Television Services Market Size and Forecast 2025 to 2034

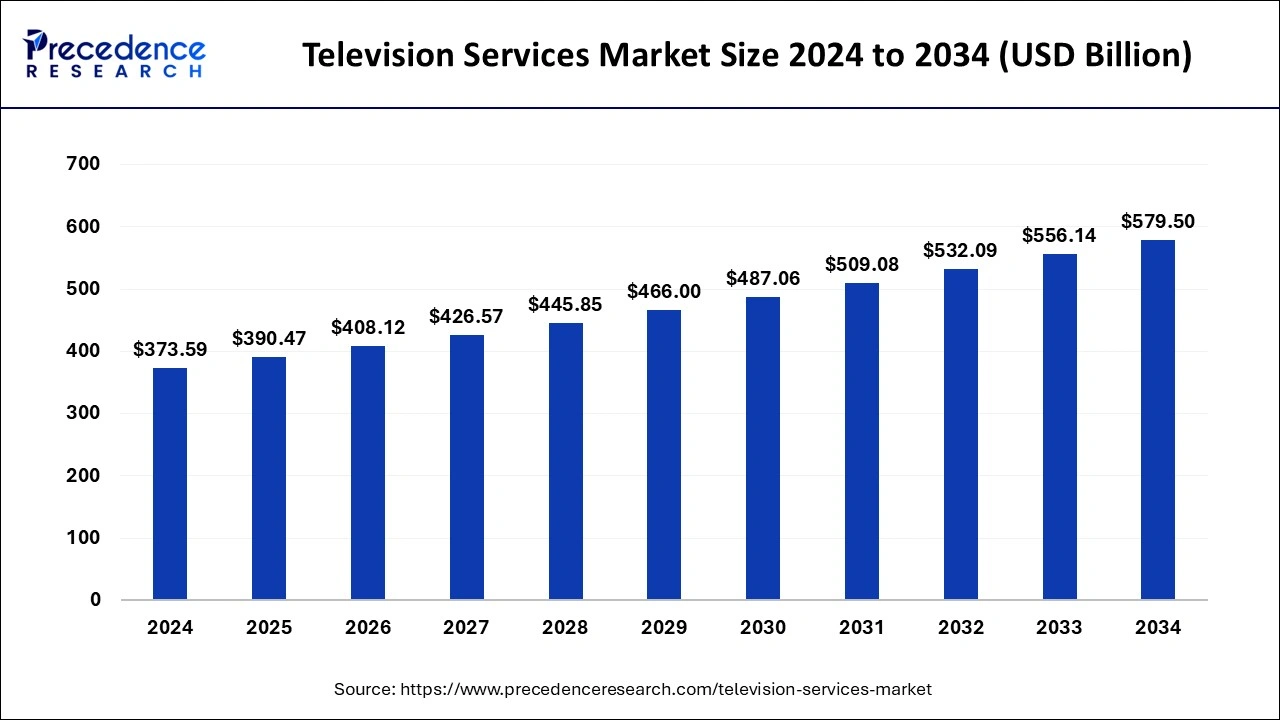

The global television services market size accounted for USD 373.59 billion in 2024 and is predicted to increase from USD 390.47 billion in 2025 to approximately USD 579.50 billion by 2034, expanding at a CAGR of 4.49% from 2025 to 2034. The television services market is driven by the technological developments in the television industry and the growing demand for smart televisions.

Television Services Market Key Takeaways

- The global television services market was valued at USD 373.59 billion in 2024.

- It is projected to reach USD 579.50 billion by 2034.

- The market is expected to grow at a CAGR of 4.49% from 2025 to 2034.

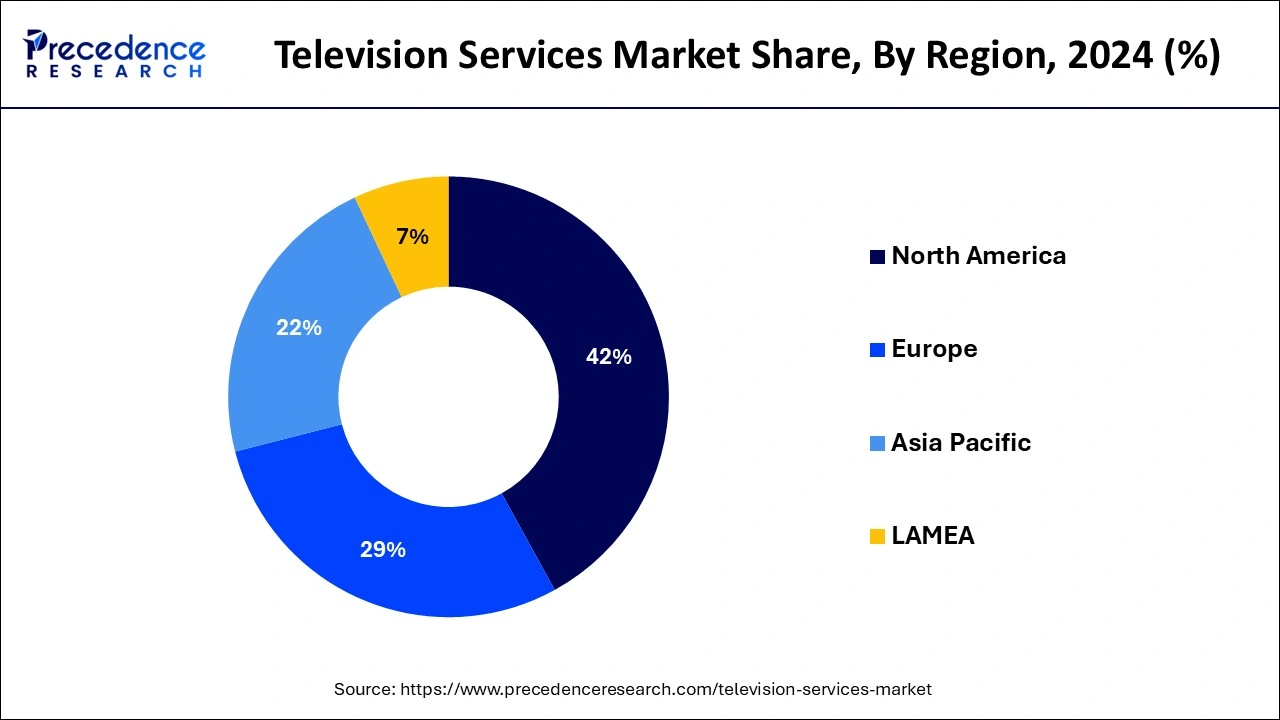

- The North America television services market size accounted for USD 156.91 billion in 2024 and is expected to attain around USD 243.39 billion by 2034.

- North America dominated the market with the largest revenue share of 42% in 2024.

- Asia- Pacific is observed to be the fastest growing market during the forecast period.

- By delivery platform, the cable television broadcasting segment has contributed the major revenue share of 37% in 2024.

- By delivery platform, the satellite broadcast segment is observed to be the fastest-growing market during the forecast period.

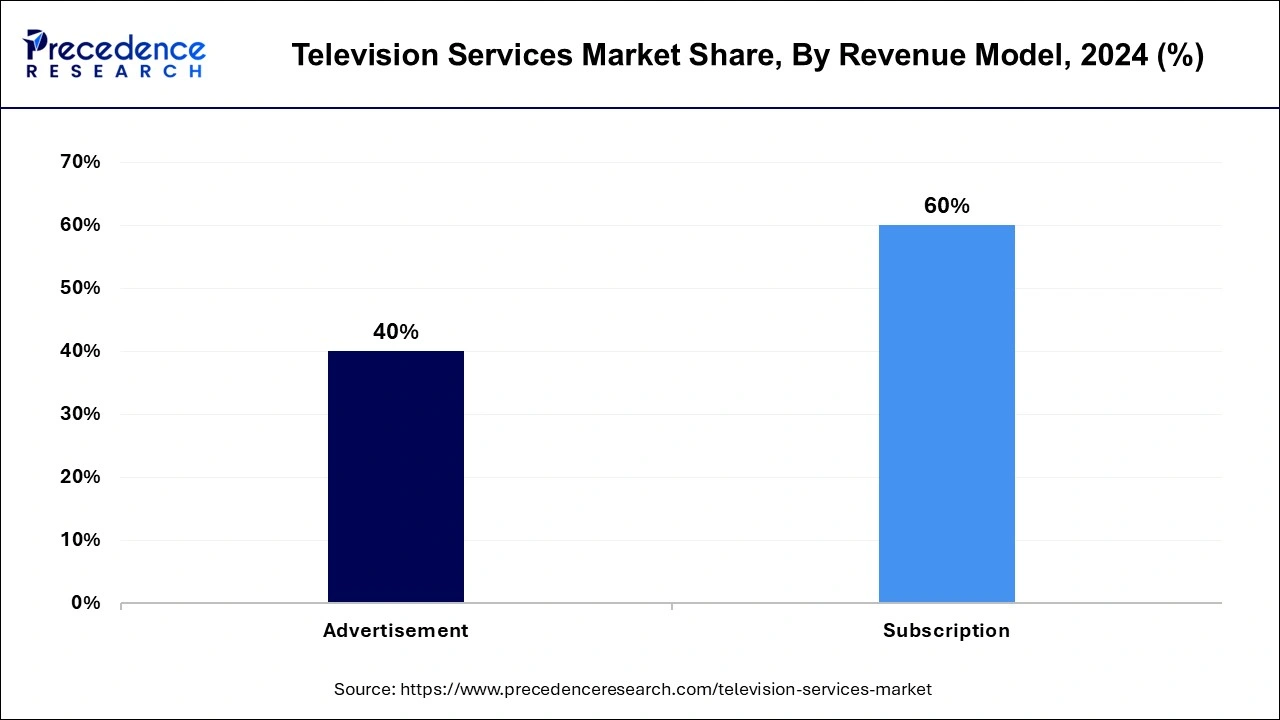

- By revenue model, the subscription segment has held the largest revenue share of 60% in 2024.

- By revenue model, the advertisement segment shows significant growth in the market during the forecast period.

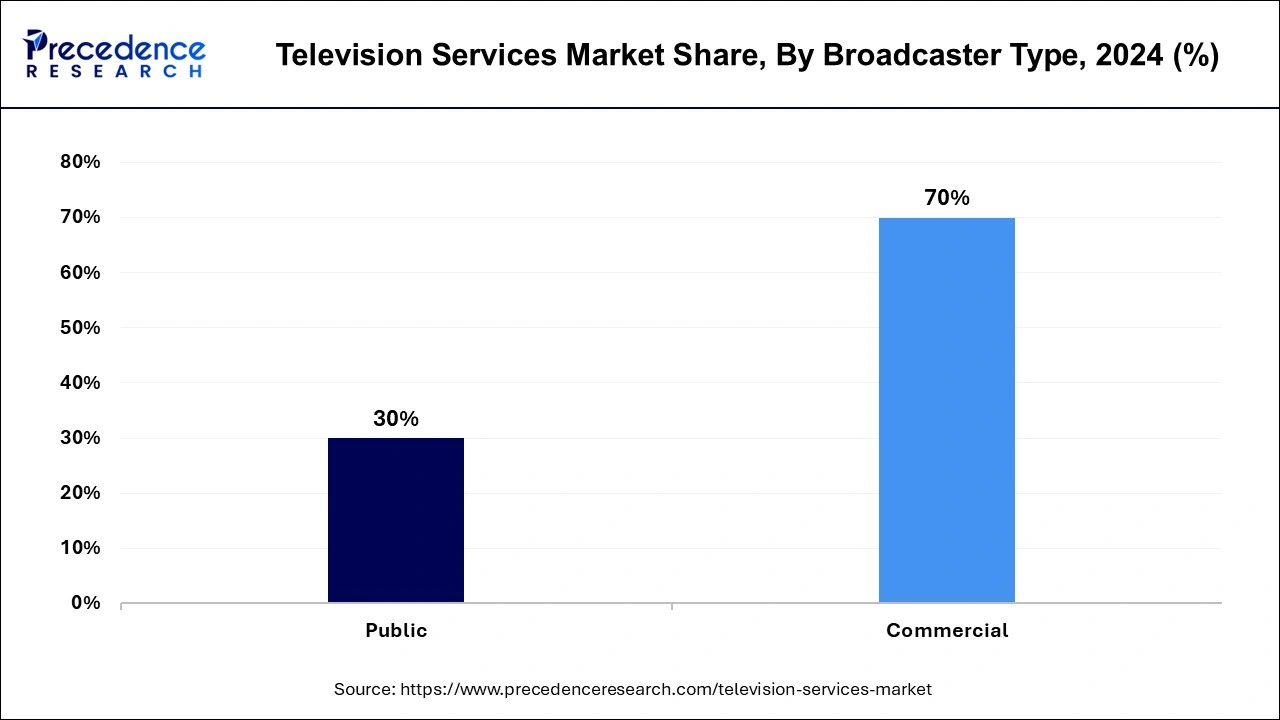

- By broadcaster type, the commercial segment has generated more than 70% of revenue share in 2024.

- By broadcaster type, the public segment shows significant growth in the market during the forecast period

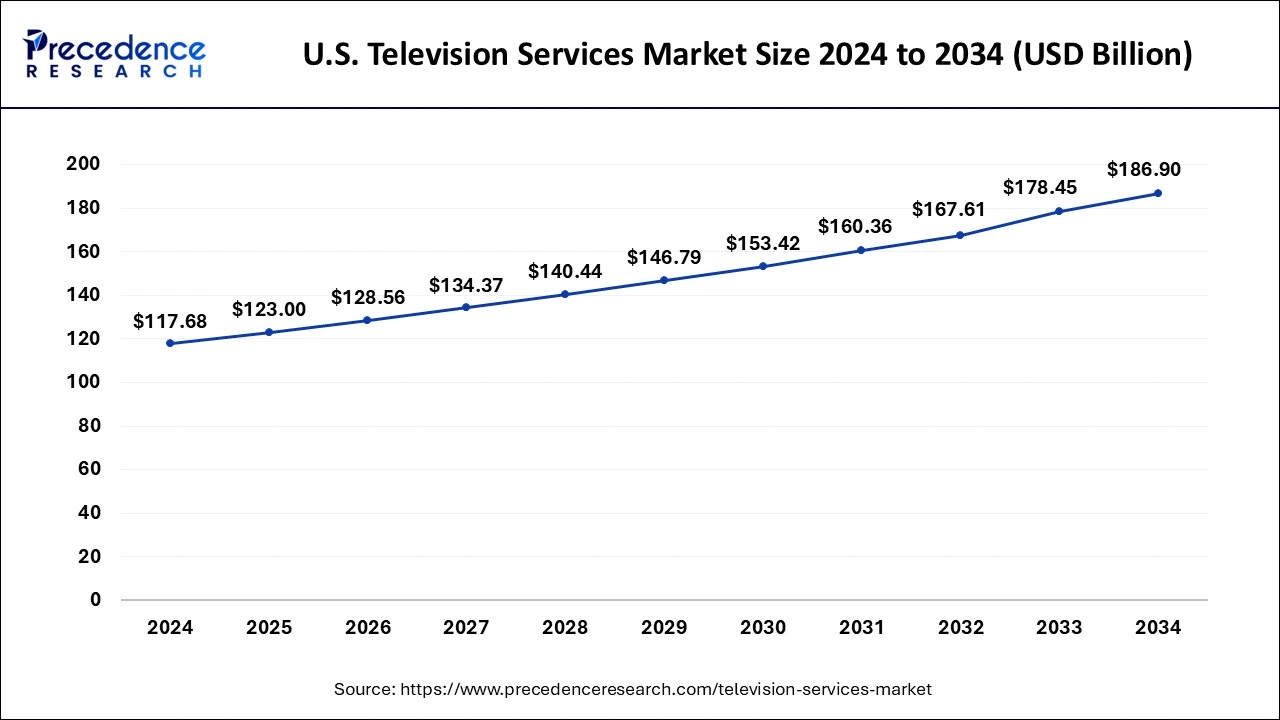

U.S.Television Services Market Size and Growth 2025 to 2034

The U.S. Television Services market size was exhibited at USD 117.68 billion in 2024 and is projected to be worth around USD 186.90 billion by 2034, growing at a CAGR of 4.73% from 2025 to 2034.

North America had largest market share in 2024 in the television services market. Many competitors fight for market share in North America's fiercely competitive television services industry. This rivalry compels providers to constantly enhance their offerings, offer attractive prices, and grow their content libraries to draw and keep clients. This intense rivalry further cements North America's dominance as the largest market for television services, which offers consumers many options.

This area has a well-developed infrastructure for providing television services, with extensive access to cutting-edge telecommunications networks and high-speed internet. This infrastructure makes the smooth distribution of streaming services, video-on-demand platforms, and other digital television options possible, which improves customer viewing experiences overall and increases demand for these services.

- In June 2023, Bell Media applied with the Canadian Radio-television and Telecommunications Commission (CRTC) to do away with the need for its stations across Canada to carry local news. Concerns are raised over the future of regional coverage by this decision. In the application submitted on June 14, the CRTC is asked to eliminate the requirements for local news expenditures and the weekly hours that stations must air locally relevant news. On the same day, Bell declared that, due to financial strain, it was eliminating 1,300 positions, closing nine radio stations, and closing two overseas bureaus.

Asia-Pacific is observed to be the fastest growing television services market during the forecast period. Asia-Pacific television networks and streaming services provide a large selection of programming to suit a variety of viewership. This comprises worldwide content that has been locally tailored, as well as regional and local programs. A wide range of viewers are drawn in by the availability of content in various languages and genres, which increases subscription and viewership rates.

The popularity of sports and live events is a significant factor in expanding television services in the area. Large crowds attend major athletic events like the Olympics, FIFA World Cup, and regional competitions, which boosts viewership and advertising revenue for streaming services and broadcasters.

- In November 2023, According to reports, the financial services company Khandwala Finstock and bag manufacturer Goblin India jointly submitted a proposal to purchase the bankrupt Television Home Shopping Network, which the National Company Law Tribunal (NCLT) approved.

Market Overview

The television services market is the industry that deals with creating, distributing, and watching television. It includes broadcasters, cable and satellite companies, streaming services, content producers, marketers, and device makers. Television is a potent tool for forming identities, attitudes, and cultural norms. It dramatically impacts how society is reflected, how public opinion is shaped, and how cultural content is shared globally. Television is a global medium that reaches many viewers regardless of location. It provides a forum for cross-cultural sharing of viewpoints, experiences, and stories between individuals from various geographical areas.

Television Services Market Growth Factors

- Traditional cable and satellite broadcasts give way to internet-based delivery technologies like OTT (Over-the-Top) services and IPTV.

- The market is expanding thanks to the rise of on-demand media and subscription services like Netflix, Amazon Prime, and Disney.

- The growing popularity of smart TVs and TV-connected devices (such as streaming sticks) fueled the need for more television services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 390.47 Billion |

| Market Size in 2024 | USD 373.59 Billion |

| Market Size by 2034 | USD 579.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Delivery Platform, Revenue Model, and Broadcaster Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Availability of diverse and high-quality content

Revenue is generated by diverse and excellent content via several channels, including advertising, content licensing, and subscriptions. While premium content frequently fetches higher subscription costs, advertisers are prepared to shell out more money to reach viewers of hit television programs. Successful programming can also be licensed to other networks or platforms, generating additional income for distributors and artists. With so much content available, viewers need excellent curation and personalization to find relevant content. To improve the viewing experience and increase engagement, television service providers use data analytics and recommendation algorithms to customize content recommendations based on viewer preferences, viewing history, and demographic data.

Restraint

Rapid advancements in technology can create barriers for traditional television service providers

The swift progress of technology has enabled the smooth amalgamation of streaming services, mobile applications, smart TVs, and streaming gadgets. Customers find streaming more appealing when features like voice-controlled search, tailored suggestions, and cross-device synchronization improve the user experience. On the other hand, conventional TV providers might find it difficult to update their antiquated infrastructure to give similar degrees of innovation and convenience. In addition to providing a vast selection of TV series and films, streaming services also create unique material that is well-received by critics and draws in new customers.

These platforms significantly invest in producing original television shows, movies, documentaries, and live events. Because of this, there is more competition for viewership and advertising dollars among traditional TV providers, especially as more people choose these premium programs.

Opportunities

Potential to reach a global audience

Geographical limitations have disappeared with the spread of high-speed internet and the development of streaming services. Viewers worldwide can now instantly receive television content. By avoiding traditional broadcast infrastructures, content providers may now more easily distribute their shows worldwide thanks to advancements in streaming technologies. Television can foster diversity and act as a medium for cross-cultural communication. Television services can promote respect and understanding of diverse cultures by presenting information from across the globe. This enhances the watching experience and fosters unity among people everywhere.

Advanced advertising technologies

Advertisers can use dynamic ad insertion technology to offer customized advertising in real-time, depending on context and viewer attributes. With this feature, adverts may be seamlessly integrated into on-demand or live content, guaranteeing their relevance and timing. By presenting advertising dynamically, advertisers can take advantage of popular themes, adjust to shifting market conditions, and provide viewers with more engaging experiences. Viewers can interact with immersive and engaging content through interactive ads made possible by advanced advertising technologies.

Interactive advertising achieves higher engagement and conversion rates. It enables viewers to interact with the content, investigate products, and make purchases straight from the ad unit. By including interaction in their ad experiences, advertisers may develop more memorable and effective campaigns that resonate with viewers.

Delivery Platform Insights

The cable television broadcasting segment dominated in the television services market in 2024. In the middle of the 20th century, cable television broadcasting first appeared to enhance television reception in places with weak broadcast signals. Its early edge set the stage for its future hegemony. Compared to traditional over-the-air broadcasting, access to a broader range of channels and content was made possible by expanding cable infrastructure throughout various regions. Coaxial cables, which are less prone to interference and signal deterioration than the traditional antennas used in broadcast television, are utilized by cable television to convey signals.

The satellite broadcast segment is observed to be the fastest growing in the television services market during the forecast period. Satellite broadcasters are collaborating and forming strategic alliances to increase their market share. Through joint ventures with content creators, distribution networks, and technological companies, broadcasters can expand into new areas, grow their subscriber base, and diversify their services. Furthermore, partnerships with telecom providers enable bundled service packages, which combine internet, phone, and television services to improve value proposition and retain customers.

The over the top television (OTT) segment shows a significant growth in the television services market during the forecast period. On-demand video viewing is becoming increasingly popular among consumers compared to traditional linear television. By removing the restrictions of scheduled content, over-the-top (OTT) services allow customers to view their favorite movies and television series whenever it suits them. One of the main factors propelling the expansion of over-the-top (OTT) services is the shift in consumer behavior toward convenience and flexibility. Unlike traditional television, which is frequently restricted by regional boundaries, OTT services are available anywhere. Content producers and distributors can reach consumers anywhere without substantial infrastructure or distribution networks.

For established businesses and newcomers to growing markets, this accessibility on a global scale creates new revenue streams and growth potential. OTT services provide three ways to monetize their content: transactional, advertising-supported, and subscription-based. Because of this adaptability, suppliers can customize their monetization tactics to specific market niches and customer preferences, driving market growth.

Revenue Model Insights

The subscription segment dominated the television services market in 2024. Subscription services can be accessed by a wide range of devices, such as game consoles, smart TVs, tablets, and smartphones. Thanks to this flexibility, customers may watch their favorite episodes whenever they want, which further contributes to the market's supremacy. Furthermore, many subscription services provide several membership tiers, so users may select the one that best suits their requirements and price range.

The advertisement segment shows a significant growth in the television services market during the forecast period. There is still a strong demand for television advertising slots since television is still one of the primary sources of information and entertainment for a large portion of the global population. Marketers understand that television can reach a wide range of viewers, including those from demographics that may be difficult to achieve with other media.

Television advertising still commands a sizable portion of advertising spending worldwide despite the rise of digital ad platforms. Marketers know television's distinct benefits, including its ability to use sight, sound, and motion to influence brand messaging emotionally. Consequently, many advertisers devote a sizeable percentage of their expenditures to television advertising, fueling the expansion of this market.

Broadcaster Type Insights

The commercial segment dominated the television services market in 2024. Ad income is a significant source of funding for commercial television services. Television appeals to advertisers because of its broad audience and capacity to hold viewers' attention with audio-visual programming. Because of this, commercial networks make significant investments in producing top-notch content that draws viewers and, consequently, more substantial advertising revenues. In addition to advertising, commercial networks use partnerships, syndication agreements, license agreements, and item sales as monetization techniques. Their financial stability is enhanced by these extra revenue streams, which also allow them to increase their investments in content production and delivery.

The public segment shows a significant growth in the television services market during the forecast period. Demand for public broadcasting services, comprising corporate and governmental-funded channels, has increased due to their dedication to public interest programming and wide range of content offerings. These channels frequently serve a broad spectrum of viewers, including specialized groups that may go unnoticed by commercial broadcasters. Particularly in this day of false information and fake news, public broadcasters are typically seen as reliable sources of information. Public service broadcasting's trustworthiness, objectivity, and accuracy are valued by viewers, who support it with continued support and attendance. Because of this, advertisers can also lean toward public channels to link their brands to audiences and material they can trust.

Public broadcasters have adopted digitalization and multiplatform distribution techniques to reach viewers on several platforms and devices. Owing to on-demand platforms, smartphone apps, and streaming services, viewers may access the material anytime, anywhere. Content availability across several platforms improves public service broadcasting's reach and visibility.

Recent Developments

- In April 2024, A new Managed Channel Services (MCS) business unit has been introduced by Frequency, the company that powers many of the world's most well-known streaming television channels. This unit enables brands, talent, rights holders, and Free Ad-Supported Television (FAST) platforms to launch premium streaming TV channels quickly. The industry's most robust and open cloud-native Software-as-a-Service (SaaS) platform is combined with decades of TV experience in the new business unit.

- In March 2024, Comcast Advertising, the advertising branch of Comcast Cable, introduced the new Signal Authentication Service. This service intends to give measurement businesses and platforms a dependable identity signal to support various privacy-forward use cases, such as impression householding for precise reach and frequency measurement, cross-device frequency optimization, and attribution measurement.

- In February 2024, funded by Sony Pictures Entertainment, Sony Pictures Television launched a specialized over-the-top (OTT) service in collaboration with Amazon Prime Video India. Sony Pictures—Stream, a new service, will be available on Prime Video Channels for an initial yearly subscription fee of Rs 399.

Television Services Market Companies

- A&E Television Networks LLC

- British Broadcasting Corporation

- Vivendi

- CenturyLink Inc.

- Channel Four Television Corporation

- Comcast Corporation (NBCUniversal Media LLC)

- Heartland Media LLC

- Warner bros. Entertainment

- Viacom CBS Inc.

- Walt Disney Studio

Segments Covered in the Report

By Delivery Platform

- Digital Terrestrial Broadcast

- Satellite Broadcast

- Cable Television Broadcasting

- Internet Protocol Television (IPTV)

- Over-The-Top Television (OTT)

By Revenue Model

- Subscription

- Advertisement

By Broadcaster Type

- Public

- Commercial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting