Ultrasound Devices Market Size and Forecast 2025 to 2034

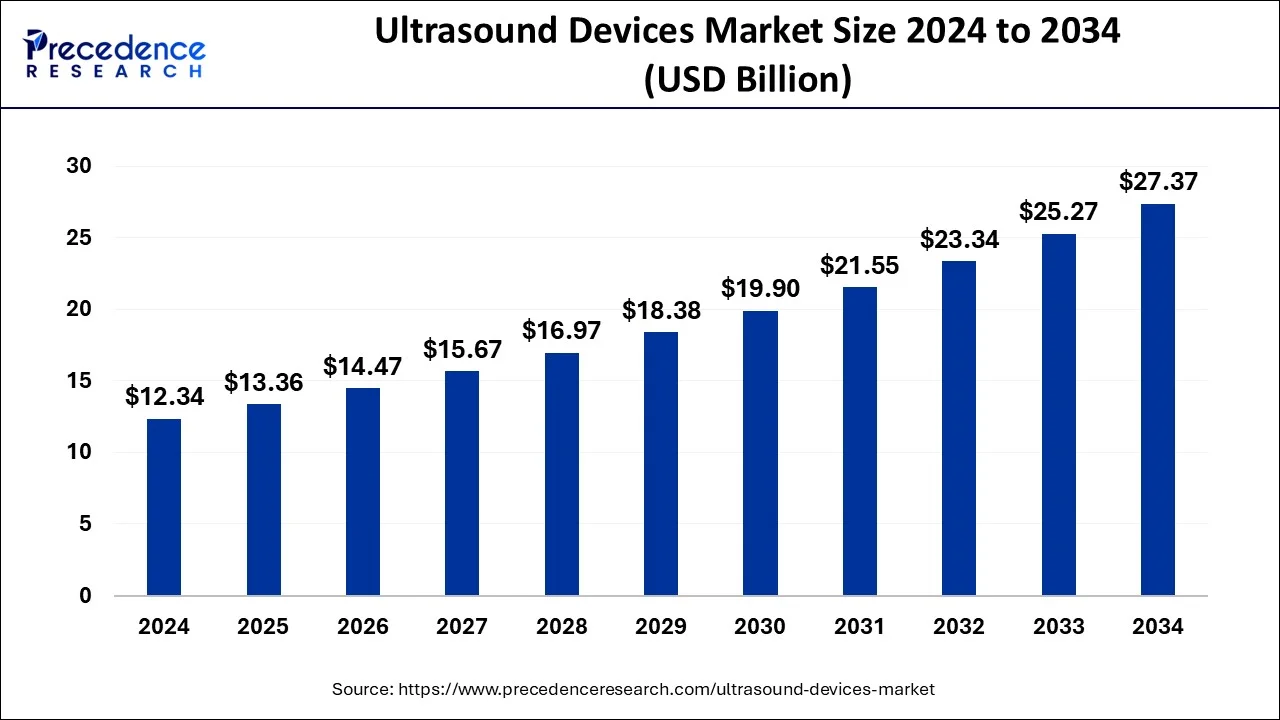

The global ultrasound devices market size accounted for USD 12.34 billion in 2024 and is expected to reach around USD 27.37 billion by 2034, expanding at a CAGR of 8.29% from 2025 to 2034. The increased integration of AI is the key factor driving the growth of the ultrasound devices market. Rising demand for non-invasive diagnostic procedures is fueling the adoption of ultrasound devices. Additionally, ongoing technology developments are expected to further boost the market growth.

Ultrasound Devices Market Key Takeaways

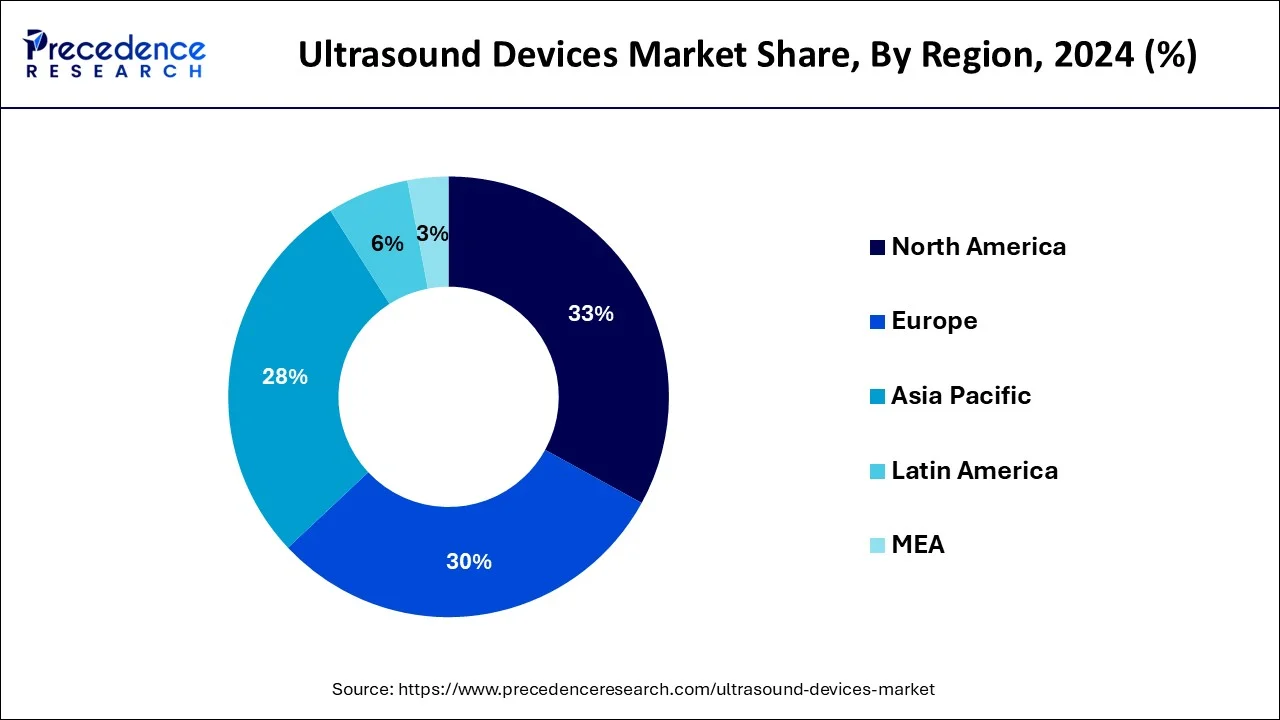

- North America generated more than 32.14% of the revenue share in 2024.

- By technology, the diagnostic segment is predicted to dominate the market between 2025 and 2034.

- By application, the radiology segment is projected to dominate in the forecast period.

- By end user, the hospital segment is expected to dominate the market between 2025 and 2034.

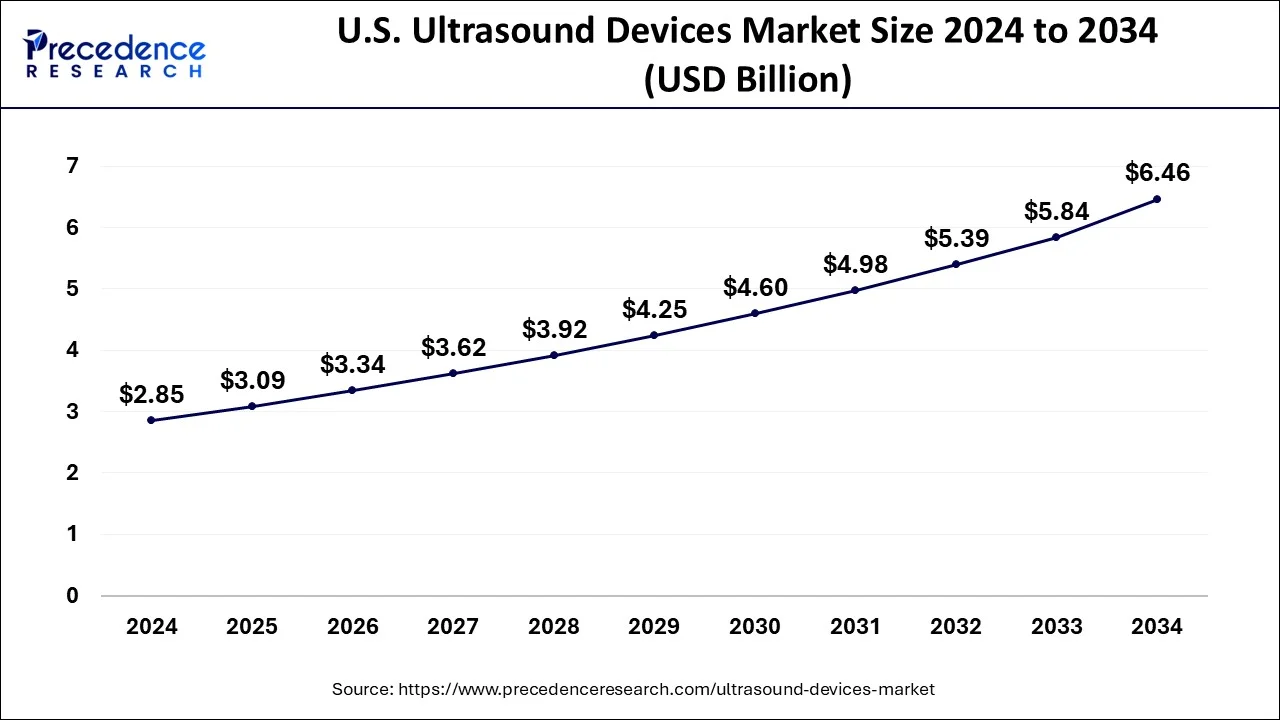

U.S. Ultrasound Devices Market Size and Growth 2025 to 2034

The U.S. ultrasound devices market size was valued at USD 2.63 billion in 2024 and is predicted to be worth around USD 6.92 billion by 2034, at a CAGR of 9.17% from 2025 to 2034.

The United States led the regional market due to the country's history of early adoption of advanced technology, expanded advanced healthcare infrastructure, and investments in research and developments. The well-established healthcare infrastructure of the United States allows the adoption of cutting-edge medical technologies, including ultrasound devices. The ongoing government and regulatory initiatives and investment in R&D firms are empowering countries key competitors for developments and launching of the advanced technologies that are improving the market situation in the country.

- In November 2024, the trophon Wireless Ultrasound Probe Holder was launched by Nanosonics. The device is made to enhance disinfection and traceability. It is the first automated high-level disinfection (HLD) solution for wireless ultrasound probes. The holder comes with an RFID tag for traceability.

Asia Pacific is anticipated to witness significant growth during the forecast period due to rising population and expanding advanced healthcare infrastructure in the region. Additionally, the rising aging population and chronic disease among elderly patients are fueling the market growth. China is leading the regional market due to countries rapidly advancing healthcare infrastructure and adoption of the advanced medical technologies. The rising developments of advanced imaging technologies for applications, including point-of-care applications, are trending in the Chinese market. However, India is anticipated to witness spectacular market growth in the forecast period due to rising incidence of chronic disease, an aging population, and government initiatives and funding in the pharmaceutical and healthcare infrastructure.

Europe Ultrasound Devices Market Trends

The rising use of diagnostic imaging and advancements in ultrasound technologies within Europe's healthcare sector are major elements driving market expansion. Ultrasound technology is experiencing increased demand in the healthcare industry due to its numerous advantages compared to other methods, including non-invasiveness, affordability, and quicker results.

Additionally, it is more secure than alternative imaging techniques because it does not utilize magnetic fields or ionizing radiation. Innovation levels in the European ultrasound device market are significant, propelled by technological advancements, evolving healthcare needs, and the requirement for more precise and efficient diagnostic solutions. The market seeks to add new functionalities, boost image quality, improve portability, and enhance efficiency.

European manufacturers are making significant investments in innovation to remain competitive and address the changing requirements of healthcare providers and patients by incorporating technologies like robotics, telemedicine platforms, and cloud-based solutions to improve connectivity, data exchange, and remote monitoring functions.

Latin America Ultrasound Devices Market Trends

The rate of occurrence and existence of chronic diseases is rising swiftly in Latin America. Consequently, a rise in the demand for ultrasound imaging is anticipated, in conjunction with the need for early disease detection and reducing the expenses of treating these chronic illnesses. It likewise raises the quantity of diagnostic imaging procedures. The important role in medical diagnosis and user-friendliness has generated high demand, leading to various funding sources investing, a trend anticipated to grow in the upcoming years. The rise in technological innovations backed by the establishment of reliable partnerships is anticipated to propel market expansion. The miniaturization of ultrasound devices has provided the market with a modest, if not notable, uplift. It provided healthcare facilities the choice of swapping out outdated heavy equipment for more compact alternatives. Minimizing the dimensions of these devices addresses the storage issue, enabling facilities to operate more effectively with additional devices. Therefore, it primarily encourages the demand for ultrasound in Latin America. The ultrasound market is being propelled by factors such as a heightened demand for medical imaging equipment, a surge in healthcare companies, and a rising variety of ultrasound applications.

Implementation of AI in Ultrasound Devices

With the growth of the IT industry and its applications in various other fields. For a long time, healthcare has led the way in technological developments, and it is now used in almost every clinical department and pharmaceutical and medical industries. AI-based solutions are being implemented to improve patient outcomes by increasing diagnostic accuracy and assisting in decision-making. For example, deep learning in medical imaging provides patients with a seamless, integrated, personalized treatment journey. With various applications of artificial intelligence integration, it may be a future opportunity for market growth. With ongoing innovations and technology developments, the AI integration is likely to empower the healthcare expenditure.

- In August 2024, according to a groundbreaking study published in the Journal of the American Medical Association (JAMA), researchers from the University of North Carolina at Chapel Hill's Institute for Global Health and Infectious Diseases and the University of Zambia have showcased an AI-enabled, low-cost handheld ultrasound device designed to deliver accurate gestational age estimates when used by healthcare workers with minimal training. This innovation is expected to enhance pregnancy care when there is a limitation of expert sonographers and high-end ultrasound machines.

Ultrasound Devices Market Growth Factors

- Rising aging population increasing incidence of chronic diseases like cancer, cardiovascular disease, and osteoporosis leading to an increase in demands for cutting-edge medical devices, including ultrasound devices.

- The prevalence of chronic disease has increased that requiring the more accurate and effective diagnosis, ultrasound devices are able to provide accuracy and efficacy with improve period of time, which makes them popular among healthcare professionals.

- The adoption of advanced technologies like 3D and 4D ultrasound is emerging in the market.

- Additionally, growing utilization of portable and handheld, user-friendly ultrasound devices significantly impact the market situation.

- Growing government focus and funding in R&D and healthcare expenditure is the significant driver for increased ultrasound device adoption rates.

- The easy accessibility of healthcare services in rural and developing areas is generating a favorable impact on the market growth.

- The need for effective diagnosis and devices to treat complexity in pregnancy and monitor fetal health is also crucial, playing a crucial role in the market growth.

- The favorable health regulations are spectacularly empowering research and development firms and supporting key companies, leading to a dramatic impact on the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 12.34 Billion |

| Market Size by 2034 | USD 27.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.29% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Ultrasound devices are less expensive.

With a rise in persistent diseases comes an increase in healthcare advancement. The ultrasound method is the oldest and most effective for patient pre-diagnosis. There are other methods for pre-diagnosis detection, such as computed tomography (CT) scans and magnetic resonance imaging (MRIs), although they are relatively expensive, and the new technological advancements and techniques make them costly. Furthermore, as technology progresses, ultrasound technology develops, with new AI integration features and high image quality, but ultrasound devices remain relatively inexpensive compared to other methods. As a result, the market's expansion is driven by the low-cost and reliable old method.

Development of advanced healthcare systems

Increases in technological advancements, the digital world, the IT industry, and artificial intelligence are key market growth factors. Furthermore, population growth and the need to expand treatment methods with technological advancement can treat a greater number of patients with positive outcomes. In addition, the quality of the treatment provided to the patient is critical, and the pre-diagnosis detection should be accurate and clear to proceed with the diagnosis.

Ultrasound technology advancements such as the incorporation of artificial intelligence, improved quality of 4D imaging, elastography methods, quantification, and selecting the ideal images are a few advancements that can enhance the quality of the results, resulting in market expansion.

Furthermore, advances in technology can provide more treatment options, thereby improving healthcare quality. According to Columbia University research news, a new ultrasound device offers a new treatment option for hypertension by calming the overactive kidney nerves with ultrasound, which consistently lowers blood pressure.

Safer than other technologies

Other imaging technologies depend on radiation, which really is harmful to human health. The ultrasound device does not use radiation, is non-invasive, and has a long track record of safety. Because of this safety feature, ultrasound is the most widely used medical imaging method for fetus during pregnancy. Ultrasound imaging is one of the best options for medical diagnosis because of its lack of harmful effects and high image quality. According to the FDA, medical professionals must consider ultrasound examinations, which use relatively little ionization radiation exposure, as part of the FDA's strategy to reduce unnecessary radiation exposure from medical imaging.

Restraints

Lack of training

Healthcare is a large industry, and medical practices and training are critical to the effectiveness and quality of treatments. There are few guidelines for ultrasound imaging treatment and training. Point-of-care ultrasound is the use of ultrasound at the point of care to answer a diagnostic question or to help the effectiveness of an invasive procedure. It has the potential to improve clinical decision-making and accuracy. Although the prevalence of point of care in hospitals varies, it has seen less use in recent years due to a lack of training.

According to a survey conducted by VA medical centers, the most frequently reported barrier to POCUS used among hospitalists include lack of training due to funding and opportunities for training. As a result, a lack of training can impact the quality of treatment, stifling market growth.

Opportunity:

Rising demand of Point-of-care testing

The demand for point-of-care testing has increased in various sectors, like primary care clinics and emergency rooms, that are driving the adoption rate of the ultrasound devices. The Poc testing helps healthcare professionals to deliver effective and fast treatments. The ability to provide remote treatment and diagnostics is making them more popular among the healthcare professionals and patients. Also, the ability of POC to reduce the need for hospitalizations and expensive laboratory testing is emerging in the market. With rising adoption of the advanced technologies, the POC testing are expected to advance in the upcoming period, leading to providing room for improvements and developments of novel treatment solutions. The rising prevalence of chronic disease, aging population, and complexities in pregnancy are driving demands for effective and faster treatment options. including point-of-care testing, which is projected to enhance the adoption of ultrasound devices, making market potential.

Product insights

The diagnostic ultrasound technology segment dominated the market as the demand for ultrasound inspection grows, owing to its ease of use, lower implementation costs, and versatility.

On the other hand, the therapeutic segment is expected to lead the market in the forecast period due to increased demand for the non-invasive ultrasound procedure. The therapeutic ultrasound devices are non-intrusive and able to work for pain management. The demand for advanced devices to reduce the risk of complications is the key factor driving the growth of the segment. The ability of therapeutic ultrasound devices to heal chronic wounds and enhance patient outcomes is making them more popular in the healthcare sector. The expanding application of therapeutic ultrasound devices in physical therapy and rehabilitation is expected to further fuel the growth of the segment in the forecast period.

Technology Insights

The ultrasound devices market is divided into diagnostic and therapeutic segments. Diagnostic ultrasound technology is expected to dominate the market as the demand for ultrasound inspection grows, owing to its ease of use, lower implementation costs, and versatility. Considering these advantages, advances in diagnostic ultrasound imaging technology for improved diagnosis and immediate clinical information have been made.

Due to its efficacy, speed, low cost, and non-invasive nature, this technology is recommended over other imaging techniques. The diagnostic ultrasound industry will continue to evolve as the clinical application scope expands, including orthopedics, cardiology, obstetrics, gynecology, breast and prostate cancer detection, and emergency medicine.

Application Insights

The radiology segment of the market is expected to dominate in the forecast period. Population growth, as well as the rising prevalence of cancer and chronic diseases, are factors influencing its expansion. Furthermore, because ultrasound devices are primarily used in the radiology segment, in vitro testing will increase demand for imaging workups due to its increased sensitivity and potential diagnoses.

Furthermore, as various advancements in imaging and capturing technology are made, the use of ultrasound devices will become more prevalent. In addition, many new features, such as harmonic tissue imaging, model-based segmentation and imaging, catheter-based ultrasound, and elastography, are increasing demand in the radiology ultrasound application.

On the other hand, the obstetrics/gynecology segment is anticipated to witness significant growth in the forecast period due to increased applications in prenatal care. Additionally, the segment growth is attributed to rising awareness of maternal and fetal health. Ultrasound devices are majorly utilized to monitor the fetal health and provide early detection of fetal abnormalities and pretends the diagnosis. The increased cancer cases are demanding the ultrasound devices for gynecological cancer screening. The need for monitoring of reproductive health, the segment is likely to lead the market in upcoming years.

End User Insights

The market for ultrasound devices market is segregated into hospitals, surgical centers, diagnostic centers, and others. The hospital segment is anticipated to dominate the market in the forecast period. A few of the driving factors of the hospital ultrasound devices market are the rise in the number of patients, an increase in chronic diseases, a large population, more treatment options, and quality diagnosis. Furthermore, an increase in the number of clinical departments in hospitals that use ultrasound devices best boosts market growth in the hospital sector.

The rise in road accidents and the increase in orthopedic surgery and surgical procedures are driving the demand for ultrasound technology for pre-diagnosis and immediate and quality treatment. According to an orthopedic study, fractures were the most common type of injury, accounting for 71% of all total injuries. As a result, the number of accidents has increased, as have the number of surgeries and the use of ultrasound devices for pre-diagnosis.

Ultrasound Devices Market Companies

- Koninklijke Philips N.V.

- Samsung Medison Co., Ltd.

- Siemens Healthineers AG

- FUJIFILM SonoSite, Inc.

- GE Healthcare

- Canon medical system corporation

- Hologic, Inc.

- Terason

- Analogic Corporation

- Mindray Medical International Ltd.

Latest Announcements by Industry Leaders:

- In September 2024, David Zollinger, head of Cardiovascular Ultrasound at Siemens Healthineers, talked about companies newly launched and FDA-cleared ACUSON Origin.

“With cutting-edge AI features and the potential of ACUSON Origin to improve diagnostic accuracy and patient care, the system is determined to change healthcare's approach to cardiovascular imaging.”

- In February 2024, Joseph DeVivo, Butterfly Network's President, Chief Executive Officer, and Board Chairman, talked about the company's new launch.

“By launching o of iQ3, the company is likely to witness a paradigm shift in ultrasound. This novel launching of the company has created a new standard of digital image quality to match with traditional handheld devices and even certain carts. The device is projected to attract POCUS experts to choose a company and support interference to generate confidence and competency through artificial intelligence and advanced imaging tools.”

Recent Developments

- In February 2024, Butterfly Network, Inc., a digital health company transforming care through the power of portable, semiconductor-based ultrasound technology and intuitive software, launched its third-generation handheld point-of-care ultrasound (POCUS) system, called Butterfly iQ3, which received FDA clearance in January 2024. The system is powered by the company's cutting-edge semiconductor chip with a data transfer rate that is double that of its predecessor.

- In September 2024, GE Healthcare introduced its Venue Sprint, a portable ultrasound device that builds on the capabilities of GE HealthCare's Venue ultrasound portfolio. This device provides wireless probing abilities and extreme image quality by fusing the well-known Venue software with tools powered by artificial intelligence.

- In September 2024, the Food and Drug Administration (FDA) passed the clearance to the ACUSON Origin, a new dedicated cardiovascular ultrasound system powered by artificial intelligence (AI) features, launched by the Siemens Healthineers. These systems will help physicians perform cardiac procedures more efficiently in the areas of diagnostics, structural heart disease, and electrophysiology.

Segments Covered in the Report

By Technology

- Diagnostic

- Therapeutic

By Application

- Radiology

- Cardiology

- Gynaecology

- Urology

- Others

By End User

- Hospitals

- Surgical centres

- Diagnostic centres

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting