U.S. Clinical Trial Management System Market Size and Forecast 2025 to 2034

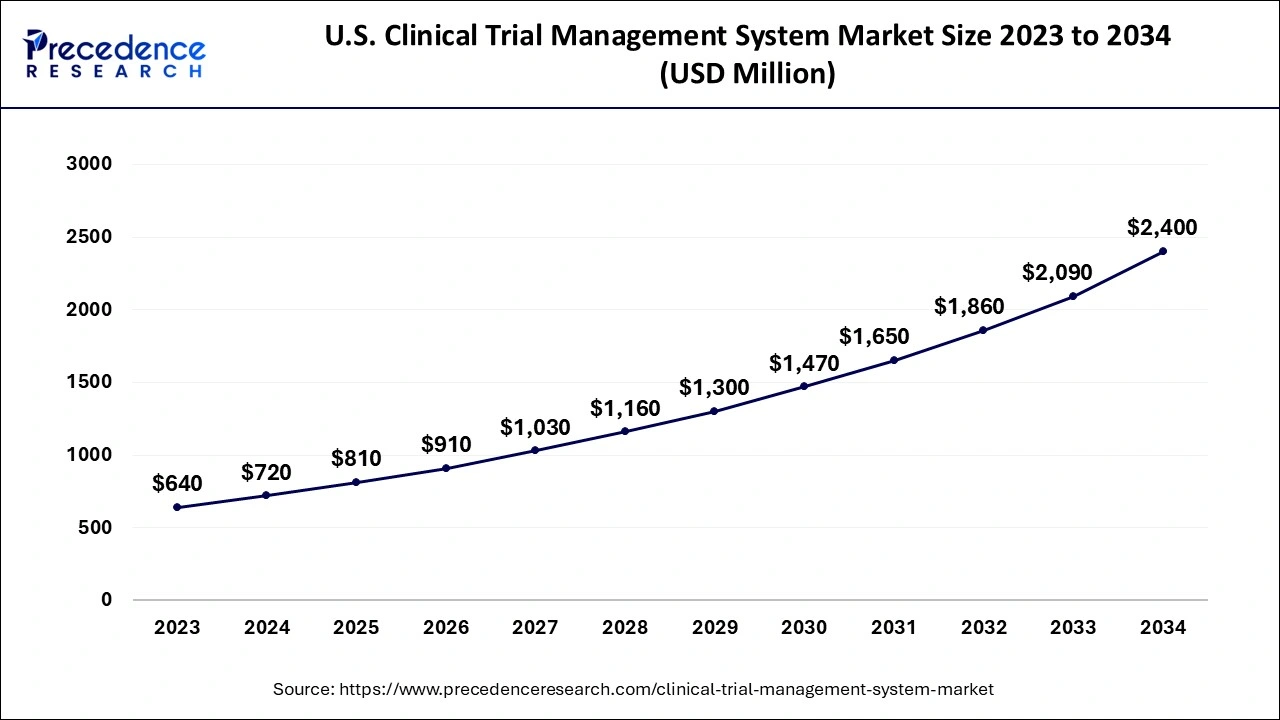

The U.S. clinical trial management system market size accounted for USD 720 million in 2024 and is predicted to increase from USD 810 million in 2025 to approximately USD 2,400 million by 2034, expanding at a CAGR of 12.79% from 2025 to 2034. The U.S. clinical trial management system market is growing due to ongoing increases in R&D investment, growing complexities in clinical trials, evolving regulatory requirements, the continuing progress of the digitization that is taking place in healthcare, and the rising burden of chronic disease across the globe.

U.S. Clinical Trial Management System Market Key Takeaways

- By type, the enterprise segment dominated the market in 2024.

- By type, the site segment is seen to grow at the fastest CAGR during the forecast period.

- By delivery mode, the web-based CTMS segment captured the biggest market in 2024.

- By component, the software segment led the market in 2024.

- By component, the services segment is seen to grow at the fastest CAGR during the forecast period.

- By end user, the pharmaceutical companies segment held the highest market in 2024.

- By end user, the clinical research organization segment is expected to expand at a notable CAGR over the projected period.

How is Artificial Intelligence Revolutionizing Clinical Trial Management Systems in United States?

Artificial intelligence is revolutionizing clinical trial management systems (CTMS) in multiple ways by improving patient recruitment, data accuracy, and overall trial efficiency. AI automates routine and repetitive tasks in CTMS, such as data entry, document management, and regulatory compliance checks. It's incumbent use and improvements in patient recruitment are best illustrated by the 2024 use of an AI-enabled patient matching process in an oncology trial by Pfizer and Tempus AI. A recent example from Deep 6 AI involves the Mayo Clinic utilizing AI to identify eligible trial patients, sometimes in real-time, which can help mitigate recruitment delays.

AI can also be utilized for predictive analytics and real-world data ingestion to ensure that trial designs are driven by the best available data and support better decision-making. The FDA is also encouraging the use of AI-based tools, with multiple recommendations on the adoption of AI, including the issuance of their draft guidance on AI in the drug development process in 2024. AI-powered CTMS platforms are tackling website deviations and monitoring compliance for site visits. AI-powered CTMS also analyzes patient data to identify and recruit suitable candidates for clinical trials.

Market Overview

The U.S. clinical trial management system market comprises platforms and software solutions used to plan, manage, monitor, and track clinical trials across their lifecycle, from study startup and site selection to subject tracking, regulatory document management, and reporting. CTMS platforms streamline operations, enhance collaboration between stakeholders (sponsors, CROs, investigators), and ensure compliance with regulatory standards such as ICH-GCP, FDA 21 CFR Part 11, and EU CTR. These systems are widely adopted by pharmaceutical and biotechnology companies, CROs, academic research centers, and medical device firms to improve data visibility, cost control, and trial efficiency.

U.S. Clinical Trial Management System Market Growth Factors

- Increasing Clinical Trials: The rise in the volume of clinical trials, driven by escalating chronic diseases and drug development, ultimately creates a greater need for effective CTMS solutions to manage the complexities of trial operations.

- Rise of Cloud-based Platforms: Cloud-based CTMS facilitates scalability, remote access, real-time monitoring, and enhanced data security, encouraging organizations to shift away from traditional solutions with limited capabilities for trial oversight and collaboration.

- Regulatory Compliance Pressure: Increased pressure to adhere to strict regulatory compliance frameworks, such as FDA drives the preferable use of CTMS tools that help ensure compliant, standardized, and auditable documentation in clinical trials.

- Growing Outsourcing to Contract Research Organizations: Many pharmaceutical companies are outsourcing their trials to Contract Research Organizations (CROs), which further underscores the need for CTMS platforms to manage a single source of truth for trial project tracking, budgets, and communication.

- Integration with Emerging Technologies: CTMS systems are becoming more integrated with other advanced technologies, such as AI, machine learning, and real-time analytics, to better support trial actors, aid in trial planning, patient recruitment, and trial monitoring, making the systems more attractive, intelligent, and efficient from the sponsor's perspective.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,400 Million |

| Market Size in 2025 | USD 810 Million |

| Market Size in 2024 | USD 720 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.79% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Delivery Mode, Component, and End-User |

Market Dynamics

Drivers

How is the Shift Toward Virtual Trials Driving CTMS Adoption?

The accelerating shift to virtual trials is a key factor boosting the growth of the U.S. clinical trial management system market. Virtual trials depend heavily on the use of digital platforms for managing remote patient participation (including telemedicine), data collection, and monitoring. CTMS tools facilitate multi-site and multi-country logistical coordination, enabling sponsors and CROs to manage multiple workflows while maintaining compliance. Regulatory entities, including the FDA and EMA, are advocating for a more digital-first approach to clinical trials. Organizations are increasingly leveraging CTMS solutions to organize operations and data related to trials, providing sponsors and CROs with greater transparency and oversight of decentralized environments, leading to continued progress in the marketplace.

How Does the Increasing Complexity of Clinical Trials Drive CTMS Adoption?

Modern clinical trials are intricate, involving multi-site coordination, adapting protocols, and regulatory hurdles, often relying on manual methods and diverse data sources. Manual management, considering these complex elements, especially across sites, increases costs in terms of time, money, and overall complexity for sponsors. CTMS platforms provide centralized data tracking throughout trials, along with reporting and real-time data insights, and facilitate integration with EDC, eTMF, and other tools, aiding in the control of trial phases. Given the need for enhanced stakeholder collaboration among sponsors, CROs, regulators, and research sites, CTMS is likely to maintain its importance over the long term.

Restraint

Is High Implementation Cost Stalling CTMS Adoption?

One of the major barriers in the U.S. clinical trial management system market is the high costs associated with the implementation and ongoing maintenance of CTMS. Small and mid-size pharma and biotech firms face challenges due to the upfront capital required for software licenses, training, IT infrastructure, and customization. Ongoing costs for support and compliance also pose issues. These factors can deter organizations with limited budgets from upgrading their CTMS or even using one at all, leading them to rely on outdated manual processes that hinder improvements and data accuracy.

Does Data Privacy Compliance Present a Large Burden?

Stringent regulations for patient data protection, such as HIPAA in the U.S., create significant constraints for both CTMS vendors and user organizations. Clients often delay essential clinical activities while CTMS companies manage legal data protection requirements, addressing concerns about data breaches or penalties for non-compliance with these requirements. Consequently, client organizations must integrate privacy requirements into CTMS design, which can limit the scalability of CTMS and hinder cross-border clinical trial conduct, especially in multinational trials where data protection rules and costs vary significantly.

Opportunity

Is Decentralized Trial Adoption Framing a New Era for CTMS Growth?

The increasing adoption of decentralized clinical trials (DCTs) creates immense opportunities in the U.S. clinical trial management system market. With the FDA's acceptance of remote monitoring, eConsent, and home-based trials, CTMS platforms must evolve to support hybrid and fully virtual trials. In April 2024, Medidata enhanced its CTMS platform by integrating wearables and remote data capture tools to improve trial efficiency and patient outreach and retention. Similarly, Oracle's partnership with ObvioHealth aims to streamline decentralized trial execution through the use of dashboards and centralized remote site management. With over 1,300 DCTs registered worldwide in the past year, CTMS providers investing in remote site coordination, mobile integrations, and telehealth capabilities are well-positioned to adapt to new trial demands and regulatory changes.

Type Insights

What Made Enterprise the Dominant Segment in the Market in 2024?

The enterprise segment continues to dominate the market because it caters to large organizations conducting multiple clinical trials across multiple sites worldwide. The data flow across departments in enterprise-wide CTMS systems integrates all interrelated departments, creates audit readiness, and enables streamlined budgeting and resource planning. Pharmaceutical companies prefer deploying enterprise-wide CTMS because they want consistent trial operations, compliance, and communication with the sponsor and the CROs.

On the other hand, the site segment is expected to expand at the highest CAGR in the coming years as clinical trial sites and academic centers are seeking control over local study operations. Securing the necessary components and processes for trial investigators to complete their site-level initiatives to manage their local study operations effectively. Decentralized trials have become a focus area, pushing the global volume of clinical trials to new levels, resulting in the need for systems designed for individual sites to be delivered and operated autonomously, yet with visibility.

Delivery Mode Insights

How Did the Web-based CTMS Segment Dominate the U.S. clinical trial management system market in 2024?

The web-based CTMS segment dominated the market while holding the largest share in 2024 due to the ongoing number of R&D programs in the nation. The deployment of web-based CTMS has increased due to the growing concerns over data security. This system offers balanced accessibility and data security, which are ideal for multi-center trials. Web-based CTMS solutions require a web browser to access trial data, eliminating the need for additional infrastructure. These solutions can be easily integrated with existing IT infrastructures, simplifying operations and maintenance.

The cloud-based CTMS segment is expected to grow at the highest CAGR during the forecast period. This is mainly due to the increasing demand for cost-effective and flexible solutions. Cloud-based CTMSs are becoming increasingly prominent as they enable organizations to engage in real-time collaboration and share perspectives through a decentralized research network. Since cloud systems require minimal IT infrastructure, they are particularly attractive to start-ups and academic centers. They are scalable and can be scaled up quickly. Cloud systems work well with e-source, e-consent, and patient-reported outcomes tools that support modern trials with an overall patient-centric strategy.

Component Insights

How Did the Software Segment Dominate the Market in 2024?

The software segment dominated the U.S. clinical trial management system market in 2024, under which enterprise CTMS held the largest revenue share as a sub-segment. This is primarily due to the essential role of enterprise CTMS software in enhancing trial planning, tracking budgets, monitoring site performance, and ensuring regulatory compliance. With its advanced functionalities, including real-time analytics, automated alerts, and centralized data access, the software has become a must-have for sponsors and CROs in their efforts to improve trial efficiency.

Enterprise CTMS software is heavily used by the largest pharmaceutical companies and CROs, with clinical trials typically having multi-sites and large scale. Enterprise CTMS solutions offer end-to-end visibility of trials, featuring index-level data integration and a customizable architecture to manage complex operations across multiple geographies.

On the other hand, the services segment is seen to grow at the fastest rate during the forecast period.

End User Insights

Which End-User Dominated the Market in 2024?

The pharmaceutical companies segment dominated the U.S. clinical trial management system market in 2024. Pharmaceutical and biotech companies are the largest end-users, as they play a direct role in sponsoring clinical trials at all stages. CTMS holds direct value for these organizations in managing site networks, GCP compliance, study budgets, protocols, and timelines. As drug pipelines continue to grow and the demands from the regulated environment become more complex, the necessity to have a robust, scalable CTMS becomes imperative to maintain quality and accelerate timelines.

The clinical research organization segment is expected to grow at the fastest CAGR over the projection period because these organizations have become better equipped to participate in investigator-led clinical trials and public-private research. With the growth of grant-funded clinical trials and non-commercially motivated research, these organizations seek CTMS platforms that offer enhanced visibility, improved compliance, and streamlined study reporting. The rising government investments in research and development further support segmental growth.

Country-level Analysis

The U.S. is a major contributor to the U.S. clinical trial management system market within North America. This is mainly due to the increasing volume of clinical trials. US-based vendors, including Oracle and Medidata, lead the space by integrating AI modules, ensuring regulatory compliance (FDA CFR 21 Part 11), and offering large-scale, scalable CTMS platforms that can accommodate both CROs and pharmaceutical companies, thereby enhancing operational efficiencies.

U.S. Clinical Trial Management System Market Companies

- Medidata Solutions (Dassault Systèmes)

- Oracle Health Sciences

- Veeva Systems

- IBM Watson Health

- IQVIA

- Bio-Optronics (Now part of Advarra)

- RealTime Software Solutions

Recent Developments

- In May 2025, Veeva announced the launch of a research site-focused Clinical Trial Management System (CTMS) to streamline trial execution, offering built-in workflows, real-time collaboration, and seamless integration with trial sponsors and CROs.

(Source: https://www.veeva.com) - In April 2025, Cloudester unveiled its advanced eCTMS platform designed to transform clinical trial management through real-time monitoring, enhanced automation, and data-driven decision-making to increase efficiency and ensure protocol adherence.

(Source: https://www.wjbf.com)

Segments Covered in the Report

By Type

- Site

- Enterprise

- By Delivery Mode

- Web-based CTMS

- Cloud-based CTMS

- On-premise CTMS

By Component

- Software

- Services

By End-User

- Pharmaceutical Companies

- Clinical Research Organization

- Health Care Providers

- Biopharmaceutical Companies

Get a Sample

Get a Sample

Table Of Content

Table Of Content