What is the U.S. Tuberculosis Diagnostics Market Size?

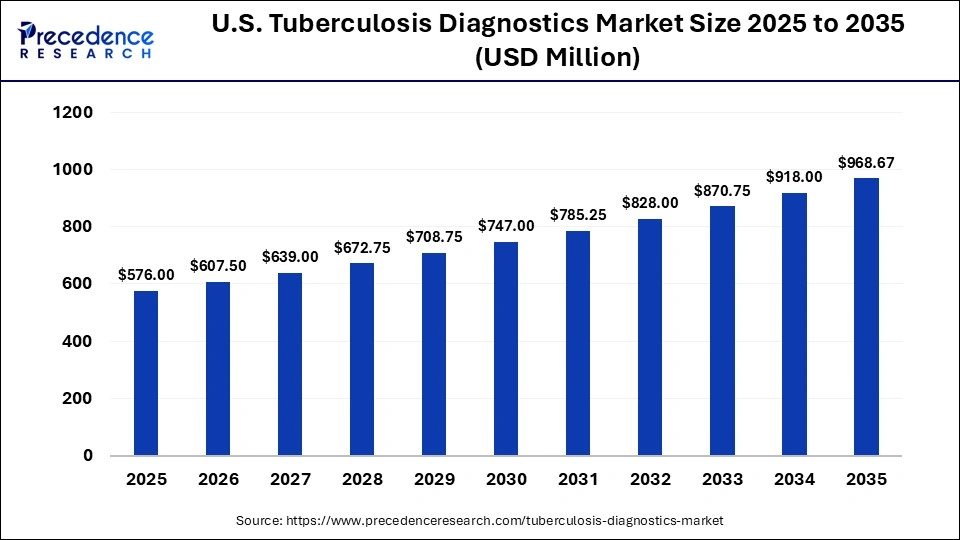

The U.S. tuberculosis diagnostics market size was calculated at USD 576.00 million in 2025 and is predicted to increase from USD 607.50 million in 2026 to approximately USD 968.67 million by 2035, expanding at a CAGR of 5.34% from 2026 to 2035. The U.S. tuberculosis diagnostics market is on the cusp of substantial expansion, driven by increasing awareness and advancements in diagnostic technologies. This growth underscores the critical demand for efficient and accurate tools to address the ongoing challenge of tuberculosis in public health.

Market Highlights

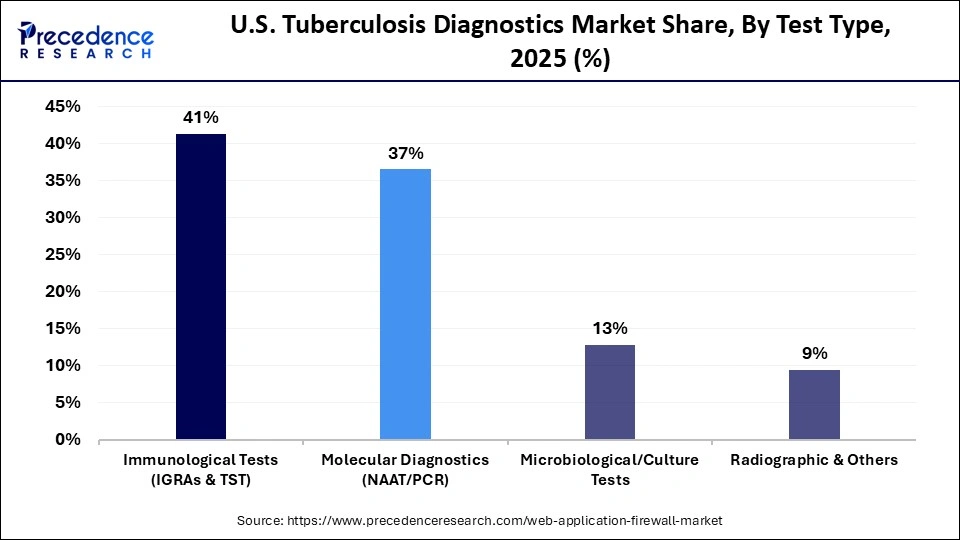

- By test type, the immunological tests segment held a dominant position in the U.S. tuberculosis diagnostics market with a share of approximately 41.3% in 2025.

- By test type, the molecular diagnostics segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

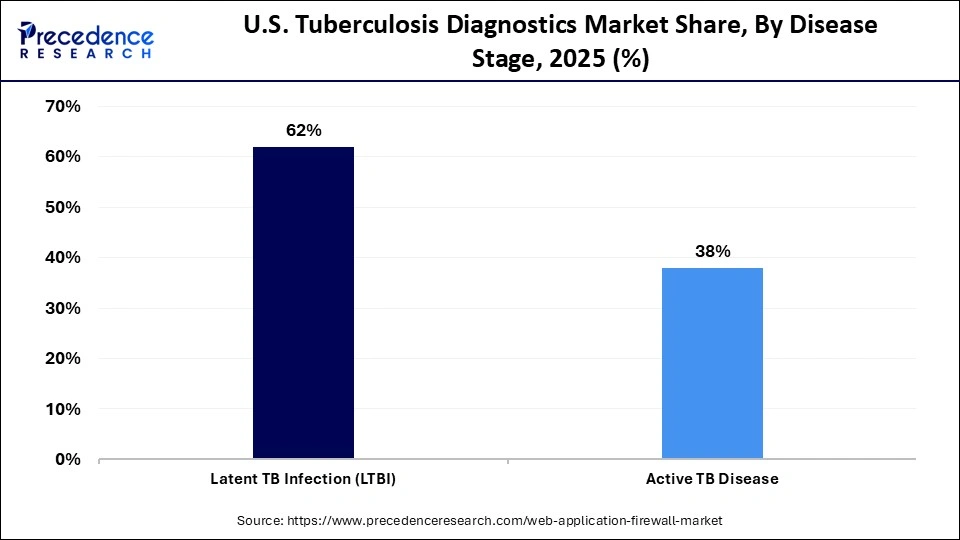

- By disease stage, the latent TB infection (LTBI) segment accounted for a considerable revenue share of approximately 62% in the market in 2025.

- By disease stage, the active TB disease segment is expected to grow with the highest CAGR in the market during the studied years.

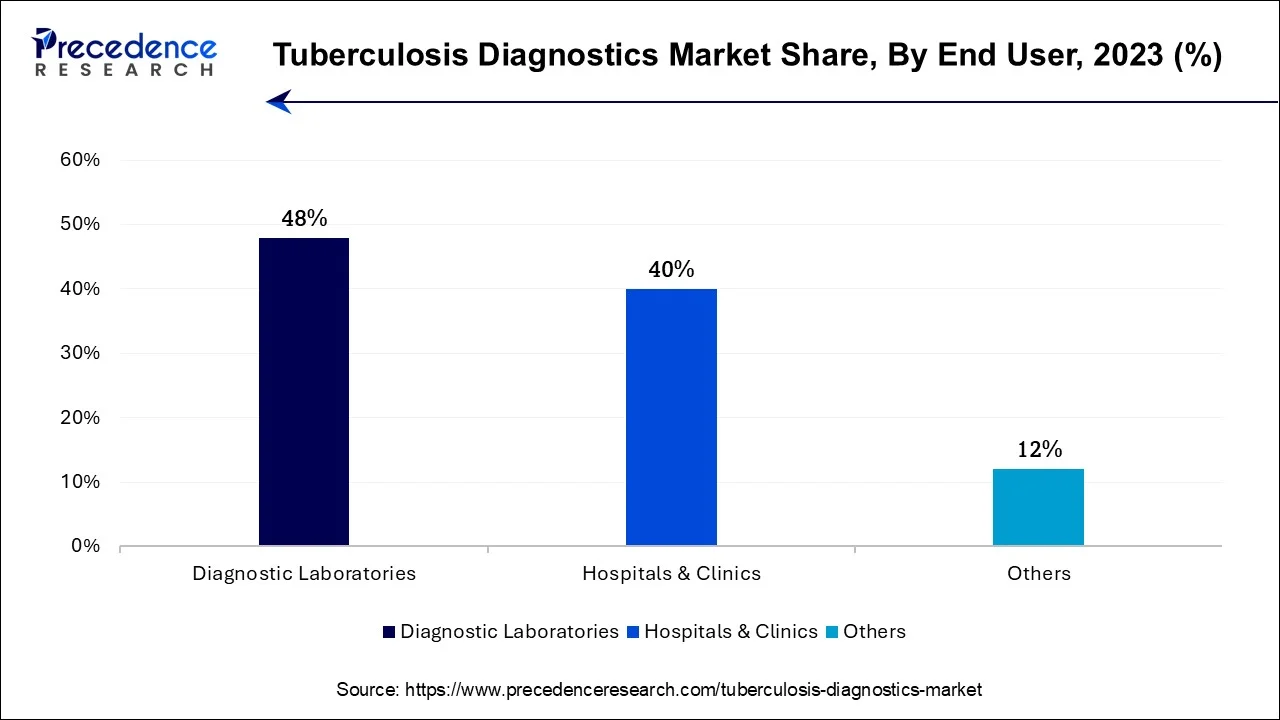

- By end-user, the diagnostic & public health laboratories segment registered its dominance over the market with a share of approximately 49% in 2025.

- By end-user, the hospitals & clinics segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

Fighting TB with Precision: Inside the Market

The U.S. tuberculosis diagnostics market is driven by the continued need for early, accurate detection to control TB transmission, particularly among high-risk and immunocompromised populations. Rising awareness, strong public health surveillance programs, and funding support from government agencies sustain a steady demand for advanced diagnostic solutions. Molecular diagnostics and rapid testing technologies are increasingly preferred due to their speed, sensitivity, and ability to detect drug resistance. Together, these factors position the market as a critical component of the U.S. infectious disease diagnostics landscape.

Key Technological Advancements in the U.S. Tuberculosis Diagnostics Market

Key technological advancements in the U.S. tuberculosis diagnostics market include the development of rapid molecular testing methods, which provide quick and accurate results, significantly reducing the time needed for diagnosis. Advances in genomic technologies have enhanced the detection of drug-resistant strains of TB, allowing for more effective treatment plans. The integration of automated systems and artificial intelligence in diagnostic processes has improved efficiency and reduced the likelihood of human error. Additionally, point-of-care testing devices have emerged, enabling healthcare providers to diagnose TB in remote or underserved areas, improving accessibility to essential healthcare services.

What are the Key Market Trends?

- Increasing adoption of rapid molecular and nucleic acid amplification tests to reduce diagnosis time and improve treatment outcomes.

- Growing focus on detection of latent and drug-resistant tuberculosis to support public health elimination goals.

- Continued reliance on government funding and public health laboratory networks for TB testing programs.

- Integration of TB diagnostics into broader respiratory and infectious disease testing panels.

- Rising emphasis on automation, digital reporting, and laboratory workflow efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 576.00 Million |

| Market Size in 2026 | USD 607.50 Million |

| Market Size by 2035 | USD 968.67 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.34% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Test Type, Disease Stage, and End-User |

Segmental Insights

Test Type Insights

Why are immunological tests dominating the Market?

The immunological tests segment is dominating the U.S. tuberculosis diagnostics market with a share of approximately 41.3%. These tests detect the body's immune response to the Mycobacterium tuberculosis bacteria, providing valuable insights for diagnosis. Their widespread use is attributed to their ability to yield results relatively quickly and their effectiveness in identifying latent TB infections. As a result, immunological tests are essential tools in managing and controlling tuberculosis in various populations.

The molecular diagnostics segment is the fastest-growing segment of the U.S. tuberculosis diagnostics market during the forecast period, driven by its ability to deliver rapid, highly accurate results compared to conventional methods. Technologies such as PCR and nucleic acid amplification tests enable early detection of active and drug-resistant TB, significantly reducing time to treatment initiation. Increasing adoption in public health laboratories and hospital settings is supported by strong government funding and CDC-backed TB control programs. Additionally, ongoing innovation in automated and point-of-care molecular platforms is expanding accessibility and strengthening this segment's growth momentum.

Disease Stage Insights

Why is Latent TB Infection (LTBI) dominating the Market?

The latent TB infection (LTBI) segment dominated the U.S. tuberculosis diagnostics market with the largest share of approximately 62%, driven by extensive screening programs of high-risk groups of patients, including healthcare workers, immigrants, and immunocompromised individuals. The detection of the latent infection early is a social health concern because prompt therapy can avoid the development of the active disease and narrow down the transmission on an extended basis. The extensive application of interferon-gamma release assays (IGRAs) and tuberculin skin tests promotes high-quality screening in clinical and occupational environments. This segment remains on top thanks to powerful government programs and prevention care provisions.

The active TB disease segment is projected to fastest CAGR in the U.S. tuberculosis diagnostics market between 2026 and 2035, due to the increasing clinical concern over prompt diagnosis and treatment of contagious cases. Enhanced knowledge on multidrug-resistant TB and TB co-infection with HIV has led to a high rate of demand for advanced molecular and culture-based diagnostic instruments. To allow the treatment of the disease early and minimize its spread in the community, hospitals and public health laboratories are switching to faster tests that are more sensitive. The increase in this segment is further enhanced by technological development and increased investment in TB elimination programs.

End-User Insights

Why are Diagnostic & Public Health Laboratories dominating the Market?

The diagnostic & public health laboratories segment dominated the U.S. tuberculosis diagnostics market with the largest share of approximately 49%, driven by healthcare workers, immigrants, and immunocompromised individuals. The detection of the latent infection early is a social health concern because prompt therapy can avoid the development of the active disease and narrow down the transmission on an extended basis. The extensive application of interferon-gamma release assays (IGRAs) and tuberculin skin tests promotes high-quality screening in clinical and occupational environments. This segment remains on top thanks to powerful government programs and prevention care provisions.

The hospitals & clinics segment is projected to fastest CAGR in the U.S. tuberculosis diagnostics market between 2026 and 2035, due to the increasing clinical concern over prompt diagnosis and treatment of contagious cases. Enhanced knowledge on multidrug-resistant TB and TB co-infection with HIV has led to a high rate of demand for advanced molecular and culture-based diagnostic instruments. To allow the treatment of the disease early and minimize its spread in the community, hospitals and public health laboratories are switching to faster tests that are more sensitive. The increase in this segment is further enhanced by technological development and increased investment in TB elimination programs.

Market Value Chain Analysis

- R&D

Research and Development (R&D) is the initial stage where new products are conceived and developed. This process involves extensive scientific research to innovate and improve healthcare solutions.

Key players:Cepheid (Danaher), QIAGEN, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Inc., Hologic, Inc., and Revvity (Oxford Immunotec).

- Clinical Trials and Regulatory Approvals

Clinical trials are essential for testing the safety and efficacy of new medications. Once the trials are completed, regulatory approvals from health authorities are required before the products can be marketed.

Key players:Cepheid (Danaher), QIAGEN, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Inc., Hologic, Inc., and Revvity (Oxford Immunotec).

- Formulation and Final Dosage Preparation

Formulation involves creating the final product that will be administered to patients, ensuring the right dose and delivery method. This stage is critical for ensuring the medication's effectiveness and safety.

Key players: Indian Immunological Ltd

- Packaging and Serialization

Proper packaging is necessary to protect the integrity of the product and provide essential information to users. Serialization involves tracking medications through unique identifiers to prevent counterfeiting and ensure patient safety.

Key players: AbbVie

- Distribution to Hospitals, Pharmacies

Once packaged, the product is distributed to hospitals and pharmacies, where it will be available for patients. This ensures timely access to medications across various healthcare settings.

Key players:Thermo Fisher Scientific Inc.

- Patient Support and Services

Patient support services are provided to assist individuals in understanding their treatments and managing side effects. These services help improve adherence to medication regimens and enhance overall patient outcomes.

Key players: HIPRA

Top Companies & Their Offerings in the Market

| Company Key | TB Diagnostics Offerings | Technology Focus | Market Role | Growth/Impact |

| epheid | Not a major listed TB test vendor; known for molecular diagnostic innovation potential | Molecular assay expertise | Emerging contributor through future rapid tests | Limited public TB data available |

| QIAGEN N.V | QuantiFERON-TB Gold Plus IGRA; advanced NGS panels for TB research | IGRA, molecular sequencing | Leader in latent TB screening | Widely adopted in U.S. clinical and public health labs, strengthening screening programs. |

| Becton, Dickinson & Co. | BD MGIT/BACTEC culture systems; support for TB labs | Culture, immuno/molecular tools | Major provider for clinical lab workflows | Drives accurate detection and lab infrastructure |

| (BD) Oxford Immunotec | T-SPOT.TB IGRA (now under Revvity); T-Cell Select automation | ELISPOT IGRA | Important for latent TB diagnostics | FDA-approved automation improves lab throughput (Revvity) |

| Abbott Laboratories | NAAT and immunoassay TB tests (e.g., Determine TB LAM) | Molecular & immunoassay | Expands rapid TB detection | Broadens screening access in clinical settings |

| Roche Molecular Systems, Inc. | COBAS MTB and related PCR assays | PCR molecular diagnostics | Supports rapid TB & drug resistance testing | Investment in point-of-care and advanced PCR solutions |

| Thermo Fisher Scientific Inc | PCR reagents & platforms; T-SPOT portfolio via Oxford Immunotec legacy | High-throughput PCR | Supplies research and clinical labs | Facilitates TB assay integration across laboratories |

| bioMérieux SA | VIDAS TB-IGRA immunoassay; culture instruments | IGRA & culture systems | Strong diagnostics portfolio | Supports both latent and active TB detection |

| Hologic, Inc. | Molecular platforms (Panther Fusion) are adaptable for TB assays | Automated molecular testing | Enhances lab workflow efficiency | Helps scale TB test delivery in high-volume labs |

| DiaSorin S.p.A. |

Immunodiagnostics and molecular assays supporting infectious disease testing |

CLIA/ELISA & molecular | Adds breadth to TB test menus | Contributes via expanded assay technology for infectious disease |

Who are the Major Players in the U.S. Tuberculosis Diagnostics Market?

The major players in the U.S. tuberculosis diagnostics market include epheid, QIAGEN N.V., Becton, Dickinson and Company, (BD) Oxford Immunotec, Abbott Laboratories, Roche Molecular Systems, Inc. , Thermo Fisher Scientific Inc. , bioMérieux SA , Hologic, Inc. , DiaSorin S.p.A. , Hain Lifescience (Bruker), Quest Diagnostics , Labcorp , Creative Diagnostics

Recent Developments in the Market

- In January 2026, A recent report highlights the alarming rise in tuberculosis cases across the globe, prompting public health officials to intensify efforts for early detection and treatment. Experts emphasize the critical need for advanced diagnostic tools and increased funding to effectively combat this persistent health threat.(source: UP to launch 100-day TB patient detection drive from Feb | Lucknow News - The Times of India)

- In January 2026, Over the past decade, we have made significant advancements in making AI-enabled X-ray technology accessible in some of the most remote areas of sub-Saharan Africa, as well as challenging terrains like Everest and rural Southeast Asia. Our efforts focus on improving the detection and diagnosis of tuberculosis (TB) in these underserved regions.(source: Qure.ai secures Gates Foundation grant to advance AI for TB and pneumonia detection - Express Healthcare)

Segments Covered in the Report

By Test Type

- Immunological Tests

- Molecular Diagnostics

- Microbiological/Culture Tests

- Radiographic & Others

By Disease Stage

- Latent TB Infection (LTBI)

- Active TB Disease

By End-User

- Diagnostic & Public Health Laboratories

- Hospitals & Clinics

- Others (Academic/Research)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting