What is the Textile Winding Machine Market Size in 2026?

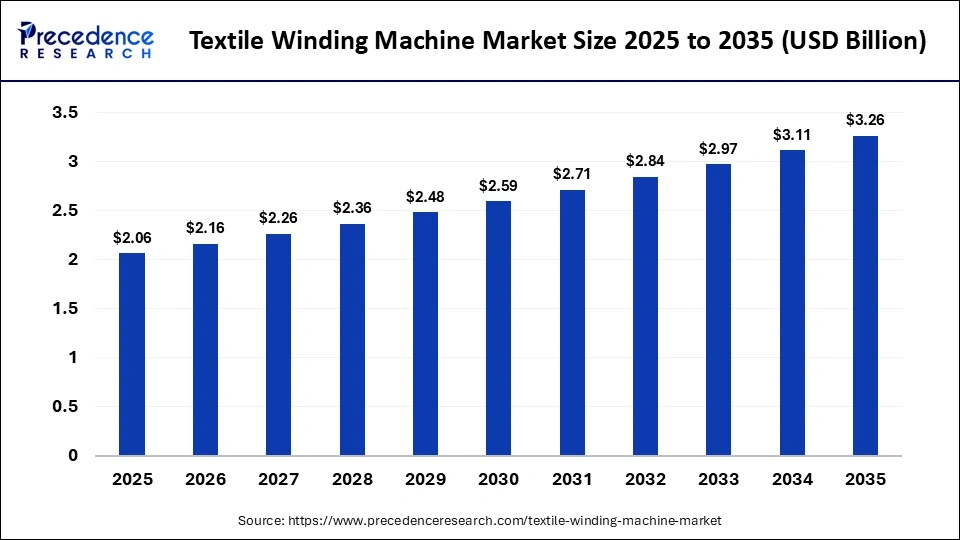

The global textile winding machine market size accounted for USD 2.06 billion in 2025 and is predicted to increase from USD 2.16 billion in 2026 to approximately USD 3.26 billion by 2035, expanding at a CAGR of 4.70% from 2026 to 2035. The growth of the market is driven by the need for automation, energy efficiency, and modernization in the textile industry.

Key Highlights

- Asia Pacific led the textile winding machine market with the largest share in 2025.

- North America is expected to grow at the fastest rate in the forecasted period.

- By winder type, the precision winder segment led the market with a major share in 2025.

- By winder type, the non-precision / drum winder segment is observed to grow at the fastest CAGR in the upcoming period.

- By yarn type, the cotton/cellulosic segment led the global market with the largest share in 2025.

- By yarn type, the polyester/nylon segment is observed to be the fastest-growing segment in the foreseen period.

- By automation & speed, the high-speed automation segment held the largest market share in 2025.

- By automation & speed, the semi-automation segment is observed to be the fastest growing in the foreseeable period.

- By end use, the spinning mills segment led the market in 2025.

- By end use, the technical textiles segment is observed to be the fastest growing in the foreseen period.

Market Overview

As the textile industry grows, textile winding machines have become essential for ensuring quality, efficiency, and reliable production, directly impacting business reputation and output. The textile winding machine market is undergoing a transformative phase, driven by advancements in automation. The increasing demand for superior yarn quality is driving the market. Modern winding systems in staple spinning now integrate enhanced fault detection, while the increasing trend toward customized textile manufacturing is boosting demand for technically diverse, yarn-specific solutions, further strengthening the market.

Impact of Advanced Technologies on the Textile Winding Machine Market

The integration of artificial intelligence into textile winding machines is enhancing quality assurance, supporting cost management, and promoting sustainability. AI-driven control systems optimize winding parameters, enhancing yarn quality and process stability. By analyzing sensor data in real time, AI identifies patterns and executes corrective actions instantly. It monitors yarn tension, speed, temperature, and layer formation, comparing live data with quality benchmarks to ensure consistent performance and reduced defects.

IoT integration enables predictive maintenance, reducing downtime, while reducing waste and improving energy efficiency. AI and machine learning allow winding machines to improve autonomously by analyzing historical production data and identifying hidden patterns. These systems automatically adjust tension for wire diameter variations and modify layering strategies to adapt to changes in ambient temperature. Global OEMs, such as Rieter, Trützschler, Uster, and Saurer, are commercializing integrated machine-and-software stacks that enable mills to shift from reactive maintenance and manual quality checks to predictive operations.

Key Market Trends

- There is a rising demand for wearable sensor fabrics, medical and healthcare textiles, and antibacterial protective fabrics, which increases the need for precision in production.

- The adoption of automation, IoT, and AI is rising, enhancing operational efficiency by improving product quality, reducing production time, and lowering costs.

- The rising development of energy-efficient winding systems is driving the market by cutting power consumption, reducing expenses, and promoting greater sustainability within the textile industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.06 Billion |

| Market Size in 2026 | USD 2.16 Billion |

| Market Size by 2035 | USD 3.26 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.70% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Winder Type, Yarn Type, Automation and Speed, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Winder Type Insights

What Made Precision Winder the Dominant Segment in the Market?

The precision winder segment dominated the textile winding machine market with the largest share in 2025. This is mainly due to its ability to deliver uniform yarn tension, consistent package density, and controlled winding geometry. Its extensive adoption across export-oriented textile mills, technical textile production facilities, and highly automated manufacturing lines further strengthens its market dominance. This leadership is also reinforced by advanced control technologies that enable precise tension regulation, programmable winding patterns, improved fault detection, and enhanced operational efficiency.

The non-precision/drum winder segment is expected to grow at the fastest rate during the forecast period, driven by its cost-effectiveness, operational simplicity, and suitability for application-specific requirements. In this process, a single yarn is wound onto the package in a helical pattern, allowing yarn layers to cross and provide structural stability. This cross-laying structure ensures adequate firmness without requiring advanced control mechanisms. Key advantages of this winder include lower capital investment, relatively faster processing for standard yarn types, and ease of maintenance. These winders are primarily preferred by startups, entry-level manufacturers, and small-scale textile units, especially those using conventional drum winding systems.

Yarn Type Insights

Why Did the Cotton/Cellulosic Segment Lead the Market in 2025?

The cotton/cellulosic segment led the textile winding machine market with a major share in 2025, driven by its extensive use in apparel, home textiles, and blended fabric production. Cotton remains the most widely used yarn, accounting for a significant portion of global textile production. Its soft texture, breathability, and moisture absorption properties make it highly suitable for apparel, home textiles, and industrial applications. Organic cotton, a popular choice for environmentally conscious consumers, is increasingly used in yarn production. These yarns require careful handling during winding to prevent fiber damage, hairiness, and uneven package build.

The polyester/nylon segment is expected to expand at the fastest rate in the market in the upcoming period, driven by its increasing use in performance and specialty textiles. Ongoing innovation in polyester/nylon blends is further accelerating this growth. Polyester contributes dimensional stability, UV resistance, and ease of dyeing, while nylon offers a unique combination of durability, flexibility, superior abrasion resistance, tensile strength, and resilience. When blended in balanced composite formulations, these properties can be precisely tailored to meet specific end-use requirements, making these yarns highly suitable for advanced textile applications.

Automation Insights

How Does the High-Speed Automation Segment Dominate the Market In 2025?

The high-speed automation segment dominated the textile winding machine market in 2025 with the largest share, driven by its ability to deliver high efficiency and large-scale yarn processing with enhanced operational precision. High-speed winding systems support the increasing demand for superior yarn quality while minimizing labor dependency and optimizing production throughput. Advanced automation ensures consistent performance across integrated textile operations, including spinning, weaving, and knitting. Strong adoption among large industrial textile manufacturers has further reinforced the segment's leading market position.

The semi-automatic segment is projected to grow at the fastest CAGR during the forecast period, supported by its optimal balance between operational efficiency and cost control. Semi-automatic winding machines enable higher productivity, consistent yarn quality, and reduced labor intensity while retaining necessary process supervision. They are increasingly preferred by emerging enterprises and mid-tier textile manufacturers with expanding production capacities and steady revenue growth. The combination of controlled automation and operational flexibility enhances reliability, making this segment highly attractive for scaling manufacturing units.

End Use Insights

Why Did the Spinning Mills Segment Lead the Market In 2025?

The spinning mills segment led the textile winding machine market in 2025. This is because they are a key component of the global textile value chain, supplying high-quality yarn to both domestic and international markets. Spinning mills have undergone a structural transformation driven by rising automation, sustainability-focused manufacturing practices, continued innovation, and expanding cross-border textile demand. Technological advancements in spinning equipment, along with process optimization, are significantly enhancing production efficiency, minimizing raw material waste, and improving yarn uniformity. These developments are strengthening operational competitiveness and enabling mills to meet evolving quality standards in the global textile industry.

The technical textiles segment is projected to grow at the fastest rate during the forecast period, driven by rising demand for specialized fabrics used in healthcare, wearable sensors, protective clothing, and industrial applications. These high-performance textiles require precise winding and advanced machinery to ensure consistent yarn quality and structural integrity. Additionally, increasing adoption of automation, IoT, and AI in winding systems supports the production of complex, application-specific textiles, further driving growth in this segment.

Regional Insights

Why Did Asia Pacific Dominate the Textile Winding Machine Market?

Asia Pacific dominated the textile winding machine market with the largest share in 2025, driven by its strong textile export base and status as a large-scale investment hub. This region's leadership is also driven by extensive yarn production capacity and an export-oriented industry structure. There is a strong focus on expanding spinning capacity, which is increasing the demand for both standard and advanced winding machines and retrofit and upgrade services. Manufacturers are prioritizing automation and high-efficiency machinery to meet rising demand and reduce operational costs. Moreover, the adoption of smart technologies, including IoT-enabled winding systems, facilitates real-time monitoring and predictive maintenance, enhancing productivity while minimizing downtime and environmental impact.

China and India are emerging as key markets due to their scale and cost competitiveness. In China, both new installations and replacement demand are strong, as high machine utilization accelerates wear and drives frequent upgrades, with buyers prioritizing operational efficiency. In India, government-led textile incentives and MSME programs support small businesses, fostering market growth. Manufacturers offering modular platforms and retrofit-friendly designs gain a competitive edge, as buyers increasingly seek flexible machines capable of handling multiple yarn counts, blends, and batch sizes while minimizing downtime and ensuring consistent package quality.

How is the Opportunistic Rise of North America in the Textile Winding Machine Market?

North America is projected to grow at the fastest CAGR throughout the forecast period, driven by rising demand for specialty yarns, technical textiles, and industrial fabrics. There is increasing adoption of automation, smart manufacturing, and advanced winding technologies to improve yarn quality and operational efficiency. Demand is supported by investments in high-performance technical textiles, research in sustainable and energy-efficient systems, and the need for precision winding in specialty applications. Additionally, manufacturers in the region are focusing on modular, retrofit-friendly solutions that reduce downtime and enhance flexibility, further strengthening North America's position in the market.

Country-Level Analysis

The U.S. is driving regional market growth through equipment modernization and operational optimization, with buyers prioritizing precision control, automation compatibility, labor cost efficiency, and long-term equipment reliability over high-volume machinery. Mexico is strengthening regional supply chains through competitive manufacturing and increasing adoption of smart technologies and high-performance materials. Meanwhile, Canada benefits from regulatory clarity and sustainability-focused policies, supporting demand for energy-efficient and high-precision winding systems.

Textile Winding Machine Market Value Chain Analysis

- Raw Material Sourcing

Manufacturers procure premium industrial components to guarantee the precision and durability essential for high-speed winding operations.

Key Players: Rieter, Saurer Group, Murata Machinery (Muratec)

- Component Fabrication and Machining

Sourced raw materials are precisely processed into high-precision components that ultimately determine machine performance.

Key Players: Rieter, Murata Machinery (Muratec), Lakshmi Machine Works (LMW)

- Testing and Certification

Testing and certification add critical value by ensuring machine safety, precise performance, compliance, and global market access.

Key Players: SGS Group, TÜV SÜD, Intertek Group Plc

- Installation and Commissioning

This is a critical phase where the machine's theoretical capabilities are validated against demanding, real-world factory operating conditions.

Key Players: Godawari Techno Solution, Coils India, Savio Macchine Tessili

- Maintenance and After-Sales Service

This stage prioritizes maximum machine uptime and longer equipment life via proactive physical servicing and continuous digital monitoring.

Key Players: Rieter (ESSENTIALmaintain), Saurer (SUN - Service Unlimited)

- Product Lifecycle Management

PLM strategically oversees a machine's lifecycle, from concept and engineering to decommissioning, recycling, and sustainability.

Key Players: Saurer Group, Murata Machinery

Textile Winding Machine Market Companies

- Murata Machinery, Ltd. (Muratec) (Japan)

- Rieter Holding AG (Switzerland)

- Savio Macchine Tessili S.p.A.

- SSM Schärer Schweiter Mettler AG (Switzerland)

- Lakshmi Machine Works Ltd (LMW) (India)

- Saurer Intelligent Technology AG (Switzerland/China)

- Vandewiele NV (Belgium)

- Trützschler Group (Germany)

- Fadis S.p.A. (Italy)

- TMT Machinery Pvt. Ltd. (India)

- Benninger AG (Switzerland)

- Peass Industrial Engineers Pvt. Ltd. (India)

- Jingwei Textile Machinery (China)

- Itema Group (Italy)

- Meera Industries Ltd. (India)

Recent Developments

- In 2025, LMW unveiled the concept of the Smart Spinning Mill at ITMA ASIA + CITME in Singapore. At ITMA ASIA + CITME 2025, LMW presented Smart Automated Machines that showcase digital connectivity and advanced material handling, enabling greater operational efficiency, consistent performance, and sustainable production.(Source: https://www.indiantextilemagazine.in)

- In 2025, NACHI TEKNEKA acquired fully integrated spinning and winding machines from a North American company. The company announced this as a landmark achievement, marking the successful acquisition of a fully integrated spinning and winding machinery project from one of North America's largest and most technologically advanced spinning facilities.(Source: https://www.indiantextilemagazine.in)

- In 2025, Reshmi Industries unveiled advanced winding solutions for post-spinning and sewing thread applications, introducing a new range of high-technology machines driven by automation, AI, and sustainability. Reshmi Industries embodied the spirit of “Make in India, Make for the World” through its world-class solutions for post-spinning and sewing thread applications.(Source: https://www.indiantextilemagazine.in)

Segment Covered in the Report

By Winder Type

- Precision Winder

- Non-Precision/Drum Winder

- Cone Winder

- Cheese/Spool & Others

By Yarn Type

- Cotton/Cellulosic

- Polyester/Nylon

- Blends/Specialty

- Wool/Silk & Others

By Automation & Speed

- High-Speed Automation

- Semi-Automation

- Manual/Basic

By End Use

- Spinning Mills

- Weaving/Knitting Units

- Technical Textiles

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting