U.S. Oncology Molecular Diagnostics Market Size and Forecast 2025 to 2034

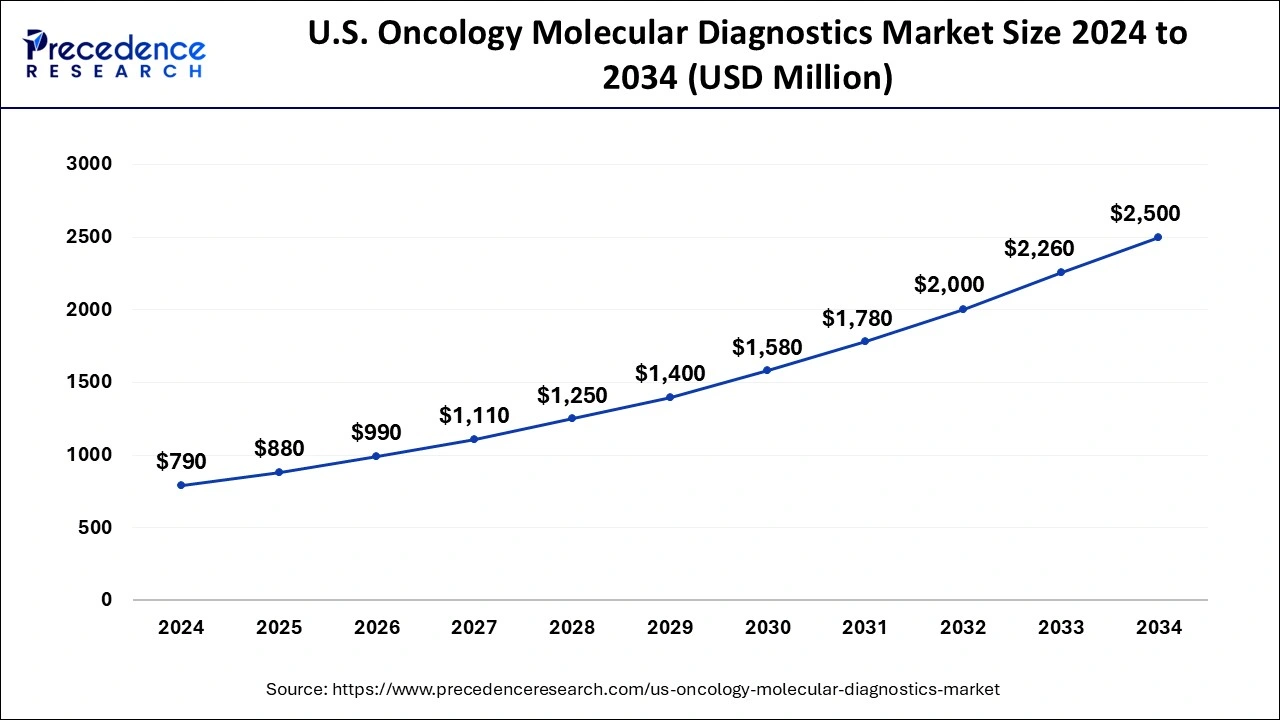

The U.S. oncology molecular diagnostics market size was estimated at USD 790 million in 2024 and is predicted to increase from USD 880million in 2025 to approximately USD 2,500 million by 2034, expanding at a CAGR of 12.21% from 2025 to 2034. The rising burden of cancer in the United States is driving the demand for the oncology molecular diagnostics market.

U.S. Oncology Molecular Diagnostics Market Key Takeaways

- The U.S. oncology molecular diagnostics market was valued at USD 790 million in 2024.

- It is projected to reach USD 2,500 million by 2034.

- The U.S. oncology molecular diagnostics market is expected to grow at a CAGR of 12.21% from 2025 to 2034.

- By type, the breast cancer segment dominated the market in 2024.

- By type, the liver cancer segment is expected to grow at a notable rate in the market during the forecast period.

- By technology, the polymerase chain reaction (PCR) segment held the largest market share in 2024.

- By technology, the sequencing segment is expected to experience significant growth in the market during the forecast period.

- By product, the reagents segment is dominated the market in 2024.

- By product, the instruments segment is expected to grow at a considerable rate during the forecast period.

Market Overview

Oncology molecular diagnostics is used in the detection of proteins, materials, genetics, or the molecule that provide the information about cancer in the body. The rising prevalence of cancer worldwide is driving the adoption of the oncology molecular diagnostic techniques for detecting and analyzing the biochemical features of the cancer cells. The rising awareness about cancer treatment and diagnostics and the technological advancements in the diagnostics process accelerates the growth of the market. The rising prevalence of the cancer in the United States due to the changing lifestyle and higher adoption of the sedentary lifestyle are boosting the growth of the U.S. oncology molecular diagnostics market.

U.S. Oncology Molecular Diagnostics Market Growth Factors

- The rising prevalence of the chronic diseases such as cancer due to the changing lifestyle preferences and aging population that driving the growth of the U.S. oncology molecular diagnostics market.

- The increasing shift in lifestyle, acceptance of sedentary lifestyle increasing consumption of alcohol and smoking, changing environmental conditions, and rising number of geriatric populations are causing the rising burden of the cancer diseases.

- The technological advancements in the healthcare industry and easy adoption of advanced healthcare solutions promote the market's expansion.

- The increasing awareness regarding the treatment and early detection of the cancer for getting preventing treatment and diagnostics are driving the expansion of the market.

- The increasing demand for personalized treatment for effective and early diagnosis of the disease and the increasing demand for point-of-care testing are further propelling the growth of the market.

- The increasing investments on the research and development activities by the U.S. government and major market players in the United States are driving the growth of the U.S. oncology molecular diagnostics market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.21% |

| U.S. Market Size in 2025 | USD 880 Million |

| U.S. Market Size by 2034 | USD 2,500 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Technology, and Product |

Market Dynamics

Driver

The rising advancements in the diagnostics process

The increasing adoption of molecular diagnostics in the treatment and the detection of the cancer that driving the growth of the market. Molecular diagnostic is used for selecting the therapy or treatment based on biomarkers identified from the Transcriptome (mRNA), and tumor's genome (DNA). Molecular diagnostics helps to analyze clear information about the molecular condition of tumor which helps in improvement in the treatment of the patients. Precision medicine helps in treating the patients and helps in improving the quality-of-life patient by understanding the biological condition of their patients. The increasing investments in research and development on molecular diagnostics helps to enhance technologies for the molecular picture of cancer. Thus, the advancements and increasing investments in the diagnostics process that boosts the growth of the U.S. oncology molecular diagnostics market.

Restraint

high cost of diagnostics

The estimated high cost of diagnostic processes for cancer in the United States is observed to hamper the growth of the U.S. oncology molecular diagnostics market. Developing and commercializing new molecular diagnostic tests for cancer involves substantial research and development costs, regulatory requirements, and market access considerations. The high upfront investment and uncertainty surrounding market acceptance may discourage companies from investing in the development of new diagnostic technologies. Some molecular diagnostic tests for cancer may require specialized equipment, expertise, and facilities that are not readily available in all healthcare settings. Patients living in rural or underserved areas may face challenges accessing these specialized testing centers, leading to disparities in diagnostic testing and treatment outcomes.

Opportunity

Rising emphasis on precision solutions

The development in cancer medication as a shift in the personalized or precision solutions for better results and treatment outcomes is observed to expand the overall molecular diagnostics market in the United States. Precision oncology emphasizes the customization of cancer treatment plans based on the individual molecular characteristics of a patient's tumor. Molecular diagnostics play a crucial role in identifying specific genetic mutations, biomarkers, and molecular signatures associated with cancer subtypes, drug responses, and disease progression. As the demand for personalized medicine continues to grow, there is increasing reliance on molecular diagnostics to guide treatment decisions and optimize patient outcomes.

Type Insights

The breast cancer segment dominated the U.S. oncology molecular diagnostics market with the largest share in 2024. The rising prevalence of breast cancer due to the damage, mutation, and DNA in breast cells. Cancer cells start to grow in the milk producing lobules of the breast that further causes breast cancer, especially in females. Molecular diagnostics play a crucial role in breast cancer screening and early detection. Tests such as BRCA gene mutation testing and HER2/neu testing help identify individuals at increased risk of developing breast cancer or those with specific molecular subtypes of the disease. Early detection enables timely intervention and improves patient outcomes.

- The breast cancer is majorly impacted females with approximately 99% and 0.5-1% in the males. The increasing integration of the next-generation sequencing technologies for improving the genetic profiling drives more effective diagnosis for breast cancer.

The liver cancer segment is expected to grow at a notable rate in the U.S. oncology molecular diagnostics market during the forecast period. The liver cancer is the fastest growing type of cancer in the United States. Cancer in liver, and cancer in bile ducts of liver are the two major types of liver cancer. The rising the acceptance of the sedentary lifestyle is causing the higher number of liver cancer in the U.S. population. Molecular diagnostics helps in the early detection and the treatment of the diseases that boosts the adoption of the market.

Technology Insights

The polymerase chain reaction (PCR) segment held the largest share in the U.S. oncology molecular diagnostics market in 2024. The growth of the segment is attributed to the rising adoption of the polymerase chain reaction (PCR) into the diagnosis method for the cancer for better and accurate results. Polymerase chain reaction (PCR) is one of the advancements in the technologies for the detection of several cancers. The technological evolution in the polymerase chain reaction (PCR) are digital PCR, and quantitative PCR (qPCR) that improves the quality of precision and accuracy in the detection of cancer specific genetics.

The sequencing segment is expected to experience a significant growth in the U.S. oncology molecular diagnostics market during the forecast period. Next-generation sequencing is one of the important methods for detecting and diagnostics of cancer and redefining cancer treatment from past several years. The rising investments in the research and development activities in sequencing technologies for the improvement and accuracy in the cancer related genetics alteration promotes the segment's growth. The advancements in sequencing technologies are driving the growth in the adoption of oncology molecular diagnostics.

Product Insights

The reagents segment is dominated the market in 2024. The growth of the segment is attributed to the rising adoption of reagents for the diagnostics and testing in cancer research. The rising development in biotechnology, molecular biology technology, and synthetic biology that driving the demand for the segment. Additionally, the rising investments in research and development activities by the biotech companies for the development of the diagnostics process further boosts the growth of the segment in the market.

The instruments segment is expected to increase its U.S. oncology molecular diagnostics market growth during the predicted period. The rising demand for the diagnostics specialized instruments and devices for the genetic and molecular analysis that boosting the demand for the instruments segment. The diagnostics instruments include PCR machines, and DNA sequencers are the major instruments or devices that help in the analyzing and processing of biological samples for the detection of genetic abnormalities with cancer.

U.S. Oncology Molecular Diagnostics Market Companies

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.

- Agilent Technologies, Inc.

- Danaher Corporation (Cepheid)

- Hologic, Inc.

- Foundation Medicine, Inc.

Recent Developments

- In April 2024, Naveris, Inc., a leading provider of precision oncology diagnostics for viral-induced cancers launched Phase II clinical study in minimal residual disease positive (MRD+) HPV-driven neck and head cancer with the leading cancer research and institution Memorial Sloan Kettering Cancer Center (MSKCC).

- In July 2022, a next-generation molecular diagnostics organization, BillionToOne, launched Northstar Select and Northstar Response, its first liquid biopsy products.

- In April 2024, Envisagenics, an artificial intelligence driven biotechnology organization announced the launch of its journal Molecular Systems Biology the study is the evaluation of the organization's SpliceCore AI/ML platform in Triple Negative Breast Cancer (TNBC).

- In April 2024, Genetic Technologies Limited, a leading global provider of genomics-based test in wellness, health, and serious disease announced the launch of company's precision oncology division and the portfolio of the latest diagnostics tests under the gene Type precision oncology brand.

- In April 2024, Labcorp, a leading brand in the innovative and comprehensive laboratory services launched the Labcorp Plasma Detect™, a clinically authorized tumor-informed molecular residual disease (MRD) and whole-genome sequencing circulating tumor DNA (ctDNA) solution for the early stage of colon cancer patients with the higher risk after the surgery or adjuvant chemotherapy (ACT).

- In April 2024, TwinStrand Biosciences, a leading player in Duplex Sequencing technology that delivers the precise results to researchers from the applications from genetic toxicology to residual cancer detection announced the acceptance of standard project submission form (SPSF) from the company for Economic Cooperation and Development (OECD).

Segment Covered in the Report

By Type

- Breast Cancer

- Liver Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical Cancer

- Lung Cancer

- Blood Cancer

- Kidney Cancer

- Other Cancer

By Technology

- PCR

- Sequencing

- In Situ Hybridization

- INAAT

- Chips and Microarrays

- Mass Spectrometry

- TMA

- Others

By Product

- Reagents

- Instruments

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content