Unmanned Aerial Vehicle (UAV) Drones Market Size and Forecast 2026 to 2035

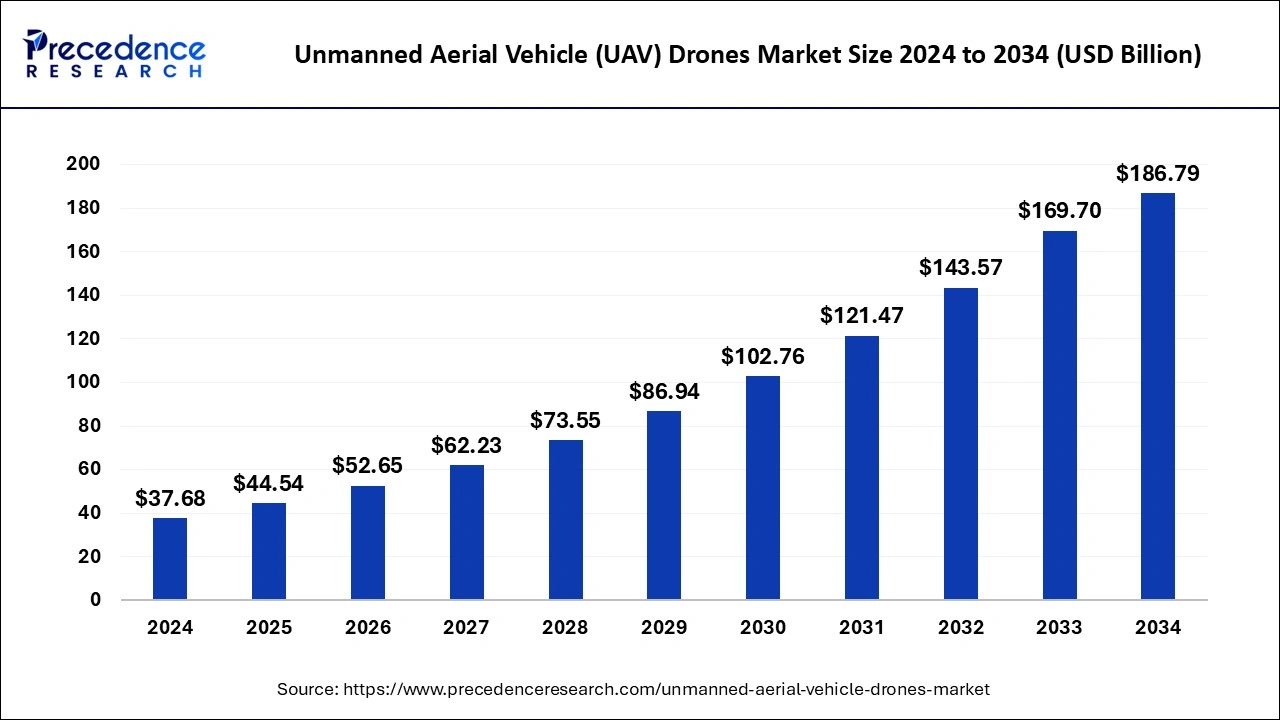

The global unmanned aerial vehicle (UAV) drones market size is accounted at USD 44.54 billion in 2025 and predicted to increase from USD 52.65 billion in 2026 to approximately USD 209.91 billion by 2035, representing a CAGR of 16.77% from 2026 to 2035.

Unmanned Aerial Vehicle (UAV) Drones Market Key Takeaways

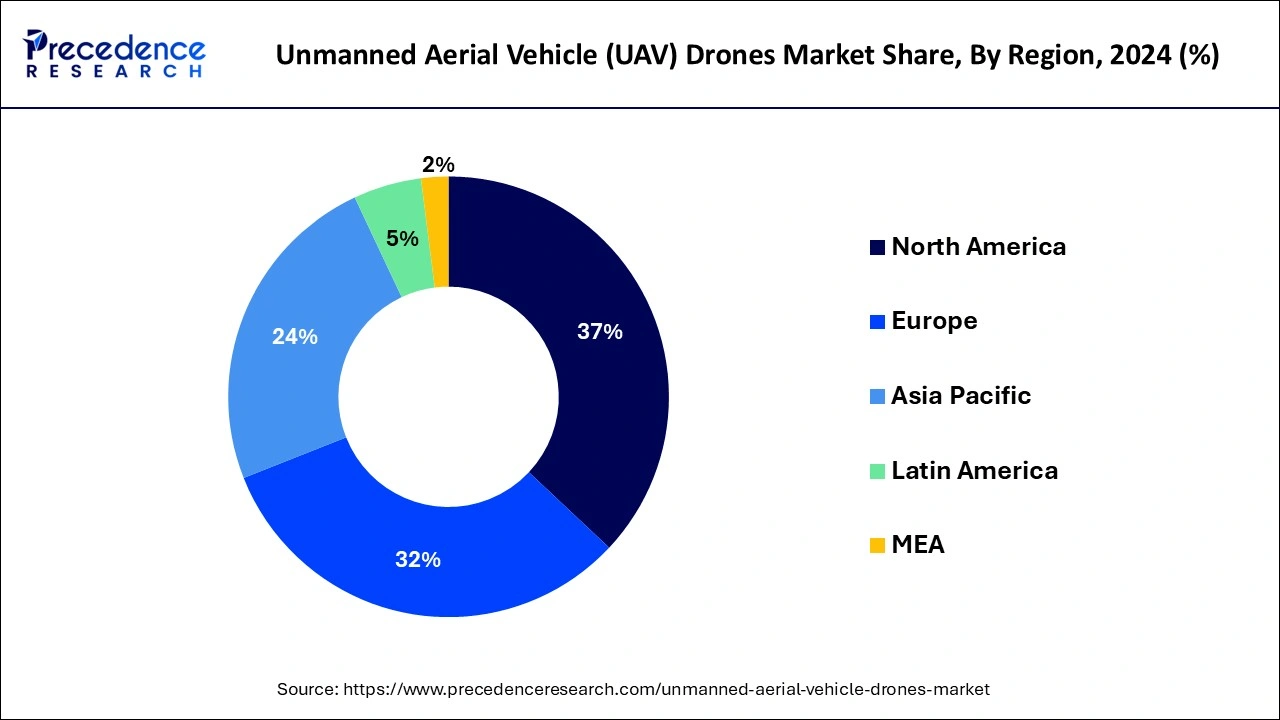

- North America dominated the unmanned aerial vehicle (UAV) drones market share of 37% in 2025.

- Asia-Pacific is expected to develop at the fastest rate during the forecast period.

- By type, the vertical take-off and landing (VTOL) had the highest revenue share in 2025.

- By component, the camera segment dominated the unmanned aerial vehicle (UAV) drones market.

- By application, the media and entertainment segment dominated the unmanned aerial vehicle (UAV) drones market in 2025.

Unmanned Aerial Vehicle (UAV) Drones Market Growth Factors

An unmanned aerial vehicle (UAV) drone is a plane that flies without a human pilot, passengers, or crew. The unmanned aerial vehicle (UAV) is a part of unmanned aircraft system (UAS), which also includes a ground-based controller and a communications system with the unmanned aerial vehicle (UAV). The unmanned aerial vehicle (UAV) drones can be controlled remotely by a human operator, as in a remotely pilot aircraft (RPA), or with varying degrees of autonomy, such as autopilot help, up to fully autonomous aircraft with no human interaction.

The unmanned aerial vehicle (UAV) drones are increasingly being used to collect data. During this process, confidential information about a private property or conduct may be gathered. As a result, safety and security concerns, as well as social issues such as privacy concerns, are limiting the market for unmanned aerial vehicle (UAV) drones.

The primary factors driving the unmanned aerial vehicle (UAV) drones market's growth are rapid technological developments in drones and an increase in demand for drone-generated data in commercial applications. The market for unmanned aerial vehicle (UAV) drones is also growing due to an increase in venture capital funding.

The unmanned aerial vehicle (UAV) drones are type of unmanned aerial vehicle (UAV) which are also used in wars. The unmanned aerial vehicle (UAV) drones are commonly used for monitoring farmlands to enable farmers to respond rapidly to problems such as pests and drought, which is driving the growth of the unmanned aerial vehicle (UAV) drones market during the forecast period.

Due to changes in government laws and an increase in the number of exceptions allowed to companies for commercial use of unmanned aerial vehicle (UAV) drones, this market is expected to grow significantly during the projected period. The surveying, inspection, media and entertainment, military and homeland security, precision agriculture, and other commercial sectors all contribute to the market for unmanned aerial vehicle (UAV) drones.

Unmanned Aerial Vehicle (UAV) Drones Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 44.54 Billion |

| Market Size in 2026 | USD 52.65 Billion |

| Market Size by 2035 | USD 209.91 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.77% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Component, Payload, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The vertical take-off and landing (VTOL) had the highest revenue share in 2025. The vertical take-off and landing (VTOL) unmanned aerial vehicle (UAV) uses rotors to take off, hover, and land vertically, similar to a helicopter. All multi-copter drones, as well as some hybrid fixed wings drones, fall under this category.

The medium altitude long endurance (MALE) segment is fastest growing segment of the unmanned aerial vehicle (UAV) drones market in 2025. A medium altitude long endurance (MALE) is an unmanned aerial vehicle (UAV) that flies for extended periods of time. The unmanned combat aerial vehicle and unmanned reconnaissance aerial vehicle are both included in this list.

Payload Insights

The up to 150 kg segment dominated the unmanned aerial vehicle (UAV) drones market in 2025. This type of unmanned aerial vehicle (UAV) drones are adaptable and can perform a wide range of operations, including search rescue, ground force support, irregular traffic surveillance, and intelligence missions.

The up to 600 kg segment, on the other hand, is predicted to develop at a rapid rate over the projection period. Nowadays, the unmanned aerial vehicle (UAV) drones are being manufactured mostly with the payload of 600 kg.

Component Insights

In 2025, the camera segment dominated the unmanned aerial vehicle (UAV) drones market. The unmanned aerial vehicle (UAV) drones employ investigation, continuous video monitoring, border security, remote surveillance, rescue and law enforcement, and vital infrastructure protection.

The sensor segment, on the other hand, is predicted to develop at the quickest rate in the future years. The inertial measurement units (IMUs) are unmanned aerial vehicle (UAV) sensors that combine data from several sensors such as accelerometers, gyroscopes, and magnetometers to generate readings that may be used to compare the unmanned aerial vehicle (UAV) drones' velocity and orientation.

Application Insights

The media and entertainment segment dominated the unmanned aerial vehicle (UAV) drones market in 2025. The unmanned aerial vehicle (UAV) drones have a number of advantages over traditional means of image capture, including lower costs and better film and photo quality. This is the primary factor driving the growth of the segment over the projection period.

The precision agriculture segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The unmanned aerial vehicle (UAV) drones are used in precision agriculture for a variety of tasks, including field and soil analysis, pesticide, and planting. The unmanned aerial vehicle (UAV) drones can be used with a variety of imaging technologies, such as multispectral, hyperspectral, and thermal, to offer farmers with temporal and site-specific information about fungal infections and crop health.

U.S. Unmanned Aerial Vehicle (UAV) Drones Market Size and Growth 2026 to 2035

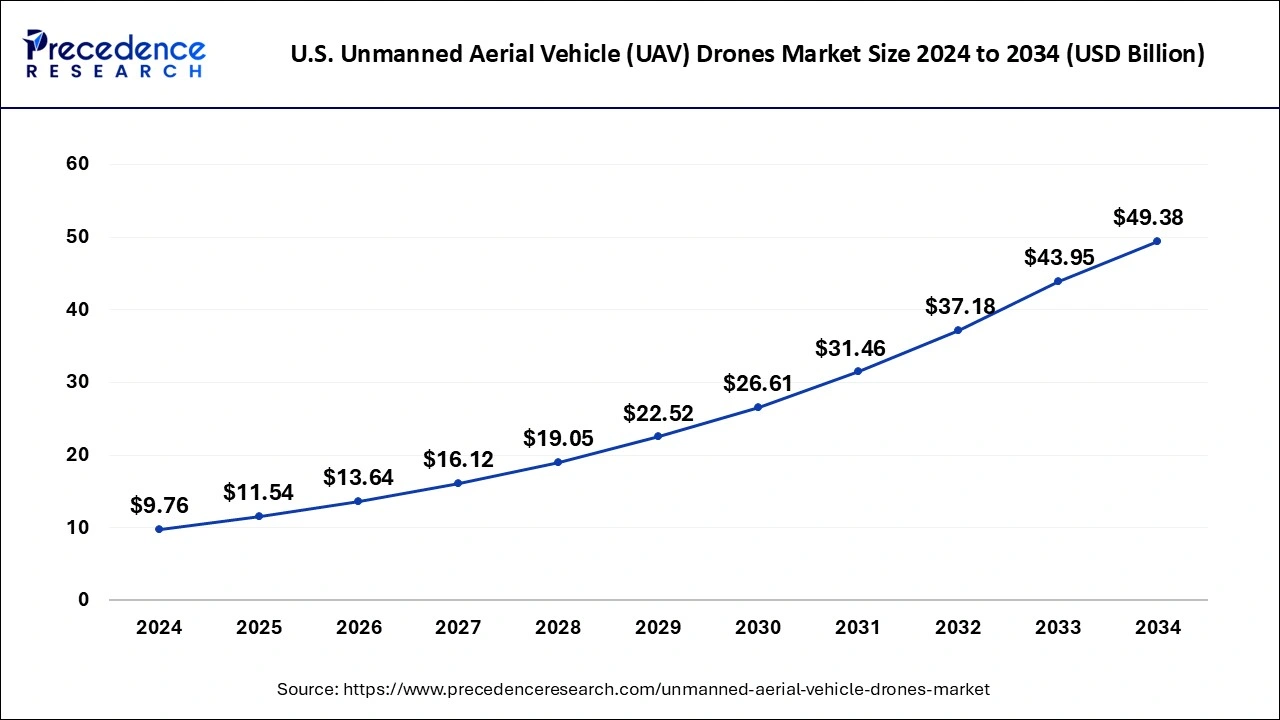

The U.S. unmanned aerial vehicle (UAV) drones market size was evaluated at USD 11.54 billion in 2025 and is projected to be worth around USD 55.70 billion by 2035, growing at a CAGR of 17.05% from 2026 to 2035.

North America Unmanned Aerial Vehicle Drones Market Trends:

North America is dominating the market for unmanned aerial vehicle drones, backed by significant defense spending, cutting-edge technology infrastructure and early commercial sector adoption. The market is still growing steadily due to widespread use in logistics pubic safety, infrastructure inspection, and agriculture, as well as changing laws governing sophisticated drone operations.

U.S. dominates the North American UAV drones market due to ongoing technological innovation quick commercial adoption and high defense procurement. Applications in agriculture, mapping, surveillance, and last-mile delivery are being accelerated by an increase in FAA approvals for commercial and long-range drone operations. Innovation in AI-enabled and sensor integrated drones is being propelled by strong venture capital funding and startup activity. Furthermore, the ongoing need for cutting-edge UAV platforms is supported by military modernization initiatives.

Asia Pacific Unmanned Aerial Vehicle Drones Market Trends:

The Asia Pacific region is growing rapidly, driven by the development of smart cities, the growth of industry, and the growing use of drones in disaster relief and farming. Widespread deployment is supported by government-led digital initiatives and robust manufacturing capabilities. Demand is also rising in a number of nations due to defense modernization initiatives and border surveillance requirements. Regional competitiveness is being further enhanced by increasing investments in R&D and local drone ecosystems.

India's UAV drones market is witnessing fast growth backed by advantageous drone regulations and growing use in logistics, defense, and agriculture. The domestic ecosystem is being strengthened by government incentives for local manufacturing and higher startup participation. Drone-based delivery mapping and crop spraying pilot projects are increasing the number of commercial use cases. The market is gaining momentum due to the growing demand for tactical drones and indigenous surveillance.

Recent Developments

- At the Advanced Naval Technology Exercise in August 2017, the company showed off its advanced mission management and control system (ANTX). This system allows several unmanned underwater vehicles, unmanned aerial vehicles, and unmanned surface vehicles to work together to gather, analyze, and synthesize data from a variety of sensors.

- The company launched a new factory in North Dakota, the U.S., in April 2017. The principal tasks carried out at this new facility include research and development, mission analysis, operator, as well as aircraft maintenance.

Unmanned Aerial Vehicle (UAV) Drones Market Companies

- General Atomics Aeronautical Systems

- Israel Aerospace Industries

- ALCORE Technologies

- BAE Systems

- Nimbus

- VTOL Technologies

- Xiaomi

- ING Robotic Aviation

- PrecisionHawk

- Lockheed Martin

Segments Covered in the Report

By Type

- Fixed Wing Drone

- Rotary Blade Drone

- Hybrid Drone

By Load Capacity

- <2KG

- 2–5 KG

- >5 KG

By Duration

- <30 Minutes

- >30 Minutes

By Range

- Short (<25 Kilometers)

- Long (>25 Kilometers)

By Application

- Aerial Photography

- Agriculture

- Emergency and Disaster Management

- Inspection & Monitoring

- Remote Sensing & Mapping

- Wildlife Research & Preservation

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting