What is the U.S. Clinical Trials Market Size?

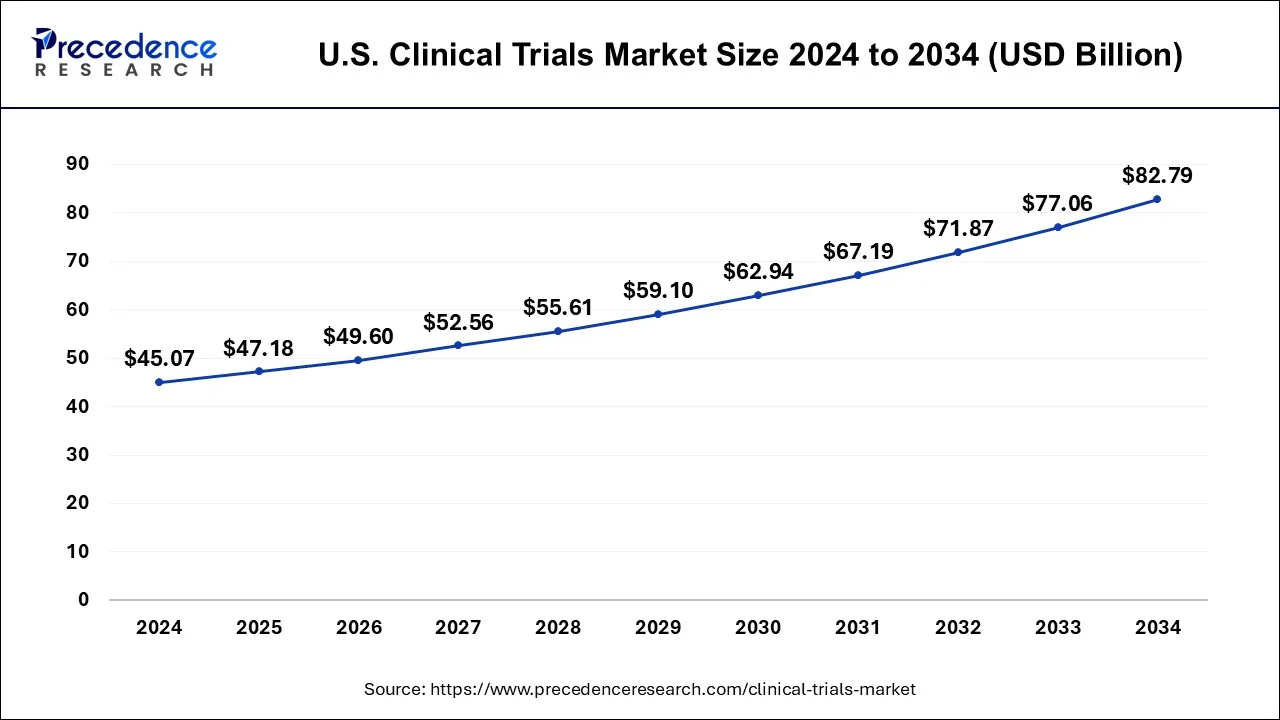

The U.S. clinical trials market size is calculated at USD 47.18 billion in 2025 and is predicted to increase from USD 49.60 billion in 2026 to approximately USD 88.16 billion by 2035, expanding at a CAGR of 6.45% from 2026 to 2035.

Key Takeaways

- On the basis of phase, the phase III segment accounted largest revenue share of more than 54% in 2025.

- On the basis study design, the interventional segment contributed the largest revenue share and is expected to dominate the market from 2026 to 2035.

- On the basis of indication, the oncology segment captured the largest share of around 26% in 2025.

US Clinical Trials Market Overview

Clinical trials are a type of clinical research method that is guided by a specific protocol, which is carefully designed to resolve a specific patient care issue. Clinical studies are separated into five phases, each of which serves a specific purpose within the clinical trial. The clinical trials market is expanding due to factors such as the rising prevalence of chronic diseases, rising number of clinical trials in developing regions, increasing incidence of biologics, rapidly increasing demand for advanced treatments such as personalized medicines, viral disease outbreaks, rising cancer cases globally, rising geriatric population, and rising R&D expenditure.

How is AI Influencing the Market?

Artificial Intelligence (AI) is significantly impacting the U.S. clinical trials market by improving patient recruitment, optimizing study designs, and accelerating data analysis for faster, more accurate outcomes. Advanced machine learning algorithms help identify suitable participants and predict potential risks, reducing trial costs and timelines. Furthermore, AI-enabled tools support real-time monitoring and personalized treatment approaches, enhancing the overall efficiency and effectiveness of clinical research.

Key Market Trends

- The growing prevalence of chronic and infectious diseases in the U.S. offers opportunities for researchers to develop new diagnostic tests, tools, vaccines, and drugs for early detection, prevention, and treatment.

- Increasing R&D investments for the development of innovative medications are expected to propel market growth in the upcoming years.

- The need for well-established contract research organizations for outsourcing clinical trials is expected to fuel the market growth over the forecast period.

- The market is also experiencing rapid advancements in technology and personalized medicine, which are driving the development of more targeted and effective therapies.

Market Outlook

- Market Growth Overview: The U.S. clinical trials market is growing rapidly, fueled by rising demand for innovative therapies, technological advancements in trial design, and increasing prevalence of chronic and lifestyle diseases. Supportive regulatory frameworks and enhanced investment in healthcare research further drive market expansion.

- Major Investors:Major investors in the market include pharmaceutical companies, contract research organizations (CROs), and venture capital firms focused on healthcare innovation. They contribute by funding clinical studies, supporting R&D infrastructure, and accelerating the adoption of advanced technologies for efficient trials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 47.18 Billion |

| Market Size in 2026 | USD 49.60 Billion |

| Market Size by 2035 | USD 88.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.45% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Phase, By Study Design, By Indication |

US Clinical Trials Market Dynamics

Drivers

Increased demand for clinical trial outsourcing

As the need for novel pharmaceuticals and enhanced medical technology rises, the demand for efficient, fast-paced, and trustworthy clinical trial programs also increases. Furthermore, the medicine development process is extremely risky for biotechnology and pharmaceutical companies, with substantially lower approval rates and associated high costs. As a result, it was concluded that outsourcing the clinical trials program to numerous contract research organizations (CRO) would save the pharmaceutical business time and money. Along with this, the spike in demand for clinical trial outsourcing is fueling the clinical trials market development throughout the forecast period.

Restraints

Expensive clinical trials procedures

The clinical trials market offers expensive services. Market labor expenses are a restraining factor for market expansion throughout the projection period. Patenting and contracting for clinical trials is a difficult procedure. As a result, labor costs in the clinical trials industry are high. Cost is a concern since it affects demand in a few markets. Clinical trial services should be cost-effective in most organizations. The high cost, on the other hand, boosts the overall operating costs of the industry. As a result, the high cost of clinical trials is limiting the clinical trials market's growth over the forecast period.

Opportunities

Technological advancements in predictive analytics and artificial intelligence

Several companies are already utilizing predictive analytics techniques such as artificial intelligence and machine learning to build models and provide suggestions. With the growing accessibility of health data to clinical trial investigators, predictive analytics tools can be utilized in clinical trial design to identify patient characteristics that are more likely to react to a particular treatment pattern, growing success rates, and lowering risk in large, multi-center clinical trials. As a result, the increasing usage of predictive analytics is opening up attractive prospects for market growth throughout the forecast period.

Segment Insights

Phase Insights

The U.S Clinical Trials are segmented into Phases I, II, III, and IV. The largest revenue share of more than 53% was for Phase III. The factor contributing to this is that the phase is most crucial as it involves 300-3000 participants and has a longer treatment period. This makes the Phase most expensive. Following this, Phase II is considered the second most expensive phase. Efficacy studies are carried out in Phase II trials. This phase also finalized the dose. Increasing investment in R&D by industry and non-industry sponsors is expected to increase the market growth of Phase II trials. For instance, there are 43 therapeutics under Phase II for COVID-19.

Study Design Insights

The U.S Clinical Trials are segmented into interventional and observational. The interventional segment acquired the largest revenue share and is expected to dominate the market over the forecast period. The direct impact of the treatment and preventive measures, that can be taken to treat a disease, are estimated by using interventional methods. The weakness and strengths of a clinical trial are identified with the help of interventional designs. Furthermore, the rising occurrence of emerging viral infections and continuous technological advancements in clinical trials are important reasons for interventional studies' high revenue share.

Indication Insights

The U.S Clinical Trials are segmented into oncology, autoimmune, pain management, CNS conditions, obesity, cardiovascular, and diabetes. The largest share of the market is accounted by the oncology segment. The factor responsible for the growth is the growing cases of cancer. Thus, the largest amount is spent on oncology clinical trials. For instance, according to the report by US FDA, USD 38 billion and more is spent on the development of drugs for various cancer diseases by pharmaceutical companies. Cardiovascular illnesses are one of the diseases exhibiting a progressive increase in incidence globally.

Modern lifestyle changes are boosting the growth of CVD. These cardiovascular conditions can result in myocardial infarction, stroke, and heart attacks. According to the WHO (World Health Organization), strokes and heart attacks account for four of the five cardiovascular diseases (CVD)-related fatalities.

Country-Level Analysis

The U.S clinical trials market is currently experiencing rapid growth, driven by factors such as advancements in technology and an increasing emphasis on patient-centric approaches. Regulatory bodies in the U.S. are keeping pace with rapid innovation, enabling the introduction of novel therapies and treatments. This approach improves trial efficiency, accelerates patient recruitment, and enhances study outcomes. Researchers are increasingly tailoring studies to specific patient populations, supporting more targeted interventions and aligning with the broader goals of precision medicine, which together are expected to further drive innovation and growth in the clinical trials market.

US Clinical Trials Market Companies

- Parexel International Corp.

- Charles River Laboratory

- PRA Health Sciences

- Wuxi AppTec

- Eli Lilly and Company

- Novo Nordisk A/S

- Clinipace

- Omnicare

- Kendle

- Chiltern

Recent Developments

- In September 2025, IQVIA (U.S.) launched a new analytics tool designed to streamline trial management and improve data accuracy. This tool is expected to provide sponsors with real-time insights, thereby facilitating quicker decision-making and potentially reducing trial timelines. The emphasis on data-driven solutions indicates a broader industry trend towards leveraging technology to enhance operational efficiency. (Source: iqvia.com)

- In August 2022,Eli Lilly, and Company's (NYSE: LLY) Phase 3 monotherapy trials in atopic dermatitis (AD) revealed that experimental lebrikizumab delivered significant and long-lasting improvements in skin clearance.

- In April 2021, ERT, a supplier of clinical endpoint data solutions, announced its complete union with Bioclinica, a technological and scientific leader in clinical imaging. The goal of the combination is to deliver best-in-class technology, scientific and clinical knowledge, and digital innovation. This strategy enabled the organization to expand its business and service offerings across many therapeutic areas. However, the combined company was renamed Clario in November 2021.

Segments Covered in the Report

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional

- Observational

By Indication

- Oncology

- Autoimmune

- Pain Management

- CNS Conditions

- Obesity

- Cardiovascular

- Diabetes

Get a Sample

Get a Sample

Table Of Content

Table Of Content