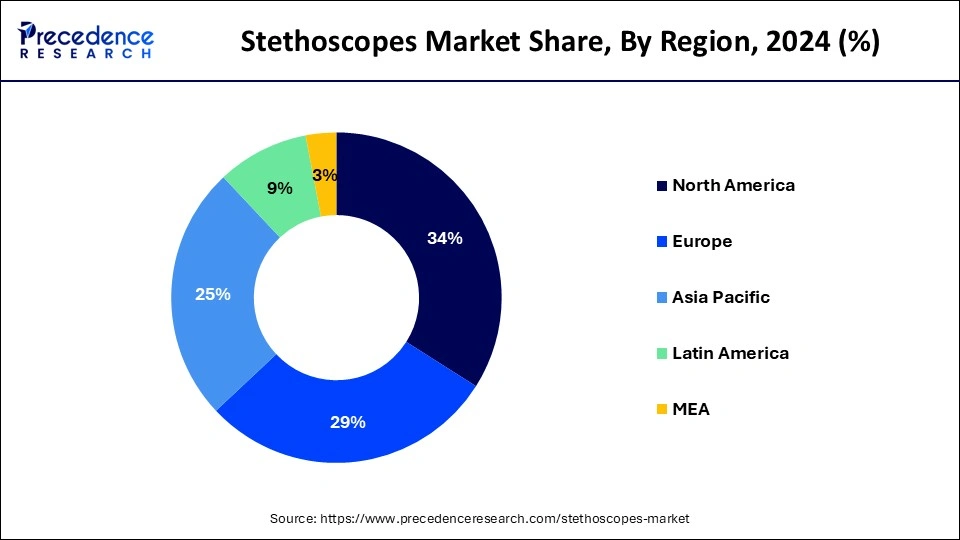

- North America has held the largest share of 34% in 2025.

- Asia Pacific is the fastest-growing region in the market.

- By technology type, the traditional acoustic stethoscope segment has generated more than 75% of the market share in 2025.

- By technology type, the smart stethoscope segment is expected to expand at the fastest CAGR of 7.10% between 2026 and 2035.

- Based on sales channels, the distributors segment has captured the largest market share of 55% in 2025.

- Based on sales channels, the e-commerce segment is projected to grow at a CAGR of 7.05% between 2026 and 2035.

- By end use, the hospital segment dominated the market with the largest market share of 42% in 2025.

Market Overview

The stethoscopes market has witnessed significant growth and innovation in recent years, driven by advancements in healthcare technology, increasing demand for diagnostic tools, and a growing emphasis on preventive medicine. Stethoscopes remain essential for healthcare professionals across various specialties, including primary care, cardiology, and emergency medicine.

One of the key drivers of growth in the stethoscopes market is the continuous development of advanced features and functionalities. Manufacturers constantly introduce stethoscopes with improved acoustics, innovative designs, and enhanced connectivity options. Digital stethoscopes equipped with Bluetooth capabilities and mobile data management and analysis apps have gained popularity among healthcare professionals seeking more efficient and accurate diagnostic tools.

Moreover, the COVID-19 pandemic has highlighted the importance of telemedicine and remote patient monitoring, further fueling the demand for stethoscopes with tele-auscultation capabilities. These devices allow healthcare providers to conduct remote consultations and monitor patients' heart and lung sounds in real time, facilitating timely interventions and reducing the need for in-person visits.

The stethoscopes market is poised for continued growth in the coming years, driven by technological advancements, increasing healthcare expenditure, and the growing adoption of telemedicine and remote patient monitoring solutions. Manufacturers will continue to develop innovative products that meet the evolving needs of healthcare professionals and patients, further propelling market expansion and diversification.

Stethoscopes Market Growth Factors

- Continuous innovation leads to the development of stethoscopes with advanced features such as digital connectivity, enhanced acoustics, and telecommunication capabilities, driving the market growth.

- Collaborations and partnerships between healthcare organizations, medical device manufacturers, and academic institutions foster innovation and drive product development in the stethoscopes market. These collaborations often lead to the introduction of stethoscopes with specialized features tailored to specific medical specialties or patient populations, further expanding the market's scope and reach.

- The rising incidence of chronic conditions such as cardiovascular diseases, respiratory disorders, and hypertension increases the need for regular monitoring and diagnosis, boosting the demand for stethoscopes.

- In addition to technological advancements, increasing healthcare expenditure and investments in infrastructure development in emerging economies are driving the expansion of the stethoscopes market.

- Rising awareness about the importance of regular health check-ups and preventive care among the general population also contributes to market growth as individuals seek to monitor their health more proactively.

- A growing understanding of preventive medicine encourages individuals to monitor their health more proactively, leading to increased adoption of stethoscopes for regular health check-ups and screenings.

- Adopting telemedicine and remote patient monitoring solutions creates opportunities for stethoscope manufacturers to develop products with telecommunication capabilities.

- Efforts to improve healthcare infrastructure and expand access to medical services, especially in underserved regions, drive the demand for medical devices like stethoscopes to support market growth.

- Strategic collaborations between healthcare organizations and medical device manufacturers.

- Innovations drive product development in the stethoscopes market, leading to the introduction of specialized products tailored to specific medical specialties or patient populations.

- Untapped markets in emerging economies present lucrative opportunities for market expansion, especially with the growing focus on improving healthcare infrastructure and increasing access to medical devices in these regions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.87% |

| Market Size in 2025 | USD 739.47 Million |

| Market Size in 2026 | USD 783.84 Million |

| Market Size by 2035 | USD 1,308.68 Million |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, Sales Channel, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing healthcare expenditure

Continuous innovation leads to the development of stethoscopes with enhanced features like digital connectivity, improved acoustics, and tele-auscultation capabilities, driving market growth. Rising healthcare spending globally, especially in emerging economies, fuels the demand for diagnostic tools like stethoscopes. Increasing awareness about preventive healthcare measures encourages individuals to monitor their health regularly, boosting the demand for stethoscopes.

Restraint

High cost of advanced stethoscopes

The price of stethoscopes with advanced features may hinder adoption, especially in resource-constrained settings. In regions with inadequate healthcare infrastructure, the adoption of stethoscopes may be limited due to factors like affordability and availability. Advancements in imaging technologies and point-of-care devices pose a challenge to the traditional use of stethoscopes for diagnosis.

Opportunity

Integration of artificial intelligence (AI) technologies

One significant opportunity for the stethoscopes market lies in integrating artificial intelligence (AI) technology. AI-powered stethoscopes can analyze auscultatory sounds more accurately and efficiently. This is helpful to healthcare professionals in diagnosis and decision-making. By leveraging machine learning algorithms, these smart stethoscopes can detect subtle abnormalities and patterns in heart and lung sounds, providing valuable insights about patients' health status more precisely.

AI-enhanced stethoscopes can streamline workflow by automating routine tasks such as documentation and data analysis, saving time and improving overall efficiency in healthcare settings. This integration of AI technology presents a promising avenue for advancing diagnostic capabilities and enhancing patient care with stethoscopes.

Segment Insights

Technology Insights

The traditional acoustic stethoscope segment held the largest market share in 2025. A traditional acoustic stethoscope is relatively economical, simple, and widely available for use by professionals in healthcare and nurses in hospitals. A stethoscope plays an essential role in diagnosing cardiac and pulmonary disorders. In emerging countries, medical imaging penetration in rural areas is limited. Hence, stethoscopes play a crucial role here. Moreover, smart or digital stethoscopes are not more accessible to the African region due to their high cost. All these factors are responsible for the growth of the traditional stethoscope segment in the market, and it is expected to boost the market further in the foreseen period.

The smart stethoscope segment is the fastest-growing segment in the stethoscopes market. The incorporation of AI technologies into stethoscopes will surge the use of smart stethoscopes over the forecast period. The rapid increase in the number of patients suffering from cardiac diseases and lung disorders is responsible for the higher demand for smart stethoscopes by medical professionals. Also, marketers are more interested in developing a smart stethoscope with various monitoring features. Hence, they invested in research and development of stethoscopes to strengthen their portfolio in the market. For instance, John Hopkins University researchers have established a lab known as Sonavi Labs, which has created an AI-powered stethoscope with clever, cutting-edge technological features like noise filtering. This technology is helpful for hearing the heartbeats clearly without interference from outside noises. Hence, such initiatives are boosting the growth of the stethoscopes market globally.

Sales Channel Insights

The distributor's segment dominated the market in 2025. Hospitals and clinics have tie-ups with manufacturers and distributors. Major players in the market are adopting partnerships to expand their reach to consumers and strengthen their portfolios in the market. This is expected to boost market growth over the forecast period. Authorized dealers have local warranties for defective stethoscopes. Warranties include repairing and replacement of defective pieces. The collaboration of distributors provides easy delivery in less time and is also helpful for minimum-quantity orders. This is anticipated to boost the market growth owing to the rising demand of this segment.

The e-commerce segment is expected to show the fastest growth over the foreseen period. Increasing online accessibility of stethoscopes is likely to foster this segment's growth. E-health is the fastest-growing part of online sales. These online stores offer customer support and access to exclusive deals, and in case of any defective product, a return policy is also applicable. They also provide solutions if the product fails to meet the consumer's expectations, which builds trust between consumers and online dealers and, in turn, increases the consumer's inclination toward online purchasing. Hence, the availability of several stethoscopes on online platforms is projected to drive the stethoscopes market growth on a larger scale.

End-use Insights

The hospital segment dominated the market in 2025 and is expected to grow further at a significant rate. Regarding the volume of stethoscopes purchased, the hospital segment is observed to be the largest consumer of products and services. The rising prevalence of chronic illness and its diagnosis takes place at a very young age for most populations is a key factor that driving the market growth owing to the increasing rate of hospitalization of patients. Also, stethoscopes have a longer life than any other medical device, which is a fundamental requirement for physicians in clinics and hospitals.

It is used to detect a patient's heart rate or cardiac activity in real-time with respiratory changes in the patient. It is useful even in the intestinal examination, which aids in further procedures on the basis of better, faster, and more accurate details. Hence, these are the primary factors driving the stethoscopes market's growth. The higher demand for stethoscopes in hospitals will lead to the further development of this segment based on end-use.

Regional Insights

What is the U.S. Stethoscopes Market Size?

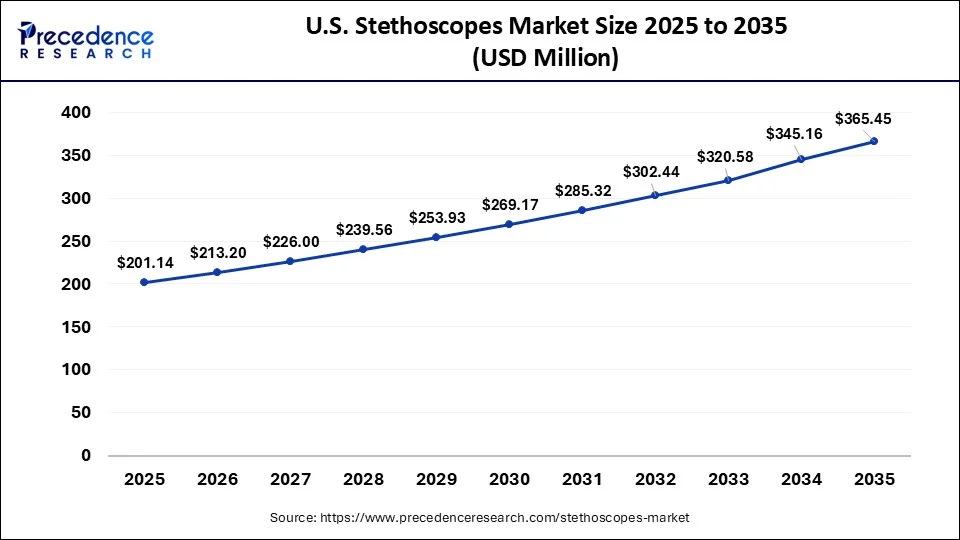

The U.S. stethoscopes market size was exhibited at USD 201.14 million in 2025 and is projected to be worth around USD 345.65 million by 2035, growing at a CAGR of 6.15%.

North America led the market with the biggest market share of 34% in 2025, driven by the presence of advanced healthcare infrastructure and high healthcare expenditure. Healthcare facilities in the region are quick to adopt advanced stethoscope technologies, such as digital stethoscopes with tele-auscultation capabilities. For instance, In the United States, the demand for digital stethoscopes has surged, with market leaders like 3M Littmann and Welch Allyn introducing innovative products tailored to healthcare professionals' needs. Unhealthy eating habits and undisciplined lifestyles lead to illness, which is irreversible and needs to be treated in the long run and is increasing in the U.S. population.

- According to the data published by the Canadian Institute for Health Information, Canada has overall healthcare spending of 11.6% of the country's total GDP. Such massive expenditures on the healthcare system are propelling market growth globally.

Asia Pacific is the fastest-growing region in the stethoscopes market. The rising culture of preventive care in the Asian Pacific is fueling the market growth. Key players ' high investment in research and development is leading the market further. Emerging companies in developing nations like India and China are trying to establish themselves in the market by launching innovative and cost-effective medical products.

Asia Pacific is expected to gain a promising portion of the stethoscopes market, driven by rapid urbanization, improving healthcare infrastructure, and rising healthcare spending. Efforts to expand access to healthcare services in countries like China and India contribute to the growing demand for medical devices, including stethoscopes. For instance, In India, the government's initiatives to strengthen primary healthcare facilities and increase healthcare access in rural areas boost the adoption of stethoscopes among healthcare providers.

What are the Advancements in the Stethoscopes Market in Europe?

Europe is expected to witness significant growth throughout the forecast years. This growth is fueled by factors like increasing healthcare expenditures and a rising geriatric population, which increases the demand for more advanced diagnostic tools. The region's strong regulatory frameworks also help to ensure that products meet high safety and efficacy standards, thus boosting consumer confidence and market demand. Germany, France, and the UK are leading players in this market.

Germany Stethoscopes Market Trends: The country's market landscape is expected to grow rapidly, driven by an increasing demand for high-quality and precise stethoscopes, with healthcare professionals increasingly emphasizing diagnostic accuracy. Hospitals and clinics are upgrading to advanced devices for improved diagnostic accuracy, while key players like 3M (Littmann), Heine, Riester, and Welch Allyn compete in both conventional and electronic categories.

What are the Key Trends in the Stethoscopes Market in Latin America?

Latin America is set to experience substantial growth in the upcoming years. Factors such as increasing healthcare expenditure and the steady adoption of technologically advanced tools help to promote market growth in this region. In addition to that, the increasing incidence of heart diseases in countries such as Brazil and Mexico pushes demand even more. The region's government efforts, coupled with a rapidly developing healthcare infrastructure, are also fueling growth.

Brazil Stethoscopes Market Trends: The region's market landscape is characterized by a high focus on affordability and accessibility of medical devices. There is also a high focus on improving healthcare delivery, thus driving growth and development in this region.

How is the Middle East and Africa Region Growing in the Stethoscopes Market?

The Middle East and Africa are witnessing steady growth in the market, driven by increasing healthcare investments and a rising number of healthcare facilities. Governments in the region are increasingly focusing on improving healthcare access and quality, which helps to drive up the demand for advanced stethoscopes. The growing prevalence of chronic diseases is also a significant factor that contributes to market growth. Countries like South Africa and the UAE are leading players in this region.

Saudi Arabia Stethoscopes Market Trends: The country's growth and development are driven by high investments in modernizing healthcare infrastructure, which thus leads to increased adoption of advanced medical devices. Traditional acoustic stethoscopes dominate in revenue, while smart and electronic models show the fastest growth.

Value Chain Analysis of the Stethoscopes Market

- Raw Material Selection: This stage deals with the sourcing of raw materials that are required to manufacture a stethoscope, such as aluminum, zinc alloys, stainless steel, PVC, etc., that are able to provide ease of use as well as enhance functionality.

Key Players: DuPont, Saint Gobain, Dow - Manufacturing Process: This stage deals with the design and assembly of the stethoscope. Components like the chest piece, diaphragm, and tubing are manufactured with a high focus on durability and sound conductivity.

Key Players: Littman, Eko Health, MDF Instruments - Quality Checks: In this stage, each component undergoes rigorous testing to ensure functionality and durability. This step is critical for analyzing the stethoscope's effectiveness in diagnosing various conditions.

Key Players: Thinklabs, McKesson, Welch Allyn

Stethoscopes Market Companies

- 3M

- Medline Industries Inc

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Eko Devices Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (Halma Plc)

- American Diagnostics Corporation

- Cardionics

- PAUL HARTMANN AG

- Heine Optotechnik GmbH & Co. KG.

- STETHOME SP. Z O.O.

Recent Developments

- In August 2022, Caregility, a telehealth platform company, partnered with Eko, a developer of stethoscopes. Their integration will provide a cloud platform from Caregility to Eko's smart stethoscopes and software. This will give high-quality auscultation for patients while doing the examination, that is, listening for heart rate and other body sounds with lungs.

- In April 2022, Sanolla Ltd, an Israeli startup, launched an AI-based stethoscope with a smart infrasound feature, which is audible too while doing a patient's check-up. This is the first smart stethoscope that is approved by the United States Food and Drug Administration for use in the market by medical professionals.

Segments Covered in the Report

By Technology Type

- Electronic/Digital Stethoscope

- Smart Stethoscope

- Traditional Acoustic Stethoscope

By Sales Channel

- Distributors

- E-Commerce

- Direct Purchase

By End-use

- Home Healthcare

- Hospitals

- Clinics

- Nurse Practitioners

- EMT/ First Responders

- Veterinary

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting