What is U.S. Retail Clinics Market Size?

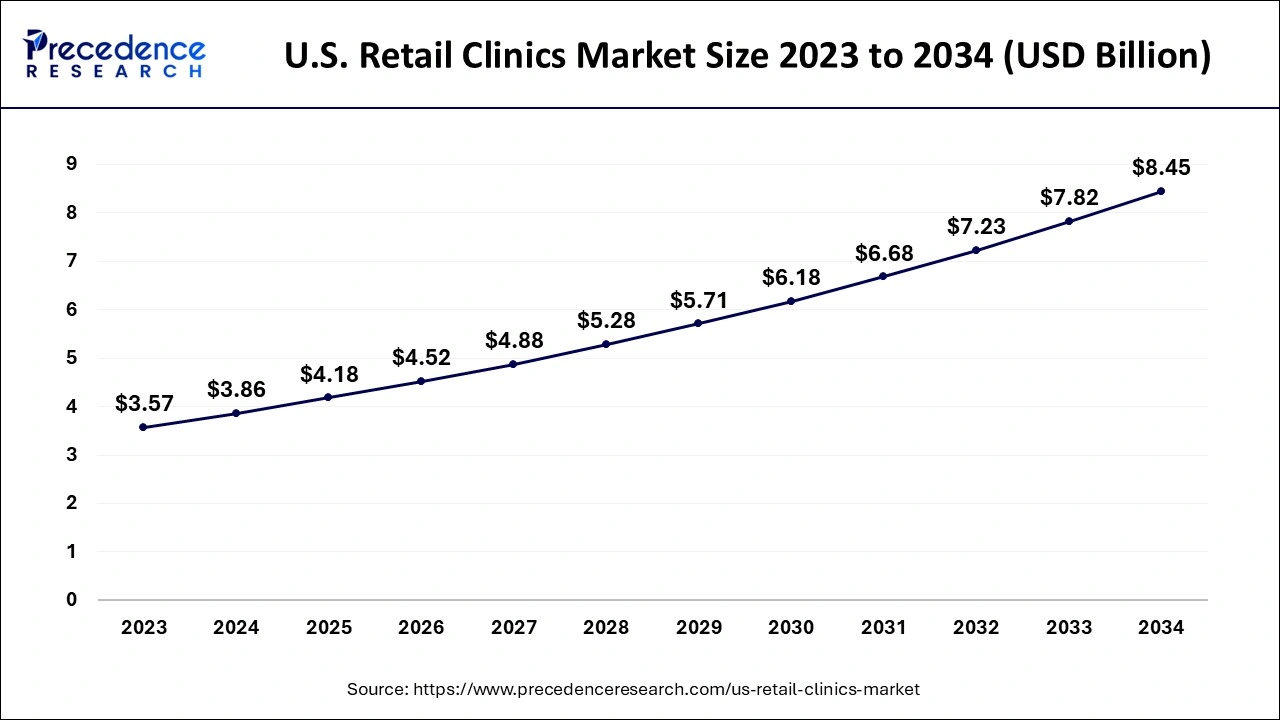

The U.S. retail clinics market sizeis estimated at USD4.18billion in 2025 and is predicted to increase from USD 4.52 billion in 2026 to approximately USD8.45billion by 2034, expanding at a CAGR of 8.15% from 2025 to 2034. The rapid evaluation of the healthcare industry in the United States and the demand for faster treatment, providing healthcare solution,s drive the growth of the U.S. retail clinic market.

Market Highlights

- The western region will witness significant growth in the market during the forecast period.

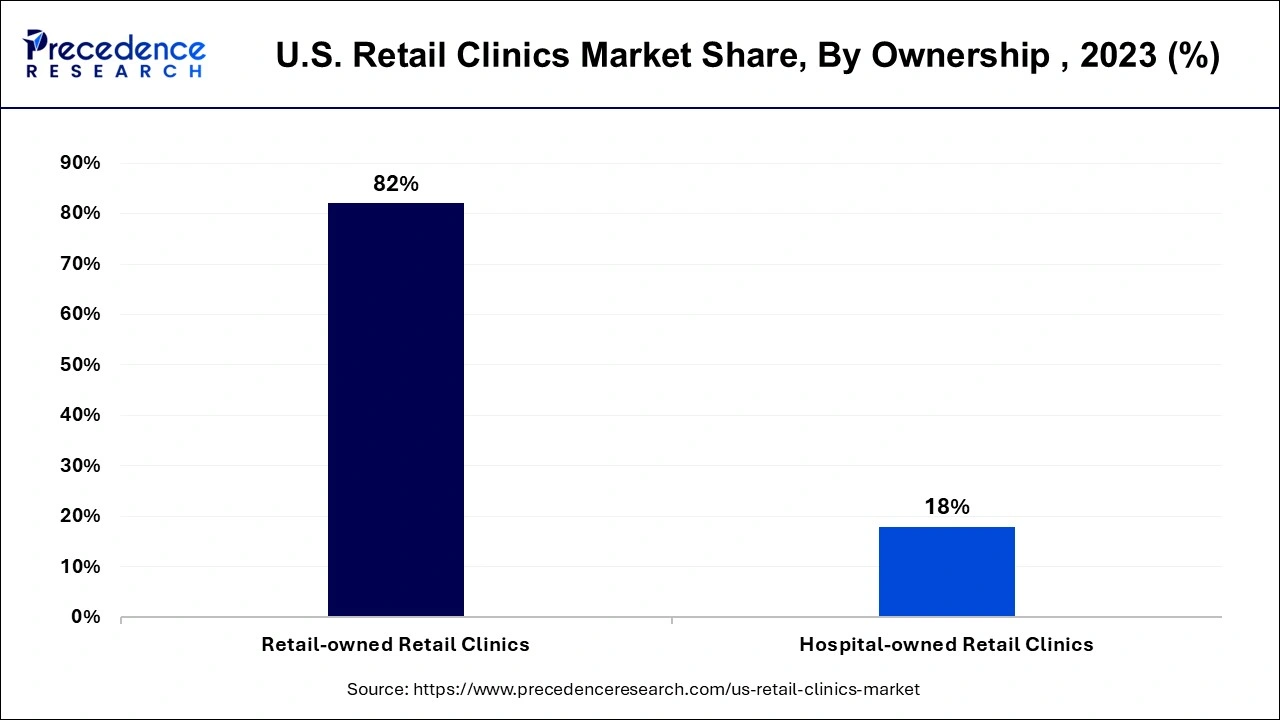

- By ownership, the retail-owned segment dominated the market in 2024.

- By ownership, the hospital-owned segment is predicted to witness significant growth in the market over the forecast period.

- By application, the point-of-care segment led the market in 2024.

- By distribution channel, the drug stores segment registered its dominance over the market in 2024.

- By distribution channel, the retail pharmacies segment will witness significant growth in the market during the forecast period.

Market Overview

Retail centers are emerging healthcare centers that are located in retail locations such as grocery stores, pharmacies, and department stores. These healthcare centers are specially designed for manageable or non-emergent health conditions. The clinics are well equipped with all the necessary medical devices and nursing facilities, and the physician's assistants are certified to treat non-life-threatening conditions and injuries. These clinics are considered the most cost- and time-efficient alternative to the traditional type of healthcare setting.

How Can AI Impact the U.S. Retail Clinics Market?

The integration of AI into healthcare is revolutionizing the industry with greater precision in treatment, healthcare devices, or instruments and improves patient outcomes. Artificial Intelligence in retail clinics is significantly changing the area of healthcare. AI and automation are increasing the personalization and diagnostic accuracy in patients with the help of advanced data and machine learning algorithms. Further investment in technological advancements in healthcare is improving the quality and efficiency of healthcare services in retail clinics.

- In November 2023, Forward, a primary care player, launched the AI-based self-serve CarePods for screening and diagnosis of health conditions. The CarePods will be installed in gyms, malls, and offices, which will be starting in New York, the San Francisco Bay Area, Philadelphia, and Chicago in the United States.

U.S. Retail Clinics Market Growth Factors

- Increasing demand for healthcare services: The rising demand for healthcare services in the United States due to the rising aging population and the increase in the disease rate due to aging and infections are accelerating the demand for efficient and accessible sources of healthcare settings.

- Rising awareness of vaccination: The increasing awareness regarding vaccination for newborns as well as for adults due to the rising number of chronic and infectious diseases spread in the country is driving the adoption of retail clinics.

- Healthcare spending: The rise in healthcare spending by the country's population and the government for the well-being of their population and further continued research and development in the healthcare industry is accelerating the growth of the U.S. retail clinics market.

- Growing respiratory conditions: Acute respiratory disease is a life-threatening disease that is majorly caused by stiff lungs. It causes lung swelling due to the fluid, which makes tiny air sacs in the lungs. Retail clinics provide emergency treatment for the condition in a number of ways, such as by providing oxygen and ventilation, medications, and others.

U.S. Retail Clinics Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising incidences of numerous chronic diseases coupled with rapid investment by government for strengthening the healthcare sector.

- Major Investors: Numerous healthcare companies are actively entering this market, drawn by collaborations, R&D and business expansions. Various market players such as CVS Health, Kroger Health, Walgreens, Advocate Health Care and some others have started investing rapidly for opening new healthcare clinics across the U.S. region.

- Startup Ecosystem: Various startup brands are engaged in providing high-quality healthcare services in the U.S. The prominent startup brands dealing in retail clinics includes NexHealth, Devoted Health, Inc., Modern Fertility and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.18 Billion |

| Market Size in 2026 | USD 4.52 Billion |

| Market Size by 2034 | USD 8.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.15% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ownership, Application, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Drivers

Rising awareness about health in the population

The increasing awareness about the healthcare and healthcare facilities in the country and the rising spending culture on self-well-being are contributing to the expansion of the U.S. retail clinics market. Retail clinics are an efficient alternative to the traditional type of medical settings, which provide essential treatment for non-emergent type of conditions like flu, cold, sore throat, allergies, strains and sprains, minor cuts, scraps, rashes, and minor respiratory conditions. They also provide diagnostics and preventive care services, including blood samplings, health screenings, and vaccination in the different commercial spots.

Restraint

Unavailability of emergency services

The unavailability of emergency healthcare facilities with specialists and the lack of awareness among people about ambulatory healthcare services are limiting the expansion of the U.S. retail clinic market.

Opportunity

The rising number of supermarkets and hypermarkets

The increasing number of supermarkets and hypermarkets in the United States is due to the rising consumer base for consumer goods. Supermarkets are the ideal place to be engaged throughout the year. There are several leading supermarket giants are investing in retail clinics to provide rapid and essential treatment to patients. There is a rising preference for adopting walk-in healthcare services that are more cost- and time-efficient. Additionally, the rising government intervention in the further launch of healthcare facilities and product advancements are observed in the recent years.

Segment Insights

Ownership Insights

The retail-owned segment dominated the U.S. retail clinics market in 2024. The increasing presence of the retail clinics owned by the retail stores, which have the ability to provide efficient and non-emergent treatment to patients, drives the growth of the segment. Retail clinics are one of the emerging fields in healthcare settings and provide quality that is comparable to other settings. Several leading retailers are investing in retail clinics to provide healthcare and transport physicians or clinical providers to patients' homes. This is a cost-effective solution and is considered the best alternative to traditional healthcare settings, which collectively boosts the growth of the segment.

- Walmart Health plans to launch and expand 28 healthcare center locations in March 2023. By the end of 2024, Walmart will be expanding its presence in two new states, Missouri and Arizona.

The hospital-owned segment is predicted to witness significant growth in the U.S. retail clinics market over the forecast period. The leading healthcare sector is heavily investing in retail clinics to provide effective treatment for patients and allow patients to be monitored at any location. Hospitals are gaining more momentum by partnering with or owning retail clinics; with the integration of retail clinics, they provide referrals to specialists or primary care physicians. The patient shows more trust in the brand name related to the retail clinics, which drives the growth of the segment.

- Cleveland Clinic launched the new Women's Comprehensive Health and Research Center, an initiative to help women during midlife and beyond thrive and have easy access to specialized care.

Application Insights

The point-of-care segment led the U.S. retail clinics market in 2023. The rising acceptance of retail clinics for the different types of vaccination and several non-emergent diseases or conditions. Point-of-care centers provide essential treatment for patients. It offers several preventive and diagnostics services, including enabling healthcare checkups in workplaces and schools, and helps in providing blood sampling and physical exams.

Distribution Channel Insights

The drug stores segment registered its dominance over the U.S. retail clinics market in 2024. The rising disposable income in the population drives the exceptional changes in the daily routine and lifestyle, which drives the adoption of over-the-counter drugs and supplements. This is driving the demand for drug stores that provide quick and efficient services.

The retail pharmacies segment is expected to witness substantial growth in the U.S. retail clinics market during the predicted period. The retail pharmacy landscape in the U.S. is evolving rapidly. This can be attributed to the increasing expenditure and overall health concerns.

Regional Insights

The southeast region dominated the U.S. retail clinics market in 2024. The growth of the market is attributed to the rising prevalence of health conditions or emergency treatment in urban areas, which are majorly present in the southeast region of the United States. A large number of hospital-owned retail clinics are available in the region that have all the necessities of the healthcare settings. The rising preference for walk-in medical facilities due to the busy lifestyle and increasing healthcare spending is accelerating the growth of the region.

The western region expects significant growth in the U.S. retail clinics market during the forecast period. The rising preference for retail clinics as compared to the cost efficiency and the reduced time is driving the growth of the market in the particular region. Additionally, the rising awareness about retail clinics for the easy maintenance of health management in the population is accelerating the growth of the U.S. healthcare market across the region.

- According to data by the U.S. Census Bureau and the National Center for Health Statistics (NCHS), there were nearly 2000 active retail health clinics (RHCs) in the United States between 2018 and 2020, with convenient health services available inside pharmacies, supercenter retailers, and grocery stores in metropolitan cities.

Key Players in U.S. Retail Clinics Market and their Offerings

- CVS Health: CVS Health is a major American healthcare company that operates a vast network of retail pharmacies, provides health insurance through Aetna, and manages pharmacy benefits through CVS Caremark. This company also offers a variety of other health services, such as clinics (MinuteClinic), specialty pharmacy, and digital health solutions, aiming to make healthcare accessible and affordable.

- Kroger Health: Kroger Health is the healthcare division of The Kroger Co., offering a range of services through its pharmacies and The Little Clinic locations. This division has a large network of healthcare practitioners and also offers telehealth services in the U.S.

- Walgreens: Walgreens is an American pharmacy-led health and wellbeing company, founded in 1901 in Chicago, that operates thousands of drugstores across the U.S. and Puerto Rico. It is the largest drugstore chain in the U.S. by sales and offers a wide range of services including prescription filling, over-the-counter products, health and wellness items, and convenience goods.

- Advocate Health Care: Advocate Health is a nonprofit health system headquartered in Charlotte, North Carolina, founded in December 2022 through the merger of Advocate Aurora Health and Atrium Health. It operates in six states—Alabama, Georgia, Illinois, North Carolina, South Carolina, and Wisconsin—and focuses on delivering equitable and affordable care.

- Kaiser Foundation Health Plan, Inc.: Kaiser Foundation Health Plan, Inc. (KFHP) is a non-profit health plan that is part of the integrated Kaiser Permanente system, which provides health coverage and care to its members. KFHP works with employers and individuals to offer prepaid health plans and contracts with its affiliated Kaiser Foundation Hospitals and independent Permanente Medical Groups to provide medical services.

- Bellin Health Systems: Bellin Health is an integrated healthcare delivery system based in Green Bay, Wisconsin. It consists of hospitals, specialty clinics, fitness centers, and professional schools that offer a wide range of services, including primary care, cardiac care, orthopedics, digestive health, sports medicine, and mental health.

- Geisinger Health: Geisinger is an integrated health services organization based in Danville, Pennsylvania, that provides medical care, medical education, and research across central, south-central, and northeast Pennsylvania. It operates 10 hospital campuses, numerous care sites, and the Geisinger Health Plan, serving over 1.2 million people.

Recent Development

- In November 2025, UT Health East Texas inaugurated a new new clinic and urgent care facility on Tyler's West Loop. This new site offers several services including urgent care, pediatric care and primary care services.(Source: https://www.gilmermirror.com

- In September 2025, Cleveland Clinic announced the opening of community pharmacy in South Pointe Hospital. This new pharmacy is inaugurated to improve access to vital pharmacy services for residents of Warrensville.(Source: https://newsroom.clevelandclinic.org)

- In August 2025, UC Davis Health opened Folsom Medical Care Clinic in the U.S. This clinic will offer cancer treatments in a state-of-the-art infusion center, and expanded radiology options, including MRI, CT and bone density scans.(Source: https://health.ucdavis.edu)

Segments Covered in the Report

By Ownership

- Retail-Owned Retail Clinics

- Hospital-Owned Retail Clinics

By Application

- Point-Of-Care Diagnostics

- Clinical Chemistry and Immunoassays

- Vaccinations

- Others

By Distribution Channel

- Retail Pharmacy Settings

- Drug Stores

- Grocery Chains and Big Box Stores

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting