What is the Thyristor Market Size?

The global thyristor market size is calculated at USD 1.55 billion in 2025 and is predicted to increase from USD 1.61 billion in 2026 to approximately USD 2.26 billion by 2035, expanding at a CAGR of 3.84% from 2026 to 2035.

Thyristor Market Key Takeaways

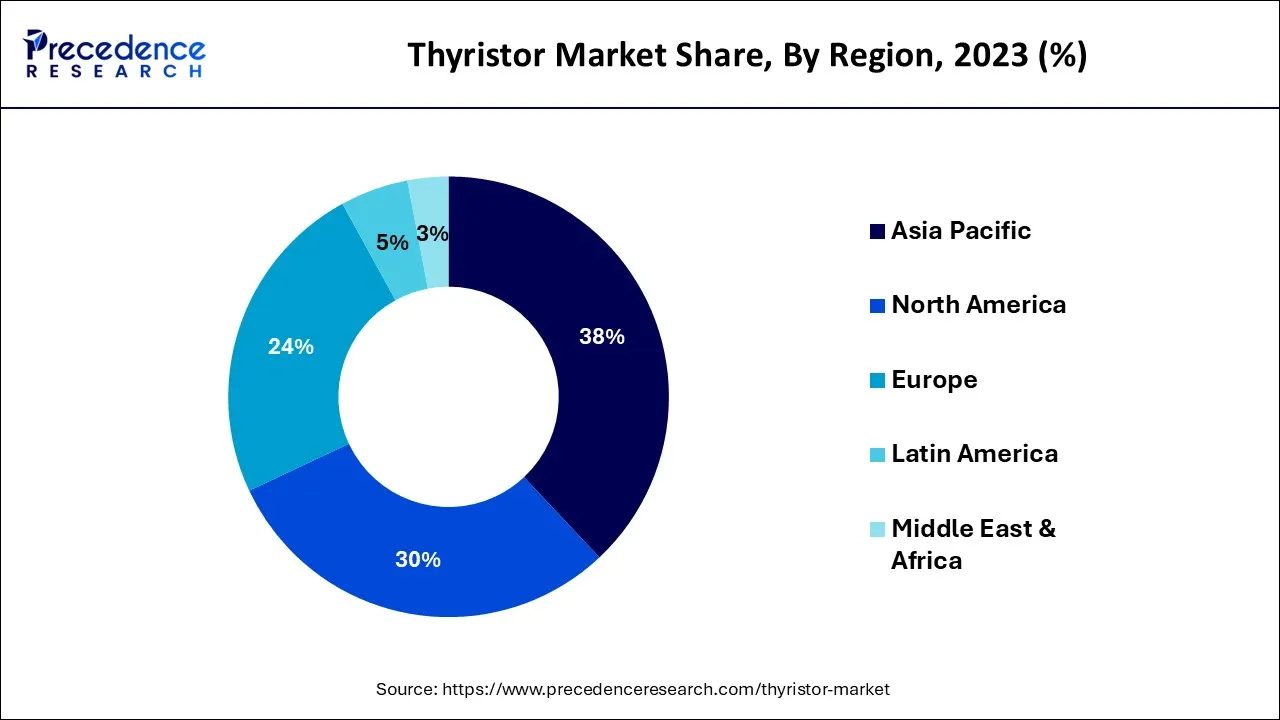

- Asia-Pacific generated more than 38% of revenue share in 2025.

- By Power Rating, the 500 MW segment contributed more than 45% of revenue share in 2025.

- By End Use, the automotive segment is expected to expand by double digits in 2025.

Strategic Overview of the Global Thyristor Industry

A thyristor is a solid-state semiconductor device along with four layered alternating p-type and N materials. The thyristor with three-lead is designed for controlling large current with the help of its two leads by combining the current with that of a smaller current from its other lead which is known as the control lead. The two-lead thyristor are used in switching if the potential difference between its lead is large. The thyristor is also known as a silicon-controlled rectifier.

Artificial Intelligence: The Next Growth Catalyst in Thyristor

AI is primarily impacting the thyristor industry by enhancing the demand for thyristors in AI-driven systems and by optimizing the technology's performance and maintenance through AI-powered solutions. The proliferation of industrial automation, smart grids, and renewable energy systems, which often integrate AI for efficiency and reliability, is a major driver of thyristor demand.

Thyristor Market Growth Factor

The pace of power consumption has grown due to an increase in population and quick technological advancements in the electronics sector (especially in consumer electronics and industrial electronics). Power grid building must thus rise as a result of this. Additionally, there are several prospects for market growth due to the development of the Internet of Things (IoT) and artificial intelligence (AI). Future market demand is also probably going to be stimulated by growing government initiatives for HDVC installations. One of the key factors driving the need for high power electronics goods throughout the industrial sector is the increased desire for devices that use less energy. Additionally, the demand for thyristors is being driven by the need for voltage beyond 1000 MW in smart industries, where robots and computers are used. Countries in APAC, such as China, are concentrating on the adoption of HVDC systems due to their large populations, which require a significant amount of power supply, which is anticipated to drive the thyristor market.

The market is being driven by an increase in consumer demand for smart gadgets and innovations in smart manufacturing. The current focus is on power conditioning using power semiconductor devices in modernizing industry technology. To reduce overall losses and increase the device's power rating, new thyristor devices are continually being developed.

- The expansion is ascribed to upgrading deteriorating electricity infrastructure, especially in industrialized economies.

- The expanding population in developing nations is driving up the demand for electricity. To fulfill the present need for electricity, metal-oxide-semiconductor field-effect transistors (MOSFET) are switched on and off quickly using thyristors. They are thus in high demand in developing economies.

- The steps governments in many nations have taken to replace deteriorating electricity infrastructure

- The growing use of electric motors in business, industry, and domestic settings.

Market Outlook

- Market Growth Overview: The thyristor market is expected to grow significantly between 2025 and 2034, driven by the rising electrification and EV, renewable energy integration, and growing industrial automation.

- Sustainability Trends: Sustainability trends involve focus on energy efficiency and reduced losses, integration into green technology sectors, and technological advancement and material shifts.

- Major Investors: Major investors in the market include Infineon Technologies AG, ABBA Ltd., Mitsubishi Electric Corporation, ON Semiconductor, and STMicroelectronics N.V.

- Startup Economy: The startup economy is focused on strategic acquisition targets, regional hotspots, and an asset-light model.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.55 Billion |

| Market Size in 2026 | USD 1.61 Billion |

| Market Size by 2035 | USD 2.26 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.84% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Power Rating and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Developing economies have an increasing demand for advanced power infrastructure

The conventional and deteriorating power infrastructures in many affluent nations face issues as a result of the increasing reliance on energy. Thyristors' low power consumption and wide range of functions make the worldwide thyristor market interesting. A semiconductor called a thyristor has four layers of alternating P- and N-type materials within. This gadget only conducts electricity in one direction since it is unidirectional. They function as switches to regulate electric current and power. The products in the worldwide thyristor market are used in a wide range of devices, including basic circuits like burglar alarms for homes and businesses and high-power circuits like electricity transmission lines. They are used in many industry verticals, including but not limited to power and energy, networking, industrial electronics, medical and healthcare, telecommunications, aerospace and military, automotive, and consumer electronics, and are small in size and need minimal maintenance.

Thyristors' robust yet small design and the rising demand for superior electrical power infrastructure in various developed countries are the primary drivers of the worldwide thyristor industry. As the population grows, so does the need for electrical energy, placing further strain on aging power infrastructure. When compared to the mechanical switches utilized in the bulk of conventional power infrastructures, thyristors consume less power and generate less heat. Switch, diodes, and rectifier functions can all be performed by thyristors. In the upcoming years, the worldwide thyristor market is anticipated to increase as a result of the flexible nature of thyristors.

Key Market Challenges

High manufacturing cost to lessen market availability

There are several factors that could affect the global thyristors devices market growth. The major hindrance would be caused due to the massive manufacturing cost. Since the implementation of the infrastructure is expensive; it poses a definite hinder to the market share. Furthermore, the lack of awareness among industry specialists and consumers. The benefits of thyristor modules are not spread across the people. These shortcomings could impact the adoption of amorphous metal ribbons in the future.

Key Market Opportunities

Increased production of electric vehicles due to stringent emission norms and improved charging infrastructure:

The new rule (EU) 2019/631, which primarily aimed to reduce CO2 emissions from automobiles, was recently released by the EU. The manufacture of fuel-efficient automobiles is expected to suffer as a result of this regulation's implementation. Given this, the automakers want to expand the number of electric vehicles they produce, which will progressively increase the use of IGBTs. Similar to this, growing investments and activities to establish additional charging stations by important companies like Charge Point, Electrify America, and Volkswagen are considerably boosting the market for charging stations for electric vehicles. With a $2 billion investment, Charge Point and Electrify America joined in 2019 with the goal of installing 30,000 Level 2 and DC fast charging stations across the US by 2023. Volkswagen announced plans to build 484 electric car charging stations with more than 2,000 dispensers around the United States by June 2019. According to the Department of Energy (DOE), over the 2019–2020 timeframe, there will be 24,807 more electric vehicle charging stations in the United States, which is expected to propel the Thyristor market.

Segment Insights

Power Rating Insights

Based on the power rating, the thyristor market is divided into three categories: below 500W, 500 to 900MW, and over 1000MW. In 2023, the income from thyristors rated below 500 MW accounted for more than 45% of the total. The widespread use of thyristors in consumer electronics applications is credited with driving the market's expansion. On the other hand, it is anticipated that thyristors rated between 500 and 900 MW would have substantial growth throughout the projection period. The industry is being propelled by the rising demand from power producers.

End Use Insights

Due to its low statistical failure probability, thyristor modules are essential in power applications. To transform electrical energy from one form to another for diverse electrical applications, thyristor modules are widely employed in the power sector. A thyristor module uses the best on-load tap-changer and saturable reactor configuration to efficiently and economically manage wide-range voltage. Systems using thyristor rectifiers offer smooth step-less control from zero to the rated voltage using thyristor gate control. Thyristors are increasingly being used in automotive ignition systems, which has further fueled the market's growth. The global automobile market will expand by double digits in 2023. Sales of new cars will rise by 15% in 2021 after falling by 18% in 2020. Sales of commercial vehicles will increase by 16% in 2021 after declining by 16% in 2020.

Thyristors are employed as a type of "circuit breaker" or "crowbar" in the power supplies for digital circuits to stop a power supply failure from harming subsequent components. Additionally, producers of thyristor modules are always working to develop new versions of these parts. These factors have increased the need for thyristor modules for long-distance power transmission, which is likely to fuel the growth of the worldwide thyristor module market during the course of the forecast period. Additionally, thyristor modules with cutting-edge technology for a range of electrical applications. Thus, it is anticipated that the market will rise as the power sector places more emphasis on developing thyristor modules.

Additionally, for decades, autotransformers and rheostats have been replaced by thyristors as lighting dimmers in television, cinema, and theater. Additionally, they have been employed in photography as a crucial element of flashes (strobes).

Regional Insights

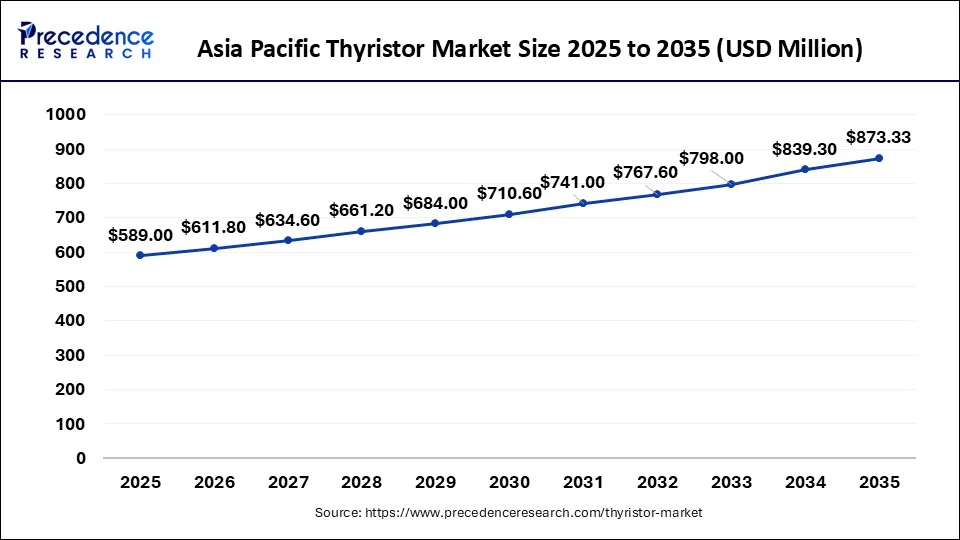

Asia Pacific Thyristor Market Size and Growth 2026 to 2035

The Asia Pacific thyristor market size is exhibited at USD 589.00 million in 2025 and is projected to be worth around USD 873.33 million by 2035, growing at a CAGR of 4.02% from 2026 to 2035.

Asia-Pacific has the highest concentration of thyristor module producers, making it the thyristor market with the quickest rate of expansion. The development of the region's thyristors market would be further aided by the emphasis of numerous well-established manufacturers on technical breakthroughs in semiconductor goods throughout the projected period.

Due to the large number of thyristor module manufacturers operating in the area, Asia-Pacific is predicted to dominate the worldwide thyristor module market throughout the projected period. In addition, several well-known manufacturers from the Asia Pacific region are concentrating on technical progress in semiconductor goods as a result of the expanding potential, which is anticipated to positively impact the area's thyristor module market throughout the course of the projected year.

The market for thyristors is benefiting from the rising use of HDVAC in developing nations. For instance, India is concentrating on direct high-voltage current (HVDC) transmission lines, according to Powerline Magazine, since they enable power to be delivered across great distances with little loss. HVDC transmission lines now make up 4% of the length of all transmission lines. Additionally, 400 kV transmission lines, which make up 43% of the country's total line length, will be the most common voltage type in India in 2020. It is followed by 220 kV transmission lines with 42%.

China Thyristor Market Trends

China's thyristor market is a cornerstone of its "Industry 4.0" and green energy mandates, serving as critical infrastructure for wind and solar power conversion. The rapid expansion of the domestic EV sector and high-power charging networks is driving massive demand for 500-1000V devices and advanced IGCTs for efficient switching.

How did North America experience the fastest growth in the Thyristor Market?

North America's modernization of aging power grids and the aggressive integration of large-scale solar and wind projects into smart grid architectures. The surge in electric vehicle infrastructure and Industry 4.0 automation is fueling demand for high-voltage, high-speed devices that ensure precise power control and minimal transmission losses.

U.S. Thyristor Market Trends

The U.S. thyristor market is experiencing moderate growth due to increasing demand from power electronics, industrial automation, electric vehicles (EVs), and renewable energy systems that rely on thyristor devices for efficient power control and conversion. Thyristor use in smart grid modernization and HVDC/FACTS transmission systems is expanding as utilities upgrade infrastructure to integrate renewables and improve grid stability.

How Did Europe Notably Grow in the Thyristor Market?

Europe's integration of renewable energy, smart grid, infrastructure, and energy efficiency mandates. The increasing demand for precise power control in manufacturing and process optimization fuels the use of thyristor modules.

Germany Thyristor Market Trends

Germany's massive expansion of renewable energy sources and stringent efficiency regulations in the country. The shift toward advanced materials such as SiC and GaN, combined with the development of faster GTOs and IGBTs, is crucial for developing efficient HVDC and smart grid solutions.

Value Chain Analysis of Thyristor Market

- Inbound Logistics (Raw Material Sourcing)

This stage involves the procurement, receiving, and storage of essential raw materials like silicon wafers, substrates, and various chemicals used in semiconductor manufacturing.

Key Players: GlobalWafers Co., Ltd., SUMCO Corporation, Siltronic AG, SK Siltron, Shin-Etsu Chemical Co., Ltd. - Operations (Manufacturing and Assembly)

Operations transform the raw materials and components into finished thyristor devices and modules through processes like wafer fabrication, assembly, and testing.

Key Players: Infineon Technologies AG, Mitsubishi Electric Corporation, ABB Ltd., STMicroelectronics, ON - Semiconductor, Fuji Electric Co., Ltd.

Outbound Logistics (Distribution and Delivery)

This stage focuses on activities required to get the finished products to customers, including packaging, storage, and managing distribution channels.

Key Players: Siemens AG and Schneider Electric

Thyristor Market Companies

- ABB: provides high-power thyristors used in demanding industrial applications like HVDC transmission systems and motor drives, leveraging its expertise in power technology and industrial automation.

- Siemens: focuses on developing specialized thyristor modules and solutions tailored for complex power electronics systems, including high-voltage applications and energy management infrastructure.

- Schneider Electric: uses thyristor technology primarily within its comprehensive portfolio of industrial automation, power distribution, and control products, such as soft starters and power control systems.

- Eaton: incorporates thyristors into its electrical power management products, offering solutions for power quality, control systems, and industrial automation designed to ensure reliable and efficient energy usage.

- Honeywell: utilizes thyristors primarily in its process automation and control solutions, where precision power switching is necessary for managing critical industrial processes and environmental controls.

- Analog Devices: focuses less on power thyristors and more on the specialized semiconductor components, such as drivers and interface integrated circuits, that enhance the control and functionality of thyristor-based power systems.

Other Major Key Players

- STMicroelectronics N.V.

- Infineon Technologies AG

- ON Semiconductor

- Fuji Electric Co., Ltd.

- Mitsubishi Electric

- NXP

- Power Semiconductors

- Bourns

- Nihon Inter Electronics Corporation

- SanRex Corporation

- Dynex Semiconductor

- Hind Rectifiers Limited.

- Semikron

- NTE

- Naina Semiconductor ltd.

Recent Developments

- New BiPolar power modules with the lowest losses and greatest working temperatures were released in May 2021 with industry-standard housings. The 60Pak module family offers the highest level of dependability and is the pinnacle of excellence. In terms of industry-standard housing, it has the lowest losses and greatest working temperatures. Failure is not an option, whether it's giving power to demanding applications or seamlessly regulating fans and industrial motors. These new solutions give the greatest performance, exceptional dependability, and greater overload capability by encasing Hitachi Energy's best-quality products in conventional industrial housing.

Segments Covered in the Report

By Power Rating

- 500 MW

- 500 MW-1000 MW

- 1000 MW

By End Use

- Consumer Electronics

- Telecommunication & Networking

- Industrial

- Automotive

- Aerospace & Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting